Dynamic Random Access Memory Dram Market Report

Published Date: 31 January 2026 | Report Code: dynamic-random-access-memory-dram

Dynamic Random Access Memory Dram Market Size, Share, Industry Trends and Forecast to 2033

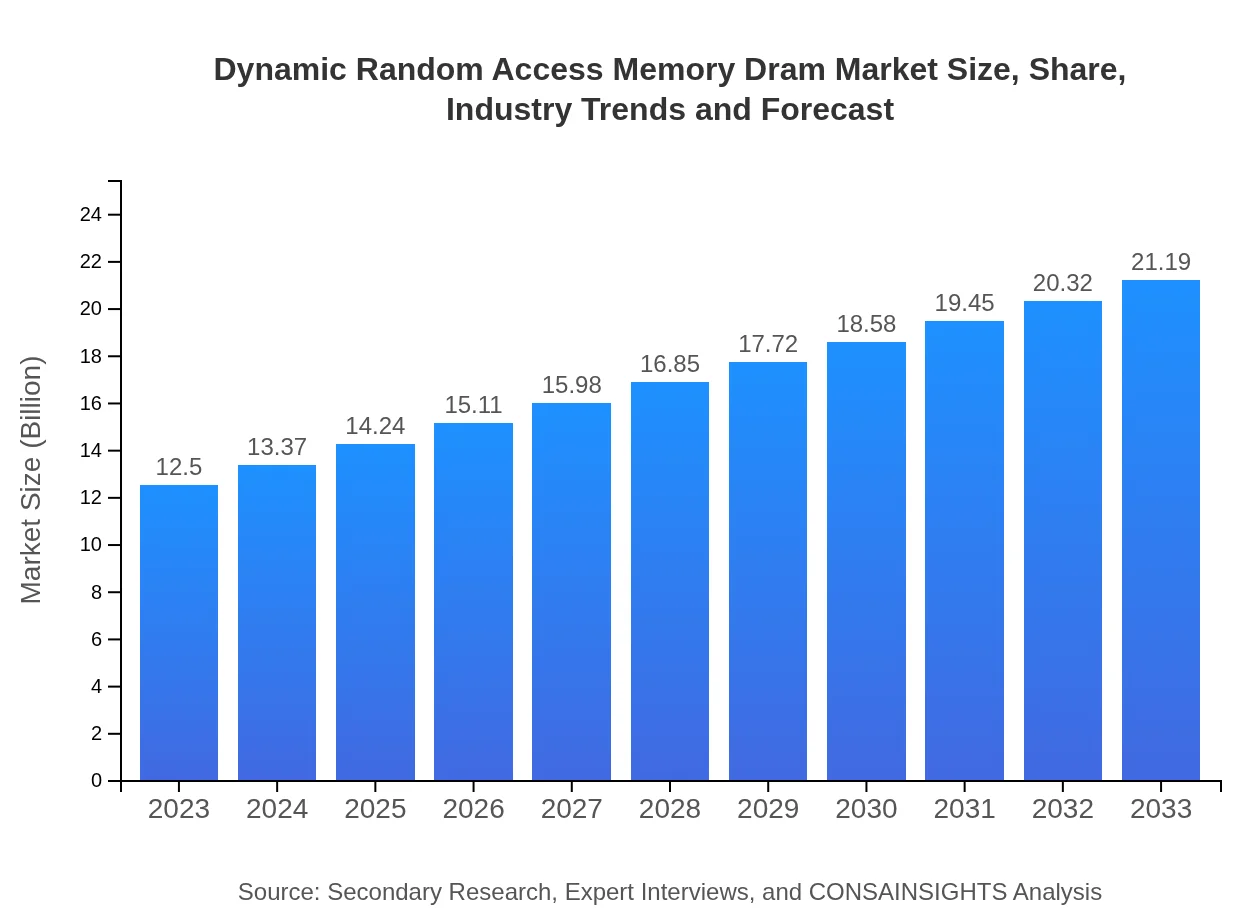

This report presents an in-depth analysis of the Dynamic Random Access Memory (DRAM) market, covering insights from 2023 to 2033 regarding market size, CAGR, industry dynamics, regional performance, and segmentation trends.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 5.3% |

| 2033 Market Size | $21.19 Billion |

| Top Companies | Samsung Electronics Co., Ltd., SK Hynix Inc., Micron Technology, Inc., Kingston Technology Corporation, Nanya Technology Corporation |

| Last Modified Date | 31 January 2026 |

Dynamic Random Access Memory Dram Market Overview

Customize Dynamic Random Access Memory Dram Market Report market research report

- ✔ Get in-depth analysis of Dynamic Random Access Memory Dram market size, growth, and forecasts.

- ✔ Understand Dynamic Random Access Memory Dram's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Dynamic Random Access Memory Dram

What is the Market Size & CAGR of Dynamic Random Access Memory Dram market in 2023?

Dynamic Random Access Memory Dram Industry Analysis

Dynamic Random Access Memory Dram Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Dynamic Random Access Memory Dram Market Analysis Report by Region

Europe Dynamic Random Access Memory Dram Market Report:

Europe's DRAM market stood at $3.04 billion in 2023, with expectations to grow to $5.15 billion by 2033. The emphasis on smart technologies and industrial automation is accelerating demand, supported by regulatory frameworks pushing for advanced computing technologies.Asia Pacific Dynamic Random Access Memory Dram Market Report:

In the Asia Pacific region, the DRAM market was valued at $2.45 billion in 2023 and is projected to reach $4.15 billion by 2033. The region is a manufacturing hub for leading semiconductor companies and benefits significantly from the increasing demand for electronics, driven by rising consumer spending and technological advancements.North America Dynamic Random Access Memory Dram Market Report:

North America leads the DRAM market, valued at $4.41 billion in 2023, projected to expand to $7.48 billion by 2033. The region is known for its technological innovations and high demand in sectors such as data centers, gaming consoles, and manufacturing, fueled by increasing data consumption and cloud services.South America Dynamic Random Access Memory Dram Market Report:

The South American DRAM market is relatively smaller, with a value of $1.11 billion in 2023, expected to grow to $1.88 billion by 2033. Growth is anticipated as countries enhance their digital infrastructure and demand for consumer electronics rises in various segments.Middle East & Africa Dynamic Random Access Memory Dram Market Report:

The Middle East and Africa DRAM market was valued at $1.50 billion in 2023, expected to reach $2.53 billion by 2033. Growth is driven by digital transformation initiatives and increasing consumer electronics adoption, although it remains a developing market compared to others.Tell us your focus area and get a customized research report.

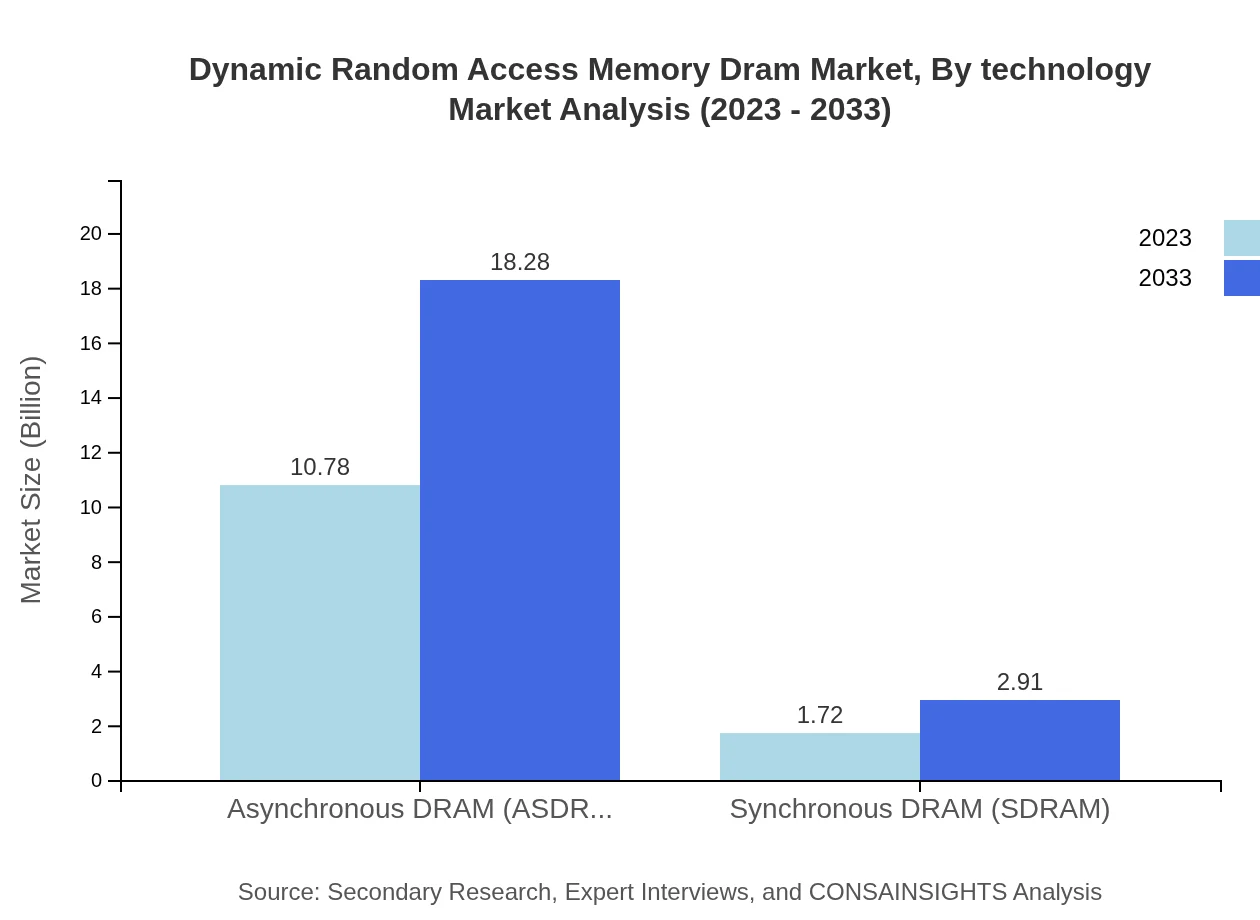

Dynamic Random Access Memory Dram Market Analysis By Product Type

The DRAM market by product type indicates that Asynchronous DRAM (ASDRAM) currently holds a significant market share, projected to grow from $10.78 billion in 2023 to $18.28 billion in 2033, reflecting an increasing demand for fast processing in consumer devices. Synchronous DRAM (SDRAM) is expected to rise from $1.72 billion to $2.91 billion, indicating a solid presence primarily in computing applications.

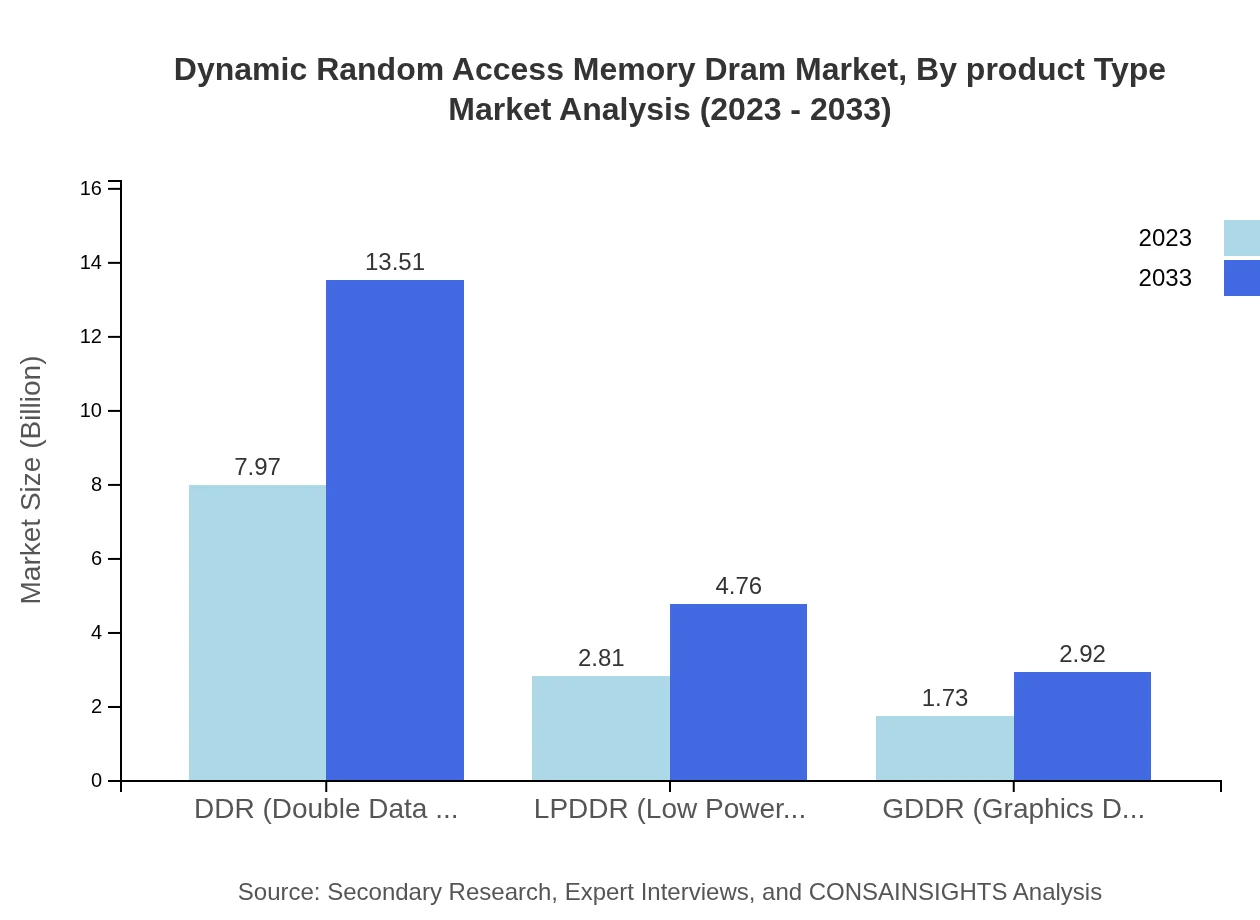

Dynamic Random Access Memory Dram Market Analysis By Technology

By technology, the DDR segment stands strong with a market size of $7.97 billion in 2023, escalating to $13.51 billion by 2033. Low Power DDR (LPDDR) also represents notable growth from $2.81 billion to $4.76 billion, essential for mobile devices. The GDDR technology, particularly used in gaming and graphics applications, is set to increase its value as gaming continues to evolve.

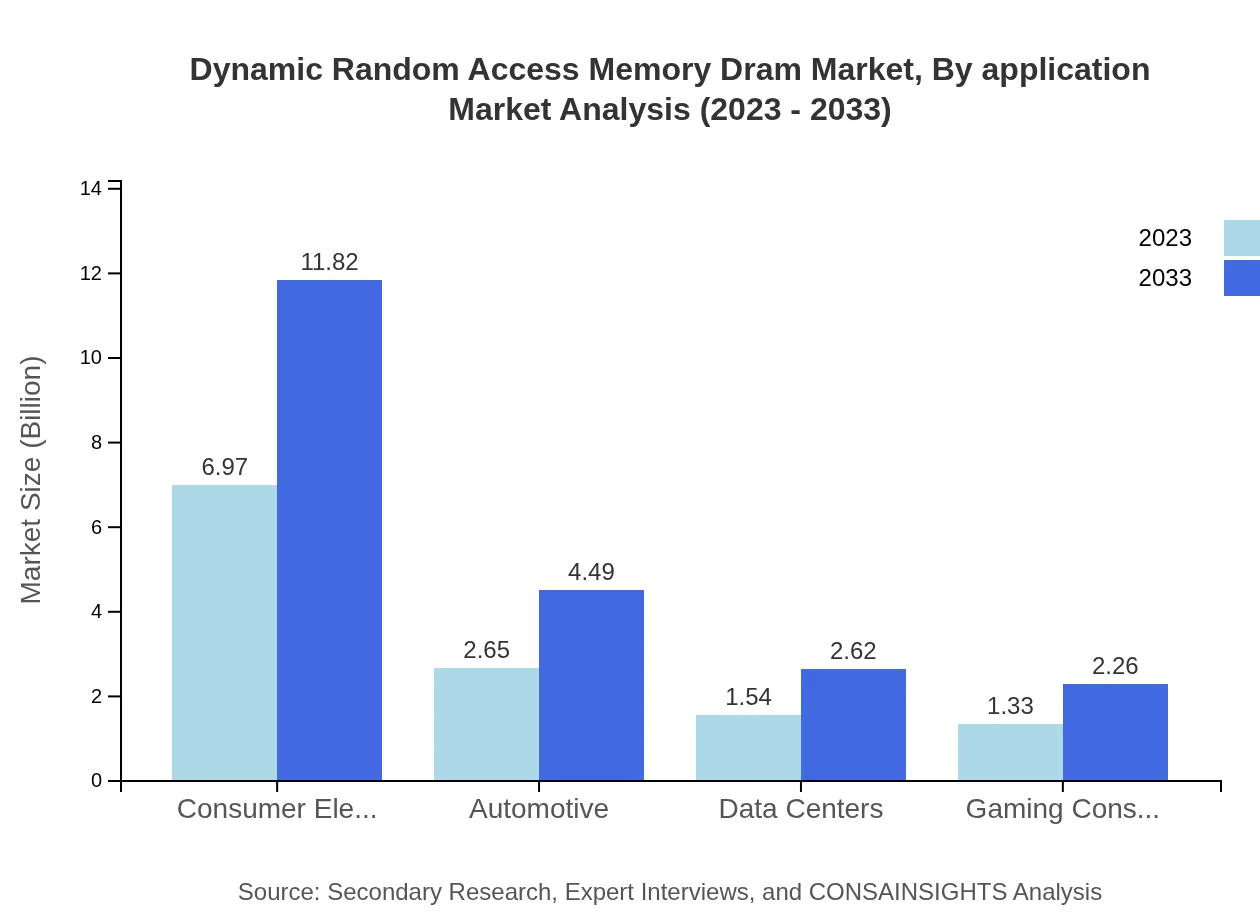

Dynamic Random Access Memory Dram Market Analysis By Application

Consumer Electronics account for a substantial portion of the DRAM market, projected to grow from $6.97 billion in 2023 to $11.82 billion by 2033, driven by the proliferation of smart devices. Other applications like automotive and data centers are also witnessing growth, reflecting the diversity of DRAM applications across industries.

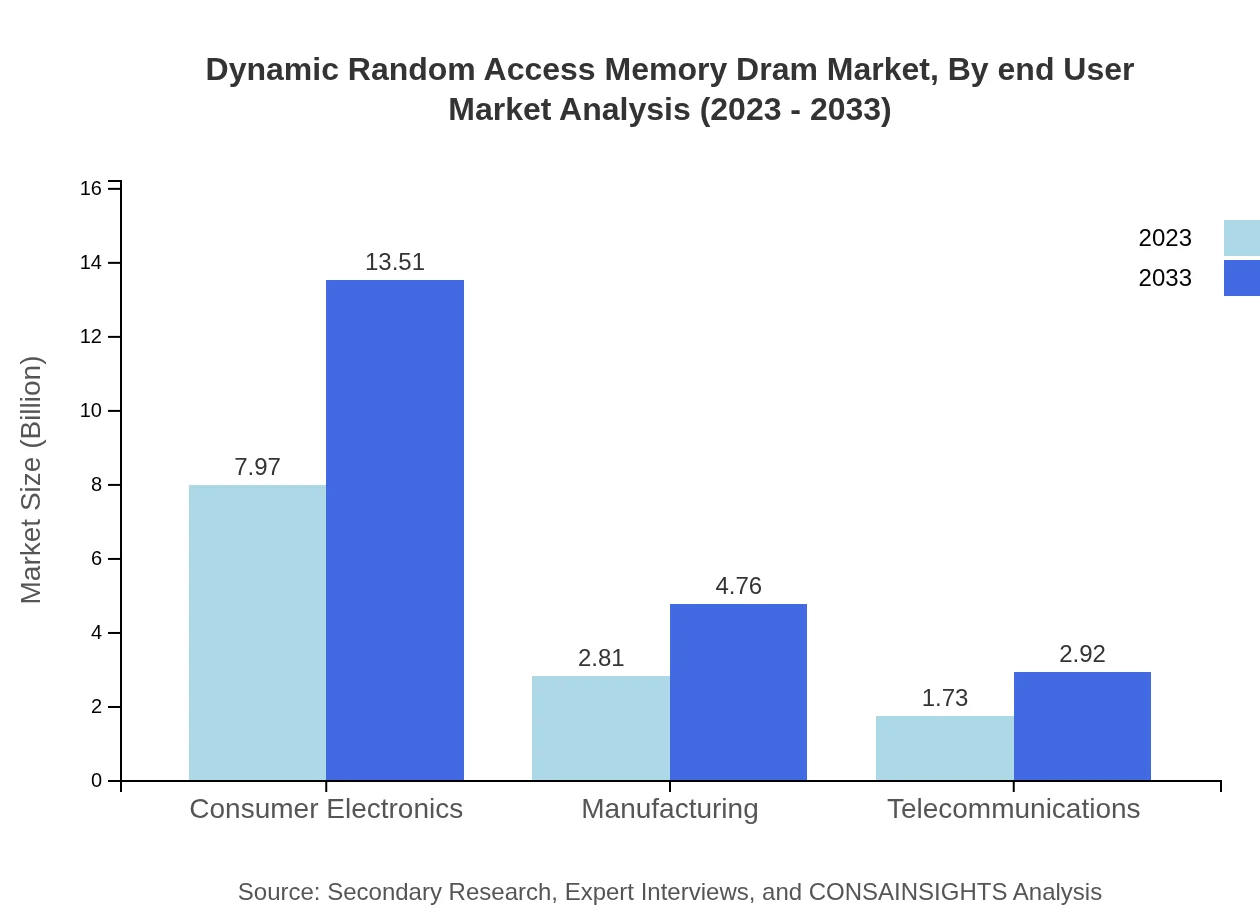

Dynamic Random Access Memory Dram Market Analysis By End User

End-users of DRAM include segments like gaming consoles, where a market size increase from $1.33 billion to $2.26 billion is anticipated through 2033. The automotive sector's demand is projected to rise as smart vehicles become commonplace, reflecting an anticipated growth from $2.65 billion to $4.49 billion.

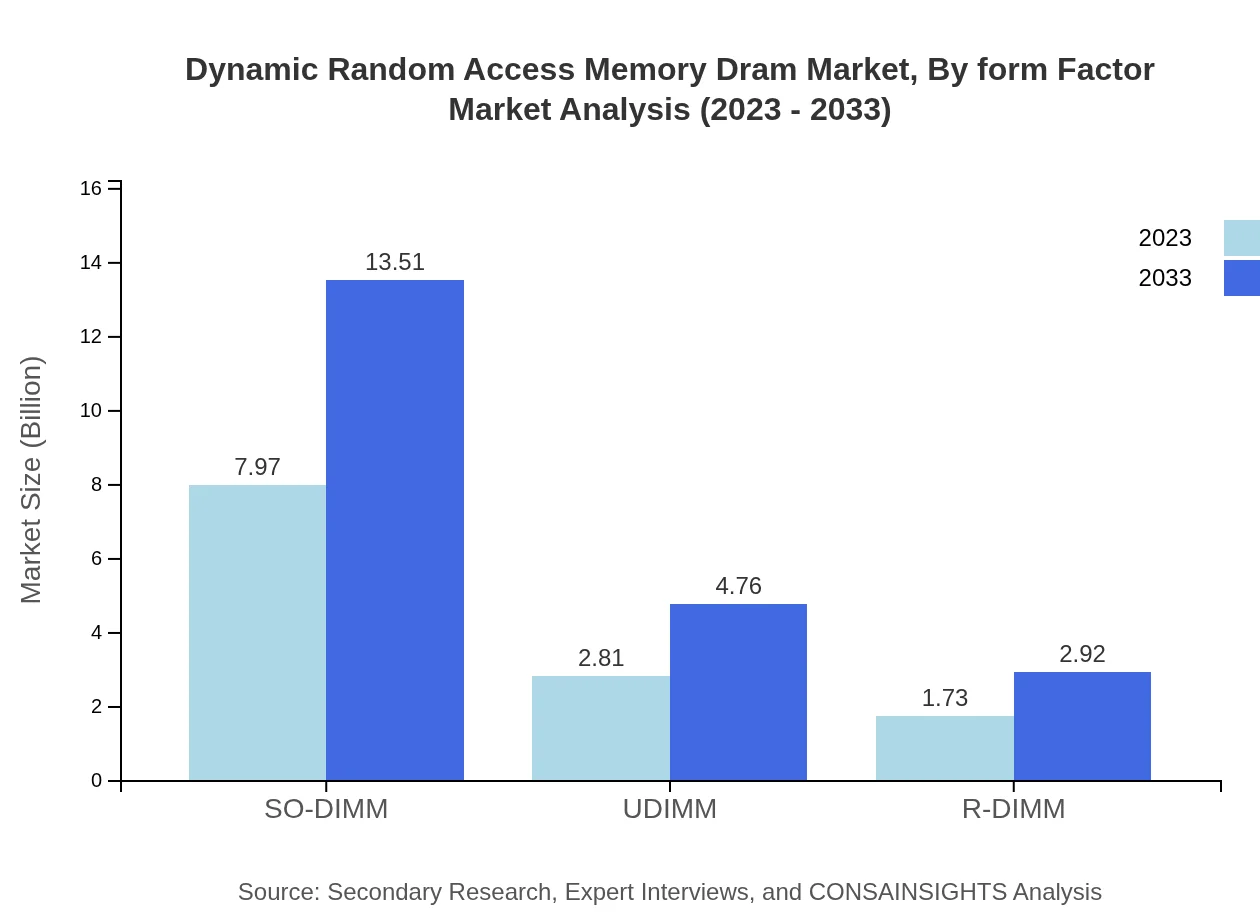

Dynamic Random Access Memory Dram Market Analysis By Form Factor

Form factor segmentation shows that SO-DIMM and UDIMM types are exceedingly popular, with SO-DIMM set to grow from $7.97 billion to $13.51 billion, while UDIMM is projected to increase from $2.81 billion to $4.76 billion. This trend is driven by the rising use of laptops and compact devices requiring efficient memory solutions.

Dynamic Random Access Memory Dram Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Dynamic Random Access Memory Dram Industry

Samsung Electronics Co., Ltd.:

Samsung is a global leader in the DRAM market, known for its high-performance memory chips and continuous innovation. The company invests heavily in research and development, leading advancements in memory technology.SK Hynix Inc.:

SK Hynix is another key player in the DRAM space, recognized for its competitive pricing and quality. It has established a strong presence in both consumer and enterprise segments, driving market growth.Micron Technology, Inc.:

An American corporation known for its cutting-edge memory solutions, Micron plays a crucial role in the DRAM market, catering to various applications from consumer electronics to data centers.Kingston Technology Corporation:

Kingston is renowned for its memory products, including DRAM solutions for PCs and servers. Its substantial market share in the consumer electronics segment contributes heavily to industry dynamics.Nanya Technology Corporation:

Nanya Technology specializes in DRAM products, focusing on providing reliable and cost-effective memory solutions, mainly catering to the Asian market.We're grateful to work with incredible clients.

FAQs

What is the market size of Dynamic Random Access Memory (DRAM)?

As of 2023, the global market size for Dynamic Random Access Memory (DRAM) is valued at approximately $12.5 billion, with a projected compound annual growth rate (CAGR) of 5.3% during the following decade, indicating sustained market demand through 2033.

What are the key market players or companies in the DRAM industry?

Key players in the DRAM industry include major companies such as Samsung Electronics, SK hynix, Micron Technology, Nanya Technology, and Winbond Electronics. These firms lead in production capacity, technological innovation, and market share.

What are the primary factors driving the growth in the DRAM industry?

The growth in the DRAM industry is primarily driven by the increasing demand for memory in consumer electronics, cloud computing, and data centers. Additionally, the rise in gaming consoles and automotive electronics is significantly contributing to market expansion.

Which region is the fastest Growing in the DRAM market?

Asia Pacific is the fastest-growing region in the DRAM market, with growth projections from $2.45 billion in 2023 to $4.15 billion by 2033. This growth is driven by the increasing demand for electronics in emerging economies.

Does ConsaInsights provide customized market report data for the DRAM industry?

Yes, ConsaInsights provides customized market reports tailored to client specifications within the DRAM industry. This allows businesses to obtain in-depth insights relevant to their operational areas and competitive strategies.

What deliverables can I expect from this DRAM market research project?

Deliverables from a DRAM market research project include comprehensive market analysis, trend forecasting, competitive landscape evaluations, segmented insights by application, and regional market data to inform strategic decisions.

What are the market trends of DRAM?

Current trends in the DRAM market include a shift towards high-density memory solutions, advancements in manufacturing technologies, and the integration of DRAM with AI applications. These trends are integral to meeting the evolving demands of various industries.