Driveline Market Report

Published Date: 02 February 2026 | Report Code: driveline

Driveline Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report analyzes the Driveline market, highlighting key insights, market trends, and forecasts for the period from 2023 to 2033. It provides an in-depth assessment of market size, segmentation, and competitive landscape, along with regional dynamics to aid stakeholders in strategic decision-making.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

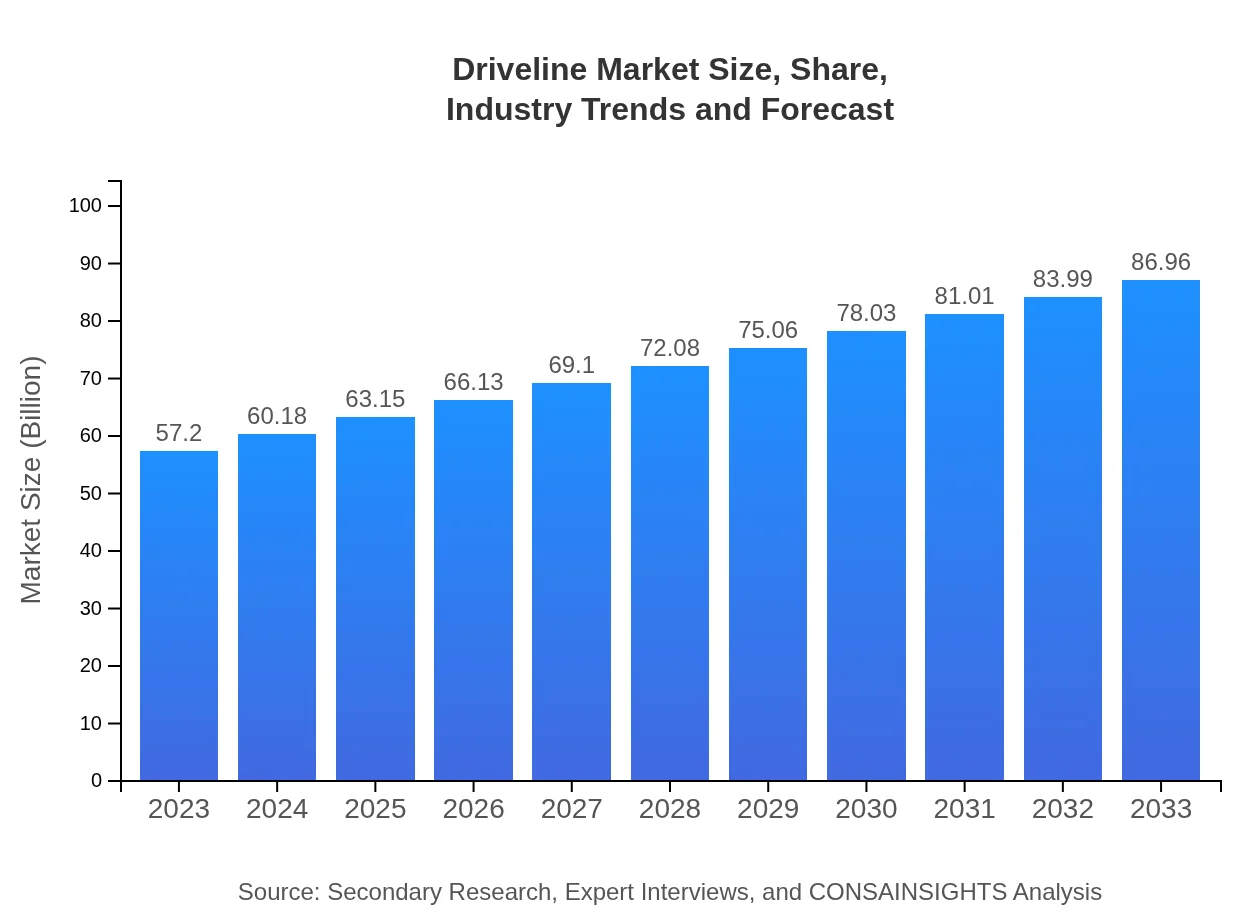

| 2023 Market Size | $57.20 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $86.96 Billion |

| Top Companies | Bosch, GKN Automotive, ZF Friedrichshafen AG, Valeo |

| Last Modified Date | 02 February 2026 |

Driveline Market Overview

Customize Driveline Market Report market research report

- ✔ Get in-depth analysis of Driveline market size, growth, and forecasts.

- ✔ Understand Driveline's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Driveline

What is the Market Size & CAGR of Driveline market in 2023?

Driveline Industry Analysis

Driveline Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Driveline Market Analysis Report by Region

Europe Driveline Market Report:

With a market size of USD 14.82 billion in 2023 and an anticipated increase to USD 22.53 billion by 2033, Europe leads in technological innovations and stringent emission regulations, influencing driveline development significantly.Asia Pacific Driveline Market Report:

In 2023, the Asia-Pacific Driveline market is valued at USD 11.55 billion, expected to grow to USD 17.56 billion by 2033. The region's growth is driven by increasing automobile production, regulatory enhancements, and rising consumer demand for efficient and advanced driveline systems.North America Driveline Market Report:

The North American Driveline market stands at USD 19.12 billion in 2023, with a forecast to reach USD 29.07 billion by 2033. This growth can be attributed to technological advancements, a shift towards EVs, and strong industry partnerships across leading automotive brands.South America Driveline Market Report:

The South American market's size in 2023 is estimated at USD 3.79 billion, projected to rise to USD 5.76 billion by 2033. Key drivers include urbanization, increasing vehicle sales, and investments in automotive infrastructure.Middle East & Africa Driveline Market Report:

The Middle East and Africa market is projected at USD 7.92 billion in 2023, expected to grow to USD 12.04 billion by 2033, driven by infrastructure development, rising vehicle production, and a growing affinity for advanced driveline technologies.Tell us your focus area and get a customized research report.

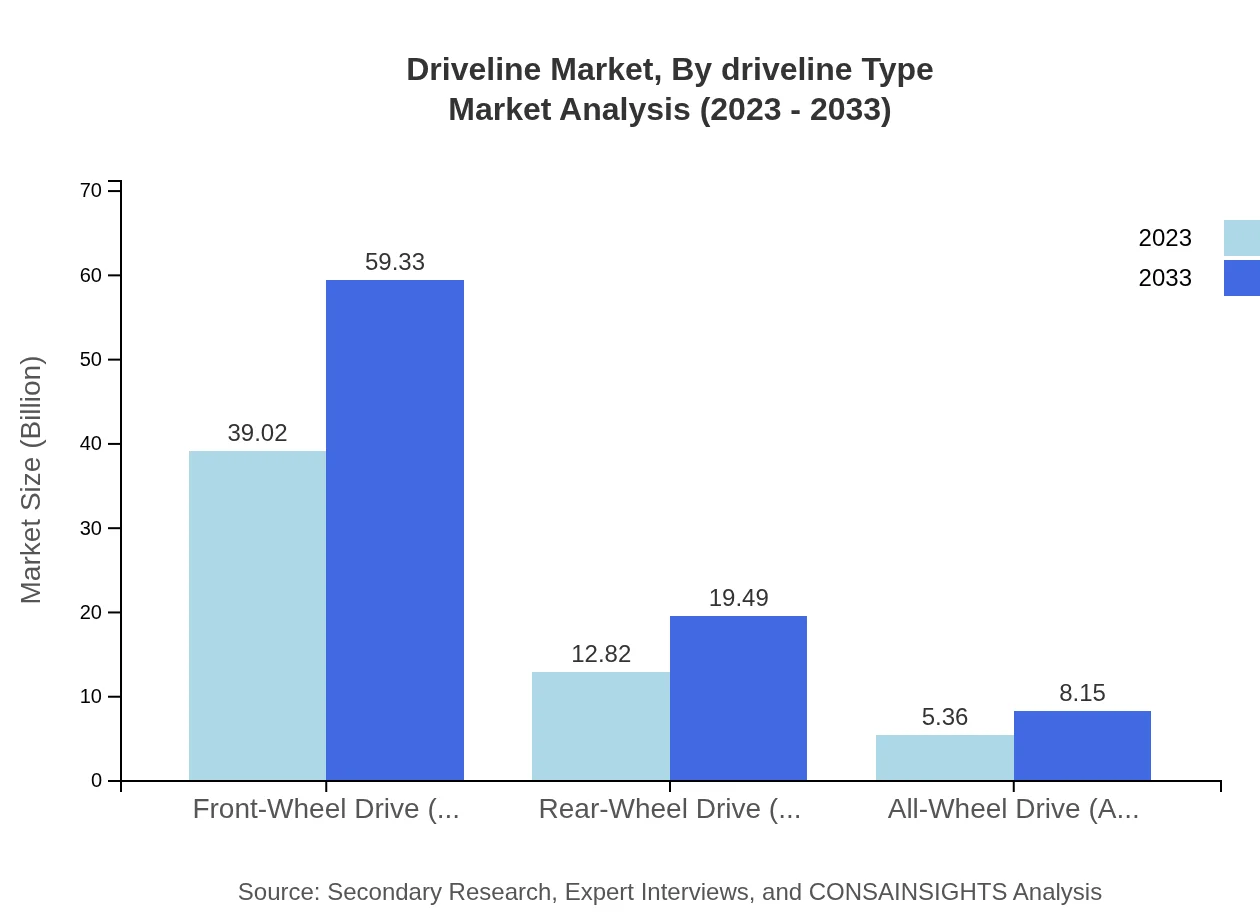

Driveline Market Analysis By Driveline Type

The Driveline market is predominantly characterized by Conventional Driveline Systems, holding a substantial share due to continued reliance on internal combustion engines. The Electrified Driveline Systems are gaining traction, reflecting the automotive industry's shift towards electric mobility. Advanced Driveline Technologies are also becoming integral to vehicle performance enhancements.

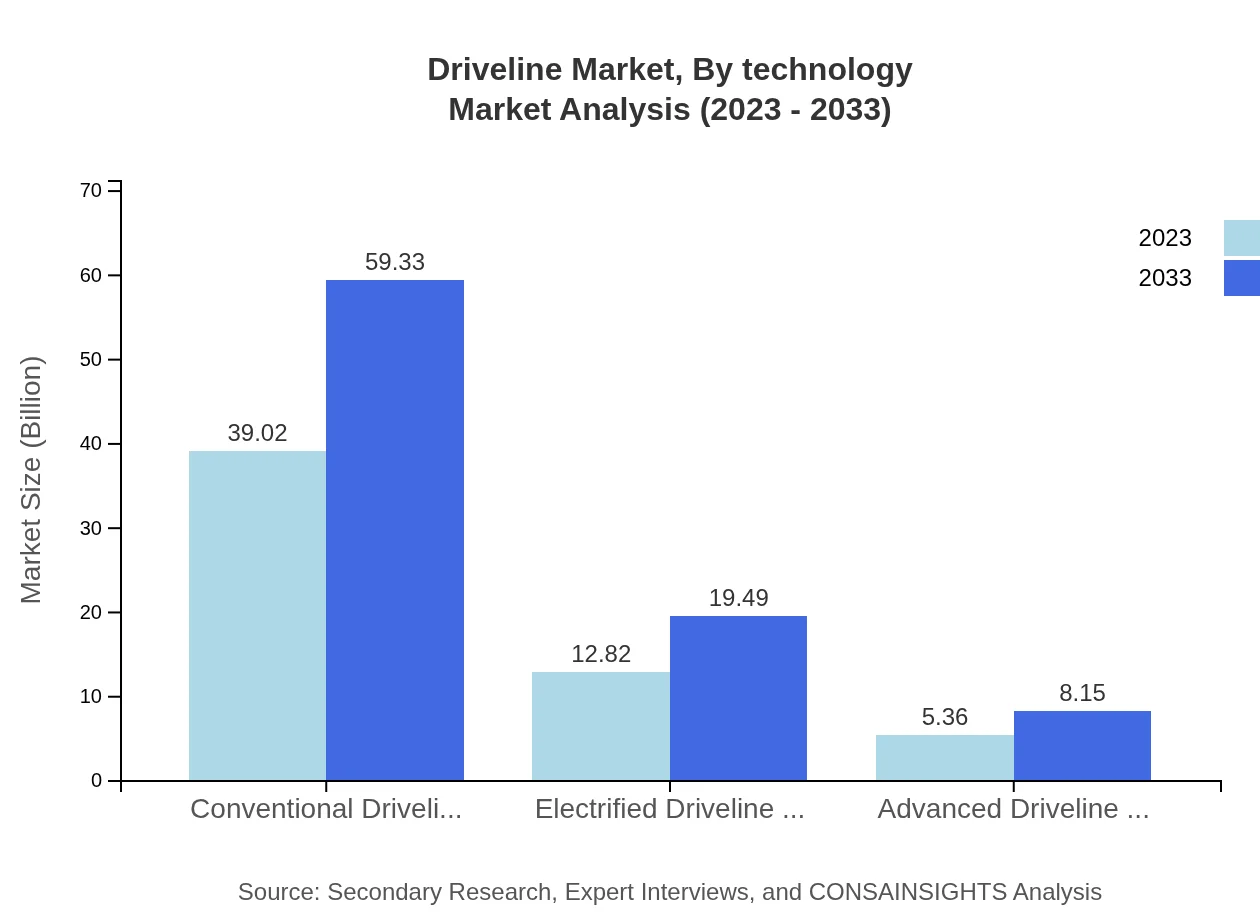

Driveline Market Analysis By Technology

Transmission Systems constitute a major part of the Driveline landscape, focusing on innovations in manual and automatic technologies that enhance power transfer efficiency. The integration of advanced transmission controls and electric vehicle drivetrains is reshaping this segment's dynamics.

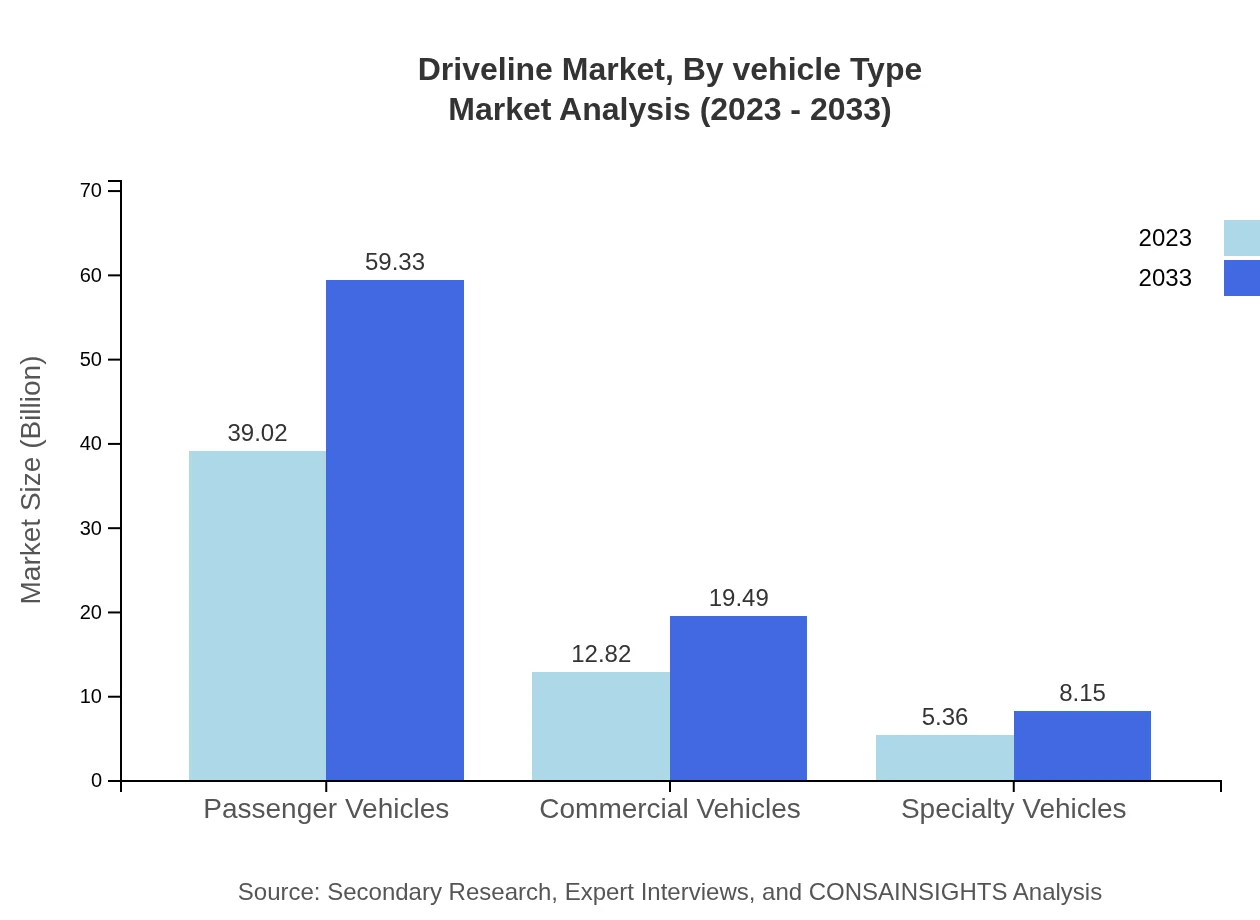

Driveline Market Analysis By Vehicle Type

Passenger Vehicles dominate the Driveline market, attributed to their significant share in global vehicle sales. Commercial Vehicles show promising growth as logistics and goods transportation demand increases, making them an essential segment in the Driveline market.

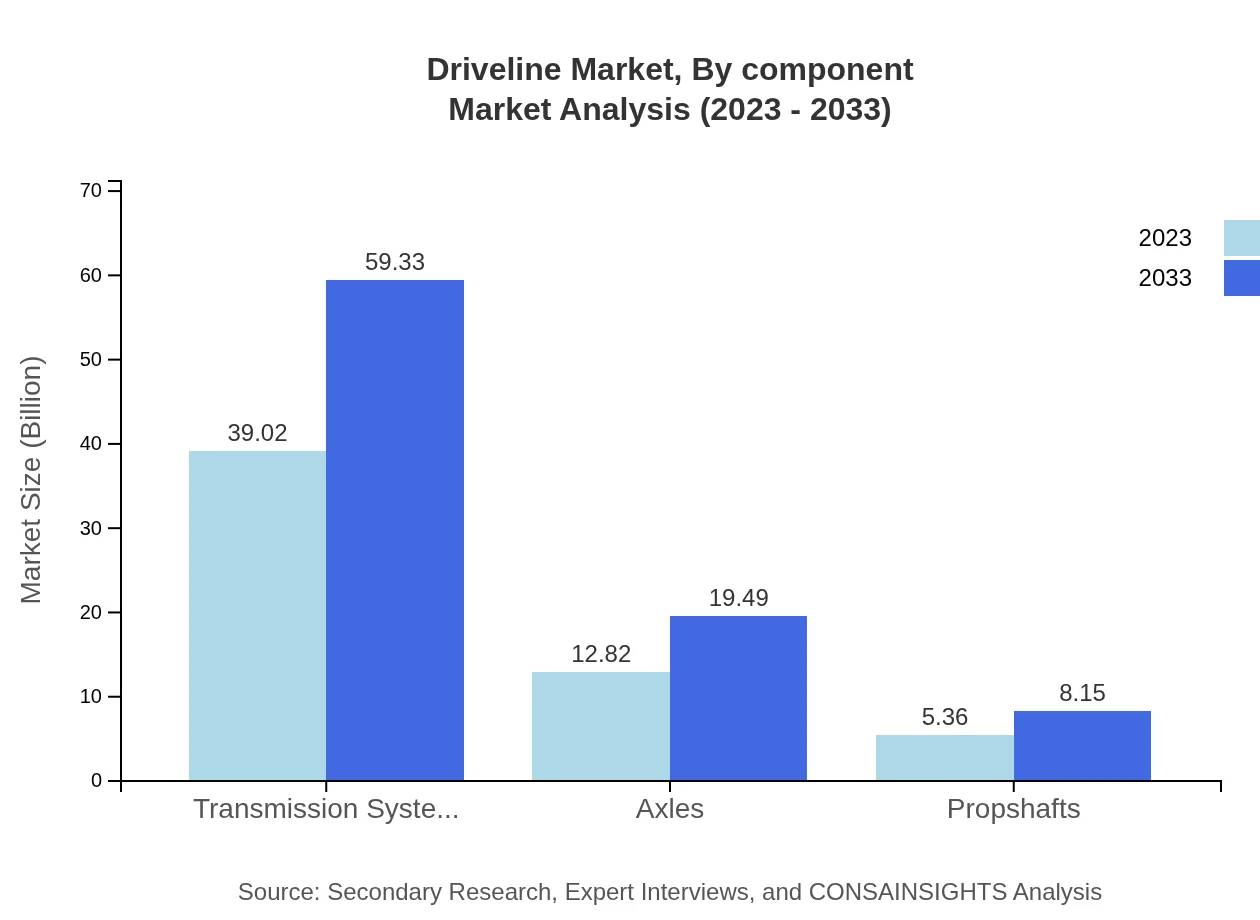

Driveline Market Analysis By Component

Transmission Systems and Axles are critical components of the Driveline assembly. The focus on lightweight and durable materials in components is helping improve vehicle dynamics and fuel economy, driving innovations in this area.

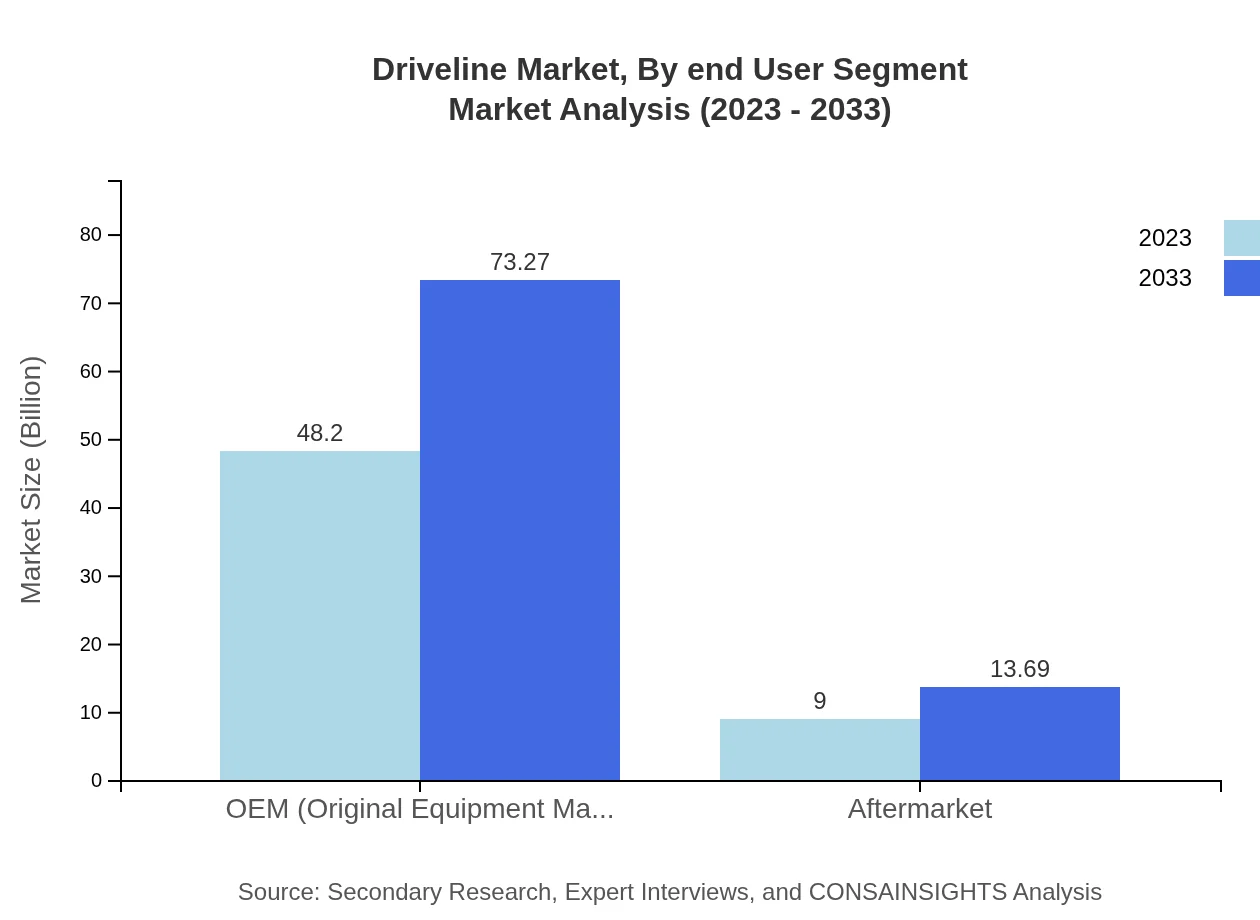

Driveline Market Analysis By End User Segment

The OEM segment provides a significant revenue stream, reflecting the ongoing trend of vehicles being equipped with advanced driveline systems straight from the manufacturing line. The Aftermarket segment is also growing, driven by the demand for replacement parts and upgrades in older vehicles.

Driveline Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Driveline Industry

Bosch:

Bosch is a leading global supplier of technology and services, heavily investing in driveline innovations, particularly in electric and hydride powertrains.GKN Automotive:

A pioneer in driveline technology, GKN focuses on delivering advanced driveline solutions that cater to both conventional and electrified vehicles.ZF Friedrichshafen AG:

ZF is recognized for its cutting-edge driveline products that enhance vehicle handling and efficiency, playing a crucial role in the evolution of electric mobility.Valeo:

Valeo specializes in automotive components and systems, focusing on innovative driveline technologies that improve performance and emissions.We're grateful to work with incredible clients.

FAQs

What is the market size of driveline?

The global driveline market size is projected to reach approximately $57.2 billion by 2033, growing at a CAGR of 4.2%. This growth reflects increasing demand for efficient and sustainable driveline systems across various vehicle segments.

What are the key market players or companies in this driveline industry?

Key players in the driveline industry include major automotive manufacturers and component suppliers, focusing on technological advancements and sustainability to enhance competitiveness and capture market share in a rapidly evolving landscape.

What are the primary factors driving the growth in the driveline industry?

Growth in the driveline industry is driven by rising vehicle production, technological advancements, demand for fuel-efficient systems, and increasing automotive electrification, as consumers and manufacturers alike prioritize sustainability and innovation.

Which region is the fastest Growing in the driveline?

The fastest-growing region in the driveline market is North America, expected to grow from $19.12 billion in 2023 to $29.07 billion by 2033, indicating a robust CAGR. Other notable regions include Europe and Asia Pacific, contributing significantly to market expansion.

Does ConsaInsights provide customized market report data for the driveline industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs, ensuring comprehensive insights into market trends, competitive analysis, and consumer behaviors within the driveline industry.

What deliverables can I expect from this driveline market research project?

The deliverables from the driveline market research project include detailed market analysis reports, segmentation insights, competitive landscape summaries, and actionable recommendations formulated based on extensive industry research.

What are the market trends of driveline?

Current trends in the driveline market indicate a shift towards electrification, with increasing investments in advanced driveline technologies, a rise in the adoption of lightweight materials, and a focus on enhancing overall vehicle efficiency.