Dry Chilies Market Report

Published Date: 02 February 2026 | Report Code: dry-chilies

Dry Chilies Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Dry Chilies market from 2023 to 2033, outlining market size, growth prospects, segment performance, and regional insights, aiming to deliver key data for stakeholders and investors.

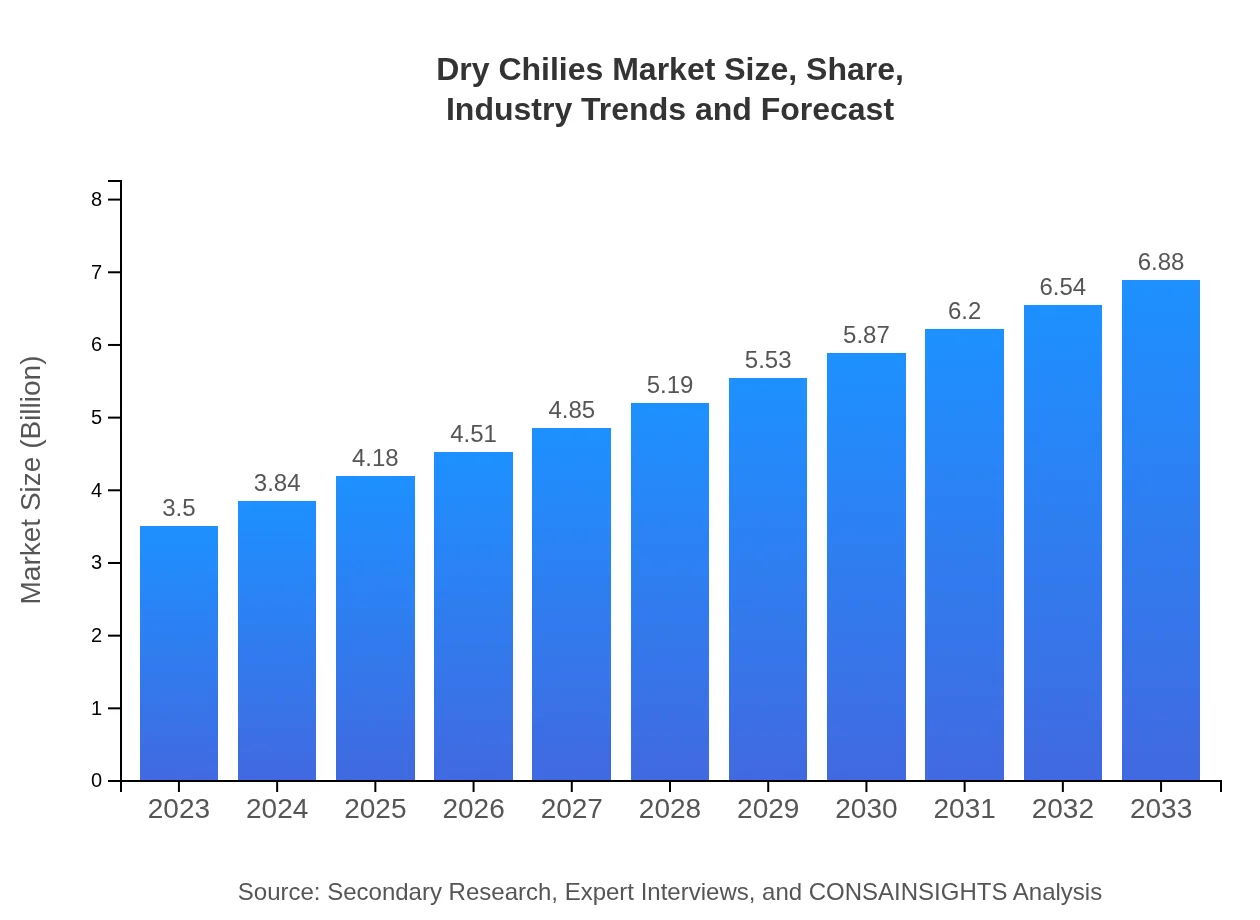

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.88 Billion |

| Top Companies | McCormick & Company, Inc., Frontier Co-op, Spice World LLC, Starwest Botanicals, Inc. |

| Last Modified Date | 02 February 2026 |

Dry Chilies Market Overview

Customize Dry Chilies Market Report market research report

- ✔ Get in-depth analysis of Dry Chilies market size, growth, and forecasts.

- ✔ Understand Dry Chilies's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Dry Chilies

What is the Market Size & CAGR of Dry Chilies market in 2023?

Dry Chilies Industry Analysis

Dry Chilies Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Dry Chilies Market Analysis Report by Region

Europe Dry Chilies Market Report:

Europe's Dry Chilies market is valued at USD 0.98 billion in 2023, expected to double to USD 1.93 billion by 2033. A growing trend towards spicy flavors and ethnic cuisines among European consumers bolsters this growth.Asia Pacific Dry Chilies Market Report:

In 2023, the market value in the Asia Pacific region is approximately USD 0.66 billion, projected to grow to USD 1.31 billion by 2033. The region's rich culinary heritage and extensive chili production ensure a robust demand for both domestic use and global exports.North America Dry Chilies Market Report:

North America has a market size of USD 1.35 billion in 2023, anticipated to rise to USD 2.64 billion by 2033. The strong preference for spicy food and an expanding food service industry are significant growth drivers in this area.South America Dry Chilies Market Report:

The South America market is currently valued at USD 0.08 billion in 2023, with expectations of reaching USD 0.16 billion by 2033. This region is emerging due to increased consumption in local cuisines and growing exports to international markets.Middle East & Africa Dry Chilies Market Report:

In 2023, the Middle East and Africa market stands at USD 0.43 billion, with a forecast to reach USD 0.84 billion by 2033. The culinary importance of chilies in local dishes is a key factor driving demand in this region.Tell us your focus area and get a customized research report.

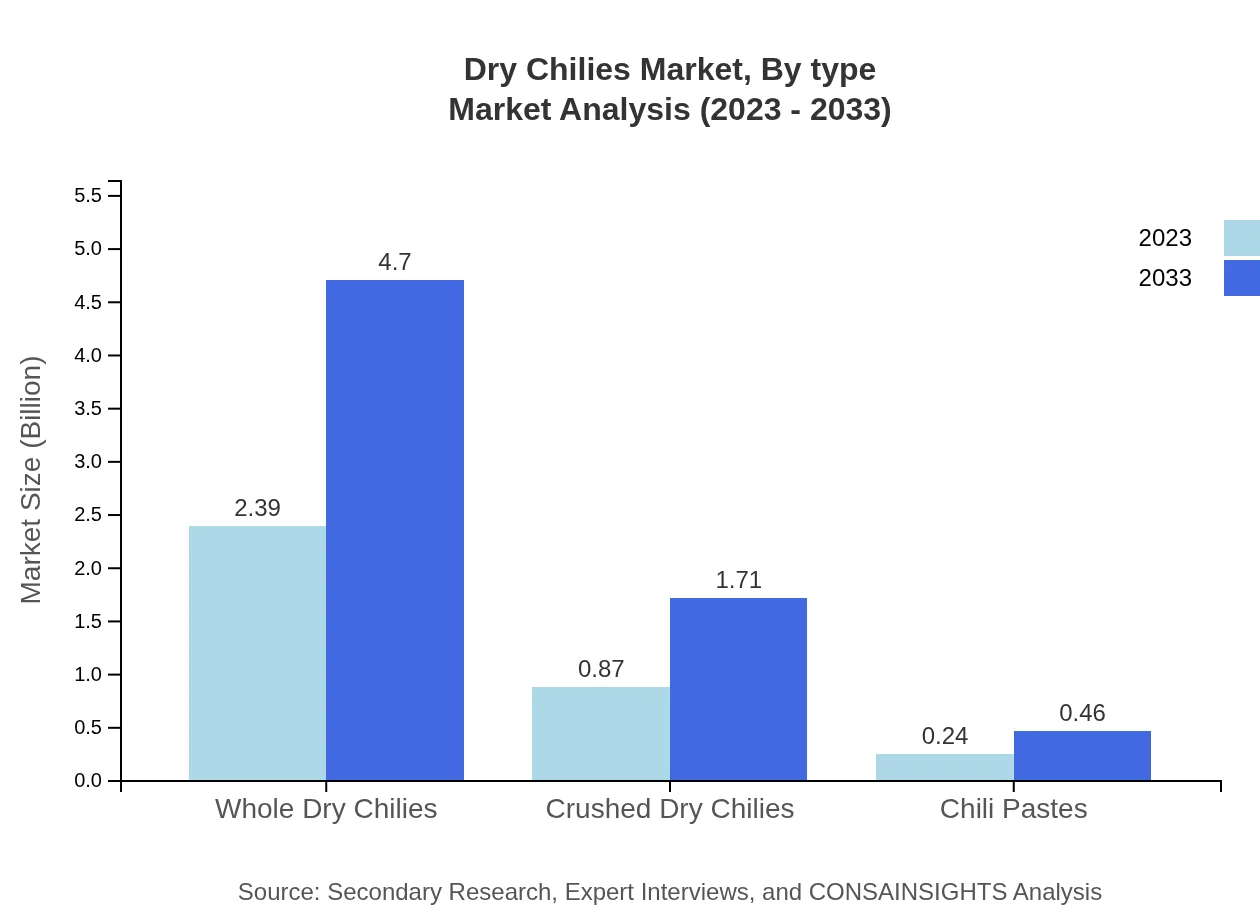

Dry Chilies Market Analysis By Type

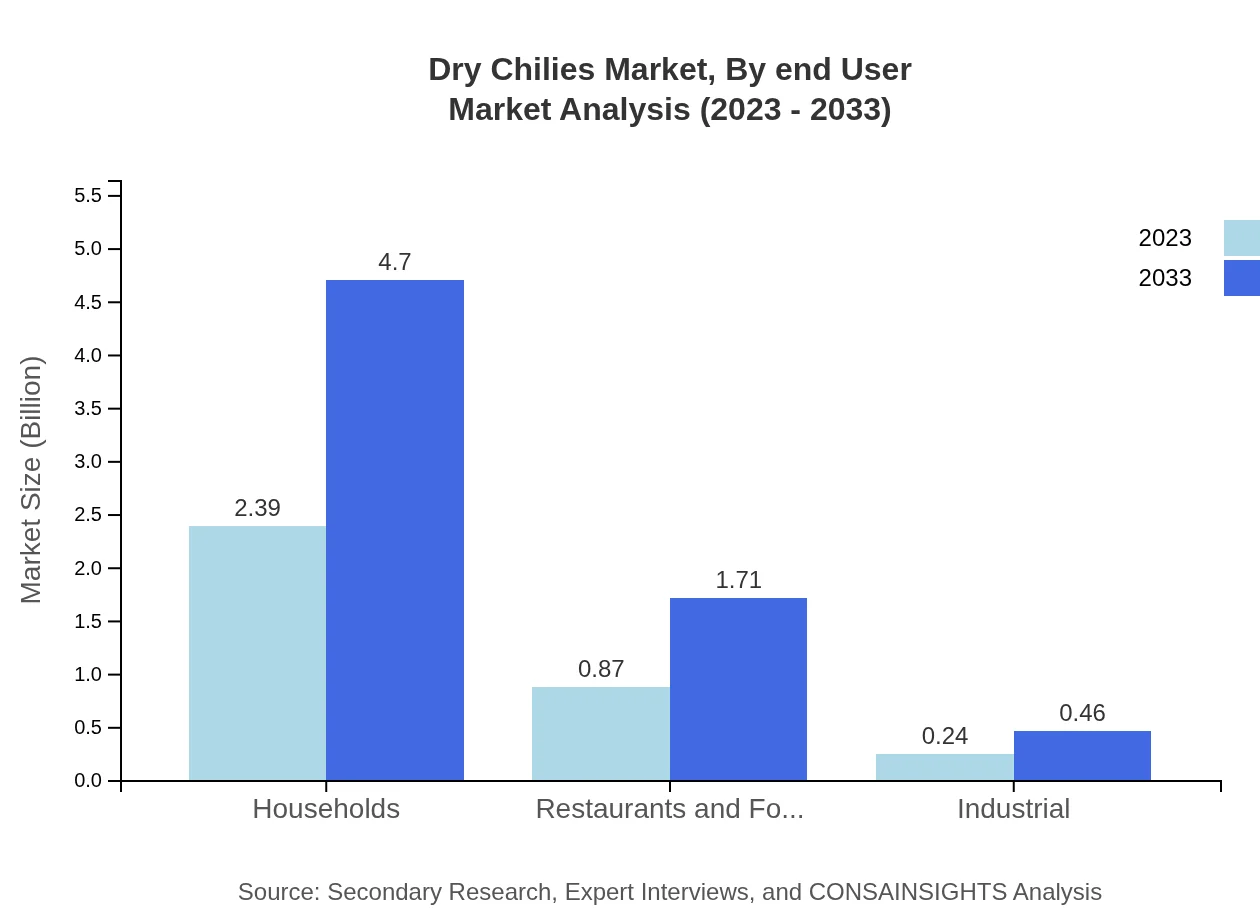

The segment for whole dry chilies is projected to grow from USD 2.39 billion in 2023 to USD 4.70 billion in 2033, maintaining a market share of 68.38%. Crushed dry chilies are also significant, growing from USD 0.87 billion to USD 1.71 billion, while chili pastes expect to grow from USD 0.24 billion to USD 0.46 billion.

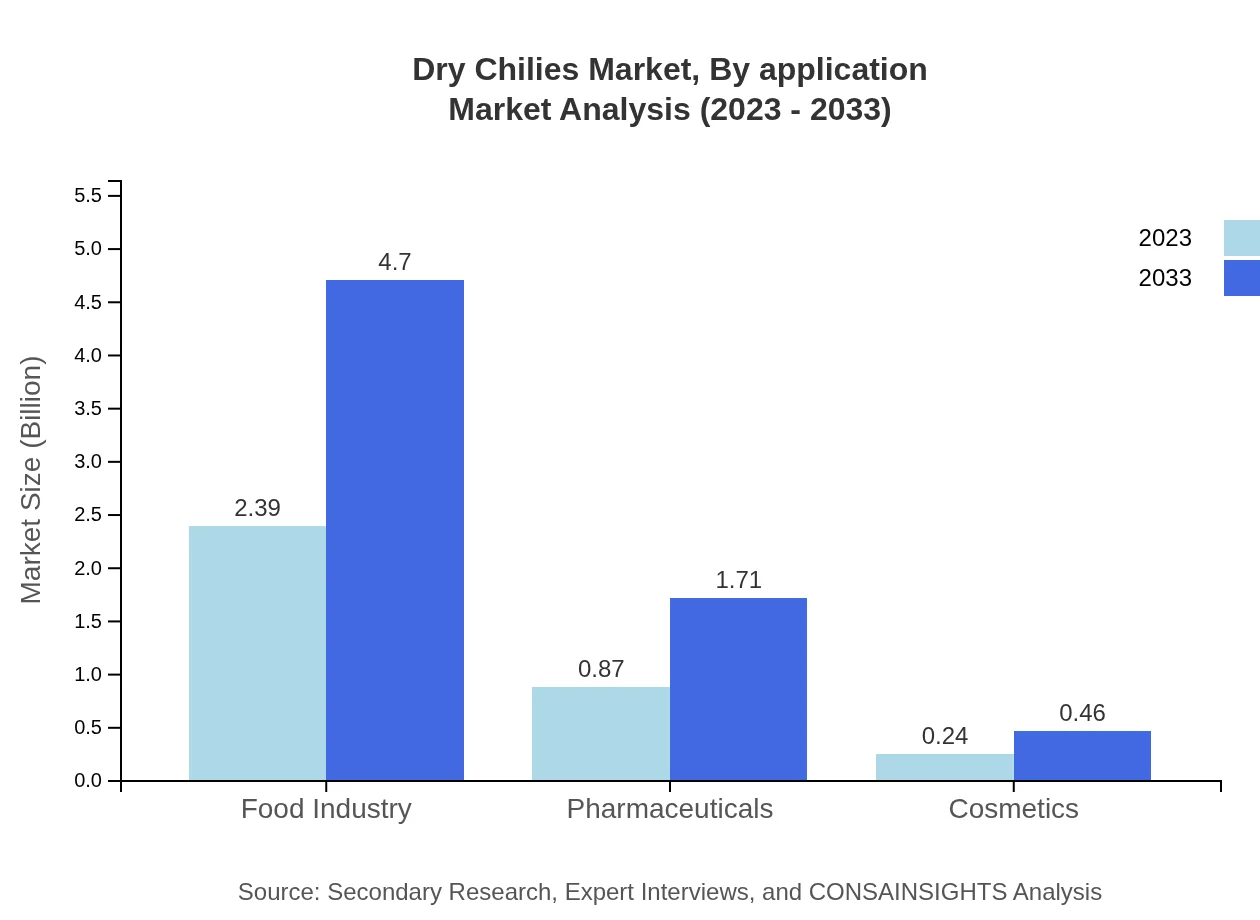

Dry Chilies Market Analysis By Application

Households account for a market size of USD 2.39 billion in 2023 and are poised to grow to USD 4.70 billion by 2033. The restaurant and food service sector are also critical, growing from USD 0.87 billion to USD 1.71 billion, supported by increasing dining experiences emphasizing spice.

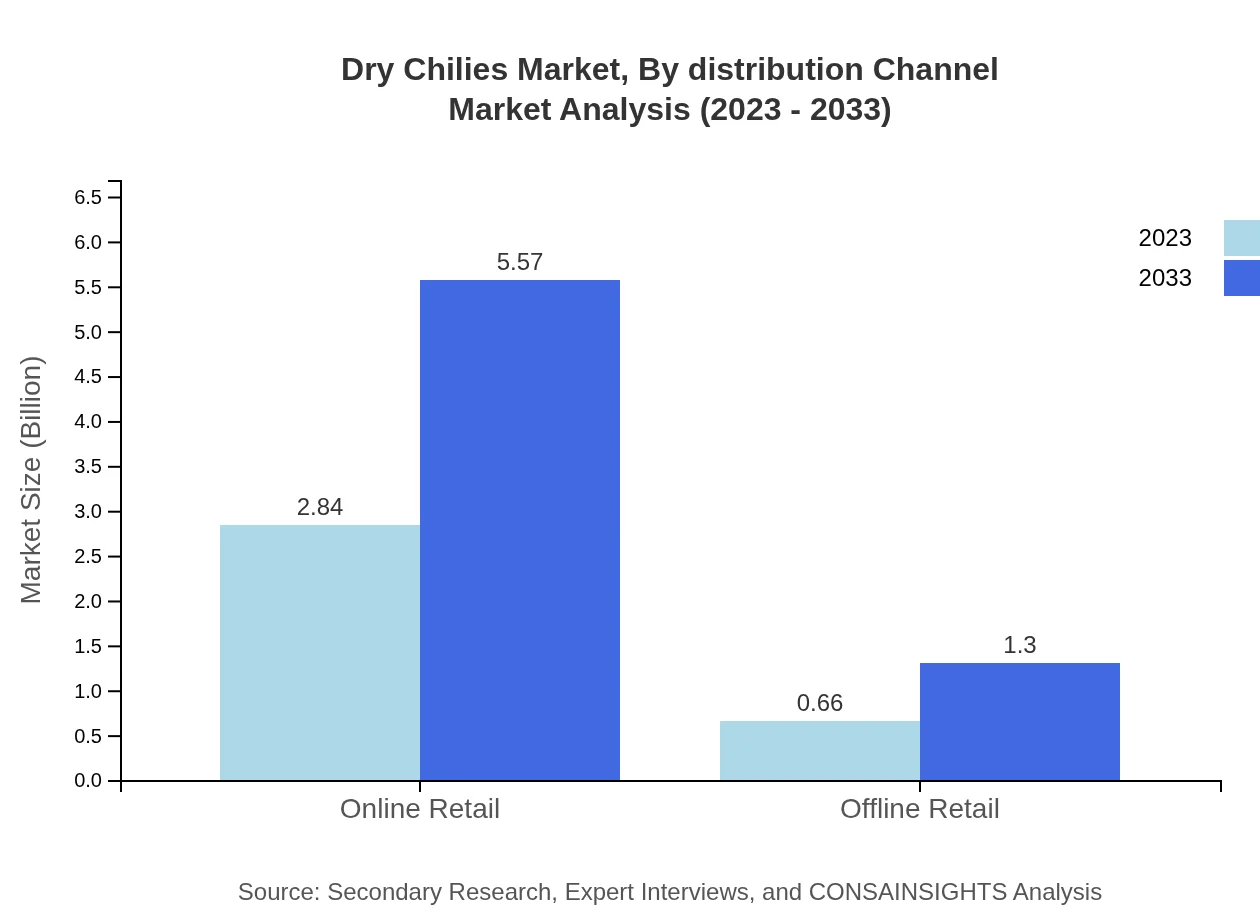

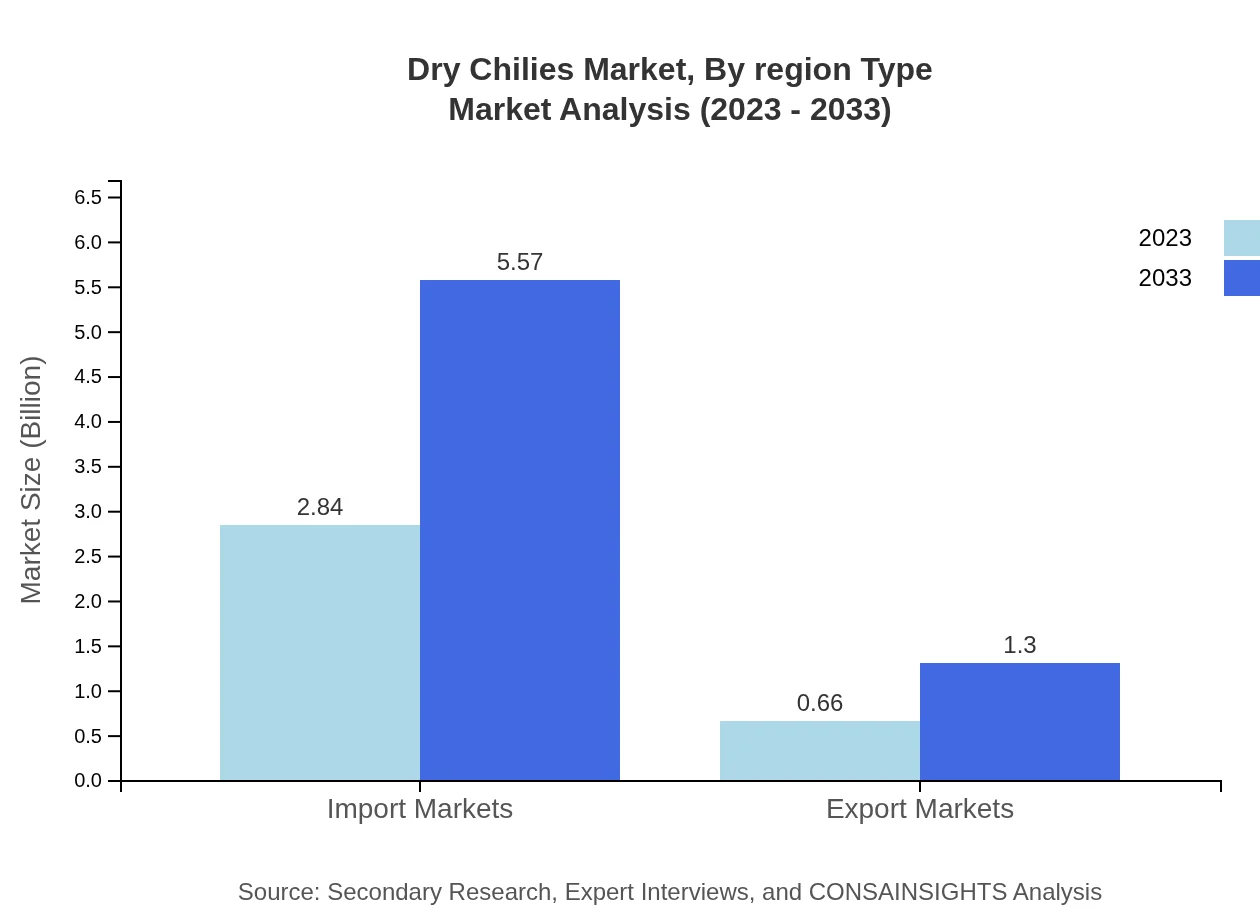

Dry Chilies Market Analysis By Distribution Channel

In 2023, the online retail segment leads with a market size of USD 2.84 billion, expected to reach USD 5.57 billion by 2033, maintaining a share of 81.03%. Offline retail follows, from USD 0.66 billion to USD 1.30 billion, driven by traditional markets.

Dry Chilies Market Analysis By End User

The food industry dominates with a market value moving from USD 2.39 billion in 2023 to USD 4.70 billion in 2033, while the pharmaceuticals sector holds a steady growth trajectory, from USD 0.87 billion to USD 1.71 billion.

Dry Chilies Market Analysis By Region Type

A comprehensive analysis of drying locations highlights region-specific consumption patterns and market dynamics influencing preferences, particularly focusing on the leading markets in Asia, North America, and Europe.

Dry Chilies Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Dry Chilies Industry

McCormick & Company, Inc.:

A global leader in food products, McCormick offers a wide range of spices, including various types of dry chilies, catering to both retail and food service industries, known for their quality and innovation.Frontier Co-op:

Specializing in organic and natural products, Frontier Co-op provides a variety of dry chilies, emphasizing sustainable sourcing and high-quality spices, appealing to health-conscious customers.Spice World LLC:

A major supplier to the food service sector, Spice World specializes in dried and fresh herbs and spices, including a selection of dry chilies for culinary applications across North America.Starwest Botanicals, Inc.:

Known for their extensive range of organic herbs and spices, Starwest supplies high-quality dry chilies, particularly to the health food and retail sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of dry chilies?

The global dry chilies market is currently valued at approximately $3.5 billion in 2023, with an expected CAGR of 6.8% leading up to 2033, indicating robust growth and increasing demand in the coming years.

What are the key market players or companies in the dry chilies industry?

Key players in the dry chilies market include major global brands, local producers, and exporters focused on quality and distribution. These companies play crucial roles in supply chain dynamics and overall market presence.

What are the primary factors driving the growth in the dry chilies industry?

Growth in the dry chilies market is primarily driven by rising consumer demand for spicy and flavorful foods, health benefits associated with chilies, and increasing usage in culinary applications across various cuisines, stimulating market expansion.

Which region is the fastest Growing in the dry chilies market?

The Asia Pacific region is witnessing the fastest growth in the dry chilies market, projected to increase from $0.66 billion in 2023 to $1.31 billion by 2033, bolstered by high consumption rates and culinary tradition.

Does ConsaInsights provide customized market report data for the dry chilies industry?

Yes, ConsaInsights offers customized market report data tailored to the unique needs of clients in the dry chilies industry, ensuring that specific insights and information are aligned with business objectives.

What deliverables can I expect from this dry chilies market research project?

Expect comprehensive reports detailing market size, growth projections, segment analysis, competitive landscape assessments, and regional data, which will aid in strategic decision-making within the dry chilies market.

What are the market trends of dry chilies?

Current trends in the dry chilies market include a growing emphasis on organic cultivation, increasing online sales channels, and a surge in innovative product formulations that incorporate chilies, highlighting evolving consumer preferences.