Dry Milling Market Report

Published Date: 31 January 2026 | Report Code: dry-milling

Dry Milling Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Dry Milling market, offering insights into market trends, opportunities, and challenges from 2023 to 2033, with a focus on industry developments, regional dynamics, and competitive landscape.

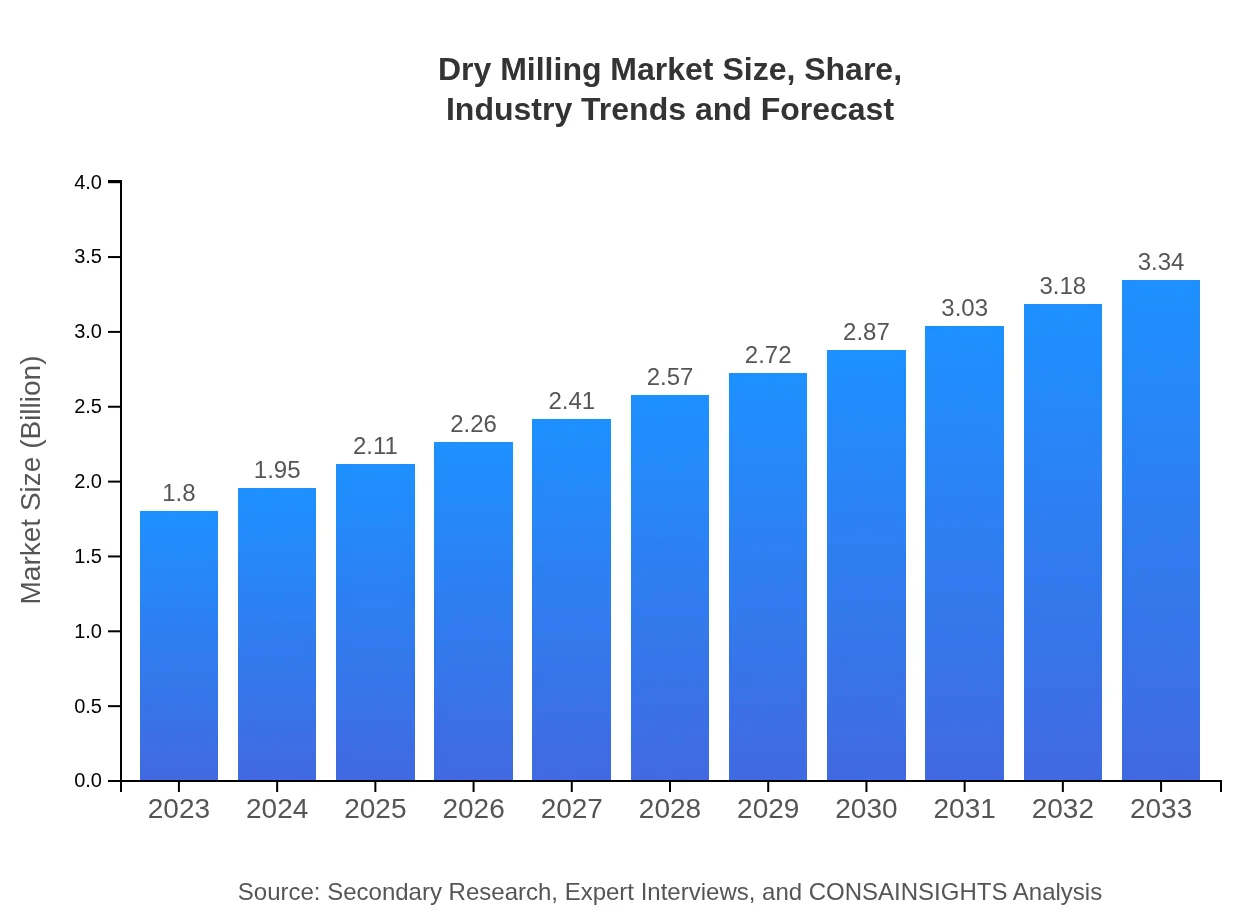

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $3.34 Billion |

| Top Companies | Archer Daniels Midland Company (ADM), Bunge Limited, Cargill, Incorporated, General Mills, Inc. |

| Last Modified Date | 31 January 2026 |

Dry Milling Market Overview

Customize Dry Milling Market Report market research report

- ✔ Get in-depth analysis of Dry Milling market size, growth, and forecasts.

- ✔ Understand Dry Milling's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Dry Milling

What is the Market Size & CAGR of Dry Milling market in 2023?

Dry Milling Industry Analysis

Dry Milling Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Dry Milling Market Analysis Report by Region

Europe Dry Milling Market Report:

Europe's Dry Milling market is estimated to move from $0.49 billion in 2023 to $0.90 billion by 2033, focusing on transitional practices towards sustainable and organic milling processes.Asia Pacific Dry Milling Market Report:

In the Asia Pacific, the Dry Milling market is anticipated to grow from $0.36 billion in 2023 to $0.67 billion by 2033, driven by rising consumer demand for processed foods and increasing investments in agricultural technology.North America Dry Milling Market Report:

North America is one of the largest markets, with the Dry Milling sector expected to expand from $0.63 billion in 2023 to $1.17 billion in 2033, influenced by high demand from the food and beverage sector and ongoing innovations in milling technologies.South America Dry Milling Market Report:

The Latin America region is projected to see growth from $0.15 billion in 2023 to $0.27 billion by 2033, supported by increasing agricultural exports and growing awareness of food processing techniques.Middle East & Africa Dry Milling Market Report:

In the Middle East and Africa, growth is expected from $0.17 billion in 2023 to $0.32 billion by 2033, propelled by increasing investments in food production capabilities and infrastructure development.Tell us your focus area and get a customized research report.

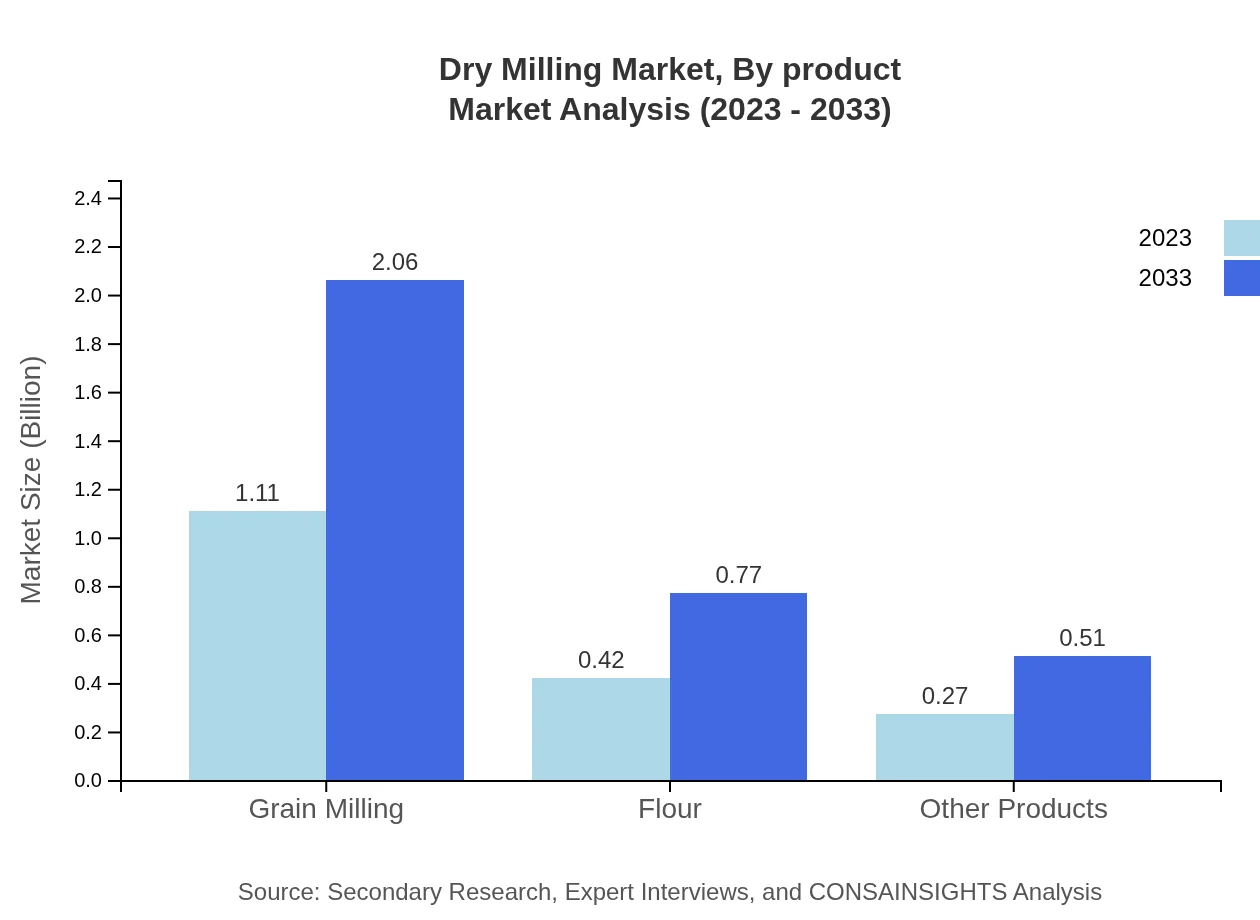

Dry Milling Market Analysis By Product

The Dry Milling market by product demonstrates significant segments, such as Grain Milling, which is projected to grow from $1.11 billion in 2023 to $2.06 billion by 2033, accounting for 61.66% of the market share. Flour production showcases growth from $0.42 billion to $0.77 billion, maintaining a 23.14% share, while products categorized as Other Products are also set to rise from $0.27 billion to $0.51 billion, comprising 15.20% of the market share.

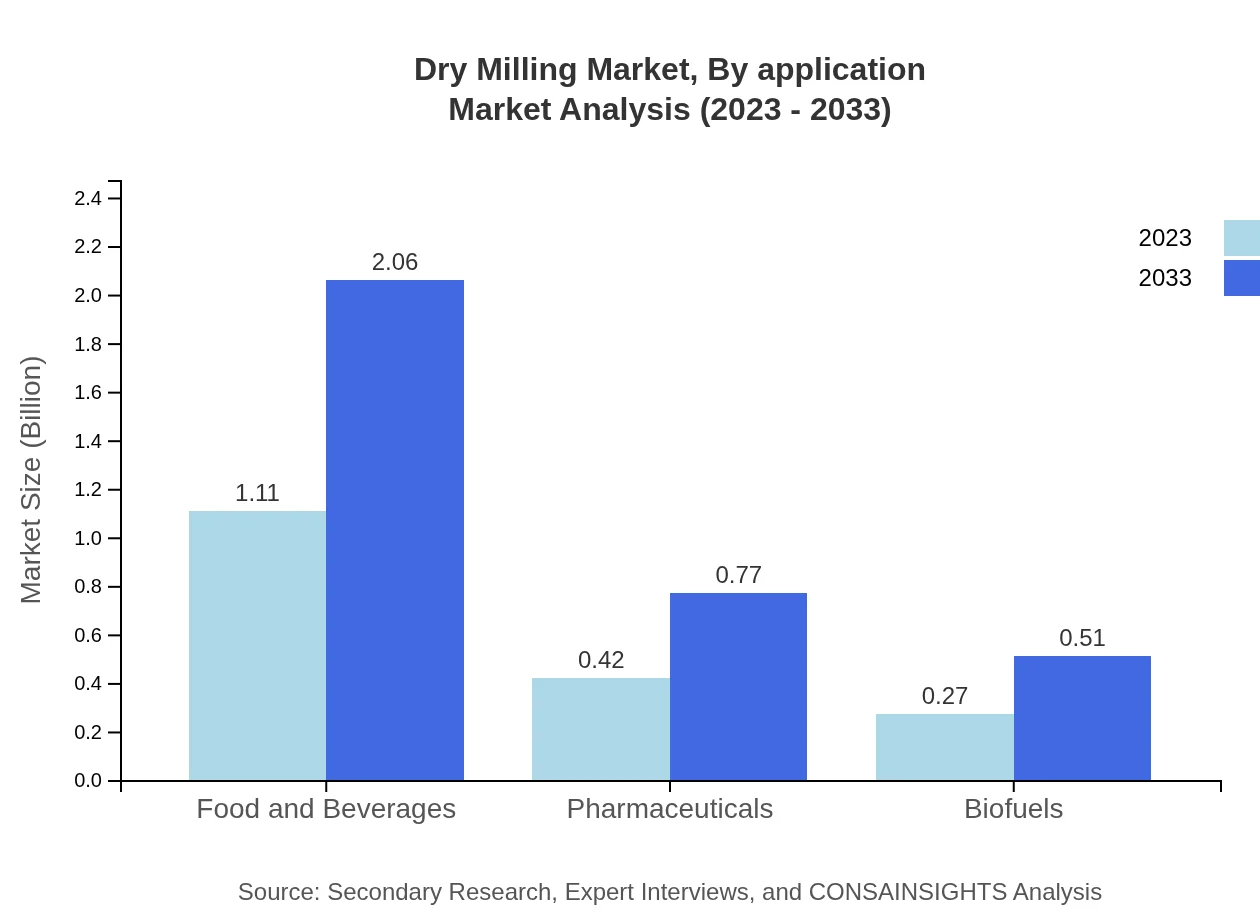

Dry Milling Market Analysis By Application

Application segmentation reveals the Food Industry as a dominant segment, moving from $1.11 billion to $2.06 billion by 2033 at a steady share of 61.66%. In comparison, the Animal Feed Industry is expected to increase from $0.42 billion to $0.77 billion, representing 23.14% of the market segment, while Biofuel Production is foreseen to grow from $0.27 billion to $0.51 billion, keeping a 15.20% share.

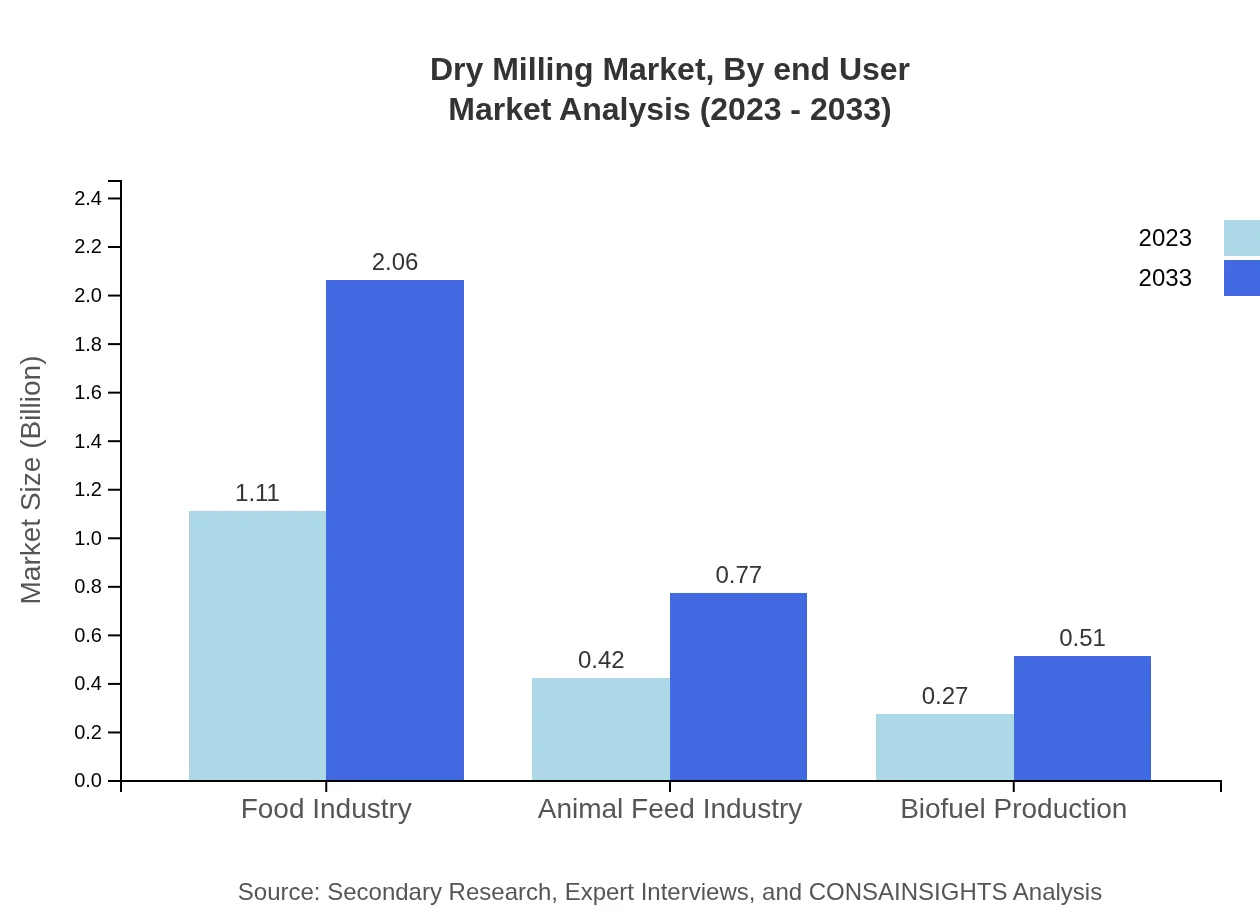

Dry Milling Market Analysis By End User

By end-user, the Food and Beverage sector stands out, projected to grow from $1.11 billion to $2.06 billion, representing 61.66% of the market. Pharmaceuticals and formulation processes for Animal Feed contribute significantly, with revenues increasing from $0.42 billion to $0.77 billion and $0.27 billion to $0.51 billion, respectively, highlighting their critical role in the Dry Milling market landscape.

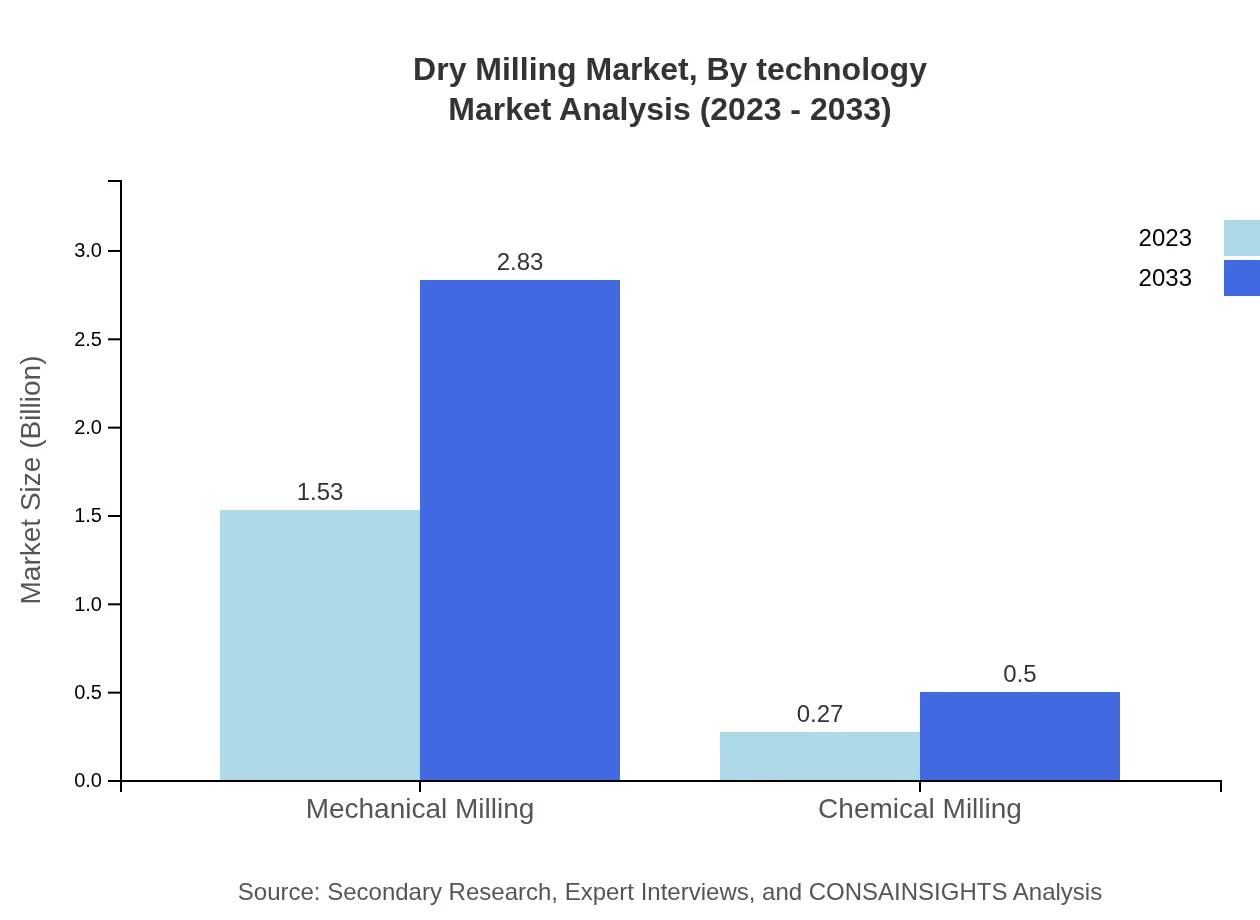

Dry Milling Market Analysis By Technology

The Dry Milling market is characterized by technologies like Mechanical Milling, accounting for 85% of the segment and expected to grow from $1.53 billion to $2.83 billion, while Chemical Milling represents a smaller share of 15% with an expected increase from $0.27 billion to $0.50 billion.

Dry Milling Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Dry Milling Industry

Archer Daniels Midland Company (ADM):

A global food processing and commodities trading corporation, ADM is a key player in the Dry Milling sector, offering high-quality grain and food products while leading innovations in milling technology.Bunge Limited:

Bunge is a leading agribusiness and food company known for its extensive grain handling and milling operations, playing a crucial role in the supply chain for various food products derived from milling processes.Cargill, Incorporated:

Cargill is a multinational corporation involved in food production and processing, with a strong presence in the Dry Milling market through its grain supply chain and innovations in food product development.General Mills, Inc.:

As a global leader in branded consumer foods, General Mills influences the milling industry by advocating for sustainable practices and advancing milling technology to produce high-quality flour and grain products.We're grateful to work with incredible clients.

FAQs

What is the market size of dry milling?

The global dry milling market is valued at approximately $1.8 billion in 2023, with a projected growth at a CAGR of 6.2%, indicating significant expansion opportunities from 2023 to 2033.

What are the key market players or companies in the dry milling industry?

Key players in the dry milling industry include major grain processing companies, which dominate the market through robust supply chains, technological innovation, and extensive product portfolios in grain, flour, and other milling products.

What are the primary factors driving the growth in the dry milling industry?

Growth in the dry milling industry is driven by increasing demand for processed food products, innovations in milling technology, and the rising need for animal feed and biofuels, enhancing market dynamics and expansion.

Which region is the fastest Growing in the dry milling?

The North America region is expected to exhibit the fastest growth in the dry milling market, expanding from $0.63 billion in 2023 to $1.17 billion by 2033, influenced by rising food processing needs.

Does ConsaInsights provide customized market report data for the dry milling industry?

Yes, ConsaInsights offers customized market report data tailored to specific business needs within the dry milling industry, ensuring detailed insights and analytics for strategic decision-making.

What deliverables can I expect from this dry milling market research project?

Deliverables include comprehensive market analysis reports, segmentation data, competitive landscape insights, growth forecasts, and actionable recommendations tailored to your specific objectives in the dry milling market.

What are the market trends of dry milling?

Key trends in the dry milling market include increasing automation in milling processes, a shift towards organic and sustainable milling practices, and growing demand for specialty flours catering to diverse dietary needs.