Ductless Heating And Cooling Systems Market Report

Published Date: 22 January 2026 | Report Code: ductless-heating-and-cooling-systems

Ductless Heating And Cooling Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Ductless Heating And Cooling Systems market from 2023 to 2033. It covers market size, growth forecasts, key trends, regional insights, and competitive landscape to guide stakeholders in decision-making.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

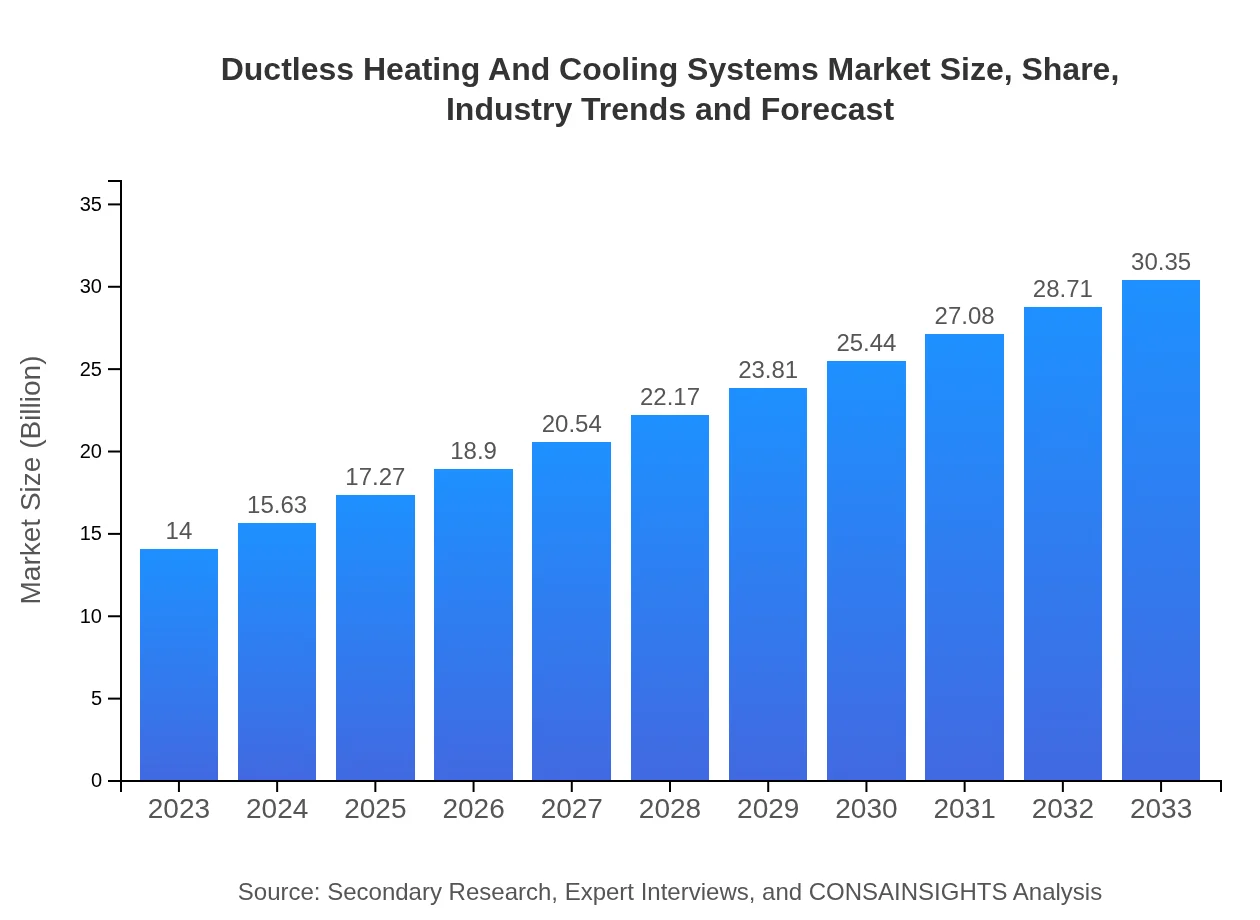

| 2023 Market Size | $14.00 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $30.35 Billion |

| Top Companies | Daikin Industries, Ltd., Mitsubishi Electric Corporation, Panasonic Corporation, LG Electronics, Toshiba Carrier |

| Last Modified Date | 22 January 2026 |

Ductless Heating And Cooling Systems Market Overview

Customize Ductless Heating And Cooling Systems Market Report market research report

- ✔ Get in-depth analysis of Ductless Heating And Cooling Systems market size, growth, and forecasts.

- ✔ Understand Ductless Heating And Cooling Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ductless Heating And Cooling Systems

What is the Market Size & CAGR of Ductless Heating And Cooling Systems market in 2023?

Ductless Heating And Cooling Systems Industry Analysis

Ductless Heating And Cooling Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ductless Heating And Cooling Systems Market Analysis Report by Region

Europe Ductless Heating And Cooling Systems Market Report:

The European market, currently valued at $3.72 billion in 2023, is forecasted to reach $8.07 billion by 2033, driven by stringent regulations on building energy efficiency and a shift towards sustainable HVAC solutions.Asia Pacific Ductless Heating And Cooling Systems Market Report:

The Asia Pacific market for Ductless Heating and Cooling Systems is projected to grow from $2.80 billion in 2023 to $6.07 billion by 2033, driven by increasing urbanization and investments in energy-efficient technologies.North America Ductless Heating And Cooling Systems Market Report:

In North America, the market size is set to expand from $5.29 billion in 2023 to $11.47 billion by 2033, fueled by high consumer demand for smart HVAC systems and government incentives aimed at energy efficiency.South America Ductless Heating And Cooling Systems Market Report:

The South American market is expected to grow from $1.33 billion in 2023 to $2.88 billion by 2033, as the region sees a rising demand for HVAC systems due to fluctuating climate conditions.Middle East & Africa Ductless Heating And Cooling Systems Market Report:

In the Middle East and Africa, the market is anticipated to grow from $0.86 billion in 2023 to $1.86 billion by 2033, primarily due to expanding infrastructure projects and a rising focus on energy conservation.Tell us your focus area and get a customized research report.

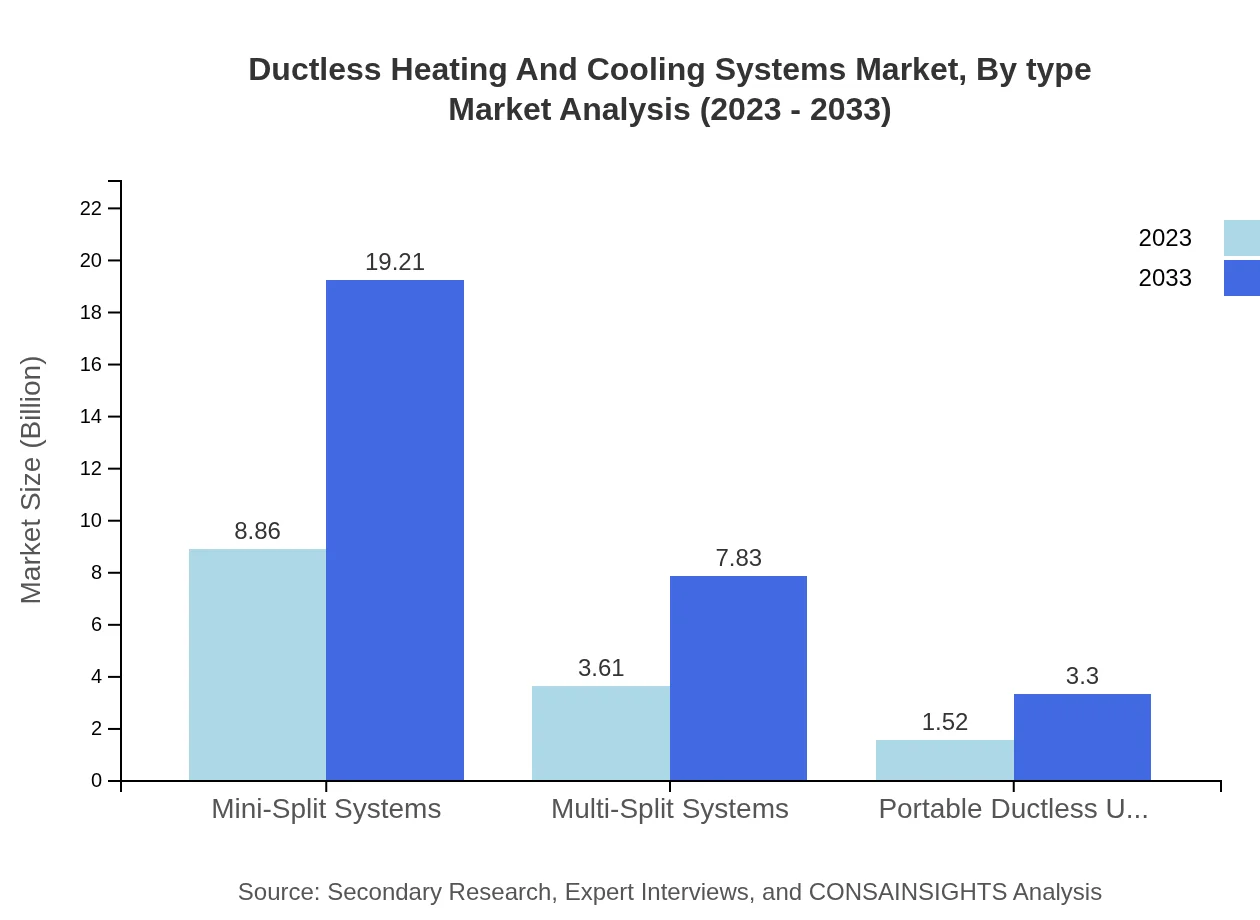

Ductless Heating And Cooling Systems Market Analysis By Type

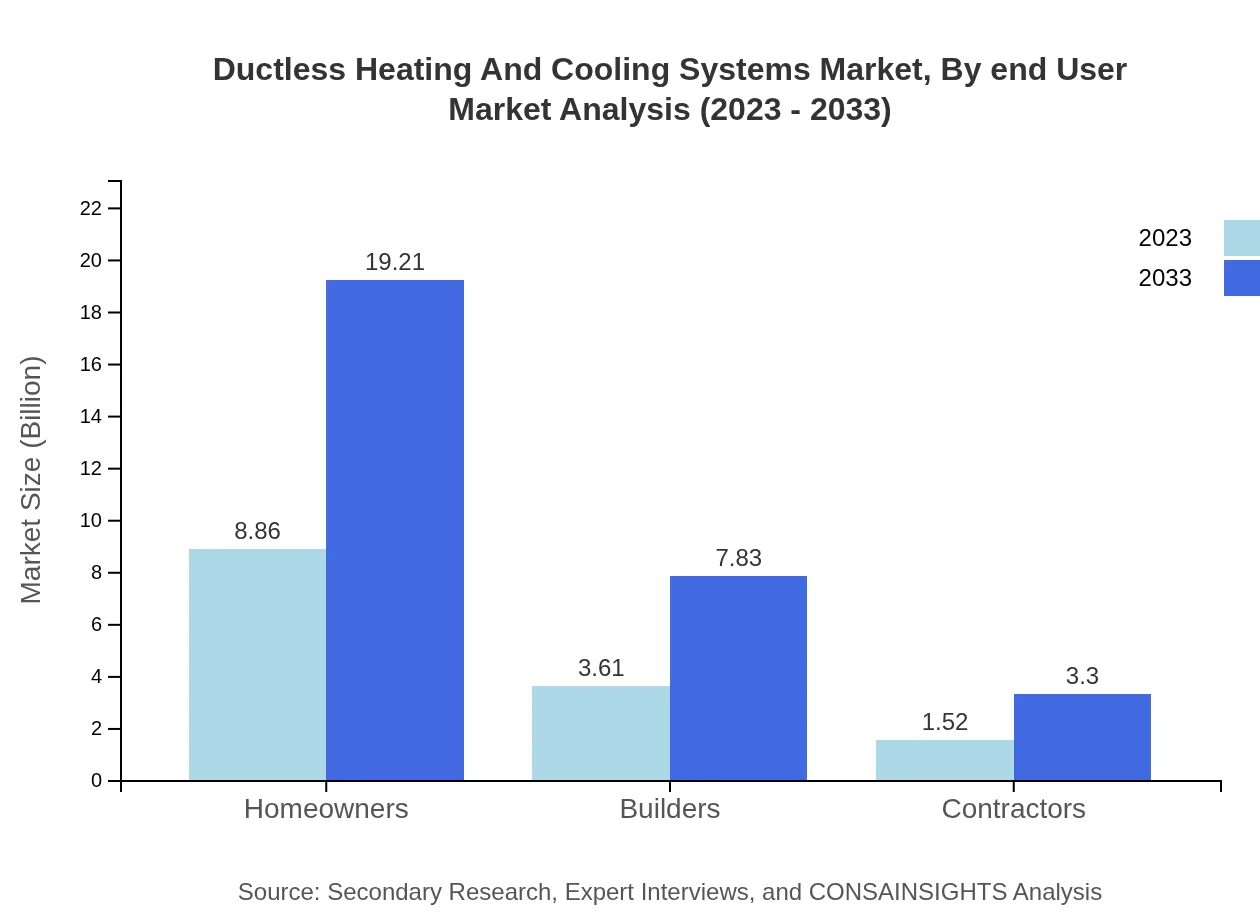

By type, the Mini-Split Systems dominate the market with a size of $8.86 billion in 2023, expected to rise to $19.21 billion by 2033, holding a 63.31% market share. Multi-Split Systems follow with a size of $3.61 billion in 2023, projected to grow to $7.83 billion by 2033, accounting for 25.81% share. Portable Ductless Units are emerging with a size of $1.52 billion in 2023 to $3.30 billion by 2033, securing 10.88% share.

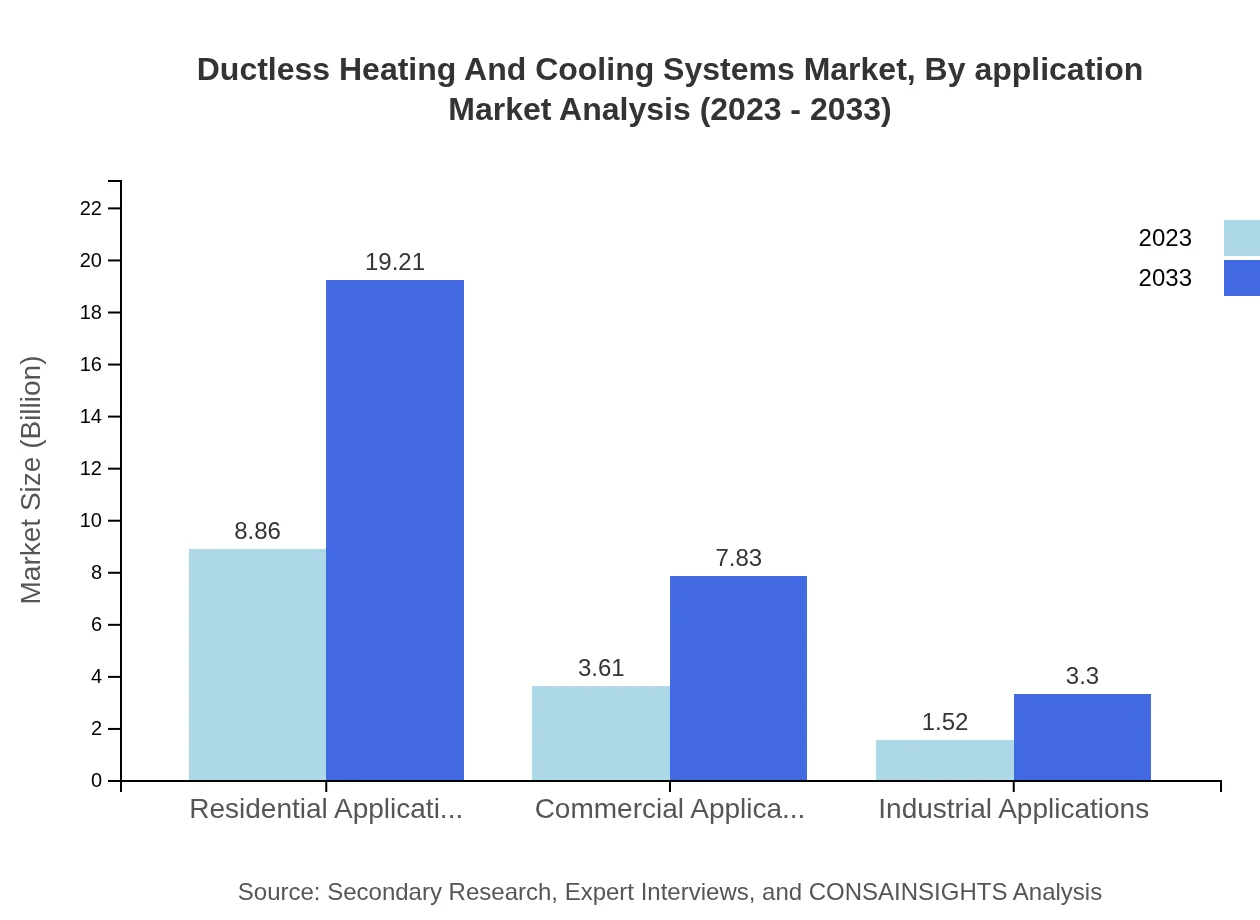

Ductless Heating And Cooling Systems Market Analysis By Application

From an application perspective, Residential Applications lead with a size of $8.86 billion in 2023, projected to increase to $19.21 billion by 2033 (63.31% share). Commercial Applications follow with $3.61 billion in 2023, advancing to $7.83 billion by 2033 (25.81% share), while Industrial Applications are set to grow from $1.52 billion to $3.30 billion over the same period (10.88% share).

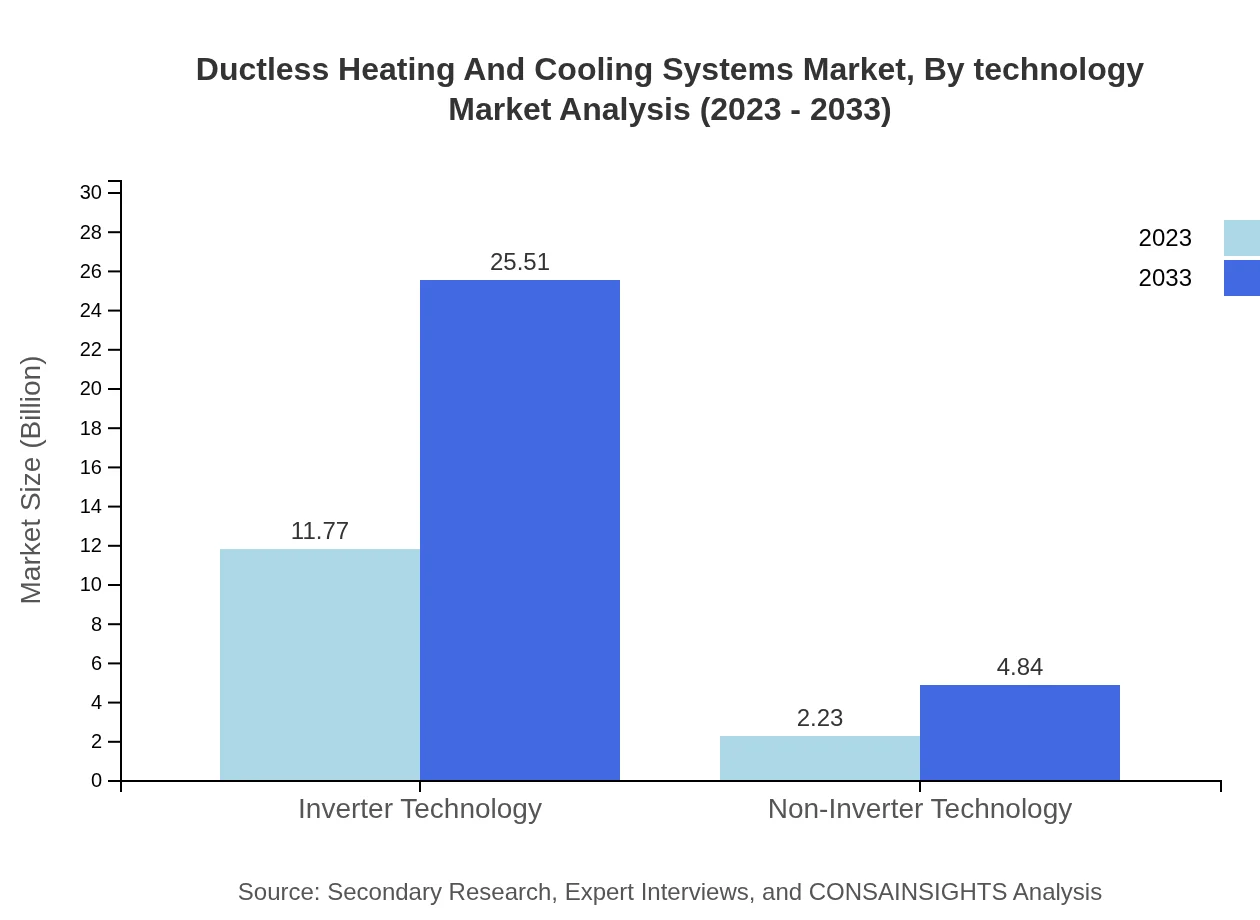

Ductless Heating And Cooling Systems Market Analysis By Technology

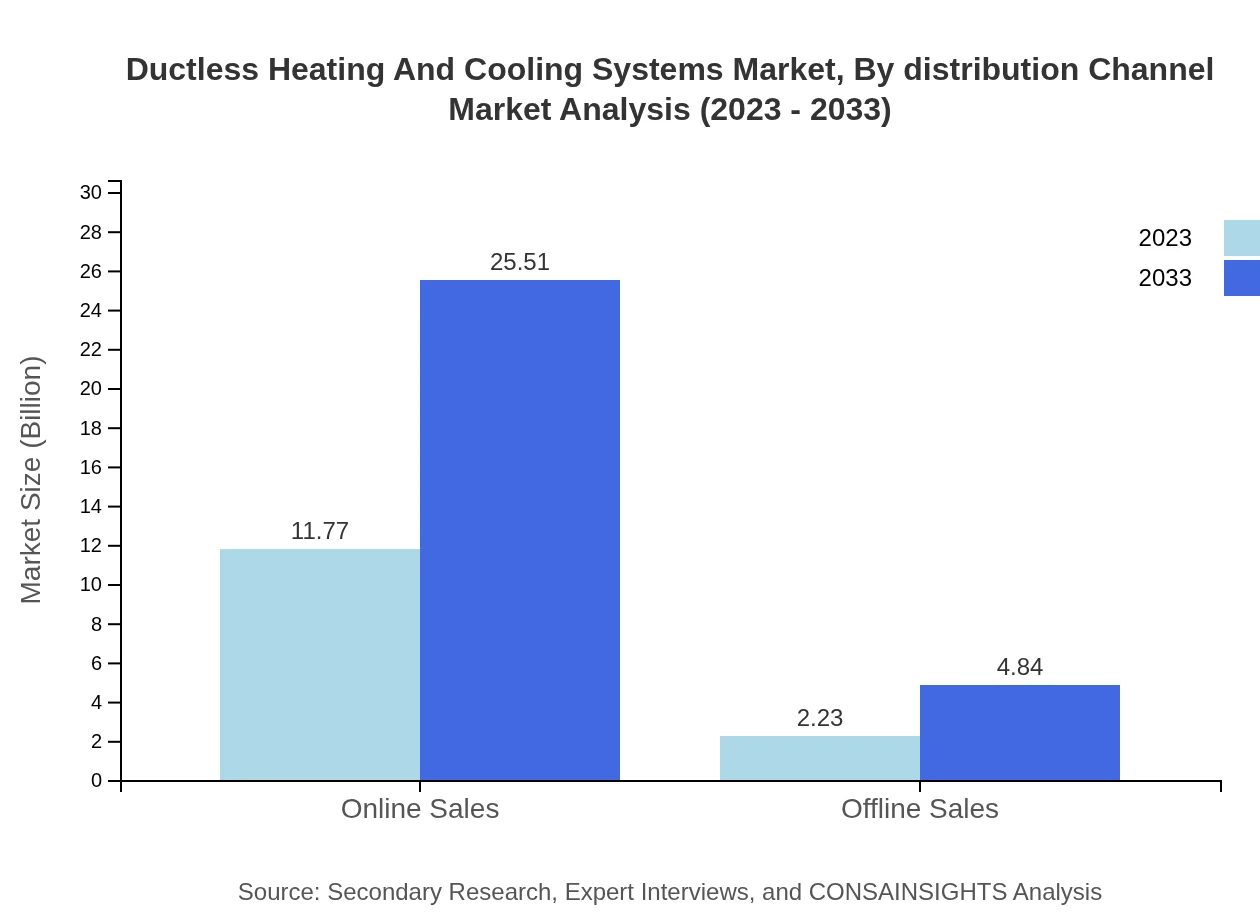

In terms of technology, Inverter Technology substantially dominates the market at $11.77 billion in 2023, with expected growth to $25.51 billion by 2033, capturing 84.05% of the market share. Non-Inverter Technology, though smaller in scale, is projected to grow from $2.23 billion to $4.84 billion, maintaining a 15.95% share.

Ductless Heating And Cooling Systems Market Analysis By Distribution Channel

The market by distribution channel sees a heavy preference for Online Sales, valued at $11.77 billion in 2023 and projected to grow to $25.51 billion by 2033, while Offline Sales are expected to rise from $2.23 billion to $4.84 billion, indicating a notable trend towards e-commerce.

Ductless Heating And Cooling Systems Market Analysis By End User

Homeowners are the primary end users, with a market size of $8.86 billion in 2023 growing to $19.21 billion by 2033 (63.31% share). Builders account for $3.61 billion in 2023, projected at $7.83 billion in 2033 (25.81% share), while Contractors are poised to grow from $1.52 billion to $3.30 billion (10.88% share).

Ductless Heating And Cooling Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ductless Heating And Cooling Systems Industry

Daikin Industries, Ltd.:

A leading global provider of HVAC systems, focusing on energy-efficient and innovative ductless solutions.Mitsubishi Electric Corporation:

Specializes in advanced ductless systems, providing energy-saving and performance-driven HVAC solutions.Panasonic Corporation:

Known for its innovative air conditioning technologies, Panasonic offers a range of ductless heating and cooling products.LG Electronics:

A significant player in the industry, LG is recognized for its cutting-edge technology and efficiency in ductless HVAC systems.Toshiba Carrier:

A joint venture known for its high-performance ductless systems, targeting both residential and commercial applications.We're grateful to work with incredible clients.

FAQs

What is the market size of Ductless Heating and Cooling Systems?

The ductless heating and cooling systems market is valued at approximately $14 billion in 2023, with a projected CAGR of 7.8% through 2033. This growth indicates a robust demand for efficient heating and cooling solutions.

What are the key market players or companies in this Ductless Heating and Cooling Systems industry?

Key players in the ductless heating and cooling industry include major manufacturers and innovators focusing on energy-efficient technologies. Companies significantly influence market dynamics through product development, strategic partnerships, and distribution networks.

What are the primary factors driving the growth in the Ductless Heating and Cooling Systems industry?

Growth in the ductless systems market is driven by rising energy costs, increased demand for energy-efficient solutions, and advancements in HVAC technology. Legislative support for green technologies also boosts market opportunities.

Which region is the fastest Growing in the Ductless Heating and Cooling Systems?

North America is the fastest-growing region for ductless heating and cooling systems, projected to grow from $5.29 billion in 2023 to $11.47 billion by 2033. This growth reflects increasing adoption across residential and commercial sectors.

Does ConsaInsights provide customized market report data for the Ductless Heating and Cooling Systems industry?

Yes, ConsaInsights offers customized market report data tailored to the needs of clients within the ductless heating and cooling systems industry, ensuring insights are relevant and actionable for business strategies.

What deliverables can I expect from this Ductless Heating and Cooling Systems market research project?

Deliverables from the ductless systems market research include comprehensive reports detailing market size, growth forecasts, competitive analysis, and strategic recommendations, providing significant insights for stakeholders and investors.

What are the market trends of Ductless Heating and Cooling Systems?

Current trends in the ductless heating and cooling systems market include a shift towards inverter technology, increased consumer preference for energy-efficient solutions, and growing online sales channels that enhance market accessibility.