Dyes And Pigments Market Report

Published Date: 02 February 2026 | Report Code: dyes-and-pigments

Dyes And Pigments Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Dyes and Pigments market, including insights on market size, growth projections, and regional dynamics from 2023 to 2033. It highlights key trends, innovations, and competitive landscape shaping the industry.

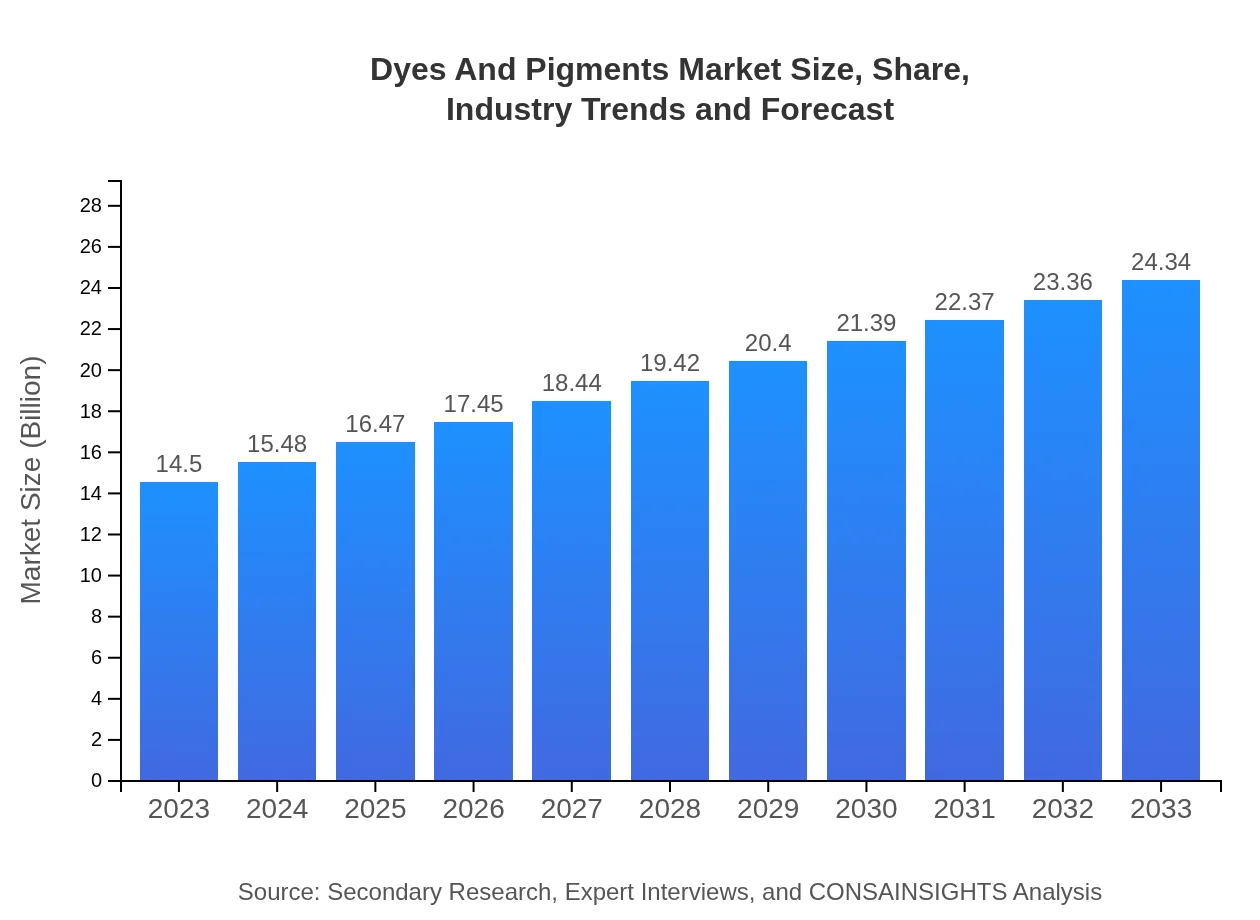

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $14.50 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $24.34 Billion |

| Top Companies | BASF SE, Huntsman Corporation, Clariant AG, Lanxess AG, DIC Corporation |

| Last Modified Date | 02 February 2026 |

Dyes And Pigments Market Overview

Customize Dyes And Pigments Market Report market research report

- ✔ Get in-depth analysis of Dyes And Pigments market size, growth, and forecasts.

- ✔ Understand Dyes And Pigments's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Dyes And Pigments

What is the Market Size & CAGR of Dyes And Pigments market in 2023?

Dyes And Pigments Industry Analysis

Dyes And Pigments Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Dyes And Pigments Market Analysis Report by Region

Europe Dyes And Pigments Market Report:

The European market is set to expand from $3.85 billion in 2023 to $6.46 billion in 2033. Stringent regulations regarding chemical usage push the market towards eco-friendly alternatives. The paints and coatings industry, alongside textiles, remains crucial for growth, influenced by sustainability trends.Asia Pacific Dyes And Pigments Market Report:

The Asia-Pacific region is anticipated to experience significant growth, with a market value of $2.88 billion in 2023 projected to rise to $4.83 billion by 2033. This growth is driven by increasing manufacturing activities and urbanization. The demand in textiles and automotive industries is particularly strong, influenced by the rise in disposable income and changing consumer preferences.North America Dyes And Pigments Market Report:

North America is projected to grow from $4.65 billion in 2023 to $7.80 billion by 2033. The region's robust economy and emphasis on innovation in manufacturing processes drive the demand for specialized and high-performance pigments, with significant applications in plastics and paints.South America Dyes And Pigments Market Report:

In South America, the market is expected to witness steady growth from $1.15 billion in 2023 to $1.92 billion in 2033. The growing focus on sustainable practices and eco-friendly products is influencing the demand for organic dyes and pigments. Industries such as textiles and packaging are vital to this region's market dynamics.Middle East & Africa Dyes And Pigments Market Report:

In the Middle East and Africa, the market is anticipated to grow from $1.98 billion in 2023 to $3.33 billion by 2033. The construction and automotive sectors are main drivers of growth, alongside increasing investments in infrastructure and manufacturing capabilities.Tell us your focus area and get a customized research report.

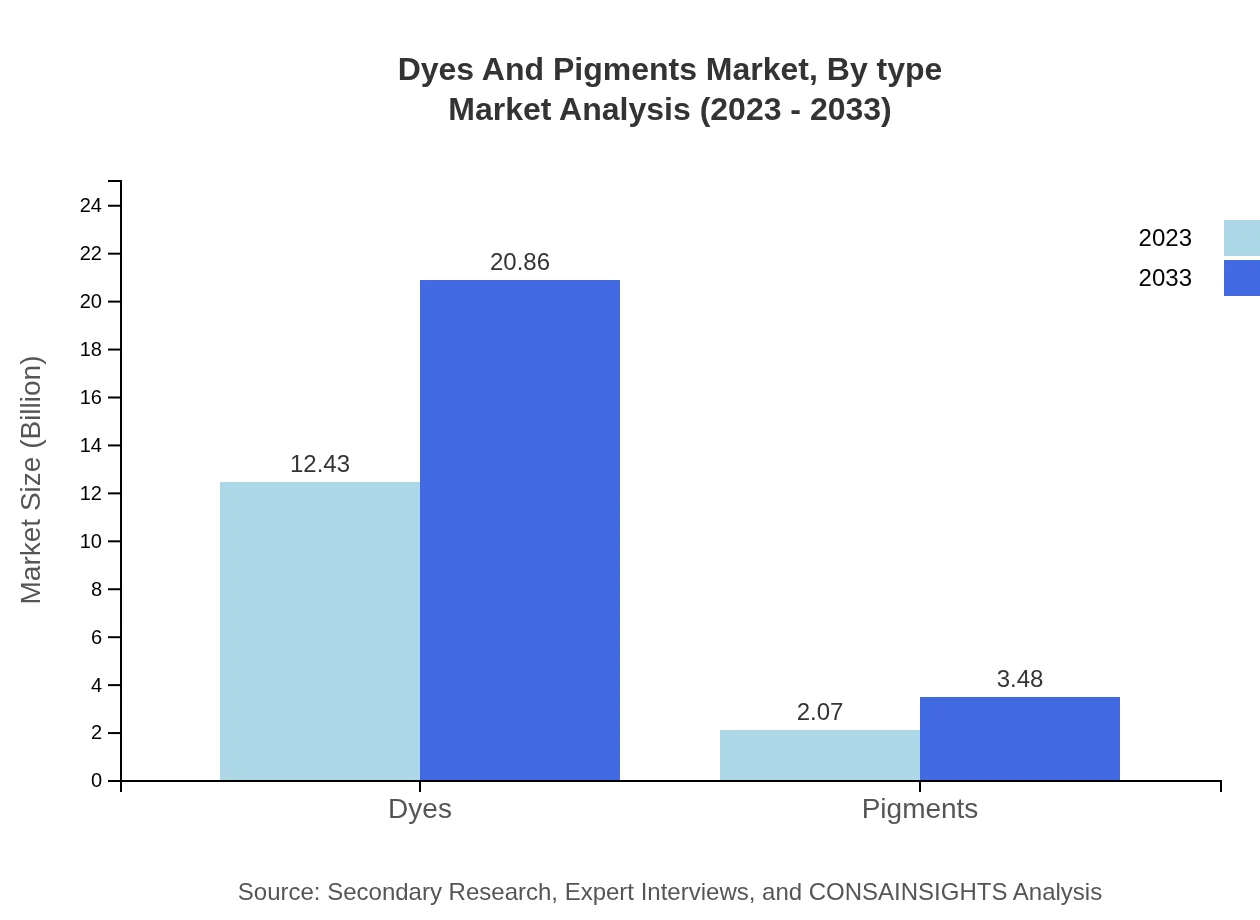

Dyes And Pigments Market Analysis By Type

The Dyes segment dominates the market, making up 85.71% of market share in 2023, valued at $12.43 billion, and is projected to grow to $20.86 billion by 2033. Conversely, the Pigments segment, though smaller at 14.29% share, is still significant, expected to grow from $2.07 billion to $3.48 billion. This growth is driven by advancements in high-performance pigments and environmental regulations stimulating the market for eco-friendly alternatives.

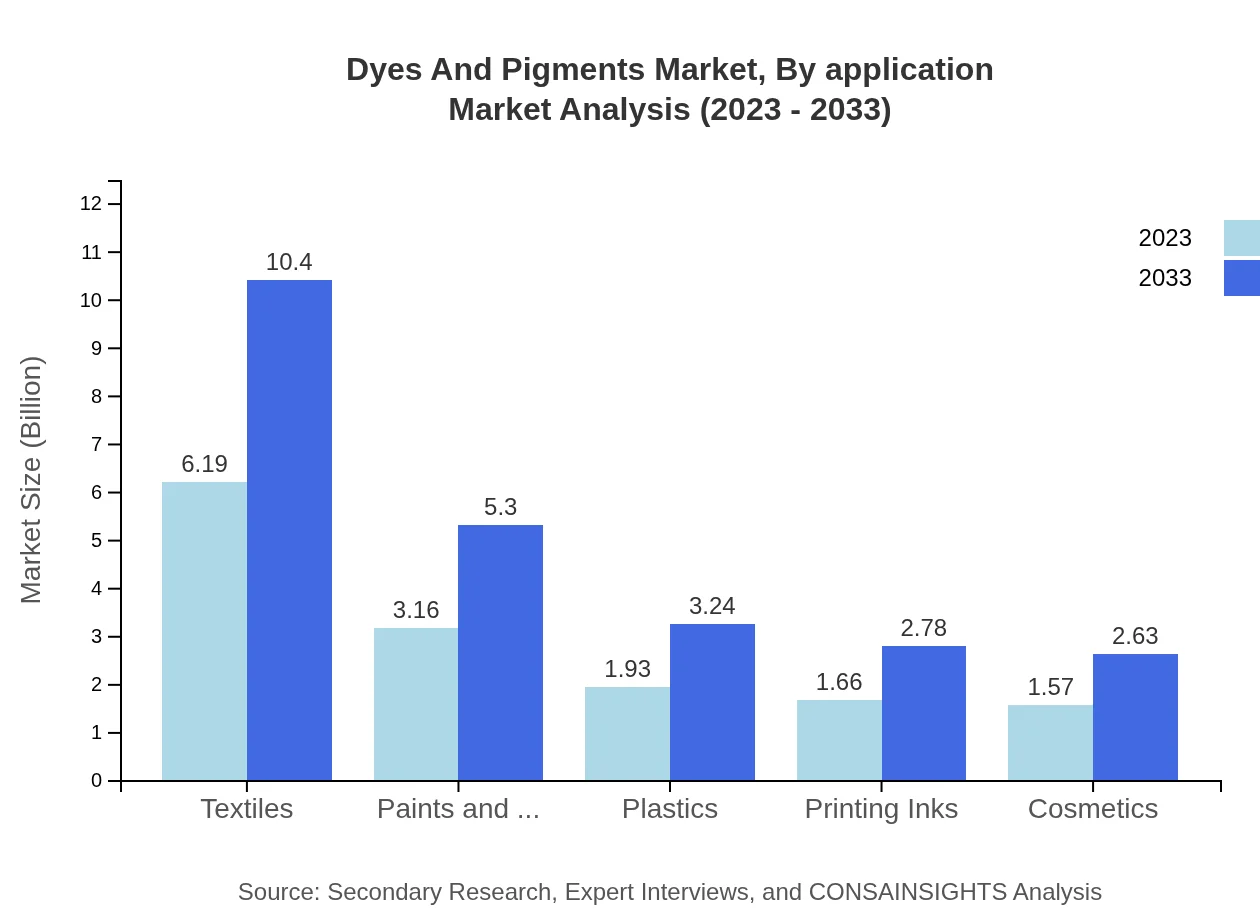

Dyes And Pigments Market Analysis By Application

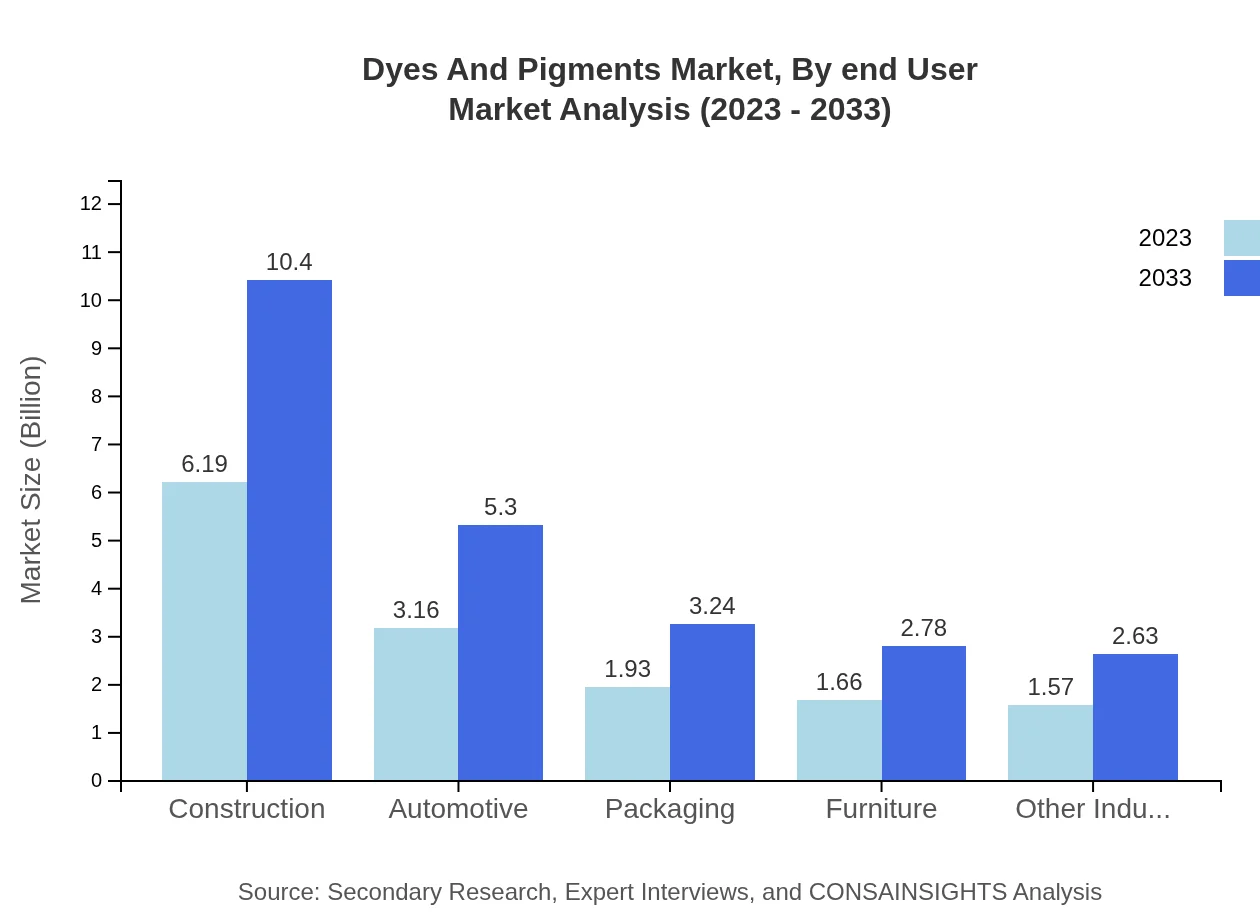

Among applications, Textiles represent the largest share, accounting for 42.71% in 2023, valued at $6.19 billion, and projected to rise to $10.40 billion by 2033. The Construction industry holds 42.71% share as well, which is crucial for growth driven by infrastructure development. The Automotive and Packaging sectors also show promising growth, with shares of 21.76% and 13.31%, respectively, indicating diverse applications influencing market expansion.

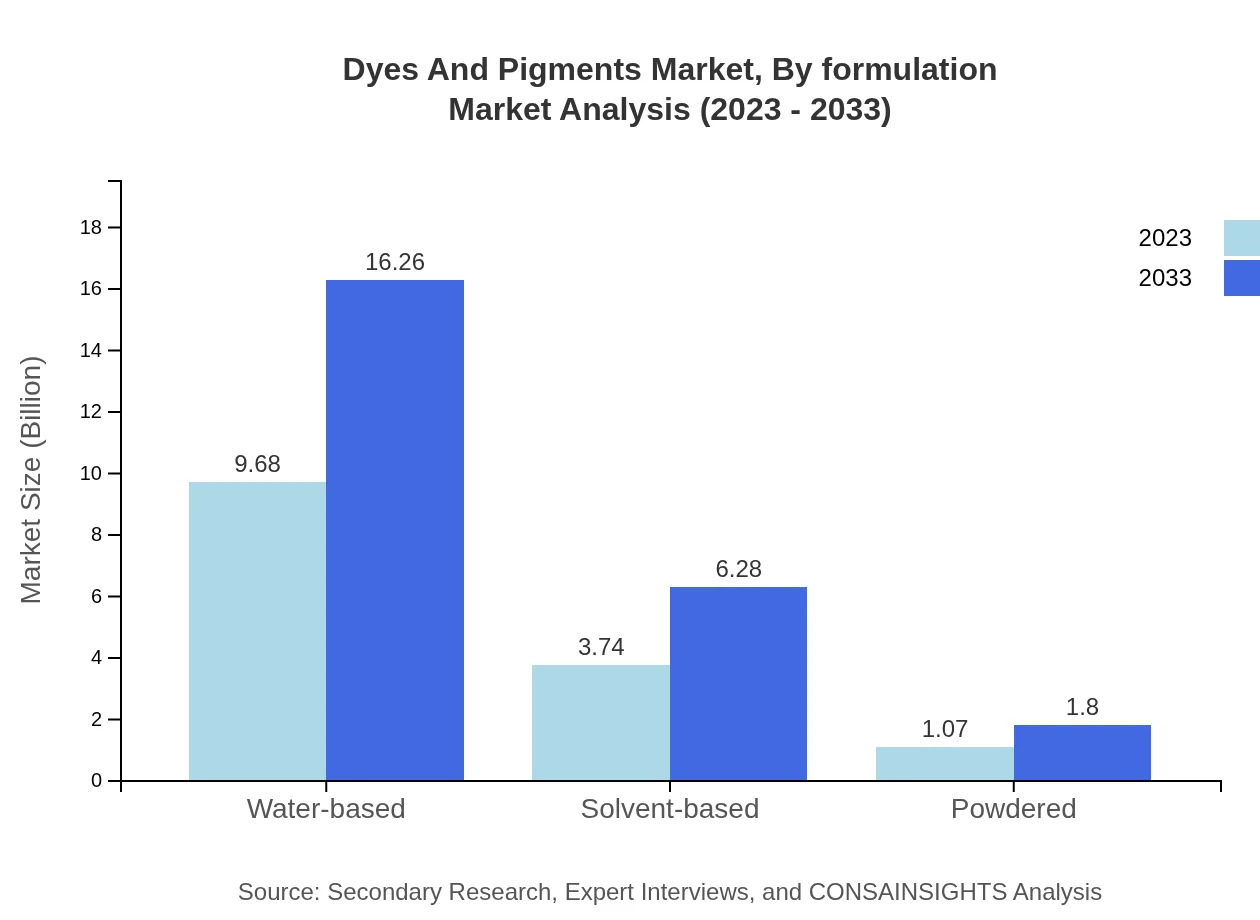

Dyes And Pigments Market Analysis By Formulation

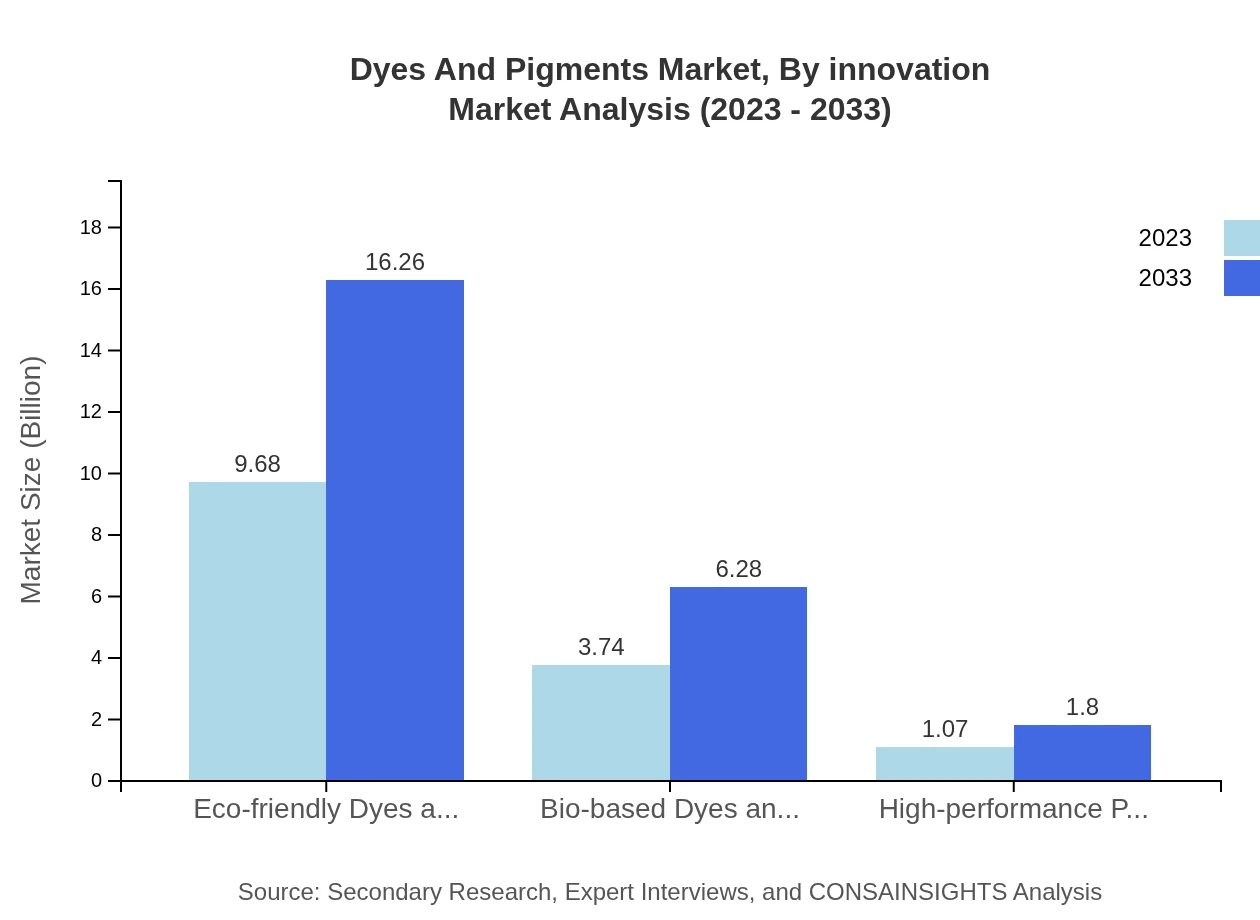

The market is increasingly favoring Water-based formulations, which hold a share of 66.79% and are expected to grow from $9.68 billion to $16.26 billion by 2033. Solvent-based formulations, while smaller at 25.82% share, also indicate growth potential, driven by demand for durability and performance in various applications such as automotive and industrial coatings.

Dyes And Pigments Market Analysis By End User

End-user segmentation categorizes industries significantly influencing demand. The Textile industry captures 42.71% market share while Automotive and Construction industries are crucial as well. These industries' growth is aligned with the increasing emphasis on aesthetics and functionality, with eco-friendly products gaining traction to meet regulation standards.

Dyes And Pigments Market Analysis By Innovation

Innovation plays a pivotal role in this market, particularly with a focus on Eco-friendly and Bio-based Dyes and Pigments. Eco-friendly products, holding a share of 66.79%, signal a shift towards sustainable practices. High-performance pigments also emerge as a significant segment, catering to industries requiring advanced properties such as chemical resistance and UV stability.

Dyes And Pigments Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Dyes And Pigments Industry

BASF SE:

BASF SE is a global leader in the chemical industry and one of the largest producers of pigments and dyes, committed to sustainable solutions and innovation in the dye and pigment sector.Huntsman Corporation:

Huntsman is a major player in the dyes and pigments market, known for its broad portfolio of colorants for textiles, plastics, and coatings, with a strong emphasis on product development and sustainability.Clariant AG:

Clariant AG focuses on specialty chemicals, including dyes and pigments. The company is renowned for its innovation in eco-friendly solutions and technical expertise in a variety of applications.Lanxess AG:

Lanxess AG is a prominent supplier of specialty chemicals and is well-regarded for its advanced pigments that cater to diverse industrial applications.DIC Corporation:

DIC Corporation provides a wide array of color materials and is advancing sustainability within its operations, driving growth in the global dyes and pigments market.We're grateful to work with incredible clients.

FAQs

What is the market size of dyes and pigments?

The global dyes and pigments market is valued at approximately $14.5 billion in 2023, with a projected CAGR of 5.2% anticipated through 2033. This growth reflects increasing demand across various industries including textiles, automotive, and construction.

What are the key market players or companies in the dyes and pigments industry?

Key players in the dyes and pigments industry include major firms such as BASF SE, Huntsman Corporation, and AkzoNobel N.V. These companies are leaders in innovation and sustainability, providing a range of products and solutions to meet industry demands.

What are the primary factors driving the growth in the dyes and pigments industry?

Growth drivers for the dyes and pigments industry include rising consumer preferences for eco-friendly and sustainable products, increased demand in the textile sector, and advancements in technology leading to improved product performance and application versatility.

Which region is the fastest Growing in the dyes and pigments industry?

The Asia Pacific region is the fastest-growing market for dyes and pigments, expected to grow from $2.88 billion in 2023 to $4.83 billion by 2033. This surge is driven by expansion in the textile and automotive industries.

Does ConsaInsights provide customized market report data for the dyes and pigments industry?

Yes, ConsaInsights offers customized market report data tailored to the needs of clients in the dyes and pigments industry. This allows businesses to gain insights specific to their operational context and strategic goals.

What deliverables can I expect from this dyes and pigments market research project?

Deliverables from the dyes and pigments market research project typically include a comprehensive analysis report, trend forecasts, competitive landscape assessment, and insights into consumer preferences and market dynamics.

What are the market trends of dyes and pigments?

Current market trends in dyes and pigments encompass a shift towards eco-friendly dyes, increasing investment in bio-based pigments, and the rising popularity of water-based formulations as industries strive to meet environmental regulations.