Dripline Market Report

Published Date: 02 February 2026 | Report Code: dripline

Dripline Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Dripline market from 2023 to 2033, offering insights into market trends, size, growth trajectory, regional performance, and competitive landscape, which will assist stakeholders in strategic decision-making.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

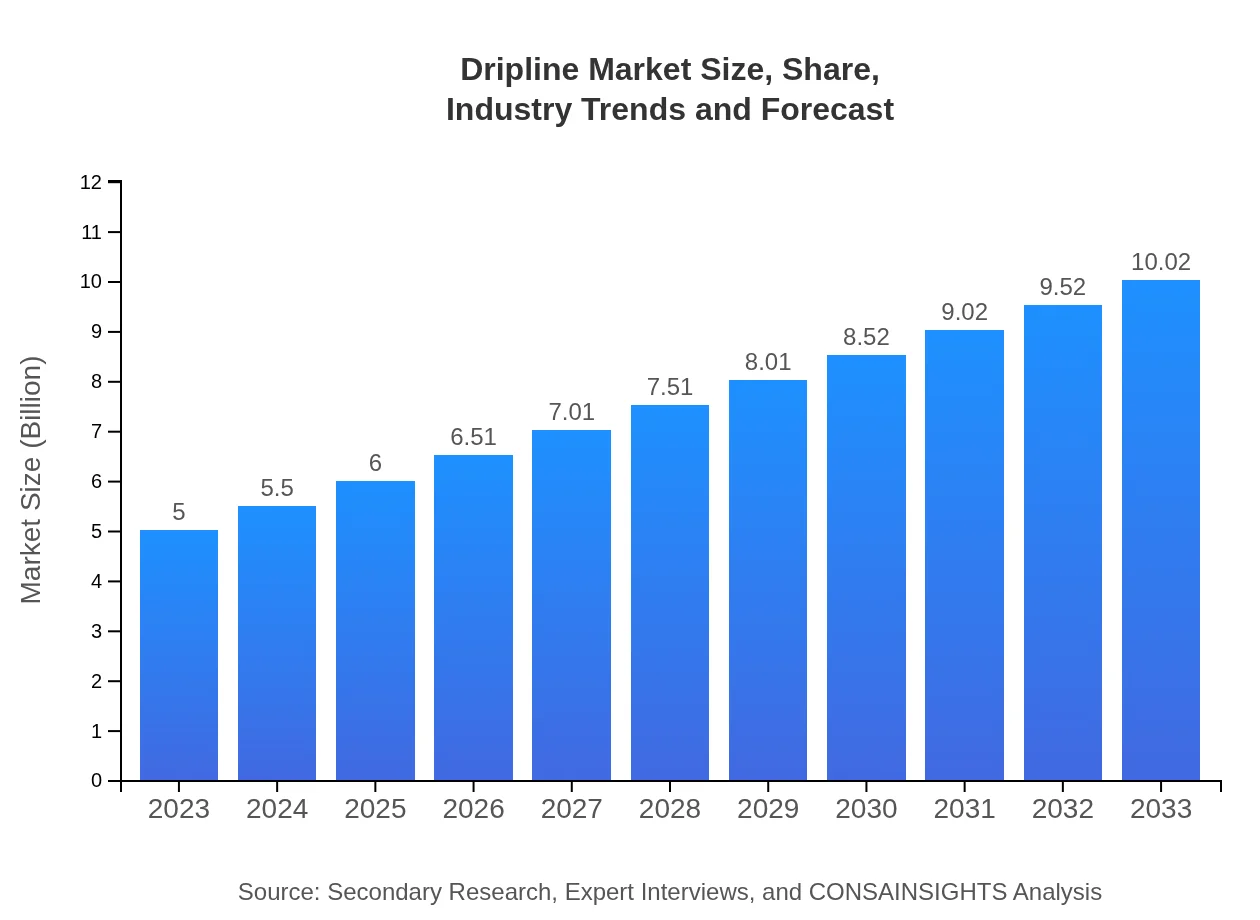

| 2023 Market Size | $5.00 Billion |

| CAGR (2023-2033) | 7% |

| 2033 Market Size | $10.02 Billion |

| Top Companies | Netafim, Toro Company, Irritec, Rain Bird Corporation |

| Last Modified Date | 02 February 2026 |

Dripline Market Overview

Customize Dripline Market Report market research report

- ✔ Get in-depth analysis of Dripline market size, growth, and forecasts.

- ✔ Understand Dripline's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Dripline

What is the Market Size & CAGR of Dripline market in 2023?

Dripline Industry Analysis

Dripline Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Dripline Market Analysis Report by Region

Europe Dripline Market Report:

Europe's market size is estimated at USD 1.40 billion in 2023, with projections of USD 2.81 billion by 2033. European policies promoting sustainability in agriculture are fostering the growth of advanced drip irrigation systems.Asia Pacific Dripline Market Report:

In the Asia Pacific region, the Dripline market was valued at USD 0.96 billion in 2023 and is projected to reach USD 1.93 billion by 2033. This growth reflects the significant agricultural expansion in countries like India and China, where water scarcity issues are pushing the adoption of efficient irrigation technologies.North America Dripline Market Report:

North America stands out with a market size of USD 1.83 billion in 2023, doubling to USD 3.66 billion in 2033, driven by technological innovation, especially in the United States, where precision agriculture is a key focus.South America Dripline Market Report:

The South American Dripline market is relatively smaller, with a value of USD 0.20 billion in 2023, expected to grow to USD 0.40 billion by 2033. Brazil and Argentina lead this growth as they modernize their agriculture sectors.Middle East & Africa Dripline Market Report:

The Middle East and Africa market, valued at USD 0.61 billion in 2023, is anticipated to grow to USD 1.23 billion by 2033, as regions with arid climates prioritize drip irrigation to enhance agricultural productivity.Tell us your focus area and get a customized research report.

Dripline Market Analysis By Product Type

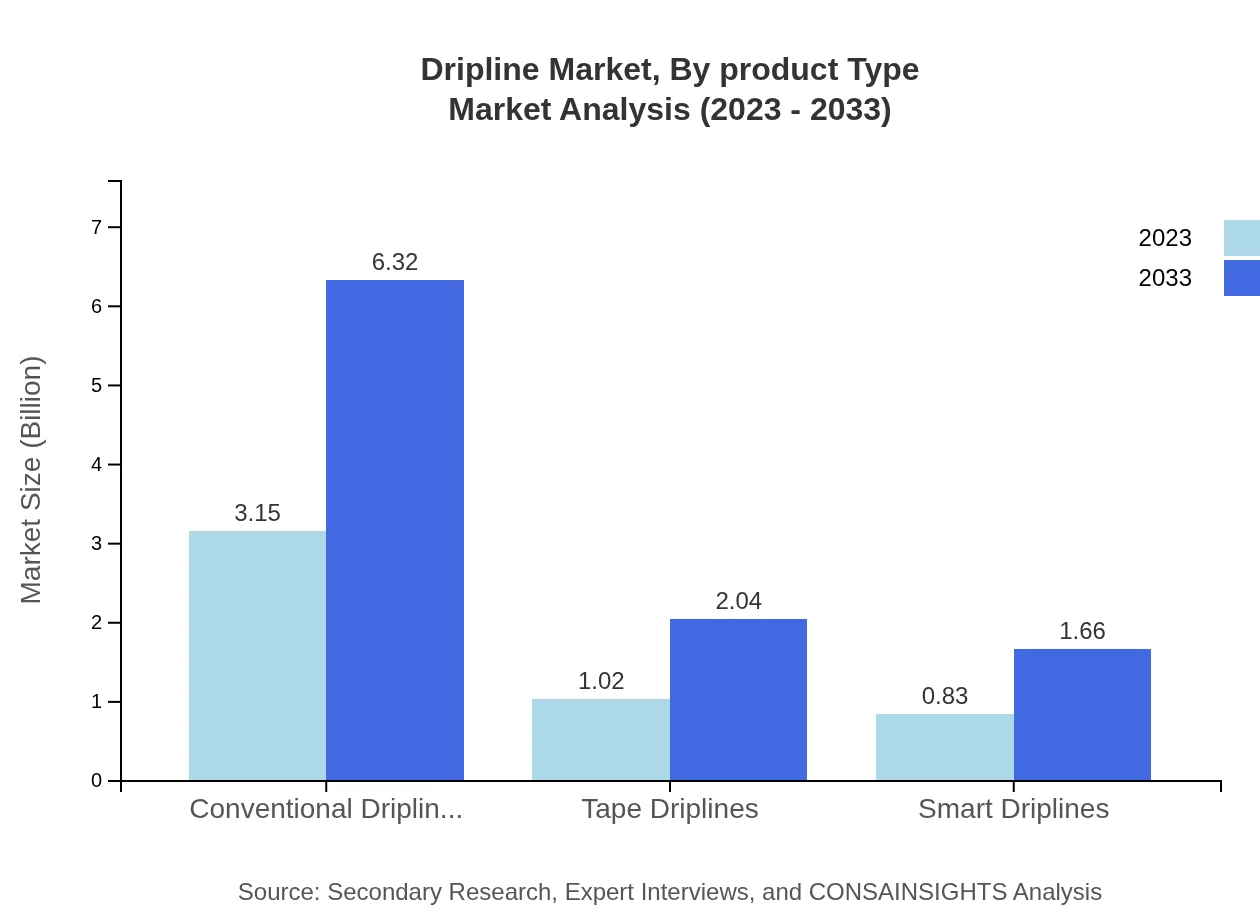

The Dripline market is dominated by conventional driplines, accounting for approximately 63.02% of the market share in 2023, valued at USD 3.15 billion. Tape driplines follow, holding 20.4% market share, valued at USD 1.02 billion. Smart driplines are gradually gaining traction, making up 16.58% of the share with a market value of USD 0.83 billion. The future is expected to see an uptick in smart driplines as precision practices become the norm.

Dripline Market Analysis By Application

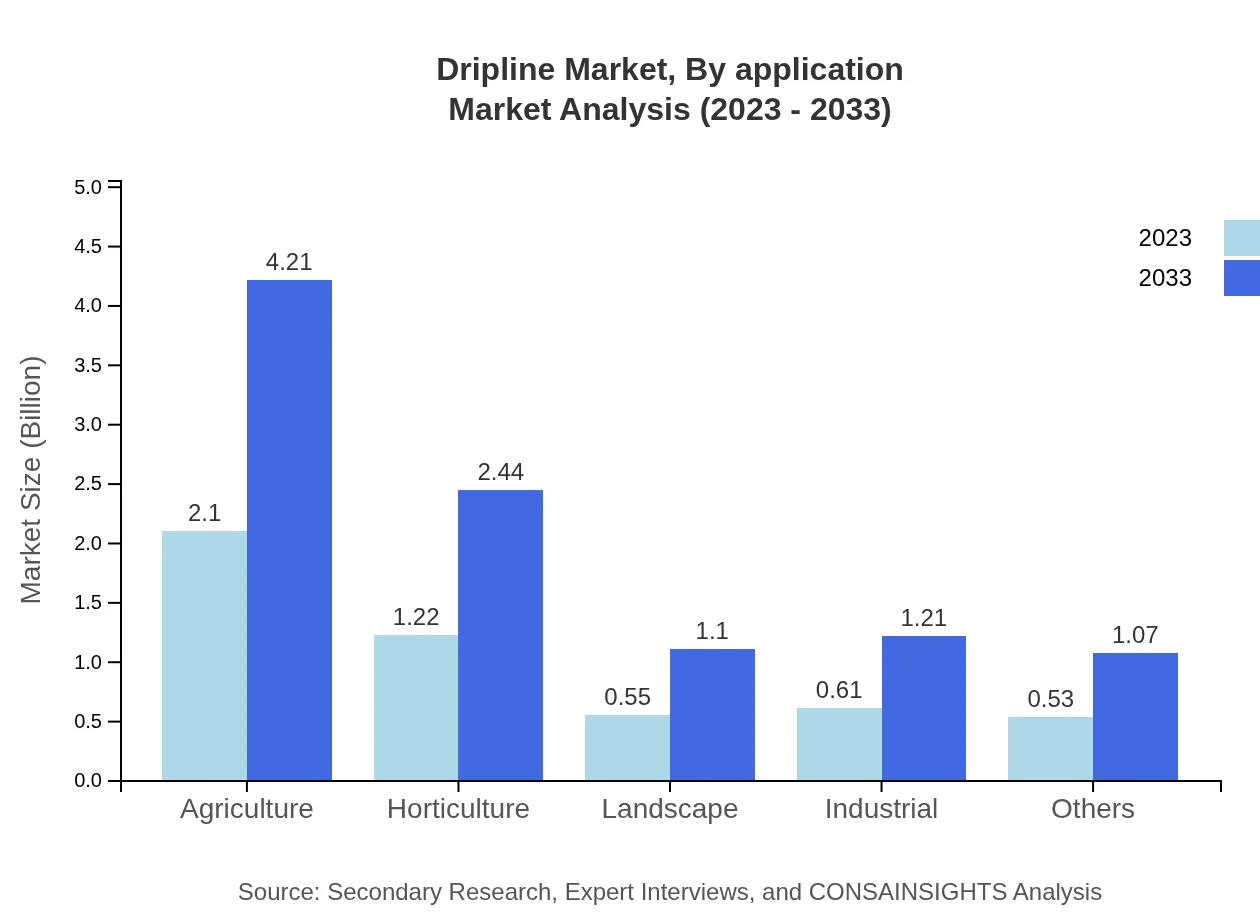

Agriculture, which constitutes 42% of the market, is the largest segment, valued at USD 2.10 billion in 2023 and projected to grow to USD 4.21 billion by 2033. Horticulture follows with a 24.31% share, primarily driven by the need for efficient water use in crop production, while industrial applications cover 12.11% of the market, reflecting the diversification of dripline uses into non-agricultural sectors.

Dripline Market Analysis By Technology

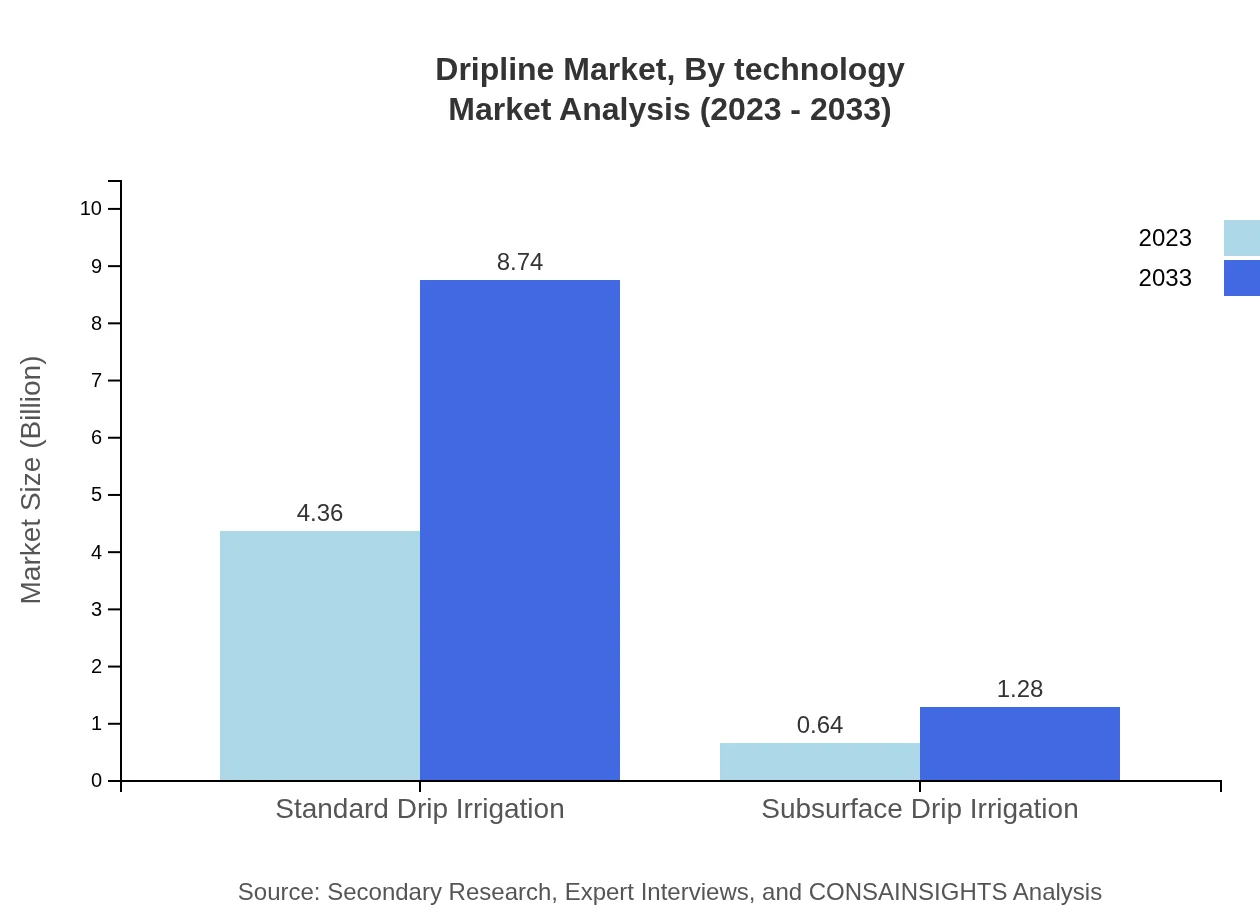

The current trends in technology show a preference for smart drip irrigation systems, enhancing crop monitoring through automation. Subsurface and standard drip irrigation are also widely used, collectively holding more than 85% of the market share presently. The integration of IoT and data analytics into drip irrigation technology is expected to revolutionize efficiency and yield in the coming years.

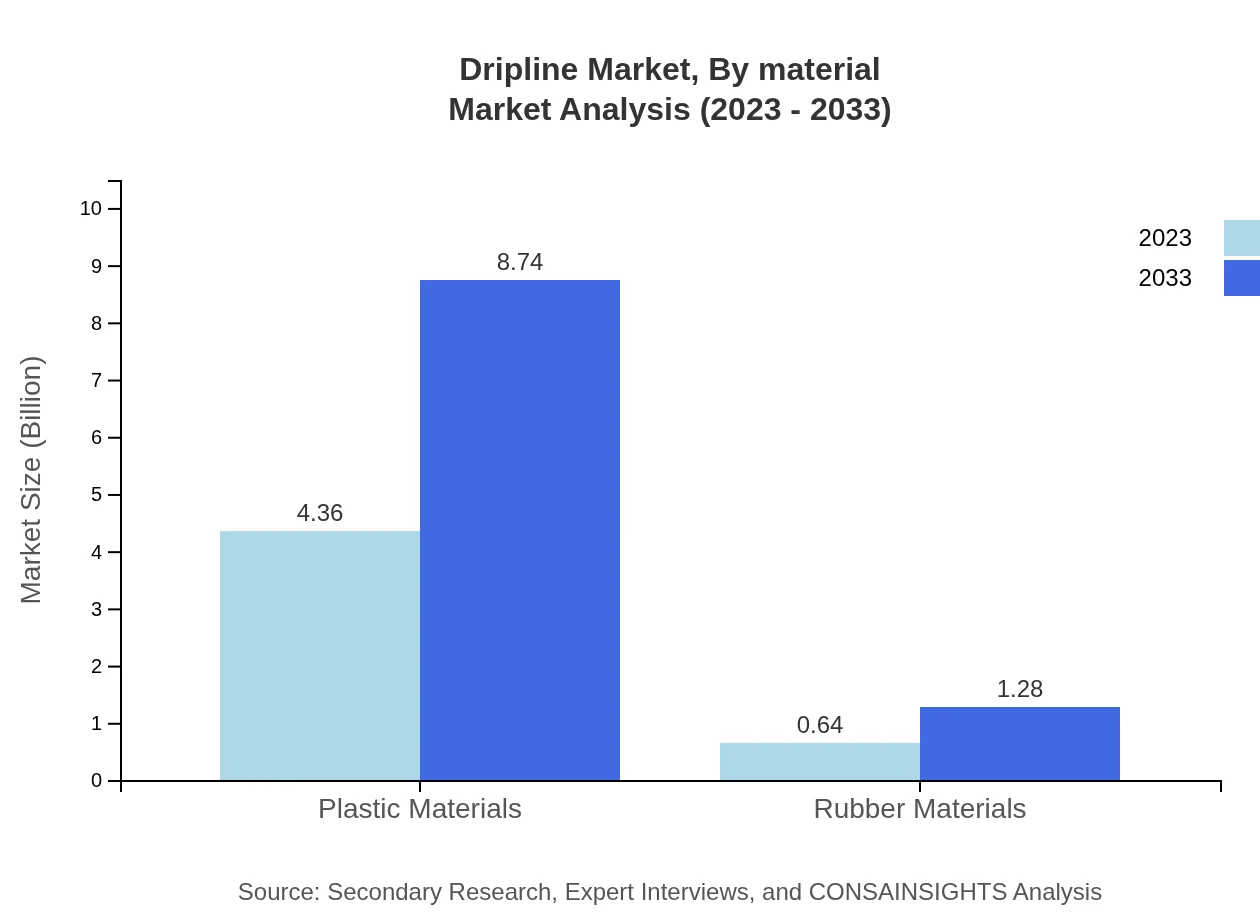

Dripline Market Analysis By Material

Plastic driplines dominate the market, representing 87.25% of the market share in 2023, attributed to their cost-effectiveness and durability. Rubber materials, while significantly contributing to the market, hold only 12.75% of the share, focusing on specialized agricultural needs where flexibility and strength are required.

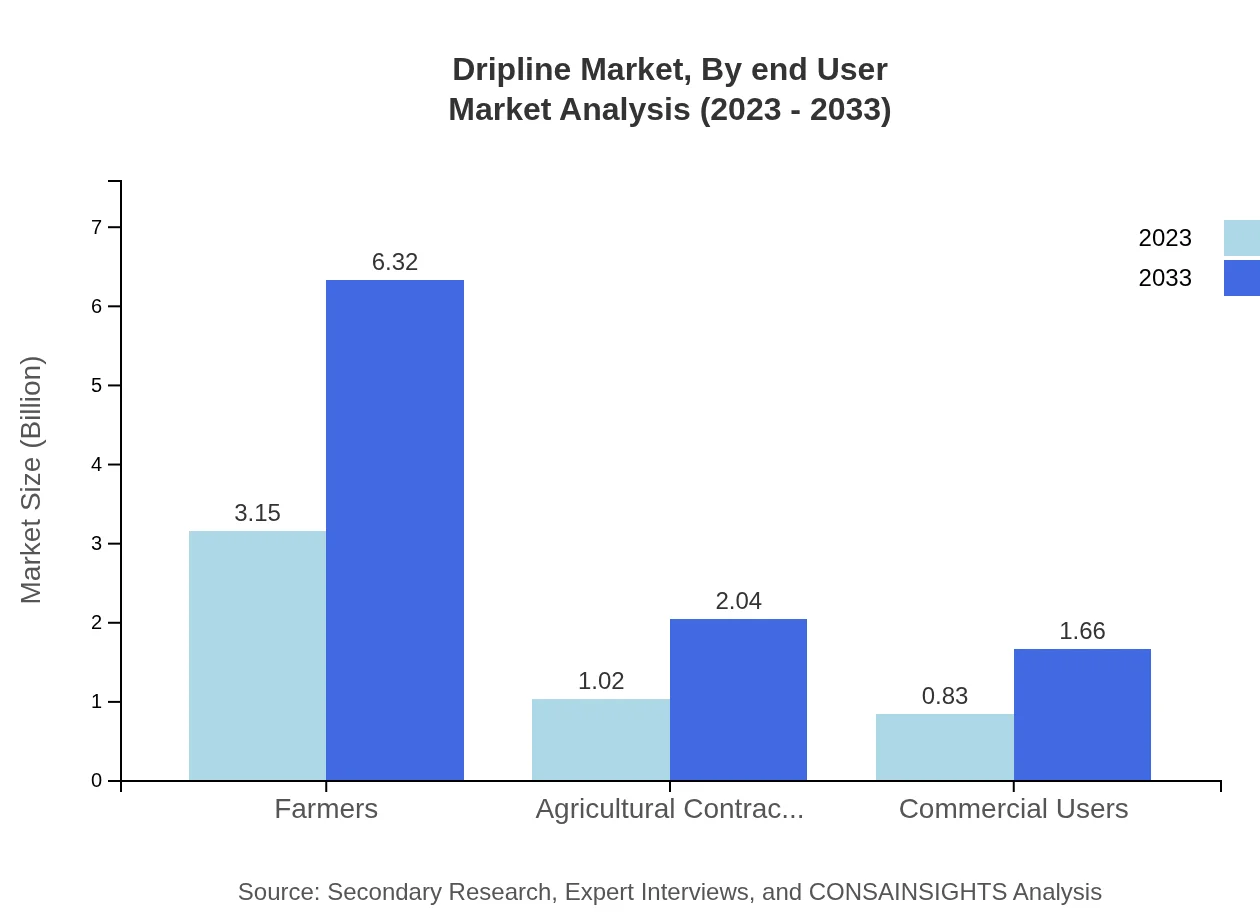

Dripline Market Analysis By End User

Farmers are the largest end-users, occupying 63.02% of the market, with a valuation of USD 3.15 billion in 2023. Agricultural contractors and commercial users follow, with respective shares of 20.4% and 16.58%. The rise of independent entrepreneurs in agriculture is seen in the growing segment for agricultural contractors.

Dripline Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Dripline Industry

Netafim:

A pioneer in smart irrigation solutions, Netafim specializes in drip irrigation technology, offering comprehensive solutions that optimize water usage and improve crop productivity.Toro Company:

The Toro Company is a leader in irrigation systems and equipment, providing innovative products and services for the agricultural and landscape industries.Irritec:

Known for its durable and high-quality products, Irritec offers a wide range of drip irrigation solutions tailored to meet the needs of various agricultural sectors.Rain Bird Corporation:

Rain Bird is recognized for developing advanced irrigation technologies, focusing on efficient water management systems for both commercial and residential applications.We're grateful to work with incredible clients.

FAQs

What is the market size of dripline?

The global dripline market is currently valued at approximately $5 billion with a projected Compound Annual Growth Rate (CAGR) of 7% from 2023 to 2033. This growth reflects a significant trend towards efficient irrigation solutions in agriculture.

What are the key market players or companies in this dripline industry?

Major players in the dripline market include companies like Netafim Ltd., Rivulis Irrigation Ltd., and The Toro Company. These companies lead in providing innovative solutions and have established a strong presence globally.

What are the primary factors driving the growth in the dripline industry?

The growth in the dripline industry is primarily driven by the increasing demand for efficient water management in agriculture, the adoption of smart irrigation technologies, and government initiatives promoting sustainable agriculture practices.

Which region is the fastest Growing in the dripline?

The North American region is the fastest-growing in the dripline market, with market values projected to rise from $1.83 billion in 2023 to $3.66 billion by 2033, indicating robust growth opportunities in this area.

Does ConsaInsights provide customized market report data for the dripline industry?

Yes, ConsaInsights offers customized market report data tailored to client specifications. This ensures detailed insights that align perfectly with specific business needs within the dripline industry.

What deliverables can I expect from this dripline market research project?

Clients can expect comprehensive deliverables including detailed market analysis, forecasts, competitive landscape assessments, and segmented data covering regions and market players in the dripline industry.

What are the market trends of dripline?

Key trends in the dripline market include a shift towards smart driplines, increasing usage in precision agriculture, and the rising adoption of sustainable irrigation methods among farmers and agricultural contractors.