Drug Delivery Devices Market Report

Published Date: 31 January 2026 | Report Code: drug-delivery-devices

Drug Delivery Devices Market Size, Share, Industry Trends and Forecast to 2033

This report explores the Drug Delivery Devices market, providing insights into market trends, regional analyses, and future forecasts from 2023 to 2033. It includes comprehensive industry analyses, segmentation details, and profiles of key market players.

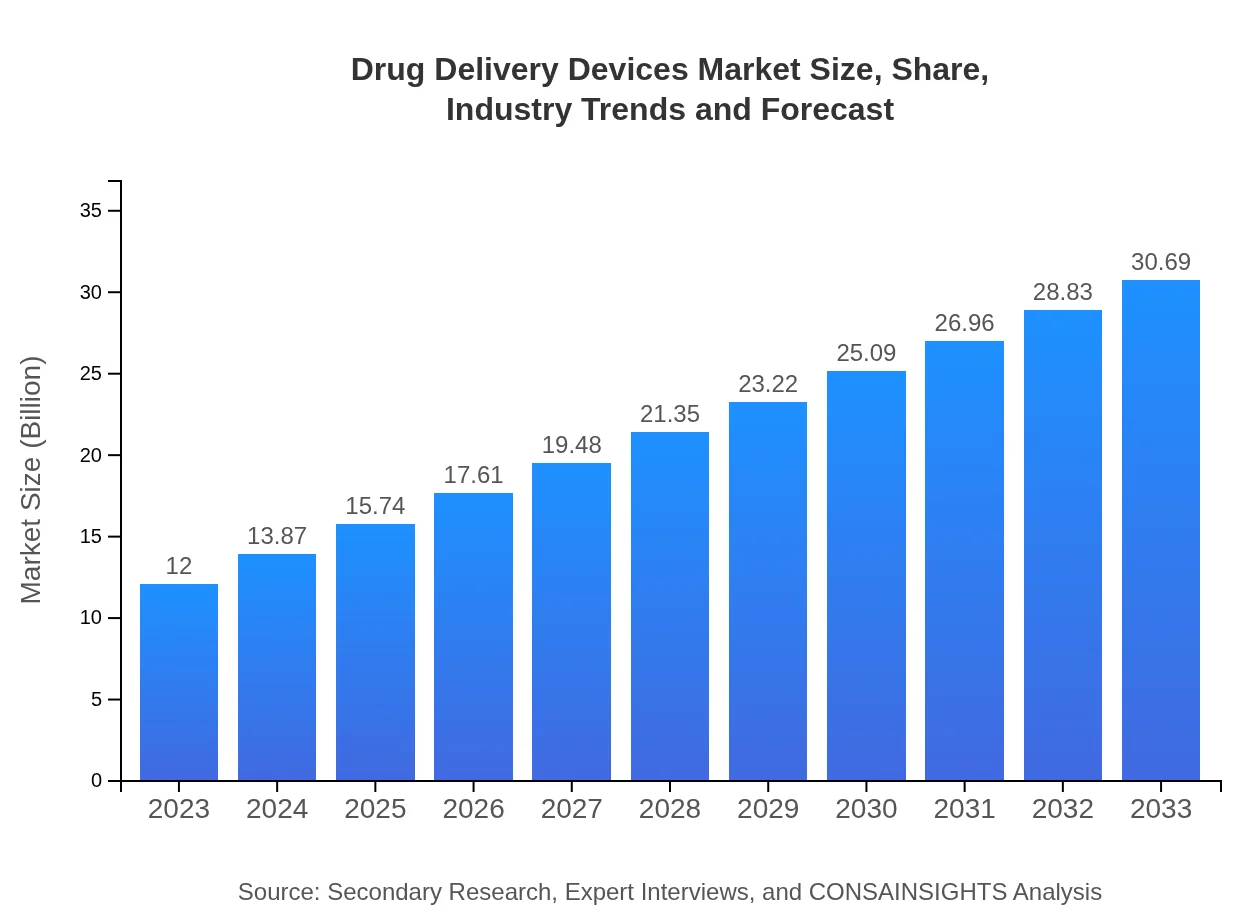

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.00 Billion |

| CAGR (2023-2033) | 9.5% |

| 2033 Market Size | $30.69 Billion |

| Top Companies | Medtronic , Becton Dickinson and Company, Johnson & Johnson, AbbVie, Fresenius Kabi |

| Last Modified Date | 31 January 2026 |

Drug Delivery Devices Market Overview

Customize Drug Delivery Devices Market Report market research report

- ✔ Get in-depth analysis of Drug Delivery Devices market size, growth, and forecasts.

- ✔ Understand Drug Delivery Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Drug Delivery Devices

What is the Market Size & CAGR of Drug Delivery Devices market in 2023?

Drug Delivery Devices Industry Analysis

Drug Delivery Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Drug Delivery Devices Market Analysis Report by Region

Europe Drug Delivery Devices Market Report:

Europe's Drug Delivery Devices market is forecasted to grow from USD 3.06 billion in 2023 to USD 7.82 billion by 2033. Key drivers include increasing healthcare expenditure, a focus on personalized medicine, and a growing preference for advanced delivery systems. Regulatory support for innovative technologies further accelerates market expansion.Asia Pacific Drug Delivery Devices Market Report:

In the Asia Pacific region, the market is expected to grow from USD 2.57 billion in 2023 to USD 6.56 billion in 2033. The growth is driven by an increase in the elderly population, rising chronic disease prevalence, and improvements in healthcare infrastructure. Additionally, technological advancements are making drug delivery methods more accessible, fostering market growth.North America Drug Delivery Devices Market Report:

In North America, the market is projected to expand from USD 4.31 billion in 2023 to USD 11.03 billion by 2033. This region holds the largest market share due to the prevalence of chronic diseases and significant investment in healthcare technology. The presence of major key players and a robust regulatory framework that fosters innovation are additional factors contributing to market growth.South America Drug Delivery Devices Market Report:

The South American market for Drug Delivery Devices is anticipated to rise from USD 0.72 billion in 2023 to USD 1.84 billion in 2033. The growth in this region is supported by increasing healthcare investments and a growing awareness of advanced drug delivery solutions. However, economic challenges may inhibit growth to some extent.Middle East & Africa Drug Delivery Devices Market Report:

The Middle East and Africa region is expected to witness growth from USD 1.35 billion in 2023 to USD 3.45 billion by 2033. The increasing demand for better healthcare services, along with government initiatives to enhance healthcare access, are propelling the market forward. However, disparities in healthcare accessibility remain a challenge.Tell us your focus area and get a customized research report.

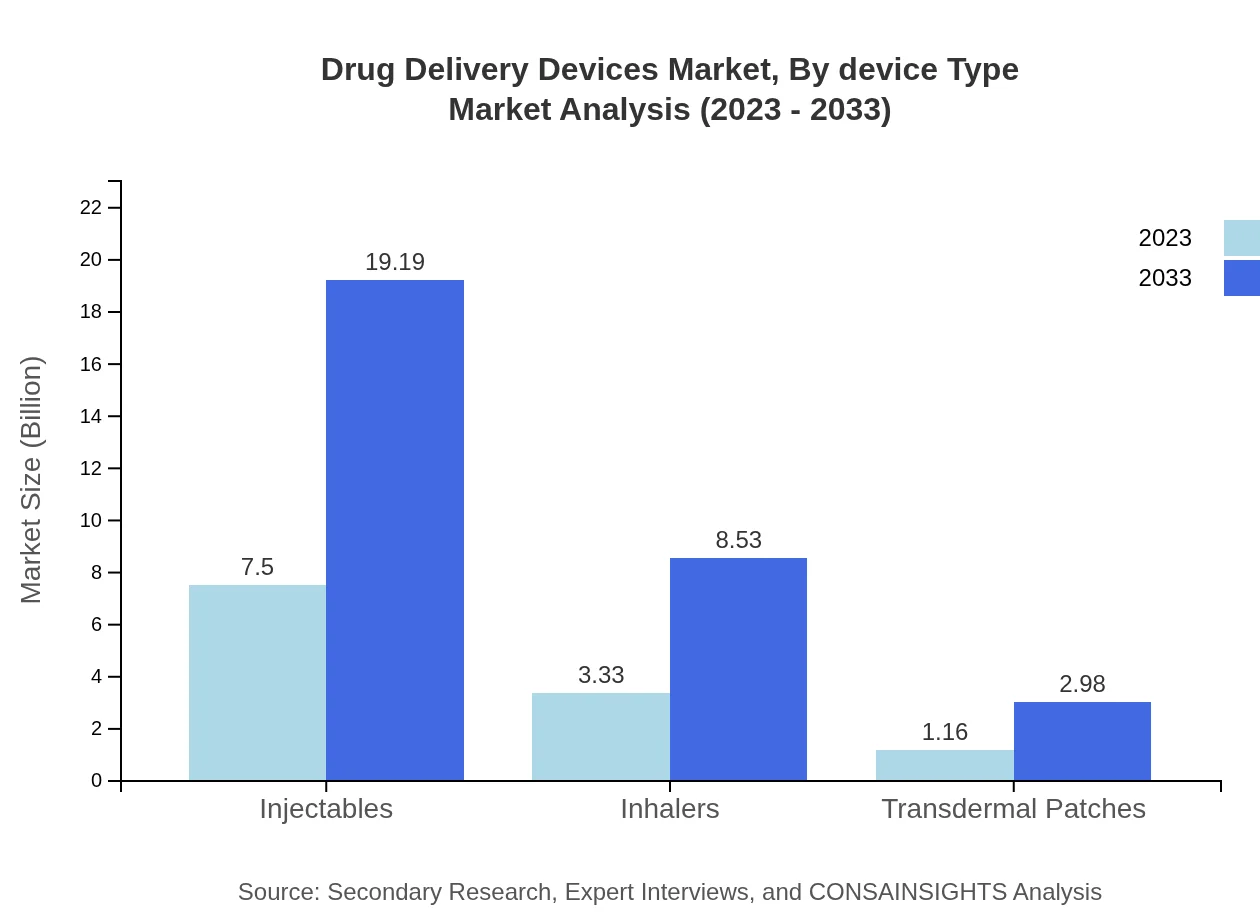

Drug Delivery Devices Market Analysis By Device Type

Drug delivery devices are classified into various categories like injectables, inhalers, transdermal patches, and needle-free technologies. The injectables segment alone has a share of 62.52% in 2023, expected to grow to USD 19.19 billion by 2033. Needle-free technologies are also rapidly gaining traction. The development of smart delivery technologies that enhance patient adherence and treatment outcomes is shaping this segment's future.

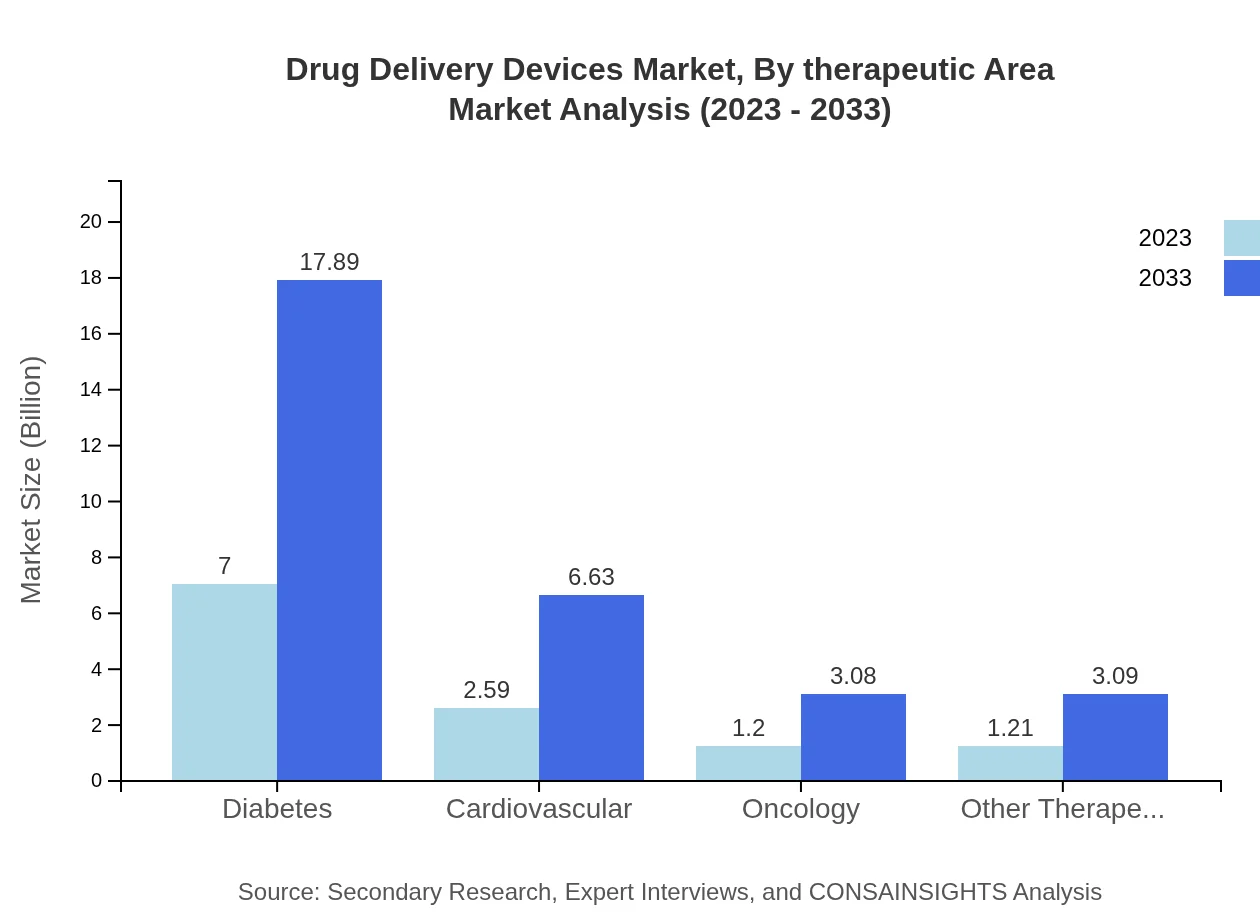

Drug Delivery Devices Market Analysis By Therapeutic Area

The therapeutic areas within the drug delivery devices market include segments like diabetes, cardiovascular, oncology, and other therapeutic areas. Diabetes treatments dominate with a market share of 58.3% in 2023 and will reach USD 17.89 billion by 2033. This is followed by cardiovascular treatments which hold a 21.59% share, reflecting the significant focus on chronic disease management.

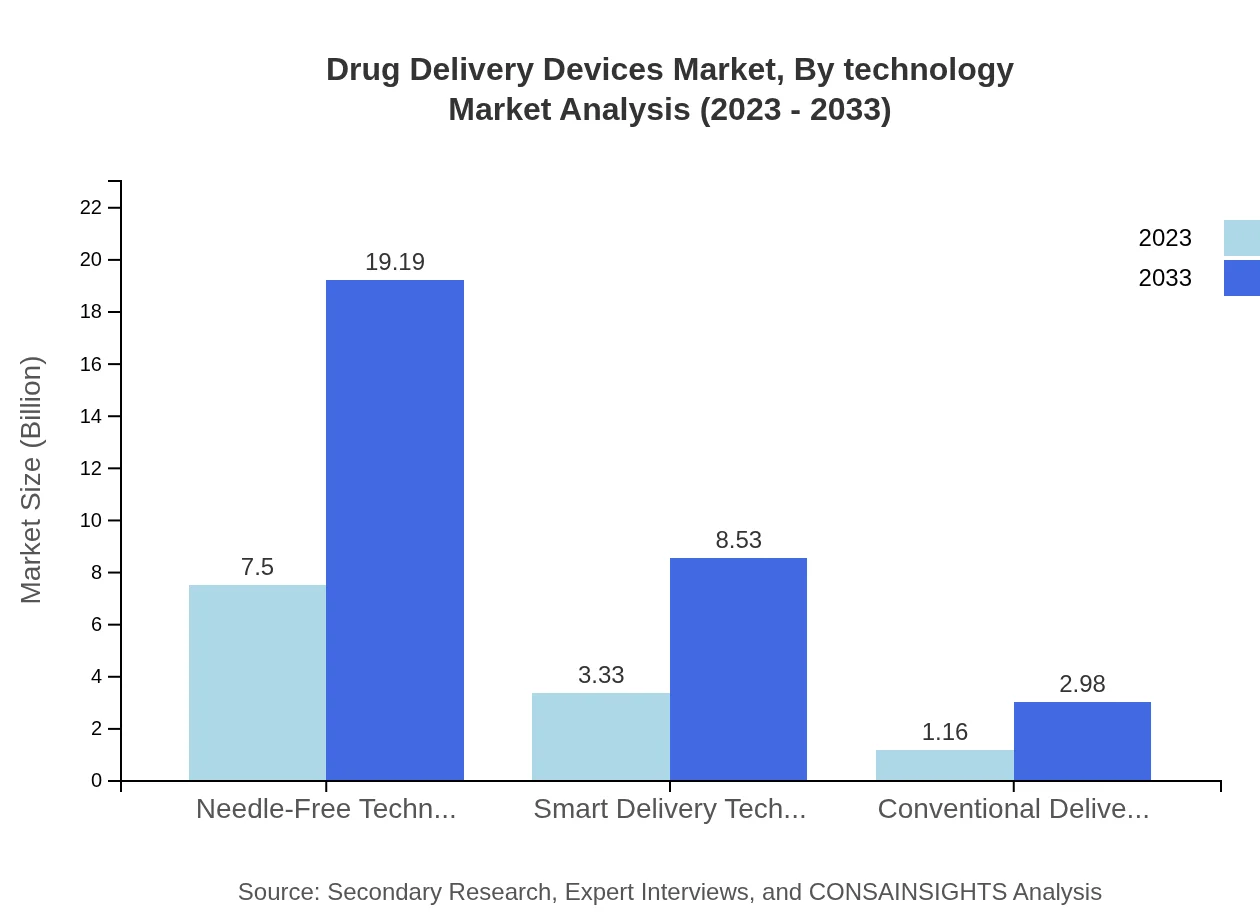

Drug Delivery Devices Market Analysis By Technology

Innovations in technology play a crucial role in advancing drug delivery systems. Technologies such as smart delivery systems, needle-free methods, and advanced injectables enhance patient comfort and compliance. The smart delivery technology market is expected to grow significantly due to its efficacy in managing chronic conditions.

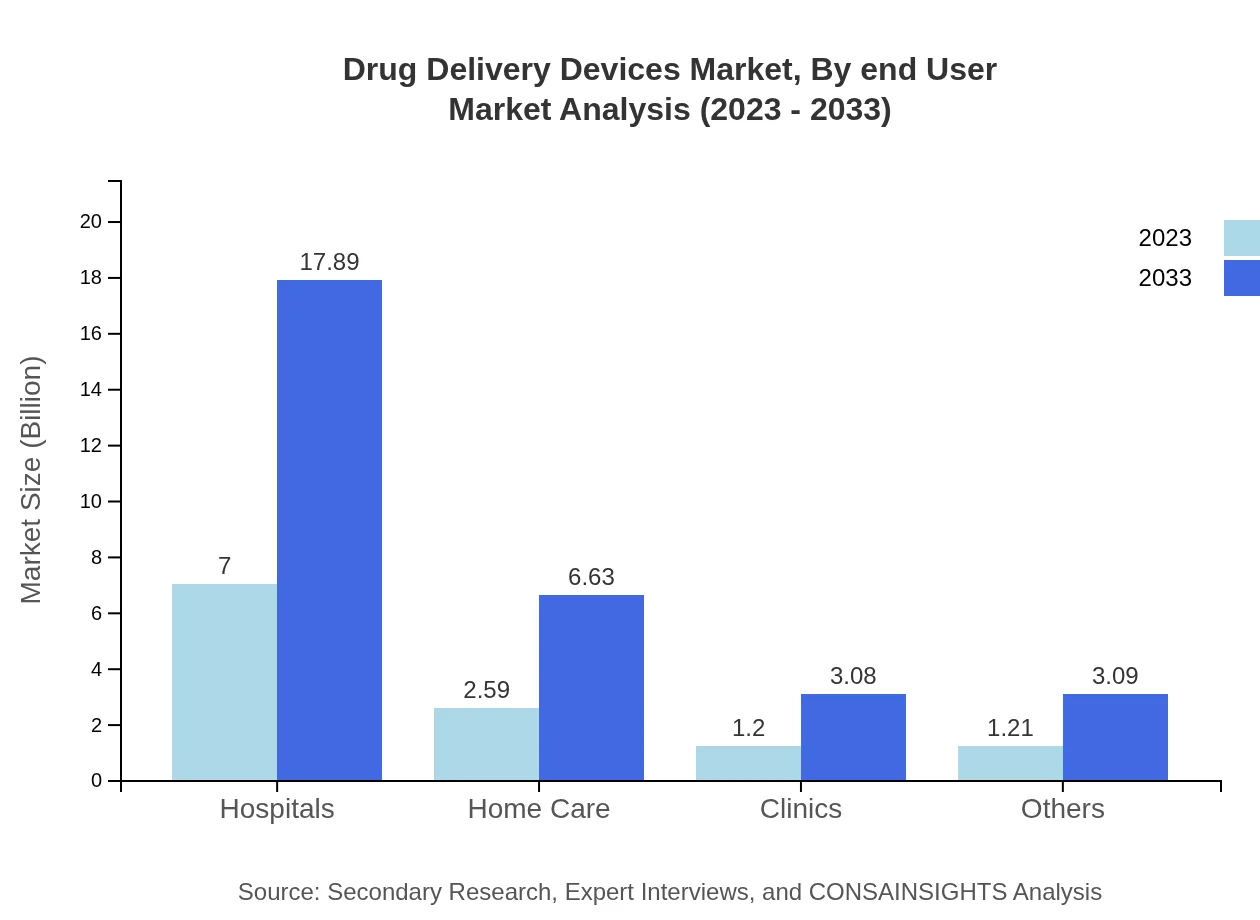

Drug Delivery Devices Market Analysis By End User

End-users of drug delivery devices include hospitals, home care settings, clinics, and others. Hospitals account for the largest share (58.3% in 2023), reflecting their pivotal role in patient treatment. The home care segment is also expanding, driven by a push for at-home health management and chronic disease management.

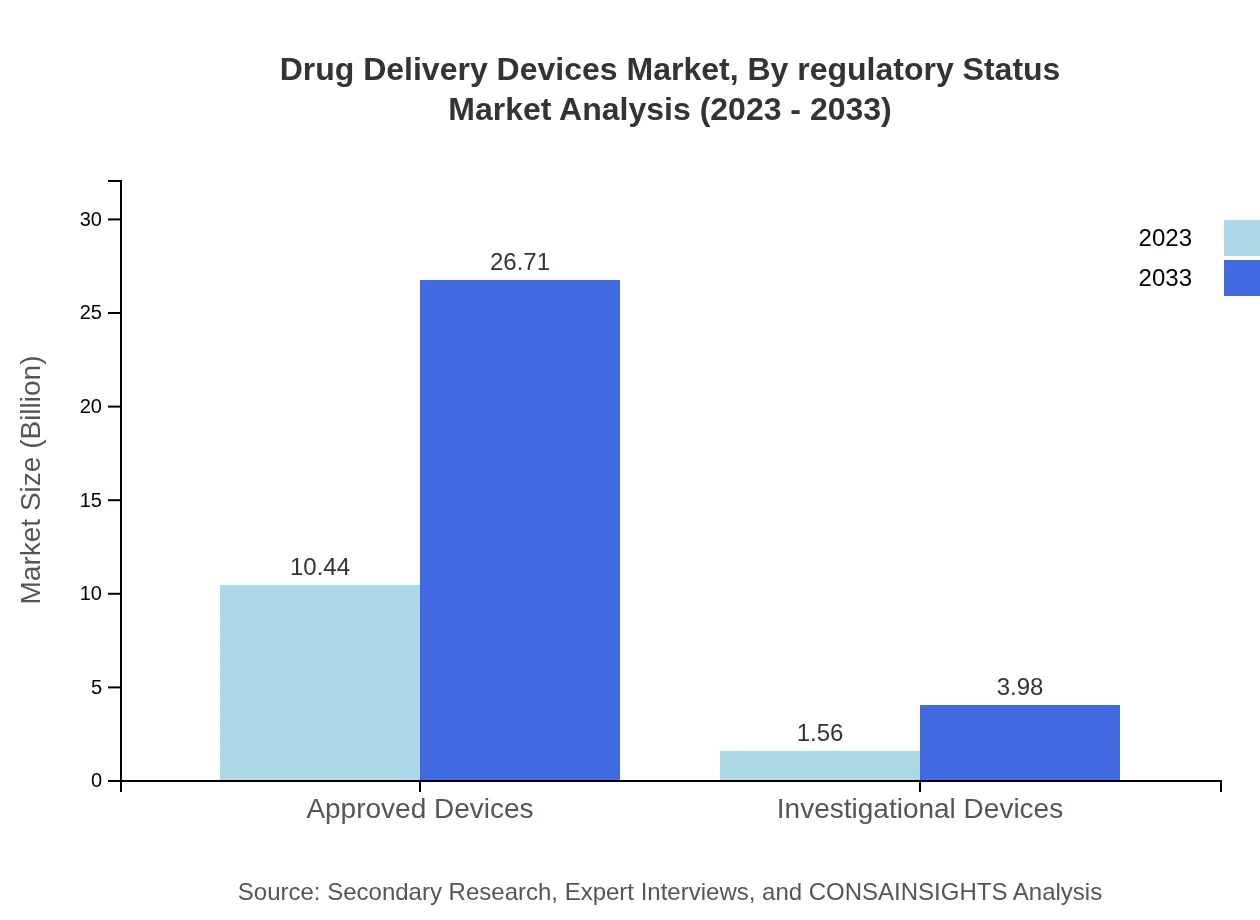

Drug Delivery Devices Market Analysis By Regulatory Status

The market is segmented into approved and investigational devices. Approved devices represent the majority, with a share of 87.03% in 2023. The focus on streamlining regulations is helping to expedite the approval of innovative devices, which is crucial for market growth.

Drug Delivery Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Drug Delivery Devices Industry

Medtronic :

Medtronic is a leading global healthcare solutions company specializing in innovative drug delivery devices and therapies to help healthcare professionals monitor their conditions.Becton Dickinson and Company:

Becton Dickinson manufactures and sells medical devices, instrument systems, and reagents, focusing heavily on advanced injectable systems for drug delivery.Johnson & Johnson:

Johnson & Johnson is a global leader in consumer health products and pharmaceuticals, with a strong portfolio in innovative drug delivery technologies.AbbVie:

AbbVie specializes in advanced pharmaceuticals and biopharmaceutical products, including drug delivery devices that address complex health needs.Fresenius Kabi:

Fresenius Kabi is a global healthcare company that specializes in lifesaving medicines and technologies, including various drug delivery devices and infusion solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of drug Delivery Devices?

The drug delivery devices market is valued at approximately $12 billion in 2023, with a projected CAGR of 9.5% leading to significant growth by 2033. This growth reflects advancements in technology and increased demand for effective treatment options.

What are the key market players or companies in the drug Delivery Devices industry?

Key players in the drug delivery devices industry include major pharmaceutical companies and biotech firms. These companies focus on innovative solutions in drug delivery systems, ensuring competitive market positioning through research and development.

What are the primary factors driving the growth in the drug delivery devices industry?

Growth in the drug delivery devices industry is primarily fueled by increasing prevalence of chronic diseases, advancements in technology, and rising patient preference for home care solutions. Furthermore, regulatory support for innovative devices enhances market dynamics.

Which region is the fastest Growing in the drug delivery devices market?

Among regions, North America represents the fastest-growing market for drug delivery devices, projected to grow from $4.31 billion in 2023 to $11.03 billion by 2033. Europe and Asia-Pacific also show robust growth trajectories.

Does ConsaInsights provide customized market report data for the drug delivery devices industry?

Yes, ConsaInsights offers customized market report data tailored to individual client needs within the drug delivery devices industry. This allows businesses to make informed decisions based on specific market trends and insights.

What deliverables can I expect from this drug delivery devices market research project?

Expect comprehensive deliverables including market size analysis, growth projections, competitive landscape assessments, and detailed regional and segment breakdowns. Reports will also cover trends influencing the market landscape.

What are the market trends of drug delivery devices?

Current trends in the drug delivery devices market include a shift to needle-free technologies and smart delivery systems. Increased adoption of home healthcare solutions is another significant trend impacting the industry's growth.