Elastography Imaging Market Report

Published Date: 31 January 2026 | Report Code: elastography-imaging

Elastography Imaging Market Size, Share, Industry Trends and Forecast to 2033

This market report provides a comprehensive analysis of the Elastography Imaging industry, covering market size, growth forecasts, regional insights, and technology trends from 2023 to 2033. It aims to guide stakeholders in making informed decisions based on the latest data and trends.

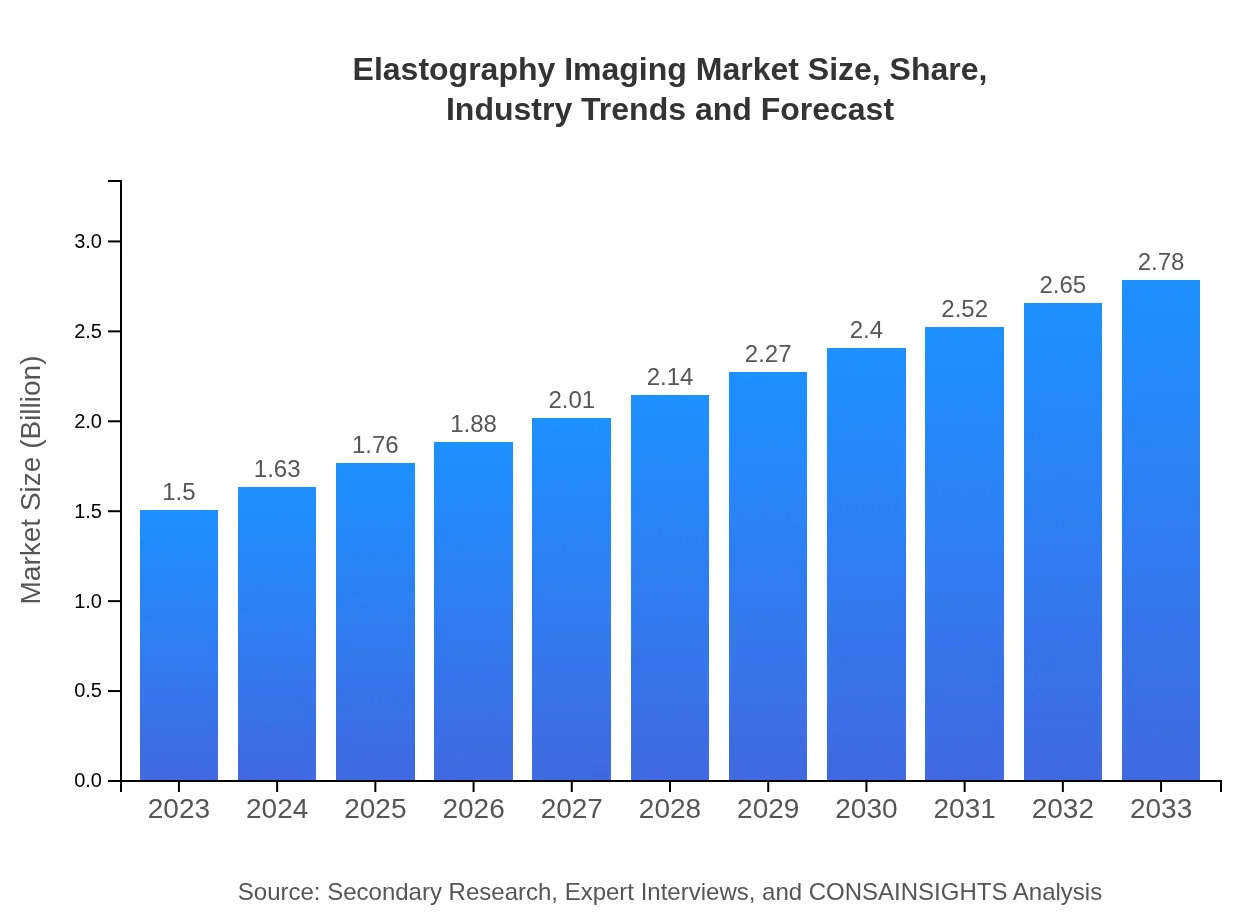

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | GE Healthcare, Philips Healthcare, Siemens Healthineers, Canon Medical Systems |

| Last Modified Date | 31 January 2026 |

Elastography Imaging Market Overview

Customize Elastography Imaging Market Report market research report

- ✔ Get in-depth analysis of Elastography Imaging market size, growth, and forecasts.

- ✔ Understand Elastography Imaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Elastography Imaging

What is the Market Size & CAGR of Elastography Imaging market in 2023?

Elastography Imaging Industry Analysis

Elastography Imaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Elastography Imaging Market Analysis Report by Region

Europe Elastography Imaging Market Report:

The European elastography imaging market is forecasted to rise from USD 0.50 billion in 2023 to USD 0.93 billion by 2033. Factors contributing to this growth include increasing government funding for healthcare, high adoption rates of new technologies, and an aging population that drives the demand for diagnostic imaging.Asia Pacific Elastography Imaging Market Report:

In the Asia Pacific region, the elastography imaging market is expected to grow from USD 0.27 billion in 2023 to USD 0.50 billion by 2033, driven by increasing healthcare accessibility, expanding patient populations, and rising investment in healthcare technologies. Countries like Japan and Australia are leading in adopting advanced diagnostic tools, enhancing market growth.North America Elastography Imaging Market Report:

North America holds a significant share of the elastography imaging market, projected to grow from USD 0.52 billion in 2023 to USD 0.96 billion by 2033. This growth is attributed to the region's advanced healthcare systems, high investments in medical technologies, and the rising prevalence of chronic diseases.South America Elastography Imaging Market Report:

The South American elastography imaging market is projected to increase from USD 0.04 billion in 2023 to USD 0.08 billion by 2033. Growth factors include improving healthcare infrastructure and rising awareness of elastography techniques among healthcare professionals, driven by the need for non-invasive diagnostic procedures.Middle East & Africa Elastography Imaging Market Report:

The Middle East and Africa elastography imaging market is expected to increase from USD 0.17 billion in 2023 to USD 0.31 billion by 2033. Development in healthcare facilities, coupled with collaborations among international medical device firms and local distributors, will foster market growth in these regions.Tell us your focus area and get a customized research report.

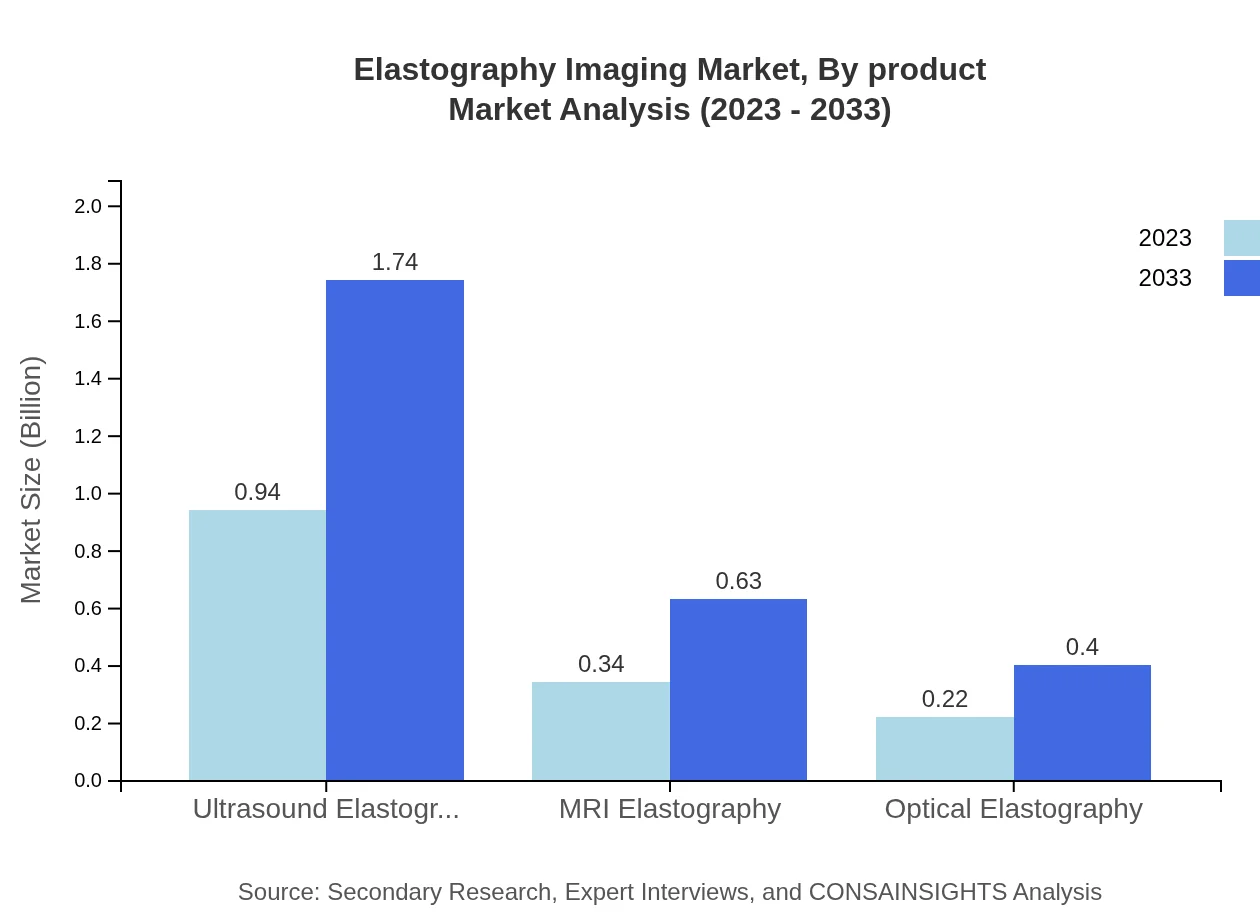

Elastography Imaging Market Analysis By Product

In 2023, the market size for ultrasound elastography is estimated at USD 0.94 billion, growing to USD 1.74 billion by 2033, indicating a strong market demand. MRI elastography, valued at USD 0.34 billion in 2023, is projected to reach USD 0.63 billion by 2033. Optical elastography also shows growth potential, moving from USD 0.22 billion in 2023 to USD 0.40 billion by 2033.

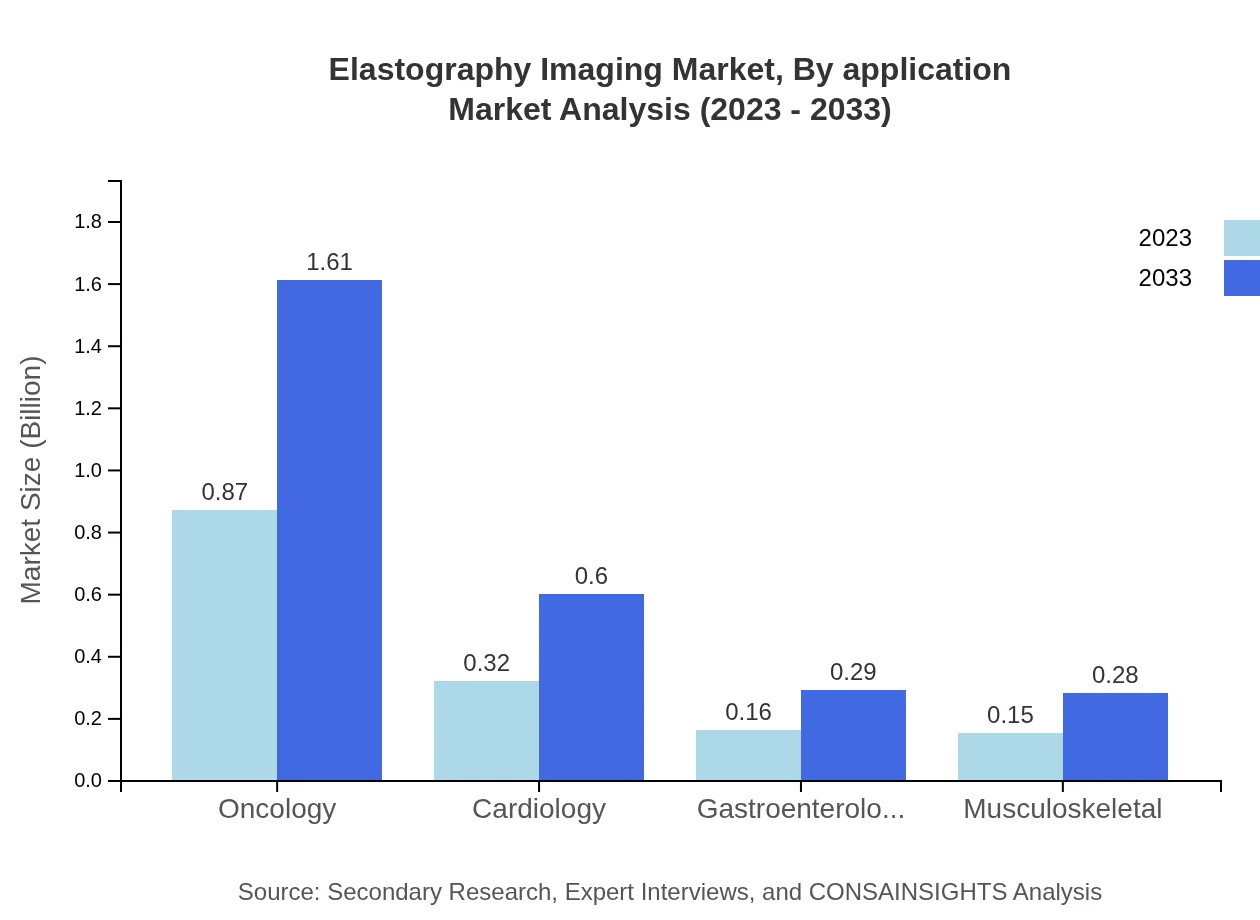

Elastography Imaging Market Analysis By Application

By application, the oncology segment commands a strong share, with sizes estimated at USD 0.87 billion in 2023 and expected to reach USD 1.61 billion by 2033. Cardiology and gastroenterology account for USD 0.32 billion and USD 0.16 billion in 2023, forecasting to grow accordingly. This diversification enhances the market's resilience against fluctuations in demand.

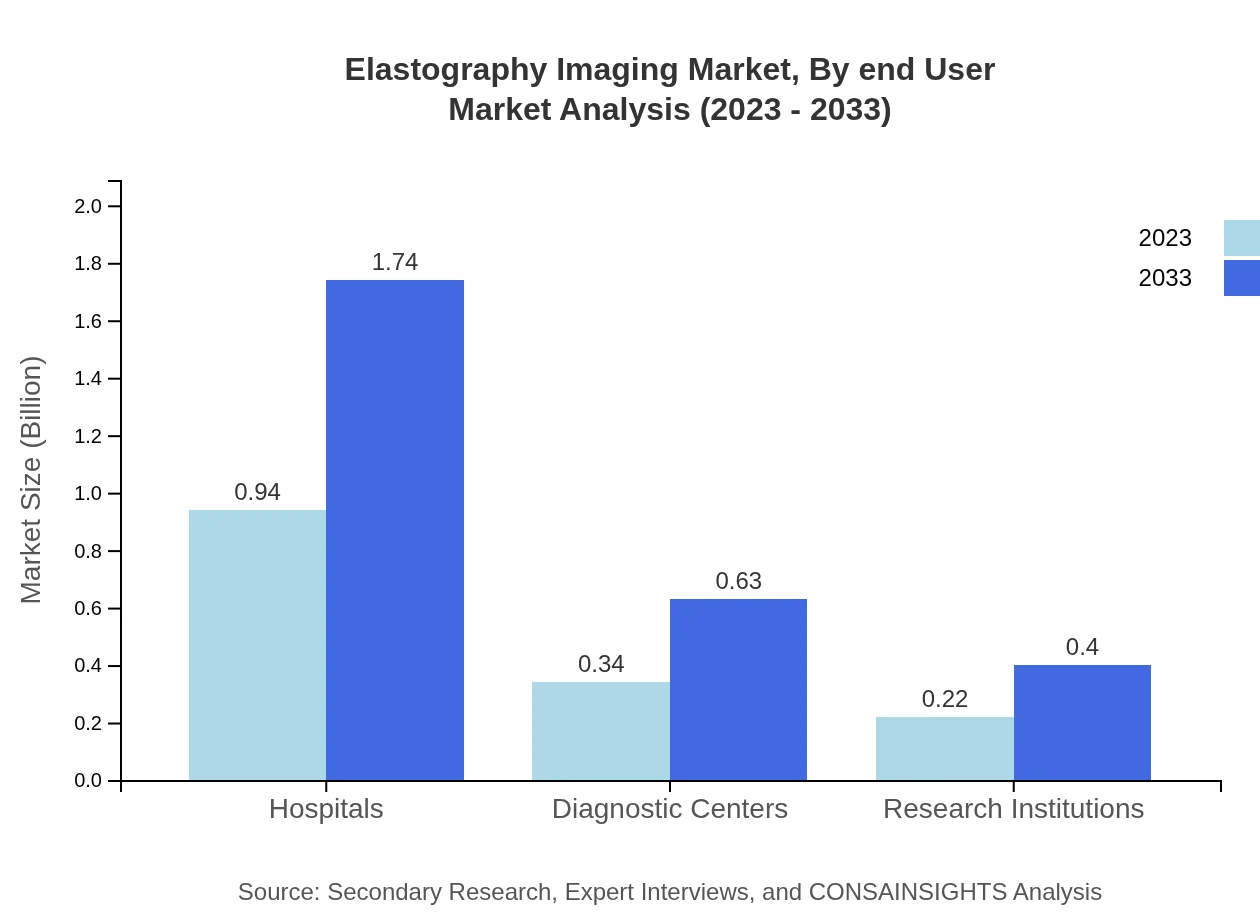

Elastography Imaging Market Analysis By End User

Hospitals remain the largest end-user with a market size of USD 0.94 billion in 2023, anticipated to grow to USD 1.74 billion by 2033. Diagnostic centers and research institutions also contribute significantly, starting at USD 0.34 billion and USD 0.22 billion respectively in 2023, with remarkable projected growth reflecting the shift towards specialized diagnostics.

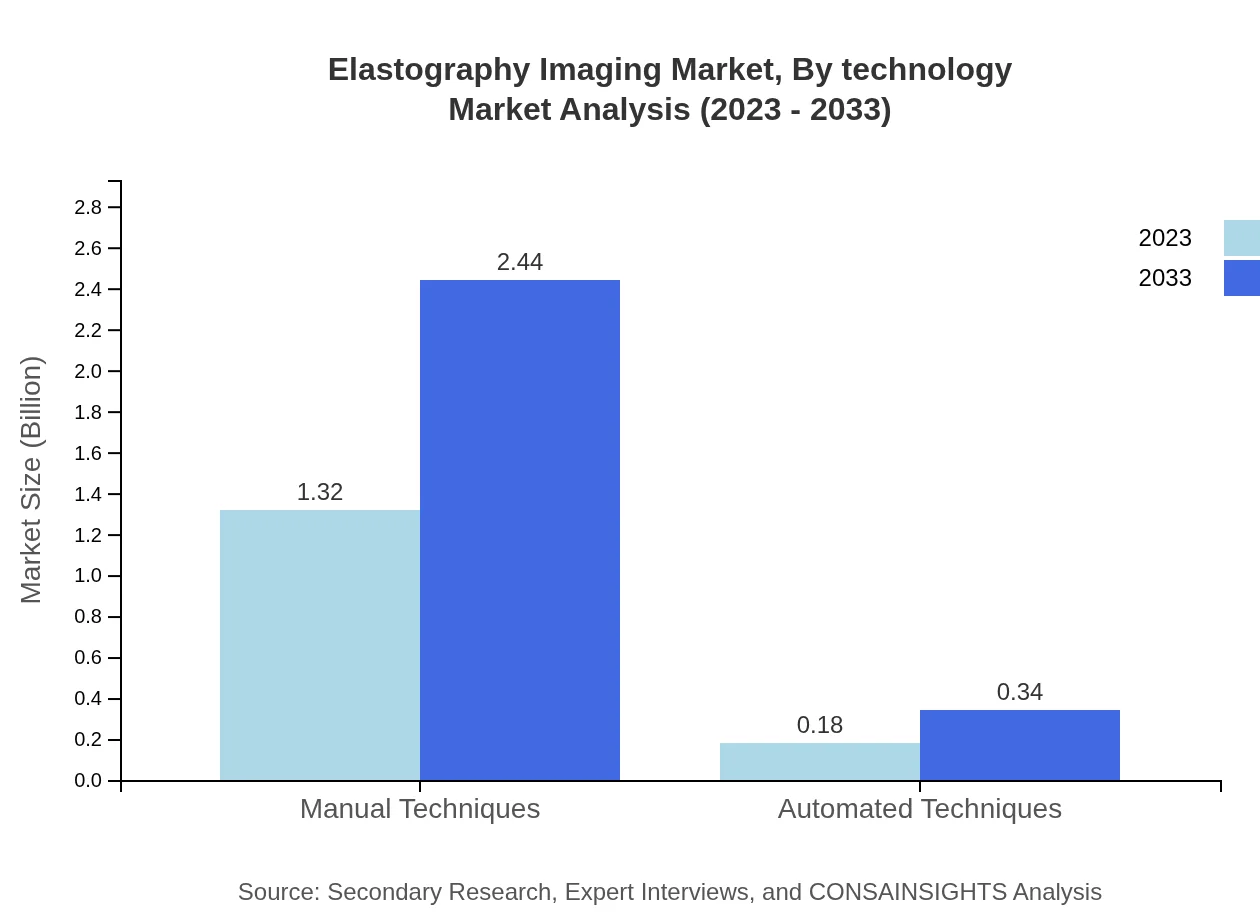

Elastography Imaging Market Analysis By Technology

Manual techniques dominate the elastography imaging market with a substantial share of 87.89% in 2023. The market for automated techniques, currently at USD 0.18 billion, is expected to grow, reflecting a shift toward enhancing diagnostics' efficiency and accuracy in patient care driven by ongoing technological advancements.

Elastography Imaging Market Analysis By Region

Global Elastography Imaging Market, By Region Market Analysis (2023 - 2033)

The region-specific analysis further illustrates how various areas are adapting and growing within the elastography imaging market, outlining the localized opportunities and dynamics influencing sustainability and expansion.

Elastography Imaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Elastography Imaging Industry

GE Healthcare:

A leader in medical imaging technologies, GE Healthcare offers advanced ultrasound elastography solutions that enhance diagnostic accuracy and patient outcomes.Philips Healthcare:

Philips is renowned for its commitment to innovation in healthcare technology, providing comprehensive elastography tools that support various clinical applications.Siemens Healthineers:

Siemens Healthineers specializes in advanced imaging systems and software solutions, significantly contributing to the elastography market through innovative technology.Canon Medical Systems:

Canon focuses on developing cutting-edge imaging technologies and elastography equipment that improve diagnostic capabilities across various healthcare settings.We're grateful to work with incredible clients.

FAQs

What is the market size of elastography Imaging?

The elastography imaging market is currently valued at approximately $1.5 billion and is projected to grow at a CAGR of 6.2% from 2023 to 2033, reflecting a substantial increase in demand for non-invasive imaging techniques.

What are the key market players or companies in the elastography Imaging industry?

Key players in the elastography imaging industry include Canon Medical Systems, Siemens Healthineers, GE Healthcare, Philips Healthcare, and Fujifilm Holdings. These companies are instrumental in advancing elastography technology and expanding market reach.

What are the primary factors driving the growth in the elastography imaging industry?

The growth in the elastography imaging industry is primarily driven by the increasing prevalence of chronic diseases, technological advancements in imaging techniques, and the rising demand for non-invasive diagnostic procedures offering accurate results and reduced patient discomfort.

Which region is the fastest Growing in the elastography Imaging market?

North America is the fastest-growing region in the elastography imaging market, with its market size projected to increase from $0.52 billion in 2023 to $0.96 billion by 2033. Strong healthcare infrastructure supports this growth.

Does ConsaInsights provide customized market report data for the elastography Imaging industry?

Yes, ConsaInsights provides customized market report data tailored to specific requirements within the elastography imaging industry, allowing stakeholders to obtain insights relevant to their market segments, geographies, and strategic objectives.

What deliverables can I expect from this elastography Imaging market research project?

Deliverables from the elastography imaging market research project include comprehensive reports detailing market size, growth trends, competitive analysis, regional breakdowns, and insights into market dynamics, ensuring informed decision-making.

What are the market trends of elastography imaging?

Market trends in elastography imaging include an increasing focus on automated techniques for better efficiency, the rise of hybrid imaging systems that incorporate elastography, and growing adoption in diverse applications including oncology and cardiology.