Duty Free Liquor Market Report

Published Date: 31 January 2026 | Report Code: duty-free-liquor

Duty Free Liquor Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Duty Free Liquor market from 2023 to 2033, detailing current market conditions, future forecasts, and insights into market trends, segmentation, and regional dynamics.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $9.40 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $19.21 Billion |

| Top Companies | DFS Group, Heinemann, Lagardère Travel Retail, Incheon Airport Duty Free |

| Last Modified Date | 31 January 2026 |

Duty Free Liquor Market Overview

Customize Duty Free Liquor Market Report market research report

- ✔ Get in-depth analysis of Duty Free Liquor market size, growth, and forecasts.

- ✔ Understand Duty Free Liquor's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Duty Free Liquor

What is the Market Size & CAGR of Duty Free Liquor market in 2023?

Duty Free Liquor Industry Analysis

Duty Free Liquor Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Duty Free Liquor Market Analysis Report by Region

Europe Duty Free Liquor Market Report:

Europe’s Duty Free Liquor market is estimated at $3.19 billion in 2023, with forecasts predicting an increase to $6.53 billion by 2033. The region benefits from strong travel flow, particularly in countries like France, Germany, and the UK, which are popular tourist destinations.Asia Pacific Duty Free Liquor Market Report:

In 2023, the Duty Free Liquor market in the Asia-Pacific region is valued at $1.78 billion and is projected to grow to $3.63 billion by 2033. Countries such as China, Japan, and Australia are leading the growth, influenced by rising middle-class incomes and increasing international travel among consumers. Enhanced retail experiences at airports are also boosting sales.North America Duty Free Liquor Market Report:

The North American market stands at $3.26 billion in 2023 and is projected to grow to $6.66 billion by 2033. The United States leads this growth due to high consumer spending on premium liquor and a robust travel sector. Duty-free shops in airports remain pivotal for market expansion.South America Duty Free Liquor Market Report:

The South American Duty Free Liquor market is valued at approximately $0.04 billion in 2023 and is expected to reach $0.08 billion by 2033. Key markets include Brazil and Argentina, where expanding international tourism and duty-free shopping culture are fostering market growth.Middle East & Africa Duty Free Liquor Market Report:

In 2023, the Middle East and Africa market is valued at $1.14 billion, with a growth projection of $2.32 billion by 2033. Increased tourism and foreign investment in the retail sector are key growth drivers, especially in the UAE.Tell us your focus area and get a customized research report.

Duty Free Liquor Market Analysis By Product

The product segmentation reveals that whiskey leads the market in both size and share, projected to grow from $3.89 billion in 2023 to $7.94 billion in 2033, representing a significant portion of overall sales. Vodka and gin also report substantial shares, while emerging categories like craft liquors show promising growth rates.

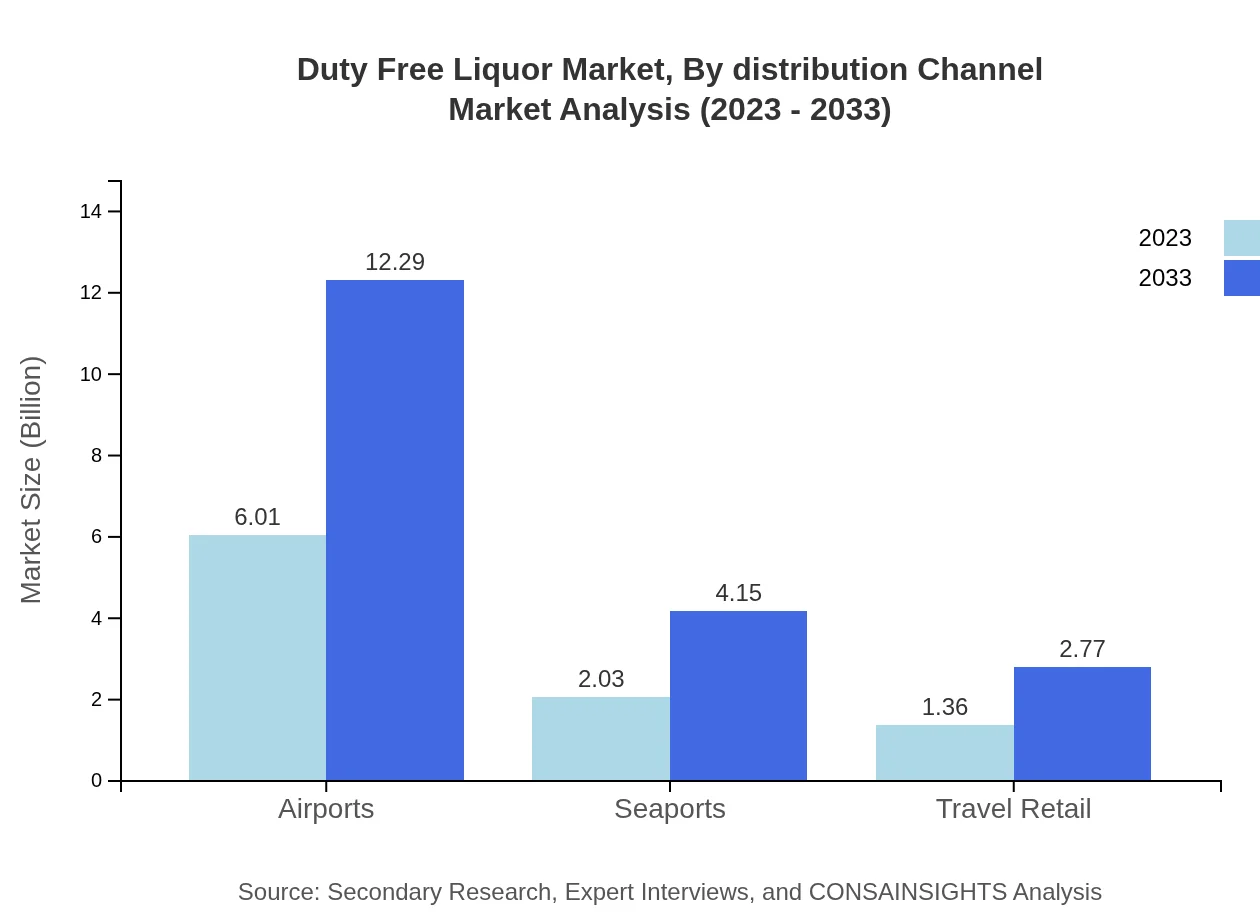

Duty Free Liquor Market Analysis By Distribution Channel

Distribution channel analysis indicates that airports dominate with a share of approximately 63.95% in 2023, valued at $6.01 billion. Seaports and travel retail points are also essential but contribute less to the overall revenue stream. As travel increases post-pandemic, airport sales are expected to rise significantly.

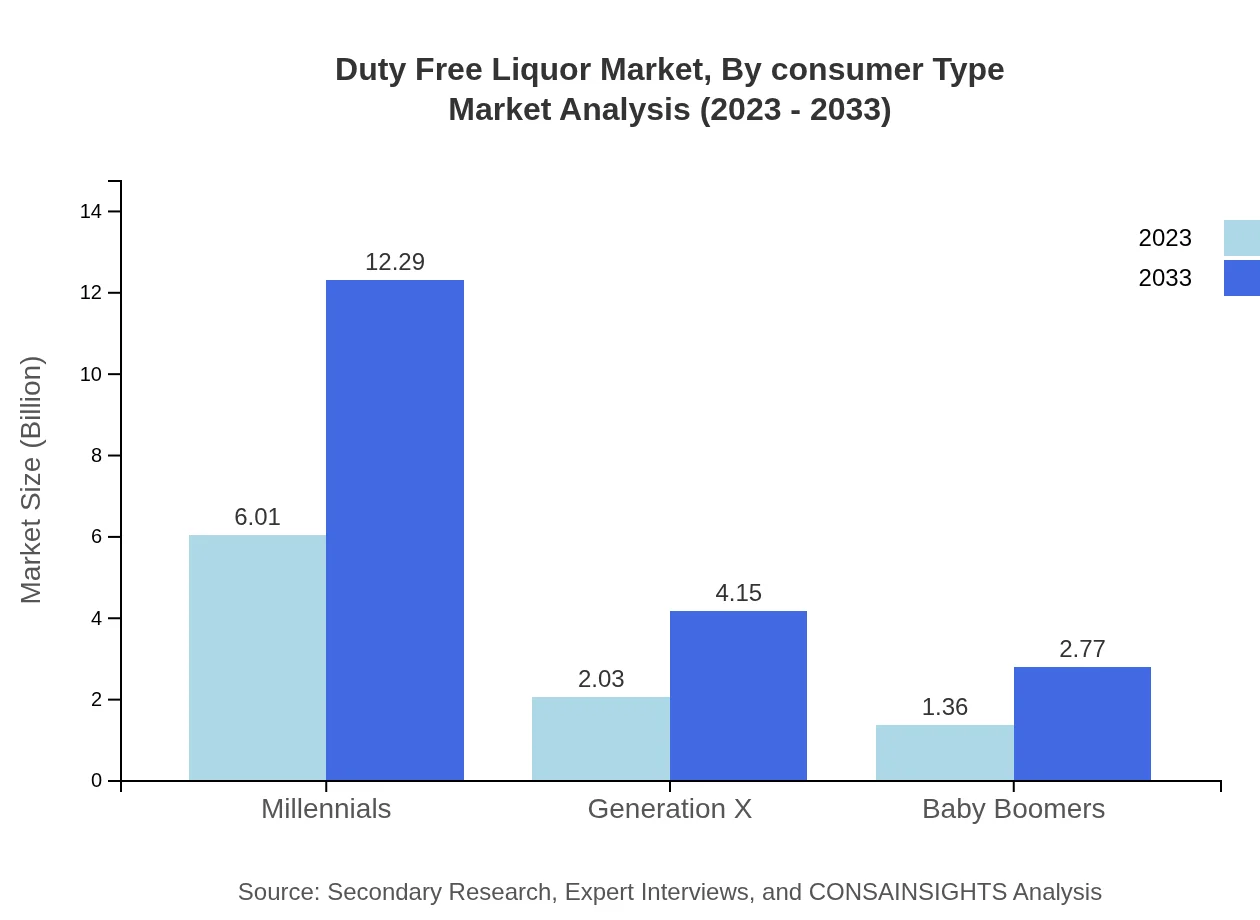

Duty Free Liquor Market Analysis By Consumer Type

Market segmentation by consumer type shows that millennials are the largest consumer group, making up about 63.95% of the market in 2023. Their preference for premium and unique products influences purchasing decisions, followed by Generation X and Baby Boomers.

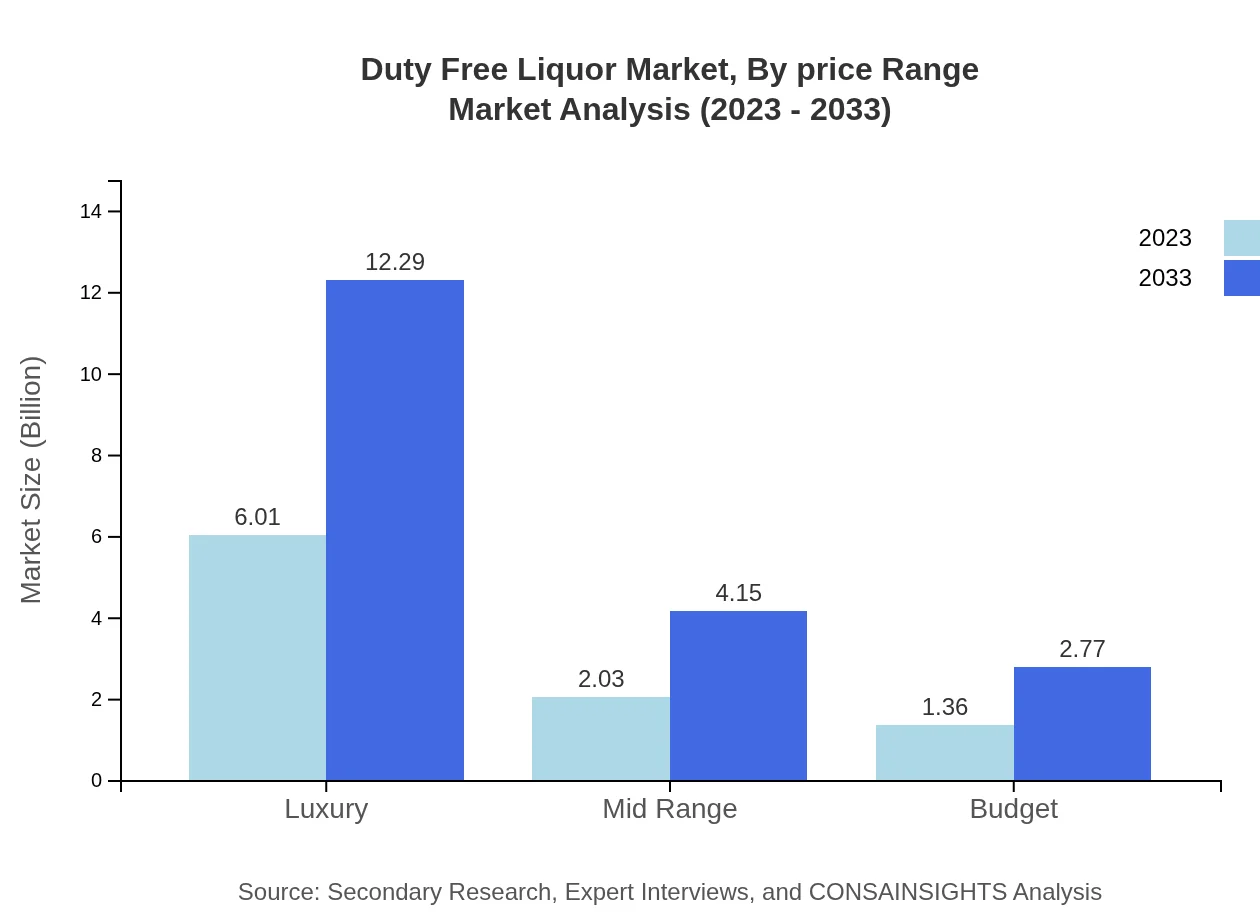

Duty Free Liquor Market Analysis By Price Range

The price range segmentation highlights a strong preference for luxury products, which account for 63.95% of the market. The projected growth emphasizes an increasing willingness to invest in superior quality liquors among travelers, while mid-range and budget sectors expand steadily.

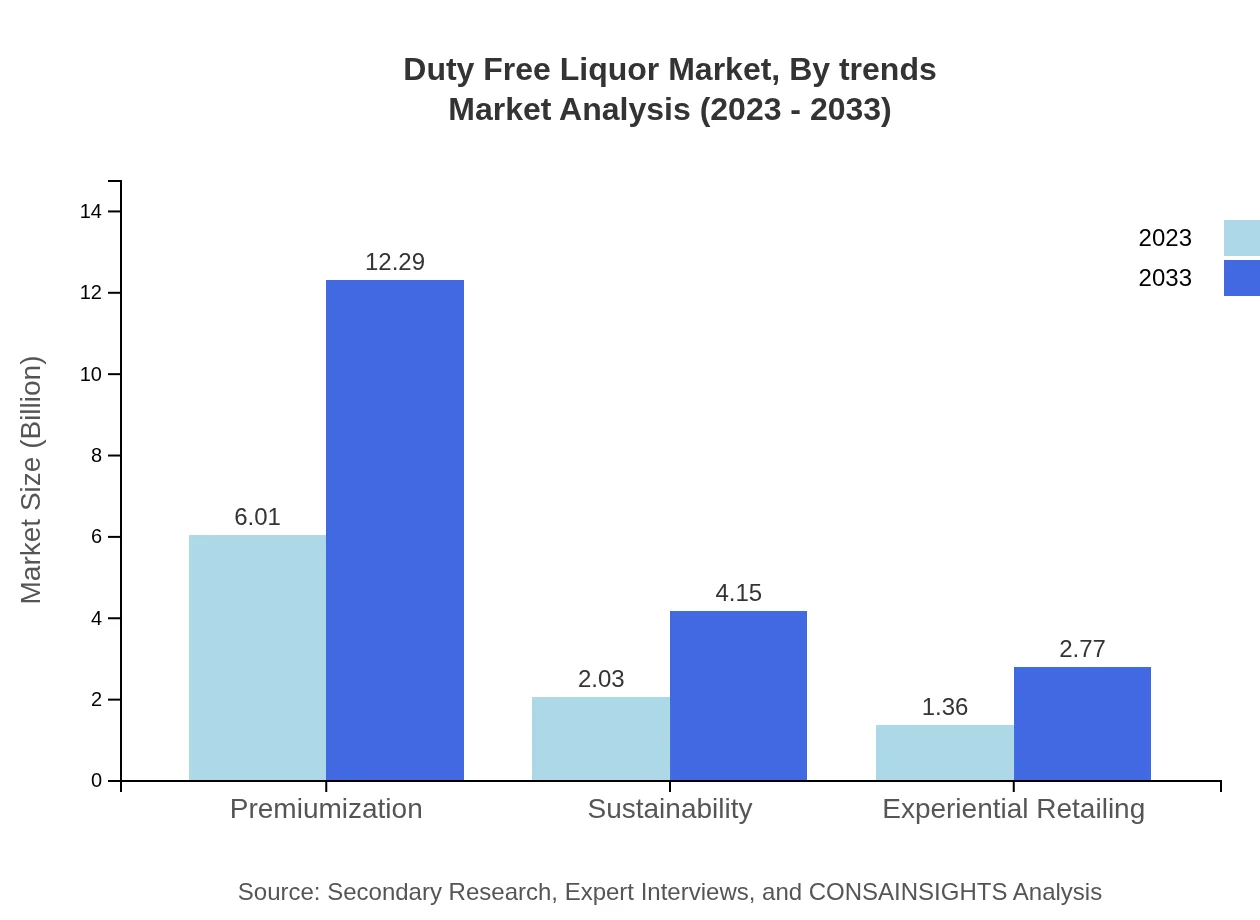

Duty Free Liquor Market Analysis By Trends

Current trends underline a significant shift towards premiumization, where the market is set to increase from $6.01 billion in 2023 to $12.29 billion in 2033. Sustainability and experiential retailing are also key trends gaining traction, shaping product offerings and shopping experiences.

Duty Free Liquor Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Duty Free Liquor Industry

DFS Group:

A leading travel retailer with extensive operations in duty-free shopping, DFS Group offers a wide array of luxury liquor brands in airports across Asia and the Pacific.Heinemann:

Known for high-quality products and expansive retail expertise, Heinemann operates numerous duty-free stores across Europe, focusing on premium and craft liquor offerings.Lagardère Travel Retail:

A major player in the travel retail sector, Lagardère provides a range of liquor brands in its duty-free network, capitalizing on the growing traveler demographic.Incheon Airport Duty Free:

Recognized for outstanding service and selection, Incheon Airport Duty Free is a notable duty-free retailer in Asia, featuring premium liquor and exclusive brands.We're grateful to work with incredible clients.

FAQs

What is the market size of duty Free liquor?

The global duty-free liquor market is valued at $9.4 billion in 2023, with a promising CAGR of 7.2%, indicating significant growth potential up to 2033 as consumer preferences evolve in travel retail.

What are the key market players or companies in the duty Free liquor industry?

Key players in the duty-free liquor market include major brands like Diageo, Pernod Ricard, and Bacardi. These companies control a significant share of the market, contributing to innovation and market expansion strategies.

What are the primary factors driving the growth in the duty Free liquor industry?

The growth in the duty-free liquor industry is driven by increasing international travel, rising disposable incomes, and a growing preference for premium liquor products among consumers as they seek exclusive travel experiences.

Which region is the fastest Growing in the duty Free liquor market?

The fastest-growing region in the duty-free liquor market is Europe, projected to increase from $3.19 billion in 2023 to $6.53 billion by 2033, showcasing robust consumer demand and expanding retail opportunities.

Does ConsaInsights provide customized market report data for the duty Free liquor industry?

Yes, ConsaInsights offers customized market report data tailored to the duty-free liquor industry, enabling stakeholders to gain insights specific to market segments and regions, enhancing strategic decision-making.

What deliverables can I expect from this duty Free liquor market research project?

Expect comprehensive deliverables including detailed market analysis, growth forecasts, competitor profiling, and insights into consumer behavior, segmented by type and region for informed decision-making.

What are the market trends of duty Free liquor?

Emerging trends in the duty-free liquor market include premiumization, sustainability efforts, and experiential retailing, with segments like whiskey and vodka leading the market growth, aligning with shifting consumer preferences.