Electromyography Devices Market Report

Published Date: 31 January 2026 | Report Code: electromyography-devices

Electromyography Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Electromyography Devices market, focusing on market trends, regional insights, industry analysis, and future forecasts from 2023 to 2033.

| Metric | Value |

|---|---|

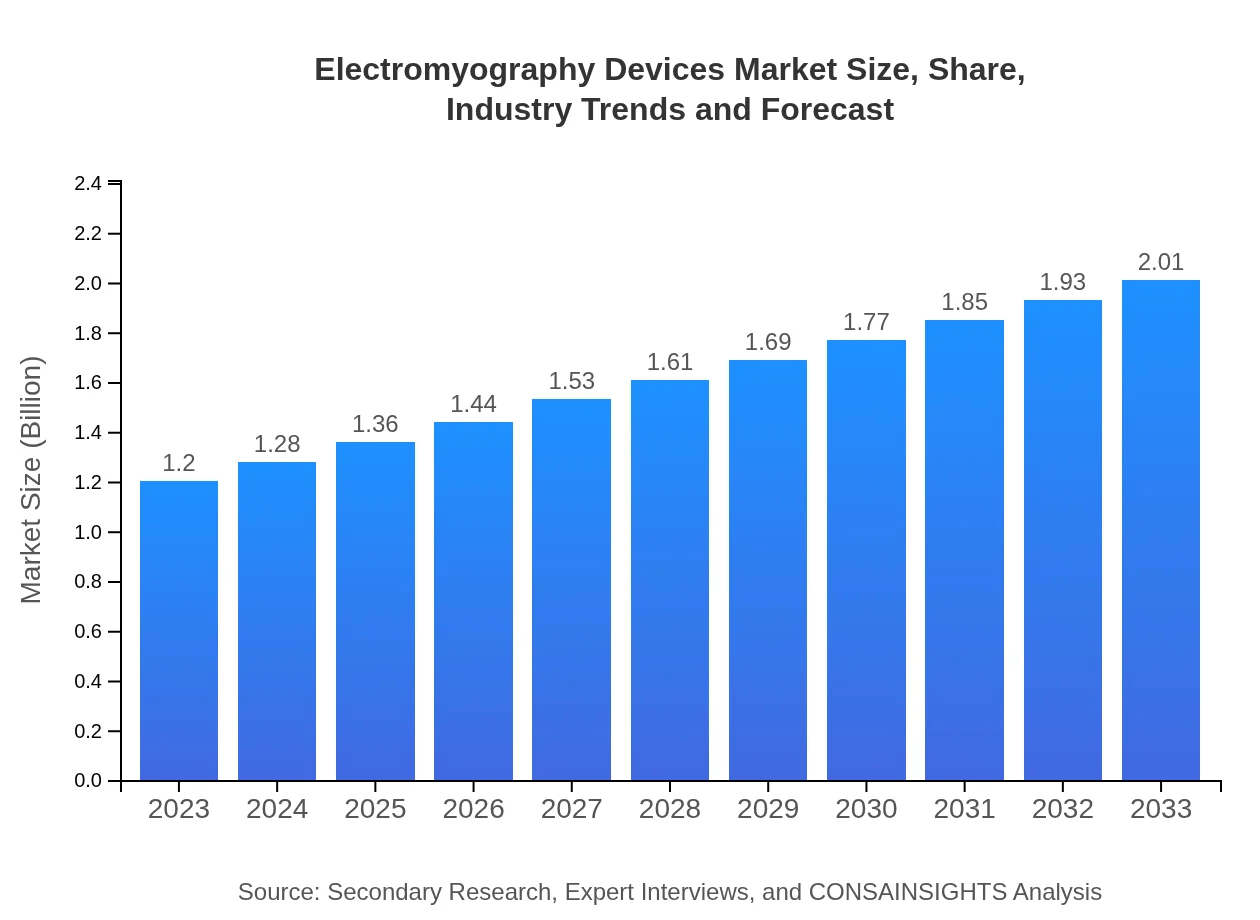

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.20 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $2.01 Billion |

| Top Companies | Natus Medical Incorporated, Medtronic PLC, Neurosoft, Dantec Dynamics |

| Last Modified Date | 31 January 2026 |

Electromyography Devices Market Overview

Customize Electromyography Devices Market Report market research report

- ✔ Get in-depth analysis of Electromyography Devices market size, growth, and forecasts.

- ✔ Understand Electromyography Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Electromyography Devices

What is the Market Size & CAGR of Electromyography Devices market in 2033?

Electromyography Devices Industry Analysis

Electromyography Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Electromyography Devices Market Analysis Report by Region

Europe Electromyography Devices Market Report:

The European Electromyography Devices market is projected to grow from USD 0.31 billion in 2023 to USD 0.51 billion by 2033. Factors such as increasing geriatric population and rising incidences of neuromuscular disorders drive this growth. The European Union's focus on enhancing healthcare technologies is also beneficial for market expansion.Asia Pacific Electromyography Devices Market Report:

The Asia Pacific region is poised for significant growth, with a market size of USD 0.25 billion in 2023, projected to reach USD 0.43 billion by 2033. The surge in population, increasing healthcare spending, and rising awareness about neurological diseases contribute to this growth. Moreover, various government initiatives enhancing healthcare technology adoption further support market expansion.North America Electromyography Devices Market Report:

North America dominates the Electromyography Devices market, valued at approximately USD 0.43 billion in 2023, expected to rise to USD 0.73 billion by 2033. The growth is supported by advanced healthcare infrastructure, a high prevalence of neuromuscular diseases, and significant investments in medical technology. The presence of major market players in this region further consolidates its leading position.South America Electromyography Devices Market Report:

In South America, the Electromyography Devices market is estimated to grow from USD 0.08 billion in 2023 to USD 0.13 billion by 2033. The increasing prevalence of neurological disorders and improvements in healthcare infrastructure are key factors driving this growth. However, economic challenges may pose temporary constraints on market development.Middle East & Africa Electromyography Devices Market Report:

The market in the Middle East and Africa is anticipated to increase from USD 0.13 billion in 2023 to USD 0.21 billion by 2033. The growth is primarily fueled by enhancements in healthcare systems and rising health awareness among the population. However, disparities in healthcare reach across regions may impact overall growth potential.Tell us your focus area and get a customized research report.

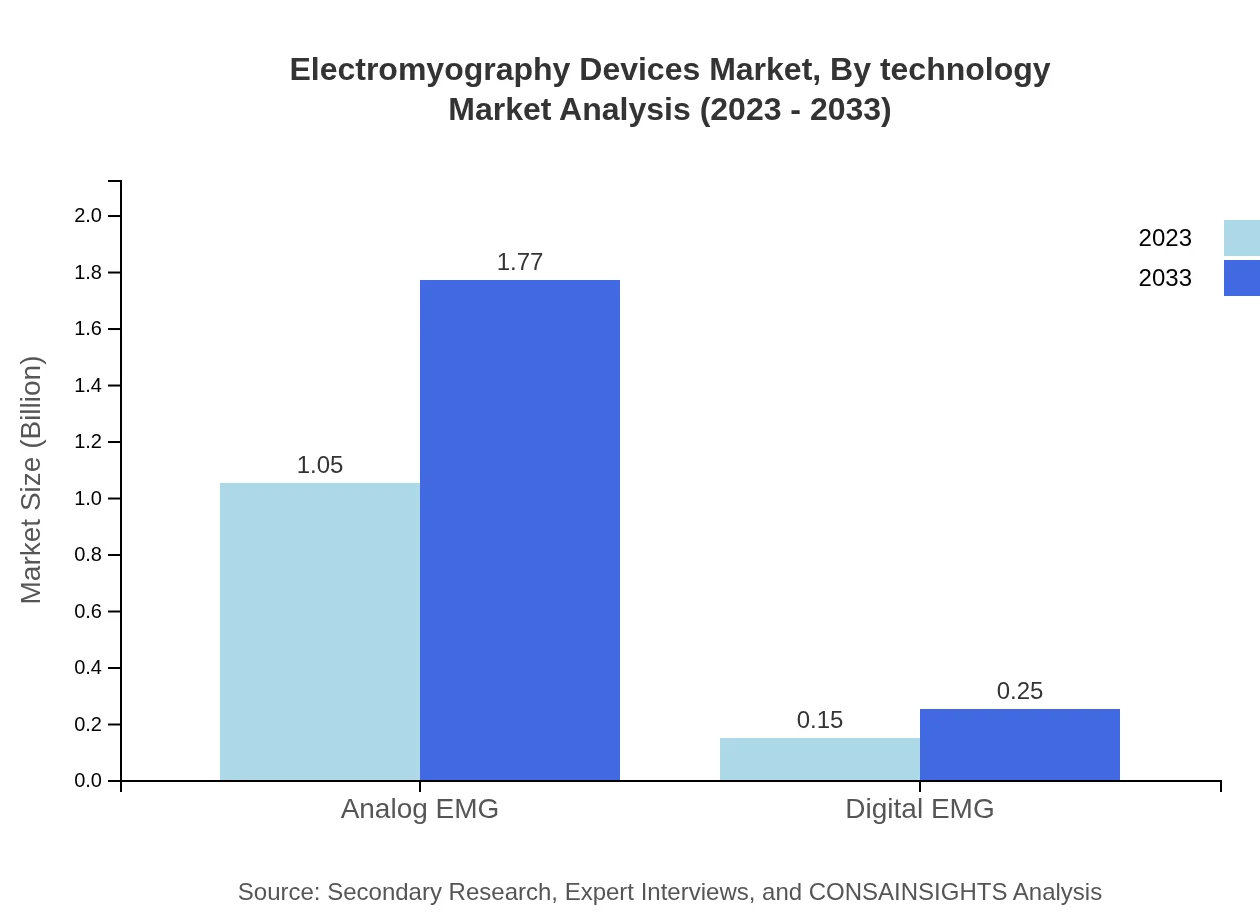

Electromyography Devices Market Analysis By Product Type

The market for Electromyography Devices by product type is dominated by Analog EMG, expected to grow from USD 1.05 billion in 2023 to USD 1.77 billion by 2033. Digital EMG is another emerging segment, projected to rise from USD 0.15 billion to USD 0.25 billion over the same period. Each product type meets specific diagnostic needs, influencing a diverse user base across various applications.

Electromyography Devices Market Analysis By Application

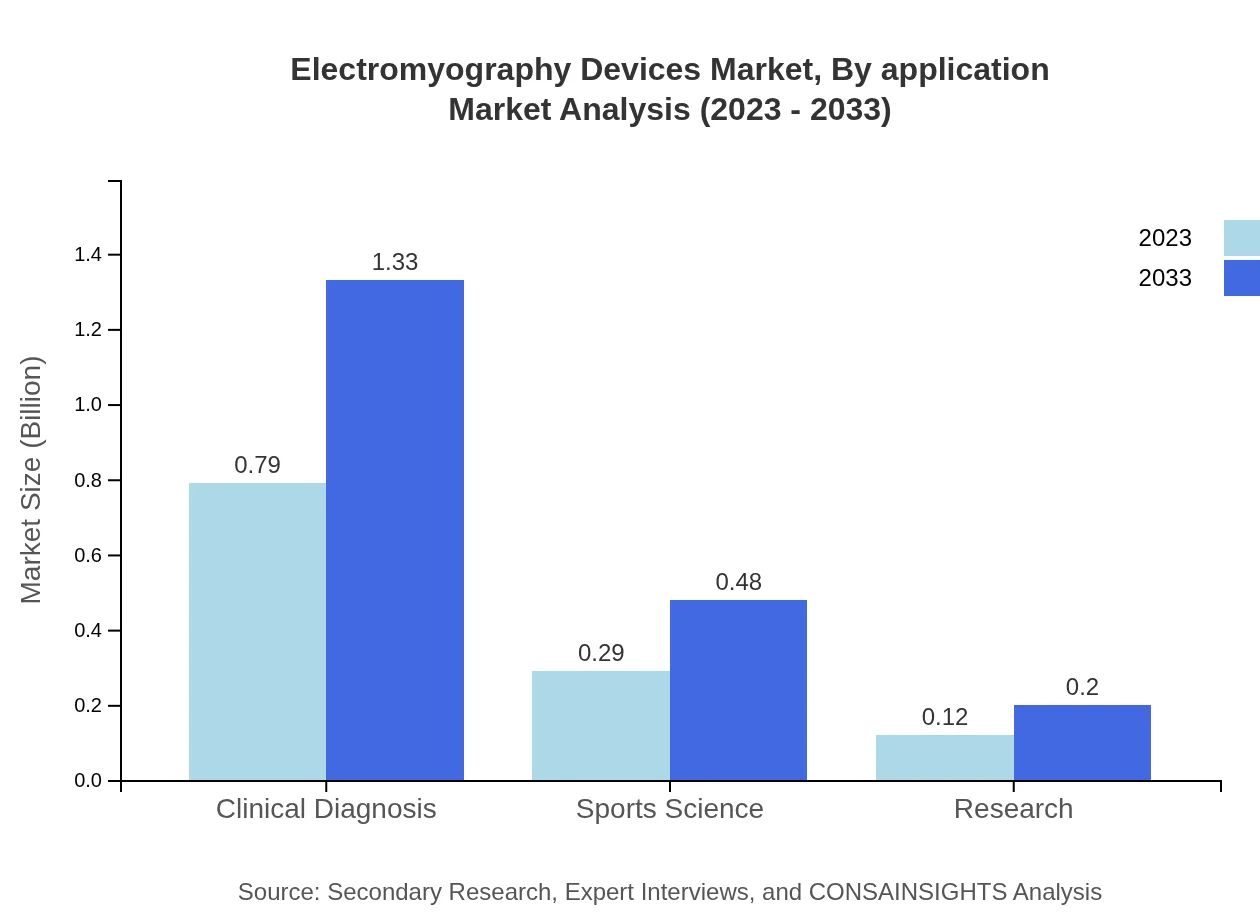

The primary application of Electromyography Devices is in clinical diagnosis, which accounted for USD 0.79 billion in 2023, anticipated to reach USD 1.33 billion by 2033. Sports science and research also represent significant segments, showcasing the versatility of EMG technologies used in various fields.

Electromyography Devices Market Analysis By End User

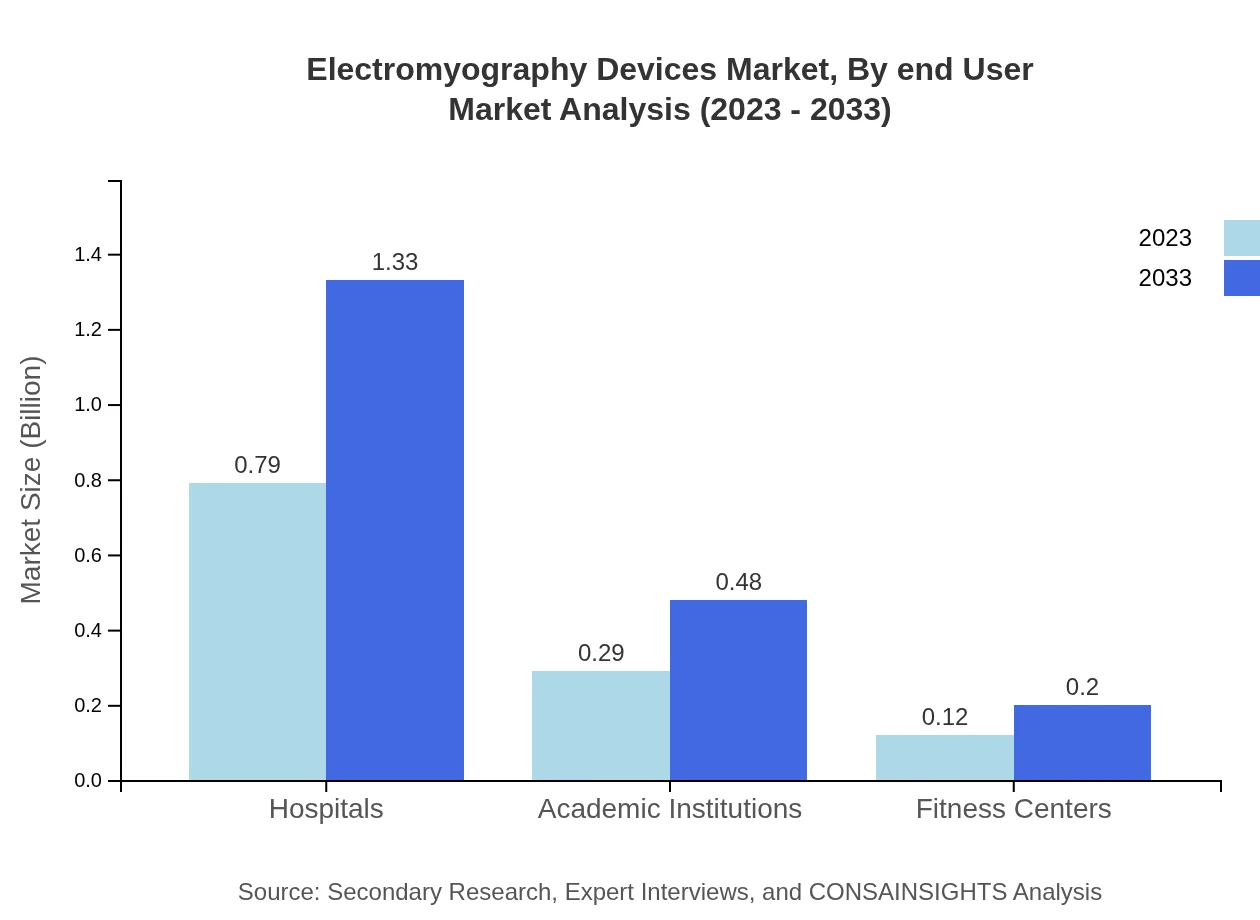

Hospitals dominate the end-user segment for Electromyography Devices, capturing approximately 65.89% market share in 2023. Academic institutions and fitness centers follow, emphasizing the importance of EMG technology in clinical settings and physical rehabilitation.

Electromyography Devices Market Analysis By Technology

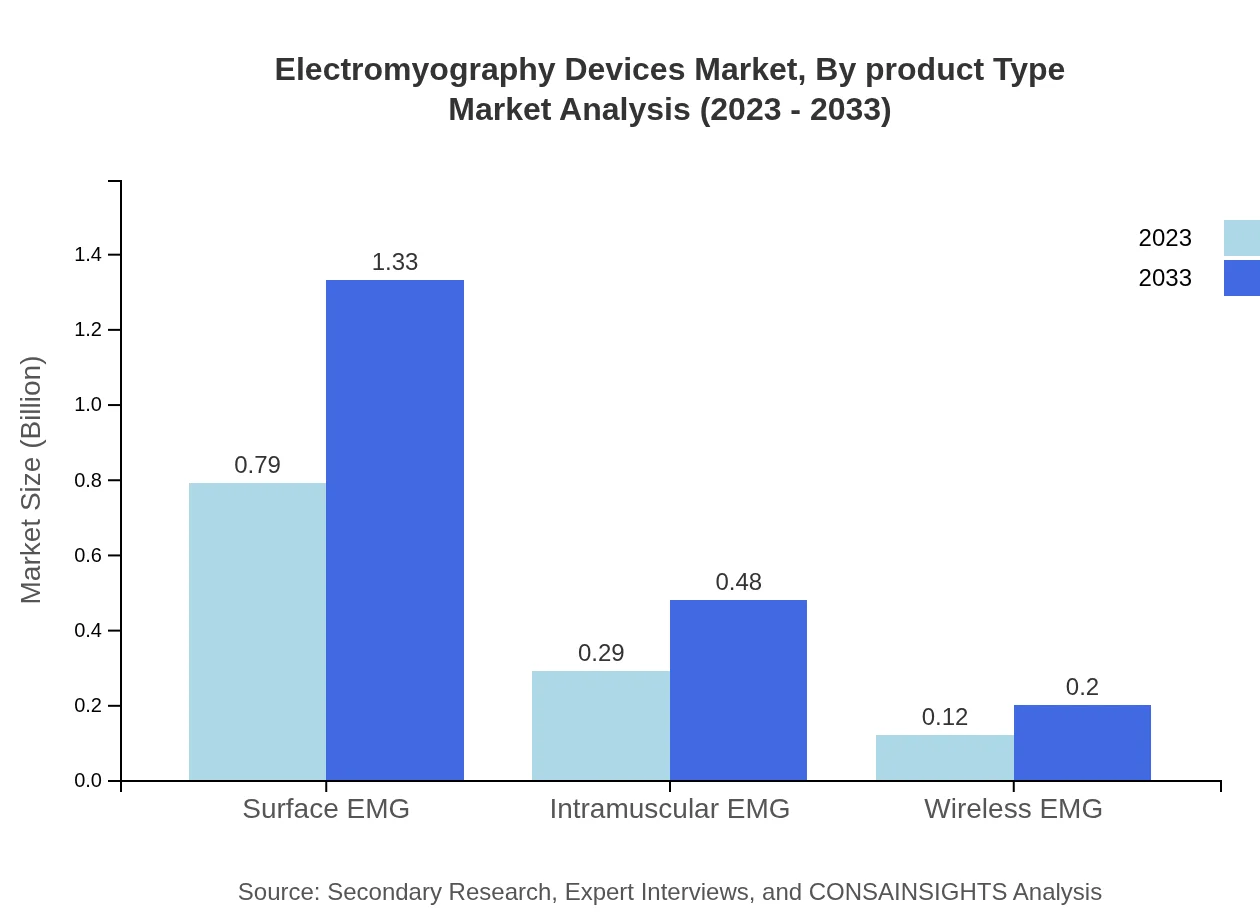

In terms of technology, Surface EMG is expected to maintain the largest market share throughout the forecast period, contributing significantly to clinical diagnosis and research applications. Wireless EMG technology is gaining traction due to its convenience and broader accessibility.

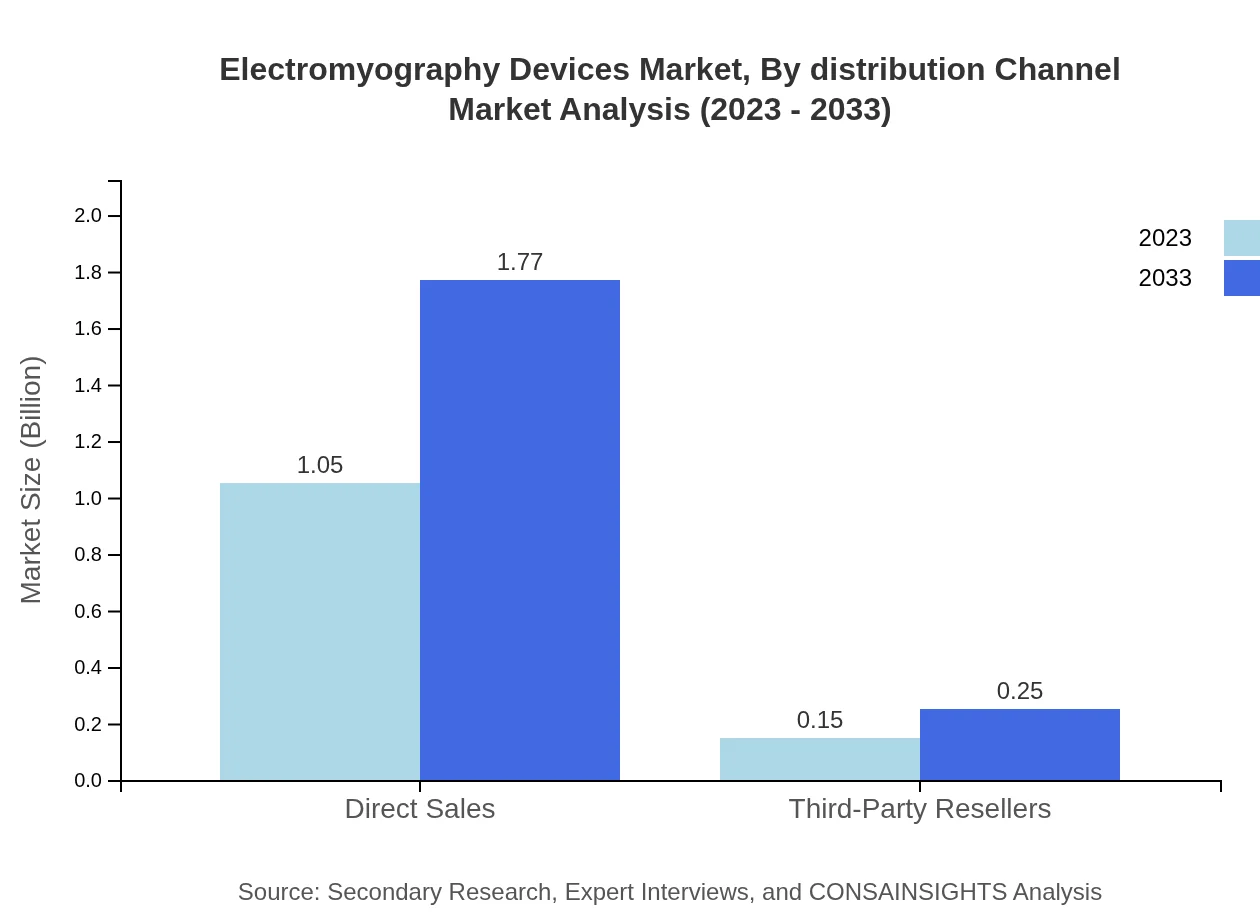

Electromyography Devices Market Analysis By Distribution Channel

Direct sales continue to dominate the distribution channel for Electromyography Devices, reflecting the preference for manufacturers' direct engagement with healthcare facilities. Third-party resellers play a supporting role, contributing to overall market accessibility.

Electromyography Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Electromyography Devices Industry

Natus Medical Incorporated:

A leading provider of medical devices, Natus specializes in EMG technologies and offers advanced diagnostic equipment for neurological disorders.Medtronic PLC:

Medtronic is a global leader in medical technology, providing a wide range of EMG devices integrated with advanced monitoring solutions.Neurosoft:

Neurosoft develops niche EMG products with a focus on innovation and usability in both clinical and research settings.Dantec Dynamics:

Known for high-quality EMG devices, Dantec Dynamics focuses on advanced technology to improve patient diagnostics and therapeutic outcomes.We're grateful to work with incredible clients.

FAQs

What is the market size of electromyography Devices?

The electromyography devices market is estimated to reach approximately $1.2 billion by 2033, growing at a CAGR of 5.2%. This growth is driven by advancements in technology and increased demand for non-invasive diagnostics.

What are the key market players or companies in this electromyography Devices industry?

Key players in the electromyography devices market include Medtronic, Siemens Healthineers, and NeuroMetrix. These companies are leading innovations by investing in research and development, as well as expanding their product offerings to enhance market share.

What are the primary factors driving the growth in the electromyography devices industry?

Growth in the electromyography devices industry is driven by factors such as increasing prevalence of neuromuscular disorders, rising elderly population, and advancements in technology. Additionally, expanded healthcare access and rising awareness of electromyography procedures contribute to this growth.

Which region is the fastest Growing in the electromyography Devices market?

North America is currently the fastest-growing region in the electromyography devices market, projected to grow from $0.43 billion in 2023 to $0.73 billion by 2033. This growth is attributed to high healthcare expenditure and robust healthcare infrastructure.

Does ConsaInsights provide customized market report data for the electromyography Devices industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs. This includes in-depth analysis, forecasts, and insights on market trends, competitors, and regional performance, ensuring clients receive relevant and actionable data.

What deliverables can I expect from this electromyography Devices market research project?

Deliverables from the electromyography devices market research project include a comprehensive market report, executive summary, detailed segmentation analysis, competitive landscape assessment, and recommendations based on key market trends and consumer insights.

What are the market trends of electromyography Devices?

Current trends in the electromyography devices market include a shift towards wireless technology, integration with AI-driven software for enhanced diagnostics, and increasing adoption in sports science and rehabilitation settings. These trends enhance user experience and diagnostic accuracy.