Edible Pigment Market Report

Published Date: 31 January 2026 | Report Code: edible-pigment

Edible Pigment Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Edible Pigment market, focusing on market size, growth trends, segmentation, technology insights, and regional analysis for the forecast period from 2023 to 2033.

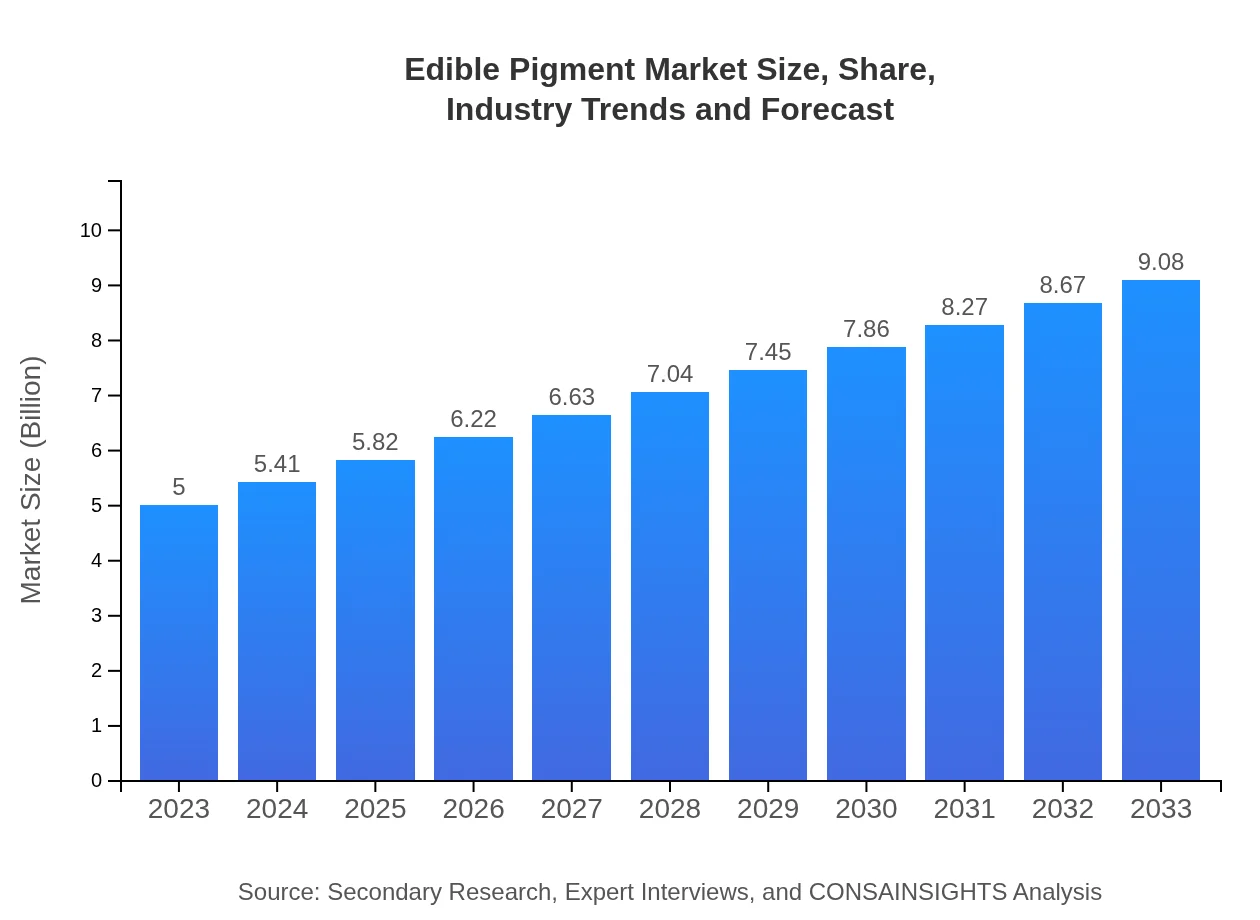

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.00 Billion |

| CAGR (2023-2033) | 6% |

| 2033 Market Size | $9.08 Billion |

| Top Companies | Sensient Technologies, Dürr Megtec, Cargill, Inc., Natural Color |

| Last Modified Date | 31 January 2026 |

Edible Pigment Market Overview

Customize Edible Pigment Market Report market research report

- ✔ Get in-depth analysis of Edible Pigment market size, growth, and forecasts.

- ✔ Understand Edible Pigment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Edible Pigment

What is the Market Size & CAGR of Edible Pigment market in 2033?

Edible Pigment Industry Analysis

Edible Pigment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Edible Pigment Market Analysis Report by Region

Europe Edible Pigment Market Report:

The European Edible Pigment market is anticipated to grow from $1.26 billion in 2023 to $2.28 billion by 2033. Europe is witnessing a trend toward clean label products owing to stringent food safety regulations. Countries like France, Germany, and the U.K. lead the market with their strong inclination towards organic and natural products.Asia Pacific Edible Pigment Market Report:

The Asia Pacific region holds a significant share of the Edible Pigment market, valued at $1.05 billion in 2023 and expected to reach $1.92 billion by 2033. With rapid urbanization and increasing disposable incomes, there is a growing demand for processed and colorful food products in countries like China and India. Moreover, the rise in health-conscious consumers propels the demand for natural colorants.North America Edible Pigment Market Report:

North America is a robust market for Edible Pigments, with a valuation of $1.80 billion in 2023 and an expected growth to $3.27 billion by 2033. The increasing regulatory focus on food labeling and consumer health drives the demand for natural pigments. The U.S. market is particularly prominent due to high per capita consumption of processed foods.South America Edible Pigment Market Report:

In South America, the Edible Pigment market is projected to grow from $0.41 billion in 2023 to $0.75 billion by 2033. The region's growing food processing industry and the increasing preference for natural ingredients in food formulations are primary drivers of this growth. The Brazilian market is expected to lead due to its large food manufacturing sector.Middle East & Africa Edible Pigment Market Report:

The Middle East and Africa market for Edible Pigments is projected to increase from $0.47 billion in 2023 to $0.86 billion by 2033, driven by rising investment in food processing and growing health awareness among consumers. The United Arab Emirates and South Africa are key contributors to this growth.Tell us your focus area and get a customized research report.

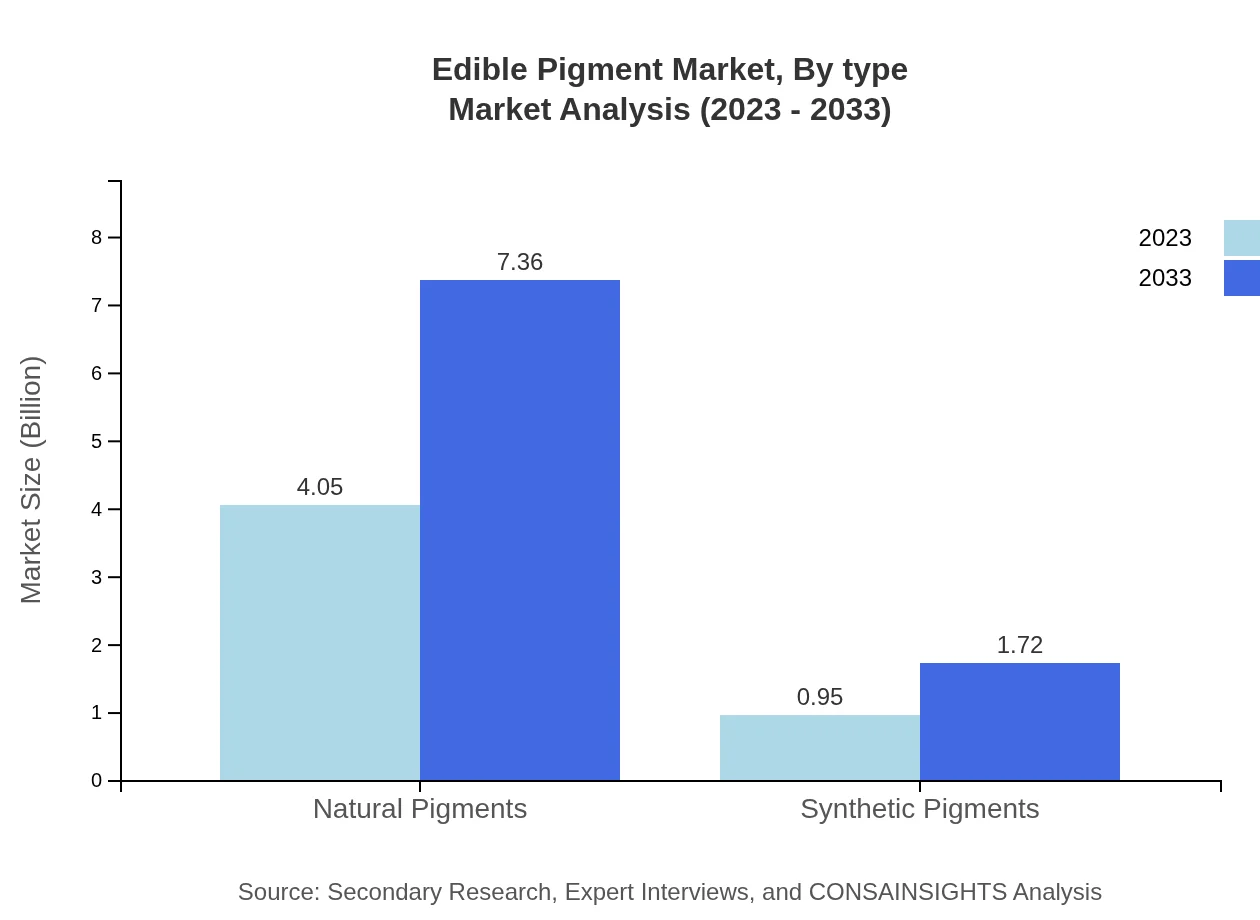

Edible Pigment Market Analysis By Type

In the Edible Pigment market, natural pigments accounted for $4.05 billion in 2023, expected to grow to $7.36 billion by 2033. They dominate the market with an 81.02% share, reflecting consumer tendencies towards healthier options. Synthetic pigments had a smaller market size of $0.95 billion in 2023 but are forecasted to rise to $1.72 billion, holding an 18.98% share.

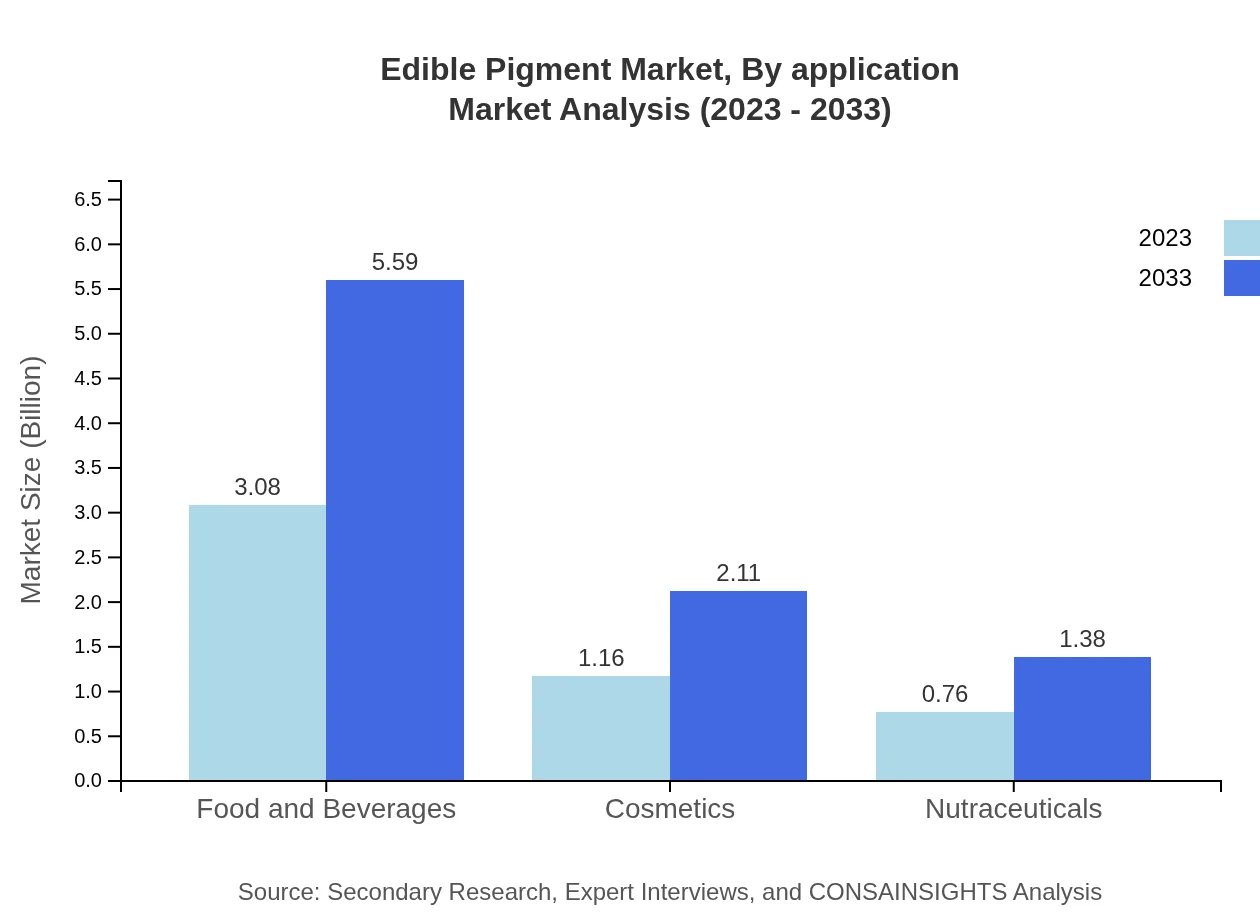

Edible Pigment Market Analysis By Application

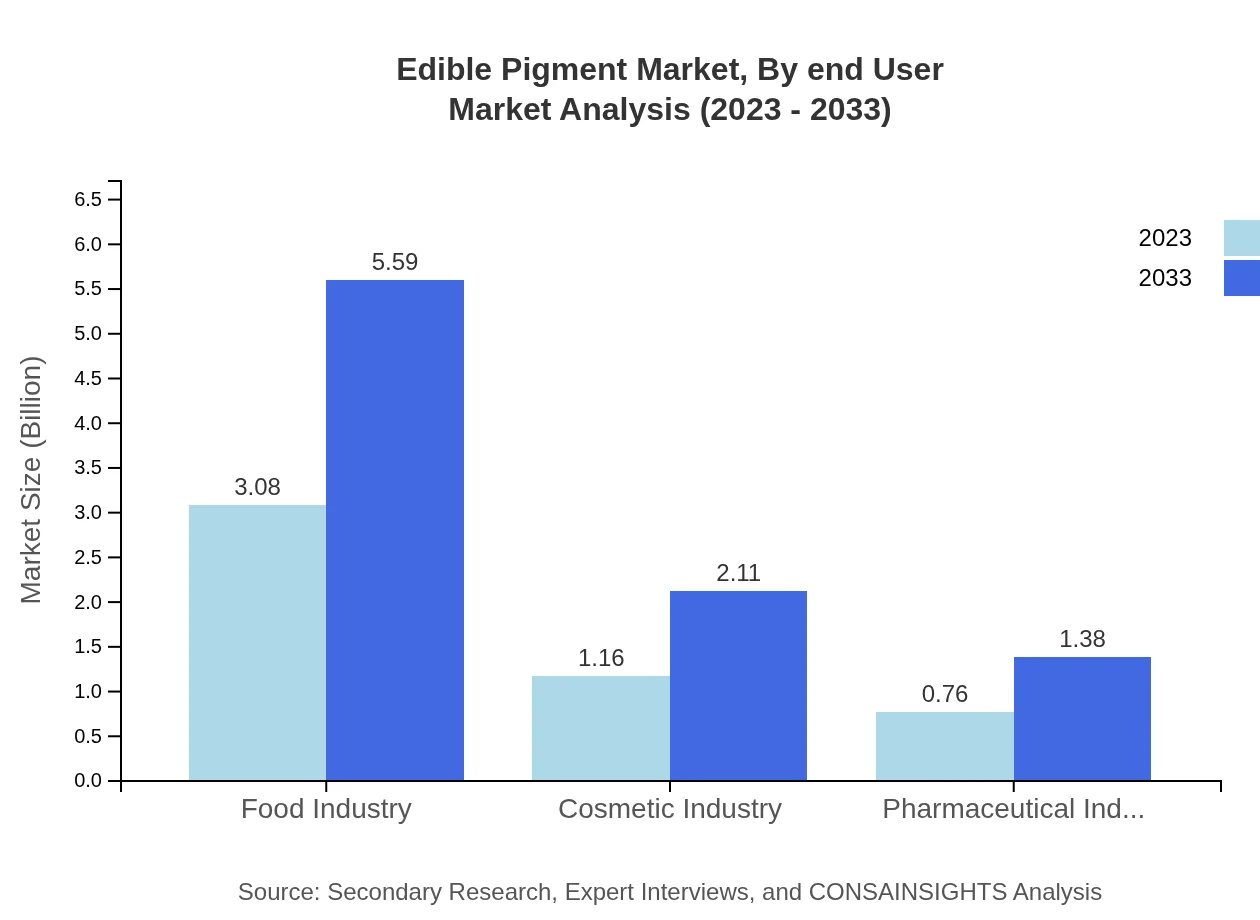

The food industry leads the Edible Pigment application segment with a size of $3.08 billion in 2023 and expected growth to $5.59 billion by 2033, capturing 61.5% of the market share. Cosmetics and pharmaceutical applications are also growing, with sizes of $1.16 billion and $0.76 billion in 2023, respectively.

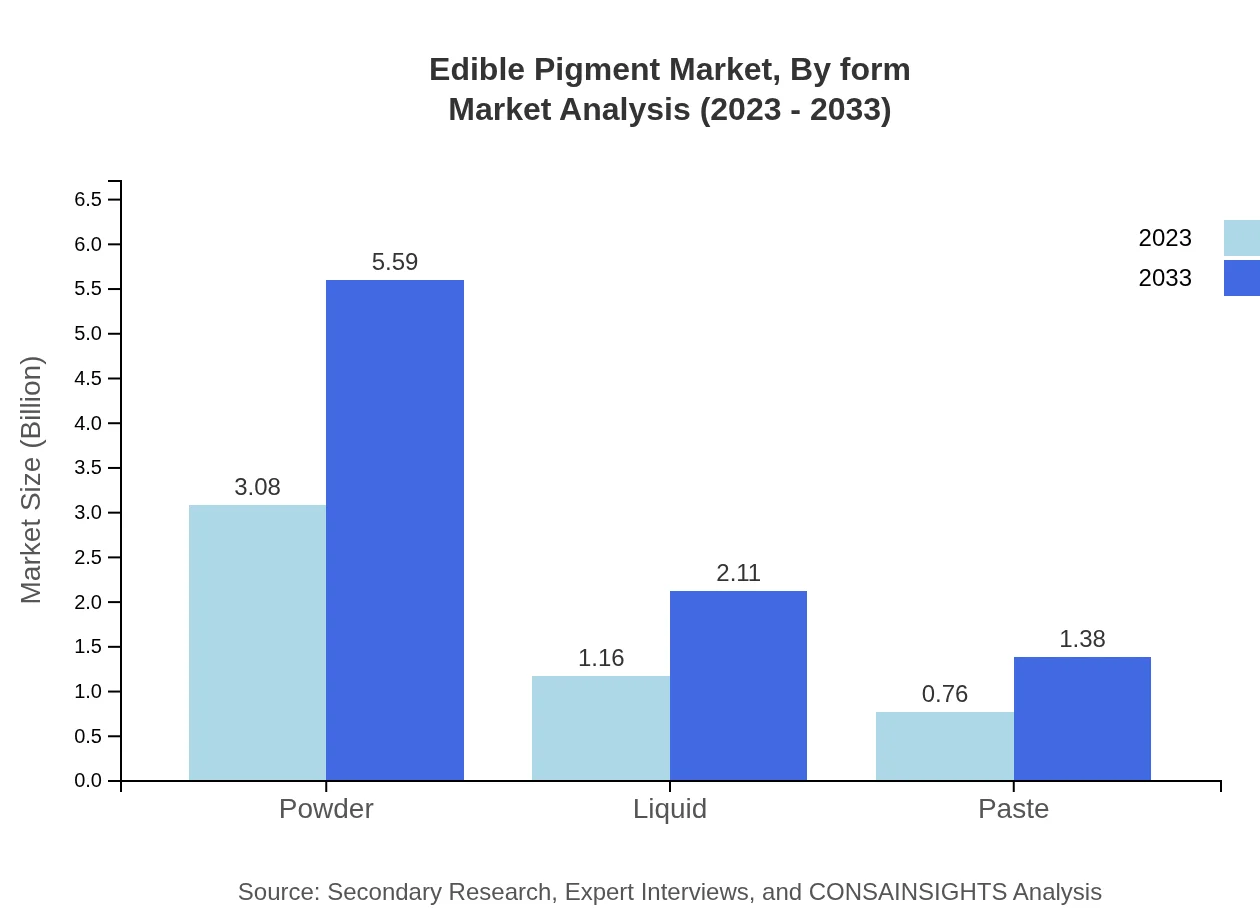

Edible Pigment Market Analysis By Form

Powdered forms of Edible Pigments are the most preferred, accounting for $3.08 billion in 2023 and anticipated to reach $5.59 billion by 2033, maintaining a 61.5% market share. Liquid forms follow closely at $1.16 billion, projected to grow to $2.11 billion, serving diverse application needs.

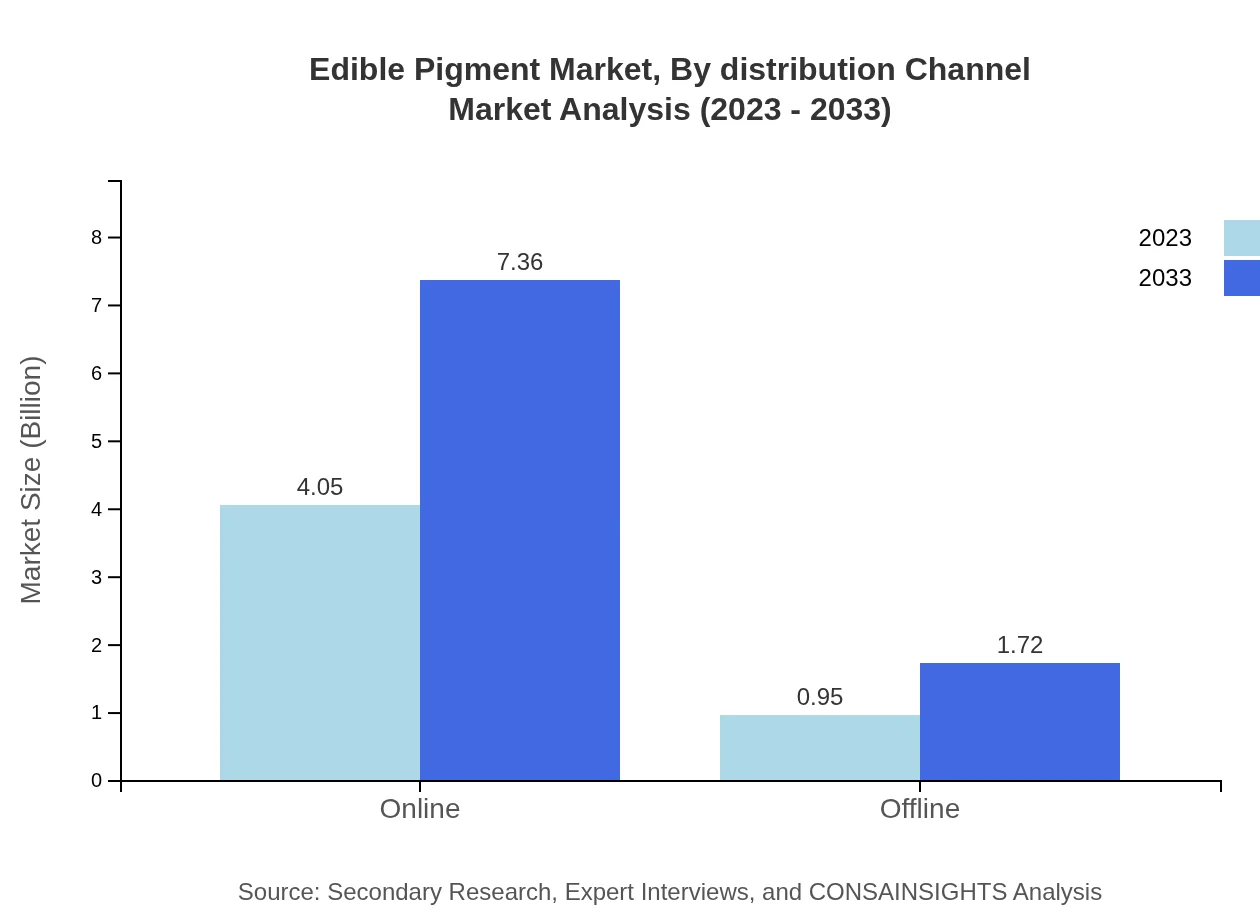

Edible Pigment Market Analysis By Distribution Channel

The online distribution channel dominates with a market size of $4.05 billion in 2023, projected to grow to $7.36 billion, holding 81.02% share. Offline channels, while smaller at $0.95 billion, are still growing, and account for 18.98% of the distribution landscape.

Edible Pigment Market Analysis By End User

Among end-users, the food and beverages sector leads with a significant size of $3.08 billion in 2023, expected to rise to $5.59 billion by 2033. The cosmetics and nutraceutical sectors also reflect substantial growth, indicating a diversifying application of Edible Pigments across industries.

Edible Pigment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Edible Pigment Industry

Sensient Technologies:

A global leader in specialty color and flavor solutions, Sensient provides innovative edible pigment products that cater to various industries, focusing on natural solutions.Dürr Megtec:

Dürr Megtec is known for its high-quality synthetic and natural pigments and is a prominent supplier to the food industry, recognized for its sustainable practices.Cargill, Inc.:

Cargill is a significant player in the Edible Pigment market, providing a wide array of natural color solutions aimed at meeting health-conscious consumer needs.Natural Color:

Natural Color is dedicated to the development of high-quality natural food colorings, ensuring compliance with health regulations while satisfying consumer preferences.We're grateful to work with incredible clients.

FAQs

What is the market size of edible Pigment?

The edible pigment market is projected to reach approximately $5 billion by 2033, growing at a CAGR of 6% from 2023. The steady demand for natural food coloring alternatives is a significant contributor to this growth.

What are the key market players or companies in this edible Pigment industry?

Key players in the edible pigment market include companies specializing in natural extracts, synthetic colorants, and food ingredient suppliers. These include global and regional firms committed to innovative product offerings, ensuring a diverse competitive landscape.

What are the primary factors driving the growth in the edible Pigment industry?

Factors driving growth in the edible pigment industry include rising consumer demand for clean label products, increased use of natural colors in food and beverages, and regulatory support promoting safer food ingredients to replace artificial additives.

Which region is the fastest Growing in the edible Pigment?

The North American region is the fastest-growing market for edible pigments, projected to expand from $1.80 billion in 2023 to $3.27 billion in 2033. This growth is fueled by a strong demand for natural food colorings in various applications.

Does ConsaInsights provide customized market report data for the edible Pigment industry?

Yes, ConsaInsights offers customized market reports for the edible pigment industry. This includes tailored analysis to meet specific market needs, providing organizations with valuable insights for strategic decision-making.

What deliverables can I expect from this edible Pigment market research project?

Clients can expect comprehensive market research deliverables, including detailed reports, market size statistics, segmentation analysis, regional insights, and trends impacting the edible pigment market, all tailored to specific business requirements.

What are the market trends of edible Pigment?

Current trends in the edible pigment market include a growing preference for natural versus synthetic pigments, increased innovation in product development, and rising usage across industries such as food, cosmetics, and pharmaceuticals.