Drug Discovery Informatics Market Report

Published Date: 31 January 2026 | Report Code: drug-discovery-informatics

Drug Discovery Informatics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Drug Discovery Informatics market, presenting insights into market size, trends, segmentation, and forecasts for the period of 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

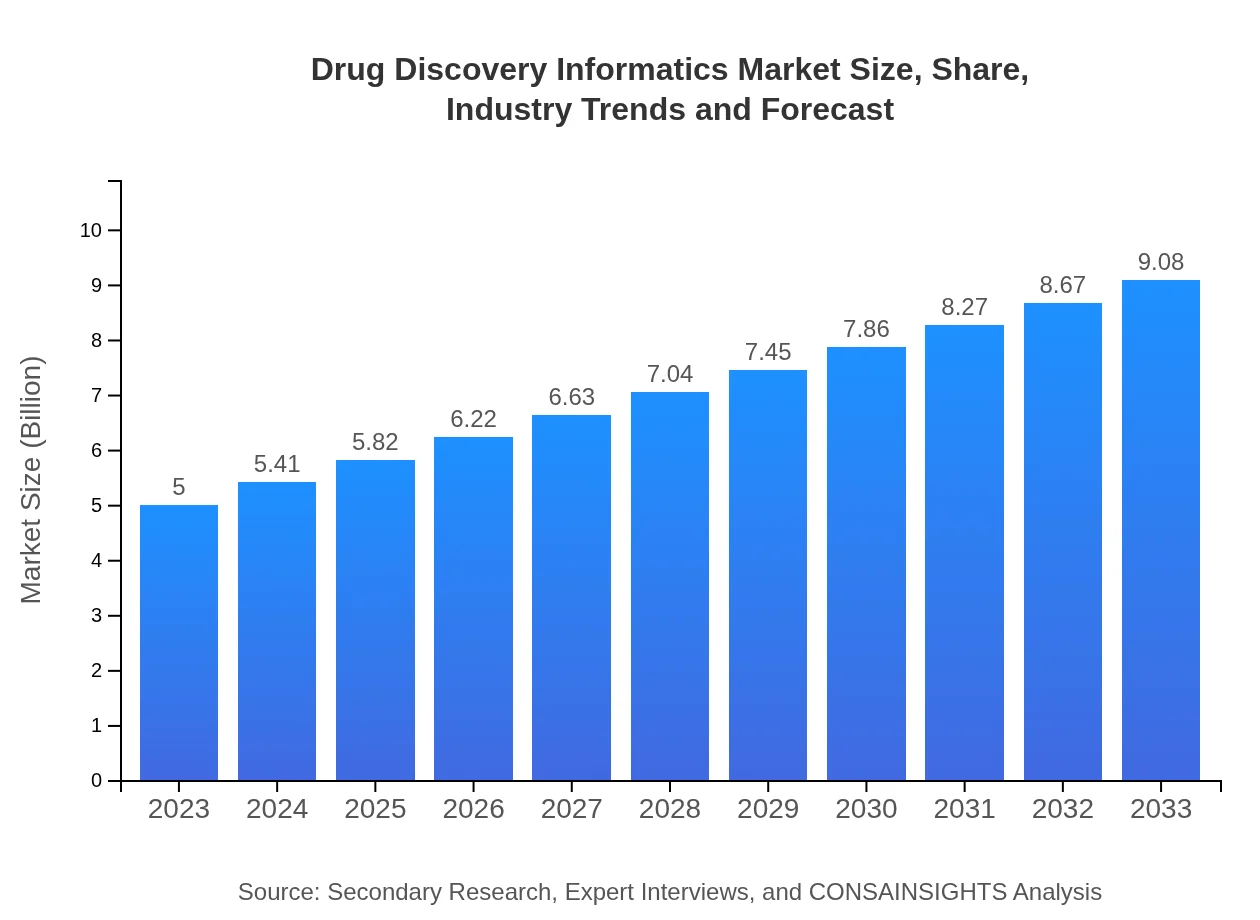

| 2023 Market Size | $5.00 Billion |

| CAGR (2023-2033) | 6% |

| 2033 Market Size | $9.08 Billion |

| Top Companies | Thermo Fisher Scientific, Schrödinger, Inc., PerkinElmer, Certara |

| Last Modified Date | 31 January 2026 |

Drug Discovery Informatics Market Overview

Customize Drug Discovery Informatics Market Report market research report

- ✔ Get in-depth analysis of Drug Discovery Informatics market size, growth, and forecasts.

- ✔ Understand Drug Discovery Informatics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Drug Discovery Informatics

What is the Market Size & CAGR of Drug Discovery Informatics market in 2023?

Drug Discovery Informatics Industry Analysis

Drug Discovery Informatics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Drug Discovery Informatics Market Analysis Report by Region

Europe Drug Discovery Informatics Market Report:

Europe's market, valued at USD 1.29 billion in 2023 and anticipated to grow to USD 2.35 billion by 2033, benefits from strong pharmaceutical sectors and significant governmental support for innovation in drug development.Asia Pacific Drug Discovery Informatics Market Report:

In the Asia Pacific region, the Drug Discovery Informatics market is valued at USD 0.96 billion in 2023 and is projected to reach USD 1.74 billion by 2033, reflecting robust growth opportunities driven by increasing drug development activities and supportive government initiatives.North America Drug Discovery Informatics Market Report:

North America holds the largest market share with a value of USD 1.65 billion in 2023 projected to reach USD 2.99 billion by 2033. This is attributed to the presence of major pharmaceutical and biotechnology companies and high R&D expenditures within the region.South America Drug Discovery Informatics Market Report:

The South America market, though smaller, shows promise with a 2023 market value of USD 0.41 billion growing to USD 0.74 billion by 2033. This growth is fueled by rising pharmaceutical investments and collaborations with international biopharmaceutical firms.Middle East & Africa Drug Discovery Informatics Market Report:

The Middle East and Africa market is expected to grow from USD 0.70 billion in 2023 to USD 1.27 billion in 2033, driven by increasing investments in healthcare infrastructure and growing interest from global pharmaceutical companies in the region.Tell us your focus area and get a customized research report.

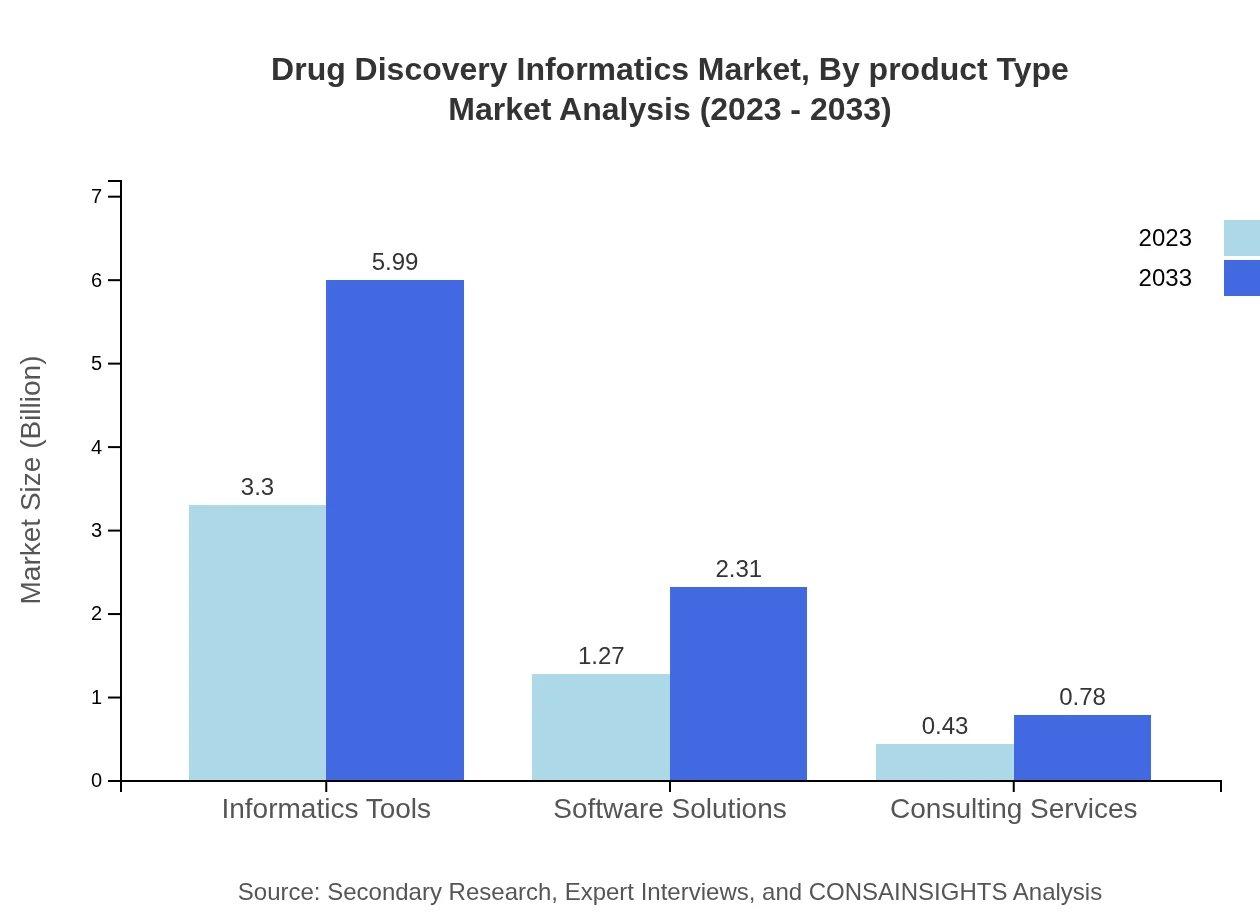

Drug Discovery Informatics Market Analysis By Product Type

The product-type segment encompasses software solutions, informatics tools, and consulting services. In 2023, software solutions dominate with a market valuation of USD 1.27 billion. Informatics tools also show strong performance with projected growth, while consulting services are expected to experience a significant uptick as companies seek expert advice on emerging innovations.

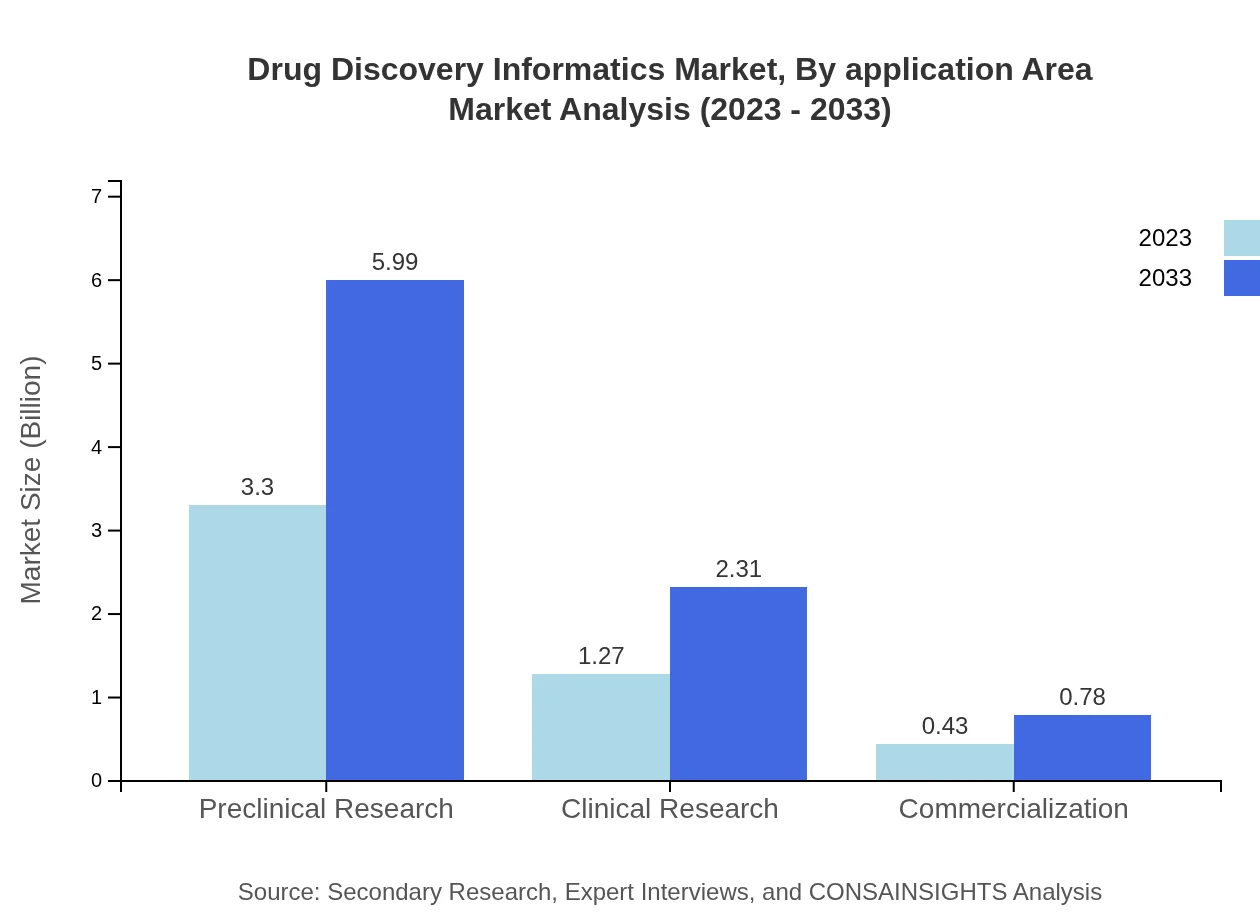

Drug Discovery Informatics Market Analysis By Application Area

Preclinical research is a major area, contributing significantly to market share, with revenues reaching USD 3.30 billion in 2023. Clinical research follows closely, reflecting a critical need for data analytics to bolster advancements in clinical trials.

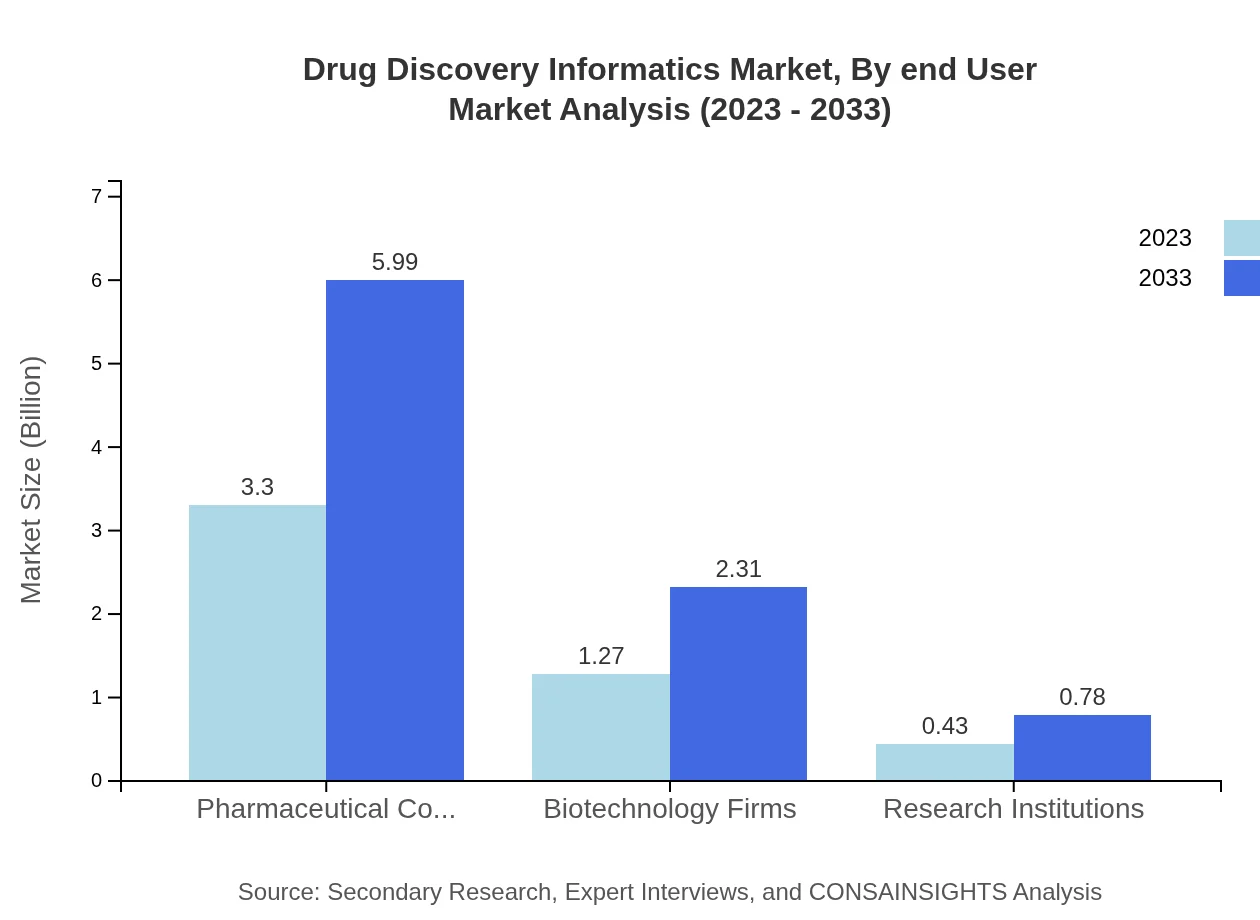

Drug Discovery Informatics Market Analysis By End User

Pharmaceutical companies command a significant share of the market at 65.98% in 2023, owing to their substantial investment in drug discovery. Biotechnology firms, with a share of 25.44%, are leveraging informatics technologies to enhance their research capabilities. Research institutions represent the remaining share, focusing on innovation and development.

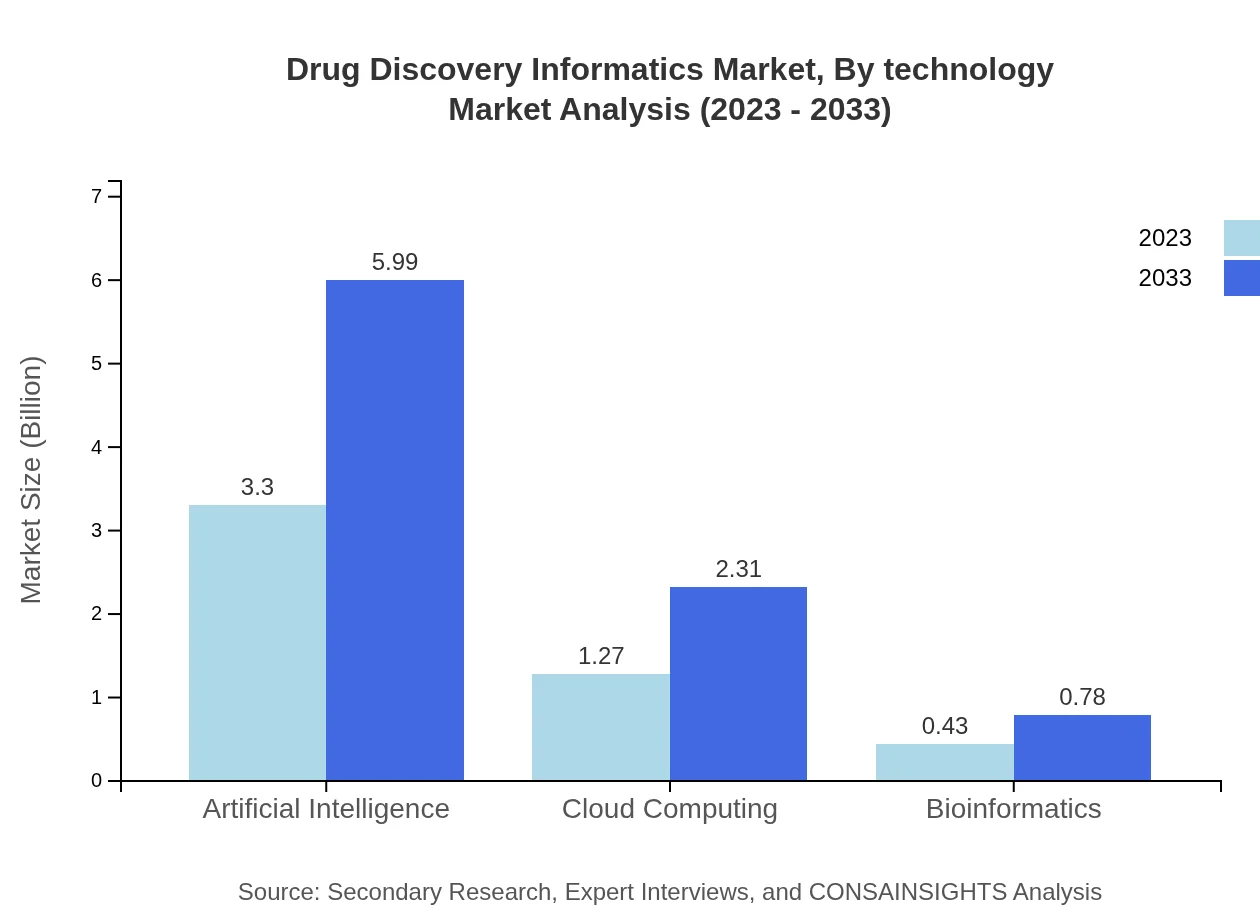

Drug Discovery Informatics Market Analysis By Technology

Technology in this market includes AI and machine learning, cloud computing, and bioinformatics. AI and machine learning solutions constitute around 65.98% market share, signifying a trend towards data-driven decision-making and enhancing efficiency in drug development.

Drug Discovery Informatics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Drug Discovery Informatics Industry

Thermo Fisher Scientific:

A leading provider of analytical instruments, reagents, and consumables for drug discovery, facilitating the integration of informatics solutions into research.Schrödinger, Inc.:

Pioneering in computational drug discovery, offering powerful software solutions that enable predictive modeling of drug candidates.PerkinElmer:

Specializes in scientific instrumentation and software that supports drug discovery and development, enhancing process efficiency and data management.Certara:

Provides advanced pharmacokinetics and predictive modeling software, critical for informed decision-making in drug development pipelines.We're grateful to work with incredible clients.

FAQs

What is the market size of drug Discovery Informatics?

The drug discovery informatics market is projected to grow from $5 billion in 2023 to substantial figures by 2033, representing a CAGR of 6%. This growth is indicative of the expanding reliance on computational methods in drug development.

What are the key market players or companies in this drug Discovery Informatics industry?

Key players in the drug discovery informatics market include major pharmaceutical companies, biotechnology firms, and tech providers specializing in AI and cloud computing solutions. Their innovative approaches help enhance drug development processes and optimize resource allocation.

What are the primary factors driving the growth in the drug Discovery Informatics industry?

Growth in the drug discovery informatics industry is fueled by advancements in AI and machine learning technologies, increasing investments in R&D, and the necessity for faster drug development processes. Regulatory mandates for enhanced precision in drug therapy are also impactful.

Which region is the fastest Growing in the drug Discovery Informatics?

Europe is the fastest-growing region in drug discovery informatics, projected to rise from $1.29 billion in 2023 to $2.35 billion by 2033. North America follows closely with growth from $1.65 billion to $2.99 billion during the same period.

Does ConsaInsights provide customized market report data for the drug Discovery Informatics industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the drug discovery informatics industry. Clients can expect comprehensive insights that align with their strategic objectives and market interests.

What deliverables can I expect from this drug Discovery Informatics market research project?

Deliverables from the drug discovery informatics market research project typically include detailed market analysis reports, segment-wise insights, growth projections, competitive landscape assessments, and strategic recommendations for stakeholders.

What are the market trends of drug Discovery Informatics?

Current trends in drug discovery informatics include increasing adoption of cloud computing, integration of bioinformatics, focus on software solutions, and the rise of preclinical and clinical research informatics tools to accelerate drug development timelines.