Electronic Discovery Market Report

Published Date: 31 January 2026 | Report Code: electronic-discovery

Electronic Discovery Market Size, Share, Industry Trends and Forecast to 2033

This report provides a thorough analysis of the Electronic Discovery market from 2023 to 2033, offering insights into market size, trends, regional dynamics, segmentation, and competitive landscape for stakeholders in the industry.

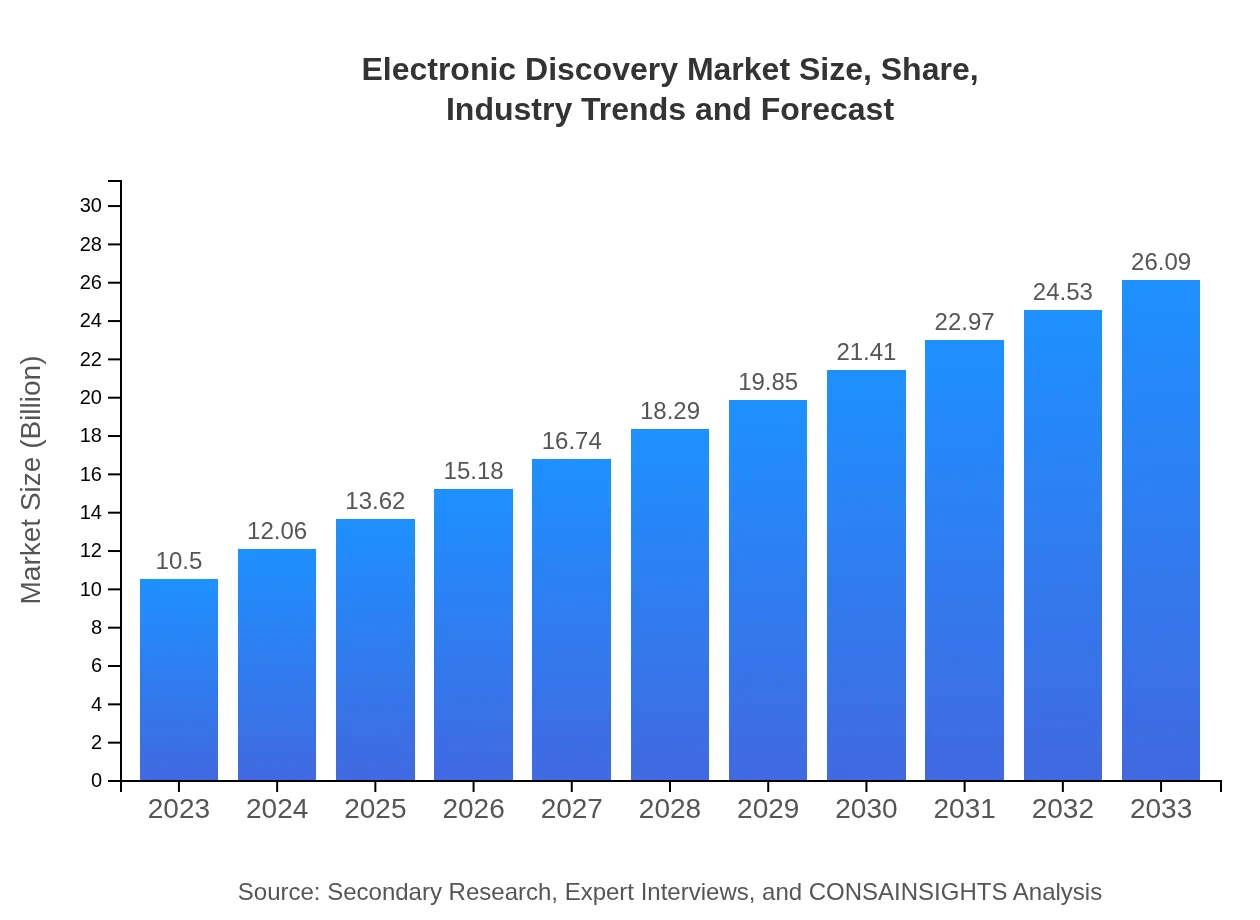

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $26.09 Billion |

| Top Companies | Relativity, FTI Consulting, OpenText, Everlaw |

| Last Modified Date | 31 January 2026 |

Electronic Discovery Market Overview

Customize Electronic Discovery Market Report market research report

- ✔ Get in-depth analysis of Electronic Discovery market size, growth, and forecasts.

- ✔ Understand Electronic Discovery's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Electronic Discovery

What is the Market Size & CAGR of Electronic Discovery market in 2023?

Electronic Discovery Industry Analysis

Electronic Discovery Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Electronic Discovery Market Analysis Report by Region

Europe Electronic Discovery Market Report:

The European e-Discovery market is estimated at USD 3.56 billion in 2023, anticipating growth to USD 8.85 billion by 2033. Regulatory compliance and GDPR implications significantly influence the demand for e-Discovery solutions in this region.Asia Pacific Electronic Discovery Market Report:

In 2023, the e-Discovery market in the Asia Pacific is valued at USD 1.90 billion and is projected to grow to USD 4.72 billion by 2033. The region's growth is fueled by rapid digital transformation, increasing data breaches, and legislative changes enhancing data protection regulations.North America Electronic Discovery Market Report:

North America accounts for a substantial share of the electronic discovery market, with a valuation of USD 3.48 billion in 2023, projected to grow to USD 8.65 billion by 2033. The strong legal framework, coupled with high litigation rates and advanced technological adoption, underpins market growth.South America Electronic Discovery Market Report:

The electronic discovery market in South America is relatively smaller, valued at USD 0.15 billion in 2023 and expected to reach USD 0.36 billion by 2033. Growing awareness about data management and compliance is driving market expansion in this region.Middle East & Africa Electronic Discovery Market Report:

The Middle East and Africa market is valued at USD 1.41 billion in 2023 and is projected to reach USD 3.51 billion by 2033. The region's expanding legal landscape and increased focus on digital evidence are driving growth.Tell us your focus area and get a customized research report.

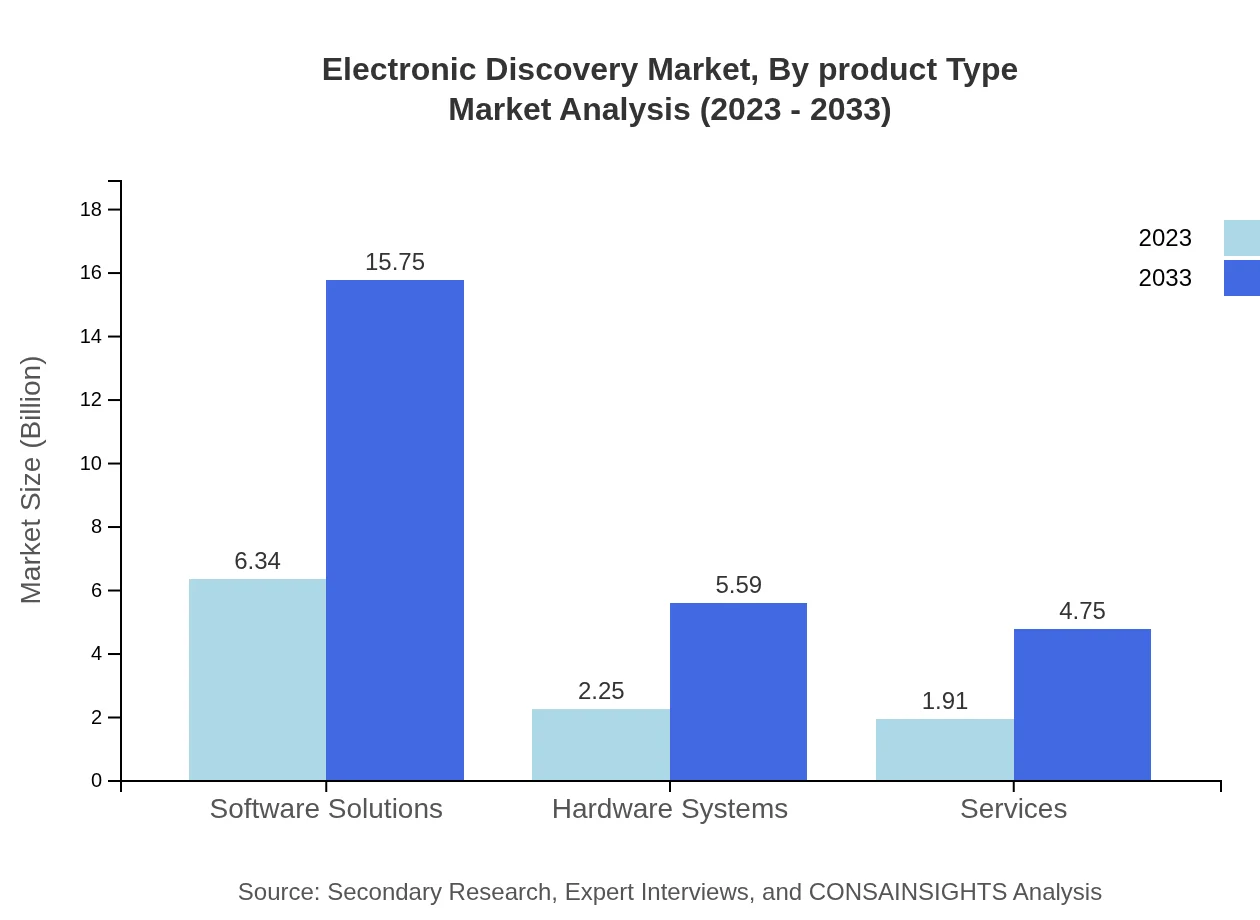

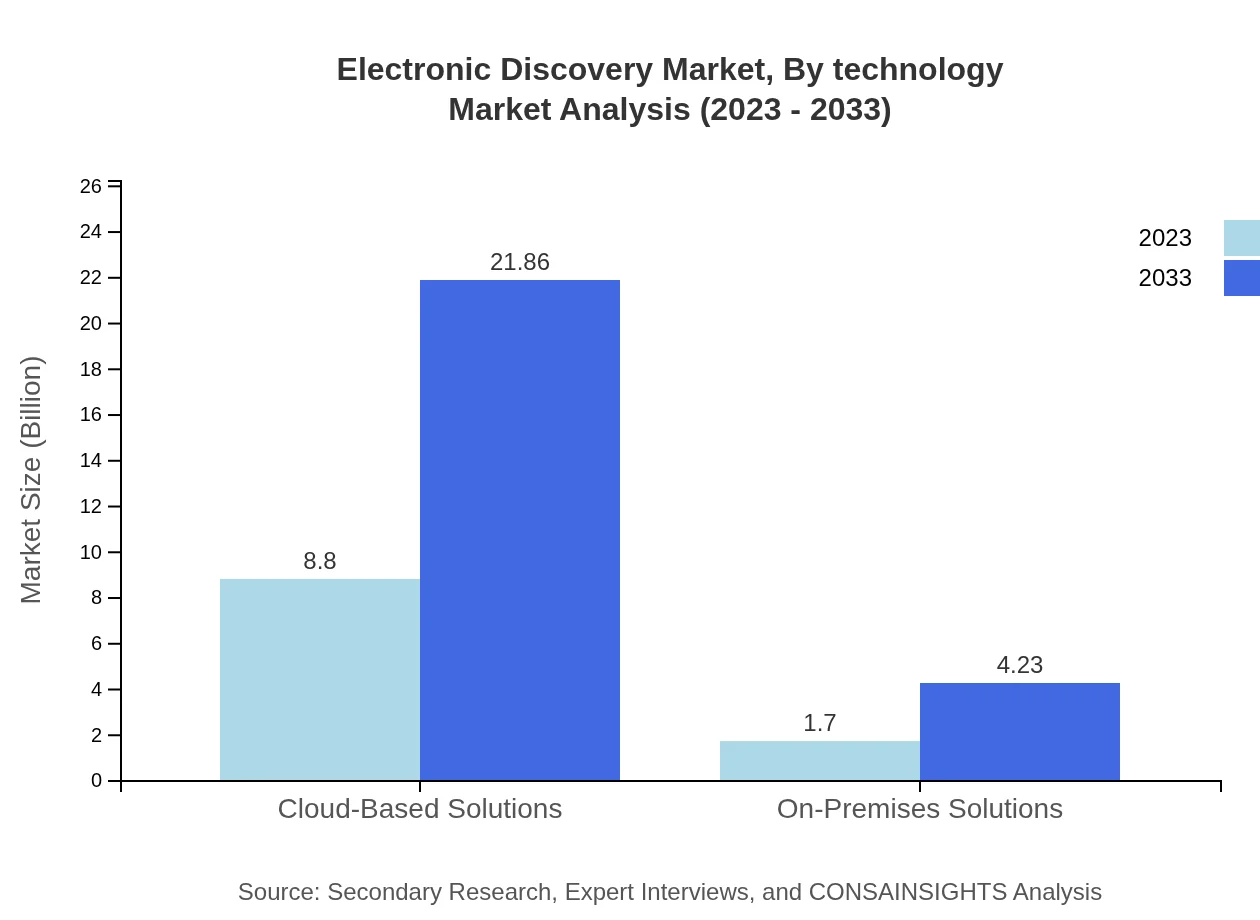

Electronic Discovery Market Analysis By Product Type

The market is highly influenced by product types such as cloud-based solutions, on-premises solutions, software solutions, hardware systems, and services. Cloud-based solutions dominate with market size growing from USD 8.80 billion in 2023 to USD 21.86 billion by 2033, showcasing a significant shift towards flexible, scalable e-Discovery options.

Electronic Discovery Market Analysis By Technology

Technological advancements significantly shape the e-Discovery market. With the adoption of AI and machine learning, organizations are leveraging automated data processing to enhance efficiency. The increasing reliance on these technologies is evident in the projected growth rates across various segments and verticals.

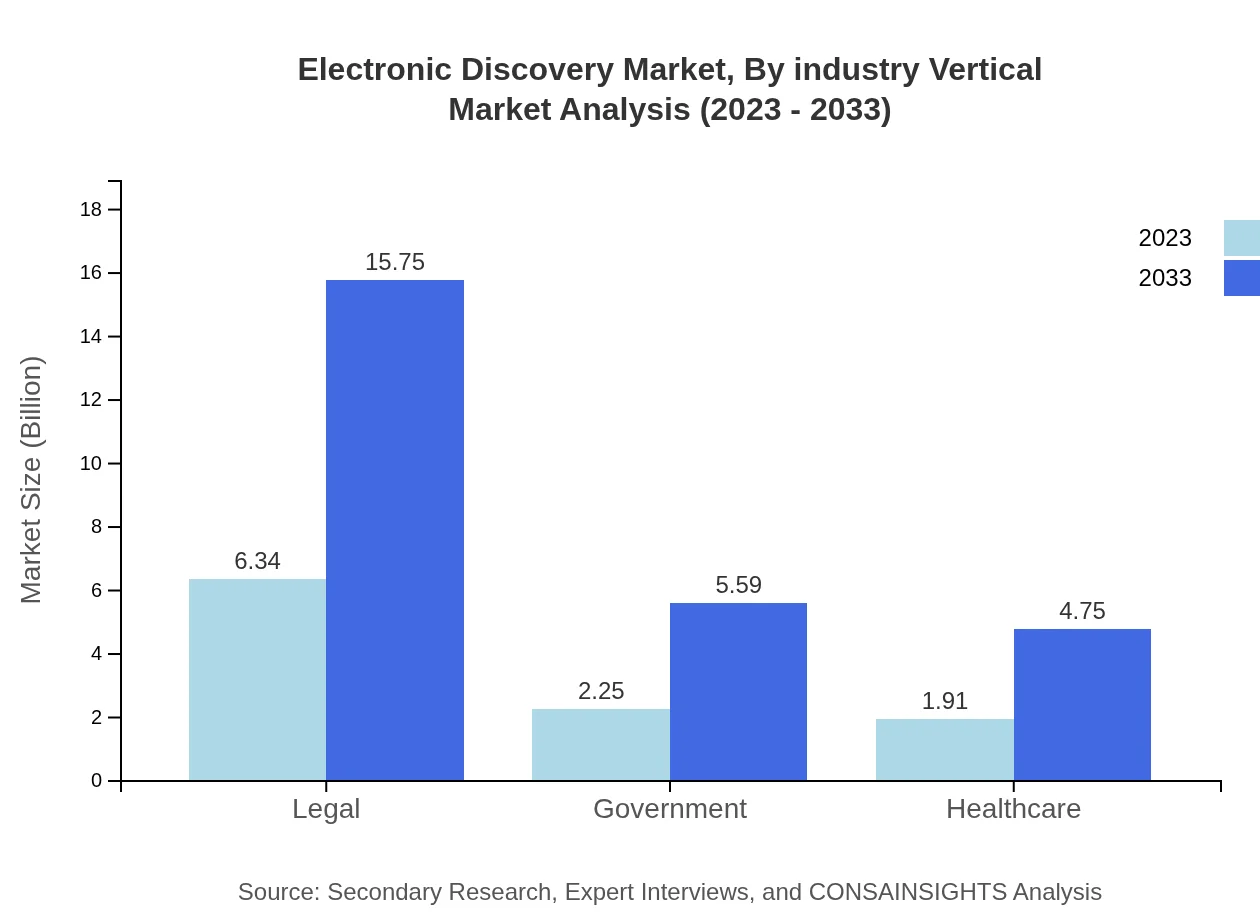

Electronic Discovery Market Analysis By Industry Vertical

The legal sector remains the largest end-user of e-Discovery solutions, projected to grow from USD 6.34 billion in 2023 to USD 15.75 billion by 2033. This substantial increase highlights the sector's commitment to compliance through enhanced e-Discovery practices.

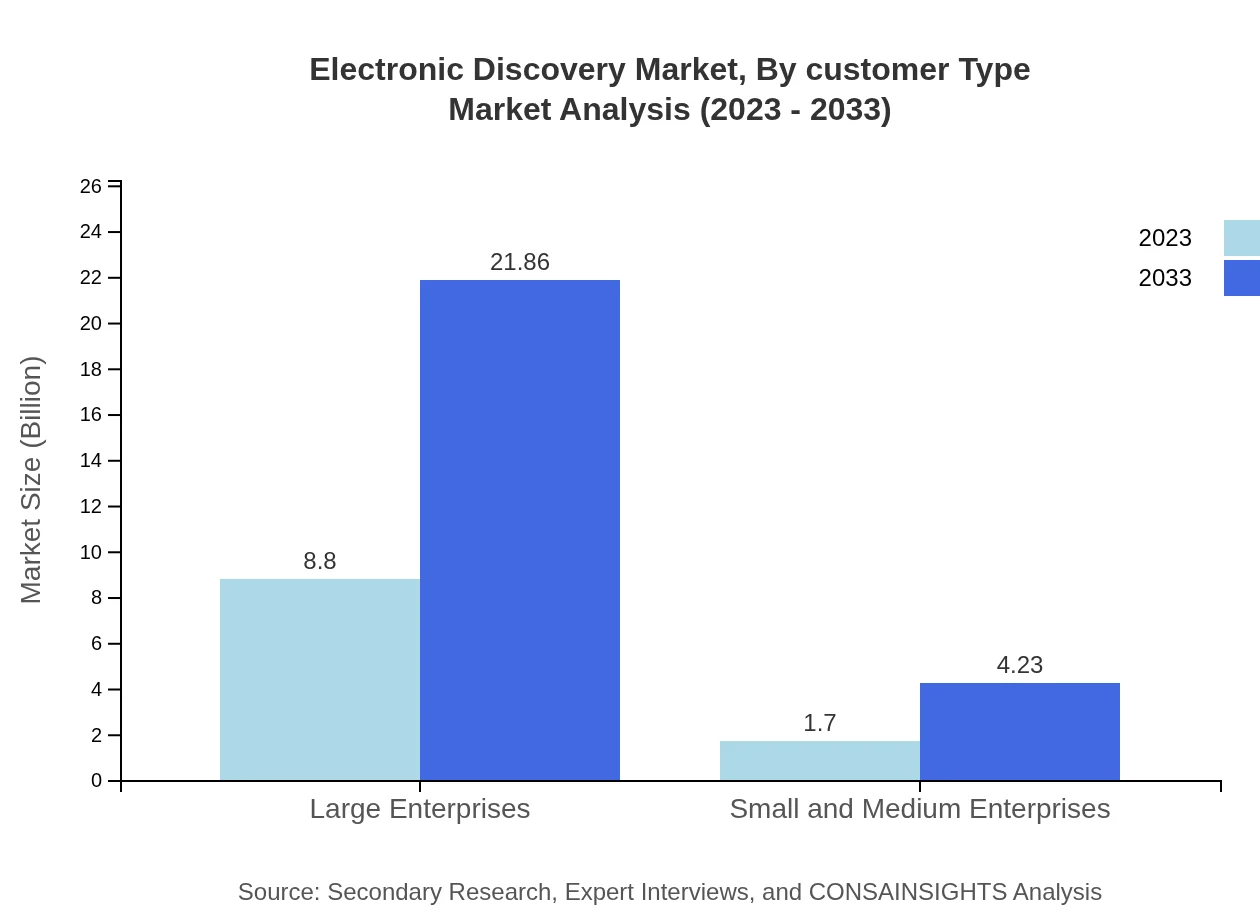

Electronic Discovery Market Analysis By Customer Type

Large enterprises lead the e-Discovery market, with a size advancing from USD 8.80 billion in 2023 to USD 21.86 billion by 2033. In contrast, small and medium enterprises are also increasingly adopting e-Discovery solutions, driven by rising awareness of compliance needs and data management efficiency.

Electronic Discovery Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Electronic Discovery Industry

Relativity:

Relativity offers a comprehensive e-Discovery platform that empowers legal professionals with tools for reviewing and analyzing vast amounts of data efficiently.FTI Consulting:

FTI Consulting provides integrated e-Discovery services, combining technology with proactive information governance to enhance legal matters.OpenText:

OpenText delivers advanced information management solutions, including e-Discovery systems that ensure compliance and streamline the legal process.Everlaw:

Everlaw provides a cloud-based e-Discovery solution that emphasizes ease of use and collaboration among legal teams.We're grateful to work with incredible clients.

FAQs

What is the market size of electronic Discovery?

The electronic discovery market is currently valued at approximately $10.5 billion in 2023. It is projected to grow at a CAGR of 9.2%, reaching significant expansion as businesses increasingly rely on digital solutions for legal and compliance purposes by 2033.

What are the key market players or companies in the electronic Discovery industry?

Key players in the electronic discovery industry include companies like Relativity, Logikcull, and OpenText. These firms are renowned for developing advanced e-discovery software solutions that streamline data collection, processing, and review, catering to large enterprises and law firms.

What are the primary factors driving the growth in the electronic Discovery industry?

Growth in the electronic discovery industry is primarily driven by the rising volume of electronic data, increasing legal disputes requiring documentation, regulatory compliance mandates, and advancements in AI and machine learning technology that enhance data processing efficiency.

Which region is the fastest Growing in the electronic Discovery?

The fastest-growing region in the electronic discovery market is Europe, with a market expected to grow from $3.56 billion in 2023 to $8.85 billion by 2033. This growth is attributed to stringent data protection regulations and an increase in digital information.

Does ConsaInsights provide customized market report data for the electronic Discovery industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the electronic discovery industry. This bespoke approach ensures clients receive relevant and actionable insights based on their unique business requirements and objectives.

What deliverables can I expect from this electronic Discovery market research project?

From this electronic discovery market research project, you can expect comprehensive reports including market size analysis, growth forecasts, segment data, competitive landscape assessments, and regional insights that inform strategic decision-making.

What are the market trends of electronic Discovery?

Current trends in the electronic discovery market include increasing adoption of cloud-based solutions, integration of AI for advanced data analytics, rising demand for cybersecurity measures, and growth in mobile e-discovery tools to enhance operational efficiency.