Drug Device Combination Products Market Report

Published Date: 31 January 2026 | Report Code: drug-device-combination-products

Drug Device Combination Products Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Drug Device Combination Products market, including insights into market trends, size forecasts for 2023-2033, and detailed examination of segments and regions impacting market growth.

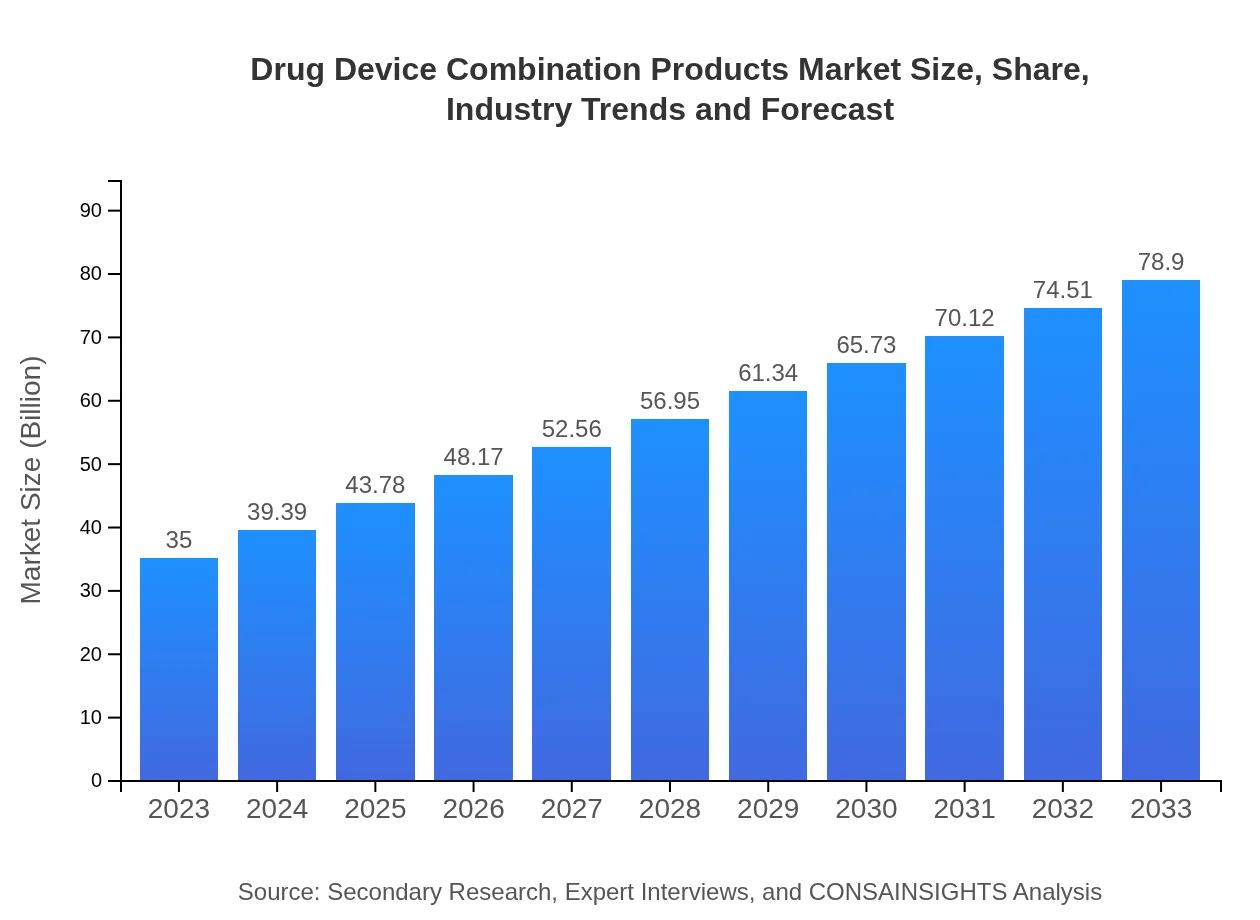

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $35.00 Billion |

| CAGR (2023-2033) | 8.2% |

| 2033 Market Size | $78.90 Billion |

| Top Companies | Medtronic , Abbott Laboratories, Baxter International, Boehringer Ingelheim, Sanofi |

| Last Modified Date | 31 January 2026 |

Drug Device Combination Products Market Overview

Customize Drug Device Combination Products Market Report market research report

- ✔ Get in-depth analysis of Drug Device Combination Products market size, growth, and forecasts.

- ✔ Understand Drug Device Combination Products's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Drug Device Combination Products

What is the Market Size & CAGR of Drug Device Combination Products market in 2023?

Drug Device Combination Products Industry Analysis

Drug Device Combination Products Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Drug Device Combination Products Market Analysis Report by Region

Europe Drug Device Combination Products Market Report:

In Europe, the market is anticipated to grow from $11.16 billion in 2023 to $25.15 billion in 2033. The growth is a result of favorable regulatory environments, increasing healthcare spending, and a focus on innovative combination therapies to address complex health challenges.Asia Pacific Drug Device Combination Products Market Report:

The Asia Pacific region is witnessing substantial growth in the Drug Device Combination Products market, projected to reach $15.78 billion by 2033 from $7.00 billion in 2023. Factors supporting this growth include improved healthcare infrastructure, increasing prevalence of chronic diseases, and rising demand for advanced medical technologies.North America Drug Device Combination Products Market Report:

North America dominates the Drug Device Combination Products market with a value of $26.06 billion projected by 2033, up from $11.56 billion in 2023. The region benefits from a robust healthcare framework, high R&D investments, and a rising incidence of chronic illnesses, supporting extensive innovation and market penetration.South America Drug Device Combination Products Market Report:

The South American market is expected to grow from $0.99 billion in 2023 to $2.24 billion in 2033, driven by expanding healthcare access and investment in healthcare systems. Challenges such as regulatory hurdles may affect market pace but positive government initiatives can aid growth.Middle East & Africa Drug Device Combination Products Market Report:

The Middle East and Africa region is projected to grow from $4.29 billion in 2023 to $9.66 billion in 2033. Factors such as evolving healthcare policies, enhanced investment in medical technologies, and increasing awareness of combination products play a crucial role in this regional growth.Tell us your focus area and get a customized research report.

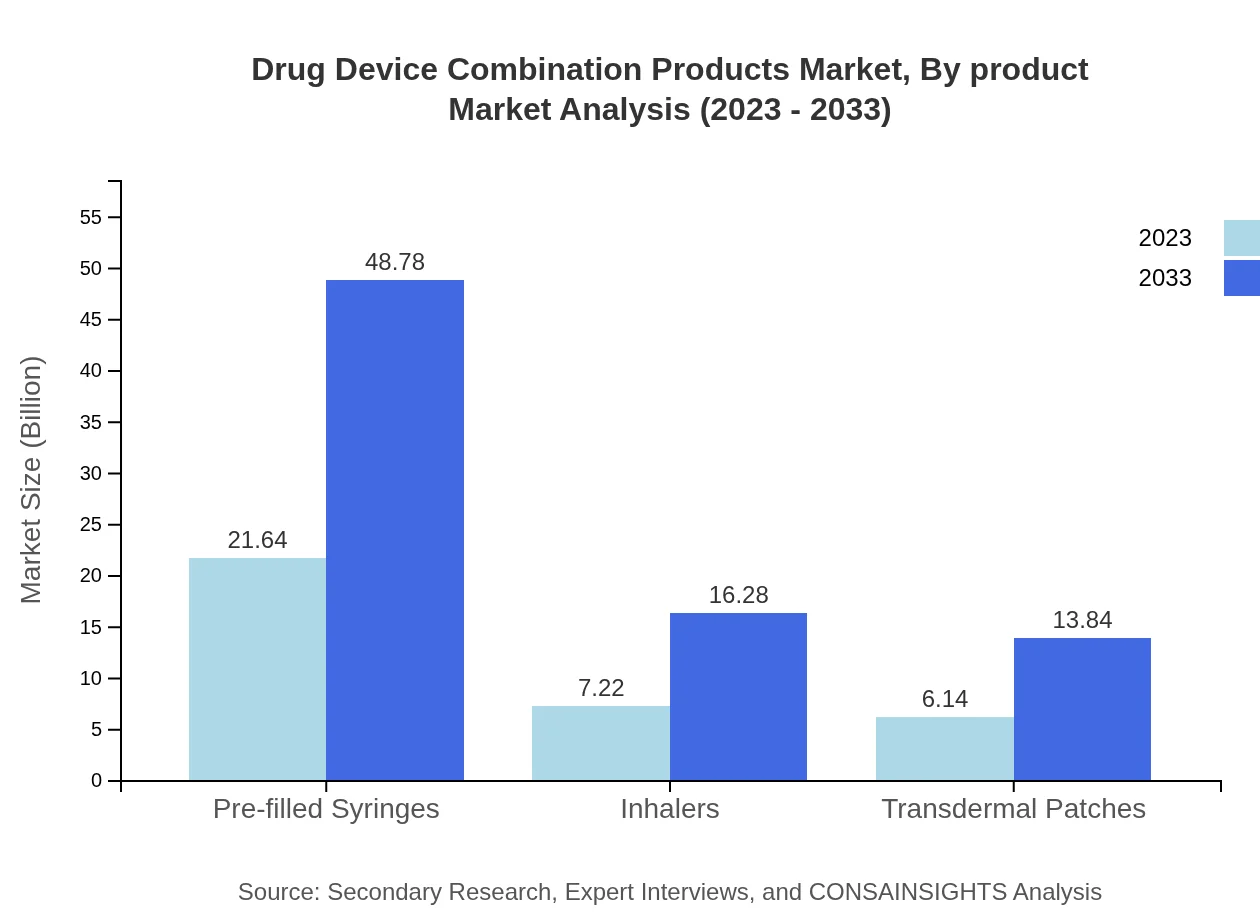

Drug Device Combination Products Market Analysis By Product

The product segmentation reveals prefilled syringes as a dominant force, predicted to grow from $21.64 billion in 2023 to $48.78 billion by 2033, maintaining a market share of 61.83% throughout the forecast period. Inhalers and transdermal patches will also see significant growth, with inhalers expected to increase from $7.22 billion to $16.28 billion.

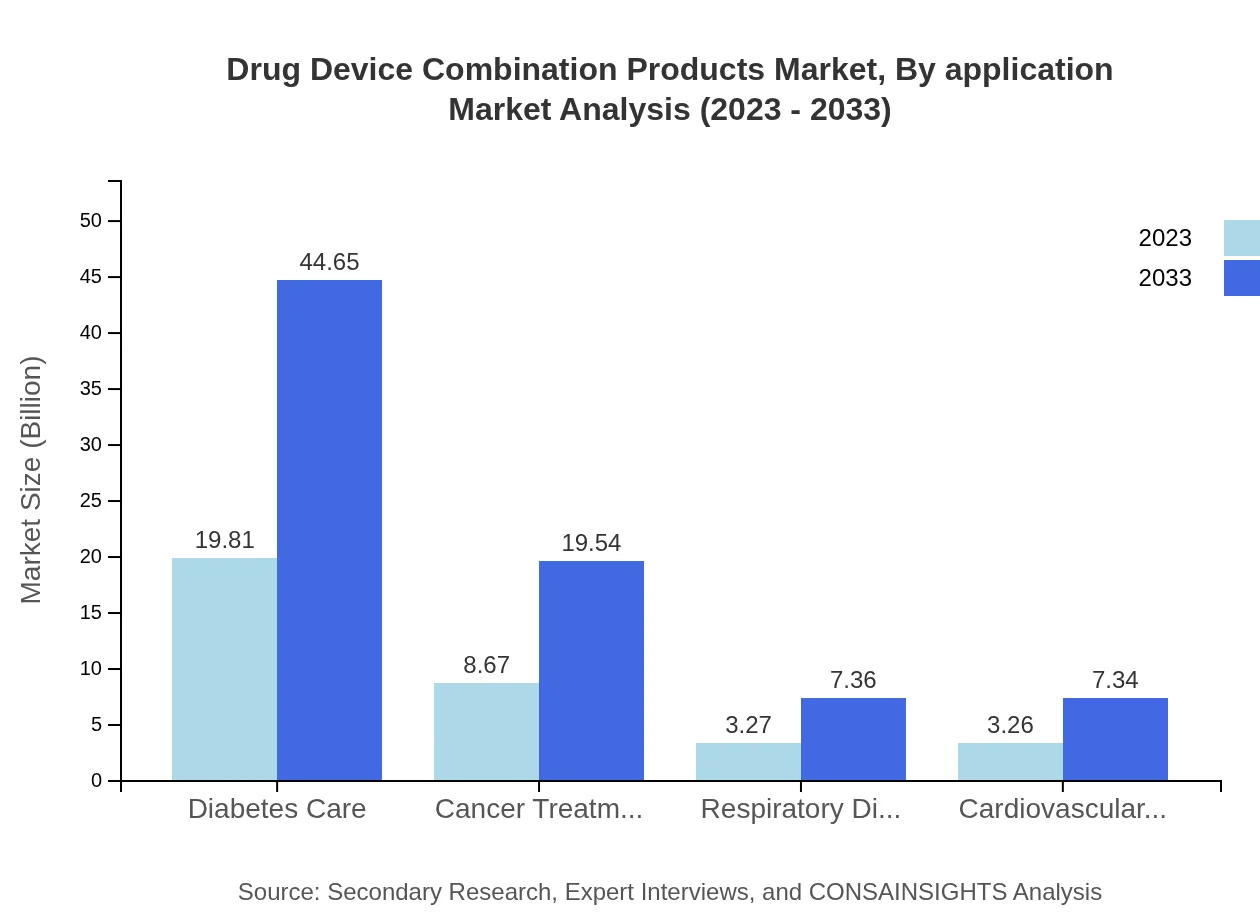

Drug Device Combination Products Market Analysis By Application

In terms of application, diabetes care products account for a substantial share, with market size expected to reach $44.65 billion by 2033 from $19.81 billion in 2023. This segment highlights the critical intersection of drug delivery and chronic disease management, underscoring the need for effective patient-centered solutions.

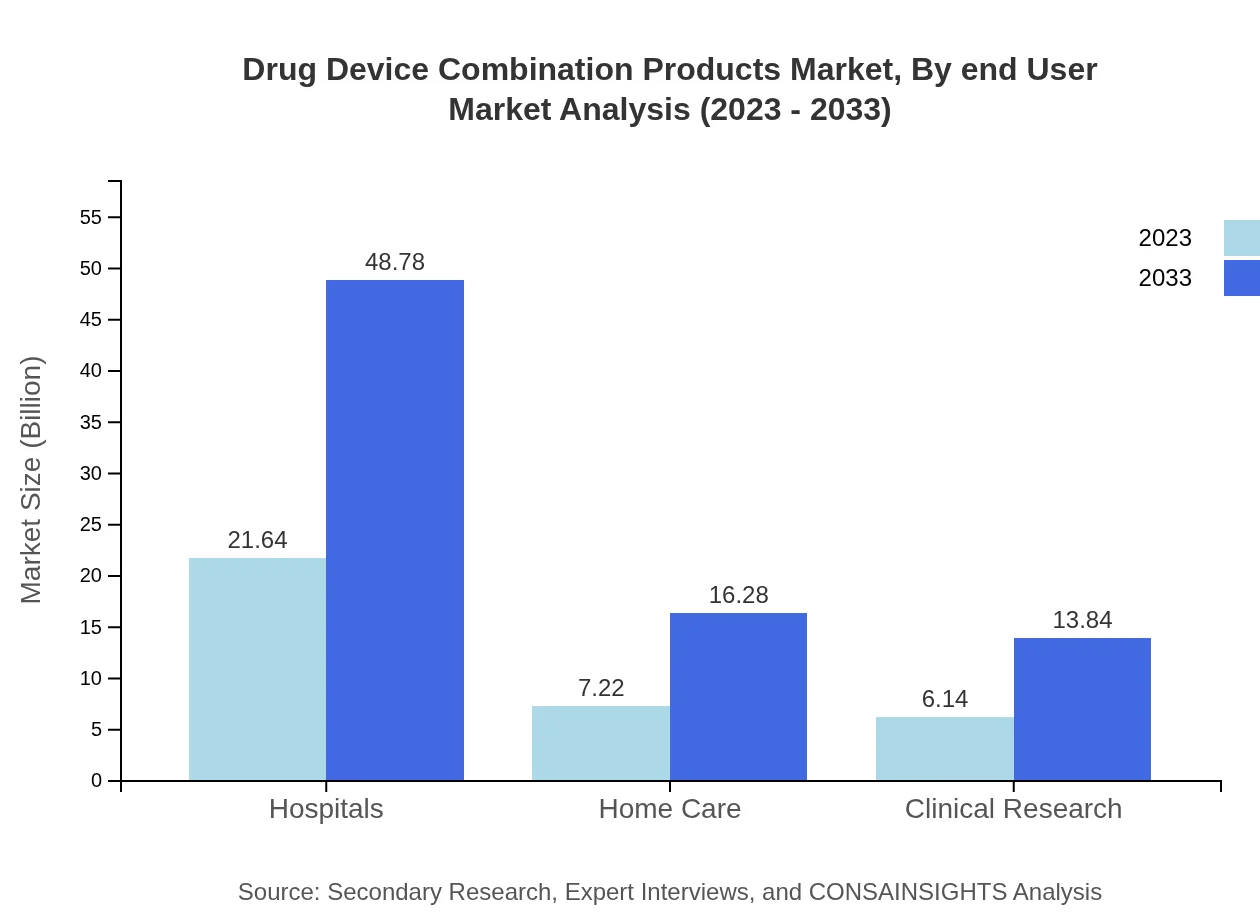

Drug Device Combination Products Market Analysis By End User

Hospitals represent a major end-user segment for Drug Device Combination Products, with a projected market size growing from $21.64 billion in 2023 to $48.78 billion by 2033, reflecting the increasing reliance on sophisticated drug delivery systems in clinical settings.

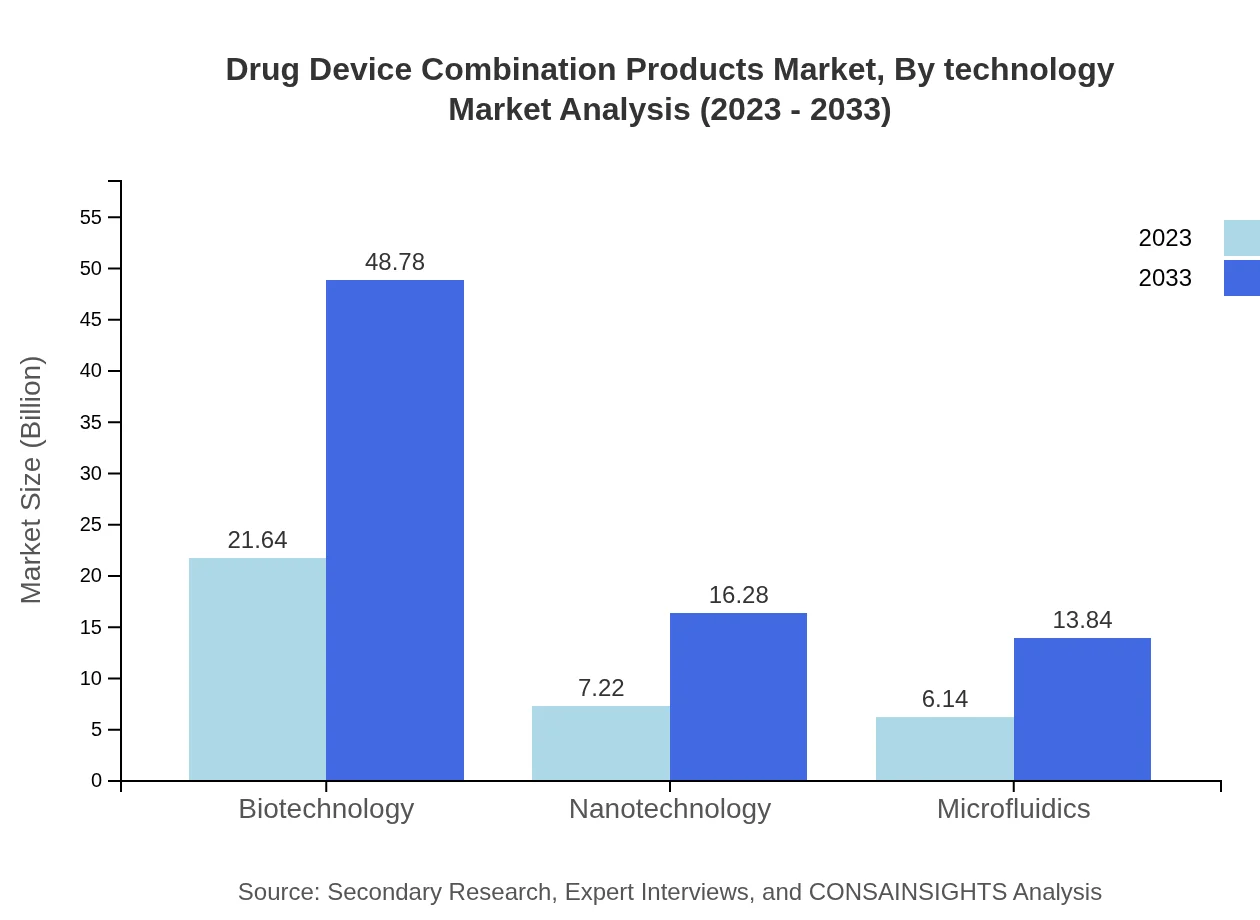

Drug Device Combination Products Market Analysis By Technology

Technological advancements such as nanotechnology and microfluidics are pivotal in evolving Drug Device Combination Products. These technologies are expected to push innovation in product development, enhancing delivery mechanisms and patient outcomes, thereby fuelling market growth across various applications.

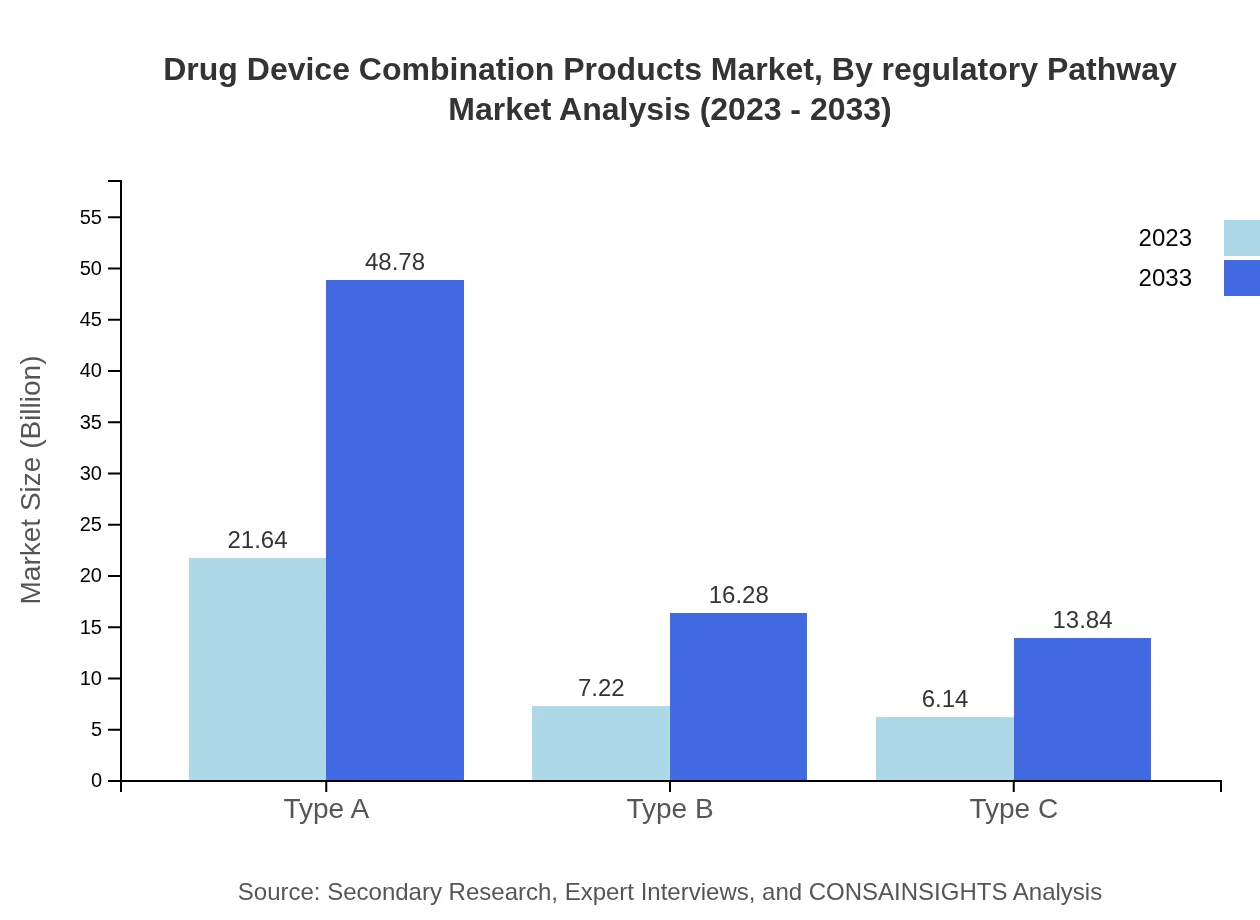

Drug Device Combination Products Market Analysis By Regulatory Pathway

This segment illustrates the pathways involved in regulatory approvals for combination products. Navigating these pathways is crucial, as it ensures high standards of safety and efficacy while also expediting access to market. Regulatory compliance remains a significant factor influencing the development timeline of new combination products.

Drug Device Combination Products Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Drug Device Combination Products Industry

Medtronic :

A leader in medical technology, Medtronic offers innovative and integrated therapies through a wide range of drug-device combination products for chronic disease management.Abbott Laboratories:

Abbott specializes in numerous healthcare fields, producing advanced diagnostics and medical devices, and investing heavily in drug-device combinations to improve patient treatment outcomes.Baxter International:

Baxter is a global healthcare provider known for its drug delivery devices and infusion systems, playing a significant role in the growth of combination products.Boehringer Ingelheim:

Boehringer Ingelheim focuses on the development and manufacturing of a range of combination products, especially within biopharmaceuticals, enhancing patient therapy experiences.Sanofi:

Sanofi is engaged in the research and development of combination therapies that align drug efficacy with innovative delivery methods, thus improving health management overall.We're grateful to work with incredible clients.

FAQs

What is the market size of drug Device Combination Products?

The drug-device combination products market is valued at approximately $35 billion in 2023, with a compound annual growth rate (CAGR) of 8.2%. This significant growth reflects the increasing integration of pharmaceuticals and medical devices.

What are the key market players or companies in the drug Device Combination Products industry?

Key players in the drug-device combination products market include major pharmaceutical companies and medical device manufacturers, although detailed names and profiles are typically provided in comprehensive market reports.

What are the primary factors driving the growth in the drug Device Combination Products industry?

Growth in the drug-device combination products industry is driven by rising demand for effective therapies, advancements in technology, the increasing prevalence of chronic diseases, and the need for integrated healthcare solutions, enhancing patient compliance and treatment efficacy.

Which region is the fastest Growing in the drug Device Combination Products?

The Asia Pacific region is anticipated to exhibit significant growth in the drug-device combination products market, with the market increasing from $7 billion in 2023 to $15.78 billion by 2033, leveraging expanding healthcare infrastructure and population.

Does ConsaInsights provide customized market report data for the drug Device Combination Products industry?

Yes, ConsaInsights offers customized market report data for the drug-device combination products industry, allowing clients to obtain tailored insights that address specific needs and focus areas, ensuring comprehensive decision-making.

What deliverables can I expect from this drug Device Combination Products market research project?

Deliverables from the drug-device combination products market research project typically include comprehensive reports, detailed data analysis, market forecasts, competitive landscape insights, and actionable recommendations to guide strategic initiatives.

What are the market trends of drug Device Combination Products?

Current market trends in the drug-device combination products sector include increased focus on personalized medicine, innovative delivery mechanisms, the rise of digitally-enabled health solutions, and evolving regulatory landscapes promoting integration of drug and device systems.