Early Toxicity Testing Market Report

Published Date: 31 January 2026 | Report Code: early-toxicity-testing

Early Toxicity Testing Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Early Toxicity Testing market, including insights into market size, growth forecasts from 2023 to 2033, regional analysis, competitive landscape, technology trends, and segmentation. It aims to equip stakeholders with valuable data for strategic decision-making.

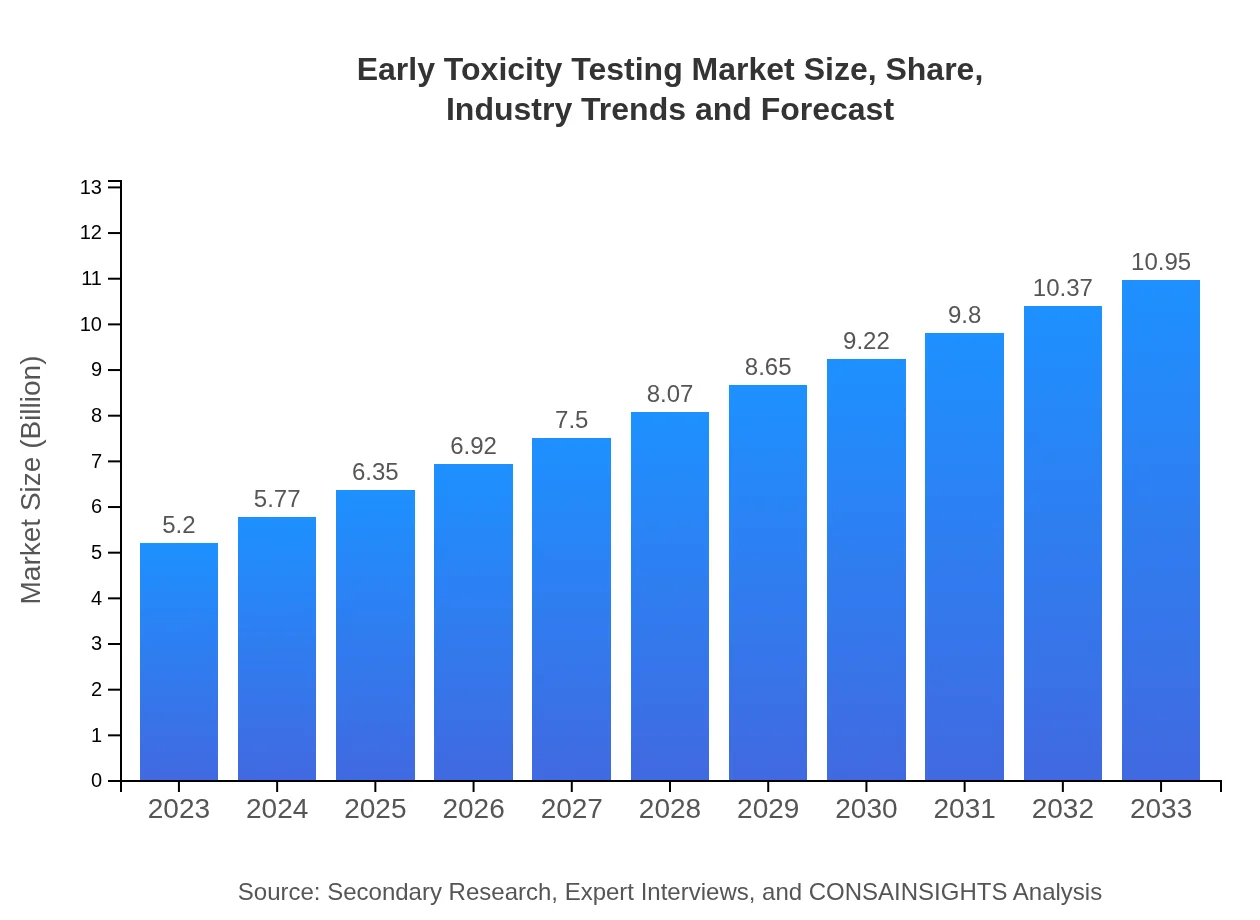

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 7.5% |

| 2033 Market Size | $10.95 Billion |

| Top Companies | Charles River Laboratories, Covance (LabCorp), Eurofins Scientific, Envigo |

| Last Modified Date | 31 January 2026 |

Early Toxicity Testing Market Overview

Customize Early Toxicity Testing Market Report market research report

- ✔ Get in-depth analysis of Early Toxicity Testing market size, growth, and forecasts.

- ✔ Understand Early Toxicity Testing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Early Toxicity Testing

What is the Market Size & CAGR of Early Toxicity Testing market in 2023 and 2033?

Early Toxicity Testing Industry Analysis

Early Toxicity Testing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Early Toxicity Testing Market Analysis Report by Region

Europe Early Toxicity Testing Market Report:

Europe's Early Toxicity Testing market, valued at $1.30 billion in 2023, is projected to expand to $2.73 billion by 2033, reflecting strong regulatory frameworks and a focus on skincare and cosmetics testing.Asia Pacific Early Toxicity Testing Market Report:

In the Asia Pacific region, the Early Toxicity Testing market was valued at $1.13 billion in 2023, with an anticipated growth to $2.38 billion by 2033. This growth is fueled by increasing regulatory pressures and growing investments in healthcare and pharmaceutical sectors.North America Early Toxicity Testing Market Report:

North America holds a significant portion of the market, with a value of $1.67 billion in 2023 projected to grow to $3.51 billion by 2033. This region's growth is driven by advanced research capabilities and the presence of major industry players.South America Early Toxicity Testing Market Report:

South America's market for Early Toxicity Testing was estimated at $0.39 billion in 2023 and is expected to reach $0.82 billion by 2033. Key drivers include the rising awareness about product safety and environmental regulations.Middle East & Africa Early Toxicity Testing Market Report:

The Middle East and Africa region's market was estimated at $0.72 billion in 2023 and is expected to grow to $1.51 billion by 2033. Growth is attributed to an increasing need for compliance with international safety standards.Tell us your focus area and get a customized research report.

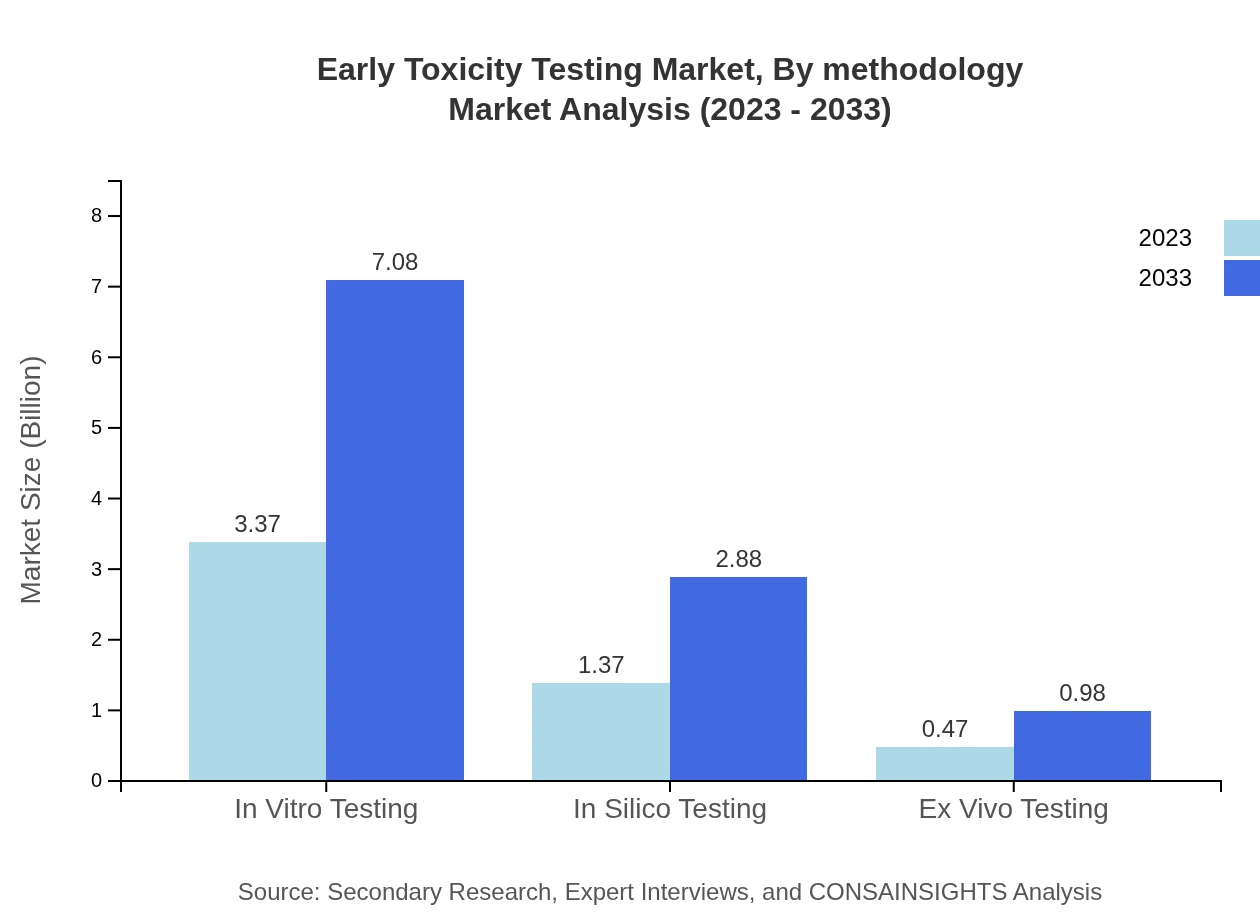

Early Toxicity Testing Market Analysis By Methodology

The Early Toxicity Testing market by methodology encompasses in vitro (approximately 64.72%), in silico (about 26.33%), and ex vivo testing (around 8.95%). The rise of in vitro testing is predominant due to its ability to provide reliable and ethical data without animal testing, enhancing the appeal of products in a market that is increasingly conscientious about humane practices.

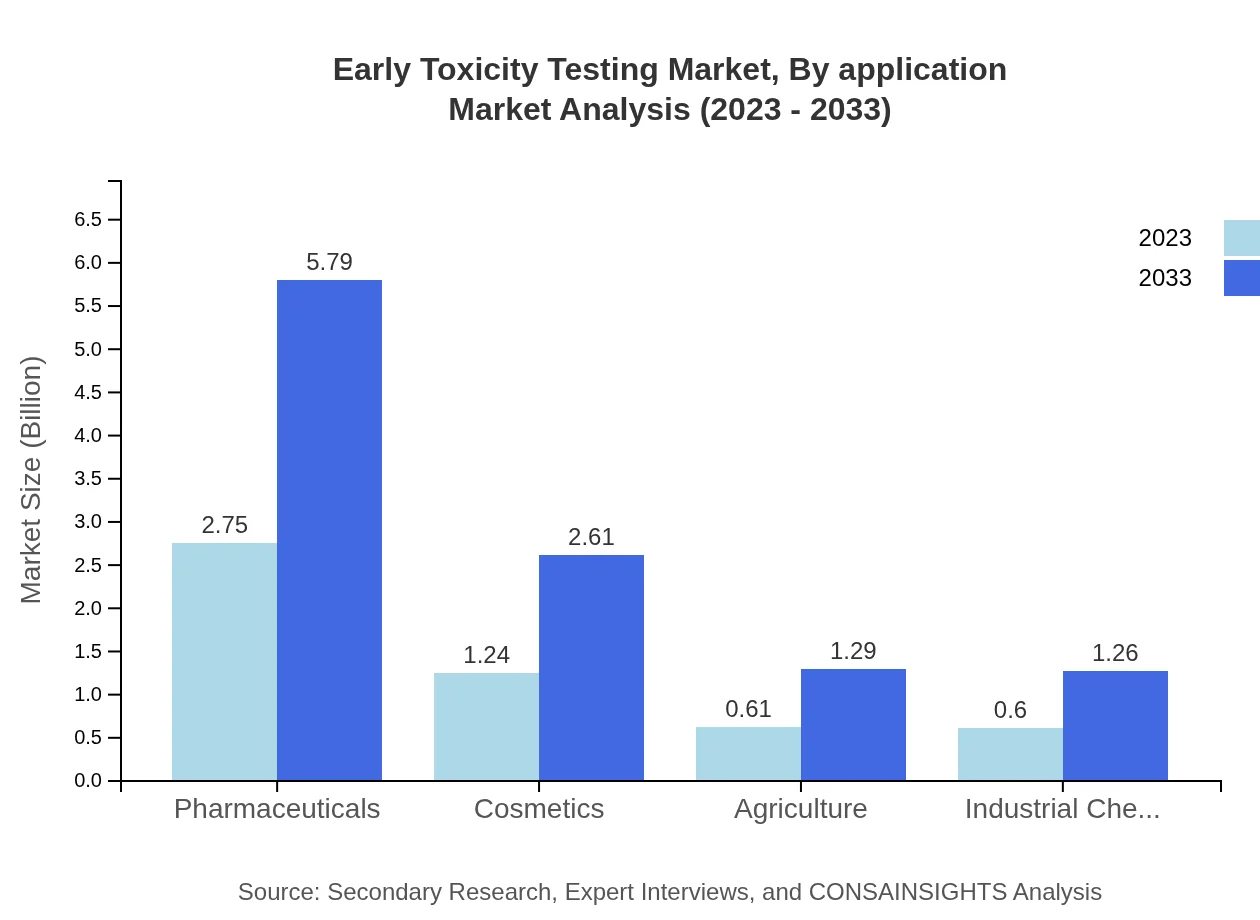

Early Toxicity Testing Market Analysis By Application

By application, the Early Toxicity Testing market is driven by pharmaceutical companies (52.89%), cosmetic companies (23.83%), and agricultural applications (11.75%). Each segment is vital, with pharmaceuticals leading the charge due to a consistent need for rigorous safety testing in drug development to adhere to FDA and EMA guidelines.

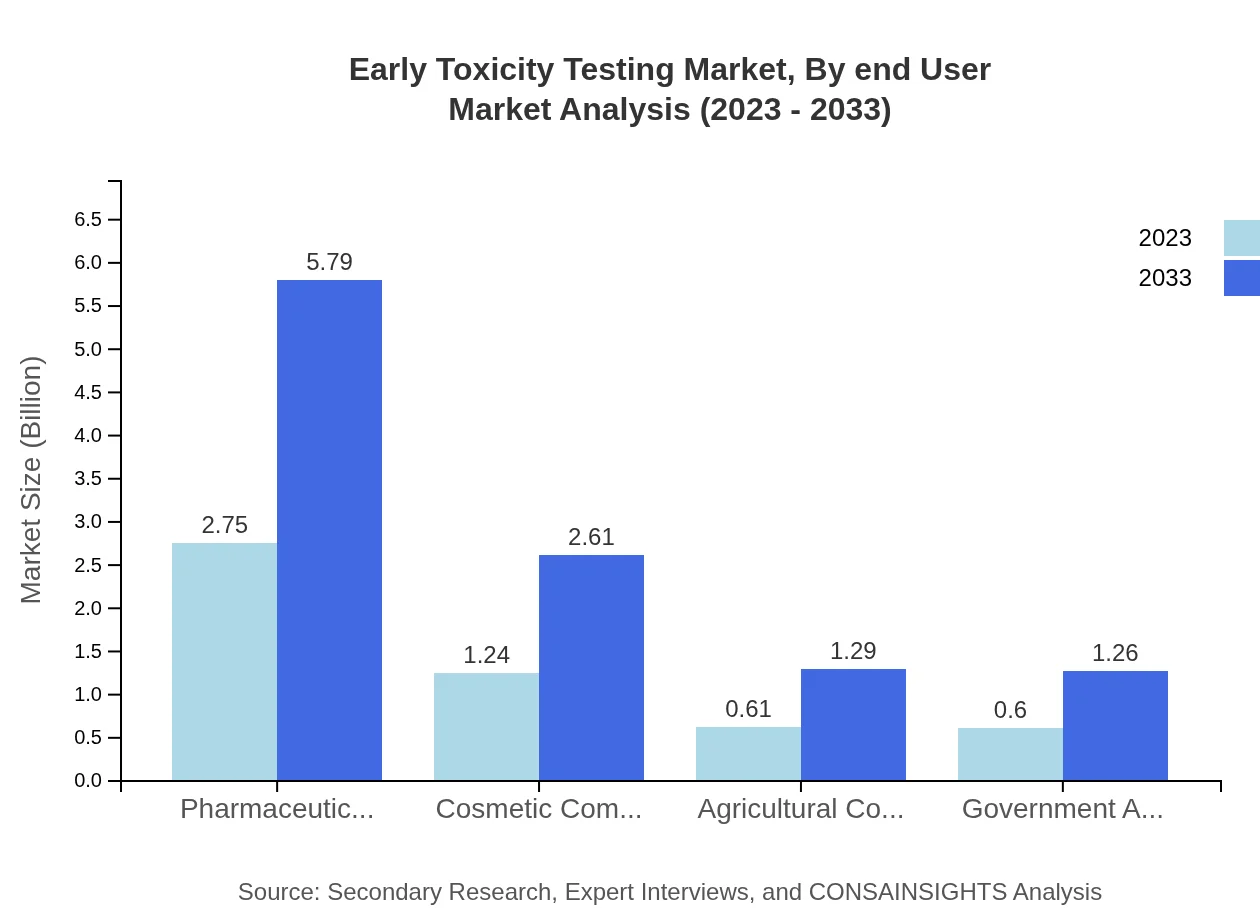

Early Toxicity Testing Market Analysis By End User

The end-users of Early Toxicity Testing include pharmaceutical firms, cosmetic manufacturers, agricultural companies, and government agencies, with pharmaceutical companies being the largest segment. Their need for compliance and innovation in drug safety reinforces the growth of toxicity testing services.

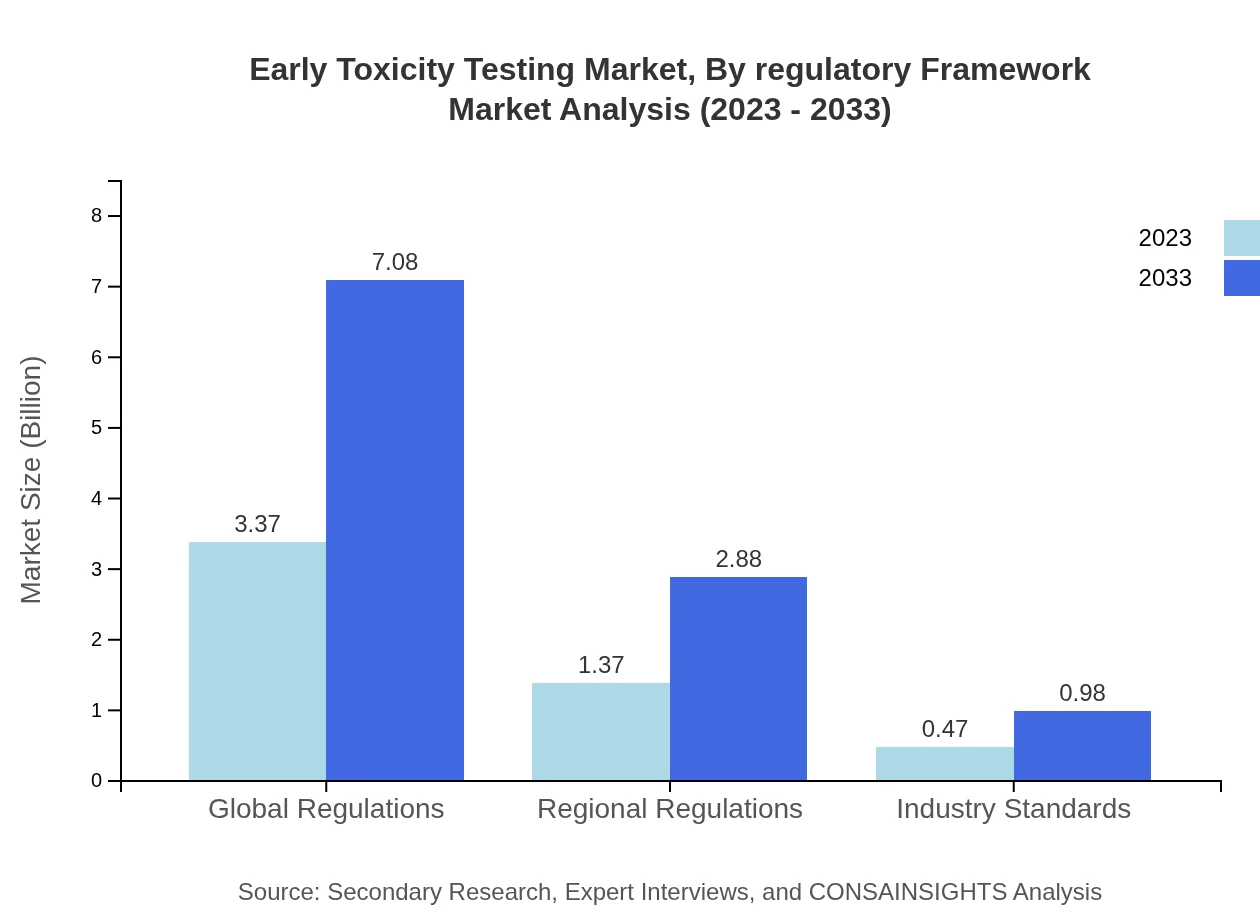

Early Toxicity Testing Market Analysis By Regulatory Framework

The regulatory framework segment is divided into global and regional regulations with significant size contributions. Global regulations, accounting for 64.72%, govern safety assessments in a uniform manner, whereas regional regulations ensure compliance with local laws, critical for market entry in diverse geographical areas.

Early Toxicity Testing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Early Toxicity Testing Industry

Charles River Laboratories:

A leading provider of preclinical and clinical laboratory services to the pharmaceutical and biotechnology industries. Charles River offers a wide array of toxicology testing, providing critical data early in the drug development process.Covance (LabCorp):

Covance is a global drug development services company known for its comprehensive early stage toxicology testing, which accelerates product safety evaluations and compliance.Eurofins Scientific:

Eurofins operates an extensive laboratory network providing innovative testing solutions including toxicology studies, thus supporting clients' R&D efforts in various sectors.Envigo:

Envigo specializes in research models and services for the pharmaceutical, biotechnology, and chemical industries, providing early toxicity testing that adheres to the highest standards.We're grateful to work with incredible clients.

FAQs

What is the market size of early Toxicity Testing?

The global early toxicity testing market is valued at approximately $5.2 billion in 2023, with a projected growth at a CAGR of 7.5% from 2023 to 2033.

What are the key market players or companies in this early Toxicity Testing industry?

Key market players in early toxicity testing include leading pharmaceutical, cosmetic, and agricultural companies that leverage advanced testing methods to ensure product safety and compliance, contributing to ongoing innovation and growth in the sector.

What are the primary factors driving the growth in the early Toxicity Testing industry?

Growth in early toxicity testing is driven by increased regulatory demands, technological advancements in testing methodologies, rising awareness of product safety among consumers, and a growing emphasis on sustainable and responsible product development.

Which region is the fastest Growing in the early Toxicity Testing?

The fastest-growing region for early toxicity testing is North America, where market growth is expected to surge from $1.67 billion in 2023 to $3.51 billion by 2033, reflecting a robust demand for innovation in safety testing.

Does ConsaInsights provide customized market report data for the early Toxicity Testing industry?

Yes, Consainsights offers customized market report data tailored to specific needs within the early toxicity testing industry, ensuring that clients receive insights relevant to their unique business objectives and strategies.

What deliverables can I expect from this early Toxicity Testing market research project?

Clients can expect comprehensive deliverables including detailed market analysis reports, segmented data, trend forecasts, and actionable insights tailored to the early toxicity testing market, aiding in strategic decision-making.

What are the market trends of early Toxicity Testing?

Current market trends in early toxicity testing emphasize automation, the integration of AI, a shift toward in silico testing methods, and increased collaboration between industry players to enhance testing efficiency and regulatory compliance.