Drug Discovery Outsourcing Market Report

Published Date: 31 January 2026 | Report Code: drug-discovery-outsourcing

Drug Discovery Outsourcing Market Size, Share, Industry Trends and Forecast to 2033

This report offers an in-depth analysis of the Drug Discovery Outsourcing market from 2023 to 2033, providing insights into market size, growth trends, industry dynamics, regional variation, and competitive landscapes.

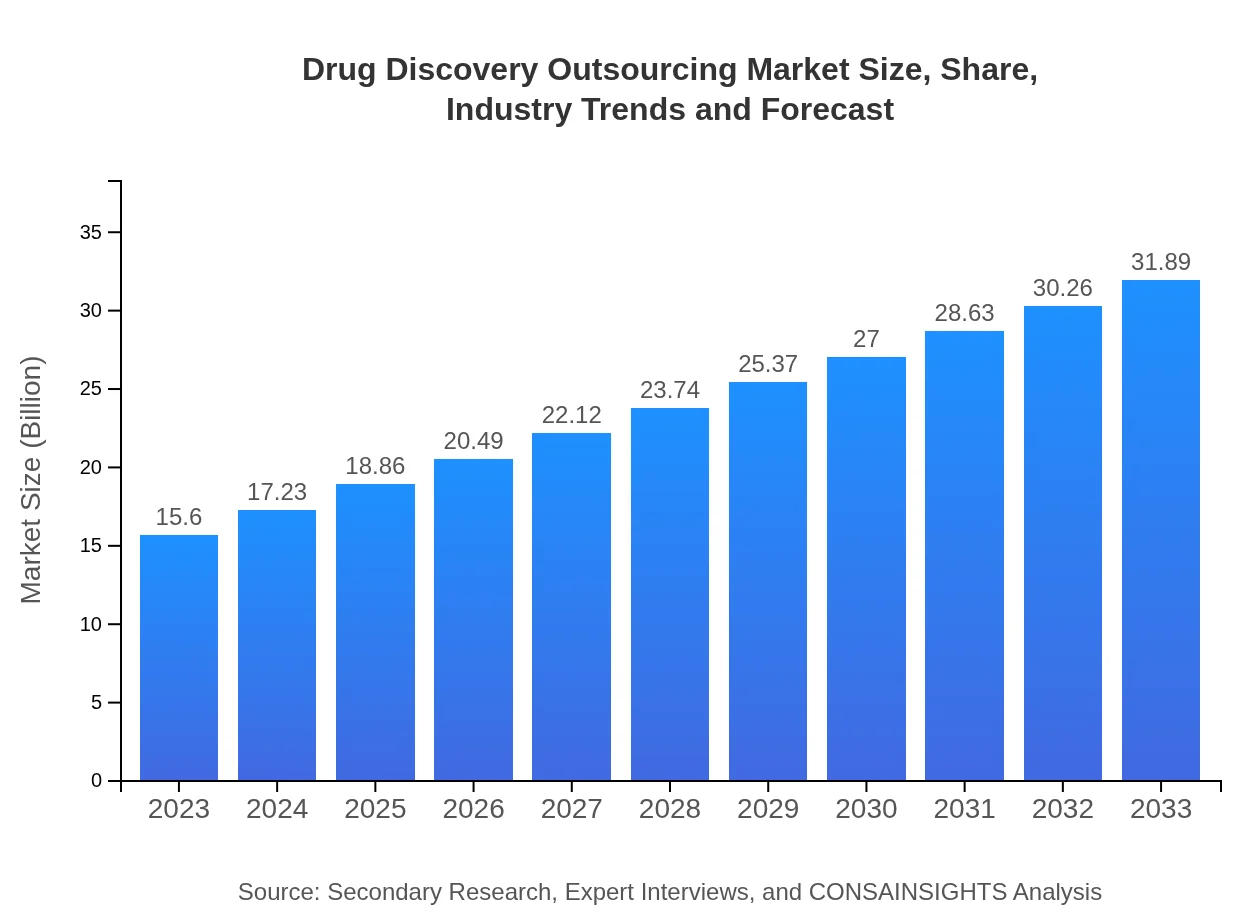

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $31.89 Billion |

| Top Companies | Covance, Charles River Laboratories, IQVIA , PRA Health Sciences, Syneos Health |

| Last Modified Date | 31 January 2026 |

Drug Discovery Outsourcing Market Overview

Customize Drug Discovery Outsourcing Market Report market research report

- ✔ Get in-depth analysis of Drug Discovery Outsourcing market size, growth, and forecasts.

- ✔ Understand Drug Discovery Outsourcing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Drug Discovery Outsourcing

What is the Market Size & CAGR of Drug Discovery Outsourcing market in 2023?

Drug Discovery Outsourcing Industry Analysis

Drug Discovery Outsourcing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Drug Discovery Outsourcing Market Analysis Report by Region

Europe Drug Discovery Outsourcing Market Report:

In Europe, the market size is projected to grow from $5.40 billion in 2023 to $11.04 billion by 2033. Factors driving this growth include stringent regulatory requirements, strong collaborative networks among EU member states, and increased investment in life sciences research.Asia Pacific Drug Discovery Outsourcing Market Report:

In the Asia Pacific region, the Drug Discovery Outsourcing market is projected to grow from $2.96 billion in 2023 to $6.04 billion by 2033, driven by a growing preference among pharmaceutical companies to exploit lower operating costs, skilled labor availability, and advanced technological infrastructure. China's and India's growing prominence as innovation hubs further reinforces market growth.North America Drug Discovery Outsourcing Market Report:

The North American Drug Discovery Outsourcing market is valued at $5.33 billion in 2023 and is anticipated to reach $10.89 billion by 2033. This surge can be attributed to high R&D expenditures, an extensive network of pharmaceutical companies, and a robust regulatory framework that fosters innovation and efficiency in drug development.South America Drug Discovery Outsourcing Market Report:

The South American market is expected to increase from $1.51 billion in 2023 to $3.09 billion by 2033. This growth is attributed to the region's developing biopharmaceutical sector and increasing governmental incentives for R&D in drug discovery.Middle East & Africa Drug Discovery Outsourcing Market Report:

For the Middle East and Africa, the market is expected to grow from $0.40 billion in 2023 to $0.82 billion by 2033, driven by increasing partnerships in research and development and a burgeoning interest in healthcare improvements across various nations in the region.Tell us your focus area and get a customized research report.

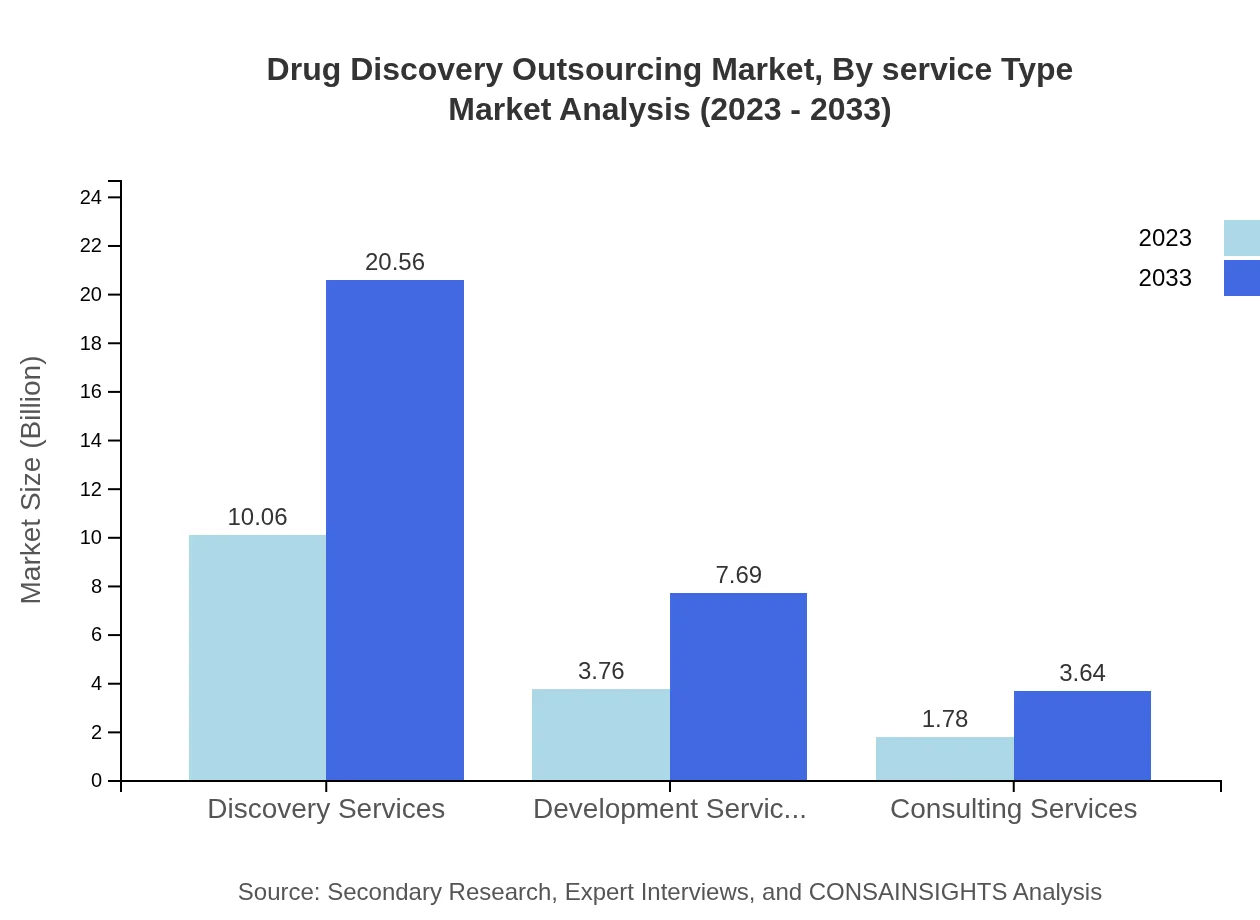

Drug Discovery Outsourcing Market Analysis By Service Type

The Drug Discovery Outsourcing market by service type includes discovery services, development services, and consulting services. Discovery services dominate the market with a value of $10.06 billion in 2023 and a projected growth to $20.56 billion by 2033, representing over 64% of the market share. Development services, starting at $3.76 billion, are expected to grow to $7.69 billion, while consulting services will expand from $1.78 billion to $3.64 billion, which showcases the increasing reliance on specialized support throughout the drug development pathway.

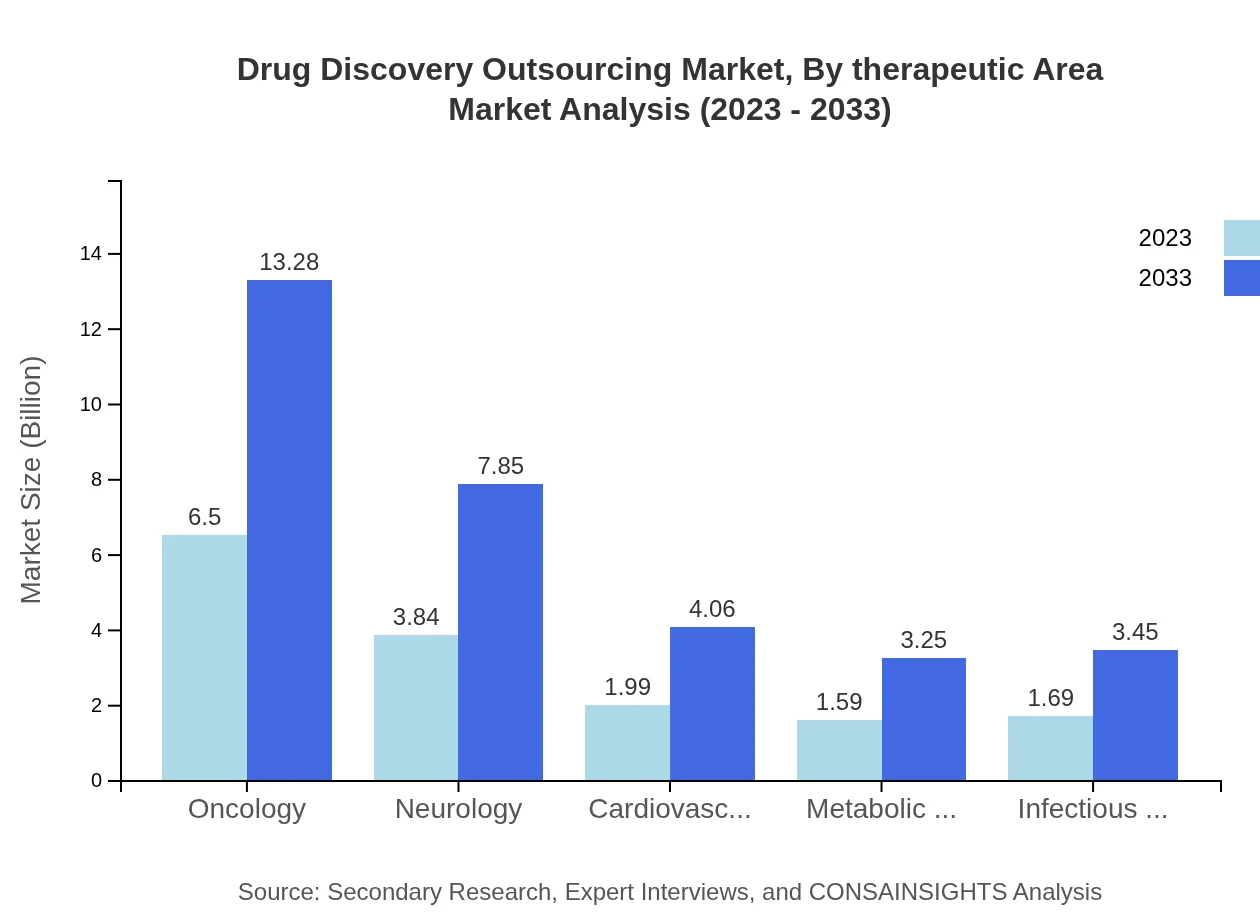

Drug Discovery Outsourcing Market Analysis By Therapeutic Area

In terms of therapeutic area, oncology leads the Drug Discovery Outsourcing market with a significant size of $6.50 billion in 2023, expected to grow to $13.28 billion by 2033, making up 41.65% of the therapeutic area share. Neurology follows, starting at $3.84 billion and anticipated to reach $7.85 billion. Other important areas include cardiovascular disorders and infectious diseases, highlighting the diverse health challenges addressed through outsourced drug discovery.

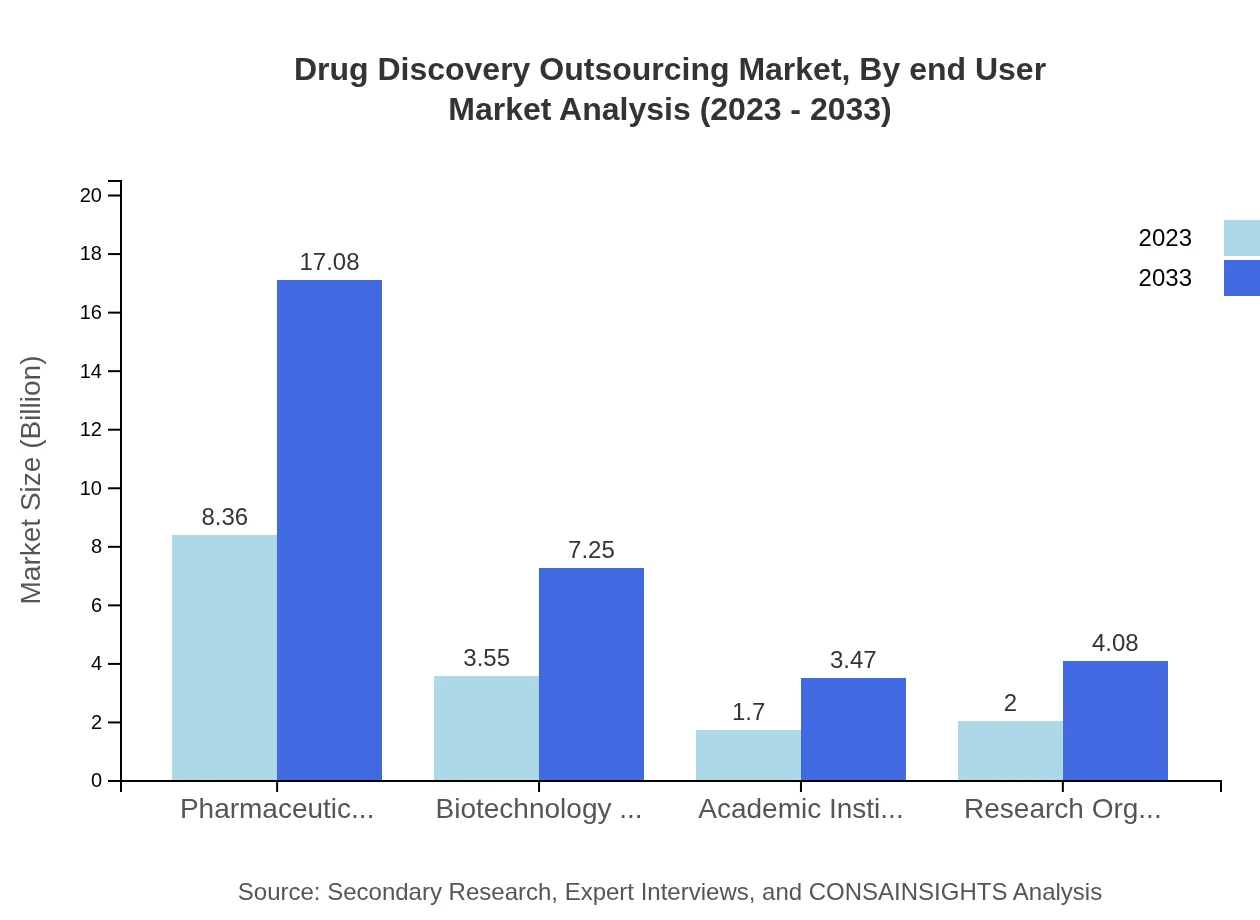

Drug Discovery Outsourcing Market Analysis By End User

The end-user segment shows pharmaceutical companies as the largest contributors to the Drug Discovery Outsourcing market, valued at $8.36 billion in 2023 and expected to grow to $17.08 billion by 2033, holding 53.56% of the market share. Biotechnology companies, academic institutions, and research organizations also play pivotal roles, emphasizing the multifaceted nature of the industry and the cross-sector collaboration in drug development.

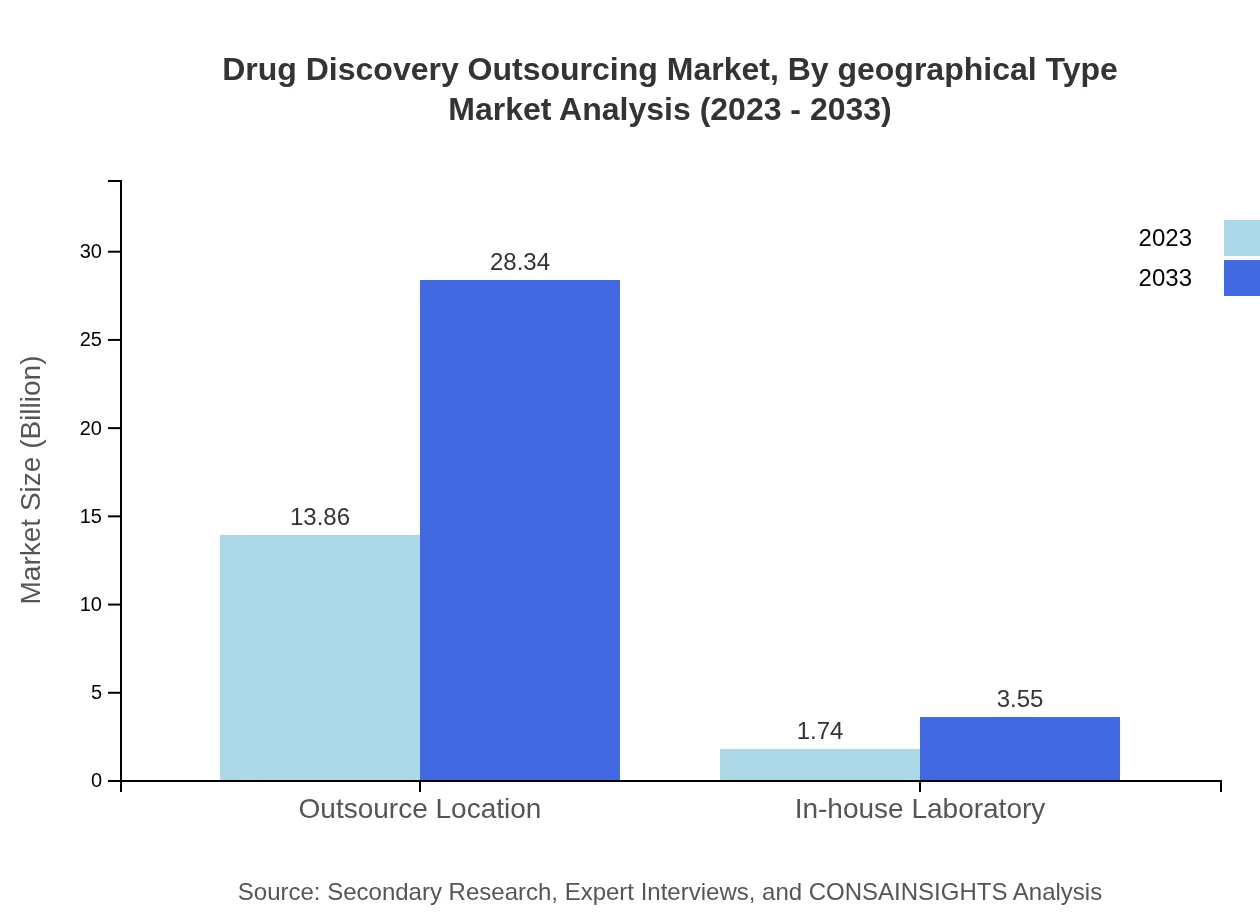

Drug Discovery Outsourcing Market Analysis By Geographical Type

The geographical analysis of Drug Discovery Outsourcing indicates North America leading with a 25.03% share in 2023, while Europe and Asia Pacific follow closely. The trend shows a gradual shift towards emerging markets in Asia due to cost-effectiveness and advanced technologies, which is reshaping how drug discovery is managed globally.

Drug Discovery Outsourcing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Drug Discovery Outsourcing Industry

Covance:

Covance, a leading global contract research organization, provides a wide range of drug development services to pharmaceutical and biotechnology companies, with significant expertise in preclinical and clinical studies.Charles River Laboratories:

Charles River Laboratories specializes in early-stage drug development and provides integrated preclinical services essential for the discovery of new therapeutics.IQVIA :

IQVIA leverages advanced analytics and technology to aid biopharmaceutical companies in accelerating product development and optimizing clinical trial efficiencies.PRA Health Sciences:

PRA Health Sciences offers comprehensive drug development and data solution services, focusing on fast, flexible operations and patient-centric strategies.Syneos Health:

Syneos Health integrates biopharmaceutical solutions to advance drug discovery and development, emphasizing collaboration and innovation.We're grateful to work with incredible clients.

FAQs

What is the market size of drug Discovery Outsourcing?

The global drug discovery outsourcing market is estimated to be valued at approximately $15.6 billion in 2023, with a projected compound annual growth rate (CAGR) of 7.2% through 2033.

What are the key market players or companies in this drug Discovery Outsourcing industry?

Key players in the drug discovery outsourcing industry include major pharmaceutical giants, biopharmaceutical companies, and specialized contract research organizations (CROs) that focus on innovative drug development and outsourcing various phases of drug discovery.

What are the primary factors driving the growth in the drug Discovery Outsourcing industry?

Growth in the drug discovery outsourcing industry is driven by factors such as increasing R&D costs, demand for specialized expertise, operational efficiency requirements, and the need for accelerated time-to-market for new drugs.

Which region is the fastest Growing in the drug Discovery Outsourcing?

Asia Pacific is the fastest-growing region in the drug discovery outsourcing market, expanding from $2.96 billion in 2023 to an anticipated $6.04 billion by 2033, driven by rising investments in biotechnology and pharmaceutical research.

Does ConsaInsights provide customized market report data for the drug Discovery Outsourcing industry?

Yes, ConsaInsights offers tailored market report data for the drug discovery outsourcing industry, allowing clients to focus on specific segments, regions, and other parameters based on unique business needs.

What deliverables can I expect from this drug Discovery Outsourcing market research project?

Deliverables from a drug discovery outsourcing market research project include detailed market analysis, segment insights, regional forecasts, competitive landscape assessments, and actionable recommendations that align with business objectives.

What are the market trends of drug Discovery Outsourcing?

Current trends in the drug discovery outsourcing market include increased reliance on digital technologies, a shift towards collaborative partnerships, a growing focus on precision medicine, and rising interest in outsourcing from emerging economies.