Drones Market Report

Published Date: 03 February 2026 | Report Code: drones

Drones Market Size, Share, Industry Trends and Forecast to 2033

This report explores the Drones market's current landscape, future growth forecasts, and technological advancements from 2023 to 2033. It provides valuable growth insights, market size, segmentation analysis, and detailed regional breakdowns.

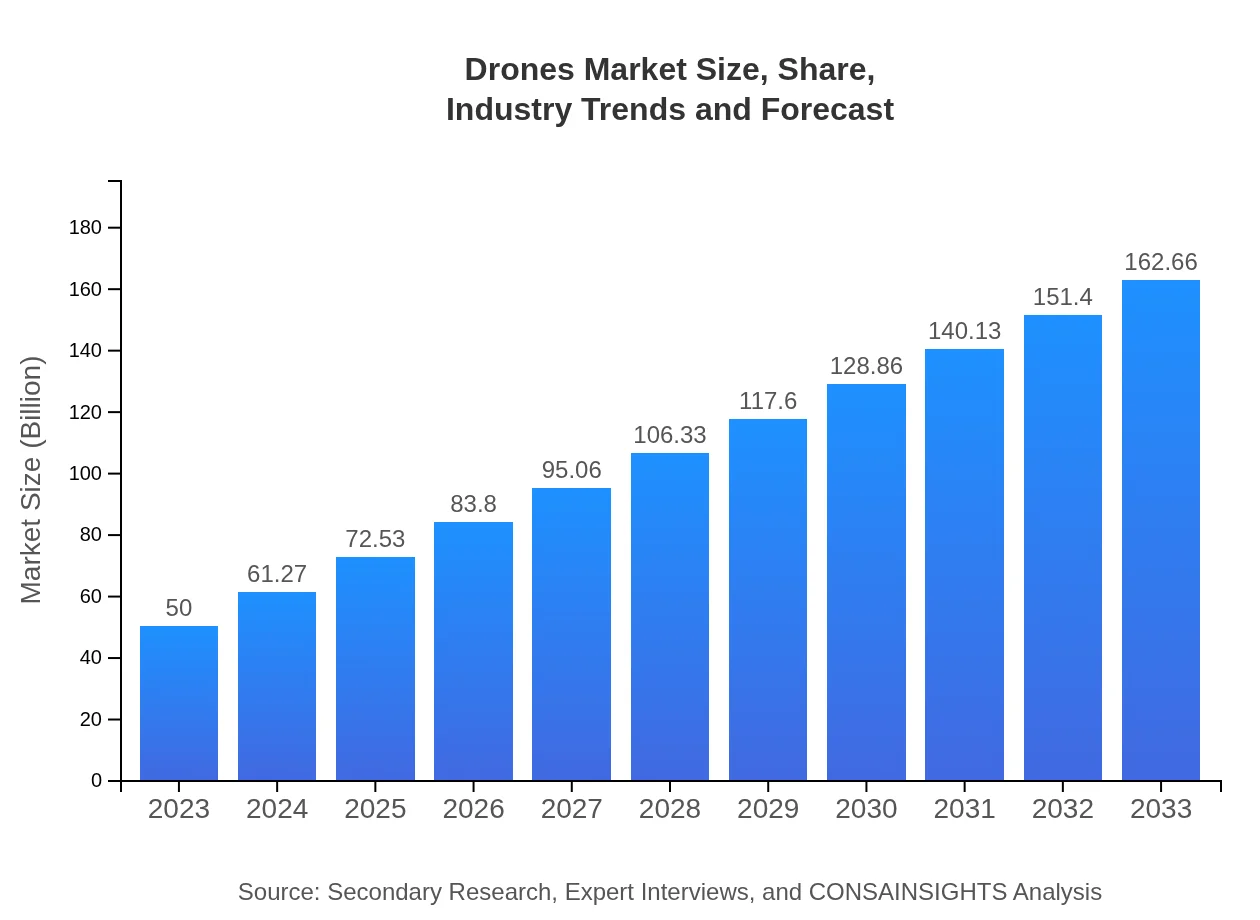

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $50.00 Billion |

| CAGR (2023-2033) | 12% |

| 2033 Market Size | $162.66 Billion |

| Top Companies | DJI, Parrot Drones, Northrop Grumman, Autel Robotics |

| Last Modified Date | 03 February 2026 |

Drones Market Overview

Customize Drones Market Report market research report

- ✔ Get in-depth analysis of Drones market size, growth, and forecasts.

- ✔ Understand Drones's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Drones

What is the Market Size & CAGR of Drones market in 2023?

Drones Industry Analysis

Drones Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Drones Market Analysis Report by Region

Europe Drones Market Report:

Europe shows significant potential with a market size of $14.83 billion expected in 2023, potentially reaching $48.25 billion by 2033. Regulatory advancements, particularly around commercial drone use, are driving investments, particularly in logistics and infrastructure inspection applications.Asia Pacific Drones Market Report:

The Asia Pacific region is anticipated to witness substantial growth, driven by increasing investments in drone technology by governments and enterprises. In 2023, the market is projected to be valued at approximately $9.69 billion, advancing to around $31.51 billion by 2033. The rapid adoption of drones for agricultural purposes and surveillance in this region is a significant growth catalyst.North America Drones Market Report:

North America remains a leader in the drones market, with a projected valuation of $16.31 billion in 2023, skyrocketing to approximately $53.06 billion by 2033. The region's dominance is chiefly due to extensive military use, advancing delivery services, and regulatory support from agencies like the FAA.South America Drones Market Report:

The South American drones market, valued at $3.56 billion in 2023, is expected to expand to $11.60 billion by 2033. The growth is supported by rising demand in agriculture and oil and gas sectors, coupled with improvements in regulatory frameworks for UAV operations.Middle East & Africa Drones Market Report:

In the Middle East and Africa, the drones market is projected to grow from $5.61 billion in 2023 to $18.25 billion by 2033. The adoption of drones for public safety, surveillance, and environmental monitoring is prompting this growth, supported by government initiatives aimed at incorporating drone technology into urban management.Tell us your focus area and get a customized research report.

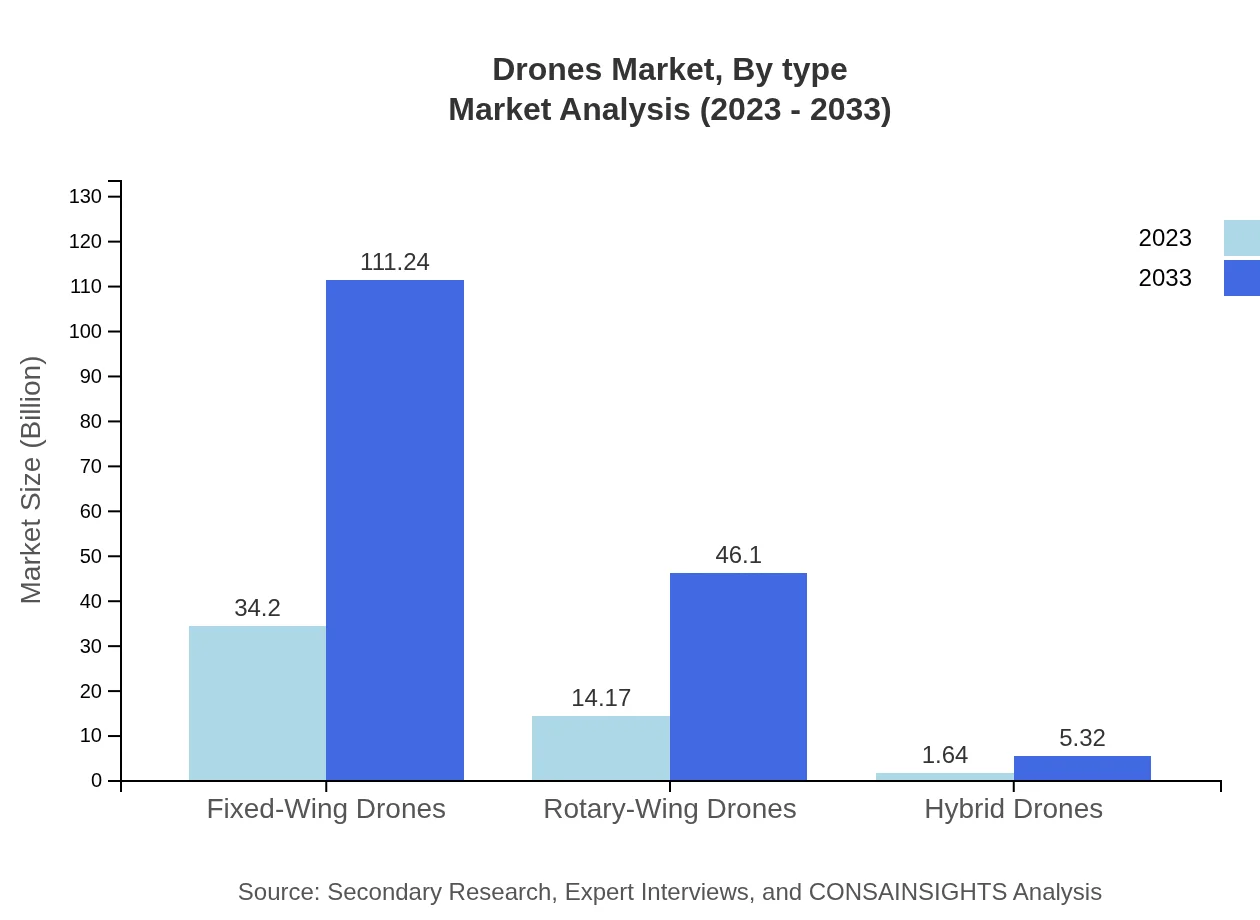

Drones Market Analysis By Type

The drones market is largely divided into fixed-wing, rotary-wing, and hybrid types. Fixed-wing drones dominate the market, projected to grow from $34.20 billion in 2023 to $111.24 billion by 2033, accounting for a 68.39% market share. Rotary-wing drones, with a current market size of $14.17 billion expected to grow to $46.10 billion by 2033, hold a 28.34% share. Hybrid drones are emerging with a smaller share but are projected to grow from $1.64 billion to $5.32 billion, indicating a trend toward multifunctional designs.

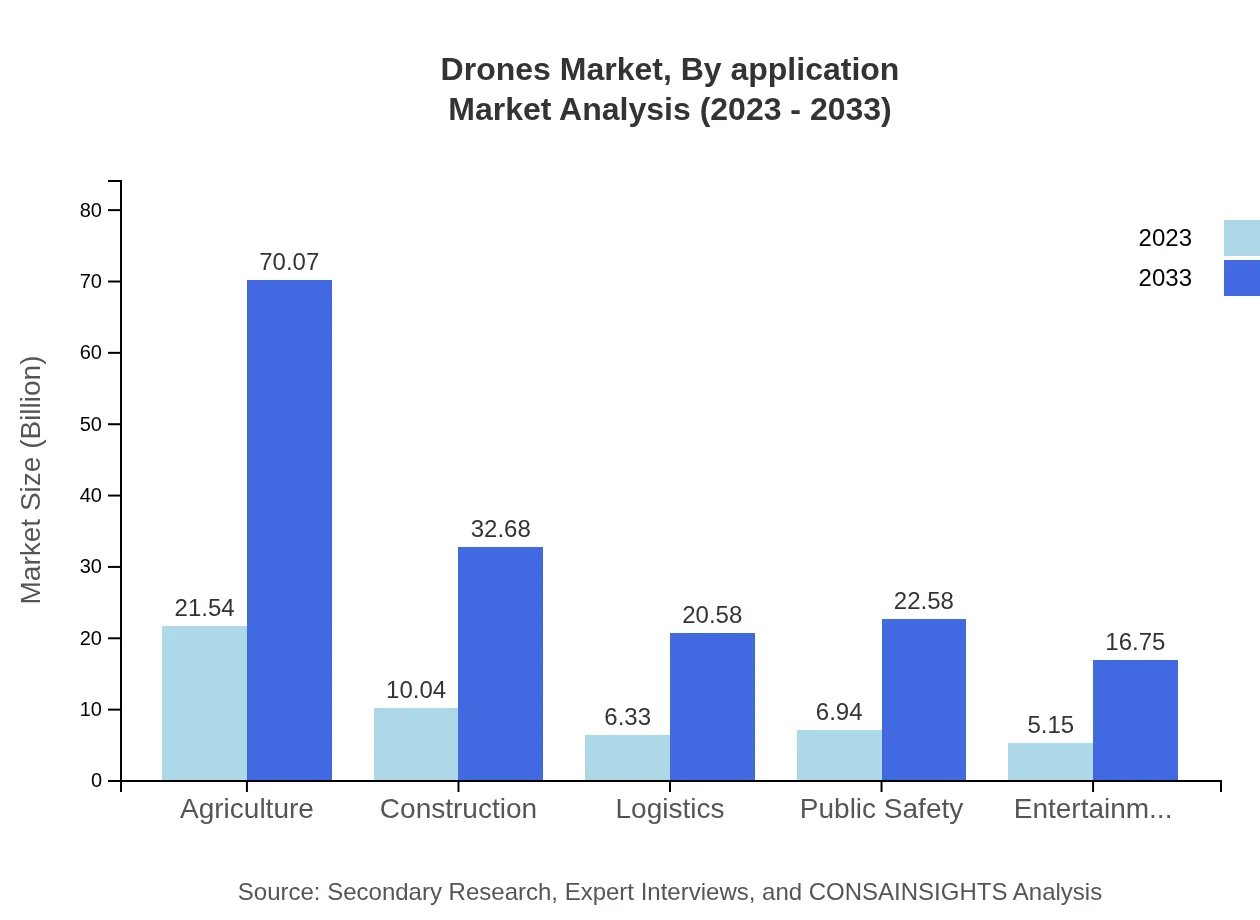

Drones Market Analysis By Application

The applications of drones are extensive, encompassing agriculture, construction, logistics, public safety, entertainment, and more. The agricultural sector leads, with a market size of $21.54 billion in 2023 expected to increase to $70.07 billion by 2033, representing a 43.08% industry share. Logistics follows closely, with projections rising from $6.33 billion to $20.58 billion over the same period, highlighting the industry's shift toward automated delivery systems.

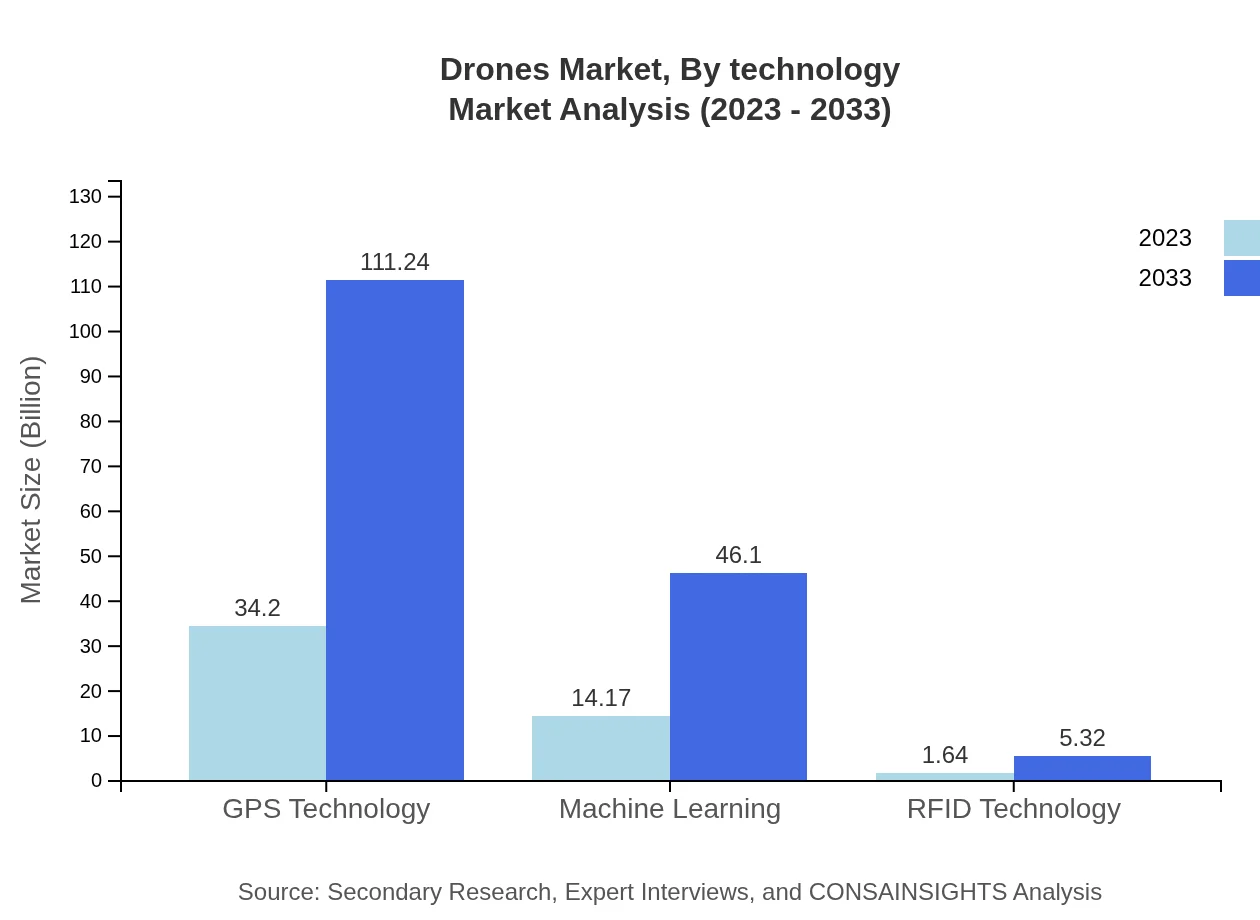

Drones Market Analysis By Technology

Significant technological advancements drive the drones market, with key technologies including GPS, machine learning, and RFID technology. GPS technology alone commands 68.39% share, growing from $34.20 billion in 2023 to $111.24 billion by 2033. Machine learning applications are also gaining traction, expected to increase from $14.17 billion to $46.10 billion, reflecting the growing importance of AI in UAV systems.

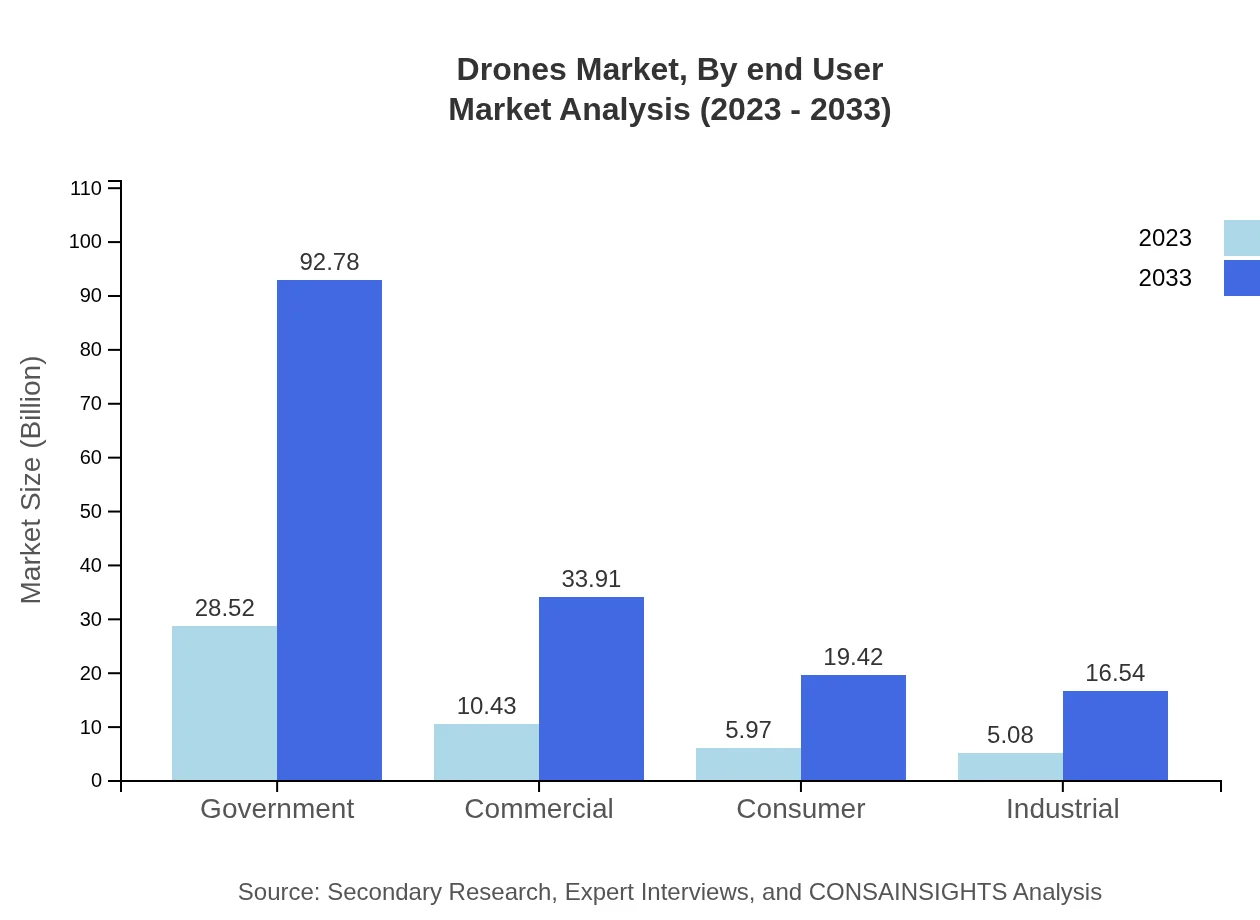

Drones Market Analysis By End User

Key stakeholders in the drones market include government sectors, commercial entities, consumers, and industrial applications. Government use leads the market with a size of $28.52 billion in 2023, projected to rise to $92.78 billion, representing over 57% of the market. Commercial applications are poised for growth, expected to escalate from $10.43 billion to $33.91 billion as businesses recognize the potential of drone technology in enhancing operational efficiency and service delivery.

Drones Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Drones Industry

DJI:

DJI is a leading manufacturer and designer of drone technology, recognized for its innovative designs and market presence in both consumer and professional drone segments globally.Parrot Drones:

Parrot is a key player known for its consumer and commercial drones, emphasizing aerial photography and surveying applications while also focusing on software solutions for drone optimization.Northrop Grumman:

Northrop Grumman specializes in defense and aerospace products, providing advanced military drone technology for reconnaissance and surveillance.Autel Robotics:

Autel Robotics is renowned for its consumer drones, offering various models aimed at photography and videography, as well as enterprise solutions for various industrial applications.We're grateful to work with incredible clients.

FAQs

What is the market size of drones?

The global drones market is projected to grow from $50 billion in 2023 to an estimated size in 2033, reflecting a compound annual growth rate (CAGR) of 12%. This growth indicates significant advancements and adoption across various sectors.

What are the key market players or companies in this drones industry?

Key players in the drones market include industry leaders focused on technological advancements and operational efficiency, though specific companies are not listed in this context. Their contributions span from manufacturing to innovative applications in various fields.

What are the primary factors driving the growth in the drones industry?

The growth of the drones market is driven by innovations in technology, increased demand for aerial data collection, applications in agriculture, logistics, and public safety, as well as favorable government regulations supporting drone integration into various sectors.

Which region is the fastest Growing in the drones market?

The Asia Pacific region is emerging as the fastest-growing market for drones, anticipated to grow from $9.69 billion in 2023 to $31.51 billion by 2033, showcasing a rapid expansion in technological adoption and usage across various industries.

Does ConsaInsights provide customized market report data for the drones industry?

Yes, ConsaInsights offers customized market report data for the drones industry. Clients can request specific insights tailored to their needs, ensuring that the analysis aligns with strategic business decisions and market exploration.

What deliverables can I expect from this drones market research project?

Deliverables from the drones market research project typically include comprehensive reports detailing market trends, forecasts, regional insights, segmentation data, and competitive analysis, allowing stakeholders to make informed business decisions.

What are the market trends of drones?

Current trends in the drones market include increasing integration of AI and machine learning technologies, expansion in agricultural applications, and a rise in demand for logistics and delivery services, reflecting the industry's dynamic evolution.