Ediscovery Market Report

Published Date: 02 February 2026 | Report Code: ediscovery

Ediscovery Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Ediscovery market from 2023 to 2033, focusing on market size, growth trends, technological advancements, and key players. Insights gathered will help stakeholders make informed decisions in this evolving landscape.

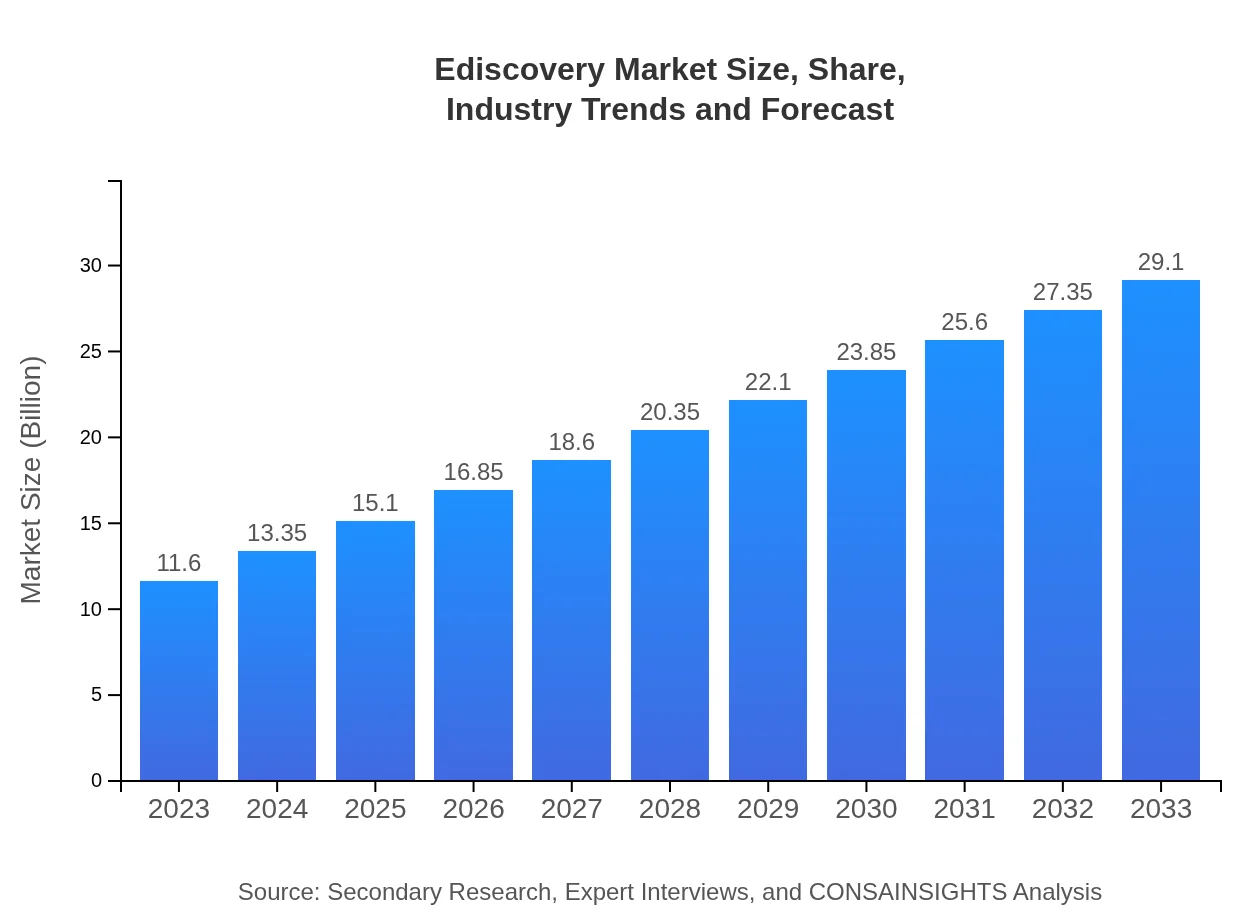

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $11.60 Billion |

| CAGR (2023-2033) | 9.3% |

| 2033 Market Size | $29.10 Billion |

| Top Companies | Relativity, Everlaw, Logikcull, OpenText, iManage |

| Last Modified Date | 02 February 2026 |

Ediscovery Market Overview

Customize Ediscovery Market Report market research report

- ✔ Get in-depth analysis of Ediscovery market size, growth, and forecasts.

- ✔ Understand Ediscovery's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ediscovery

What is the Market Size & CAGR of Ediscovery market in 2023?

Ediscovery Industry Analysis

Ediscovery Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ediscovery Market Analysis Report by Region

Europe Ediscovery Market Report:

The European Ediscovery market is projected to grow from $3.22 billion in 2023 to $8.07 billion by 2033. The increase in stringent data protection regulations such as GDPR is driving organizations to invest in comprehensive Ediscovery solutions. Moreover, advancements in technology and rising demand for digital evidence gathering enhance market dynamics.Asia Pacific Ediscovery Market Report:

In 2023, the Ediscovery market in the Asia Pacific region is valued at $2.22 billion, with projections to reach $5.58 billion by 2033. The growth is attributed to rapid digital transformation, increasing legal complexity, and heightened awareness about compliance among businesses. Countries like India and China are leading in burgeoning IT sectors, fostering demand for Ediscovery solutions.North America Ediscovery Market Report:

North America holds the largest share of the Ediscovery market, valued at $4.33 billion in 2023 and expected to expand to $10.85 billion by 2033. The growth is fueled by the presence of numerous legal firms and corporations that require robust Ediscovery solutions to cope with complex legal frameworks and the growing incidences of cybersecurity breaches.South America Ediscovery Market Report:

The South American Ediscovery market is valued at $0.67 billion in 2023, expecting to grow to $1.68 billion by 2033. Increased corporate legal activities and regulatory compliance mandated by governments are key drivers. As businesses evolve, there is a notable shift towards structured data management, enhancing the Ediscovery ecosystem in the region.Middle East & Africa Ediscovery Market Report:

In the Middle East and Africa, the Ediscovery market is estimated at $1.16 billion in 2023, anticipated to grow to $2.92 billion by 2033. The market benefits from the increasing digitization of businesses, coupled with the rise in litigation activities in the region. As organizations focus on compliance, investments in advanced Ediscovery tools are likely to surge.Tell us your focus area and get a customized research report.

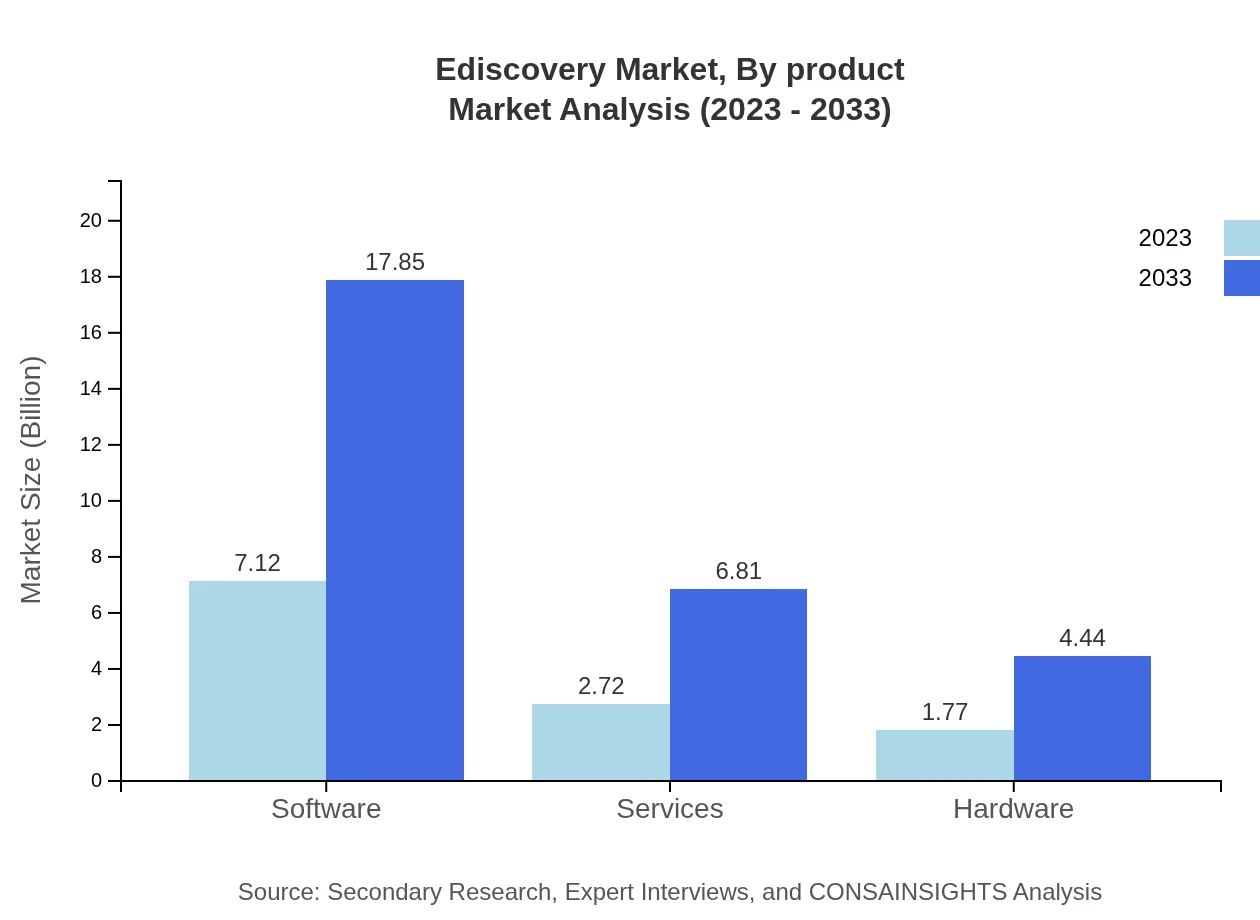

Ediscovery Market Analysis By Product

The product segmentation of the Ediscovery market includes Software, Services, and Hardware. The software segment alone is projected to grow from $7.12 billion in 2023 to $17.85 billion by 2033, holding a 61.35% market share throughout the period. Services also play a crucial role, expanding from $2.72 billion to $6.81 billion, representing 23.41% share. Hardware remains significant but is the smallest portion, growing from $1.77 billion to $4.44 billion with a 15.24% share.

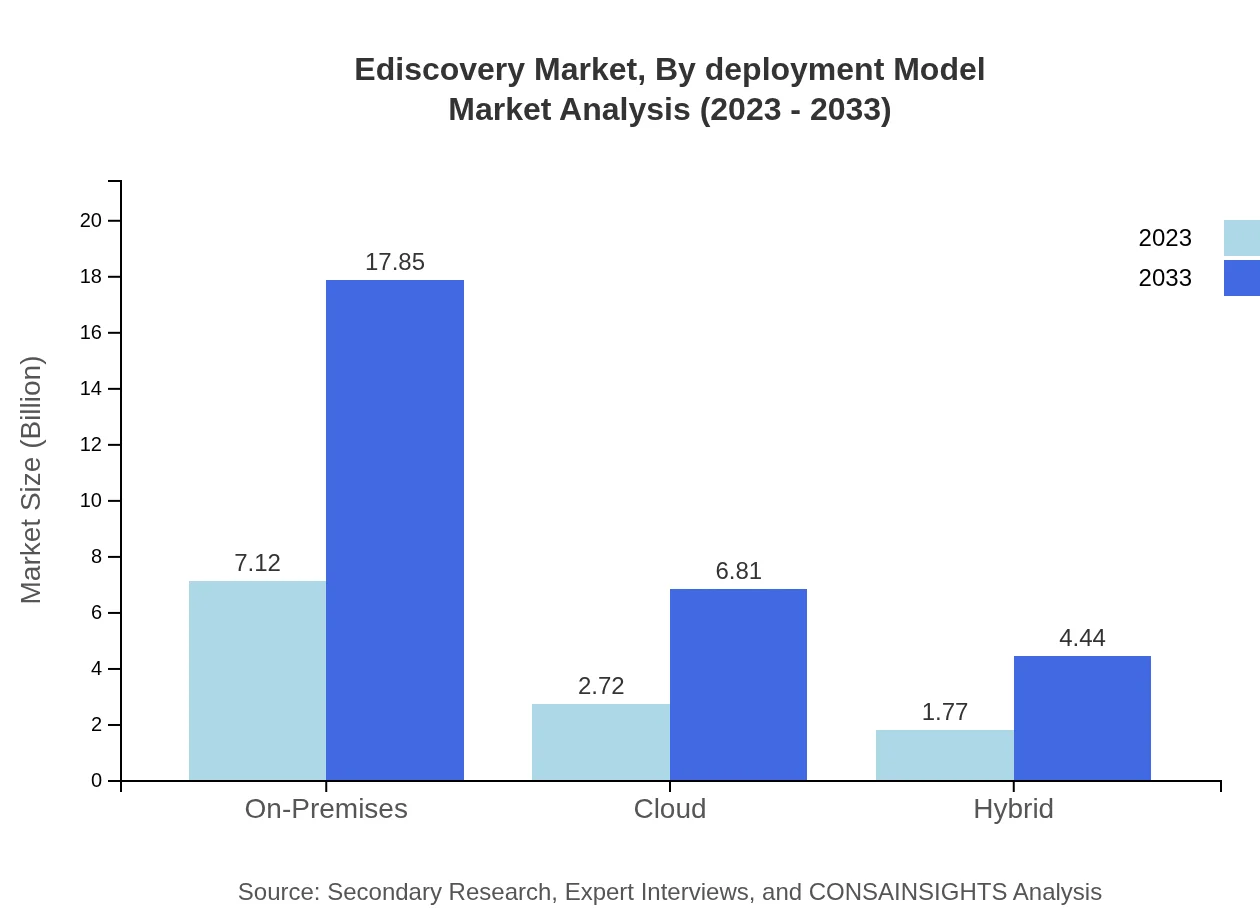

Ediscovery Market Analysis By Deployment Model

The market is segmented by deployment models into On-Premises, Cloud, and Hybrid solutions. On-Premises solutions dominate the market, representing 61.35% in 2023 with a projection to achieve $17.85 billion by 2033. Cloud deployment is also gaining traction, expected to grow from $2.72 billion to $6.81 billion, constituting a 23.41% share.

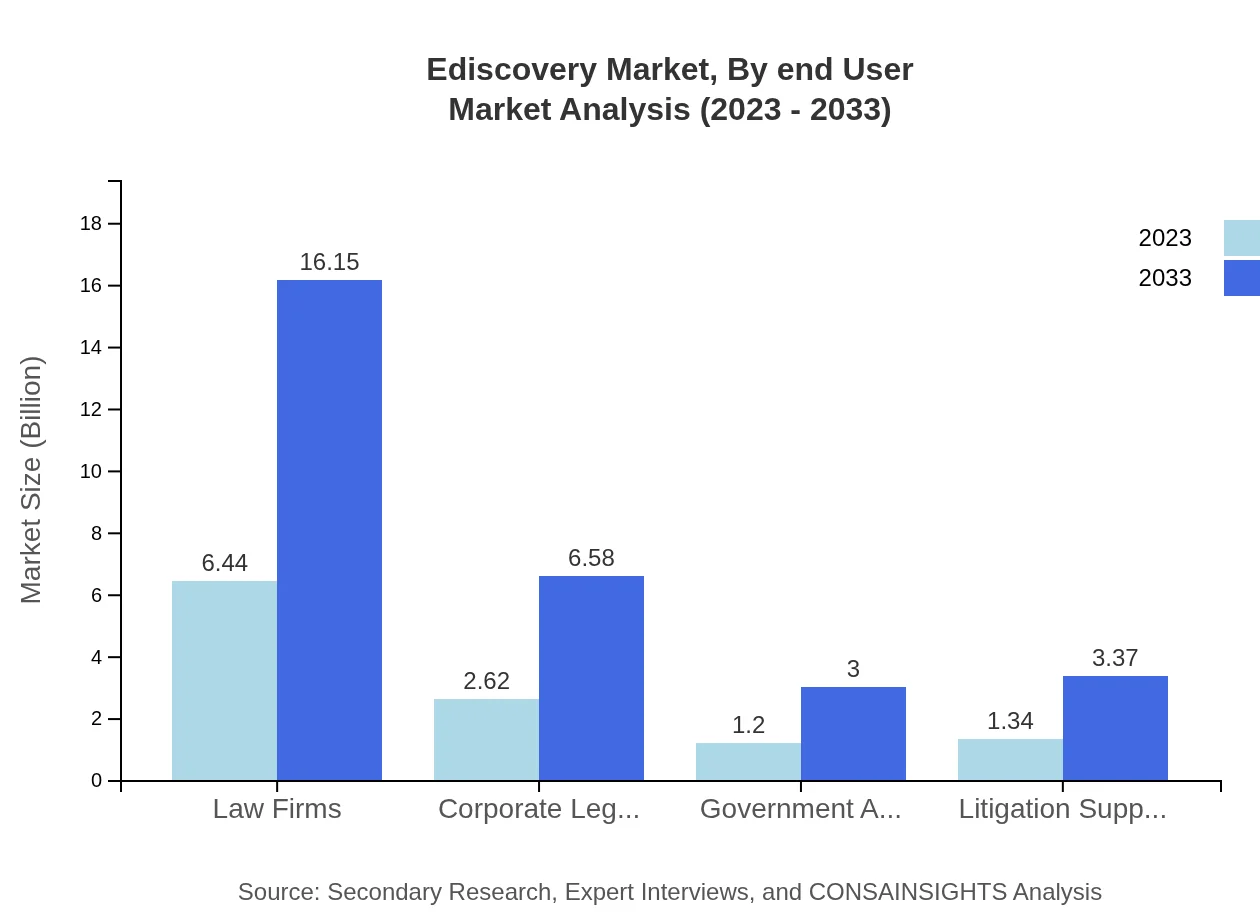

Ediscovery Market Analysis By End User

Major end-users in the Ediscovery market include Law Firms, Corporate Legal Departments, Government Agencies, and Litigation Support Companies. Law Firms lead the market with a substantial size from $6.44 billion in 2023 to $16.15 billion by 2033, maintaining a 55.5% market share. Corporate Departments and Government Agencies are also significant contributors, expanding from $2.62 billion & $1.20 billion respectively.

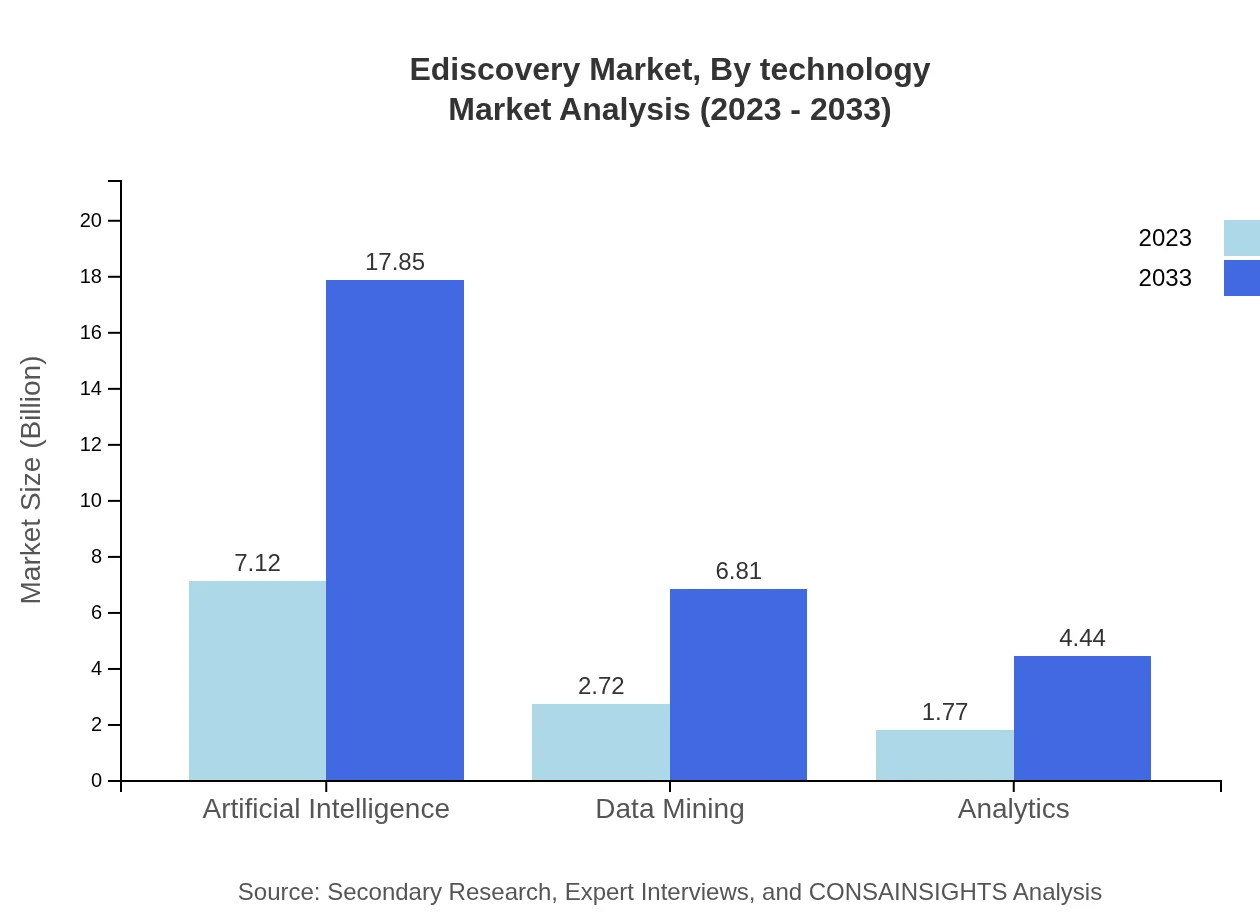

Ediscovery Market Analysis By Technology

Technology analysis focuses on solutions like Artificial Intelligence, Data Mining, and Analytics. AI technology will see significant growth, projected from $7.12 billion to $17.85 billion. Data Mining and Analytics are also crucial segments, with substantial growth predicated on their ability to enhance data discovery and analysis in legal proceedings.

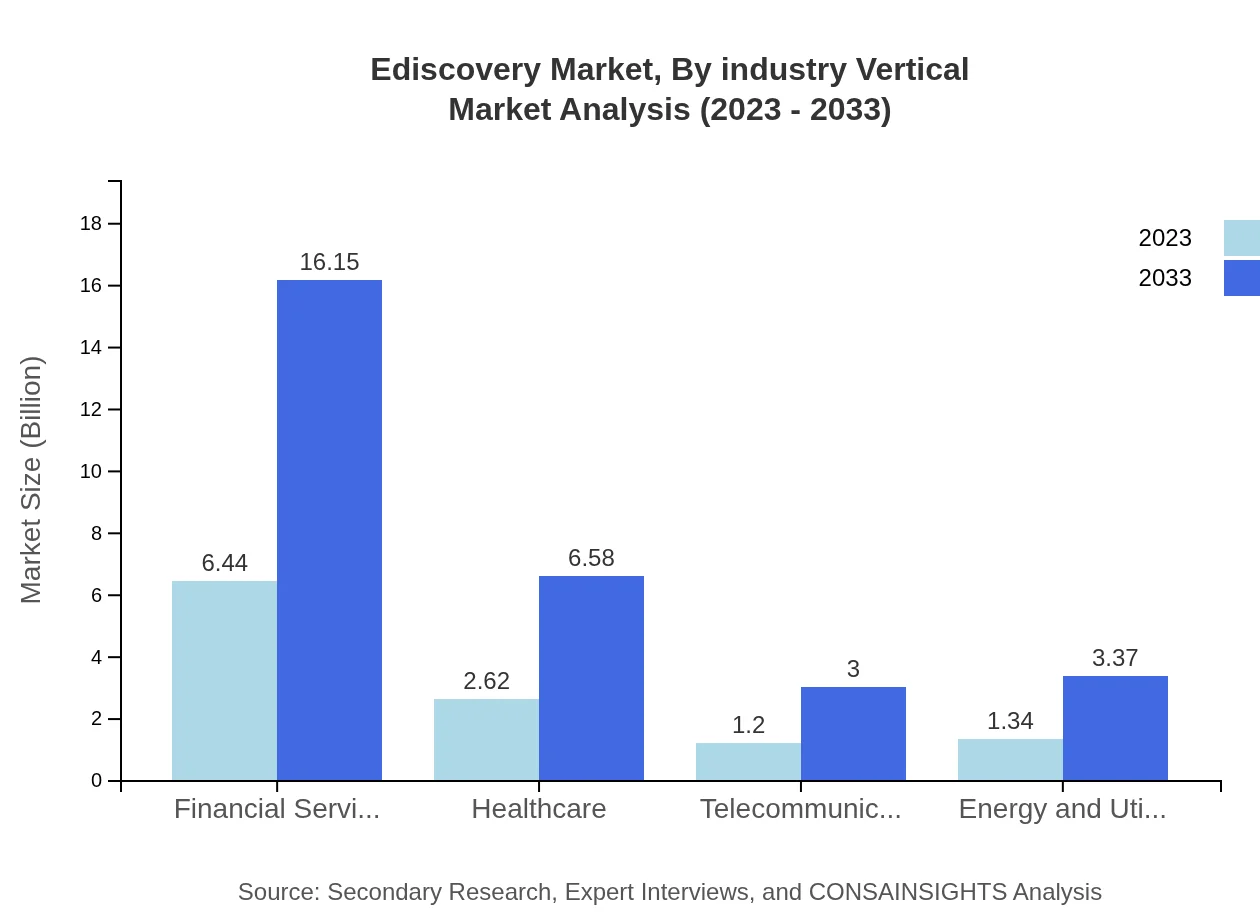

Ediscovery Market Analysis By Industry Vertical

Industries such as Financial Services, Healthcare, Telecommunications, and Energy are prominent within the Ediscovery space. Financial Services alone will grow from $6.44 billion to $16.15 billion, driven by compliance requirements and litigation management efficiency. Healthcare and Telecommunications also reveal significant growth trends, supporting the overall market expansion.

Ediscovery Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ediscovery Industry

Relativity:

A leader in the Ediscovery solutions market, Relativity offers a comprehensive platform that simplifies data management and enhances review processes with advanced analytics.Everlaw:

Known for its innovative cloud-based Ediscovery software, Everlaw helps legal teams collaborate effectively while managing massive amounts of data efficiently.Logikcull:

Logikcull provides a user-friendly Ediscovery platform designed for businesses of all sizes to handle legal document reviews and workflows effortlessly.OpenText:

OpenText offers Ediscovery solutions that integrate seamlessly with enterprise information management systems, catering to large enterprises.iManage:

iManage focuses on providing solutions tailored to legal document management, further empowering law firms and corporate legal departments in their Ediscovery processes.We're grateful to work with incredible clients.

FAQs

What is the market size of ediscovery?

The global ediscovery market is projected to reach approximately $11.6 billion by 2033, growing at a CAGR of 9.3%. This growth is fueled by increasing data volumes and legal complexities necessitating advanced ediscovery solutions.

What are the key market players or companies in this ediscovery industry?

Key players in the ediscovery market include prominent companies such as Relativity, Logikcull, Everlaw, and Nuix. These companies are recognized for their innovative solutions and comprehensive services that streamline the ediscovery processes for various sectors.

What are the primary factors driving the growth in the ediscovery industry?

Growth in the ediscovery industry is primarily driven by the ever-increasing volume of electronic data, stringent regulatory compliance requirements, advancements in artificial intelligence for data analysis, and a heightened focus on data security and privacy measures across organizations.

Which region is the fastest Growing in the ediscovery?

The fastest-growing region in the ediscovery market is Europe, with a projected market size increase from $3.22 billion in 2023 to $8.07 billion by 2033. This growth reflects the region's emphasis on legal compliance and data protection regulations.

Does ConsaInsights provide customized market report data for the ediscovery industry?

Yes, ConsaInsights offers customized market report data for the ediscovery industry. Clients can request tailored insights specific to their business needs, including regional analysis and market segment data, ensuring relevant and applicable findings.

What deliverables can I expect from this ediscovery market research project?

From the ediscovery market research project, clients can expect comprehensive reports including market size, growth forecasts, competitive analysis, and insights into key segments and geographical markets, along with actionable recommendations tailored to their objectives.

What are the market trends of ediscovery?

Current market trends in ediscovery include the increasing integration of AI and machine learning for data processing, a shift towards cloud-based solutions, and a growing focus on data privacy, compliance, and cybersecurity measures as organizations adapt to evolving legal landscapes.