Edge Computing In Automotive Market Report

Published Date: 31 January 2026 | Report Code: edge-computing-in-automotive

Edge Computing In Automotive Market Size, Share, Industry Trends and Forecast to 2033

This report examines the Edge Computing in Automotive market, providing insights and forecasts from 2023 to 2033. It analyzes market trends, regional insights, key players, and technological advancements that will shape the industry over the next decade, helping stakeholders make informed decisions.

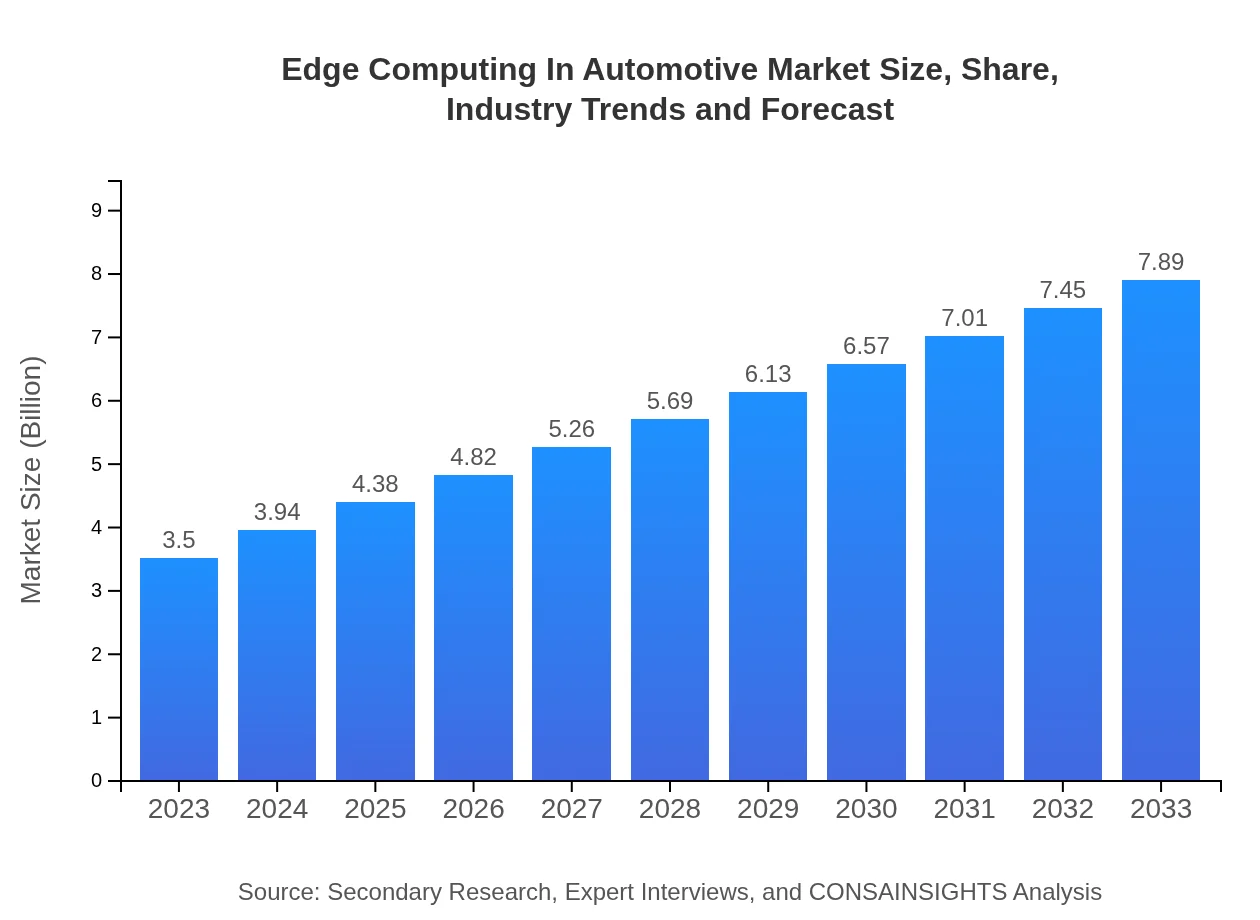

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 8.2% |

| 2033 Market Size | $7.89 Billion |

| Top Companies | NVIDIA Corporation, Intel Corporation, Samsung Electronics, Qualcomm Technologies, Inc., Microsoft Corporation |

| Last Modified Date | 31 January 2026 |

Edge Computing In Automotive Market Overview

Customize Edge Computing In Automotive Market Report market research report

- ✔ Get in-depth analysis of Edge Computing In Automotive market size, growth, and forecasts.

- ✔ Understand Edge Computing In Automotive's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Edge Computing In Automotive

What is the Market Size & CAGR of Edge Computing In Automotive market in 2023?

Edge Computing In Automotive Industry Analysis

Edge Computing In Automotive Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Edge Computing In Automotive Market Analysis Report by Region

Europe Edge Computing In Automotive Market Report:

Europe's market is anticipated to grow from $0.85 billion in 2023 to $1.92 billion by 2033. The region places a high emphasis on regulations governing automotive technologies and environmental standards. Countries like Germany and France lead in automotive innovation, driving a strong demand for advanced edge computing solutions to enhance vehicle connectivity and safety features.Asia Pacific Edge Computing In Automotive Market Report:

In the Asia-Pacific region, the Edge Computing in Automotive market is valued at $0.74 billion in 2023 and is expected to grow to $1.68 billion by 2033. The region is witnessing significant investments in smart transportation systems and connected vehicle technologies, driven by urbanization and the adoption of IoT. Countries like China and Japan are leading advancements in automotive technology, emphasizing analytics and real-time data processing.North America Edge Computing In Automotive Market Report:

North America is a significant market for Edge Computing in Automotive, valued at $1.12 billion in 2023 and projected to increase to $2.53 billion by 2033. The region's automotive sector is heavily influenced by technological innovations, with a strong presence of major players in the automotive and technology sectors. The demand for connected vehicles and autonomous driving has significantly driven the growth of edge computing solutions.South America Edge Computing In Automotive Market Report:

The South American market, valued at $0.29 billion in 2023, is forecasted to reach $0.66 billion by 2033. The adoption of edge computing in automotive is comparatively slower due to economic and infrastructural challenges. However, rising interest in connected cars and government initiatives to support smart mobility projects are expected to stimulate growth.Middle East & Africa Edge Computing In Automotive Market Report:

The Middle East and Africa market, valued at $0.49 billion in 2023, is expected to double to $1.10 billion by 2033. Growth in this region is driven by urbanization and the need for enhanced road safety measures. As smart city initiatives gain traction, edge computing solutions will play a pivotal role in transforming transportation and automotive services.Tell us your focus area and get a customized research report.

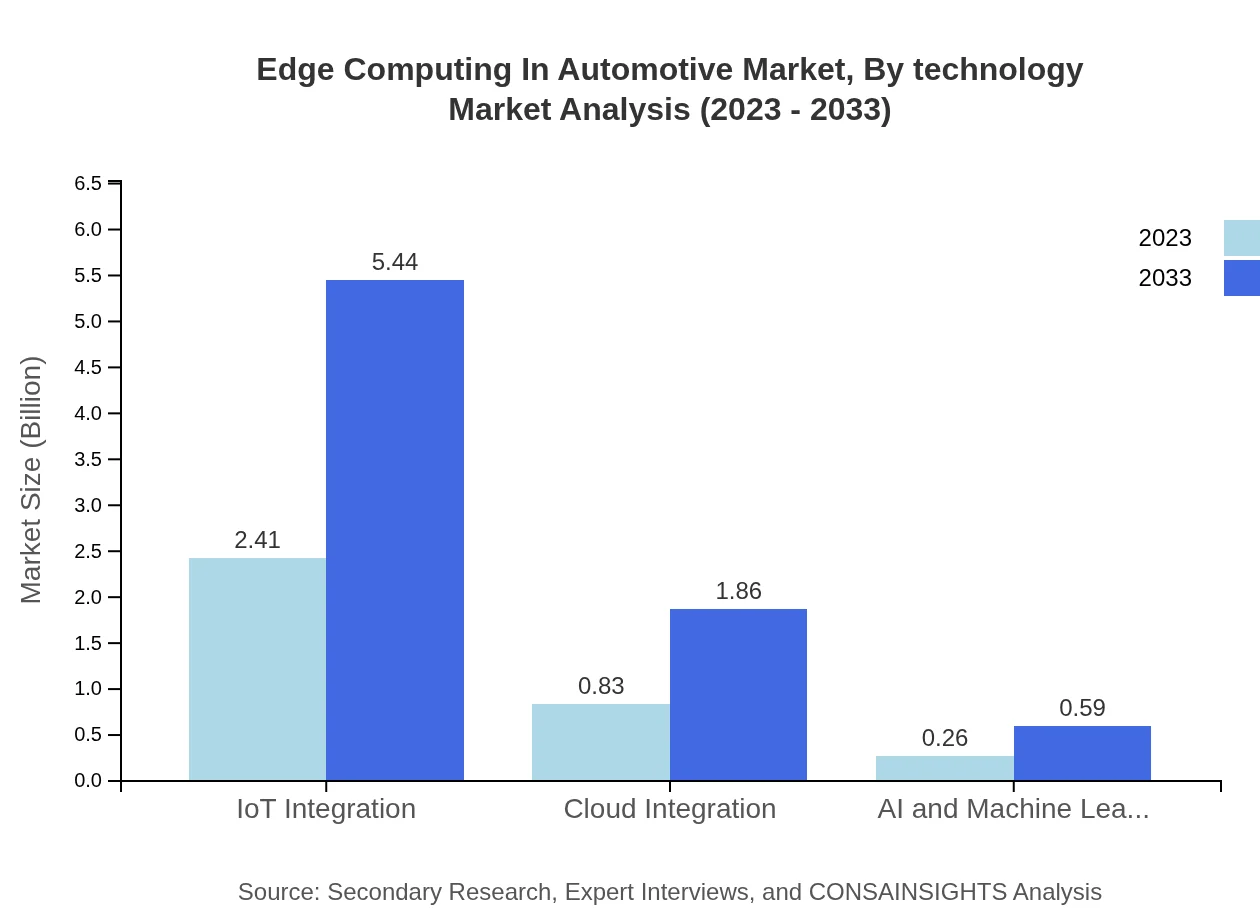

Edge Computing In Automotive Market Analysis By Technology

The market segmentation by technology highlights the growing importance of IoT Integration, which dominated the market with a size of $2.41 billion in 2023 and is expected to reach $5.44 billion by 2033, capturing 68.96% market share. Following closely are traditional cloud integrations and AI, which are vital for developing smart automotive systems. Edge computing technologies are also on the rise, underpinning critical real-time decision-making in vehicles.

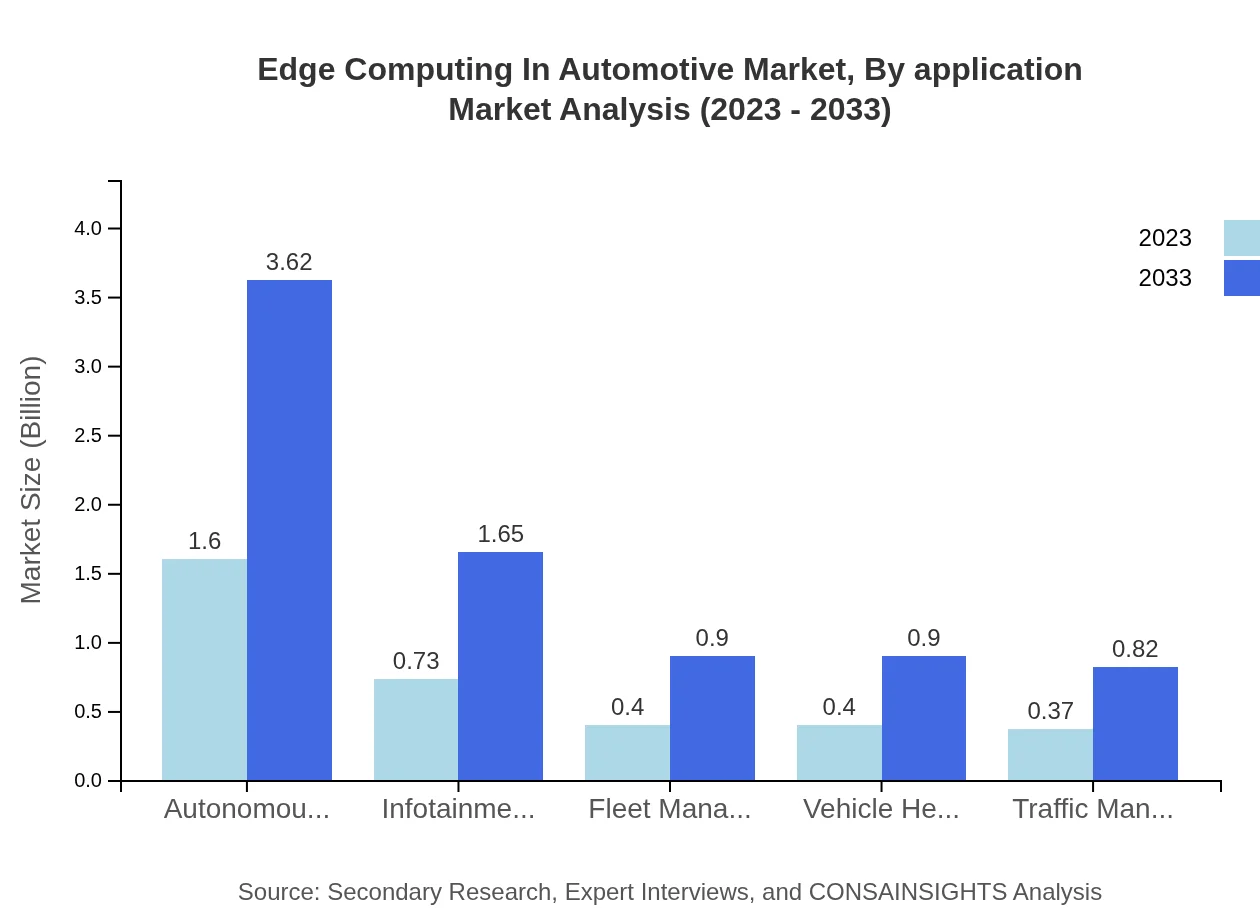

Edge Computing In Automotive Market Analysis By Application

Applications in the Edge Computing in Automotive sector are broad, encompassing significant areas like Autonomous Driving ($1.60 billion in 2023) and Infotainment Systems ($0.73 billion in 2023). The Autonomous Driving segment is expected to grow substantially, highlighting the need for fast and reliable data processing. Other areas such as Fleet Management and Vehicle Health Monitoring are also witnessing growing investment due to increasing consumer reliance on connected services.

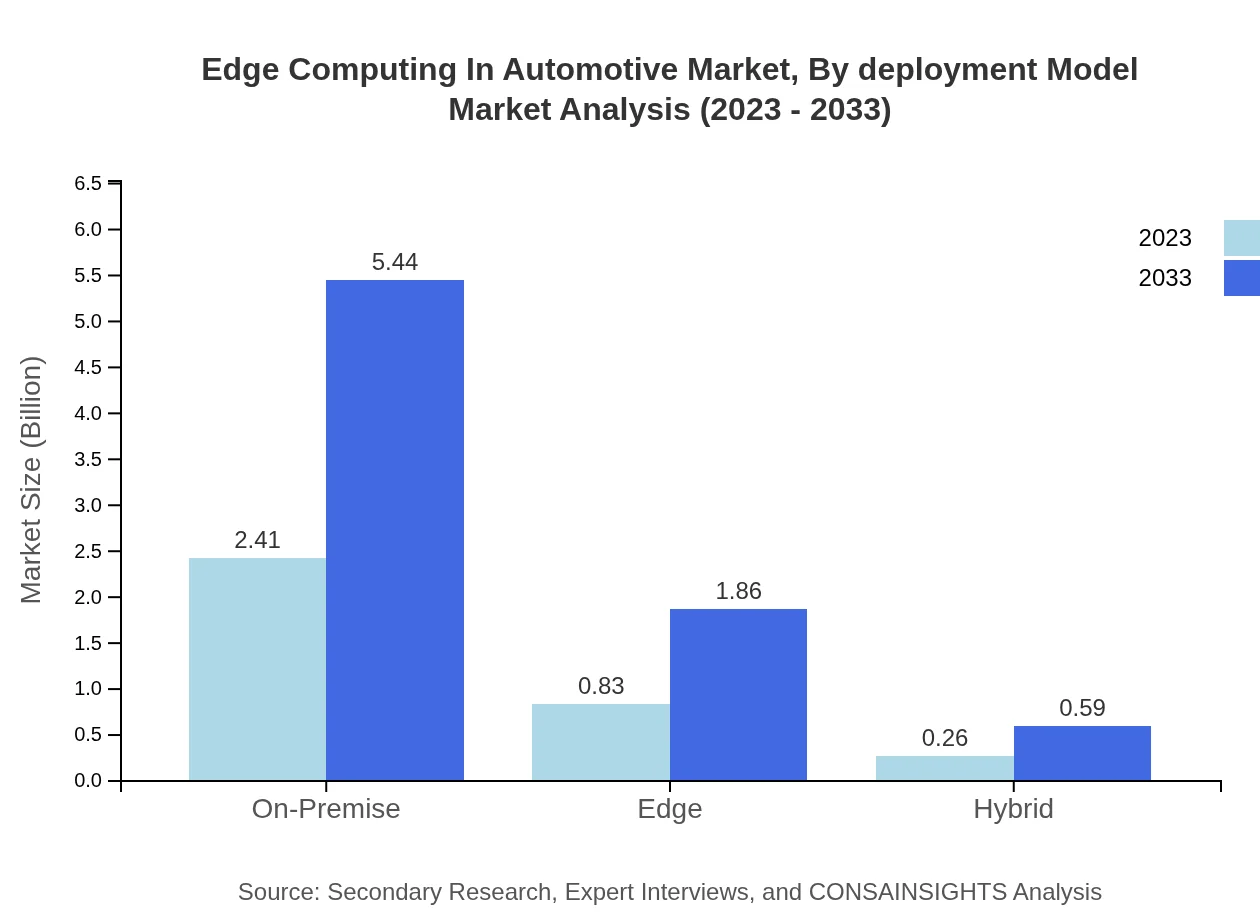

Edge Computing In Automotive Market Analysis By Deployment Model

In terms of deployment models, the On-Premise approach offers significant advantages with estimated revenue of $2.41 billion in 2023, expected to grow to $5.44 billion by 2033. This model supports critical applications requiring low latency and high data security. The Hybrid model is also emerging as a flexible option to pair cloud capabilities with edge solutions, catering to various operational requirements and enhancing system resilience.

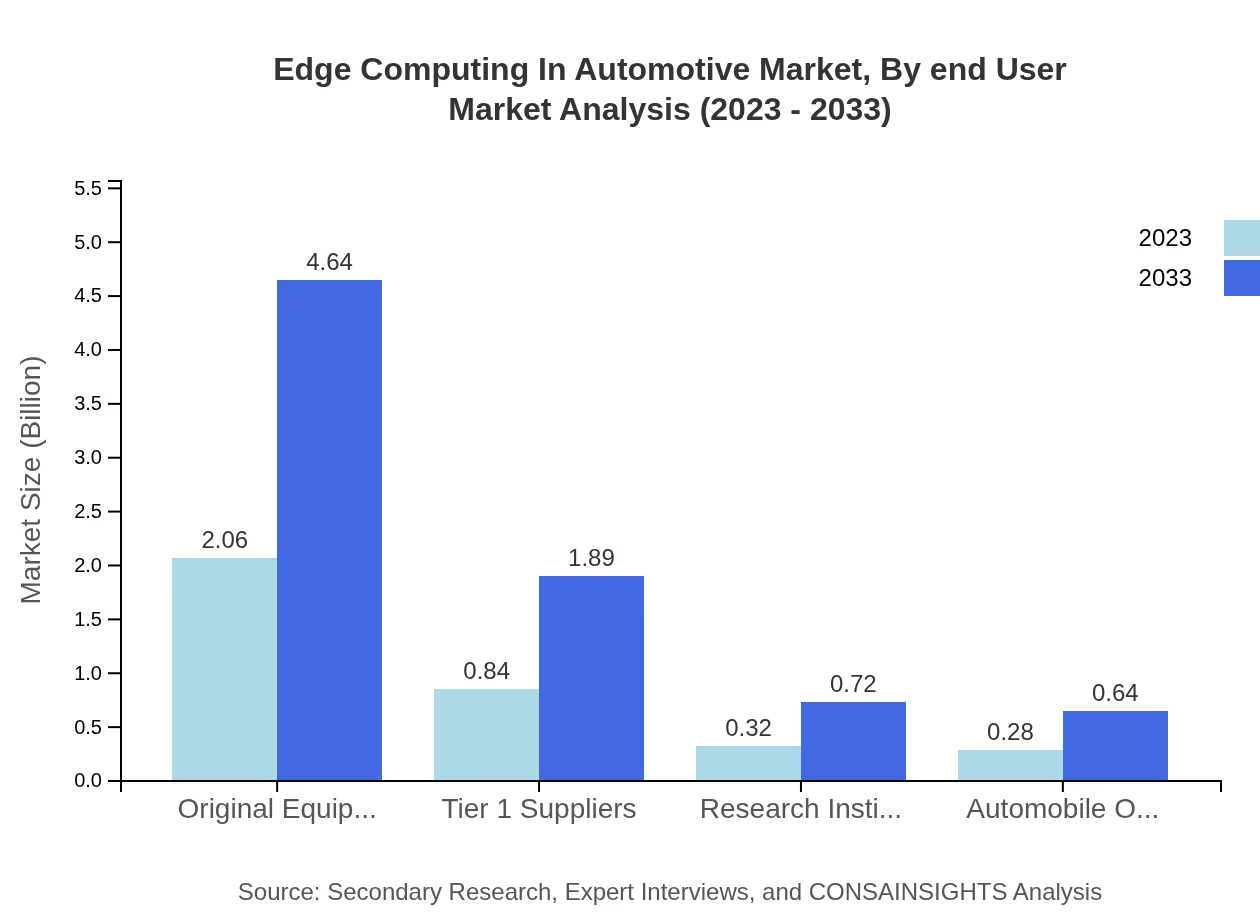

Edge Computing In Automotive Market Analysis By End User

The end-user segmentation indicates a dominating market share by Original Equipment Manufacturers (OEMs), contributing a substantial $2.06 billion in 2023. This trend is reinforcing the pivotal role traditional manufacturers play as they work to integrate cutting-edge technologies into vehicles. Tier 1 suppliers and research institutes are also vital contributors, focusing on enhancing product offerings and technological innovations.

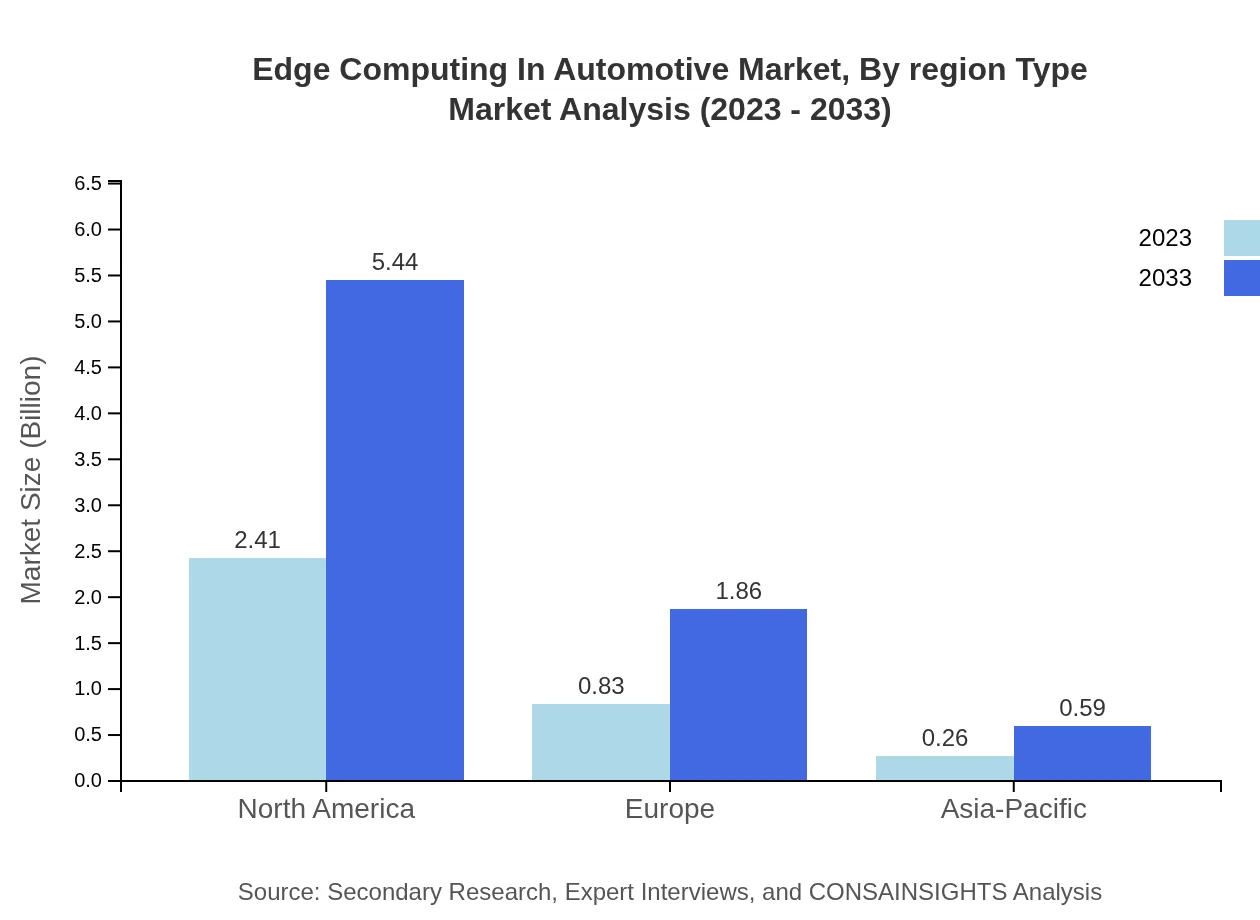

Edge Computing In Automotive Market Analysis By Region Type

Regionally, North America leads the market due to its advanced automotive infrastructure and technology ecosystem. Europe follows, spurred by regulatory standards and innovations in vehicle safety. Asia-Pacific is rapidly gaining traction, with significant investments from emerging markets. Together, these regions shape a dynamic global landscape for Edge Computing in Automotive, with varied growth trajectories and market demands.

Edge Computing In Automotive Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Edge Computing In Automotive Industry

NVIDIA Corporation:

NVIDIA is a leading technology company specializing in GPU computing and AI. The company provides cutting-edge solutions for automotive applications, focusing on autonomous driving and in-car AI systems, enhancing the edge computing capabilities within vehicles.Intel Corporation:

Intel is a global leader in semiconductor manufacturing and a key player in the automotive semiconductor market. They are heavily investing in edge computing technologies that support automotive safety and connectivity innovations.Samsung Electronics:

Samsung Electronics has been at the forefront of integrating cutting-edge technology into automobiles, providing advanced edge computing solutions that facilitate seamless connectivity and enhanced user experiences in infotainment systems.Qualcomm Technologies, Inc.:

Qualcomm is renowned for its advancements in automotive technology, particularly around connected vehicle platforms. They offer integrated chipsets that enhance the performance of edge computing systems in modern vehicles.Microsoft Corporation:

Microsoft has developed platforms that merge cloud services with edge computing capabilities tailored for automotive applications, providing scalable solutions for manufacturers aiming to increase vehicle connectivity.We're grateful to work with incredible clients.

FAQs

What is the market size of edge Computing In Automotive?

The edge computing in automotive market is valued at approximately $3.5 billion in 2023 and is projected to grow at a CAGR of 8.2%, reaching significant heights by 2033, reflecting increasing demand for advanced computing solutions in vehicles.

What are the key market players or companies in this edge Computing In Automotive industry?

Key players in the edge computing in automotive market include major automotive manufacturers, technology firms specializing in IoT and AI, and suppliers of vehicular data processing solutions, contributing to innovative applications in autonomous vehicles and connected services.

What are the primary factors driving the growth in the edge Computing In Automotive industry?

Growth is driven by increasing demand for advanced driver-assistance systems (ADAS), the rise of autonomous vehicles, and enhanced connectivity requirements. The integration of IoT solutions accelerates data processing and improves vehicle safety and performance, propelling market expansion.

Which region is the fastest Growing in the edge Computing In Automotive?

North America is currently the fastest-growing region, with a market size projected to grow from $2.41 billion in 2023 to $5.44 billion by 2033, reflecting a strong focus on technological advancements and adoption of smart vehicle solutions.

Does ConsaInsights provide customized market report data for the edge Computing In Automotive industry?

Yes, ConsaInsights offers tailored market reports for the edge computing in automotive industry, catering to specific client needs, helping businesses gain insights into market trends, competitive landscape, and opportunities essential for strategic planning.

What deliverables can I expect from this edge Computing In Automotive market research project?

You can expect comprehensive reports including market sizes, growth forecasts, competitive analysis, segment data, regional insights, and actionable recommendations, enabling informed decision-making and strategic planning for stakeholders in the automotive industry.

What are the market trends of edge Computing In Automotive?

Key trends include the growing implementation of AI and machine learning technologies, increased focus on cybersecurity measures for vehicle data, the shift towards real-time data processing, and the rise of smart infrastructure, shaping the future of automotive applications.