Electronic Contract Assembly Market Report

Published Date: 31 January 2026 | Report Code: electronic-contract-assembly

Electronic Contract Assembly Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Electronic Contract Assembly market from 2023 to 2033, featuring insights into market trends, growth, and regional dynamics, alongside a deeper look at technology, product performance, and key market players.

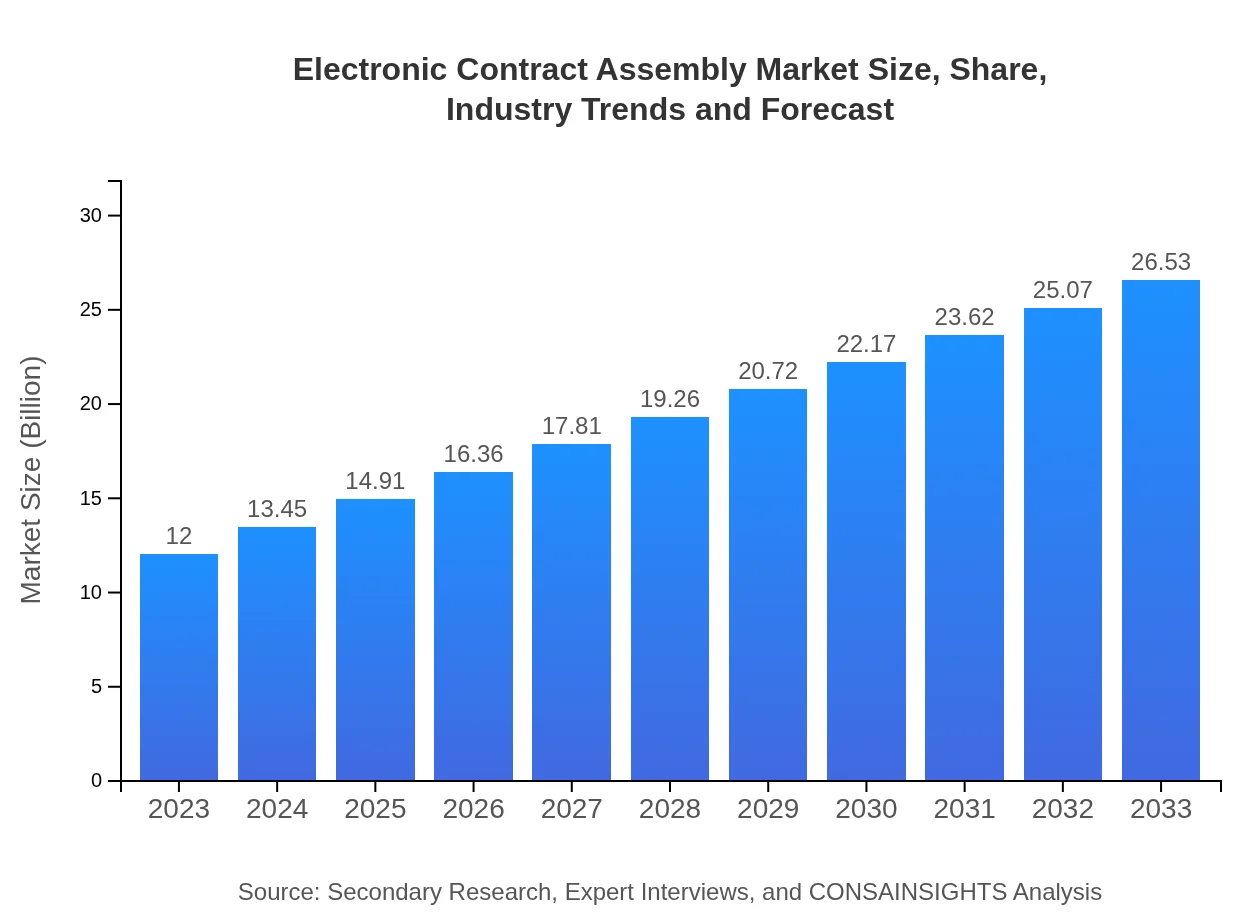

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.00 Billion |

| CAGR (2023-2033) | 8.0% |

| 2033 Market Size | $26.53 Billion |

| Top Companies | Foxconn Technology Group, Flex Ltd., Jabil Inc., Celestica Inc., Sanmina Corporation |

| Last Modified Date | 31 January 2026 |

Electronic Contract Assembly Market Overview

Customize Electronic Contract Assembly Market Report market research report

- ✔ Get in-depth analysis of Electronic Contract Assembly market size, growth, and forecasts.

- ✔ Understand Electronic Contract Assembly's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Electronic Contract Assembly

What is the Market Size & CAGR of Electronic Contract Assembly market in 2023?

Electronic Contract Assembly Industry Analysis

Electronic Contract Assembly Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Electronic Contract Assembly Market Analysis Report by Region

Europe Electronic Contract Assembly Market Report:

Europe's market, estimated at $3.42 billion in 2023, is forecasted to grow to $7.55 billion by 2033. The region emphasizes high-quality manufacturing standards and sustainability, leading to greater demand for eco-friendly assembly practices and technologies.Asia Pacific Electronic Contract Assembly Market Report:

The Asia Pacific region is poised to lead the market, with a size of $2.29 billion in 2023 and projected to reach $5.05 billion by 2033. This growth is bolstered by countries like China, Japan, and South Korea, which are at the forefront of electronics manufacturing. The region benefits from lower production costs and a robust supply chain ecosystem.North America Electronic Contract Assembly Market Report:

North America shows strong growth momentum, with the market size projected to expand from $3.91 billion in 2023 to $8.65 billion by 2033. The presence of key players and a shift towards advanced manufacturing technologies underpin this expansion, with a resurgence in domestic production amid geopolitical shifts.South America Electronic Contract Assembly Market Report:

In South America, the market is expected to grow from $0.74 billion in 2023 to $1.64 billion by 2033. The expansion is significantly driven by increased electronics production in Brazil and Argentina, aligned with new governmental policies encouraging foreign investments.Middle East & Africa Electronic Contract Assembly Market Report:

The Middle East and Africa's market is expected to grow from $1.64 billion in 2023 to $3.63 billion by 2033. The burgeoning electronics market, coupled with investment in infrastructure and technology, positions the region as an emerging player in contract assembly services.Tell us your focus area and get a customized research report.

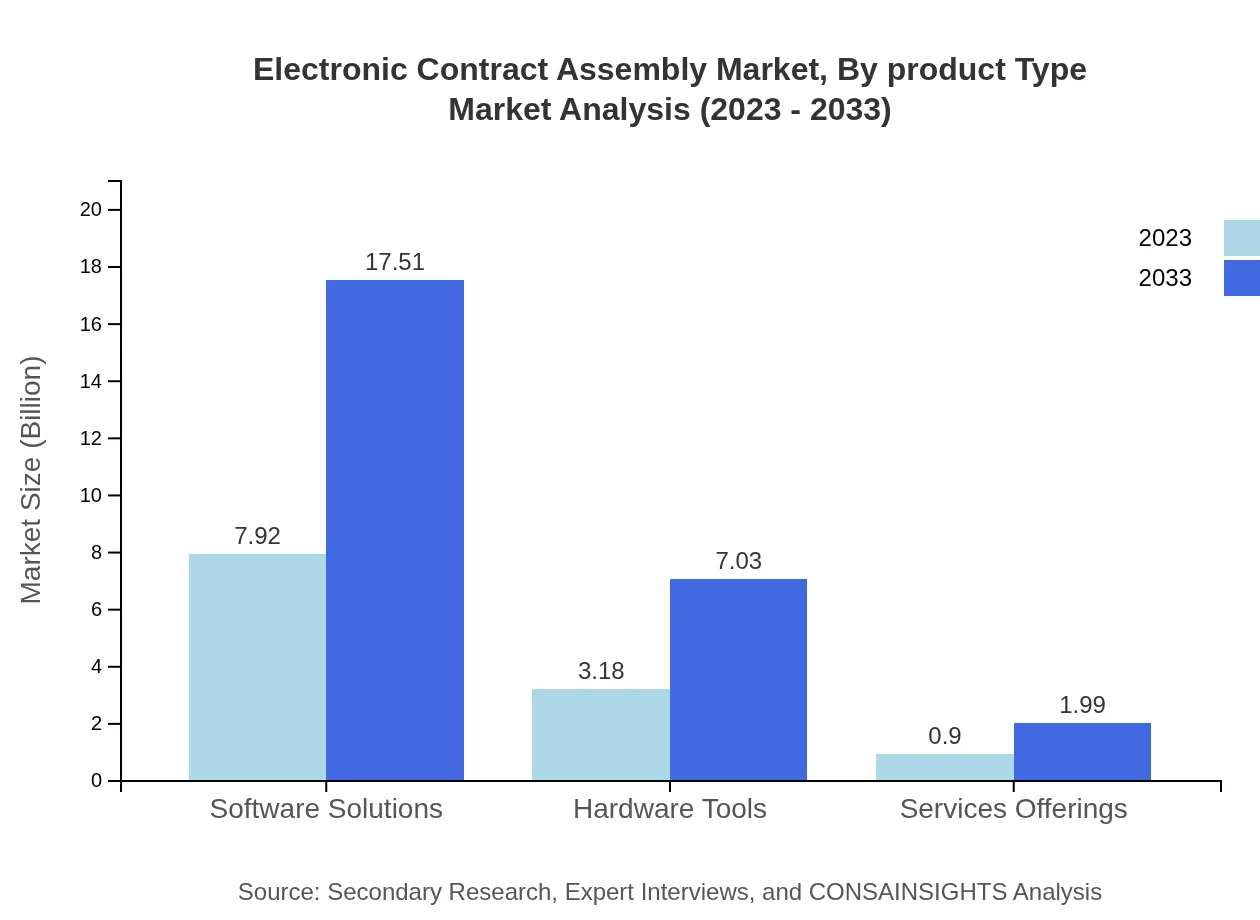

Electronic Contract Assembly Market Analysis By Product Type

Within the Electronic Contract Assembly market, Software Solutions dominate with a market size of $7.92 billion in 2023, expected to increase to $17.51 billion by 2033, while maintaining a stable market share of 66%. Hardware Tools follow, growing from $3.18 billion to $7.03 billion over the same period, holding 26.49% of the market. Services Offerings, Service Contracts, and Purchase Agreements also form essential segments, illustrating the diverse revenue streams within the market.

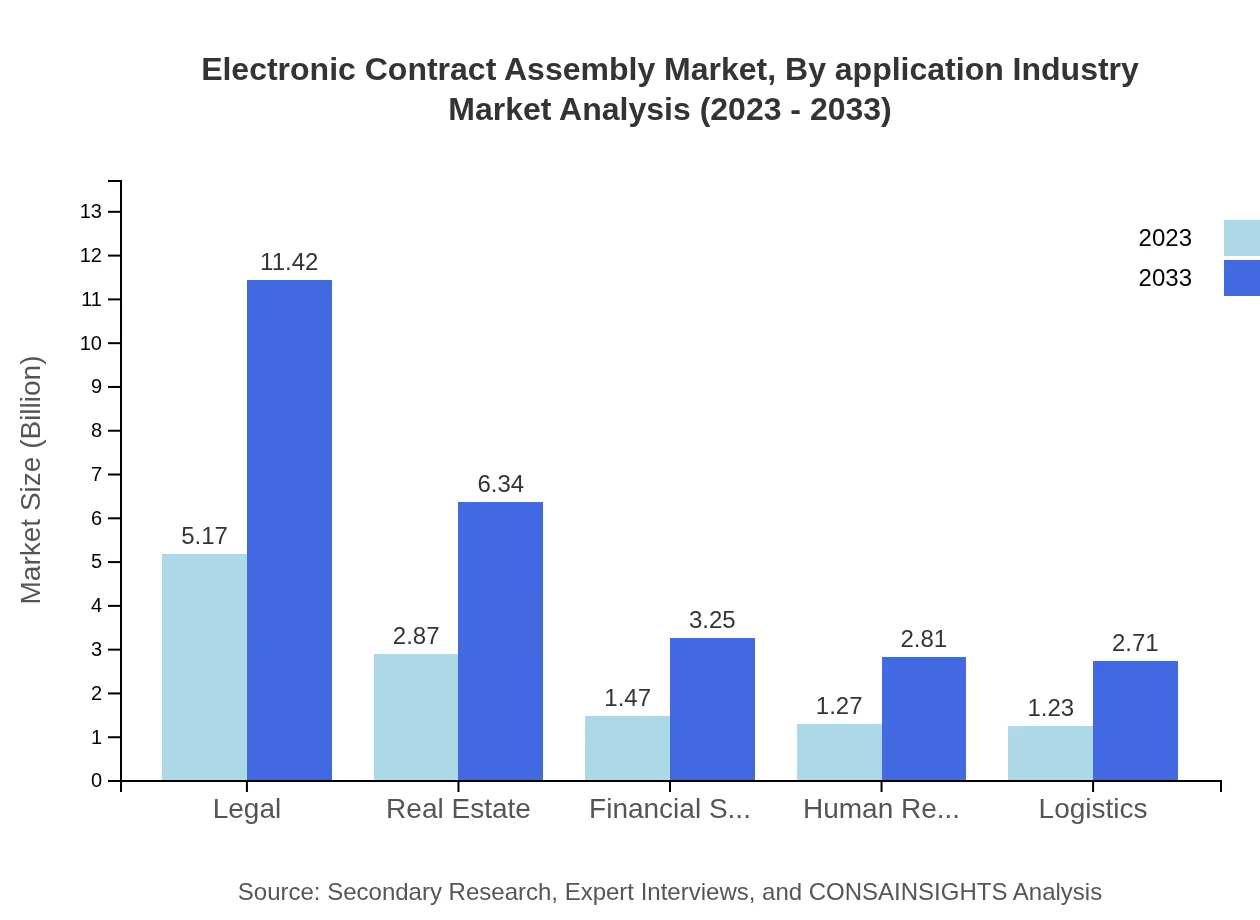

Electronic Contract Assembly Market Analysis By Application Industry

The contract assembly landscape includes key application industries such as automotive, consumer electronics, telecommunications, and medical devices. The automotive sector enjoys significant share and growth, driven by advancements in electric vehicle production. Consumer electronics demand is spurred by rapid technological developments, while medical device assembly requires stringent quality controls, propelling the need for specialized contract manufacturers.

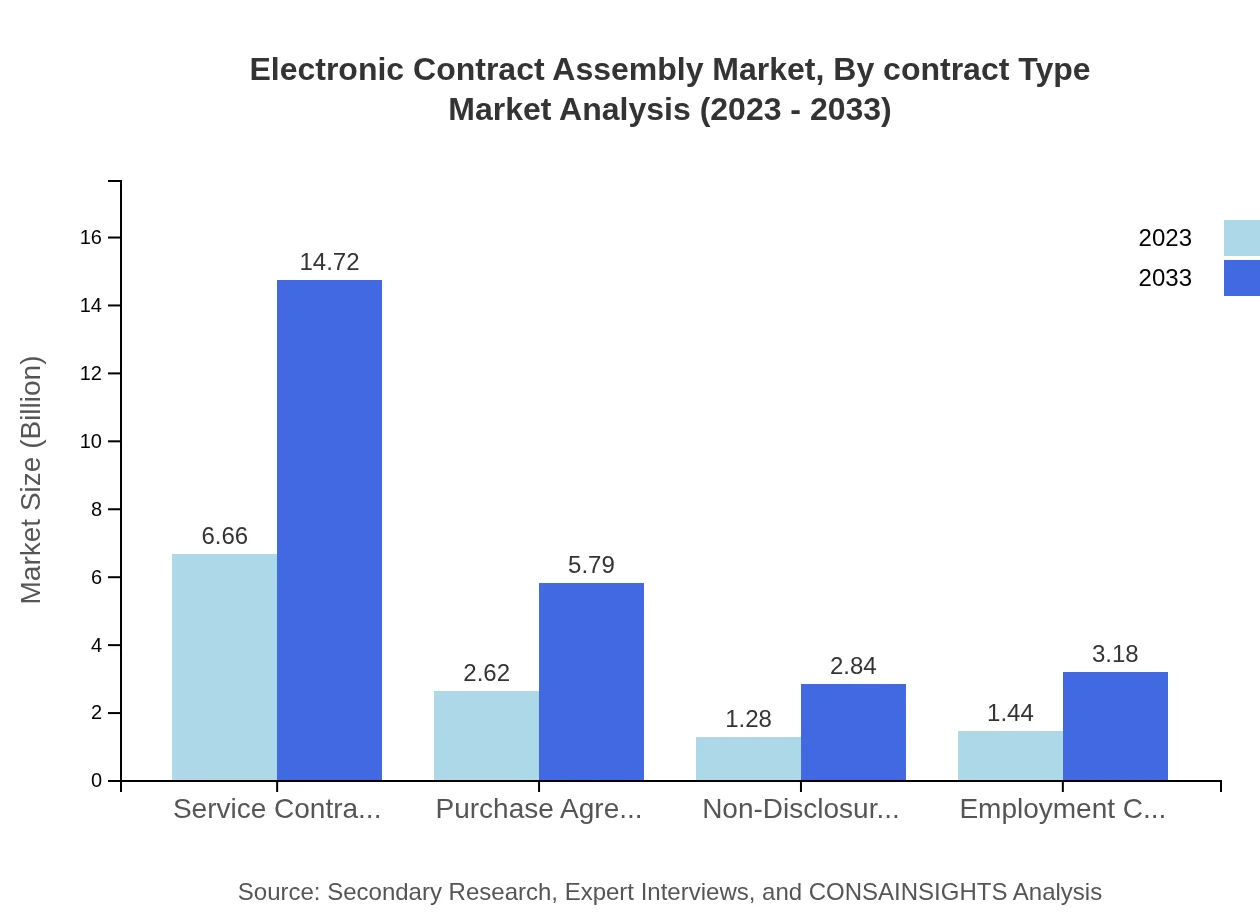

Electronic Contract Assembly Market Analysis By Contract Type

Contract types are critical in defining partnerships between manufacturers and assembly service providers. Service Contracts lead the segment with a market size of $6.66 billion in 2023, anticipated to double by 2033, while Purchase Agreements and Non-Disclosure Agreements also contribute notably to market dynamics.

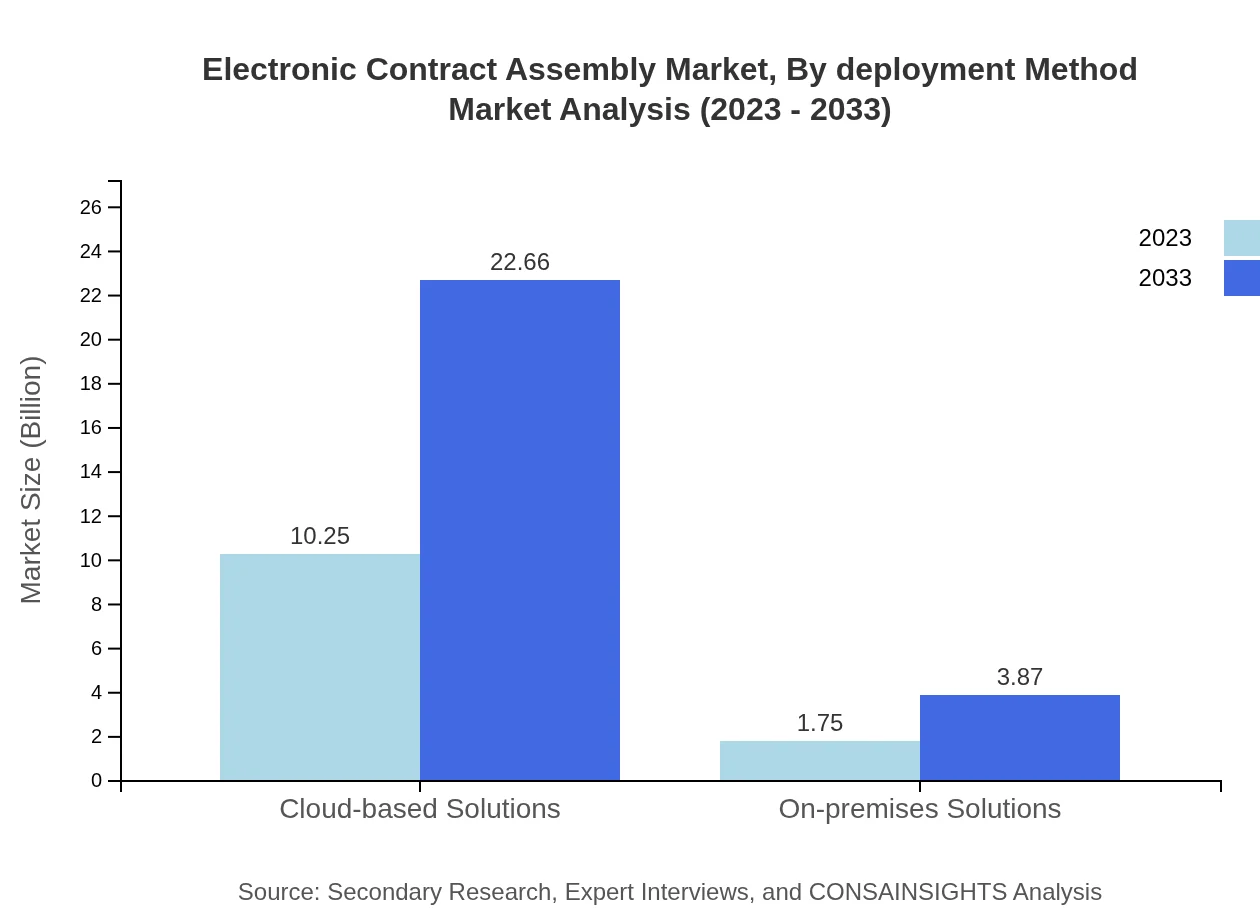

Electronic Contract Assembly Market Analysis By Deployment Method

The deployment of electronic contract assembly solutions varies between cloud-based and on-premises solutions. Cloud-based Solutions dominate with market sizes projected to escalate from $10.25 billion to $22.66 billion. In contrast, on-premises solutions, while important, account for a smaller segment with growth from $1.75 billion to $3.87 billion.

Electronic Contract Assembly Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Electronic Contract Assembly Industry

Foxconn Technology Group:

A prominent player in electronics manufacturing services, Foxconn specializes in the assembly of consumer electronics and has extensive experience with major brands.Flex Ltd.:

Flex is well-known for providing innovative supply chain solutions and manufacturing services, particularly in electronics, automotive, and healthcare sectors.Jabil Inc.:

A major global player in electronic manufacturing services, Jabil emphasizes operational efficiency and product innovation to drive value for its customers.Celestica Inc.:

Celestica is recognized for its advanced manufacturing and supply chain solutions, delivering integrated technologies tailored for multiple industries.Sanmina Corporation:

Sanmina specializes in high-quality electronic manufacturing services for a wide range of sectors, with a focus on complex products and services.We're grateful to work with incredible clients.

FAQs

What is the market size of electronic Contract Assembly?

The electronic contract assembly market is projected to reach approximately $12 billion by 2033, with a compound annual growth rate (CAGR) of 8.0% from 2023 to 2033.

What are the key market players or companies in this electronic Contract Assembly industry?

Key players in the electronic contract assembly industry include major firms specializing in software solutions, hardware tools, and comprehensive service offerings, which are crucial for delivering efficient contract assembly solutions.

What are the primary factors driving the growth in the electronic Contract Assembly industry?

Growth in the electronic contract assembly market is driven by increasing demand for automation in legal processes, advancements in cloud technologies, and the need for secure and efficient contract management solutions.

Which region is the fastest Growing in the electronic Contract Assembly?

The fastest-growing region in the electronic contract assembly market is North America, projected to grow from $3.91 billion in 2023 to $8.65 billion by 2033, reflecting strong demand for electronic solutions.

Does ConsaInsights provide customized market report data for the electronic Contract Assembly industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the electronic contract assembly industry, helping businesses gain tailored insights and competitive advantages.

What deliverables can I expect from this electronic Contract Assembly market research project?

Expect deliverables including detailed market analysis, segment insights, regional trends, growth forecasts, and competitive landscapes within the electronic contract assembly industry.

What are the market trends of electronic Contract Assembly?

Current market trends include a shift towards cloud-based solutions which dominate with an 85.41% market share, increasing digitalization across various sectors, and a move towards integrated service offerings.