Electronic Chemicals And Materials Market Report

Published Date: 02 February 2026 | Report Code: electronic-chemicals-and-materials

Electronic Chemicals And Materials Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Electronic Chemicals and Materials market from 2023 to 2033, covering market size, trends, and key insights to forecast future changes and industry developments.

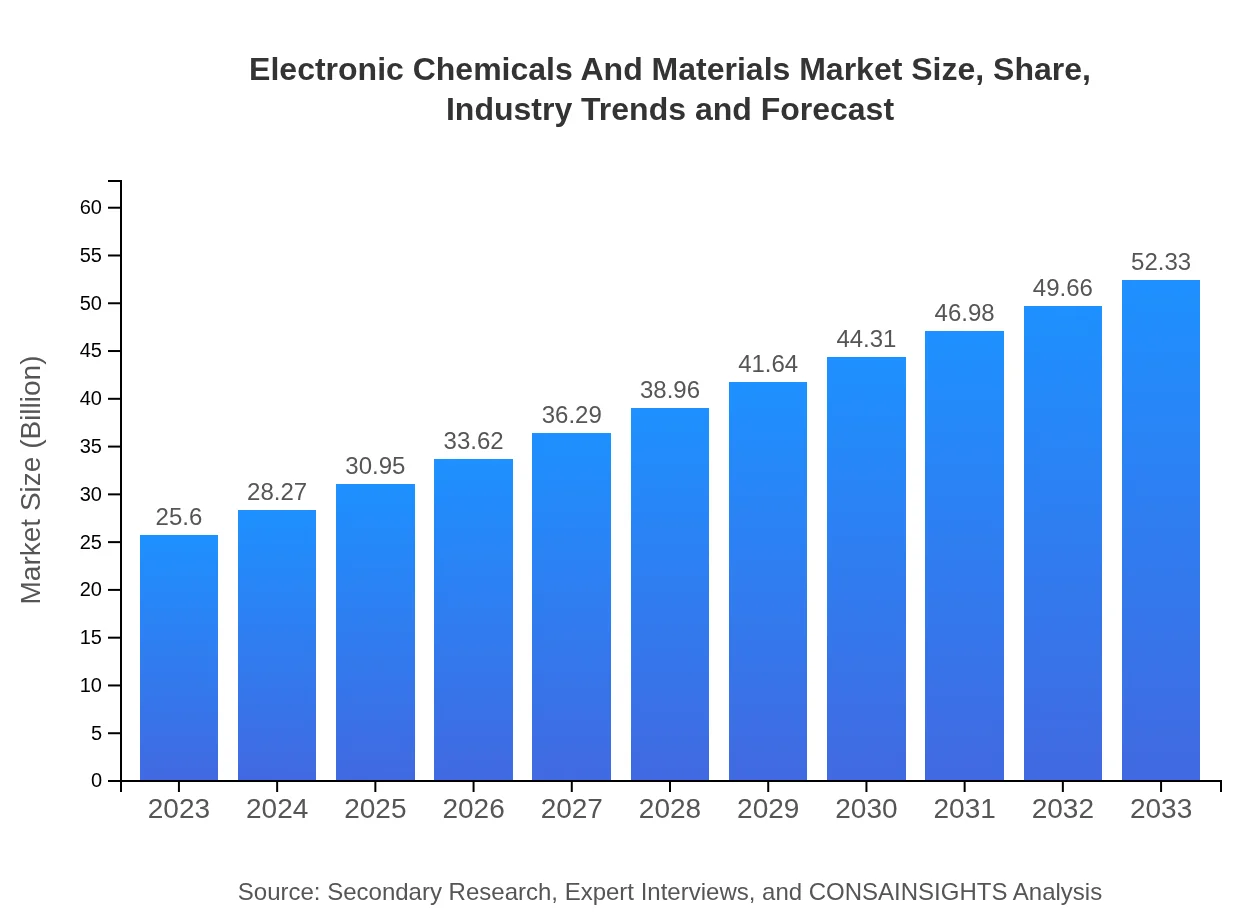

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.60 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $52.33 Billion |

| Top Companies | BASF SE, Dow Inc., Air Products and Chemicals Inc., DuPont |

| Last Modified Date | 02 February 2026 |

Electronic Chemicals And Materials Market Overview

Customize Electronic Chemicals And Materials Market Report market research report

- ✔ Get in-depth analysis of Electronic Chemicals And Materials market size, growth, and forecasts.

- ✔ Understand Electronic Chemicals And Materials's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Electronic Chemicals And Materials

What is the Market Size & CAGR of Electronic Chemicals And Materials market in 2023?

Electronic Chemicals And Materials Industry Analysis

Electronic Chemicals And Materials Market Segmentation and Scope

Tell us your focus area and get a customized research report.

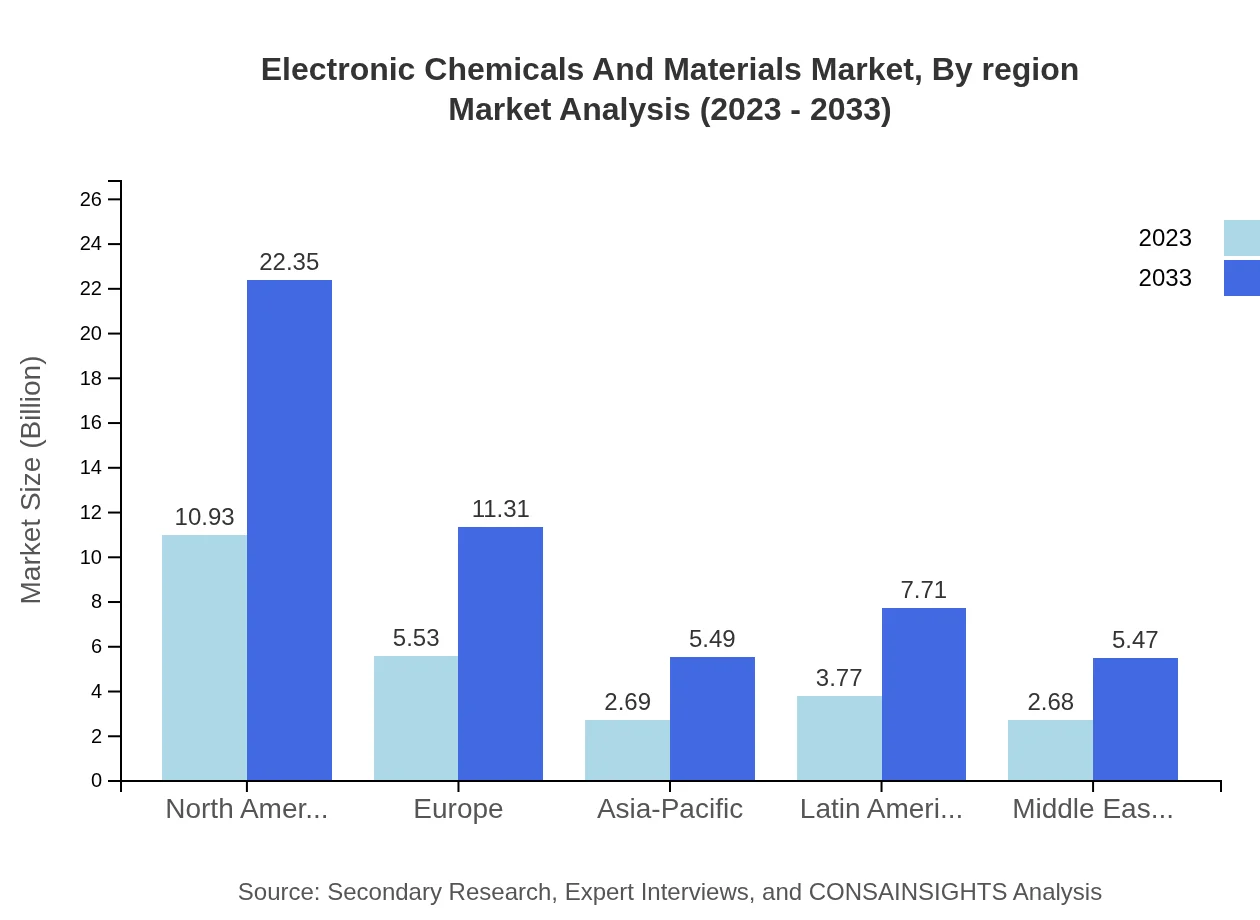

Electronic Chemicals And Materials Market Analysis Report by Region

Europe Electronic Chemicals And Materials Market Report:

Europe's market is anticipated to grow from $7.44 billion in 2023 to $15.21 billion in 2033. The region's focus on sustainable technologies and high-quality manufacturing processes is driving demand for advanced electronic materials.Asia Pacific Electronic Chemicals And Materials Market Report:

The Asia-Pacific region is projected to witness substantial growth in the Electronic Chemicals and Materials market, with an estimated market size of $9.97 billion by 2033, up from $4.88 billion in 2023. The increasing manufacturing capacities in countries like China, Japan, and South Korea, spurred by robust electronic device exports, are key drivers.North America Electronic Chemicals And Materials Market Report:

North America holds a crucial part of the Electronic Chemicals and Materials market, projected to expand from $8.22 billion in 2023 to $16.80 billion by 2033. This growth is attributed to high technology adoption and significant investments in research and development led by the USA.South America Electronic Chemicals And Materials Market Report:

In South America, the market is expected to grow from $2.46 billion in 2023 to $5.02 billion by 2033. This growth is aided by a gradual increase in electronic manufacturing and consumption, particularly in Brazil and Argentina, supported by rising investment in technology.Middle East & Africa Electronic Chemicals And Materials Market Report:

In the Middle East and Africa, the Electronic Chemicals and Materials market is projected to increase from $2.60 billion in 2023 to $5.32 billion by 2033. This growth results from emerging market developments in electronics and efforts to modernize existing infrastructures.Tell us your focus area and get a customized research report.

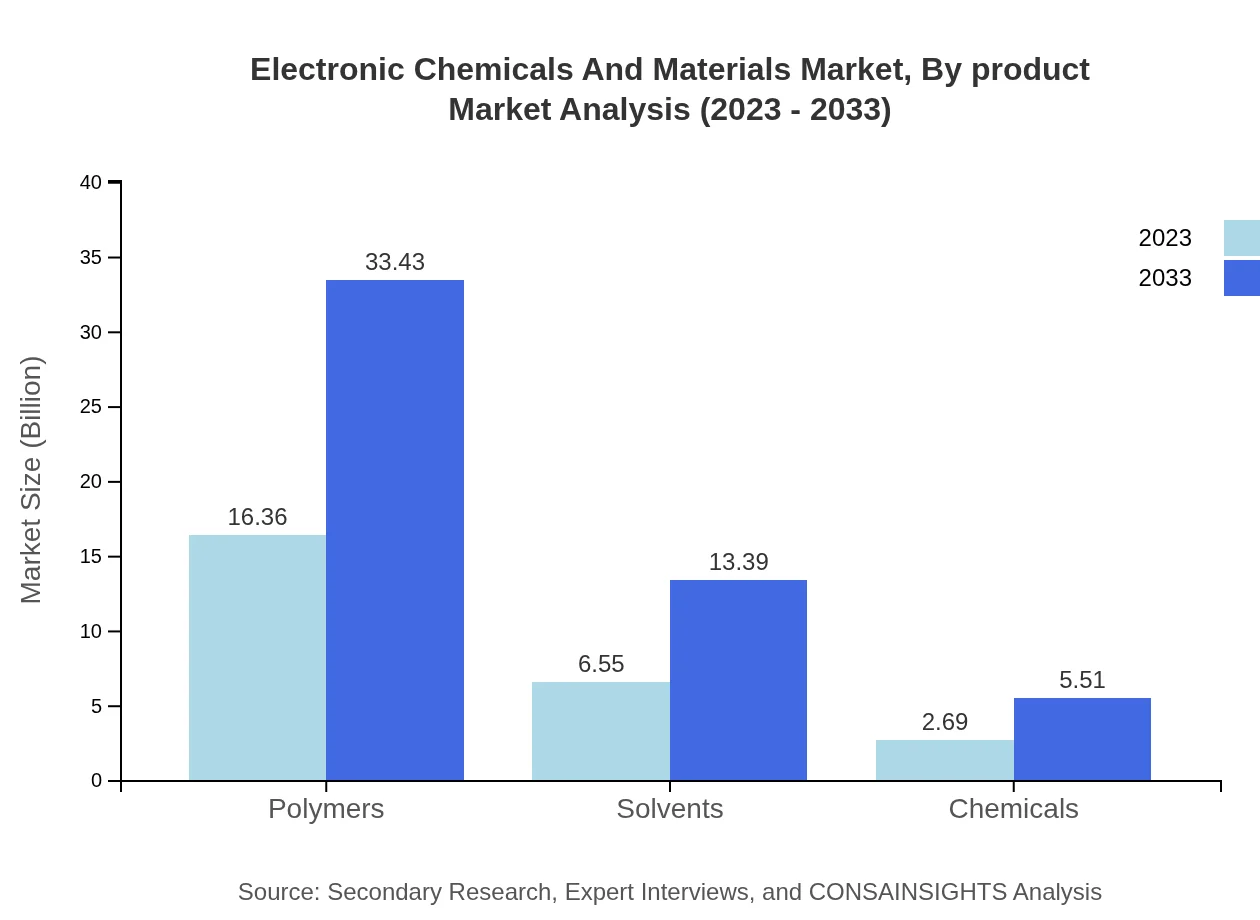

Electronic Chemicals And Materials Market Analysis By Product

Product segments such as polymers dominate the market, estimated to grow from $16.36 billion in 2023 to $33.43 billion by 2033, holding a 63.89% market share. Solvents and specialized chemicals are the next significant segments, with a projected share of 25.59% and 10.52%, respectively.

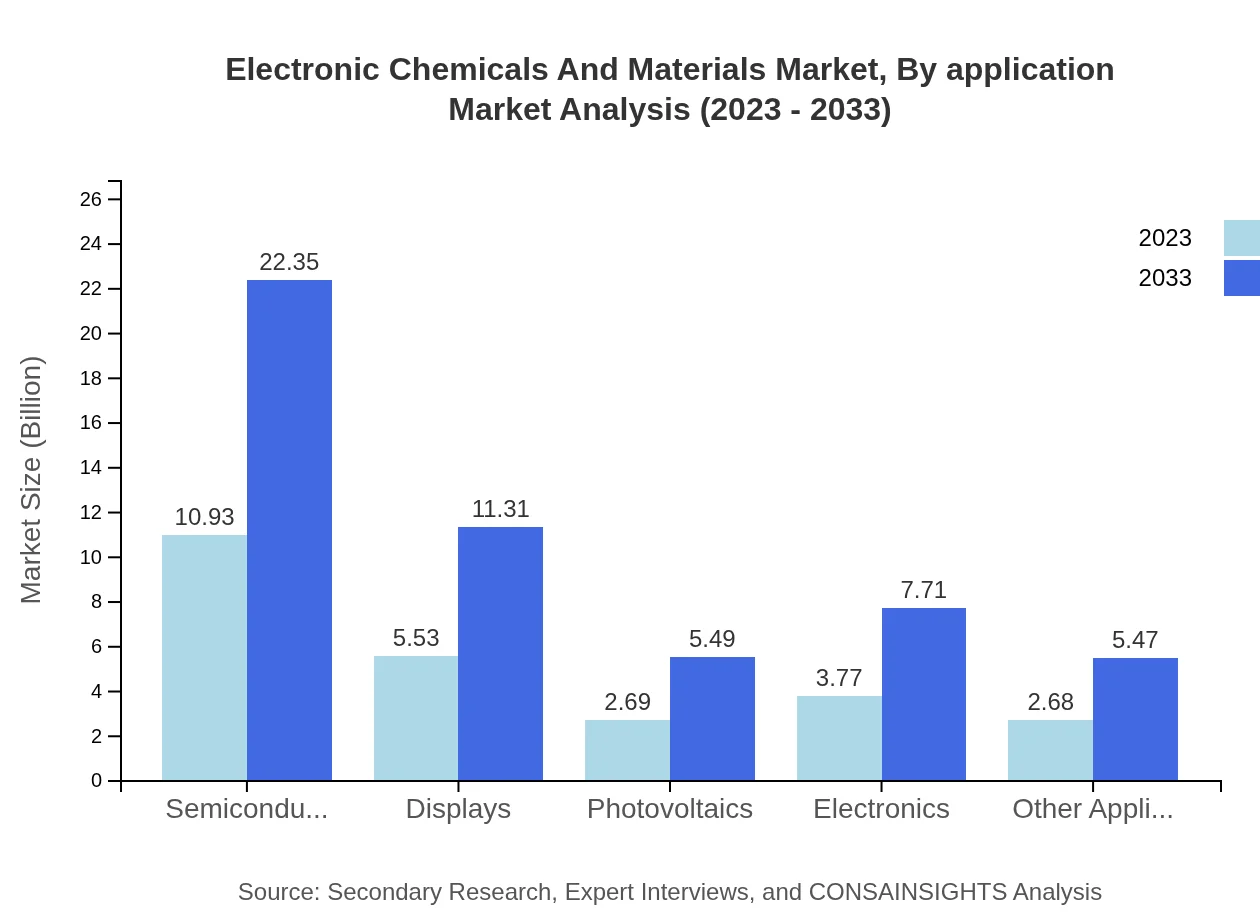

Electronic Chemicals And Materials Market Analysis By Application

Key applications driving the market growth include consumer electronics and healthcare, with consumer electronics alone estimated to increase from $10.93 billion in 2023 to $22.35 billion by 2033, maintaining a 42.71% market share. Other important applications include automotive and telecommunications.

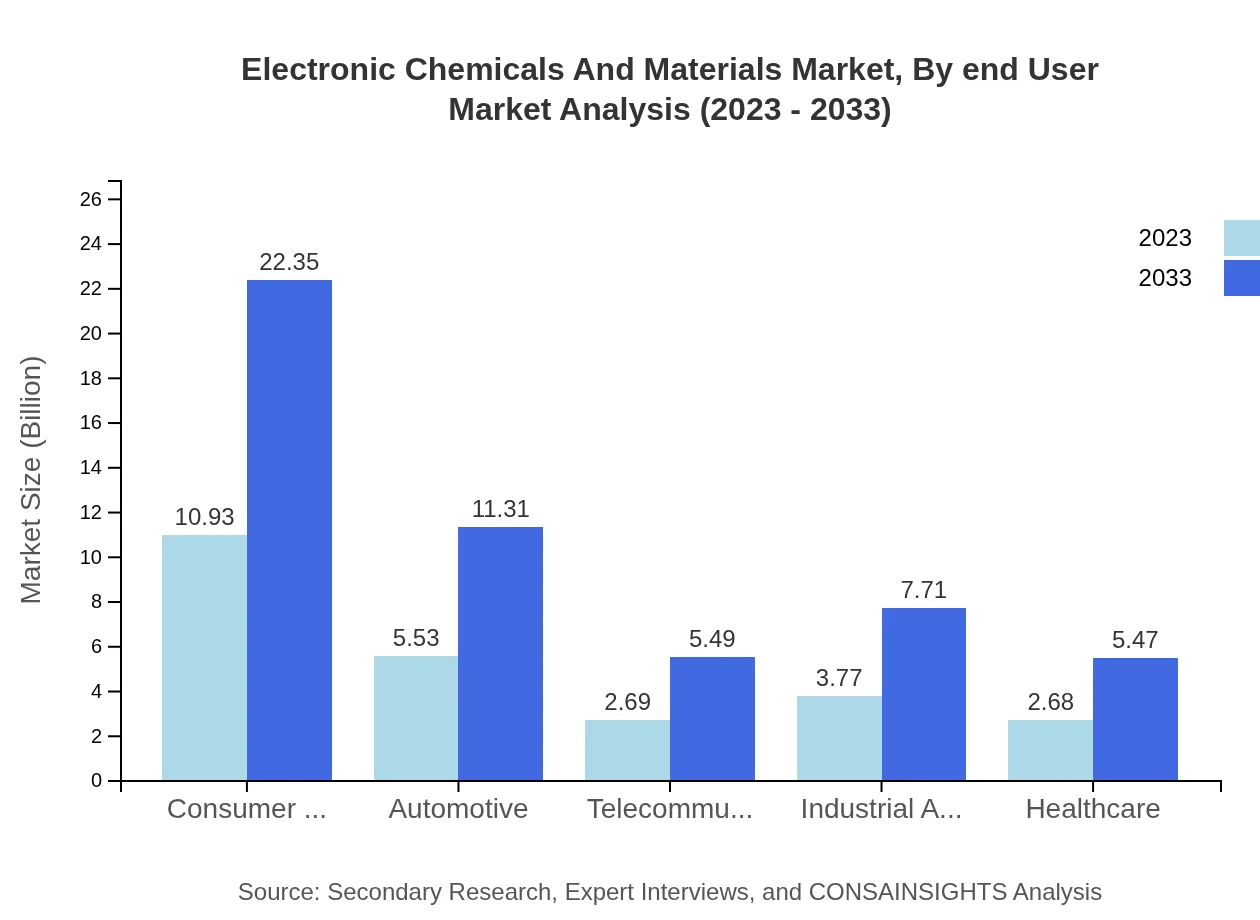

Electronic Chemicals And Materials Market Analysis By End User

The growth of the Electronic Chemicals and Materials market is significantly influenced by end-user industries, especially semiconductors and consumer electronics. The semiconductor segment is on track to grow from $10.93 billion in 2023 to $22.35 billion by 2033, maintaining a strong market share of 42.71%.

Electronic Chemicals And Materials Market Analysis By Region

Regional analysis highlights North America, Asia-Pacific, and Europe as leaders in the Electronic Chemicals and Materials market. These regions collectively account for over 75% of the global market share, driven by technological advancements and robust demand.

Electronic Chemicals And Materials Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Electronic Chemicals And Materials Industry

BASF SE:

BASF is a global leader in chemical production known for its commitment to innovation and sustainability, offering a diverse range of electronic chemicals and materials.Dow Inc.:

Dow is a prominent chemical company providing advanced materials and technologies, significantly impacting the electronics segment through innovative product offerings.Air Products and Chemicals Inc.:

Specializing in industrial gases and specialty chemicals, Air Products enhances electronic manufacturing technologies and processes.DuPont:

DuPont is a well-known brand in the electronic materials sector, offering solutions for semiconductor manufacturing and advanced electronics.We're grateful to work with incredible clients.

FAQs

What is the market size of electronic Chemicals And Materials?

The electronic chemicals and materials market is projected to reach $25.6 billion in 2033, growing at a CAGR of 7.2% from its current value. This growth signifies increasing demand for advanced electronic applications and technologies.

What are the key market players or companies in the electronic Chemicals And Materials industry?

Key players in the electronic chemicals and materials industry include global leaders like BASF, Dow Chemical, and Merck Group. These companies dominate with their cutting-edge innovations and extensive product portfolios tailored for electronics manufacturing.

What are the primary factors driving the growth in the electronic chemicals and materials industry?

Growth drivers for the electronic chemicals and materials market include rising demand for consumer electronics, advances in semiconductor manufacturing, and the expansion of renewable energy technologies. Increased investments in R&D and infrastructure also contribute significantly.

Which region is the fastest Growing in the electronic chemicals and materials?

The Asia-Pacific region is identified as the fastest-growing area for electronic chemicals and materials, expected to increase from $4.88 billion in 2023 to $9.97 billion in 2033, catalyzed by burgeoning electronics manufacturing and technology adoption.

Does ConsaInsights provide customized market report data for the electronic chemicals and materials industry?

Yes, ConsaInsights offers customized market reports tailored specifically to client needs within the electronic chemicals and materials industry, delivering insights that guide strategic decision-making and market entry.

What deliverables can I expect from this electronic chemicals and materials market research project?

From the electronic chemicals and materials market research project, you can expect detailed reports including market size analyses, growth forecasts, competitive landscapes, consumer behavior insights, and strategic recommendations for market entry.

What are the market trends of electronic chemicals and materials?

Current trends in the electronic chemicals and materials market include the rise in eco-friendly materials, innovations in nanotechnology, and increased demand for advanced semiconductor applications, highlighting the sector's focus on sustainability and technological advancement.