Drone Payload Market Report

Published Date: 03 February 2026 | Report Code: drone-payload

Drone Payload Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Drone Payload market for the forecast period of 2023 to 2033. It includes insights on market size, growth rates, industry dynamics, regional performance, and key trends shaping the future of the market.

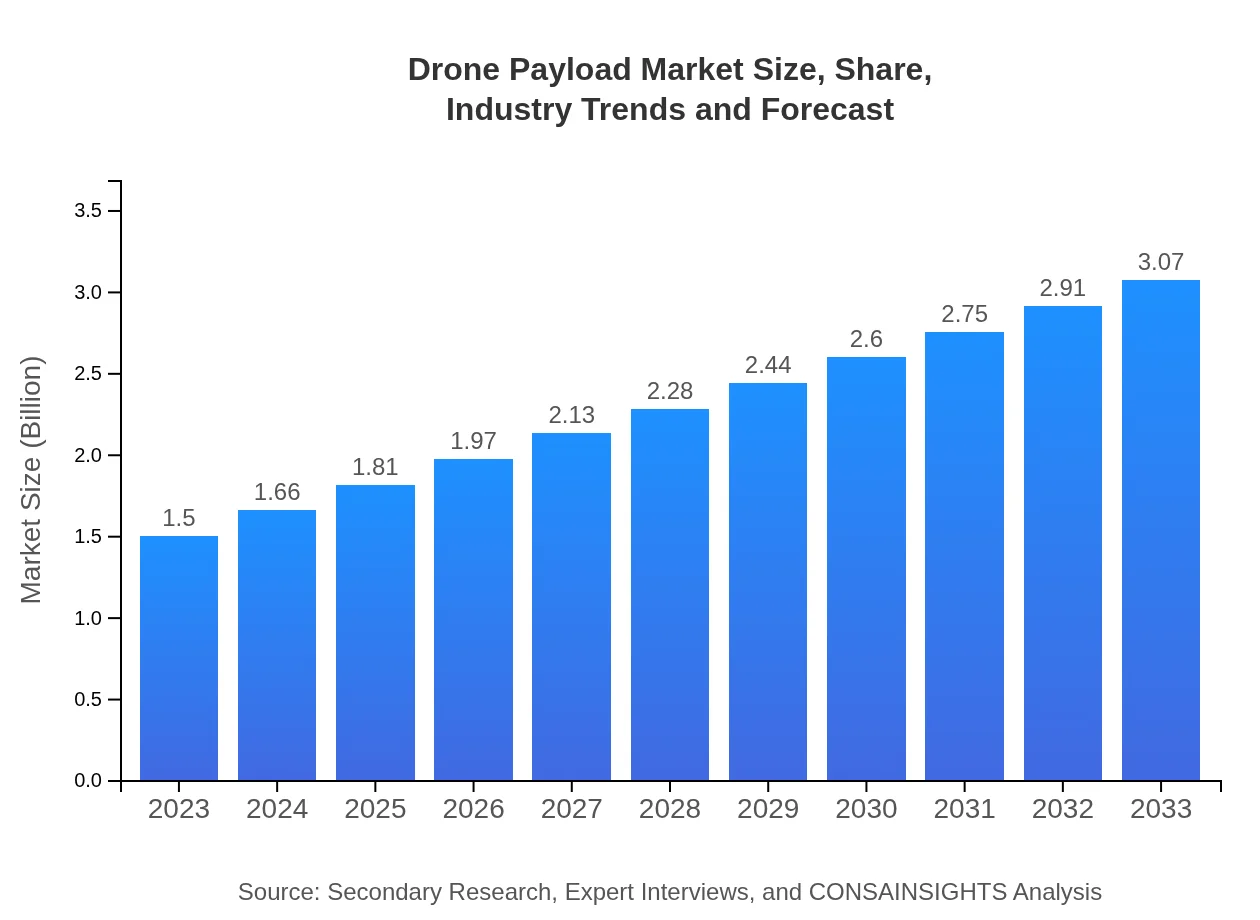

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $3.07 Billion |

| Top Companies | DJI, Northrop Grumman, Parrot Drones, Textron |

| Last Modified Date | 03 February 2026 |

Drone Payload Market Overview

Customize Drone Payload Market Report market research report

- ✔ Get in-depth analysis of Drone Payload market size, growth, and forecasts.

- ✔ Understand Drone Payload's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Drone Payload

What is the Market Size & CAGR of Drone Payload market in 2023?

Drone Payload Industry Analysis

Drone Payload Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Drone Payload Market Analysis Report by Region

Europe Drone Payload Market Report:

The European market is set to expand from $0.39 billion in 2023 to $0.79 billion by 2033, driven by increasing regulations for drone operations and growing applications in industries such as surveillance, agriculture, and disaster management.Asia Pacific Drone Payload Market Report:

The Asia Pacific region is expected to exhibit significant growth, with the market projected to grow from $0.31 billion in 2023 to $0.64 billion by 2033. Rapid urbanization and increasing agricultural practices are driving demand for drone applications in logistics and agriculture, further supported by government initiatives promoting UAV technology.North America Drone Payload Market Report:

North America leads the Drone Payload market, anticipated to grow from $0.56 billion in 2023 to $1.14 billion by 2033. This growth is attributed to advancements in drone technology, widespread adoption in commercial markets, and strong investments in R&D by leading companies in the region.South America Drone Payload Market Report:

In South America, the Drone Payload market is projected to grow from $0.13 billion in 2023 to $0.26 billion by 2033. The region's focus on improving agricultural output and addressing environmental challenges through the use of drones is a primary growth driver.Middle East & Africa Drone Payload Market Report:

The Middle East and Africa region is expected to grow from $0.12 billion in 2023 to $0.24 billion by 2033. The rising adoption of drones for security, surveillance, and environmental monitoring in this region is boosting market development.Tell us your focus area and get a customized research report.

Drone Payload Market Analysis By Type

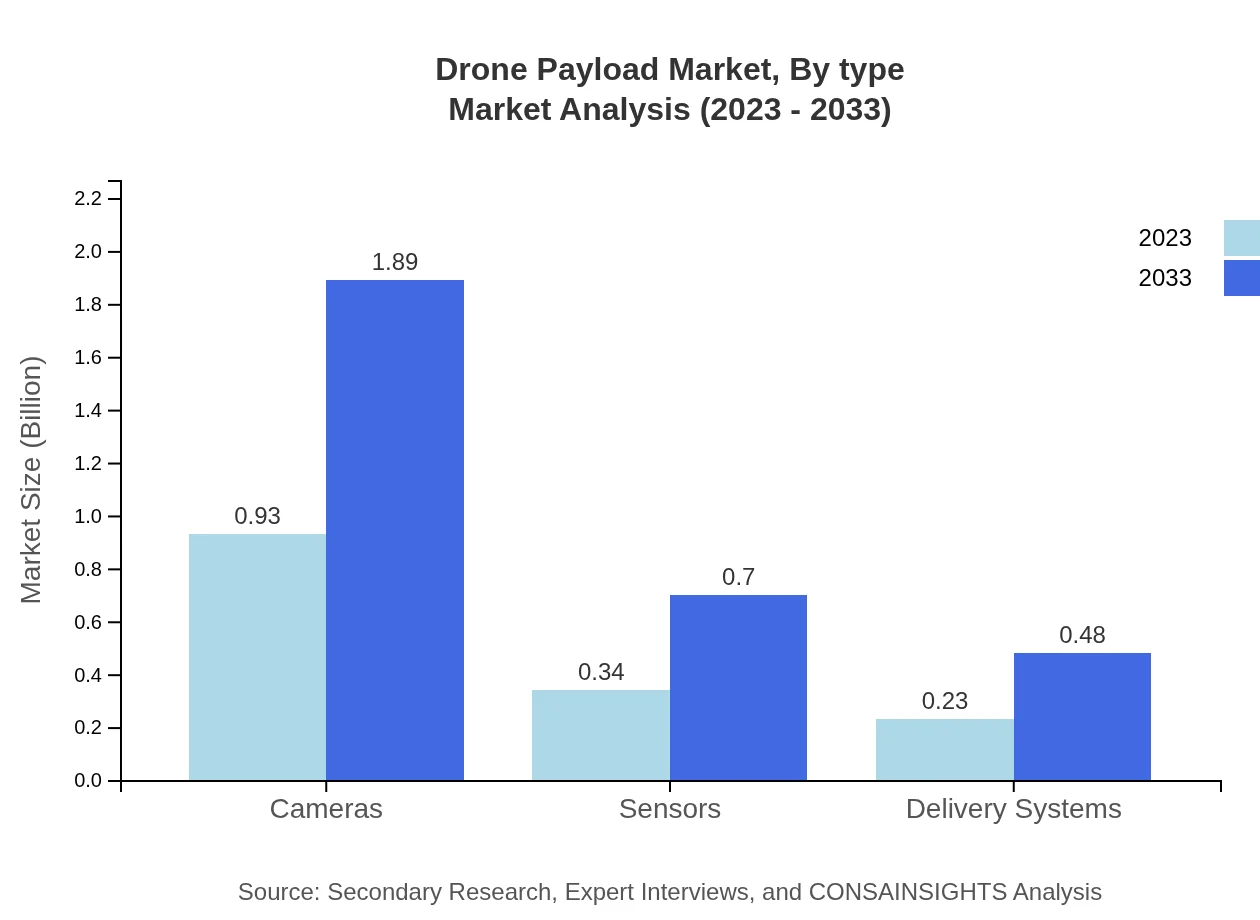

The drone payload market by type is dominated by cameras, which are projected to generate $0.93 billion in 2023, growing to $1.89 billion by 2033, holding a market share of 61.76%. Sensors represent the next significant segment, growing from $0.34 billion to $0.70 billion, capturing a 22.69% share. Delivery systems and autonomous systems continue to evolve, projected to grow similarly, expanding their role in logistics and enterprise solutions.

Drone Payload Market Analysis By Application

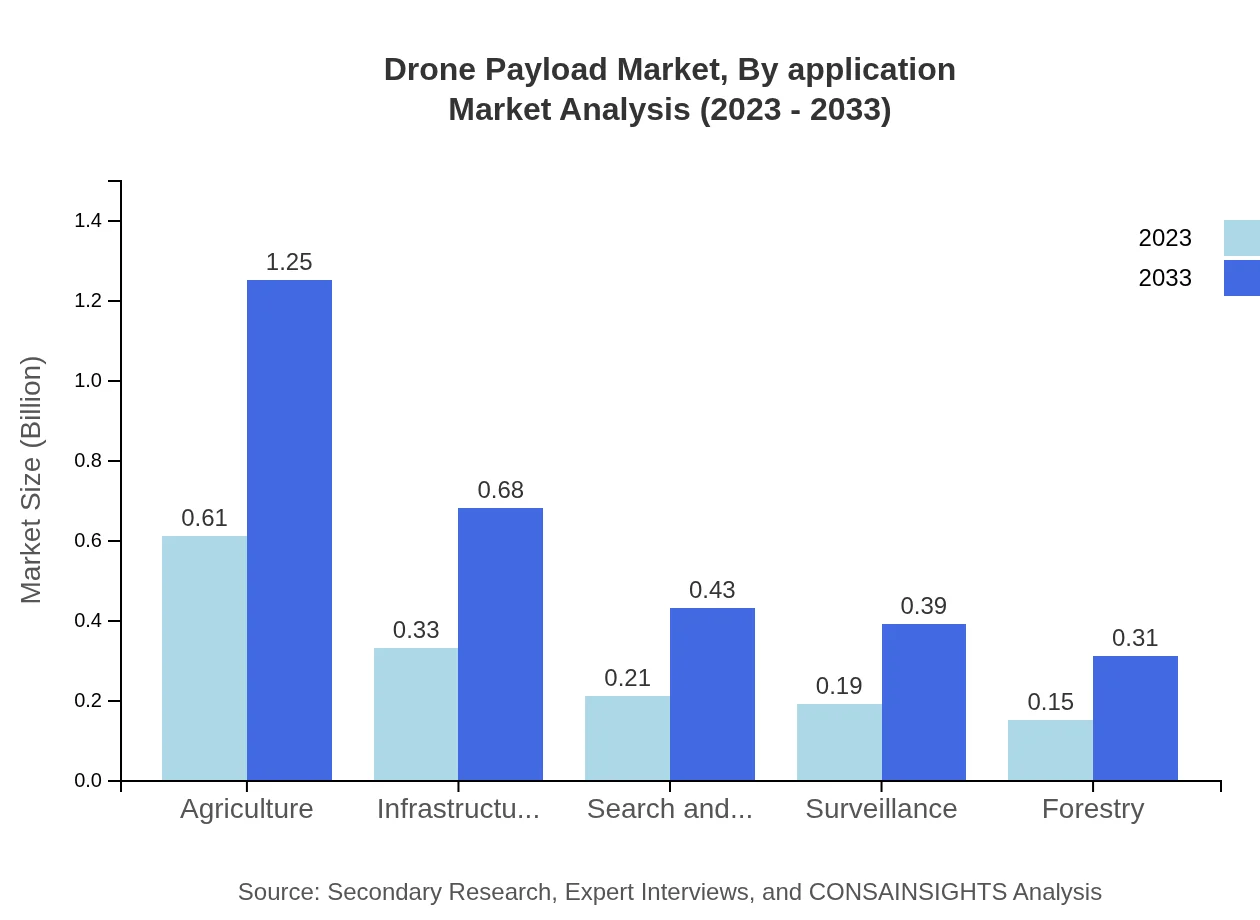

In terms of applications, the agriculture segment leads, projected to expand from $0.61 billion in 2023 to $1.25 billion by 2033, reflecting a 40.76% market share. Defense applications are close behind, expected to grow from $0.76 billion to $1.55 billion, making up 50.69% of the market. Other notable applications include infrastructure inspection and search and rescue services, each contributing significantly to the market.

Drone Payload Market Analysis By Market Segment

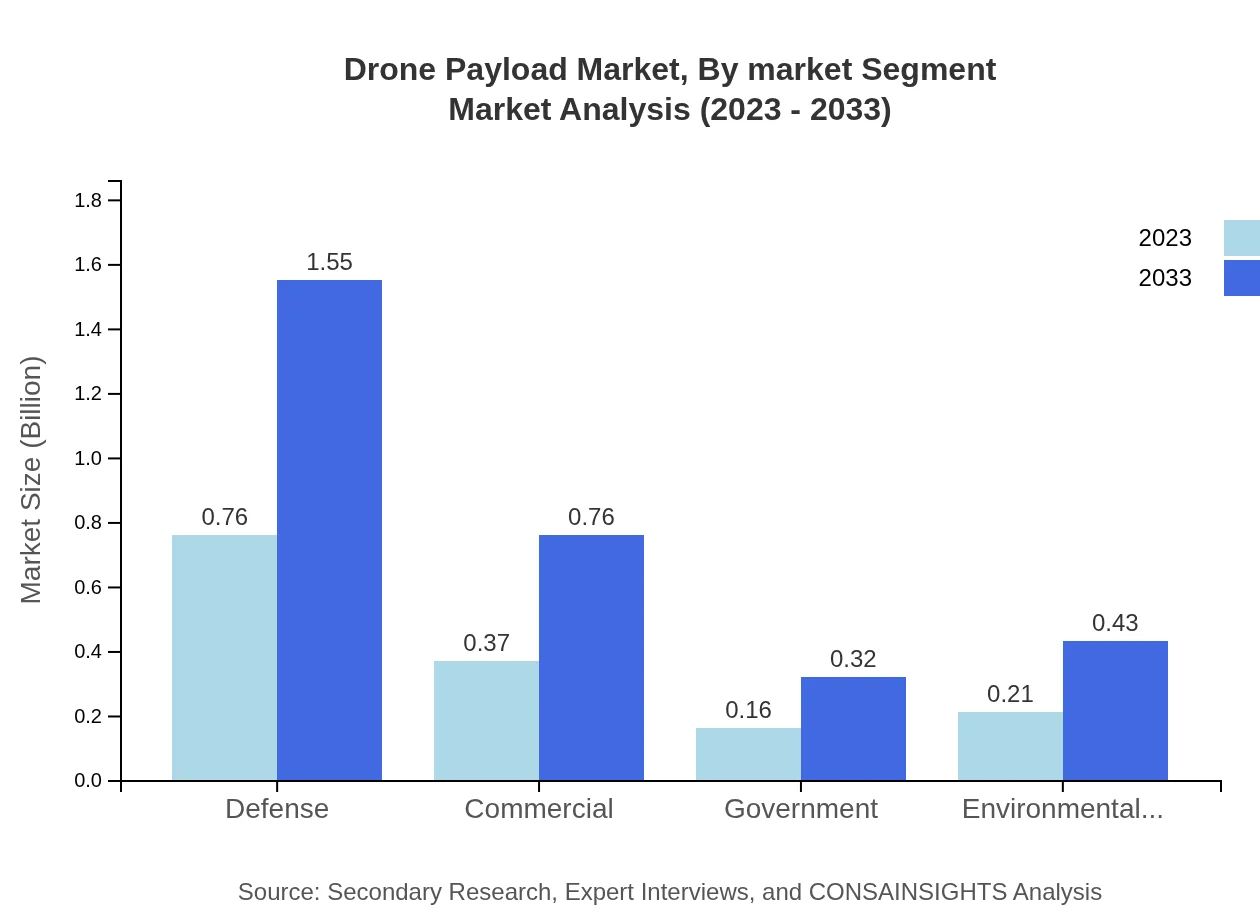

The market is further segmented by market segment, with commercial applications generating substantial revenue due to increased adoption in various industries. The government segment is also noteworthy, capturing a 10.39% market share, growing from $0.16 billion to $0.32 billion, focusing on environmental monitoring and public safety.

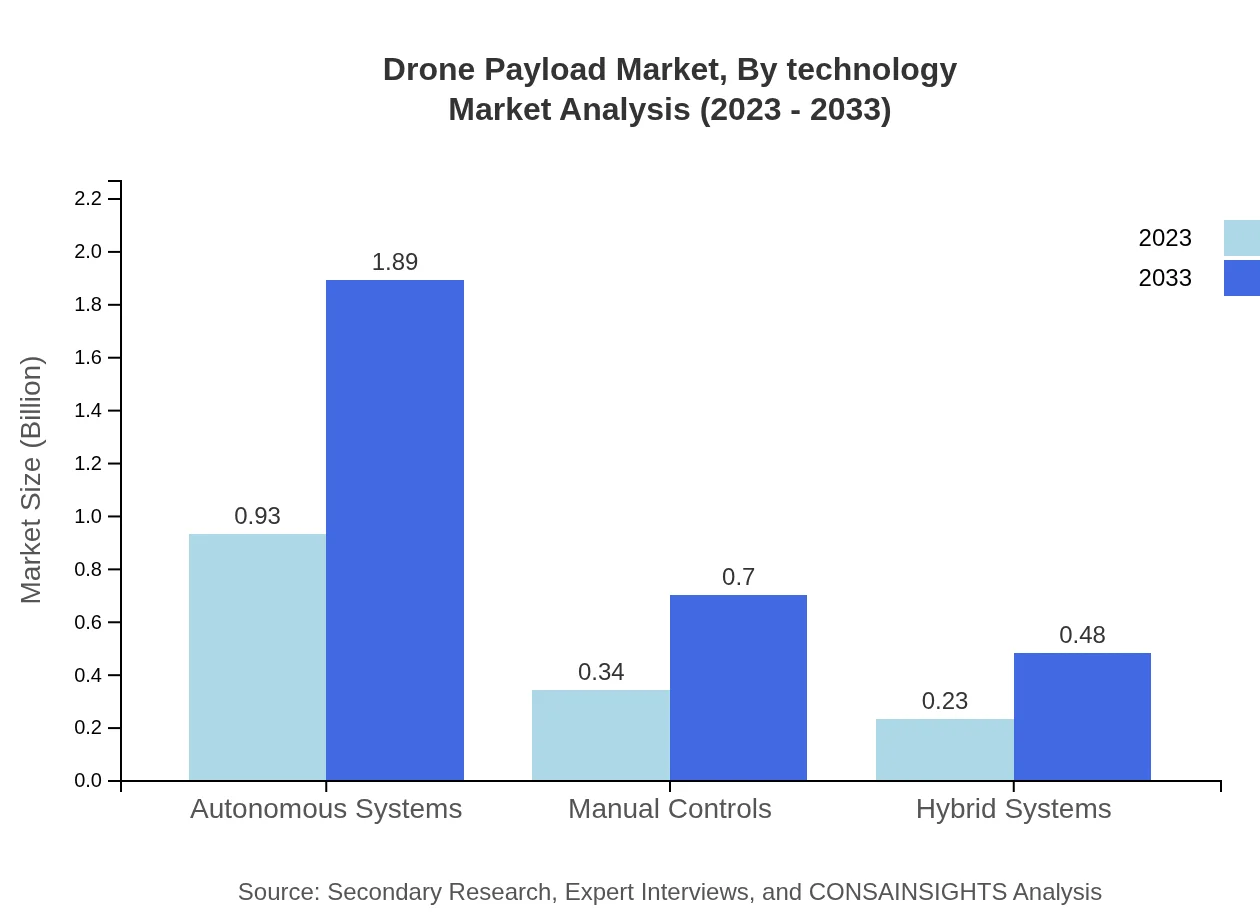

Drone Payload Market Analysis By Technology

Technologically, the drone payload market showcases rapid advancements in autonomous systems. This segment is expected to reach $1.89 billion by 2033, with an impressive market share growth. Innovations in artificial intelligence, machine learning for drone operations, and real-time data processing are transforming payload efficiency and effectiveness in multiple sectors.

Drone Payload Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Drone Payload Industry

DJI:

A leading manufacturer of consumer and professional drones, DJI is pivotal in setting standards in drone technology with innovative payload and imaging solutions.Northrop Grumman:

Specialized in defense, Northrop Grumman develops UAVs with advanced payload capabilities for military surveillance and reconnaissance.Parrot Drones:

Parrot specializes in commercial drones for agriculture and professional use, providing integrated payloads to enhance operational efficiency.Textron:

Known for its diverse portfolio in aerospace and defense, Textron manufactures military drones equipped with sophisticated payload systems.We're grateful to work with incredible clients.

FAQs

What is the market size of drone Payload?

The global drone payload market is projected to grow significantly, valued at approximately $1.5 billion in 2023 and expected to grow at a CAGR of 7.2%, illustrating its increasing relevance and application in various industries.

What are the key market players or companies in this drone Payload industry?

Key players in the drone payload market include established companies specializing in aerospace technology, sensor integration, and hardware development, showcasing a competitive landscape focused on innovation and tailored solutions for diverse applications.

What are the primary factors driving the growth in the drone payload industry?

Driving factors include advancements in drone technology, increased demand for surveillance and monitoring applications, and significant investments in agriculture and logistics sectors, emphasizing efficiency and precise delivery systems.

Which region is the fastest Growing in the drone payload market?

North America is the fastest-growing region in the drone payload market, projected to expand from $0.56 billion in 2023 to $1.14 billion by 2033, reflecting robust technological adoption and favorable regulatory frameworks.

Does ConsaInsights provide customized market report data for the drone payload industry?

Yes, ConsaInsights offers tailored market report data for the drone payload industry, accommodating specific business needs and providing detailed insights to support strategic decision-making and market positioning.

What deliverables can I expect from this drone payload market research project?

Expect comprehensive deliverables including detailed market analysis, trends forecasting, competitive landscape review, and tailored recommendations to navigate the evolving drone payload market effectively.

What are the market trends of drone payload?

Market trends indicate a surge in autonomous drone systems, increasing integration of advanced sensors, and heightened focus on regulatory compliance, all contributing to enhanced operational capabilities and expanded application areas.