Drone Sensor Market Report

Published Date: 31 January 2026 | Report Code: drone-sensor

Drone Sensor Market Size, Share, Industry Trends and Forecast to 2033

This report covers the comprehensive analysis of the Drone Sensor market from 2023 to 2033, providing insights on market size, segmentation, growth trends, and major players, along with forecasts for future market developments.

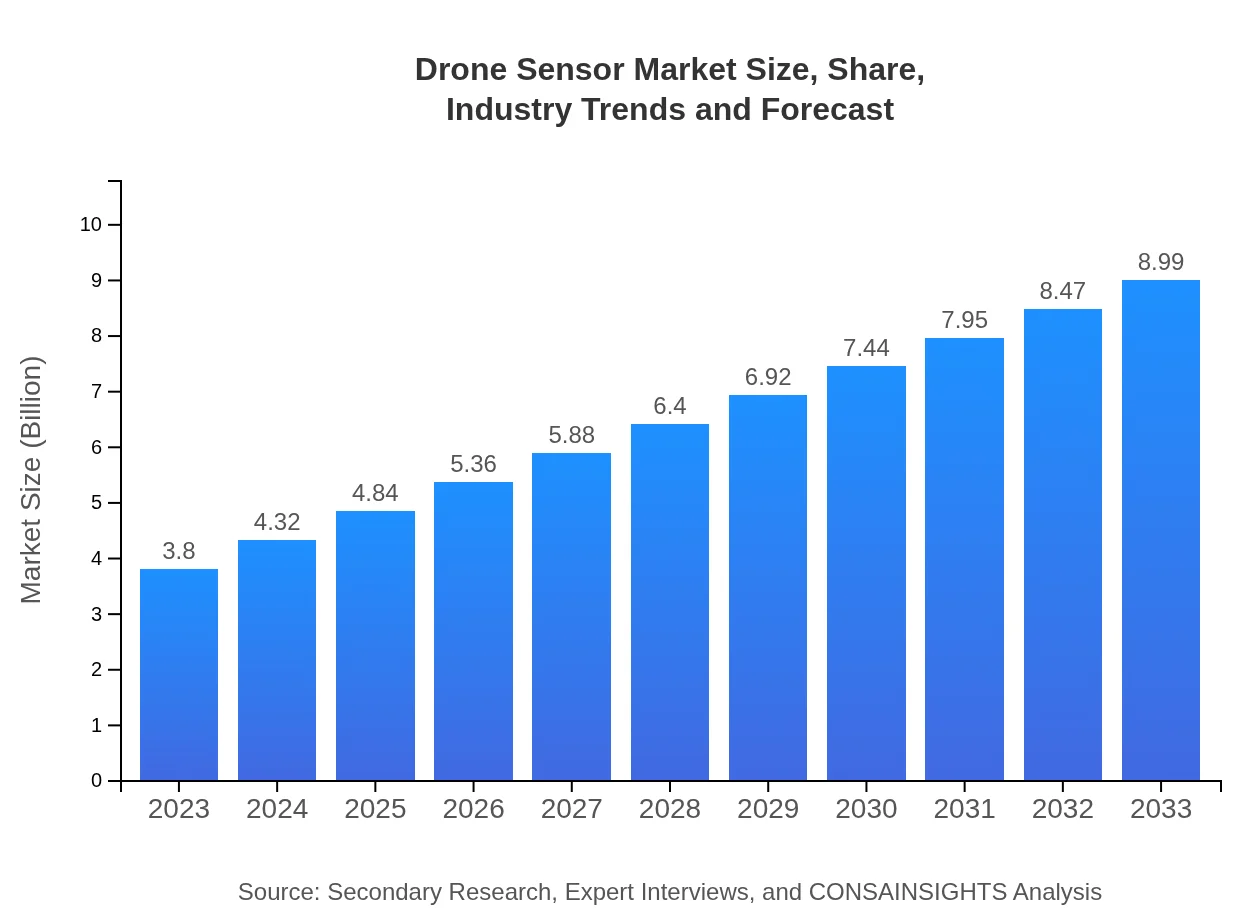

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.80 Billion |

| CAGR (2023-2033) | 8.7% |

| 2033 Market Size | $8.99 Billion |

| Top Companies | DJI, senseFly, Parrot, FLIR Systems, 3D Robotics |

| Last Modified Date | 31 January 2026 |

Drone Sensor Market Overview

Customize Drone Sensor Market Report market research report

- ✔ Get in-depth analysis of Drone Sensor market size, growth, and forecasts.

- ✔ Understand Drone Sensor's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Drone Sensor

What is the Market Size & CAGR of Drone Sensor market in 2023?

Drone Sensor Industry Analysis

Drone Sensor Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Drone Sensor Market Analysis Report by Region

Europe Drone Sensor Market Report:

The European Drone Sensor market is projected to expand from $1.03 billion in 2023 to $2.45 billion by 2033. The growth trend can be attributed to the increasing use of drones in various sectors such as environmental monitoring, emergency services, and delivery applications.Asia Pacific Drone Sensor Market Report:

In the Asia Pacific region, the Drone Sensor market is projected to grow from $0.82 billion in 2023 to $1.95 billion by 2033. This growth is propelled by the rapid industrialization in countries like China and India, alongside significant government investments in drone technology for agricultural and surveillance purposes.North America Drone Sensor Market Report:

North America represents one of the largest markets, anticipated to grow from $1.29 billion in 2023 to $3.06 billion by 2033. This is largely due to the high adoption rates of drone technology in commercial applications, significant investments by key industry players, and favorable regulatory environments.South America Drone Sensor Market Report:

The Drone Sensor market in South America is expected to increase from $0.23 billion in 2023 to $0.55 billion in 2033. The growth in this region is driven by increasing applications in agriculture and infrastructure monitoring with a rising awareness of technological advancements.Middle East & Africa Drone Sensor Market Report:

In the Middle East and Africa region, the market is forecasted to grow from $0.42 billion in 2023 to $0.99 billion by 2033, driven primarily by advancements in security and surveillance applications in defense and border control.Tell us your focus area and get a customized research report.

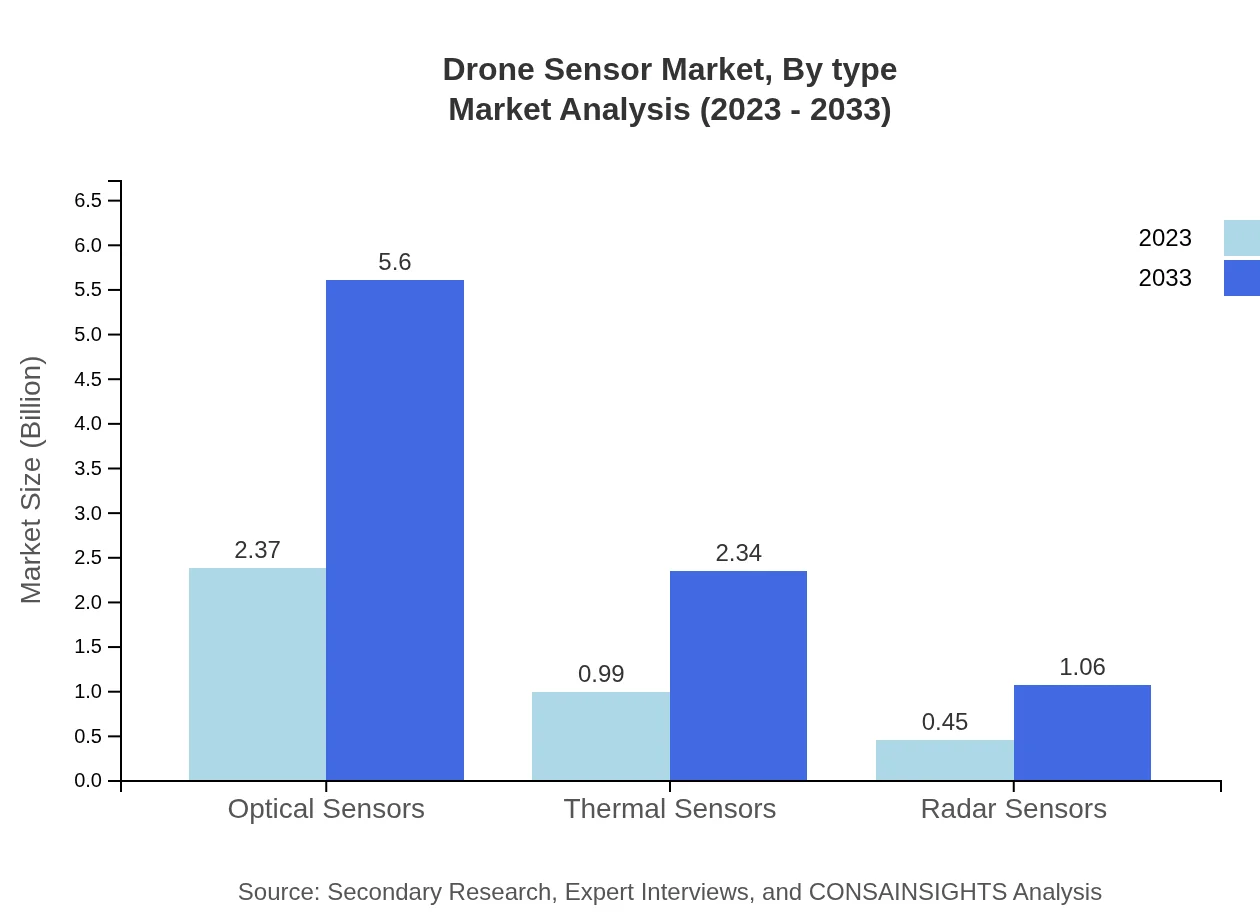

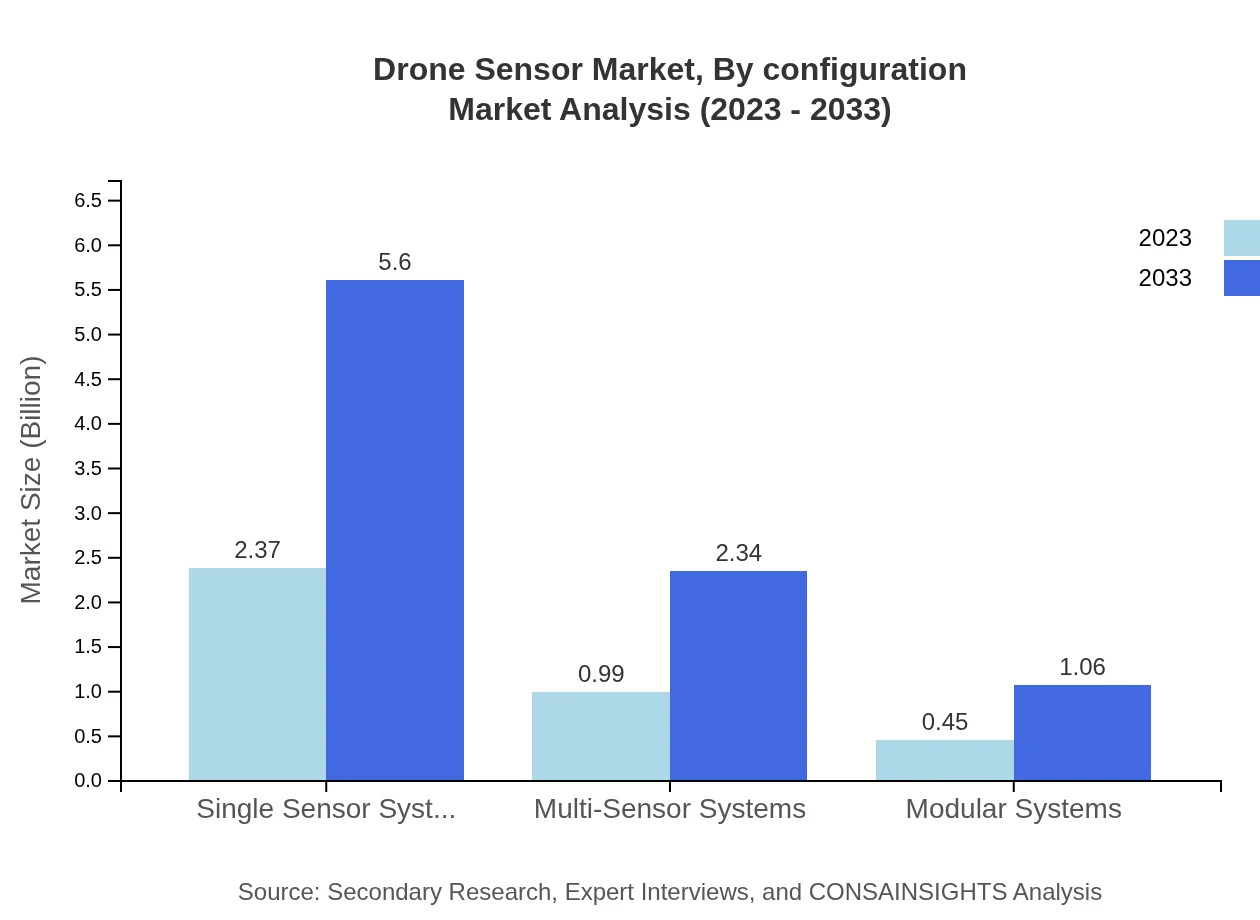

Drone Sensor Market Analysis By Type

The market by type includes Optical Sensors, Thermal Sensors, and Radar Sensors. Optical Sensors constituted the largest share in 2023, valued at $2.37 billion and projected to reach $5.60 billion by 2033 with a share maintaining at 62.26%. Thermal Sensors, valued at $0.99 billion in 2023, are expected to expand to $2.34 billion (25.97% share). Radar Sensors, although the smallest segment at $0.45 billion, will grow to $1.06 billion (11.77% share).

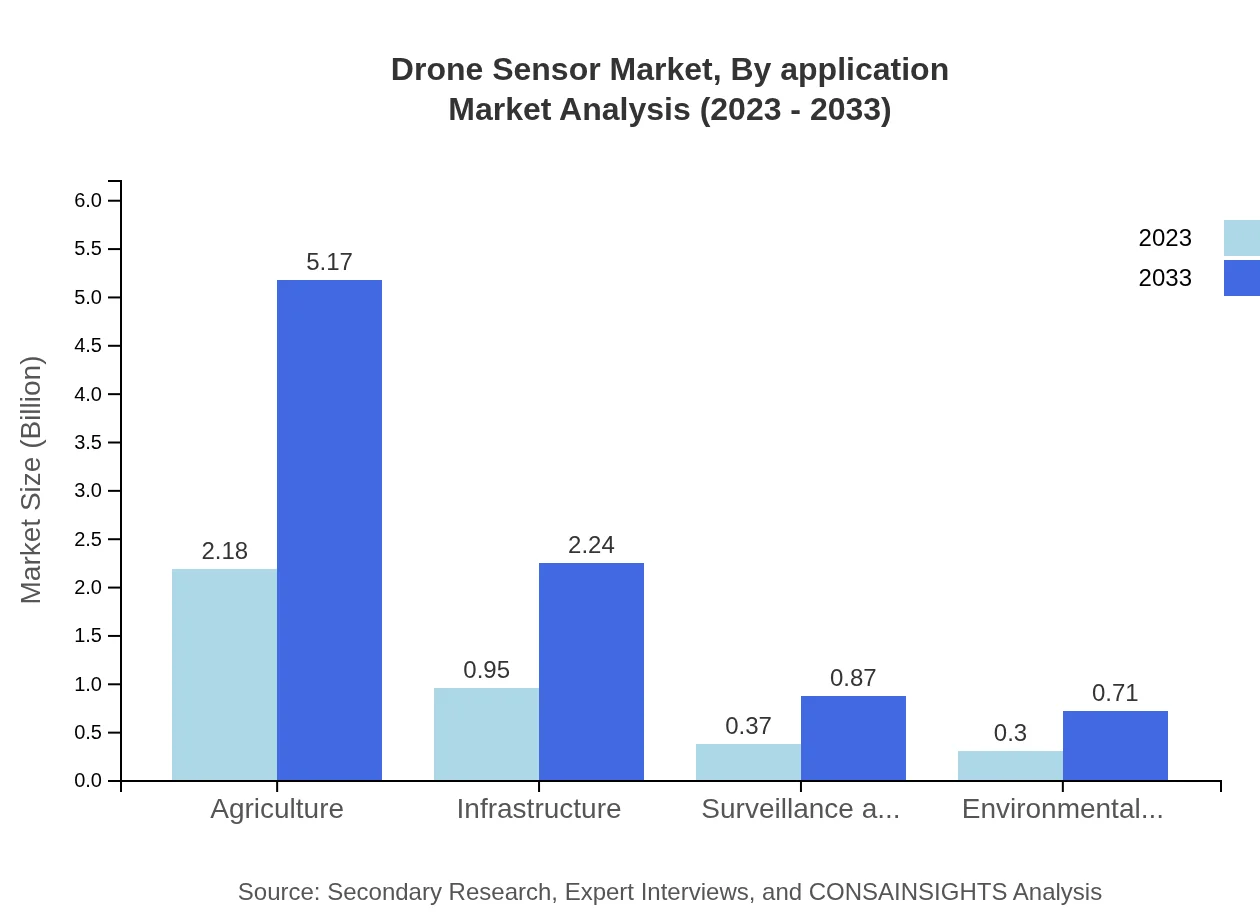

Drone Sensor Market Analysis By Application

The key applications are Commercial, Government, Agriculture, and Research & Academia. The Commercial segment leads with a market size of $2.18 billion in 2023, growing to $5.17 billion by 2033 (57.48% share). Government applications are also significant, expected to expand from $0.95 billion (24.94% share) to $2.24 billion. Agriculture, while smaller, is anticipated to grow from $0.37 billion to $0.87 billion (9.67%).

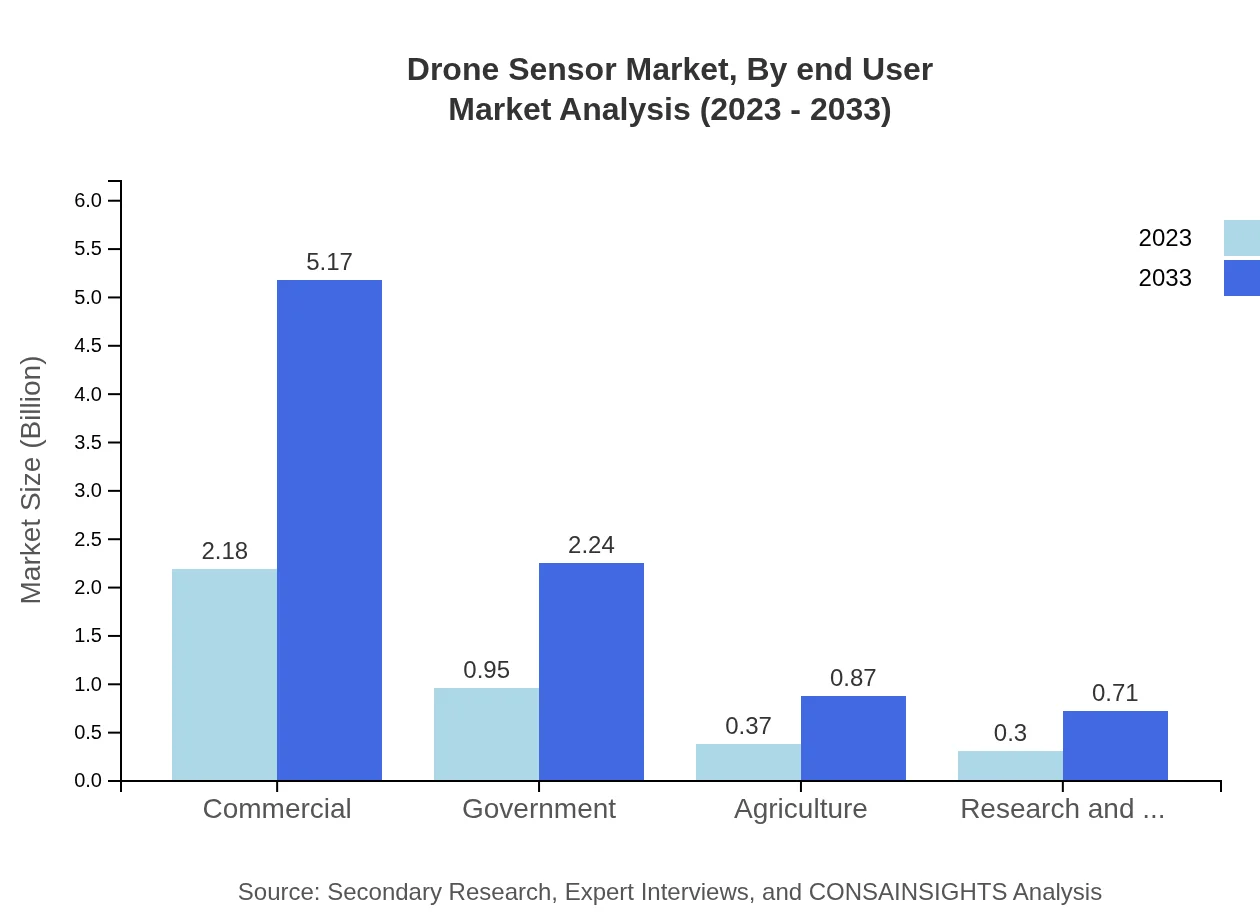

Drone Sensor Market Analysis By End User

The market indicates varying growth across end-user categories. Commercial users dominate the market size at $2.18 billion in 2023 (57.48% share). Government projects are essential, with forecasts indicating growth from $0.95 billion to $2.24 billion (24.94% share). Research and Academia will also grow with a smaller size but notable at $0.30 billion (7.91%).

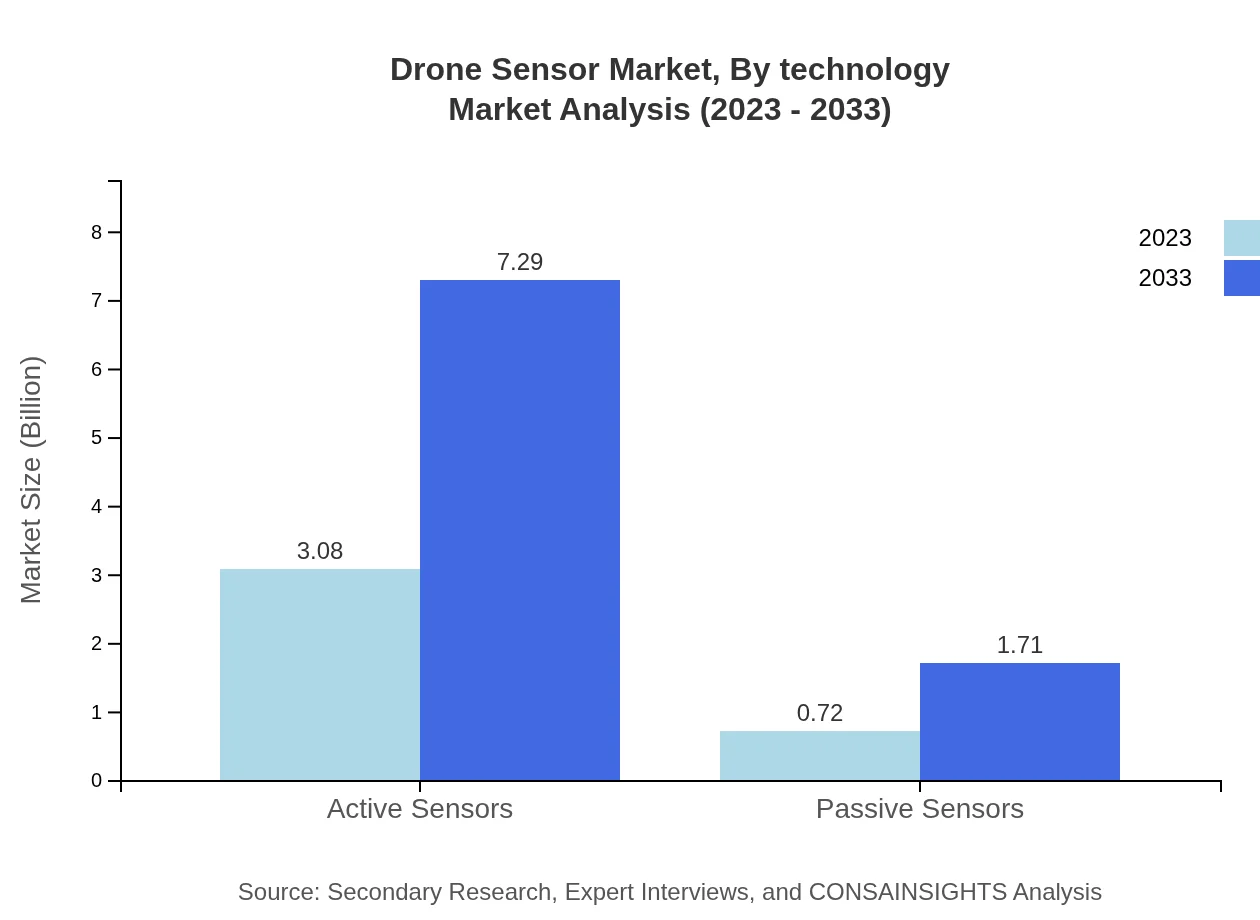

Drone Sensor Market Analysis By Technology

In terms of technology, Active Sensors is the largest category at $3.08 billion (81.04% share) and is expected to grow considerably. Passive Sensors, at $0.72 billion (18.96% share), is also seeing favorable growth metrics, projected at $1.71 billion by 2033.

Drone Sensor Market Analysis By Configuration

The configuration categories primarily include single sensor systems, multi-sensor systems, and modular systems. Single Sensor Systems lead with $2.37 billion (62.26% share) in 2023, while Multi-Sensor Systems account for $0.99 billion (25.97% share), projected to improve as technology advances. Modular Systems, although a niche segment, will see growth from $0.45 billion (11.77%).

Drone Sensor Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Drone Sensor Industry

DJI:

As a leading manufacturer of drones, DJI integrates advanced sensor technologies into its products, helping to revolutionize aerial imaging and data collection.senseFly:

Known for its fixed-wing drones, senseFly specializes in providing drone solutions for mapping and surveying, utilizing cutting-edge sensor technology.Parrot:

A pioneer in consumer drones, Parrot develops a range of products equipped with sophisticated sensing mechanisms for various applications, from entertainment to agriculture.FLIR Systems:

A leader in thermal imaging technologies, FLIR contributes to the drone sensor market with advanced thermal sensors used for security and surveillance.3D Robotics:

3D Robotics offers drone-based solutions primarily targeting the professional market, integrating multiple sensors for improved data accuracy in various sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of Drone Sensor?

The global Drone Sensor market is projected to reach $3.8 billion by 2033, exhibiting a CAGR of 8.7%. This growth reflects the increasing demand for advanced aerial surveillance, mapping, and data collection applications.

What are the key market players or companies in the Drone Sensor industry?

The key players in the Drone Sensor market include leading companies such as DJI, FLIR Systems, and Honeywell, who provide innovative sensor technologies to cater to various industrial applications, including agriculture, infrastructure, and military.

What are the primary factors driving the growth in the Drone Sensor industry?

Factors driving the growth include increasing demand for UAVs in agriculture for crop monitoring, advancements in sensor technology, and the rising need for efficient surveillance and security solutions in urban areas and critical infrastructures.

Which region is the fastest Growing in the Drone Sensor market?

North America is the fastest-growing region in the Drone Sensor market, with a projected growth from $1.29 billion in 2023 to $3.06 billion by 2033. This growth is fueled by technological advancements and extensive adoption across various sectors.

Does ConsaInsights provide customized market report data for the Drone Sensor industry?

Yes, ConsaInsights offers tailored market report data for the Drone Sensor industry, allowing clients to access specific insights and analytics based on their unique requirements and research focus.

What deliverables can I expect from this Drone Sensor market research project?

Deliverables from this market research project include detailed market analysis reports, segment-wise data, regional insights, competitive landscape evaluation, and forecasts that cater to strategic decision-making.

What are the market trends of Drone Sensor?

Current market trends in the Drone Sensor industry showcase a shift towards multi-sensor systems integration, increased focus on regulatory compliance, and innovation in sensor technologies driven by the rise of autonomous aerial vehicles.