Ehr Market Report

Published Date: 31 January 2026 | Report Code: ehr

Ehr Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the EHR (Electronic Health Records) market, covering key insights, market dynamics, and growth forecasts from 2023 to 2033. The data includes market size, segmentation, regional analysis, and trends necessary for strategic planning.

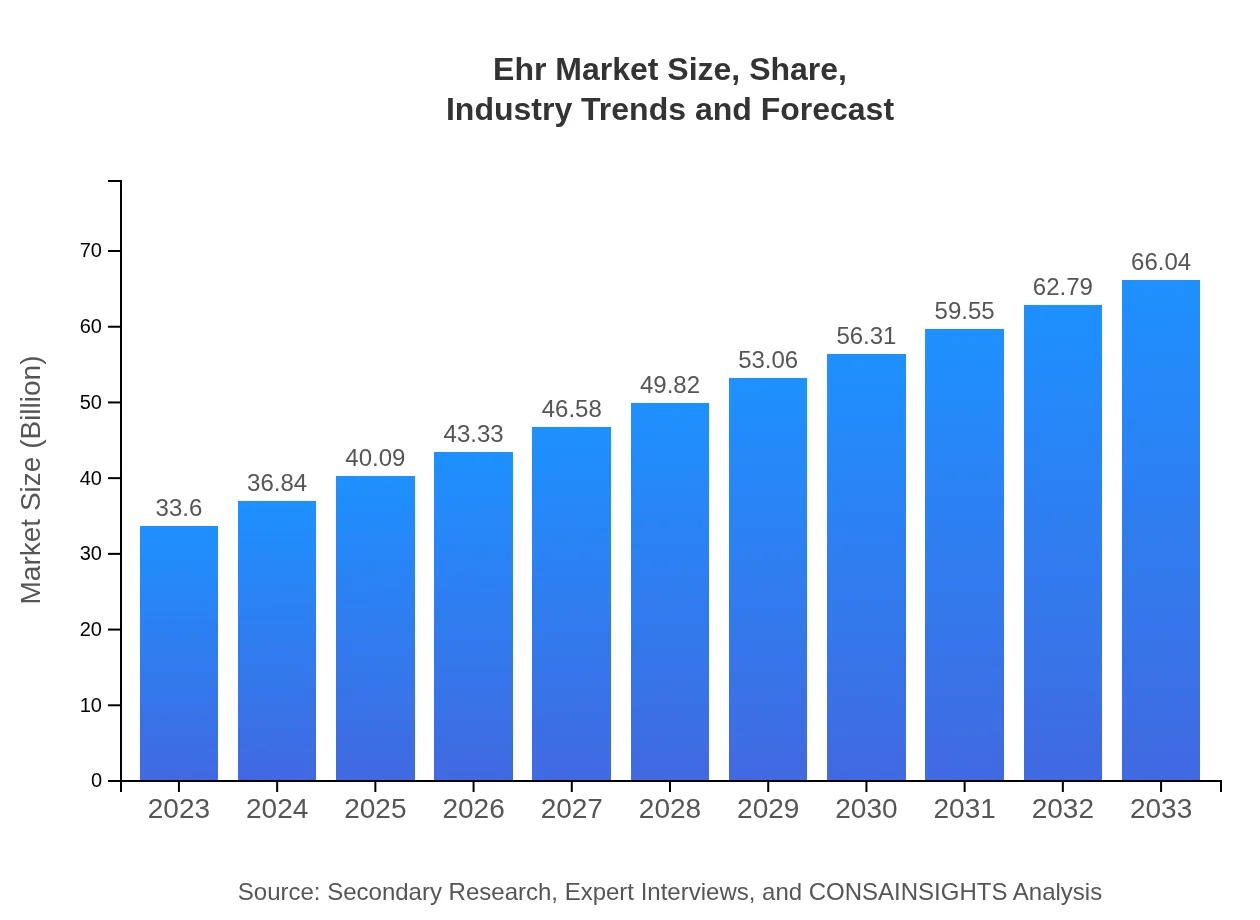

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $33.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $66.04 Billion |

| Top Companies | Epic Systems Corporation, Cerner Corporation, Allscripts Healthcare Solutions, Meditech, Athenahealth |

| Last Modified Date | 31 January 2026 |

EHR Market Overview

Customize Ehr Market Report market research report

- ✔ Get in-depth analysis of Ehr market size, growth, and forecasts.

- ✔ Understand Ehr's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ehr

What is the Market Size & CAGR of EHR market in 2023?

EHR Industry Analysis

EHR Market Segmentation and Scope

Tell us your focus area and get a customized research report.

EHR Market Analysis Report by Region

Europe Ehr Market Report:

In Europe, the EHR market was valued at $9.79 billion in 2023 and is projected to reach $19.24 billion by 2033. This growth is supported by favorable government initiatives and a growing focus on healthcare digitization. The regulatory framework in Europe emphasizes patient data protection, necessitating EHR systems to comply with stringent data privacy laws.Asia Pacific Ehr Market Report:

In the Asia Pacific region, the EHR market was valued at $6.65 billion in 2023, expected to grow to $13.06 billion by 2033. The growth is attributed to increasing investments in healthcare infrastructure and government initiatives aimed at promoting EHR adoption. However, challenges such as varying technological advancements and healthcare policies across countries may affect growth rates in different markets.North America Ehr Market Report:

North America remains the largest market for EHR systems, valued at $11.50 billion in 2023 and expected to escalate to $22.60 billion by 2033. The region’s strong regulatory environment aligns with heightened healthcare IT spending as organizations transition towards digital platforms, driven by demand for better patient outcomes and data interoperability.South America Ehr Market Report:

The EHR market in South America stood at $1.28 billion in 2023, with projections of reaching $2.52 billion by 2033. This growth is fueled by rising awareness of digital healthcare solutions and increasing public health funding. The region faces challenges related to data privacy and integration of systems, requiring tailored solutions to overcome.Middle East & Africa Ehr Market Report:

The EHR market in the Middle East and Africa is projected to grow from $4.38 billion in 2023 to $8.62 billion by 2033. Increasing healthcare investments and a shift towards digital health solutions are key drivers. However, disparate healthcare systems and varying regulations across countries pose challenges that may slow adoption.Tell us your focus area and get a customized research report.

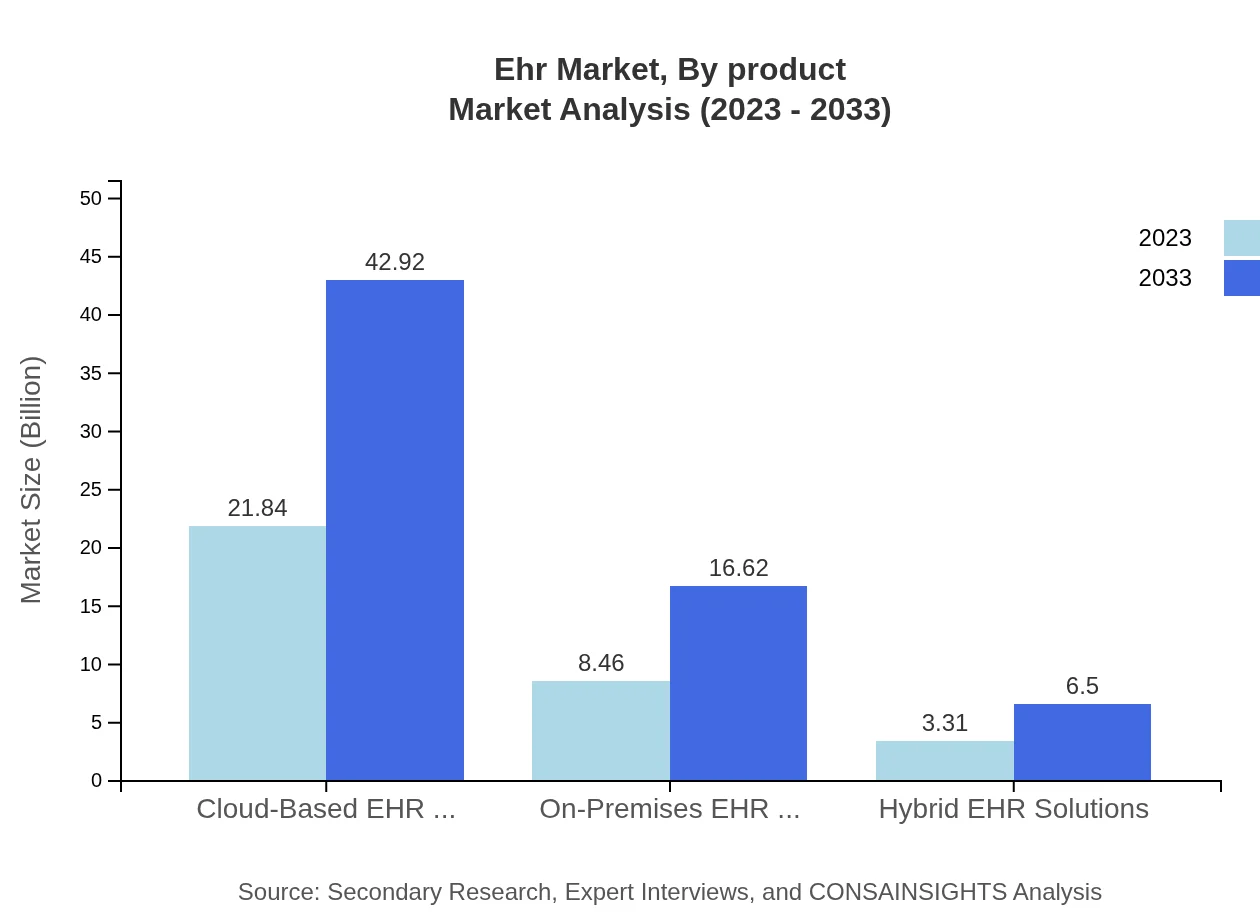

Ehr Market Analysis By Product

The EHR market is primarily segmented into Cloud-Based EHR Systems, On-Premises EHR Systems, and Hybrid EHR Solutions. Cloud-based systems accounted for a significant portion of the market due to their scalability and ease of access, with size expected to grow from $21.84 billion in 2023 to $42.92 billion by 2033. On-Premises solutions are also vital, starting at $8.46 billion and projected to reach $16.62 billion within the same period. Hybrid solutions are gaining traction as organizations seek flexibility, expanding from $3.31 billion to $6.50 billion by 2033.

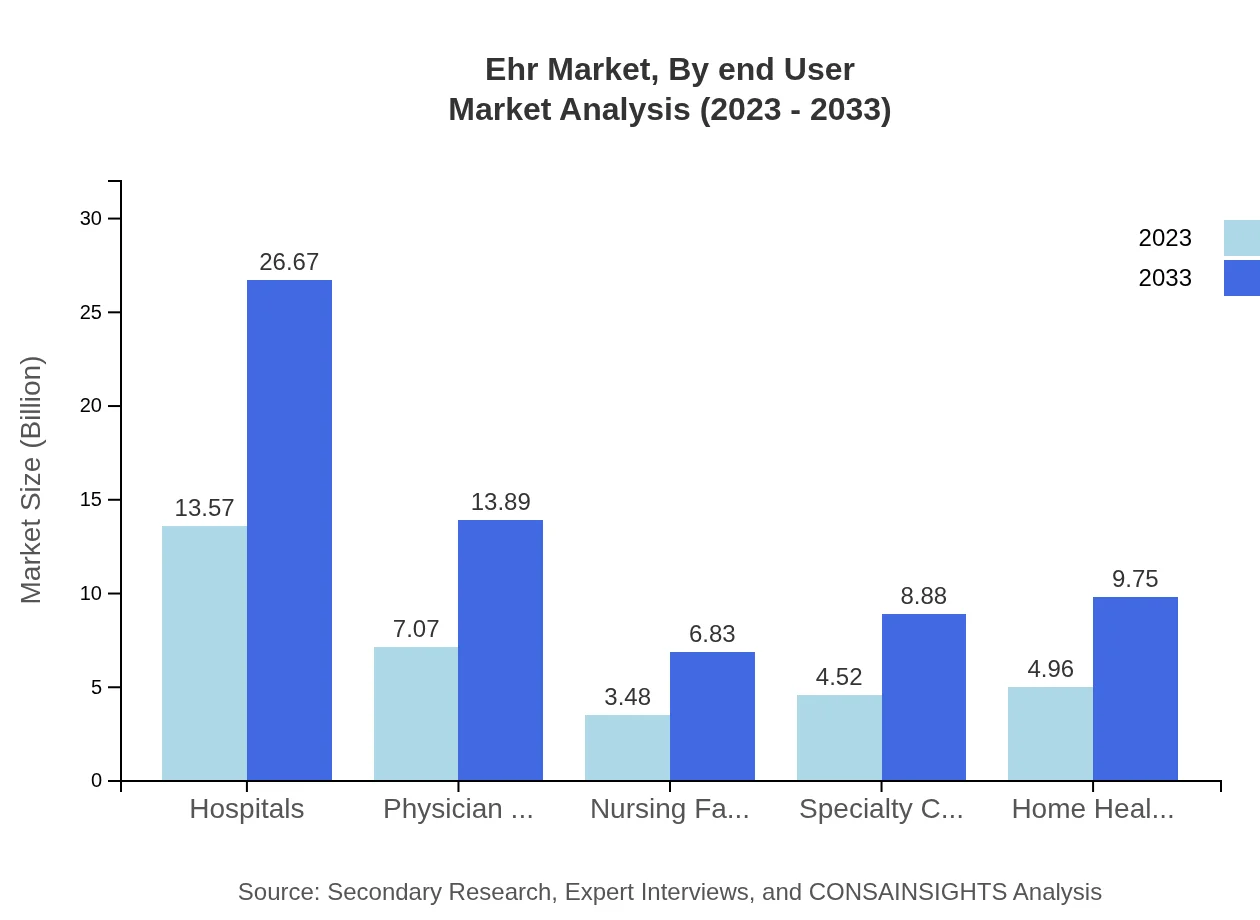

Ehr Market Analysis By End User

Segmented by end-users, the EHR market reveals distinct demands from Hospitals, Physician Offices, Nursing Facilities, and Specialty Clinics. Hospitals lead the market, anticipated to grow from $13.57 billion in 2023 to $26.67 billion by 2033. Physician Offices, while smaller, are projected to grow from $7.07 billion to $13.89 billion. Other facilities like Nursing Facilities and Specialty Clinics also represent vital segments expected to evolve as healthcare demands increase.

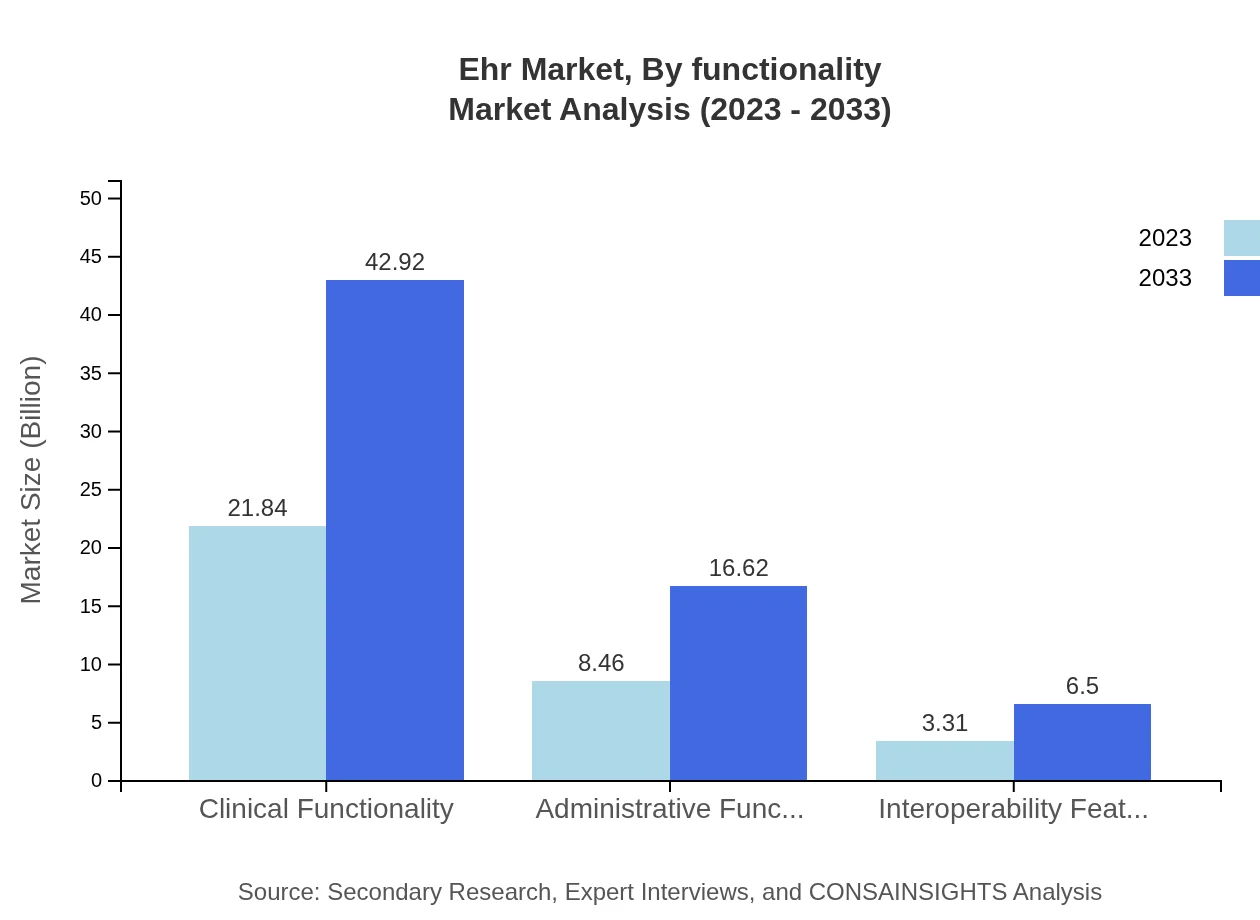

Ehr Market Analysis By Functionality

The functionality of EHR systems includes Clinical Functionality, Administrative Functionality, and Interoperability Features. Clinical functionality is a primary focus, projected to grow from $21.84 billion to $42.92 billion by 2033. Administrative functionalities and interoperability features, although smaller segments at $8.46 billion and $3.31 billion in 2023, will experience incremental growth, enhancing overall system performance and user satisfaction.

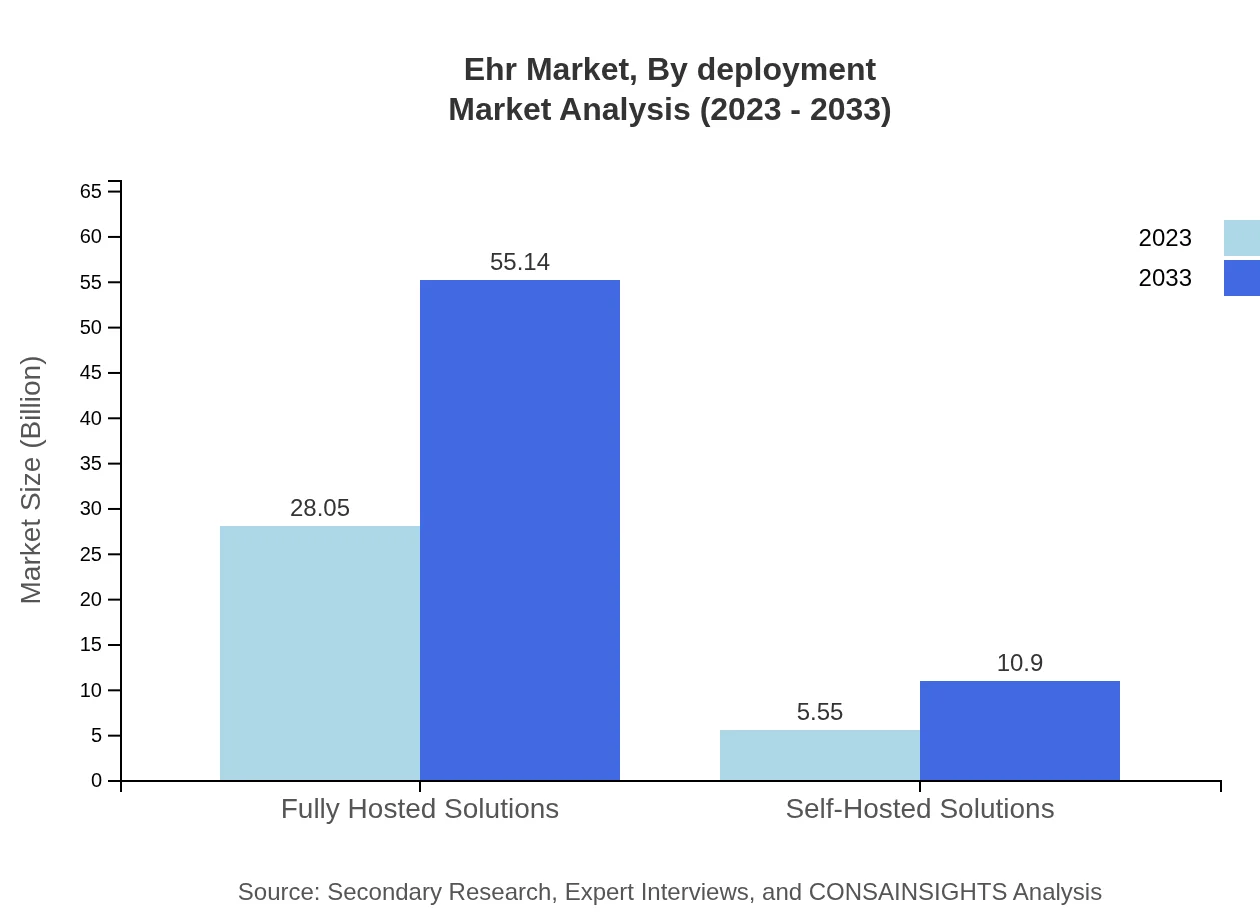

Ehr Market Analysis By Deployment

Deployment types in the EHR sector are mainly Cloud-based, On-premises, and Hybrid deployments. Both Cloud-based and Hybrid deployments showcase considerable growth trajectories amid increasing demand for flexibility and remote access. In contrast, On-Premises solutions maintain a stable market presence, ensuring on-site data control for many healthcare providers.

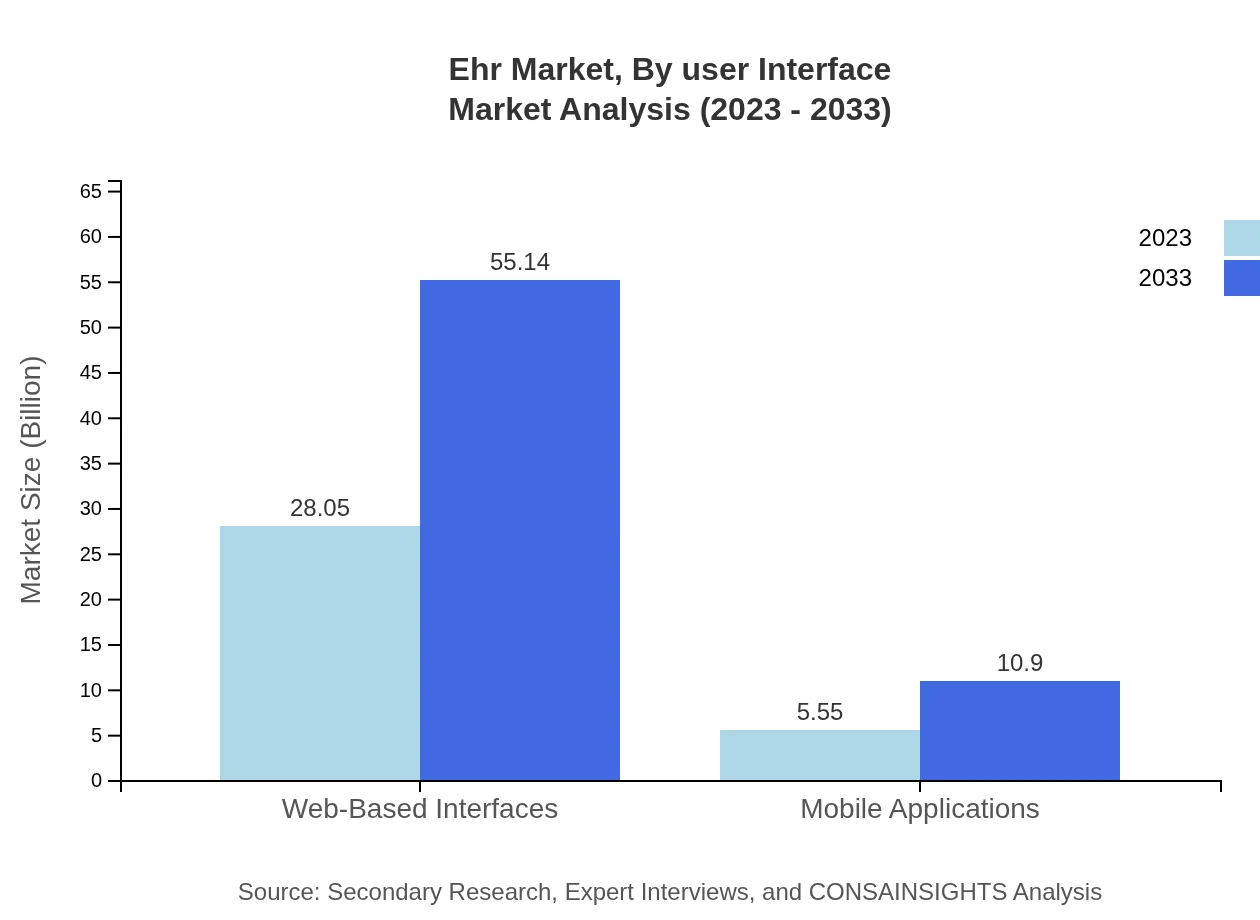

Ehr Market Analysis By User Interface

User interface types include Web-Based Interfaces and Mobile Applications. Web-Based Interfaces dominate the market, reflecting a steady shift toward online access, growing from $28.05 billion to $55.14 billion by 2033. Mobile applications, while smaller, also show potential growth, reinforcing the trend toward accessing EHR data on-the-go.

EHR Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in EHR Industry

Epic Systems Corporation:

Epic Systems Corporation is a leading EHR vendor known for delivering comprehensive healthcare software solutions that facilitate patient management and improve clinical workflows.Cerner Corporation:

Cerner Corporation provides a wide range of health information technology solutions, including EHR systems that enhance healthcare delivery and improve patient engagement.Allscripts Healthcare Solutions:

Allscripts specializes in EHR solutions aimed at empowering healthcare organizations with integrated data and analytics to improve care quality.Meditech:

Meditech is a pioneer in the EHR industry, focusing on making healthcare technology accessible and optimizing clinical and financial outcomes for healthcare organizations.Athenahealth:

Athenahealth offers cloud-based EHR solutions that enhance operational efficiency for healthcare providers through innovative technology and user-centric design.We're grateful to work with incredible clients.

FAQs

What is the market size of EHR?

The market size of the Electronic Health Records (EHR) industry is projected to reach approximately $33.6 billion by 2033, growing at a compound annual growth rate (CAGR) of 6.8% from its current value.

What are the key market players or companies in this EHR industry?

Key players in the EHR industry include major healthcare tech companies such as Epic Systems, Cerner Corporation, Allscripts Healthcare Solutions, and Meditech, which lead with innovative solutions, expansive market share, and strong customer relationships.

What are the primary factors driving the growth in the EHR industry?

Key growth drivers in the EHR industry encompass the increasing digitization of healthcare records, the rise in government initiatives promoting EHR adoption, and the growing demand for improved patient care and operational efficiency within healthcare facilities.

Which region is the fastest Growing in the EHR market?

The fastest-growing region in the EHR market is North America, expected to increase from $11.50 billion in 2023 to $22.60 billion by 2033. Europe and Asia Pacific also show significant growth, with robust healthcare systems and technological advancements.

Does Consainsights provide customized market report data for the EHR industry?

Yes, Consainsights specializes in delivering customized market report data for the EHR industry, tailoring insights and analyses to meet specific client needs, helping stakeholders make informed decisions based on unique market dynamics.

What deliverables can I expect from this EHR market research project?

Deliverables from EHR market research typically include comprehensive market analysis reports, detailed segmentation data, forecasts, competitive landscape assessments, and regional breakdowns, along with actionable insights tailored to specific business goals.

What are the market trends of EHR?

Current trends in the EHR market include the shift towards cloud-based systems, increasing interoperability among healthcare IT solutions, and the rise of mobile health applications, reflecting a broader movement towards digital transformation in healthcare.