Eas Systems Market Report

Published Date: 31 January 2026 | Report Code: eas-systems

Eas Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Eas Systems market from 2023 to 2033. It details market trends, segmentation, regional insights, and future forecasts, equipping stakeholders with the information needed for strategic decision-making.

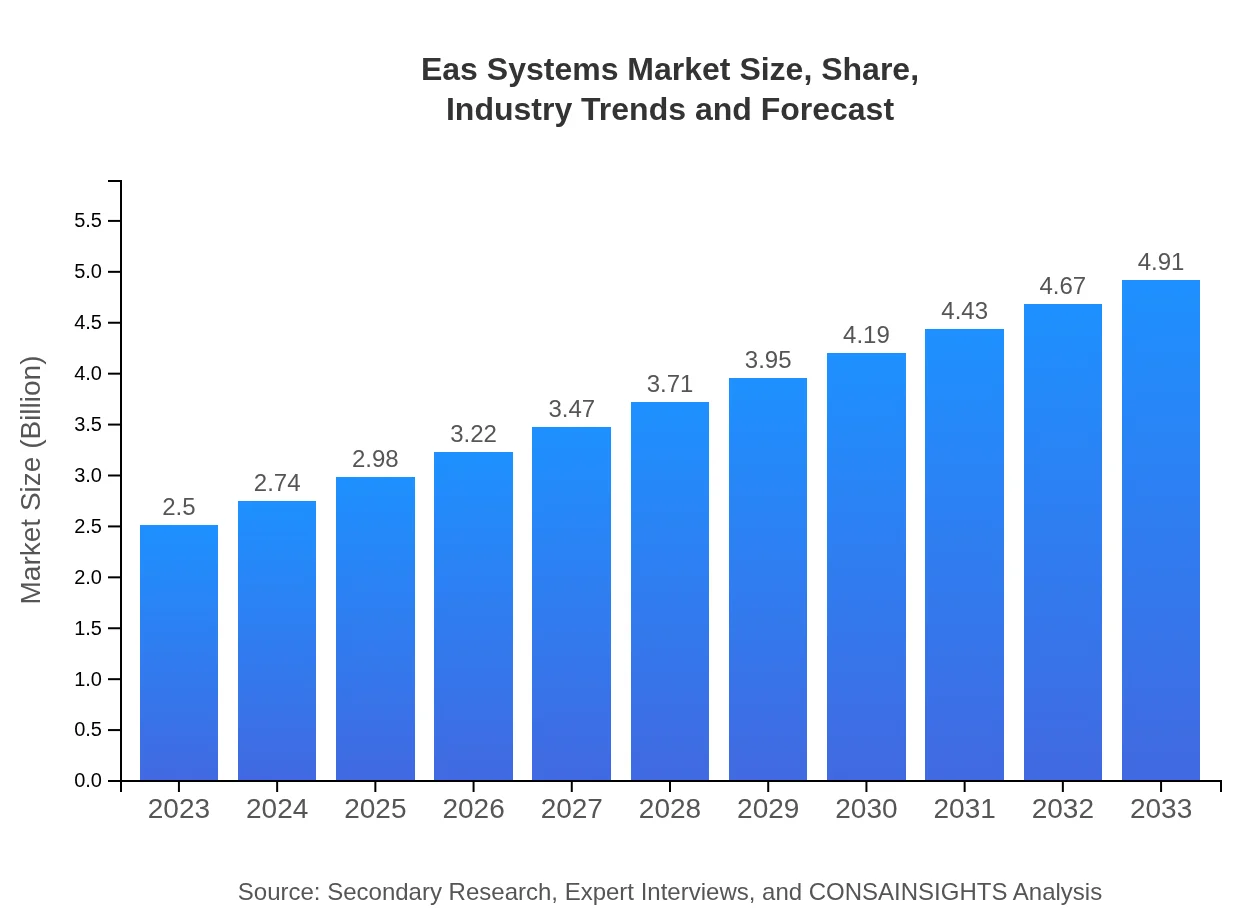

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | Checkpoint Systems, Tyco Integrated Security, Sensormatic Solutions, SNP Security |

| Last Modified Date | 31 January 2026 |

Eas Systems Market Overview

Customize Eas Systems Market Report market research report

- ✔ Get in-depth analysis of Eas Systems market size, growth, and forecasts.

- ✔ Understand Eas Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Eas Systems

What is the Market Size & CAGR of Eas Systems market in 2023?

Eas Systems Industry Analysis

Eas Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Eas Systems Market Analysis Report by Region

Europe Eas Systems Market Report:

Europe's market, valued at $0.74 billion in 2023, is anticipated to reach $1.45 billion by 2033. The emphasis on innovative security solutions and a strong retail sector underpins this growth, with investments in technology paving the way for advanced EAS installations.Asia Pacific Eas Systems Market Report:

In the Asia Pacific, the Eas Systems market is projected to grow from $0.52 billion in 2023 to $1.02 billion by 2033. This growth can be attributed to rising retail sectors in emerging economies and increasing incidences of shoplifting, driving the demand for enhanced security solutions.North America Eas Systems Market Report:

North America leads the Eas Systems market with a current value of $0.83 billion expected to grow to $1.63 billion by 2033. The region's high adoption rate of advanced security systems drives this growth, along with stringent regulations promoting loss prevention.South America Eas Systems Market Report:

The South American market for Eas Systems is relatively smaller but growing steadily, expected to rise from $0.13 billion in 2023 to $0.25 billion by 2033. Enhanced security measures in logistics and retail sectors are fuelling this growth as businesses look to combat theft.Middle East & Africa Eas Systems Market Report:

The Middle East and Africa market is set to experience growth from $0.29 billion in 2023 to $0.56 billion by 2033. Increasing urbanization and security concerns drive demand for effective Eas Systems solutions in various sectors.Tell us your focus area and get a customized research report.

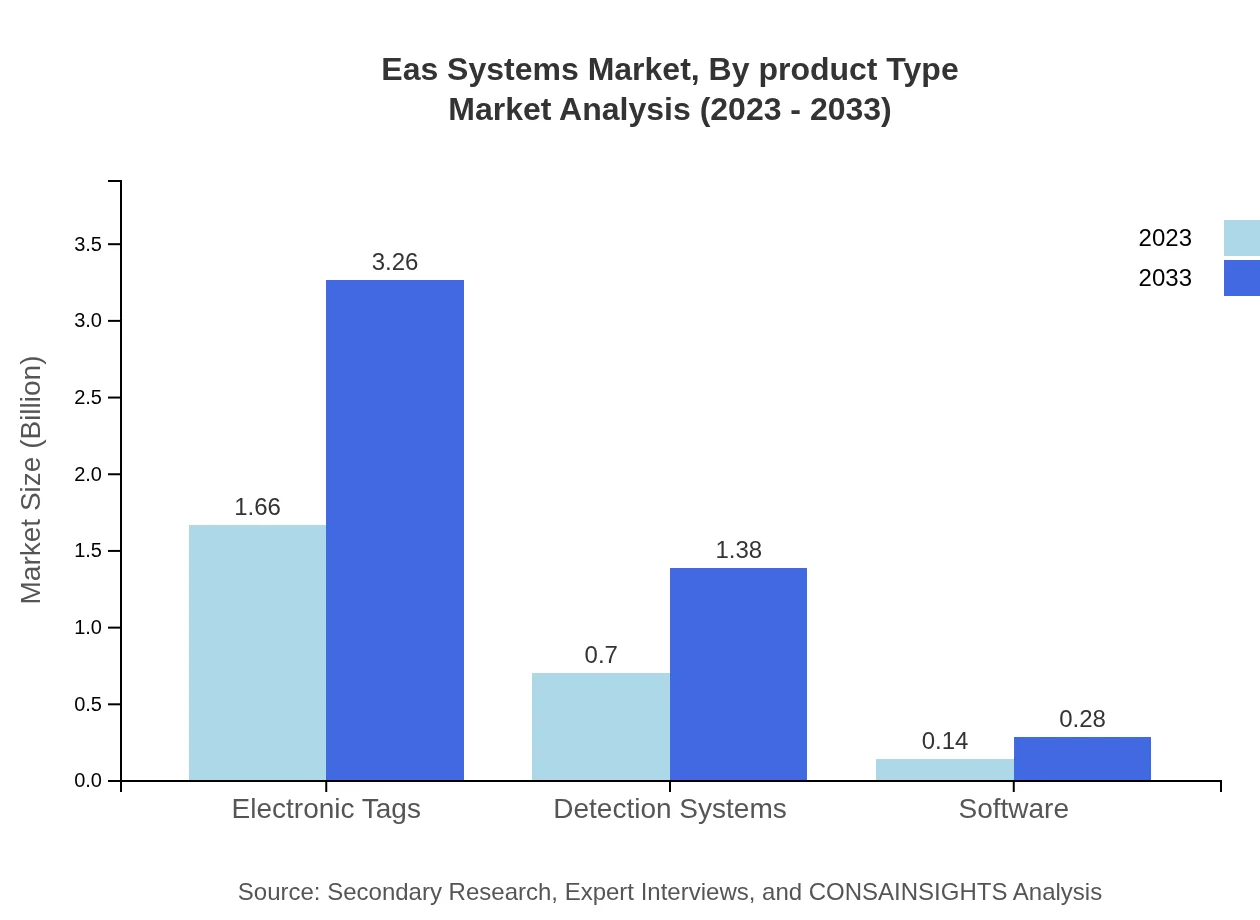

Eas Systems Market Analysis By Product Type

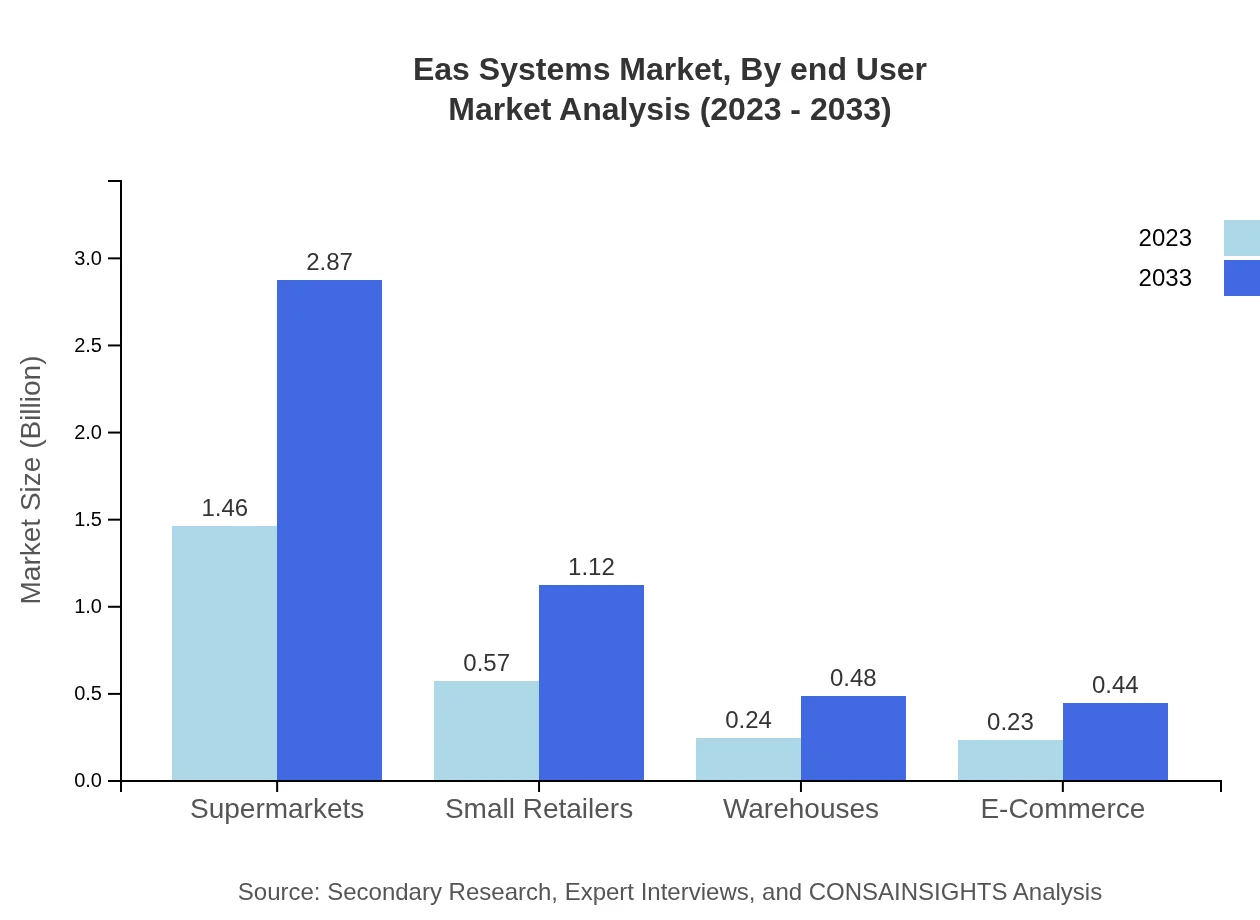

The product type segmentation reveals substantial insights: **Supermarkets** dominate the market with a size of $1.46 billion in 2023, projected to reach $2.87 billion by 2033, holding a market share of 58.49%. **Small Retailers** follow with $0.57 billion, increasing to $1.12 billion and maintaining a share of 22.72%. **Warehouses** represent $0.24 billion, expected to double to $0.48 billion, while **E-Commerce** solutions present a notable growth opportunity from $0.23 billion to $0.44 billion. Additionally, **RFID Technology** shows impressive growth from $1.66 billion to $3.26 billion, responsible for 66.25% market share, indicating a trend towards more sophisticated tagging solutions.

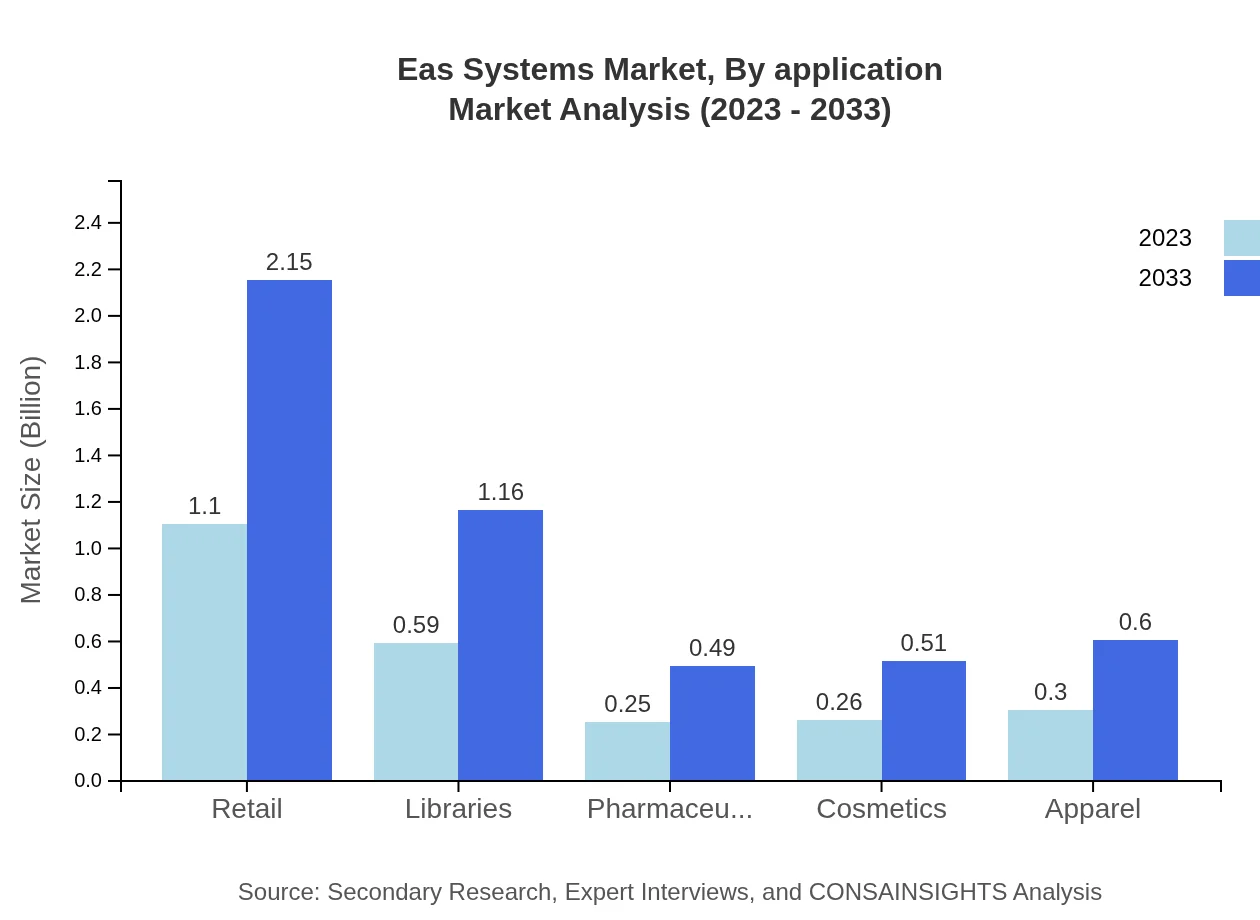

Eas Systems Market Analysis By Application

The application segmentation reveals retail as the primary sector, with a market size of $1.10 billion growing to $2.15 billion with a 43.83% share. Libraries are projected to grow from $0.59 billion to $1.16 billion, encompassing 23.66% of the market. The pharmaceutical sector expects to grow from $0.25 billion to $0.49 billion. Other sectors including cosmetics and apparel are also critical players, rapidly increasing their market presence.

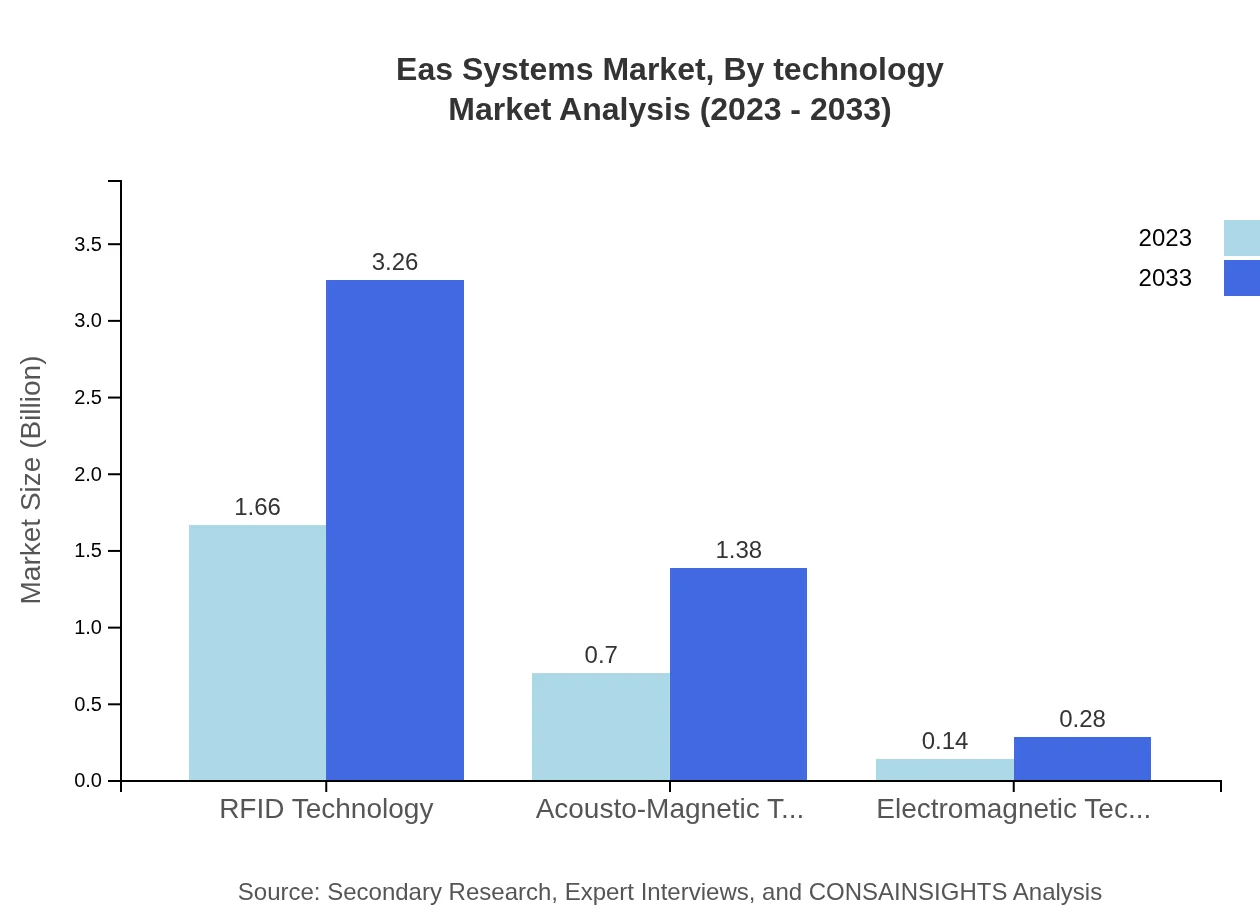

Eas Systems Market Analysis By Technology

The technology-based segmentation indicates a strong market presence for **RFID Technology**, which will progress from $1.66 billion to $3.26 billion, exhibiting a 66.25% share. **Acousto-Magnetic Technology** and **Electromagnetic Technology** maintain respective positions, growing steadily from $0.70 billion to $1.38 billion and $0.14 billion to $0.28 billion. This indicates a move toward more sophisticated, responsive security systems as technologies advance.

Eas Systems Market Analysis By End User

The end-user analysis showcases diverse applications of Eas Systems across various industries. The retail sector is the largest consumer, followed by healthcare facilities, libraries, and warehouses seeking robust protection against theft losses. Moreover, growing e-commerce demands are boosting the market as more businesses adapt to integrate EAS solutions into their logistics and operations.

Eas Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Eas Systems Industry

Checkpoint Systems:

Checkpoint Systems is a leading global provider of EAS solutions, transforming retail security with innovative technologies and services to enhance loss prevention.Tyco Integrated Security:

As a key player in the safety and security market, Tyco offers advanced EAS products and services, emphasizing intelligent security solutions tailored for retail.Sensormatic Solutions:

A subsidiary of Johnson Controls, Sensormatic provides comprehensive EAS products and services, focusing on advancing security technologies for various retail environments.SNP Security:

Specializing in security technology solutions, SNP Security focuses on integrating EAS systems to offer tailored, effective deterrents against theft.We're grateful to work with incredible clients.

FAQs

What is the market size of eas Systems?

The eas-systems market is valued at approximately $2.5 billion in 2023, with a projected growth at a CAGR of 6.8% through 2033. This indicates a healthy expansion driven by increased adoption across various industries.

What are the key market players or companies in this eas Systems industry?

Key players in the eas-systems market include major companies that specialize in electronic article surveillance technology, such as Checkpoint Systems, Sensormatic, and Tyco Integrated Security. These companies significantly influence industry standards and innovation.

What are the primary factors driving the growth in the eas Systems industry?

The growth of the eas-systems industry is primarily driven by the increasing need for retail security, the rise of e-commerce, and technological advancements in inventory management and theft prevention systems.

Which region is the fastest Growing in the eas Systems?

The Asia-Pacific region is expected to be the fastest-growing market for eas-systems, expanding from $0.52 billion in 2023 to $1.02 billion by 2033, indicative of rising retail sectors and security concerns.

Does ConsaInsights provide customized market report data for the eas Systems industry?

Yes, ConsaInsights offers customized market report data for the eas-systems industry, tailoring insights to specific client needs, including market segments, competitive landscapes, and regional analyses.

What deliverables can I expect from this eas Systems market research project?

Expect comprehensive deliverables, including detailed market analysis, forecasts, competitive profiling, and insights into consumer trends within the eas-systems market. These deliverables will aid strategic decision-making.

What are the market trends of eas Systems?

Current trends in the eas-systems market include the integration of RFID technology, increased adoption of smart security solutions, and a focus on sustainability. These trends underscore the evolving landscape of retail security.