Dry Packaged Scallops Market Report

Published Date: 31 January 2026 | Report Code: dry-packaged-scallops

Dry Packaged Scallops Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Dry Packaged Scallops market, encompassing market size, growth forecasts, industry trends, and segmentation from 2023 to 2033. Insights into regional performance and key market players are also presented for a comprehensive overview.

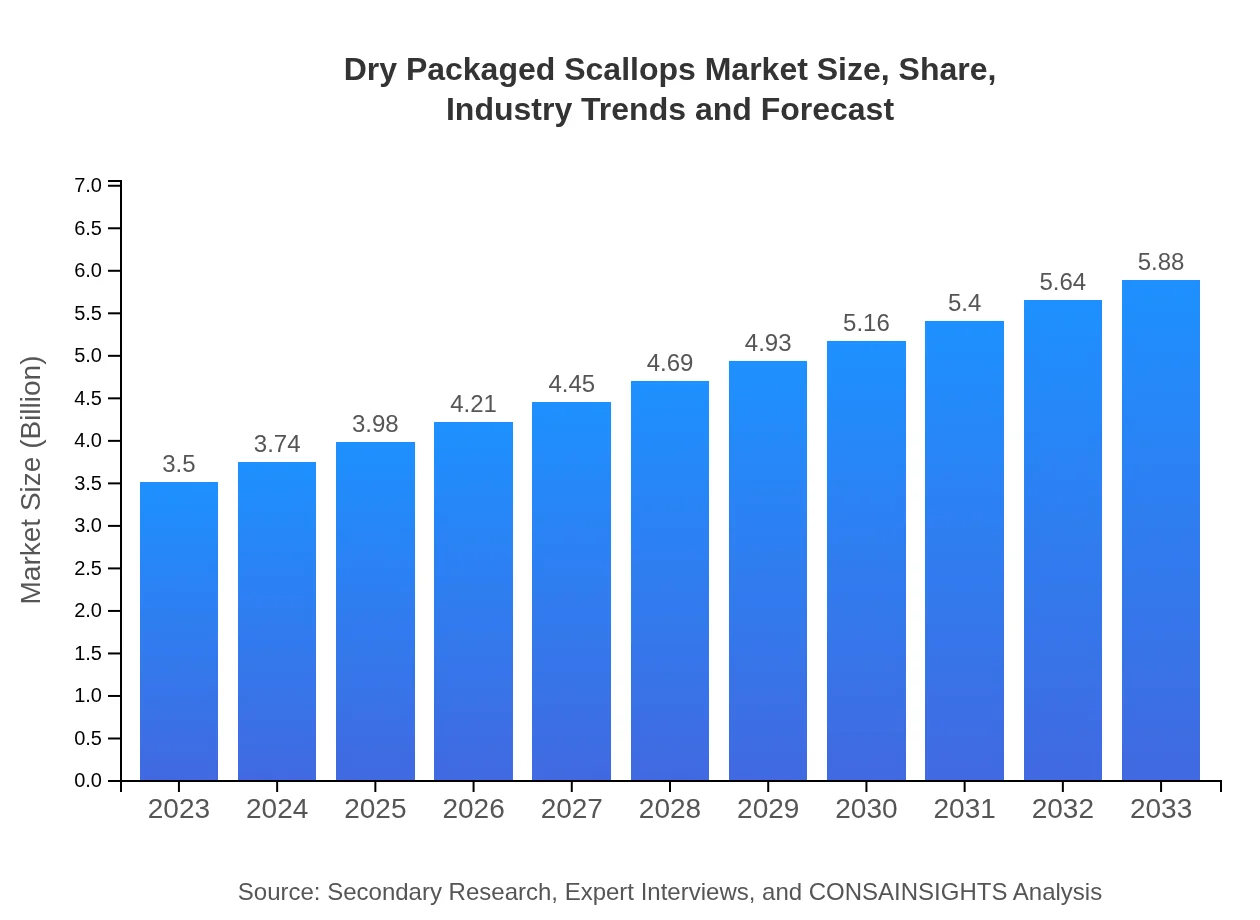

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $5.88 Billion |

| Top Companies | Pacific Seafood, High Liner Foods, Maruha Nichiro Corporation |

| Last Modified Date | 31 January 2026 |

Dry Packaged Scallops Market Overview

Customize Dry Packaged Scallops Market Report market research report

- ✔ Get in-depth analysis of Dry Packaged Scallops market size, growth, and forecasts.

- ✔ Understand Dry Packaged Scallops's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Dry Packaged Scallops

What is the Market Size & CAGR of Dry Packaged Scallops market in 2023?

Dry Packaged Scallops Industry Analysis

Dry Packaged Scallops Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Dry Packaged Scallops Market Analysis Report by Region

Europe Dry Packaged Scallops Market Report:

The European market is estimated to grow from 1.28 billion USD in 2023 to 2.15 billion USD by 2033, benefiting from a combination of health-conscious consumers and a strong retail infrastructure supporting food sales.Asia Pacific Dry Packaged Scallops Market Report:

In the Asia-Pacific region, the market size for Dry Packaged Scallops was valued at approximately 0.58 billion USD in 2023, expected to grow to 0.98 billion USD by 2033, driven primarily by increasing seafood consumption and lifestyle changes. Countries like Japan and China play significant roles in this growth.North America Dry Packaged Scallops Market Report:

North America shows a robust market for Dry Packaged Scallops, starting at 1.13 billion USD in 2023 and anticipated to reach 1.89 billion USD by 2033, fueled by high consumer demand for premium seafood products and sustainable sourcing practices.South America Dry Packaged Scallops Market Report:

South America holds a smaller share of the market with a value of 0.06 billion USD in 2023, projected to achieve 0.10 billion USD by 2033, influenced by emerging demand in local culinary practices and growing export opportunities.Middle East & Africa Dry Packaged Scallops Market Report:

The Middle East and Africa region is developing a market valued at 0.45 billion USD in 2023, projected to grow to 0.75 billion USD by 2033. The growth is stimulated by increasing interest in seafood consumption.Tell us your focus area and get a customized research report.

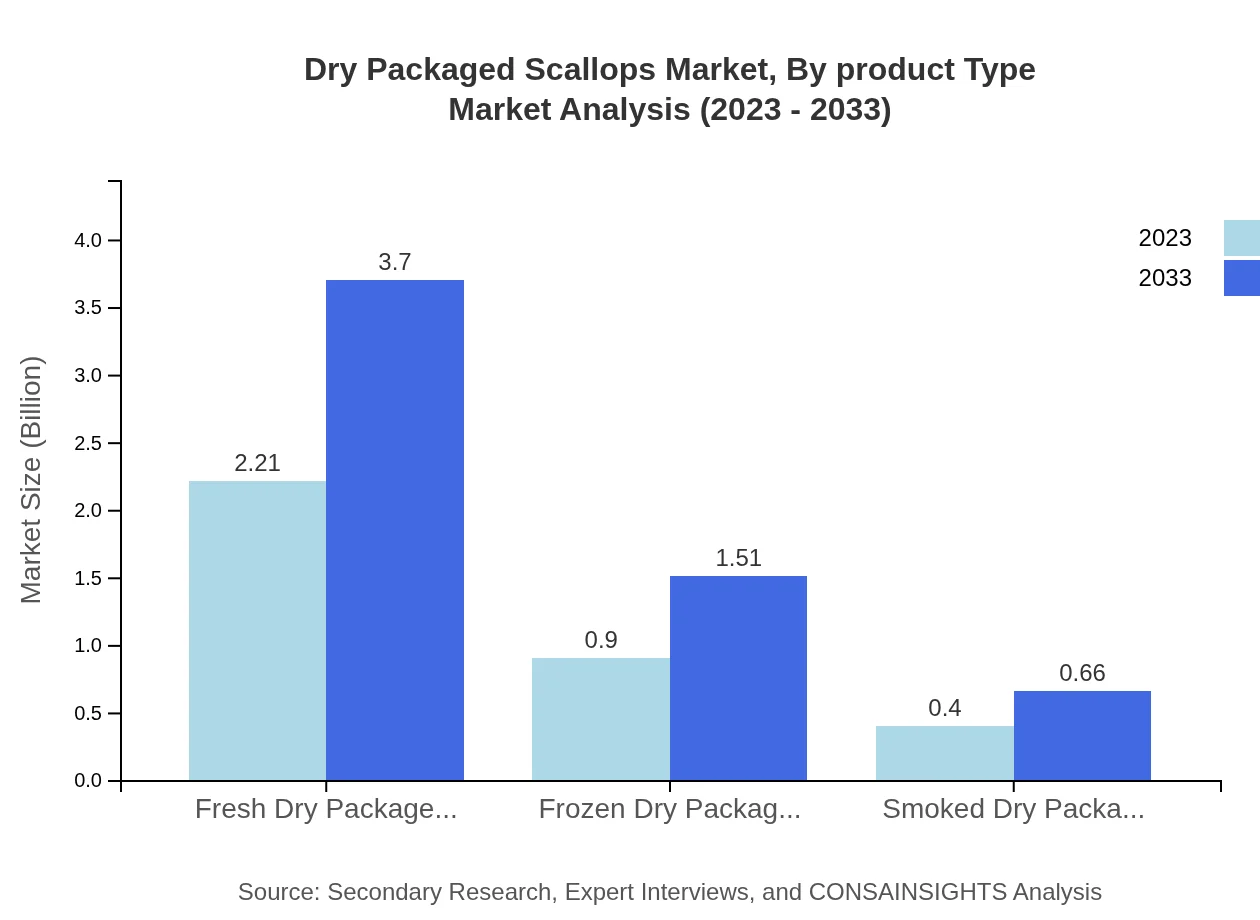

Dry Packaged Scallops Market Analysis By Product Type

The product segmentation consists of fresh, frozen and smoked dry packaged scallops. Fresh dry packaged scallops dominate the sector, holding a 63% market share in 2023, projected to grow to 63% by 2033, showcasing the deep-rooted consumer inclination towards natural products. Frozen and smoked varieties have significant roles as well, with shares of approximately 25.69% and 11.31% respectively, remaining consistent over the forecast period.

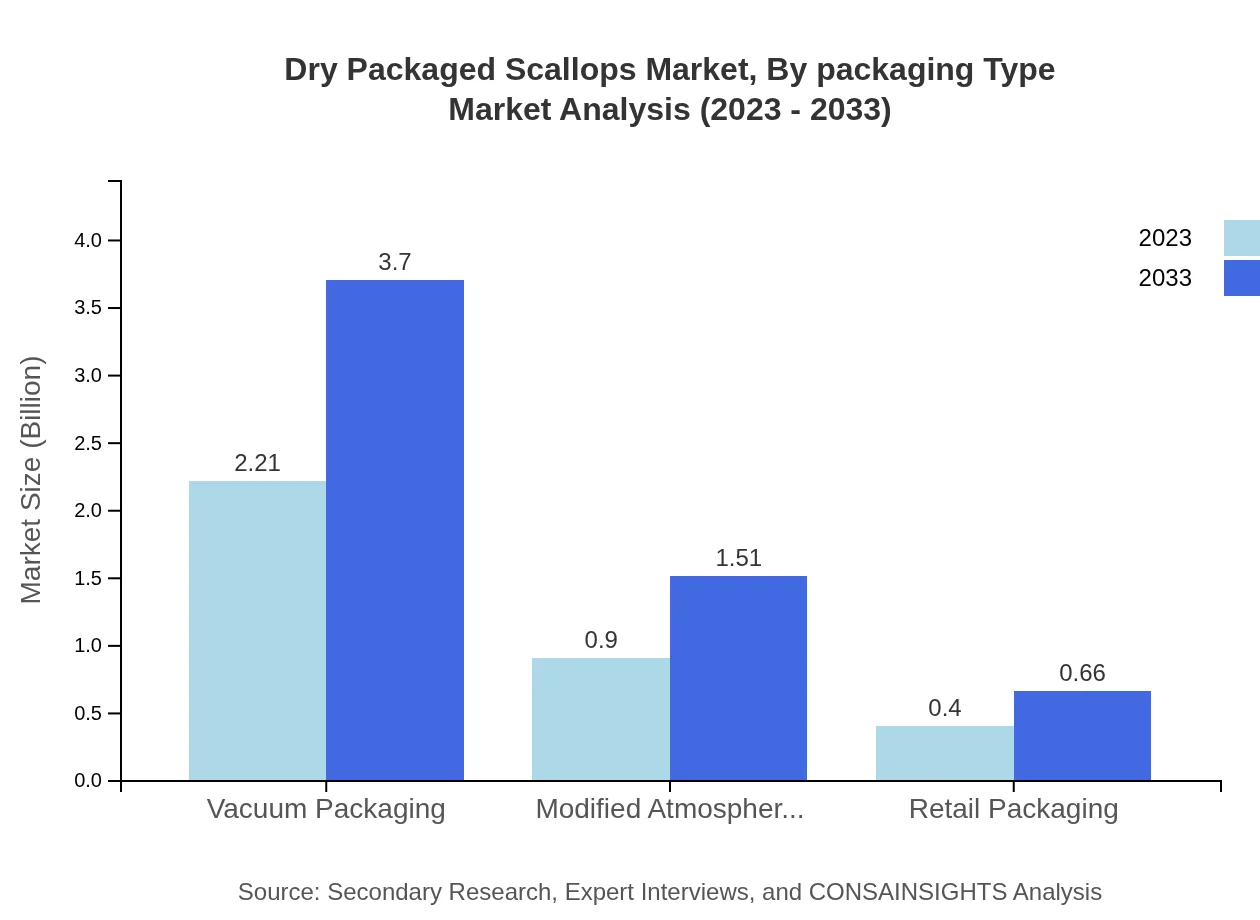

Dry Packaged Scallops Market Analysis By Packaging Type

The packaging types for dry scallops include vacuum packaging, modified atmosphere packaging, and retail packaging. Vacuum packaging retains a prominent share of 63% in 2023, projected to maintain that level through to 2033. Modified atmosphere packaging holds 25.69% and is expected to remain stable, while retail packaging accounts for 11.31%.

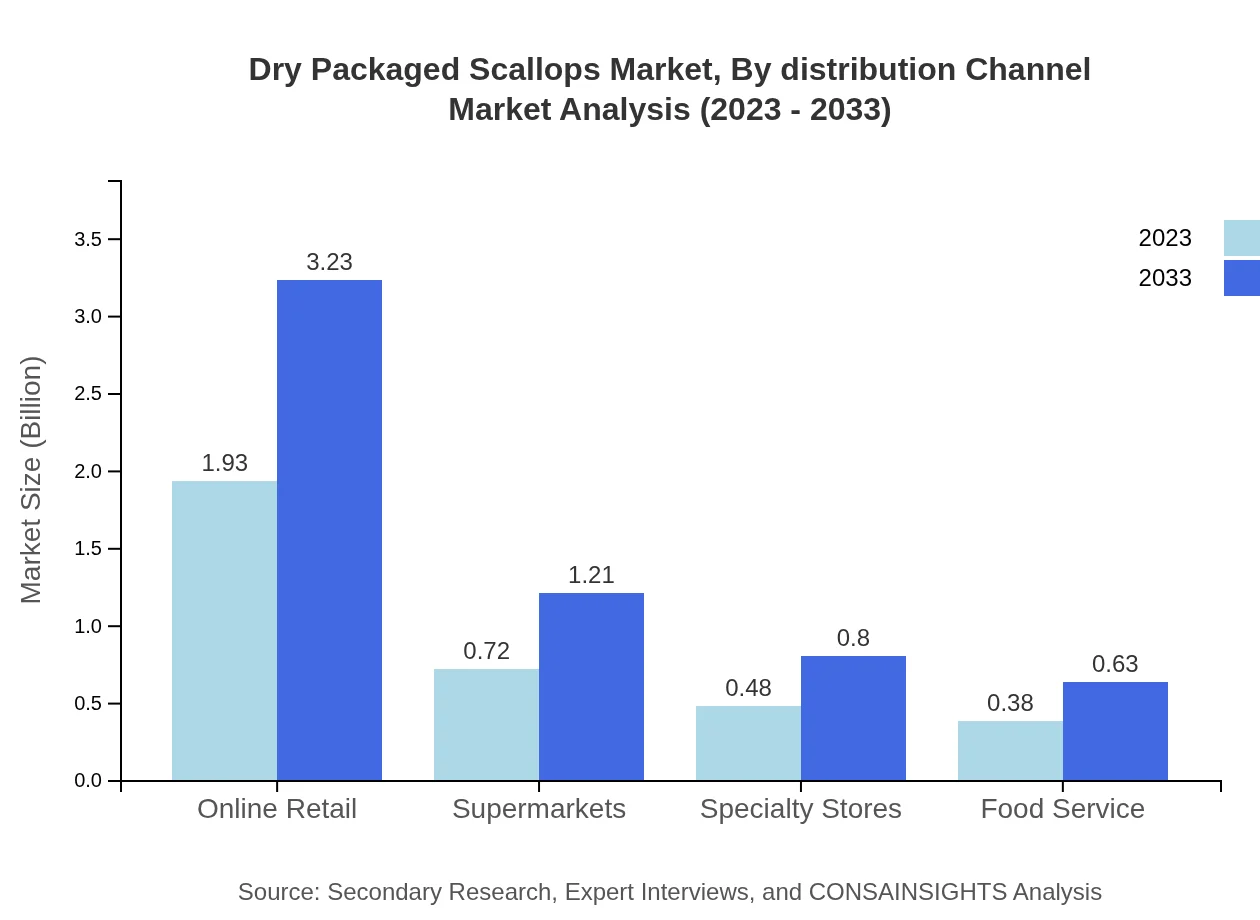

Dry Packaged Scallops Market Analysis By Distribution Channel

Distribution channels include online retail, supermarkets, specialty stores, and food service. Online retail is rising rapidly, achieving a 55.03% market share in 2023, expected to expand to 55.03% by 2033, reflecting changes in consumer buying habits. Supermarkets currently hold 20.66%, while specialty stores cover another 13.58%.

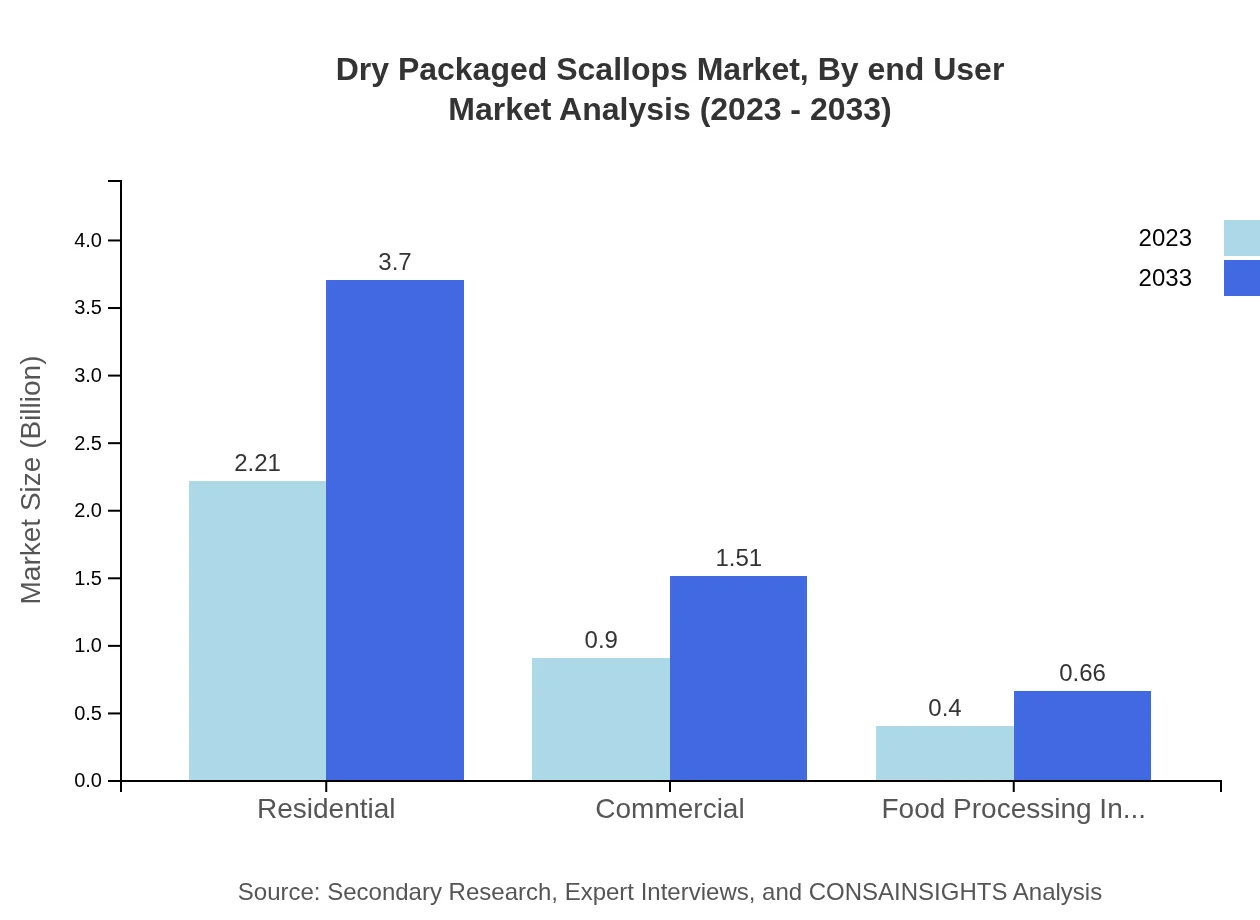

Dry Packaged Scallops Market Analysis By End User

The end-user segment encompasses residential, commercial, and food processing industries. The residential sector represents a major portion at 63% of the 2023 market, linked to home cooking trends. Commercial establishments command about 25.69%, while the food processing industry holds 11.31%.

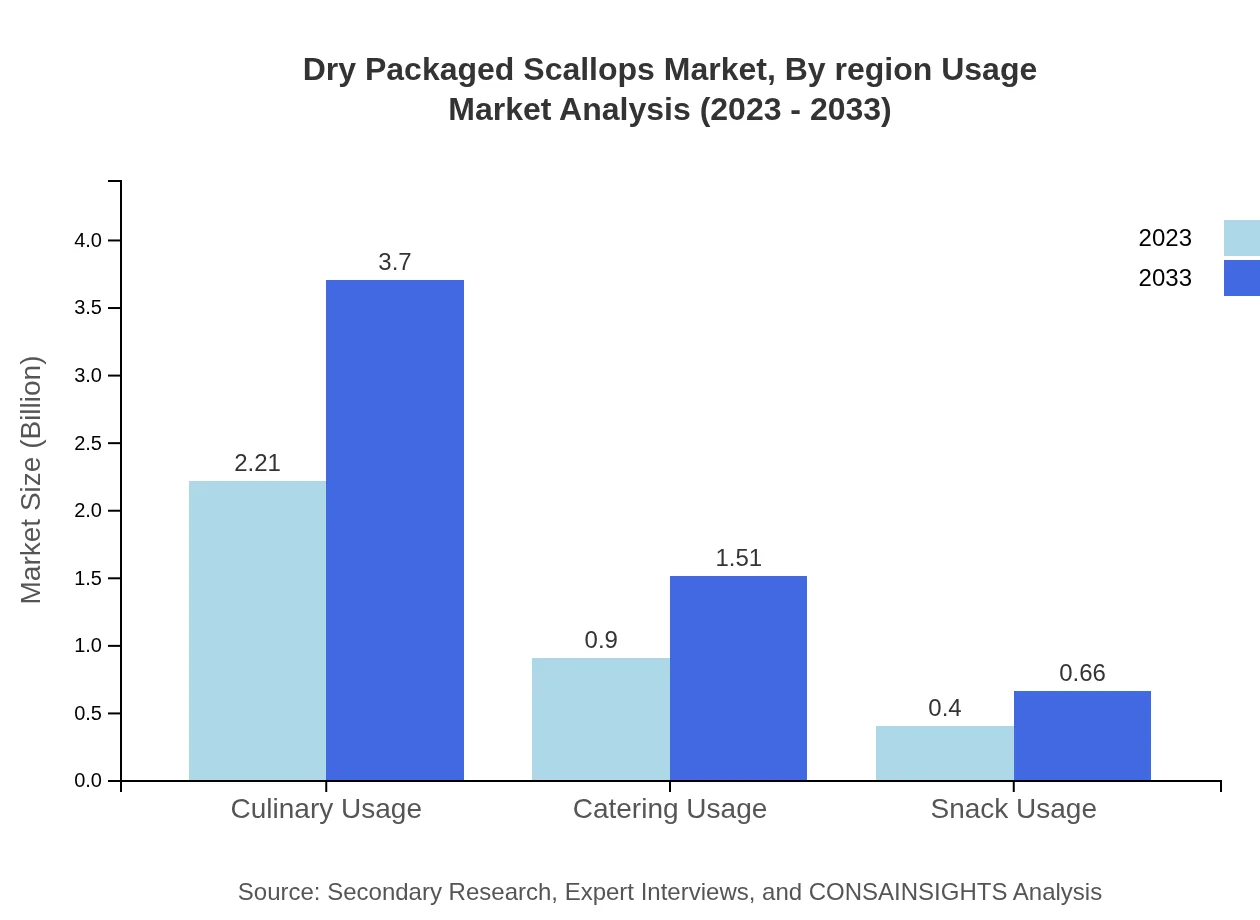

Dry Packaged Scallops Market Analysis By Region Usage

Usage patterns reflect culinary, catering, and snack applications. Culinary usage dominates with 63% market share as of 2023, remaining constant through 2033, supported by increasing home cooking. Catering applications follow with a 25.69% share, while snacks account for 11.31%.

Dry Packaged Scallops Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Dry Packaged Scallops Industry

Pacific Seafood:

A leading provider of seafood products, Pacific Seafood is notable for its commitment to sustainability and its extensive range of dry packaged options catering to both local and international markets.High Liner Foods:

High Liner Foods specializes in the distribution of frozen and packaged seafood products. Known for its quality and variety, it has solidified its position in the dry scallops market through innovative packaging and product development.Maruha Nichiro Corporation:

A large player in the global seafood business, Maruha Nichiro goes beyond traditional offerings, introducing high-quality dry packaged scallops tailored to consumer demands for convenience and health.We're grateful to work with incredible clients.

FAQs

What is the market size of dry Packaged Scallops?

The global dry-packaged scallops market is valued at approximately 3.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 5.2% through 2033. This growth indicates a rising consumer demand and expanding market potential.

What are the key market players or companies in this dry Packaged Scallops industry?

Key players in the dry-packaged scallops market include multinational seafood companies and local suppliers that specialize in seafood processing. Their leadership in distribution, production efficiency, and quality contributes significantly to shaping market dynamics.

What are the primary factors driving the growth in the dry Packaged Scallops industry?

Growth in the dry-packaged scallops sector is driven by increasing global seafood consumption, health trends favoring lean protein, and innovations in packaging technology that enhance product shelf-life and convenience for consumers.

Which region is the fastest Growing in the dry Packaged Scallops?

Europe is the fastest-growing region for dry-packaged scallops, projected to grow from 1.28 billion in 2023 to 2.15 billion by 2033. This growth is attributed to a rising trend in gourmet dining and seafood consumption.

Does ConsaInsights provide customized market report data for the dry Packaged Scallops industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the dry-packaged scallops industry. This includes detailed insights on market trends, consumer preferences, and competitive analysis.

What deliverables can I expect from this dry Packaged Scallops market research project?

Deliverables from the dry-packaged scallops market research project include comprehensive market analysis reports, regional insights, segmentation data, and actionable recommendations designed to inform strategic decision-making.

What are the market trends of dry Packaged Scallops?

Current market trends indicate a shift towards online retail, with online sales expected to grow significantly from 1.93 billion in 2023 to 3.23 billion by 2033, reflecting changing consumer purchasing behaviors.