Egrc Market Report

Published Date: 02 February 2026 | Report Code: egrc

Egrc Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the eGovernance, Risk Management, and Compliance (eGRC) market, highlighting key market trends, size forecasts for 2023-2033, and insights into industry performance across various sectors and regions.

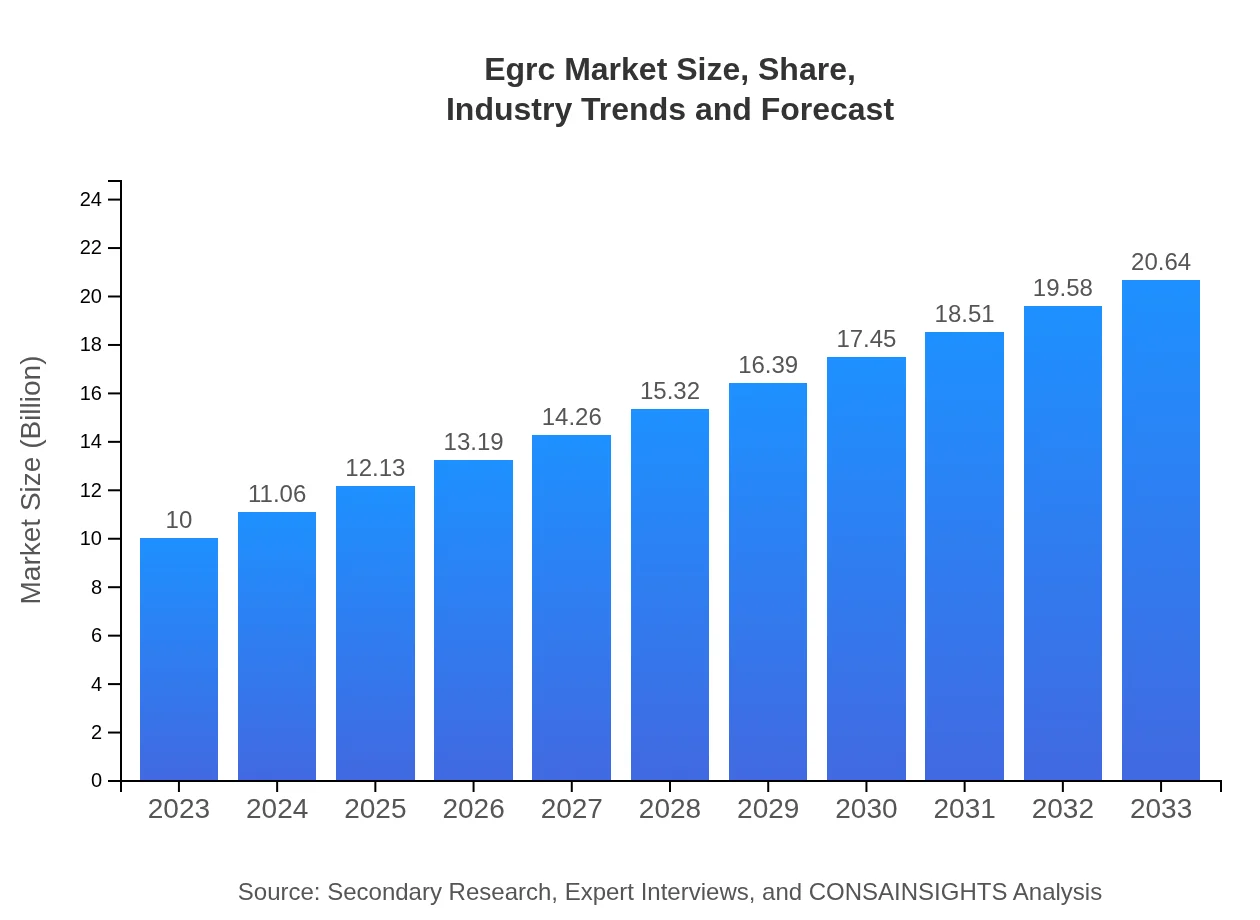

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 7.3% |

| 2033 Market Size | $20.64 Billion |

| Top Companies | SAP SE, IBM Corporation, RSA Security LLC, MetricStream Inc. |

| Last Modified Date | 02 February 2026 |

Egrc Market Overview

Customize Egrc Market Report market research report

- ✔ Get in-depth analysis of Egrc market size, growth, and forecasts.

- ✔ Understand Egrc's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Egrc

What is the Market Size & CAGR of Egrc market in 2023?

Egrc Industry Analysis

Egrc Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Egrc Market Analysis Report by Region

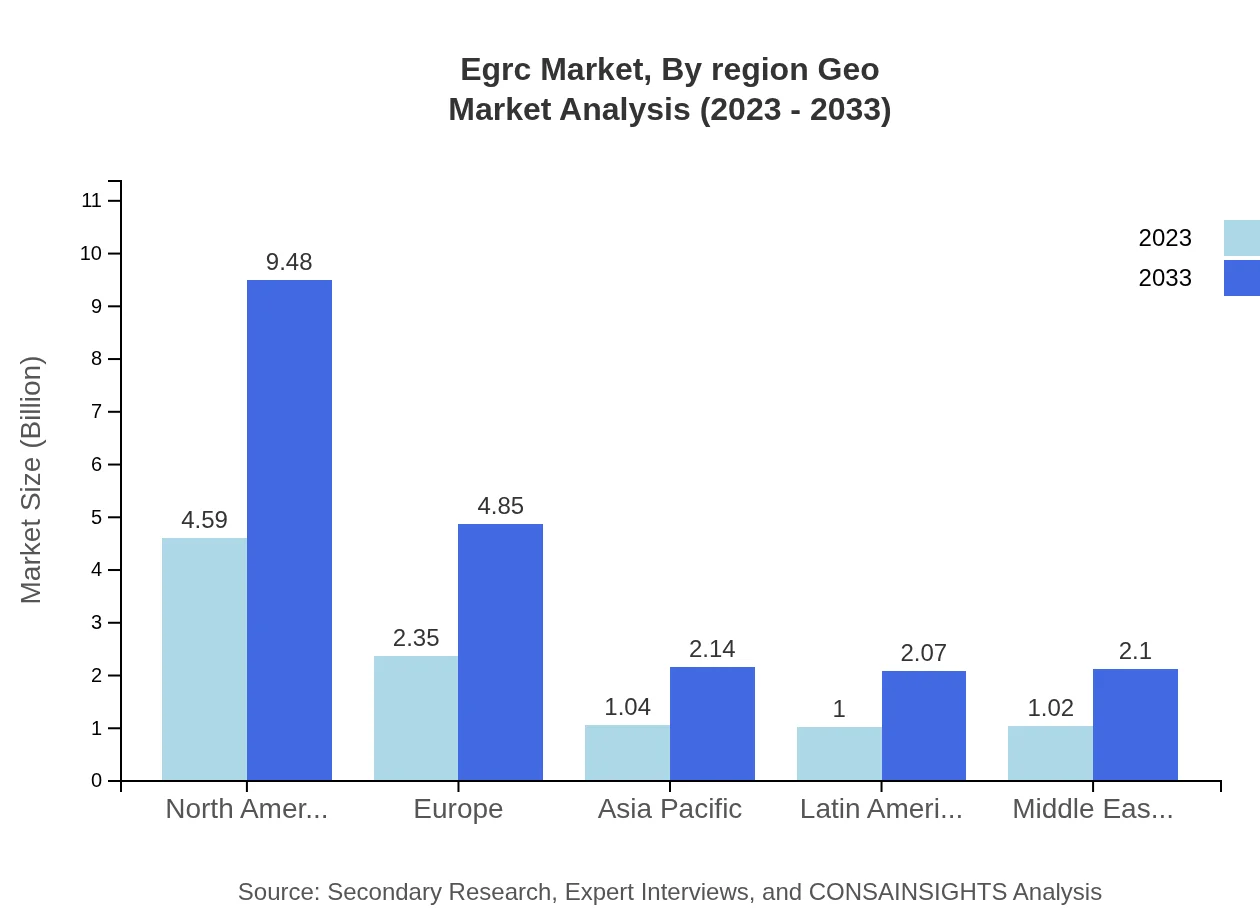

Europe Egrc Market Report:

Europe's eGRC market is forecasted to expand from $2.86 billion in 2023 to $5.90 billion in 2033. The European Union's evolving regulations and a robust focus on data protection (highlighted by GDPR) drive businesses to adopt comprehensive eGRC solutions.Asia Pacific Egrc Market Report:

The Asia Pacific eGRC market is expected to grow from $1.98 billion in 2023 to $4.09 billion by 2033. Factors driving this growth include increasing regulatory compliance, digital transformation initiatives, and the growing need for cybersecurity measures. Countries like India and China are at the forefront, promoting innovation in eGRC frameworks.North America Egrc Market Report:

North America retains a leading position in the eGRC market, with projections suggesting a growth from $3.60 billion in 2023 to $7.44 billion by 2033. The presence of major technology vendors, alongside stringent regulatory frameworks, propels this region's demand for integrated risk management solutions.South America Egrc Market Report:

In South America, the eGRC market is projected to increase from $0.20 billion in 2023 to $0.42 billion by 2033. The market is driven by the regional push for governance reforms and improvements in digital infrastructure, which stimulate the adoption of compliance solutions across sectors.Middle East & Africa Egrc Market Report:

In the Middle East and Africa, the eGRC market will grow from $1.36 billion in 2023 to $2.81 billion by 2033. This growth is supported by an increasing emphasis on compliance and regulatory measures in various industries, alongside the region's advancements in technology.Tell us your focus area and get a customized research report.

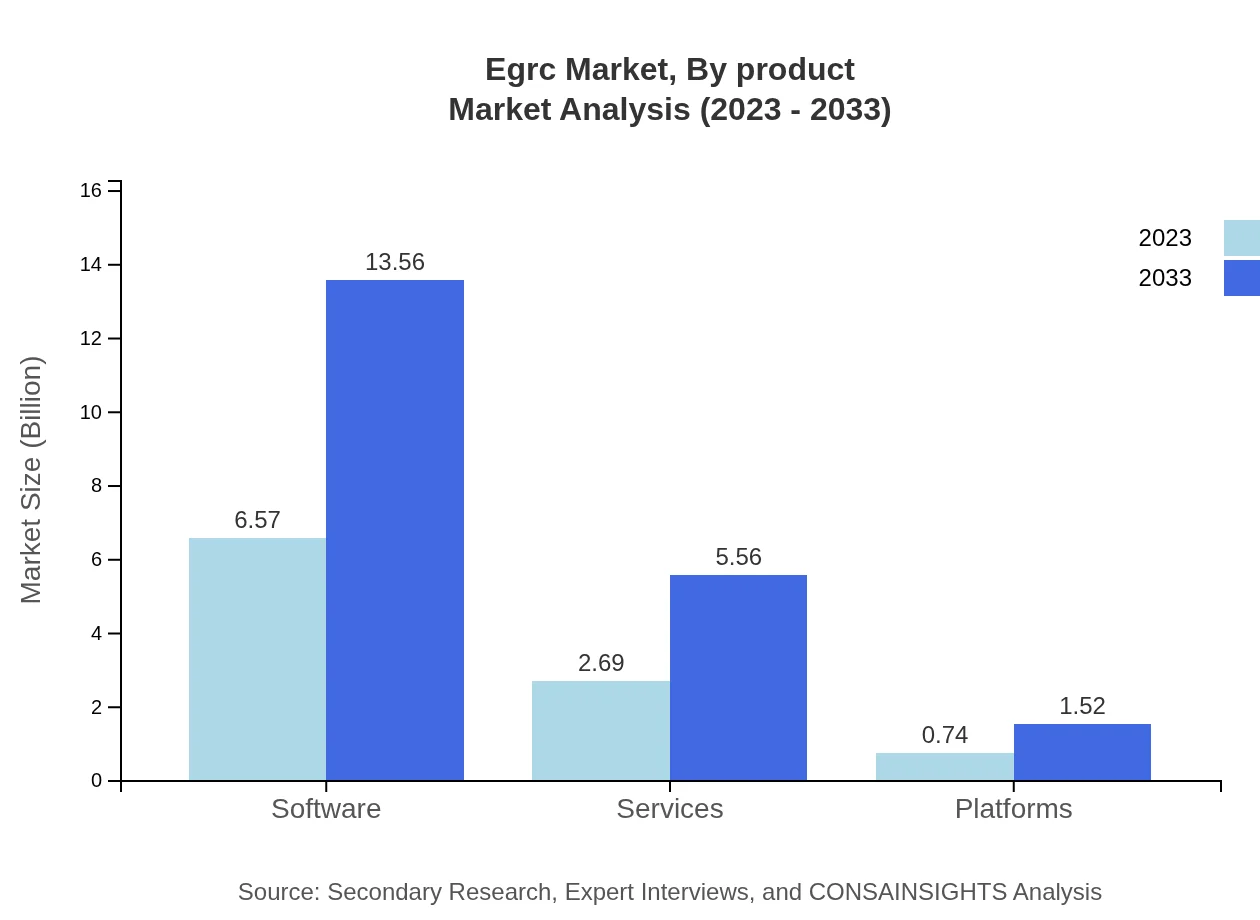

Egrc Market Analysis By Product

The eGRC market is predominantly driven by software solutions, which are anticipated to grow from $6.57 billion in 2023 to $13.56 billion by 2033. Software accounts for approximately 65.68% of the total market share by 2023. Following closely are services, projected to increase from $2.69 billion to $5.56 billion, capturing a market share of 26.94%. Platforms, while smaller, are expected to grow notably from $0.74 billion to $1.52 billion, reflecting a niche yet vital area of expansion.

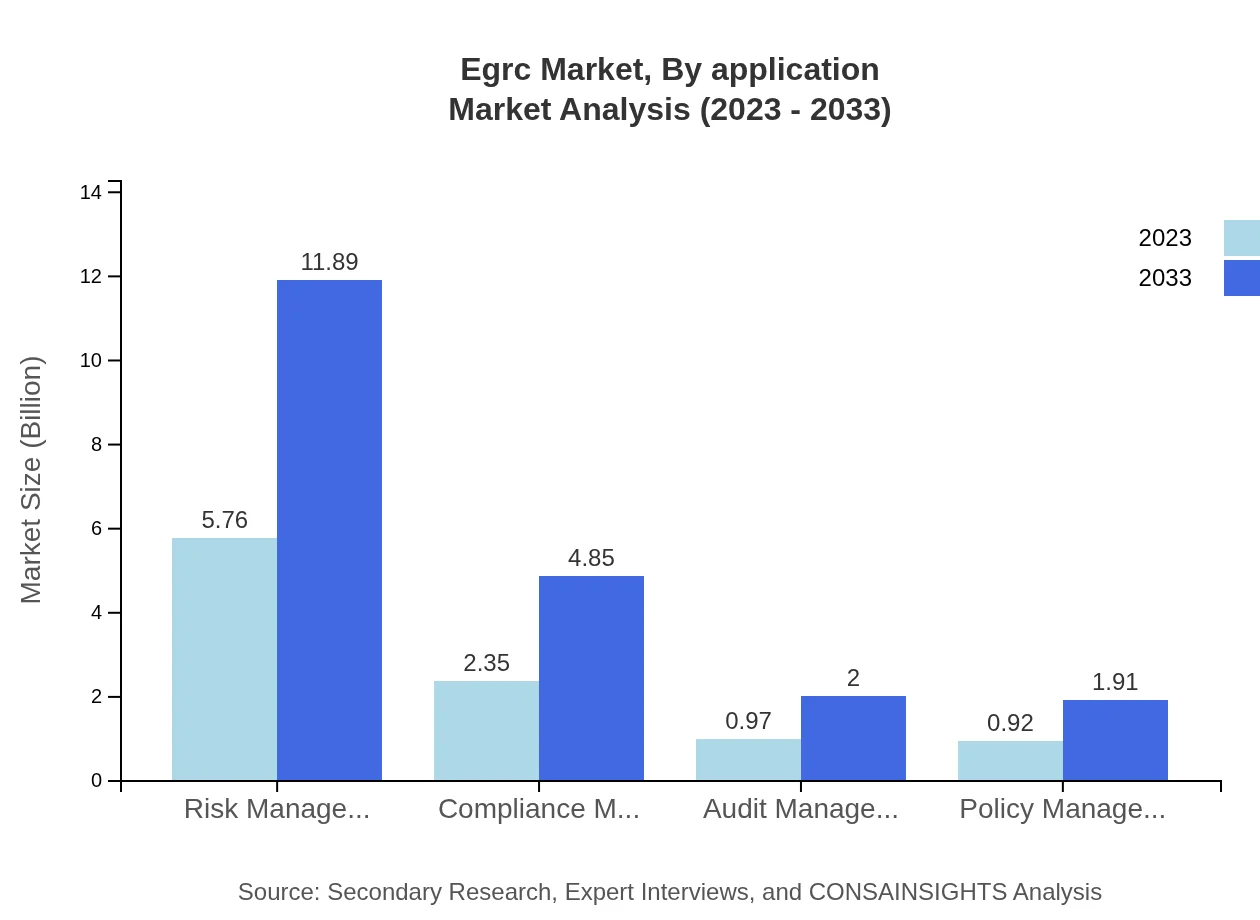

Egrc Market Analysis By Application

The applications of eGRC products encompass risk management, compliance management, and audit management, alongside services tailored to different sectors. Risk management is the largest segment, with market size projected to grow from $5.76 billion in 2023 to $11.89 billion by 2033. Compliance management follows, expected to rise from $2.35 billion to $4.85 billion, while audit management is projected to grow from $0.97 billion to $2.00 billion.

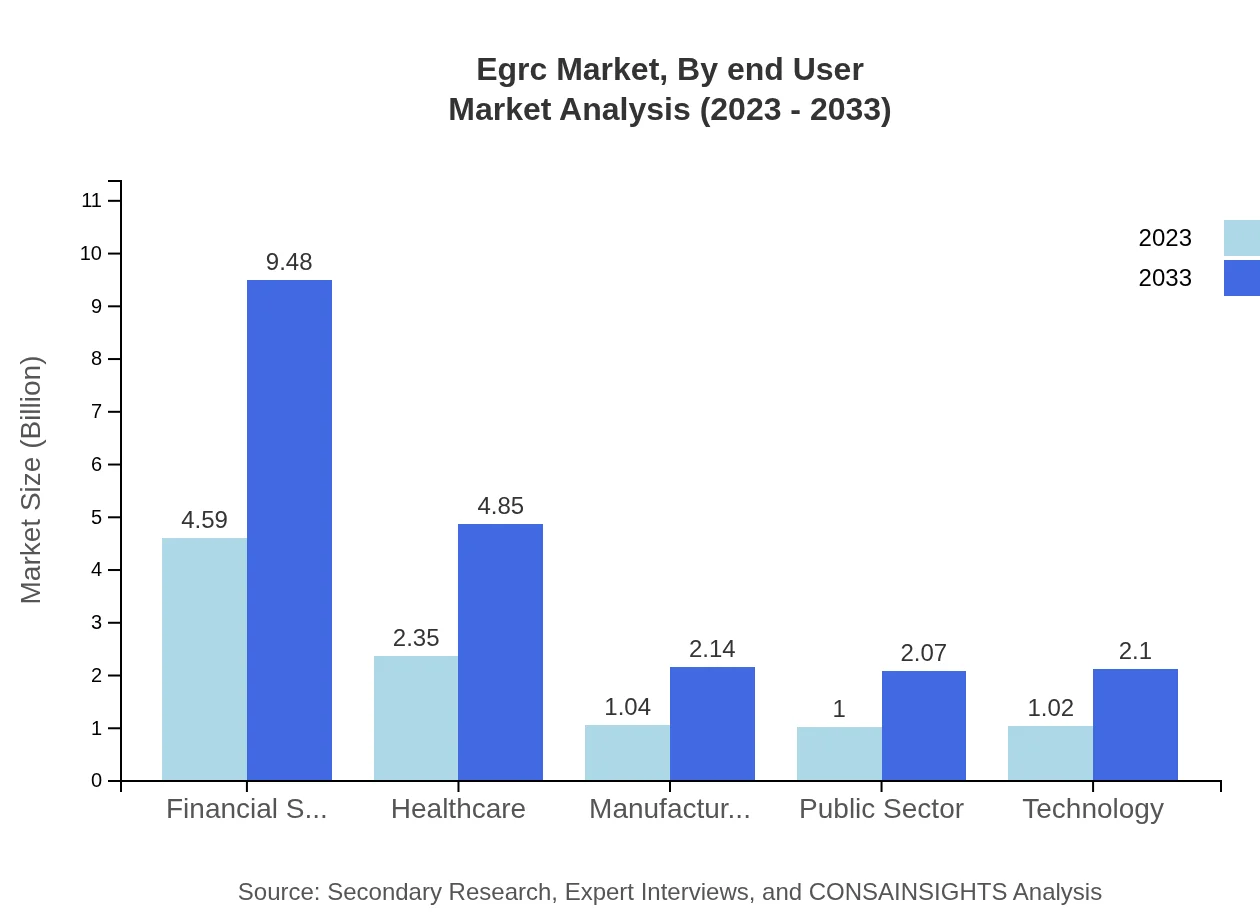

Egrc Market Analysis By End User

Key end-user industries for eGRC include financial services, healthcare, manufacturing, and the public sector. Financial services hold the significant share of the market at 45.93% in 2023, valued at $4.59 billion, and will grow to $9.48 billion by 2033. Healthcare represents 23.48% ($2.35 billion to $4.85 billion), while manufacturing captures 10.36%, projected to rise from $1.04 billion to $2.14 billion during the same period.

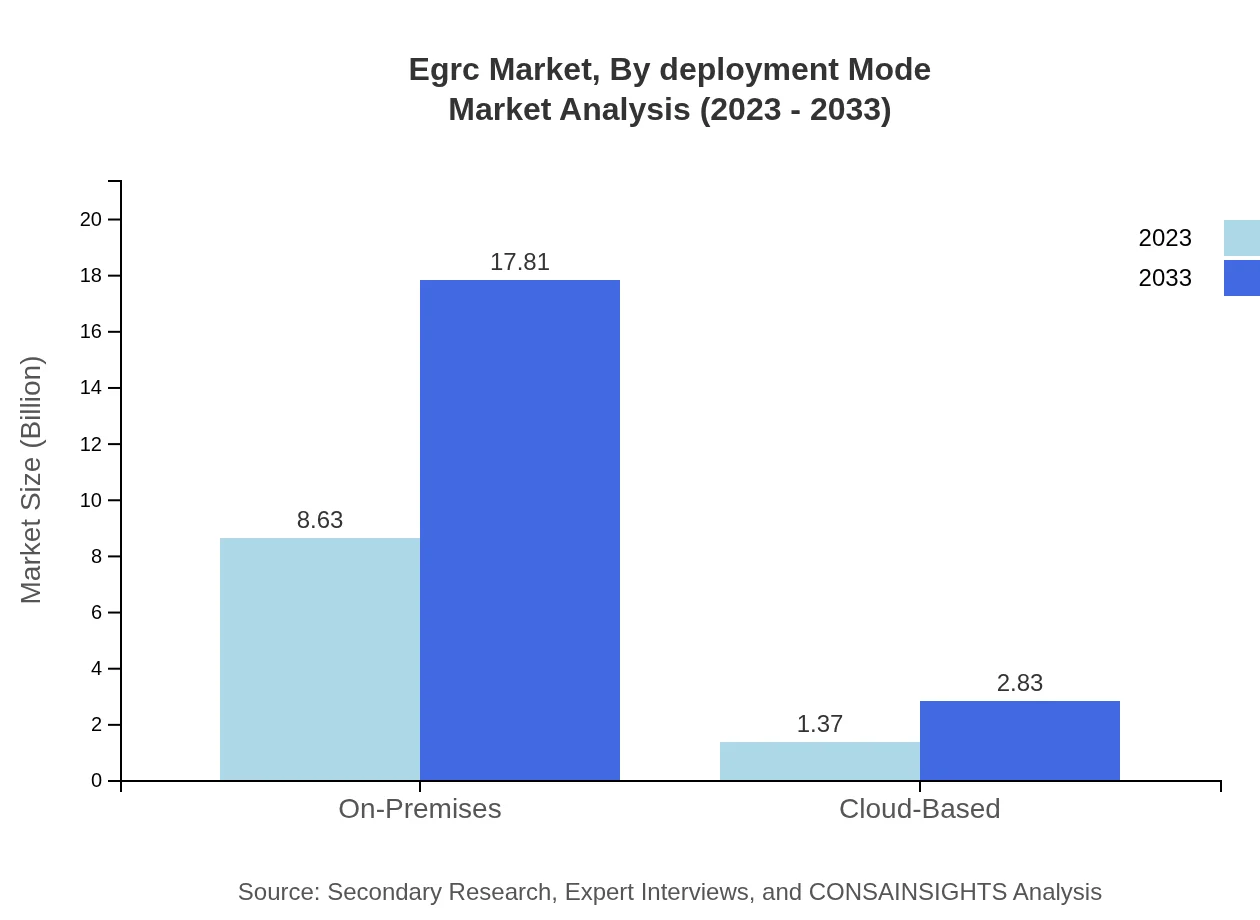

Egrc Market Analysis By Deployment Mode

Deployment models include on-premises and cloud-based solutions. On-premises solutions dominate with a market share of 86.28%, growing from $8.63 billion in 2023 to $17.81 billion by 2033. Cloud-based deployments, while smaller, are gaining traction, forecasting growth from $1.37 billion to $2.83 billion.

Egrc Market Analysis By Region Geo

Regionally, North America and Europe lead the eGRC market, with their robust regulatory environments driving demand for comprehensive compliance solutions. Asia Pacific shows strong growth potential due to digital adoption, while the Middle East and Africa highlight an emerging market trend emphasis on compliance frameworks and technology developments.

Egrc Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Egrc Industry

SAP SE:

SAP SE offers an extensive range of eGRC solutions that integrate risk management, audit management, and compliance capabilities, empowering organizations to streamline complex governance requirements.IBM Corporation:

IBM provides artificial intelligence-powered eGRC solutions that enhance decision-making processes and risk analysis to ensure compliance with evolving regulations.RSA Security LLC:

RSA offers comprehensive risk management and compliance solutions, focusing on security-focused governance to help organizations maintain compliance in an increasingly complex digital world.MetricStream Inc.:

MetricStream specializes in integrated risk management software, providing solutions that empower companies to manage their governance, risk, and compliance needs efficiently.We're grateful to work with incredible clients.

FAQs

What is the market size of egrc?

The eGRC market is projected to reach $10 billion by 2033, representing a CAGR of 7.3% from its current valuation. This growth is driven by increasing regulatory requirements and the need for efficient governance, risk, and compliance systems.

What are the key market players or companies in this egrc industry?

Key players in the eGRC industry include SAP, RSA Security, MetricStream, and IBM. These companies lead in providing innovative solutions catering to compliance, risk management, and governance needs across various sectors.

What are the primary factors driving the growth in the egrc industry?

The growth of the eGRC industry is primarily driven by rising regulatory pressures, the need for integrated risk management solutions, and increased demand for cloud-based and on-premises software to manage data and compliance effectively.

Which region is the fastest Growing in the egrc?

The fastest-growing region in the eGRC market is North America, projected to grow from $3.60 billion in 2023 to $7.44 billion by 2033, led by increasing technological advancements and high adoption rates among enterprises.

Does ConsaInsights provide customized market report data for the egrc industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the eGRC industry. Clients can request detailed insights based on geography, industry segments, and technology trends.

What deliverables can I expect from this egrc market research project?

From the eGRC market research project, clients can expect comprehensive reports, data analytics, market forecasts, and insights on trends, along with recommendations for strategic planning and decision-making.

What are the market trends of egrc?

Current eGRC market trends include a shift towards cloud-based solutions, increased focus on risk management, and growing integration of AI and analytics for enhanced compliance and governance frameworks.