Drone Logistics And Transportation Market Report

Published Date: 03 February 2026 | Report Code: drone-logistics-and-transportation

Drone Logistics And Transportation Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Drone Logistics and Transportation market from 2023 to 2033, including market size, growth forecasts, challenges, and key trends shaping the industry.

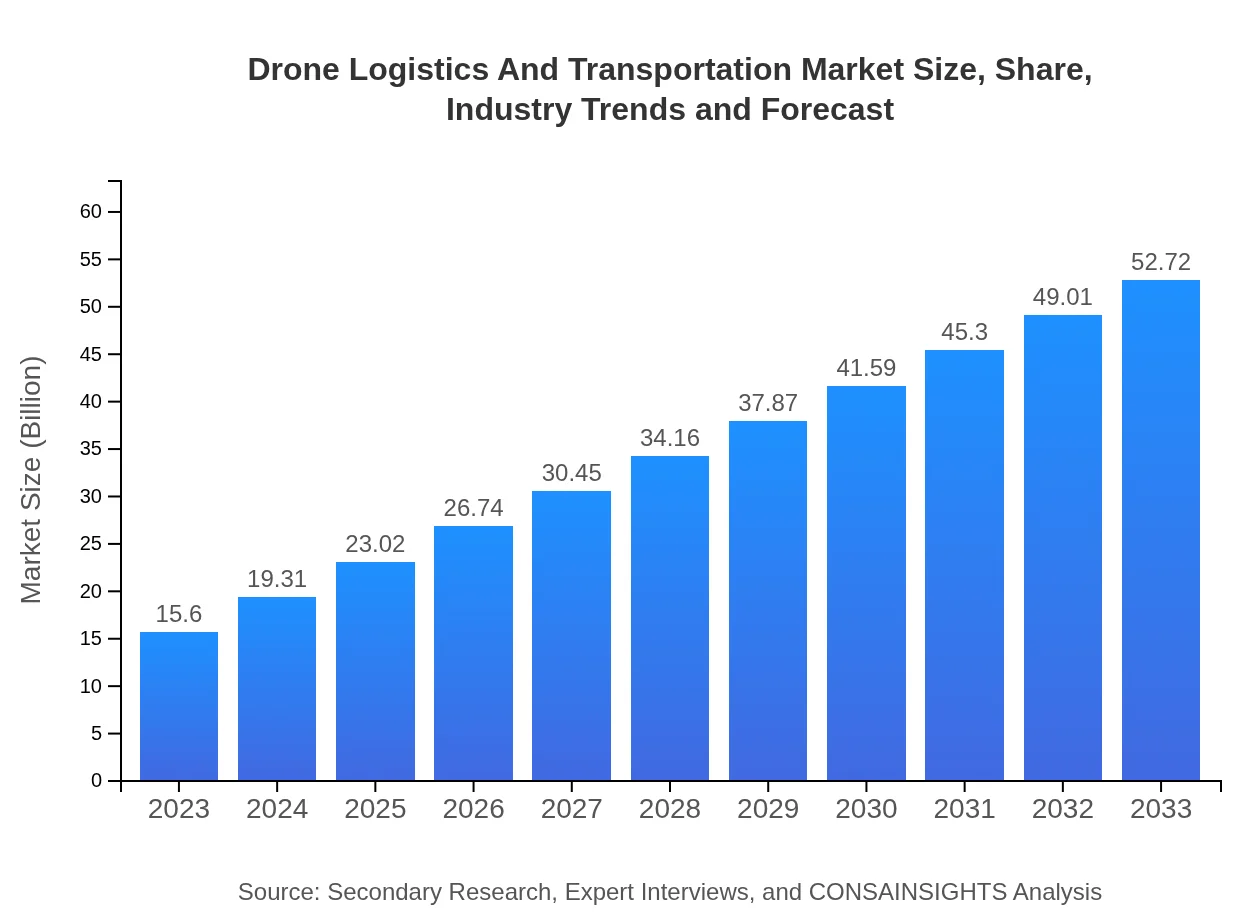

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 12.4% |

| 2033 Market Size | $52.72 Billion |

| Top Companies | Amazon Prime Air, Zipline, Wing (Alphabet Inc.), DHL |

| Last Modified Date | 03 February 2026 |

Drone Logistics And Transportation Market Overview

Customize Drone Logistics And Transportation Market Report market research report

- ✔ Get in-depth analysis of Drone Logistics And Transportation market size, growth, and forecasts.

- ✔ Understand Drone Logistics And Transportation's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Drone Logistics And Transportation

What is the Market Size & CAGR of Drone Logistics And Transportation market in 2023?

Drone Logistics And Transportation Industry Analysis

Drone Logistics And Transportation Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Drone Logistics And Transportation Market Analysis Report by Region

Europe Drone Logistics And Transportation Market Report:

Europe's drone logistics market is projected to grow from $5.14 billion in 2023 to $17.36 billion by 2033, driven by a robust e-commerce sector and increasing investment in smart city initiatives that incorporate drone technology.Asia Pacific Drone Logistics And Transportation Market Report:

The Asia Pacific region is a rapidly growing market for drone logistics, projected to expand from $2.93 billion in 2023 to $9.89 billion by 2033. This growth is fueled by increasing urbanization, rising demand for e-commerce, and governmental support for drone delivery initiatives in densely populated urban centers.North America Drone Logistics And Transportation Market Report:

With a market size of $5.53 billion in 2023, North America remains a significant player in the drone logistics market, expected to grow to $18.71 billion by 2033. The U.S. leads in regulatory advancements and technological innovation, contributing to the rapid adoption of drone delivery services.South America Drone Logistics And Transportation Market Report:

The South American market is developing, with a market size of $1.52 billion in 2023 and expected to reach $5.15 billion by 2033. Countries that face geographic challenges are increasingly adopting drone logistics to improve delivery efficiency, especially in rural areas.Middle East & Africa Drone Logistics And Transportation Market Report:

The Middle East and Africa region, while smaller, is expected to experience growth from $0.48 billion in 2023 to $1.62 billion by 2033, as countries invest in drone technology for humanitarian aid and infrastructure monitoring.Tell us your focus area and get a customized research report.

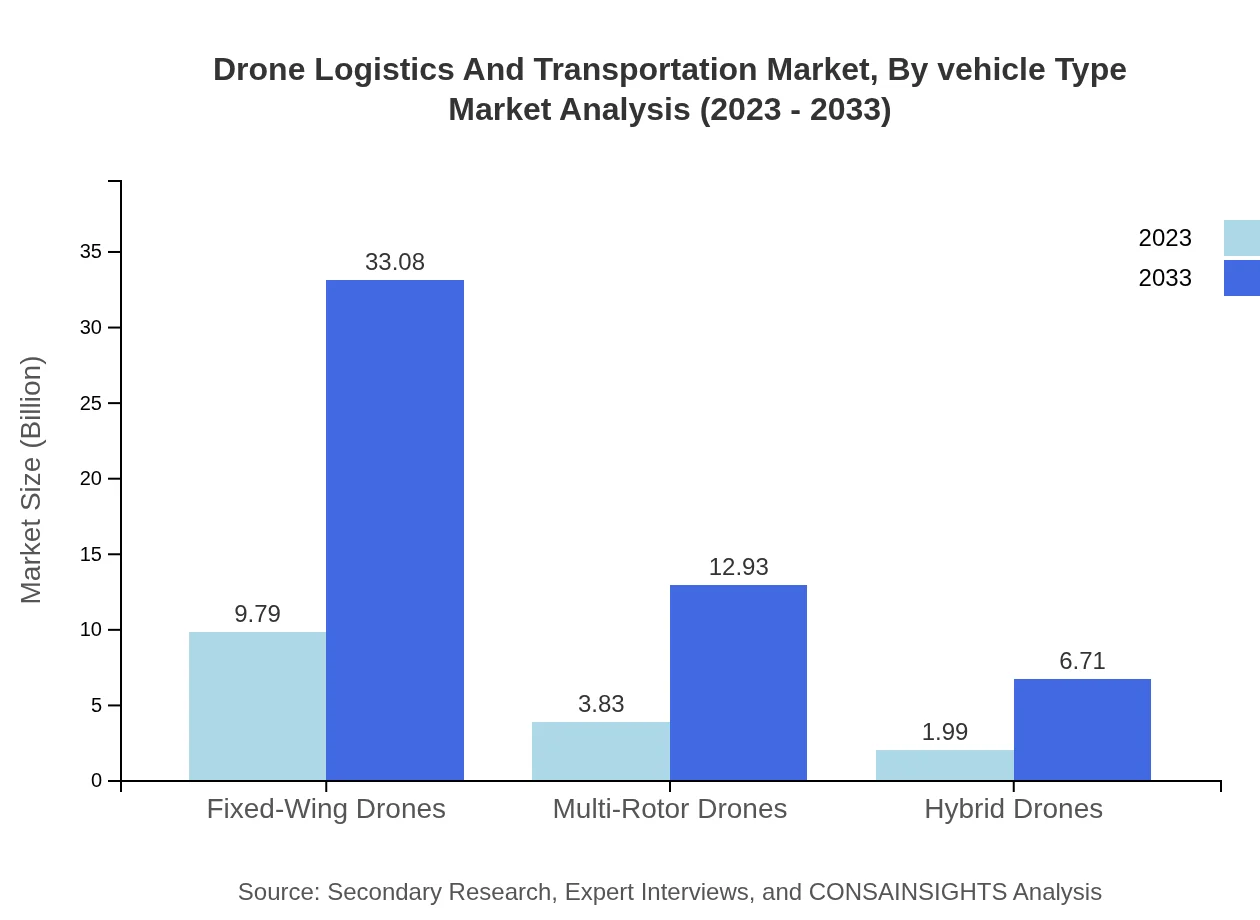

Drone Logistics And Transportation Market Analysis By Vehicle Type

In terms of vehicle types, the market is dominated by Autonomous Drones, anticipated to grow from $9.79 billion in 2023 to $33.08 billion by 2033, capturing a significant share of approximately 62.74%. Remote Piloted Drones contribute significantly as well, with growth from $3.83 billion to $12.93 billion and holding a share of 24.53%. Drone Navigational Systems, essential for efficient operation, are on track to grow from $1.99 billion to $6.71 billion.

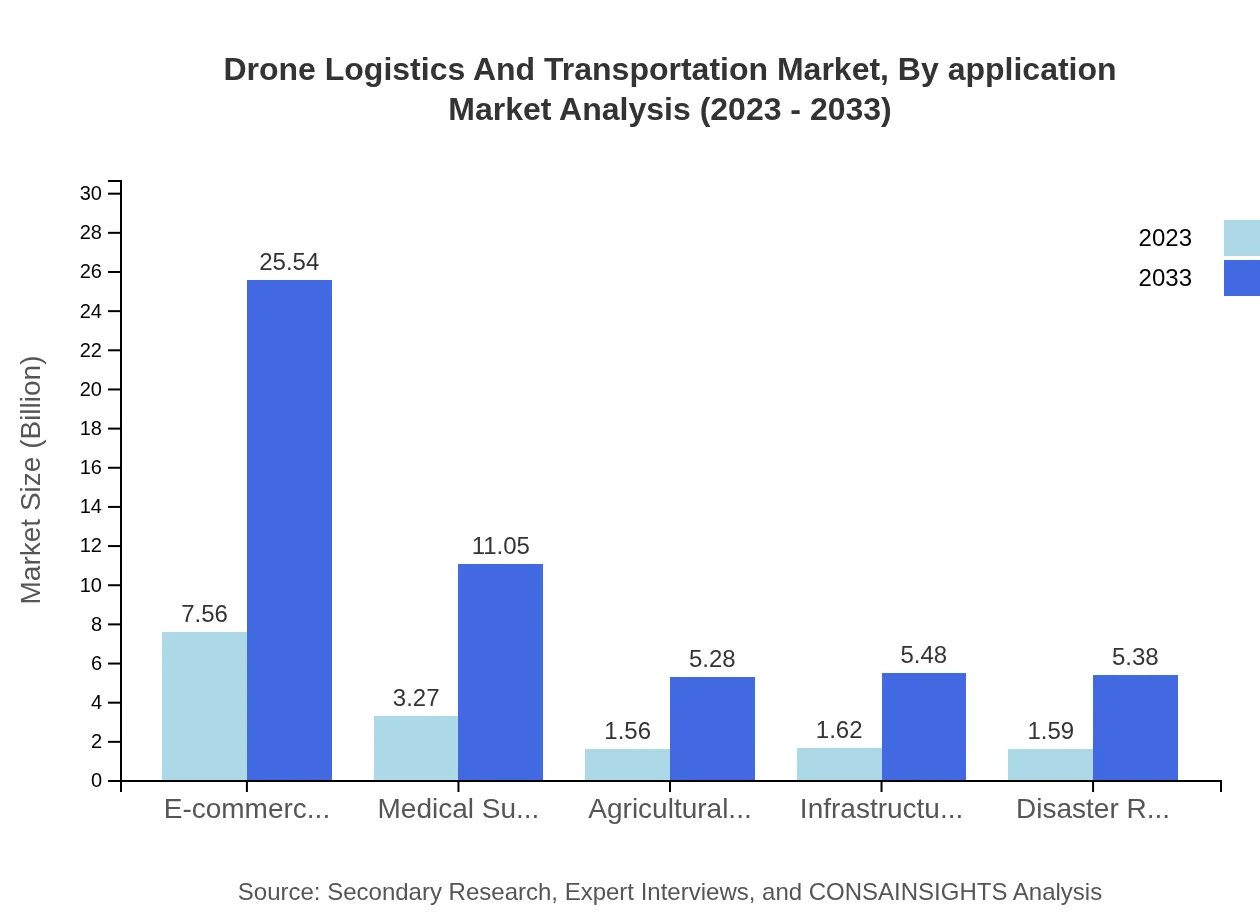

Drone Logistics And Transportation Market Analysis By Application

E-commerce Delivery remains the leading application segment, projected to reach $25.54 billion by 2033 from $7.56 billion in 2023, with a dominating 48.44% market share. Medical Supply Delivery is also critical, expected to grow from $3.27 billion to $11.05 billion capturing 20.96%. Agricultural Services and other applications likewise show promise for growth as industries recognize the efficiency gains drones offer.

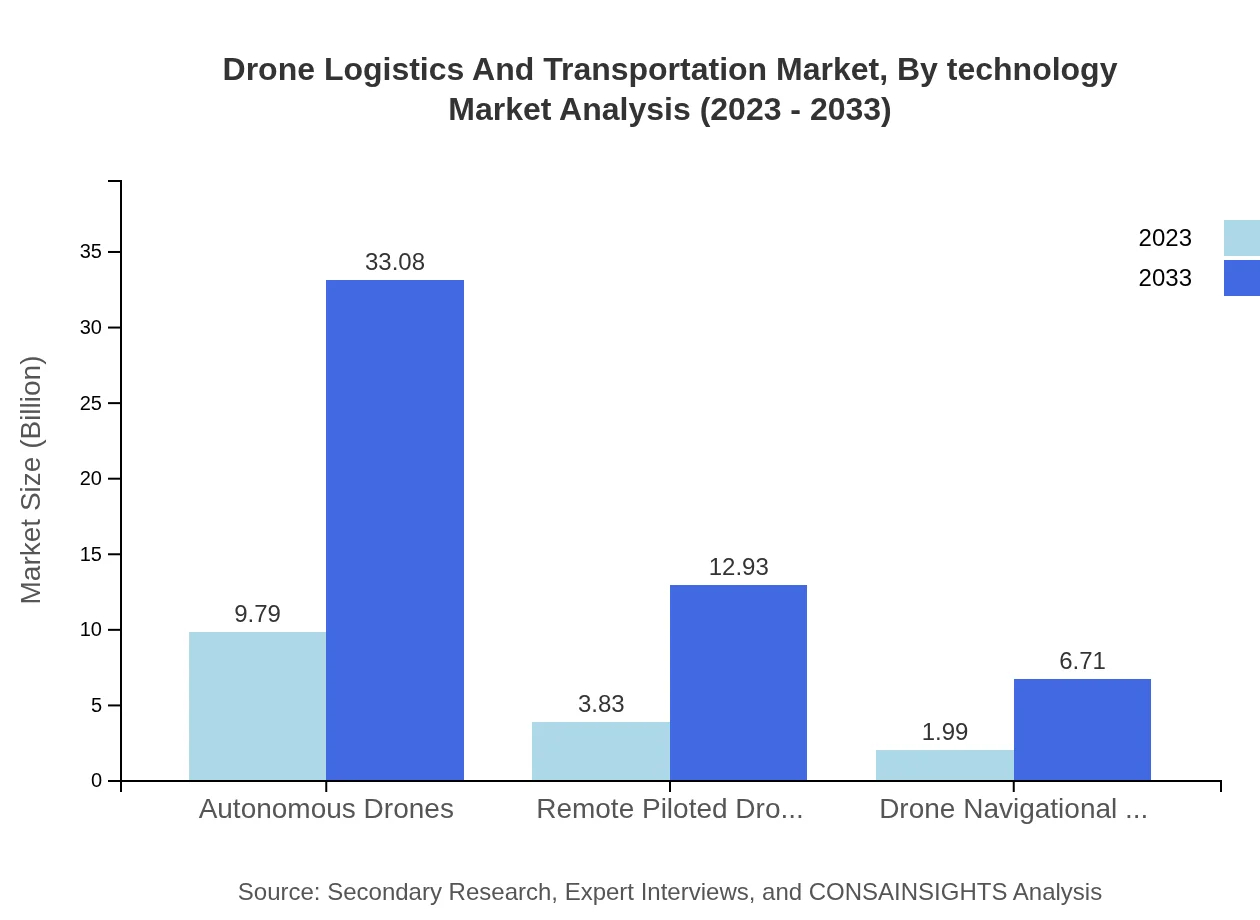

Drone Logistics And Transportation Market Analysis By Technology

The technology segment emphasizes innovations in navigational systems enabling drones to perform efficiently in complex environments. Advances in AI and machine learning are key drivers. Drones equipped with superior navigational technology are projected to meet diverse delivery needs, ensuring optimal routes and safety during operations.

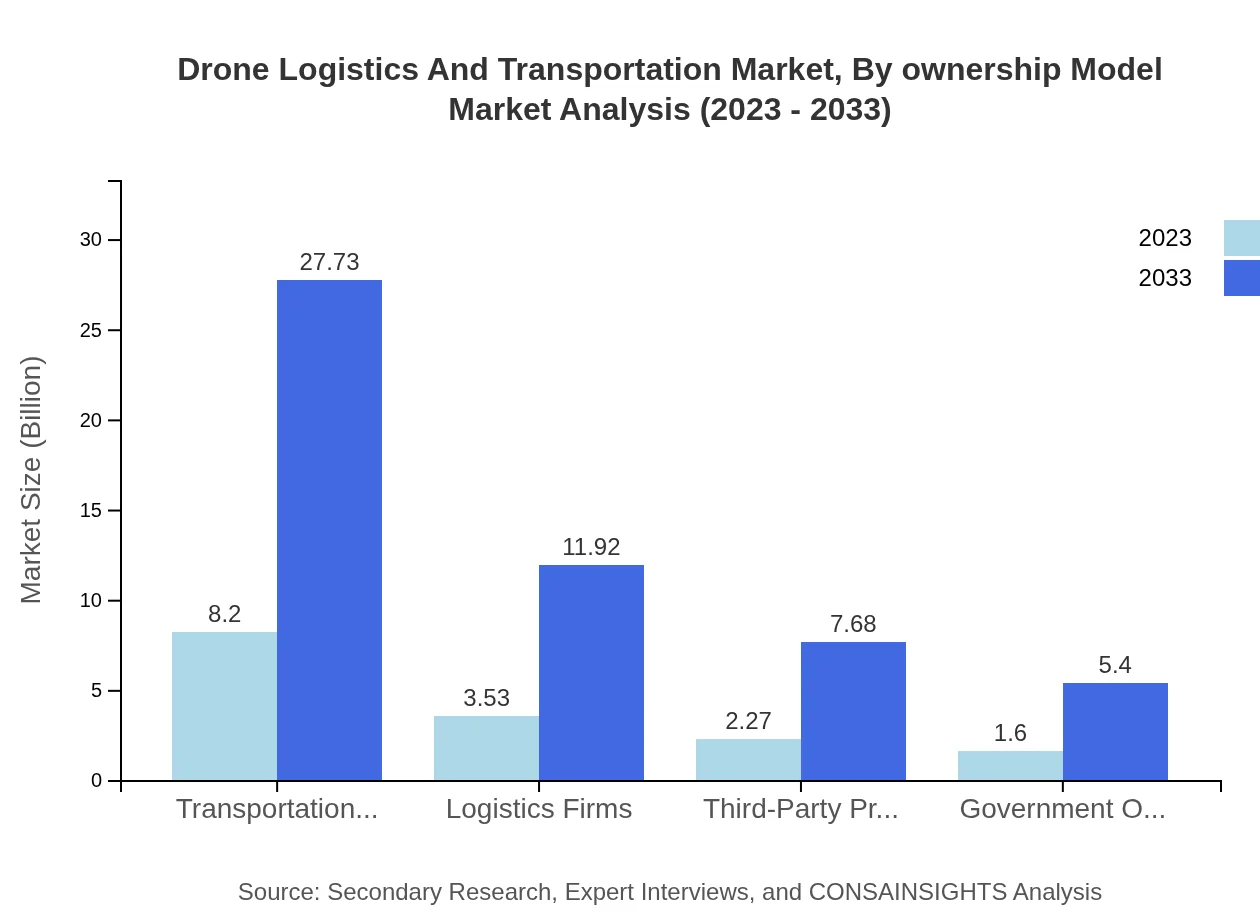

Drone Logistics And Transportation Market Analysis By Ownership Model

The ownership model segment is characterized by Transportation Companies and Logistics Firms, which collectively dominate the market. In 2023, Transportation Companies represent about 52.59% share with an estimated market size of $8.20 billion. Third-Party Providers are also emerging, expected to capture a growing share as companies seek to outsource logistics operations.

Drone Logistics And Transportation Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Drone Logistics And Transportation Industry

Amazon Prime Air:

Amazon's logistics division focusing on using drones for fast delivery. They are pioneering the market with ongoing trials and investments in drone infrastructure.Zipline:

Specializing in drone delivery of medical supplies, Zipline has successfully implemented drone logistics in several countries, significantly impacting healthcare delivery possibilities.Wing (Alphabet Inc.):

A leader in drone delivery technology, Wing is extending its services in urban areas, working on regulatory advancements and technology refinement.DHL:

A top logistics provider investing in drone technology to improve its delivery efficiency and offer innovative logistics solutions for its clients.We're grateful to work with incredible clients.

FAQs

What is the market size of drone Logistics And Transportation?

The global market size of the drone logistics and transportation industry is projected to reach approximately $15.6 billion by 2033, growing with a CAGR of 12.4% from 2023. This significant expansion highlights the increasing demand for drone services in logistics.

What are the key market players or companies in this drone Logistics And Transportation industry?

Key players in the drone logistics and transportation industry include major companies such as Zipline, Amazon Prime Air, Google Wing, and UPS Flight Forward, among others, who are all heavily investing in innovative drone technologies to enhance delivery efficiency.

What are the primary factors driving the growth in the drone Logistics And Transportation industry?

Growth in the drone logistics and transportation sector is driven by factors such as the need for faster delivery options, increasing investments in drone technology, rising e-commerce activities, and demand for efficient medical supply delivery in remote areas.

Which region is the fastest Growing in the drone Logistics And Transportation?

The fastest-growing region in the drone logistics and transportation industry is projected to be North America, with a market size expected to grow from $5.53 billion in 2023 to $18.71 billion by 2033, reflecting significant adoption of drone technologies.

Does ConsaInsights provide customized market report data for the drone Logistics And Transportation industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the drone logistics and transportation industry, ensuring that stakeholders have access to accurate and relevant insights for strategic planning.

What deliverables can I expect from this drone Logistics And Transportation market research project?

Expected deliverables from the drone logistics and transportation market research project include comprehensive market analysis reports, insights on competitive landscape, consumer trends, and detailed segment data across various categories including regional performance.

What are the market trends of drone Logistics And Transportation?

Current market trends in drone logistics and transportation include the rise of autonomous drones, growth in e-commerce delivery applications, enhancement of drone navigational systems, and increasing governmental regulations supporting drone operations in various sectors.