Drug Discovery Market Report

Published Date: 31 January 2026 | Report Code: drug-discovery

Drug Discovery Market Size, Share, Industry Trends and Forecast to 2033

This report provides in-depth insights into the global Drug Discovery market, covering current trends, market size, and forecasts for 2023 to 2033, along with a detailed analysis of regions, segments, and key players within the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

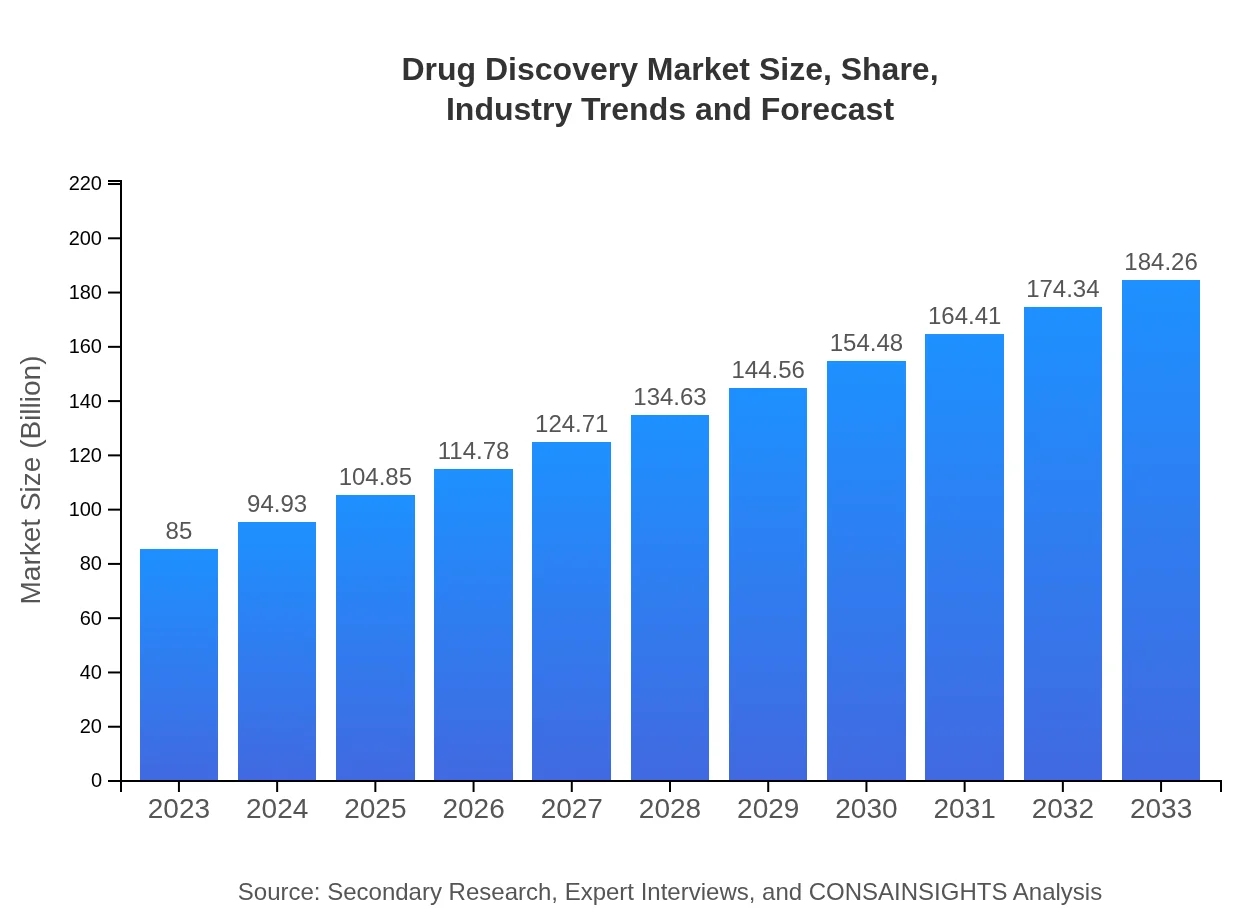

| 2023 Market Size | $85.00 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $184.26 Billion |

| Top Companies | Pfizer , Novartis, Roche |

| Last Modified Date | 31 January 2026 |

Drug Discovery Market Overview

Customize Drug Discovery Market Report market research report

- ✔ Get in-depth analysis of Drug Discovery market size, growth, and forecasts.

- ✔ Understand Drug Discovery's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Drug Discovery

What is the Market Size & CAGR of Drug Discovery market in 2023?

Drug Discovery Industry Analysis

Drug Discovery Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Drug Discovery Market Analysis Report by Region

Europe Drug Discovery Market Report:

In Europe, the Drug Discovery market is anticipated to increase from $32.02 billion in 2023 to approximately $69.41 billion by 2033. Europe's strong emphasis on healthcare research and development, coupled with its well-established regulatory frameworks, promotes rapid innovation in drug discovery. Countries such as Germany, the UK, and France are significant players driving this growth, focusing on personalized medicine and biologics.Asia Pacific Drug Discovery Market Report:

The Asia Pacific Drug Discovery market in 2023 is valued at $15.68 billion and is projected to reach approximately $34 billion by 2033. Emerging economies in this region are a hotspot for outsourcing drug development, with countries like China and India spearheading growth through lower operational costs and an increasing talent pool in life sciences. The market is being further buoyed by government initiatives encouraging local research and bilateral collaborations with global pharmaceutical companies.North America Drug Discovery Market Report:

North America remains a dominant force in the Drug Discovery market, valued at $27.26 billion in 2023 and expected to expand to $59.09 billion by 2033. The region benefits from a robust healthcare infrastructure, significant investment in R&D, and home to many leading pharmaceutical companies and biotech firms. Additionally, collaboration between industry and research institutions fosters innovation and accelerates new drug discoveries.South America Drug Discovery Market Report:

In South America, the Drug Discovery market is valued at $2.46 billion in 2023, with expectations to grow to $5.34 billion by 2033. The region is experiencing a growing interest in biopharmaceutical research, supported by enhanced infrastructure and increased investment from both public and private sectors. However, market players must navigate regulatory challenges and limited access to advanced technologies.Middle East & Africa Drug Discovery Market Report:

The Middle East and African Drug Discovery market is projected to grow from $7.57 billion in 2023 to $16.42 billion by 2033. This growth is fueled by increasing healthcare budgets and the establishment of research institutions focused on drug development. However, factors such as political instability and varying regulatory environments pose challenges for market expansion.Tell us your focus area and get a customized research report.

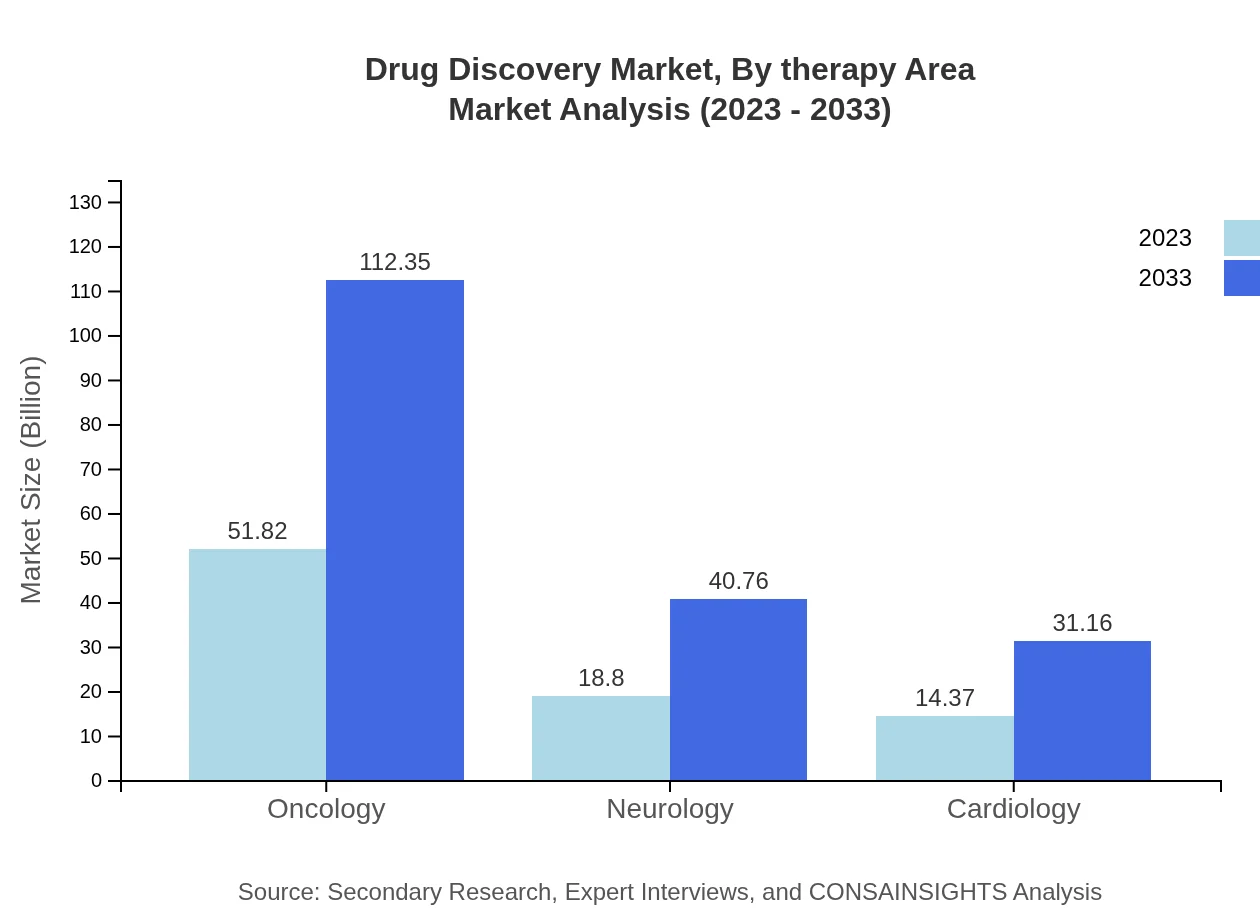

Drug Discovery Market Analysis By Therapy Area

In the drug discovery sector, oncology leads the therapy area, with a market size of $51.82 billion expected to grow to $112.35 billion by 2033, accounting for a significant market share of 60.97% in 2023. Neurology and cardiology also represent critical areas, each projected to show steady growth, driven by increasing disease prevalence and demand for innovative therapeutic agents.

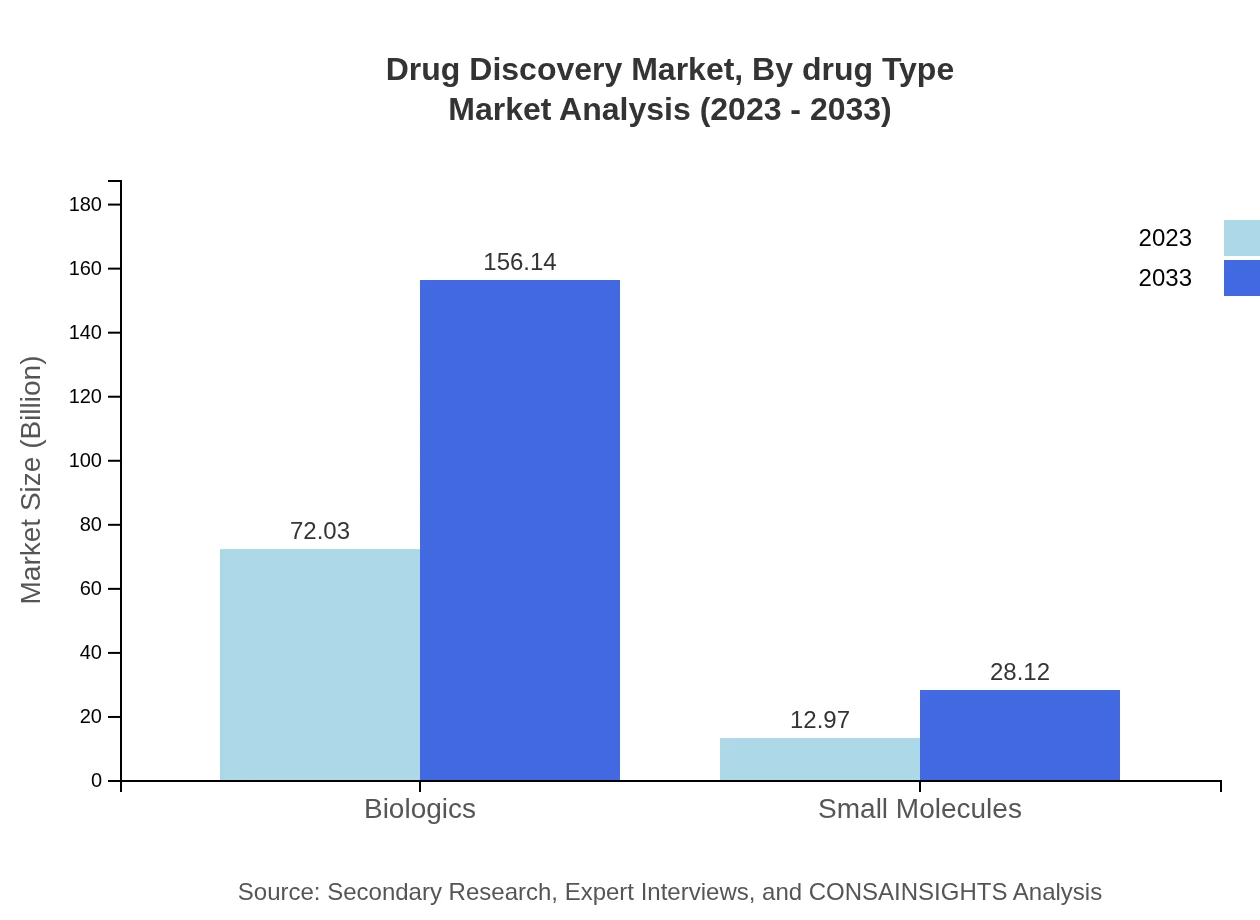

Drug Discovery Market Analysis By Drug Type

Biologics dominate the drug discovery market with an expected size growth from $72.03 billion in 2023 to $156.14 billion by 2033, maintaining an impressive market share of 84.74%. Meanwhile, small molecules are also valuable, exhibiting growth from $12.97 billion in 2023 to $28.12 billion by 2033.

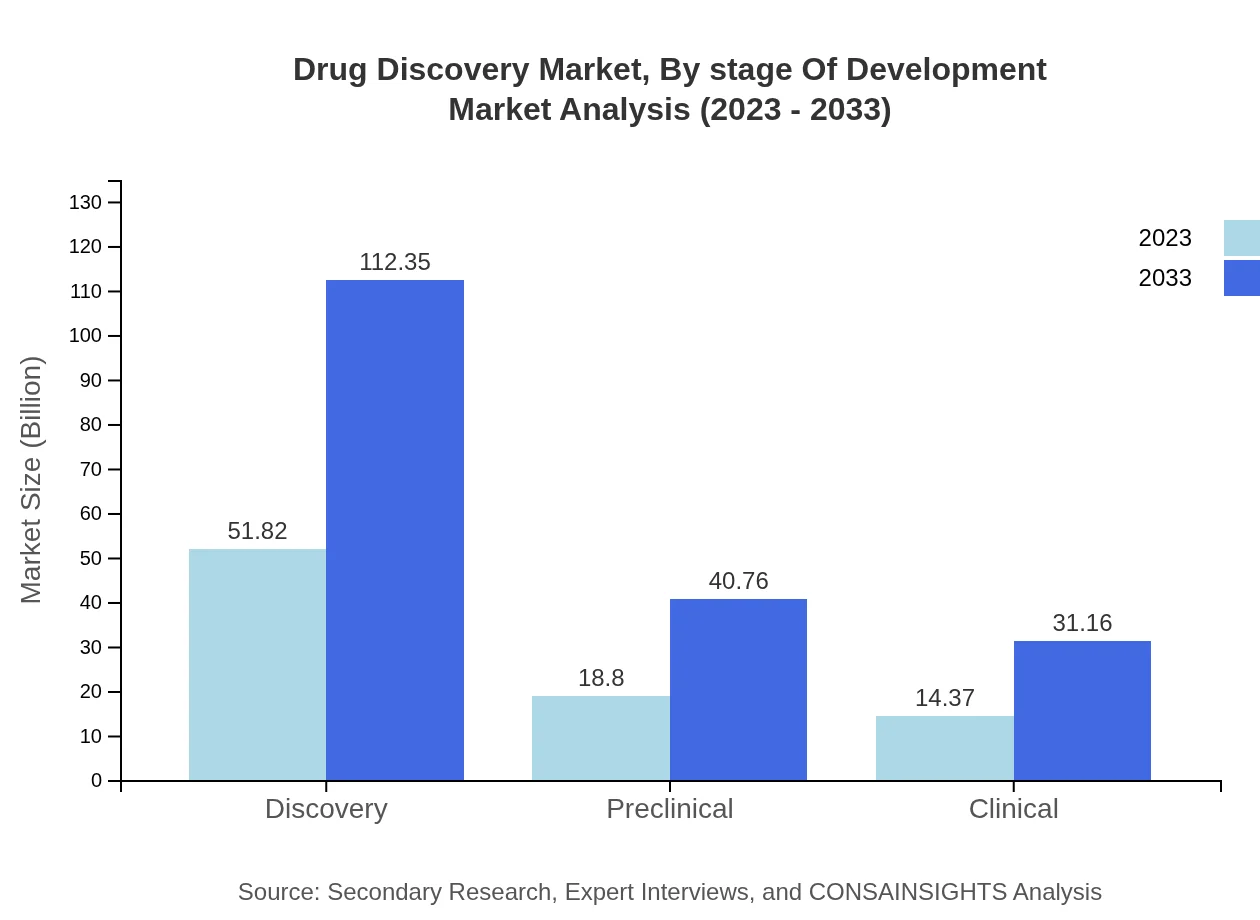

Drug Discovery Market Analysis By Stage Of Development

The Drug Discovery market is categorized into Discovery, Preclinical, and Clinical stages. The discovery stage accounts for $51.82 billion and is anticipated to grow to $112.35 billion by 2033. The preclinical phase and clinical trials also show substantial growth projections, signifying robust research activities aimed at advancing drug candidates through development.

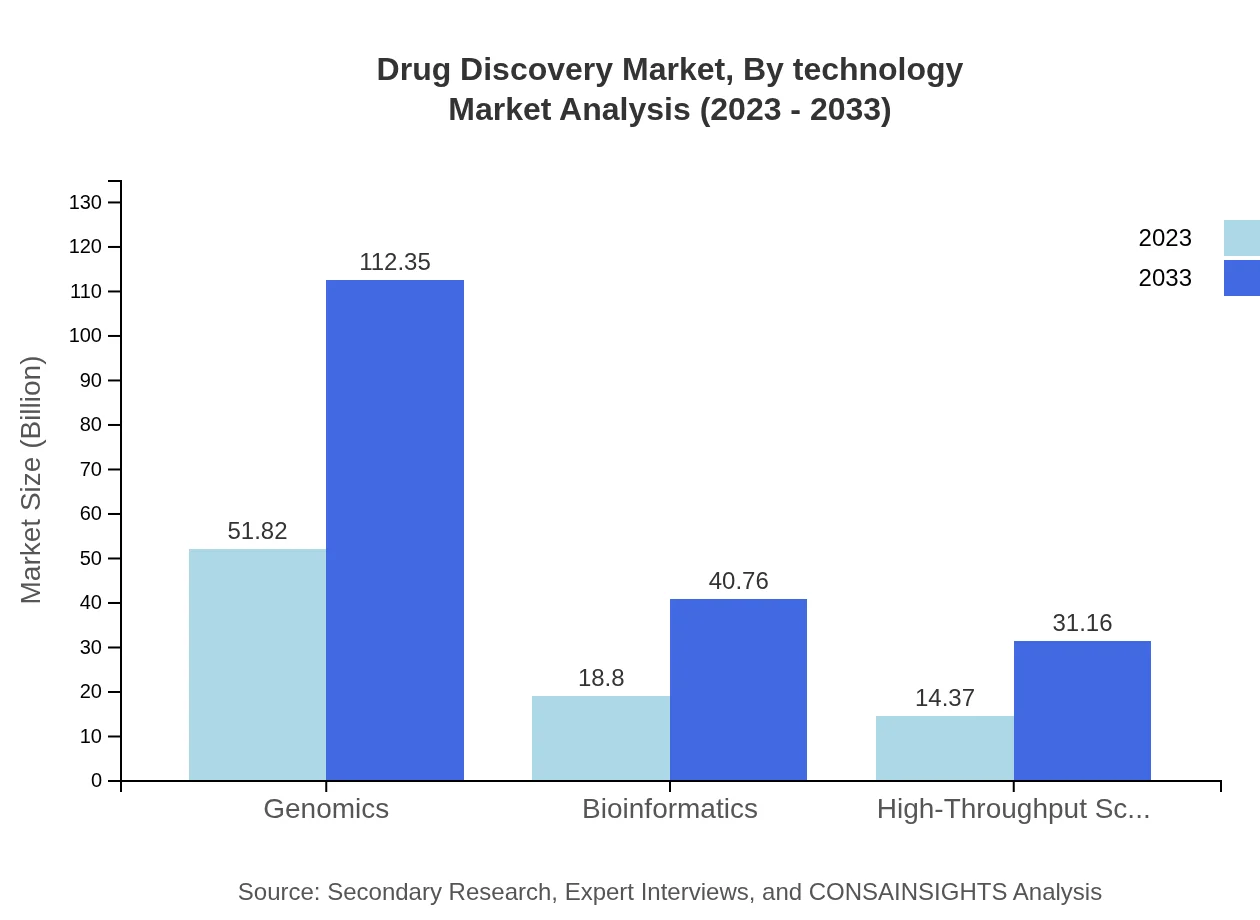

Drug Discovery Market Analysis By Technology

Technological advancements are reshaping drug discovery, especially through high-throughput screening and bioinformatics strategies. The market for high-throughput screening accounts for approximately $14.37 billion, growing to $31.16 billion by 2033, while bioinformatics is expected to increase from $18.80 billion to $40.76 billion over the same timeline.

Drug Discovery Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Drug Discovery Industry

Pfizer :

A leading pharmaceutical company known for its diversified portfolio and a significant investment in drug discovery processes, pioneering advancements in vaccine development and oncology.Novartis:

Renowned for its innovative medicines and commitment to R&D, Novartis actively engages in drug discovery across various therapeutic areas, particularly in biologics and personalized medicine.Roche:

Focused on oncology and personalized healthcare, Roche is a prominent player in drug discovery, leveraging extensive research programs and partnerships to innovate in therapeutics.We're grateful to work with incredible clients.

FAQs

What is the market size of drug Discovery?

The drug discovery market is projected to reach $85 billion by 2033, growing at a CAGR of 7.8%. This growth reflects advancements in research, increased biotech funding, and a rising need for novel therapies tailored to complex diseases.

What are the key market players or companies in the drug Discovery industry?

Key players in the drug discovery industry include major pharmaceutical companies such as Pfizer, Novartis, and Roche, as well as biotech firms like Amgen and Biogen. These companies lead in innovative research and development practices.

What are the primary factors driving the growth in the drug discovery industry?

Growth in the drug discovery industry is driven by factors such as increasing prevalence of chronic diseases, advances in genomics and bioinformatics technologies, regulatory support for drug innovation, and increased investment in research and development.

Which region is the fastest Growing in drug discovery?

The Asia Pacific region is the fastest-growing in the drug discovery industry. The market size is expected to grow from $15.68 billion in 2023 to $34.00 billion by 2033, driven by more investments and advancements in healthcare infrastructure.

Does ConsaInsights provide customized market report data for the drug Discovery industry?

Yes, ConsaInsights offers customized market report data for the drug discovery industry. Clients can request tailored insights based on specific needs, focusing on particular segments, regions, or trends.

What deliverables can I expect from this drug Discovery market research project?

Deliverables from the drug discovery market research project include detailed market analysis reports, trend forecasts, competitive landscape assessments, and insights on regional developments, providing actionable data for strategic decision-making.

What are the market trends of drug discovery?

Key market trends in drug discovery include the rise of biologics and personalized medicine, leveraging AI and machine learning for drug development, increased focus on rare diseases, and collaboration between biotech firms and academia.