Electro Optics Market Report

Published Date: 31 January 2026 | Report Code: electro-optics

Electro Optics Market Size, Share, Industry Trends and Forecast to 2033

This report presents a comprehensive analysis of the Electro Optics market, covering insights into market size, trends, and forecasts for the period 2023 to 2033. It aims to equip stakeholders with valuable data on current conditions and future projections to facilitate informed decision-making.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

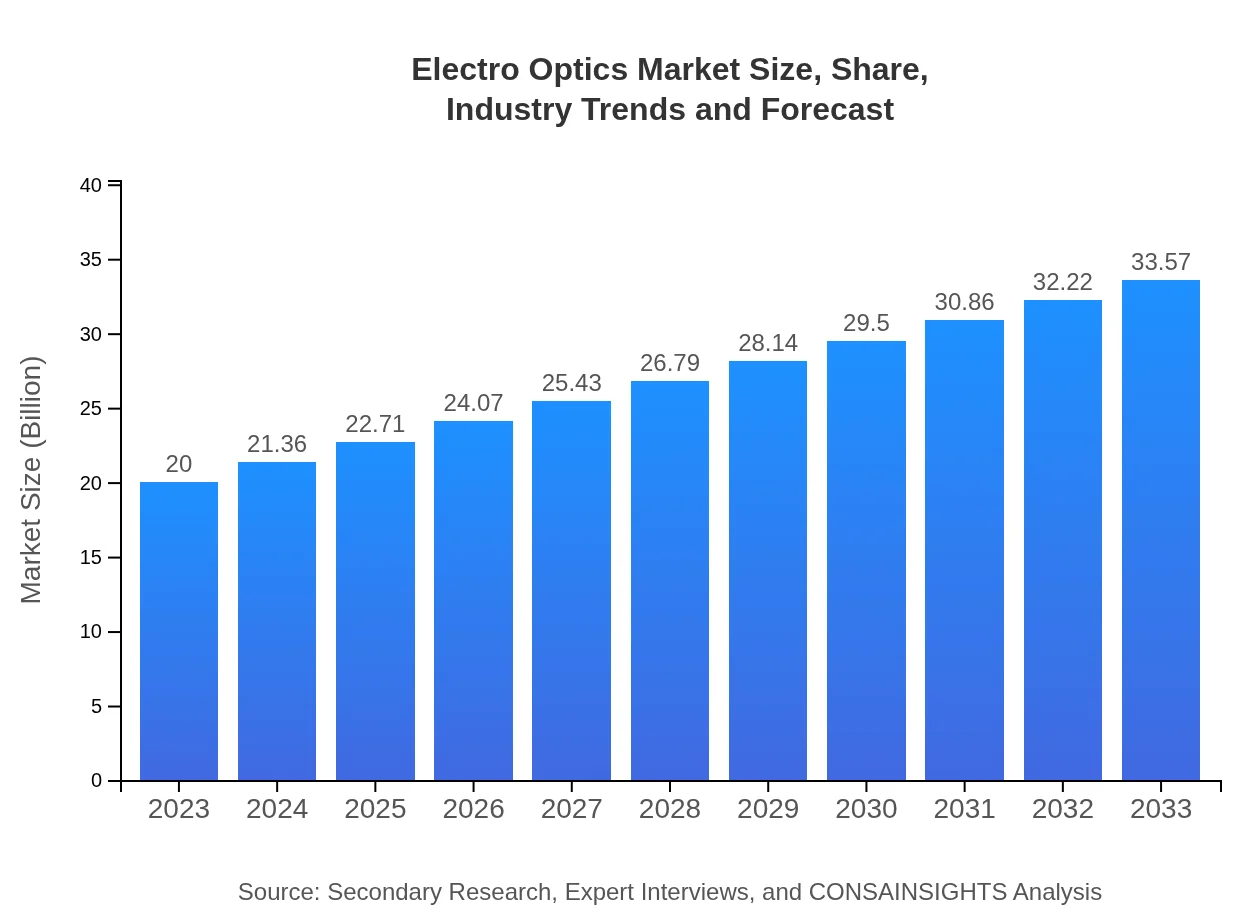

| 2023 Market Size | $20.00 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $33.57 Billion |

| Top Companies | Thorlabs, Inc., Coherent, Inc., FLIR Systems, Inc., Oclaro, Inc., Finisar Corporation |

| Last Modified Date | 31 January 2026 |

Electro Optics Market Overview

Customize Electro Optics Market Report market research report

- ✔ Get in-depth analysis of Electro Optics market size, growth, and forecasts.

- ✔ Understand Electro Optics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Electro Optics

What is the Market Size & CAGR of the Electro Optics market in 2023?

Electro Optics Industry Analysis

Electro Optics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Electro Optics Market Analysis Report by Region

Europe Electro Optics Market Report:

Europe's market is forecasted to expand from $6.66 billion in 2023 to $11.18 billion by 2033, supported by robust governmental and private investments in defense technology and smart manufacturing.Asia Pacific Electro Optics Market Report:

In the Asia Pacific, the Electro Optics market is expected to grow from $3.56 billion in 2023 to $5.97 billion by 2033. The region is witnessing increased adoption of advanced technologies in manufacturing and a burgeoning electronics market.North America Electro Optics Market Report:

North America remains a significant market, anticipated to increase from $6.88 billion in 2023 to $11.55 billion by 2033, largely due to strong demand in the defense and aerospace sectors.South America Electro Optics Market Report:

The South American market is projected to see growth from $0.56 billion in 2023 to $0.93 billion by 2033, driven by advances in telecommunications and increasing investment in research.Middle East & Africa Electro Optics Market Report:

In the Middle East and Africa, the Electro Optics market is expected to grow from $2.35 billion in 2023 to $3.94 billion by 2033, influenced by increasing investments in mobile telecommunications and extensive defense initiatives.Tell us your focus area and get a customized research report.

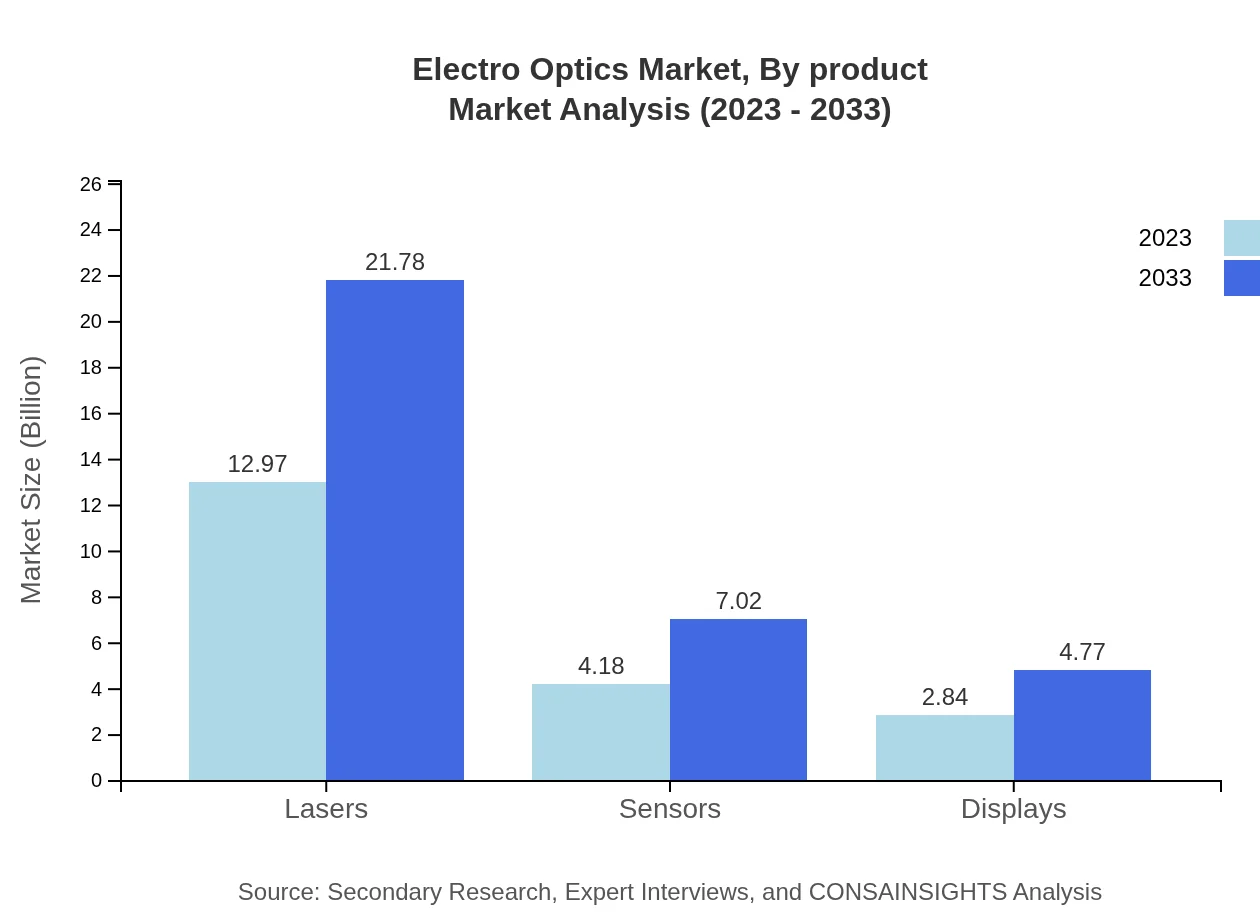

Electro Optics Market Analysis By Product

The product segment of the Electro Optics market includes lasers, sensors, displays, and other optical devices. Lasers dominate the market, showing a valuation of approximately $12.97 billion in 2023, growing to $21.78 billion by 2033, and capturing a market share of 64.87%. Sensors are also critical, with a market size of $4.18 billion by 2023, expected to reach $7.02 billion by 2033, and maintaining a share of 20.91%.

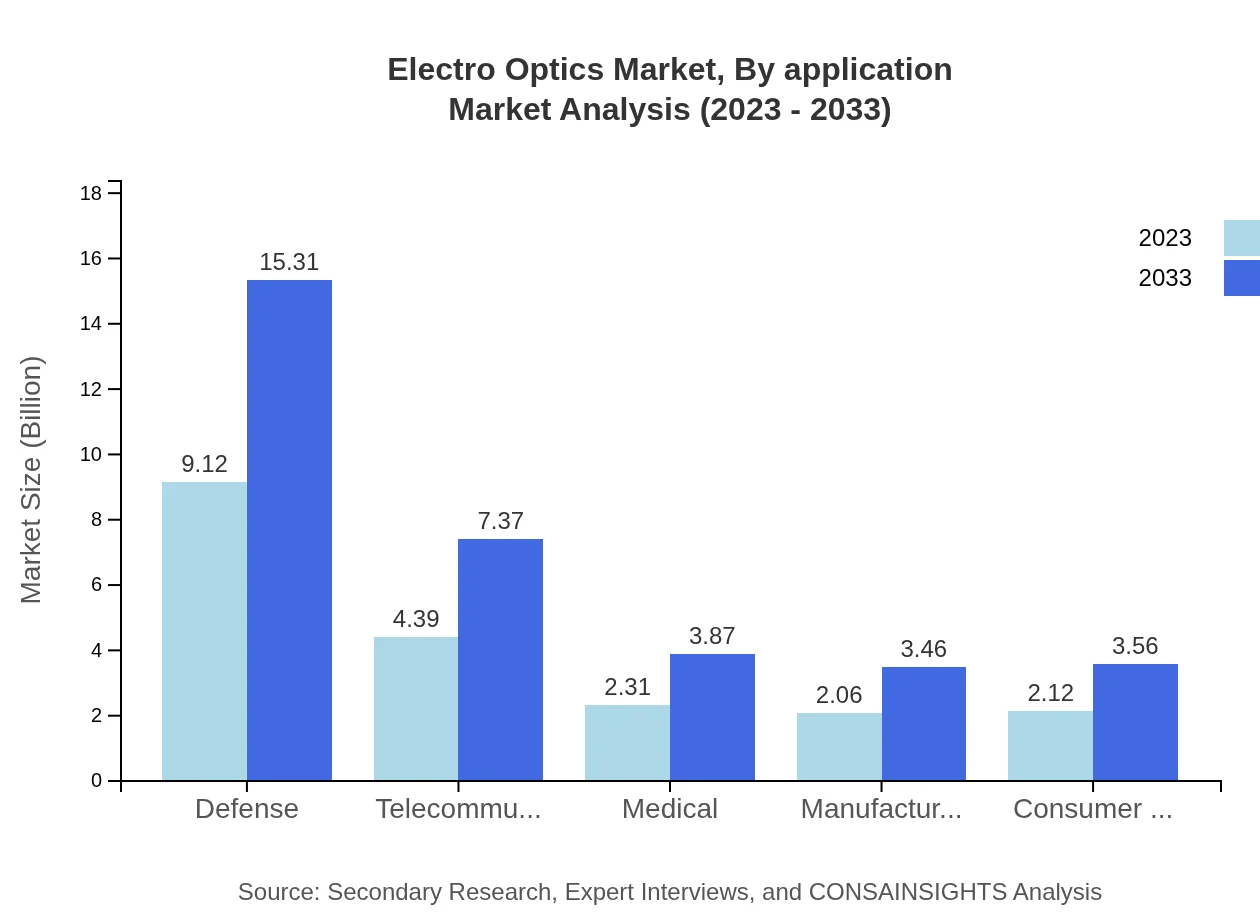

Electro Optics Market Analysis By Application

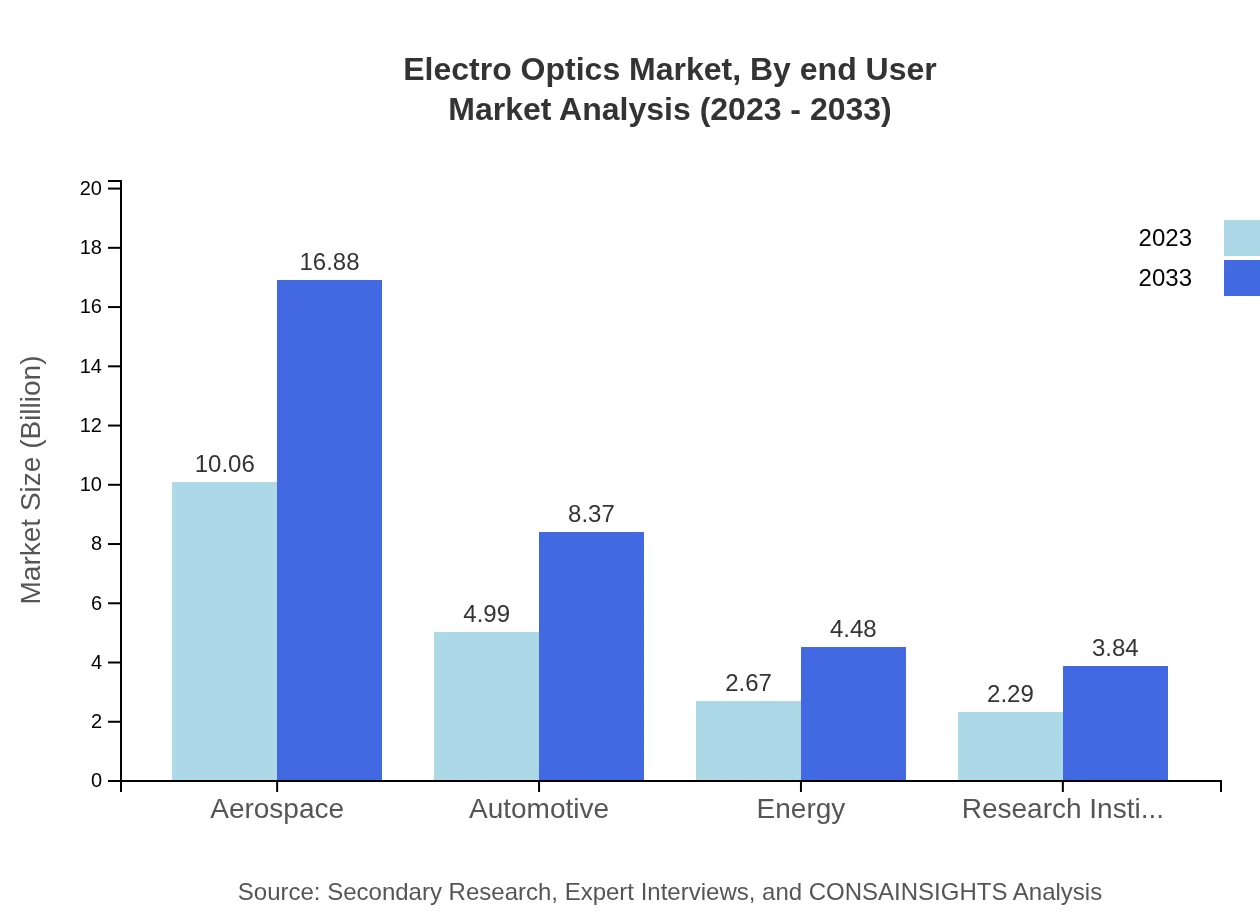

The applications of Electro Optics span across various sectors such as telecommunications, healthcare, automotive, aerospace, and defense. Aerospace applications are particularly notable, valued at $10.06 billion in 2023 and projected to grow to $16.88 billion by 2033, holding a 50.28% share of the market. Telecommunications are also significant, growing from $4.39 billion to $7.37 billion, representing 21.95% of the share.

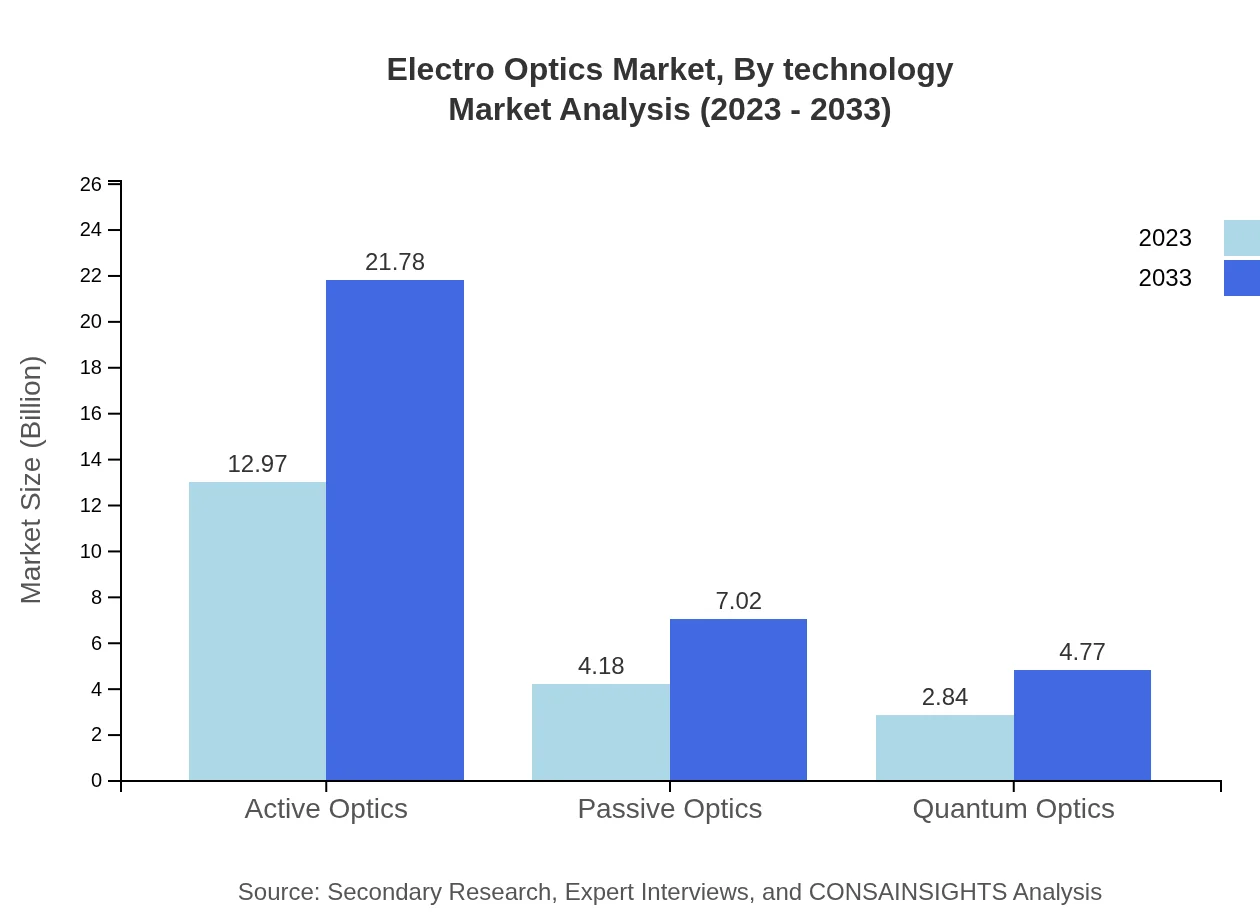

Electro Optics Market Analysis By Technology

Technology in Electro Optics continues to evolve, driven by innovations in active and passive optics. Active optics, which enhance performance and capability, comprise $12.97 billion in market size for 2023 and project to $21.78 billion by 2033, sharing 64.87%. Passive optics, while smaller, still exhibit growth from $4.18 billion to $7.02 billion with a 20.91% market share.

Electro Optics Market Analysis By End User

The end-user analysis reveals that sectors such as defense, manufacturing, and healthcare heavily utilize electro-optical technologies. The defense segment, valued at $9.12 billion in 2023, is anticipated to grow to $15.31 billion by 2033 while maintaining a 45.61% market share. The healthcare segment, though smaller, also presents significant growth potential, moving from $2.31 billion to $3.87 billion over the period.

Electro Optics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in the Electro Optics Industry

Thorlabs, Inc.:

Thorlabs specializes in precision optical and photonic devices, distinguishing itself through a comprehensive product range that supports various applications in science and engineering.Coherent, Inc.:

Coherent, Inc. is focused on laser-based technologies and offers essential manufacturing tools across many industries, contributing to advancements in industrial and medical applications.FLIR Systems, Inc.:

FLIR Systems develops innovative sensor technologies in thermal imaging, allowing for enhanced situational awareness across defense, industrial, and commercial sectors.Oclaro, Inc.:

Known for its high-performance laser diodes, Oclaro is pivotal in telecommunications, driving connectivity with their advanced lightwave technologies.Finisar Corporation:

Finisar Corporation plays a critical role in optical communication components, providing essential support for the burgeoning internet infrastructure demands.We're grateful to work with incredible clients.

FAQs

What is the market size of electro Optics?

The global electro-optics market is projected to reach approximately $20 billion by 2033, growing at a CAGR of 5.2% from the current market size. This steady growth signifies increasing demand across various sectors.

What are the key market players or companies in this electro Optics industry?

Leading companies in the electro-optics market include prominent manufacturers and developers in the fields of lasers, sensors, and optics technologies. These companies are pivotal in driving innovations and product development within the industry.

What are the primary factors driving the growth in the electro Optics industry?

Key factors fueling the growth of the electro-optics industry include advancements in laser technologies, burgeoning demand in aerospace and defense sectors, and increased applications in telecommunications and consumer electronics.

Which region is the fastest Growing in the electro Optics?

The North American region is the fastest-growing market for electro-optics, expected to grow from $6.88 billion in 2023 to $11.55 billion by 2033. Europe and Asia-Pacific also display significant growth potential.

Does ConsaInsights provide customized market report data for the electro Optics industry?

Yes, ConsaInsights offers tailored market research data for the electro-optics industry. Clients can request specific insights and analyses based on individual business needs to inform strategic decision-making.

What deliverables can I expect from this electro Optics market research project?

Expect comprehensive deliverables including detailed market analysis, growth forecasts, competitor benchmarking, and insights into regional and segment-wise performance, aiding informed strategy development in the electro-optics sector.

What are the market trends of electro Optics?

Current trends in the electro-optics market include increasing integration of advanced optical technologies in defense systems, growing automation in manufacturing processes, and the rise of quantum optics applications, reflecting an innovative landscape.