Electronic Drug Delivery Systems Market Report

Published Date: 31 January 2026 | Report Code: electronic-drug-delivery-systems

Electronic Drug Delivery Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Electronic Drug Delivery Systems (EDDS) market, focusing on insights, segmentation, regional performance, and future forecasts from 2023 to 2033.

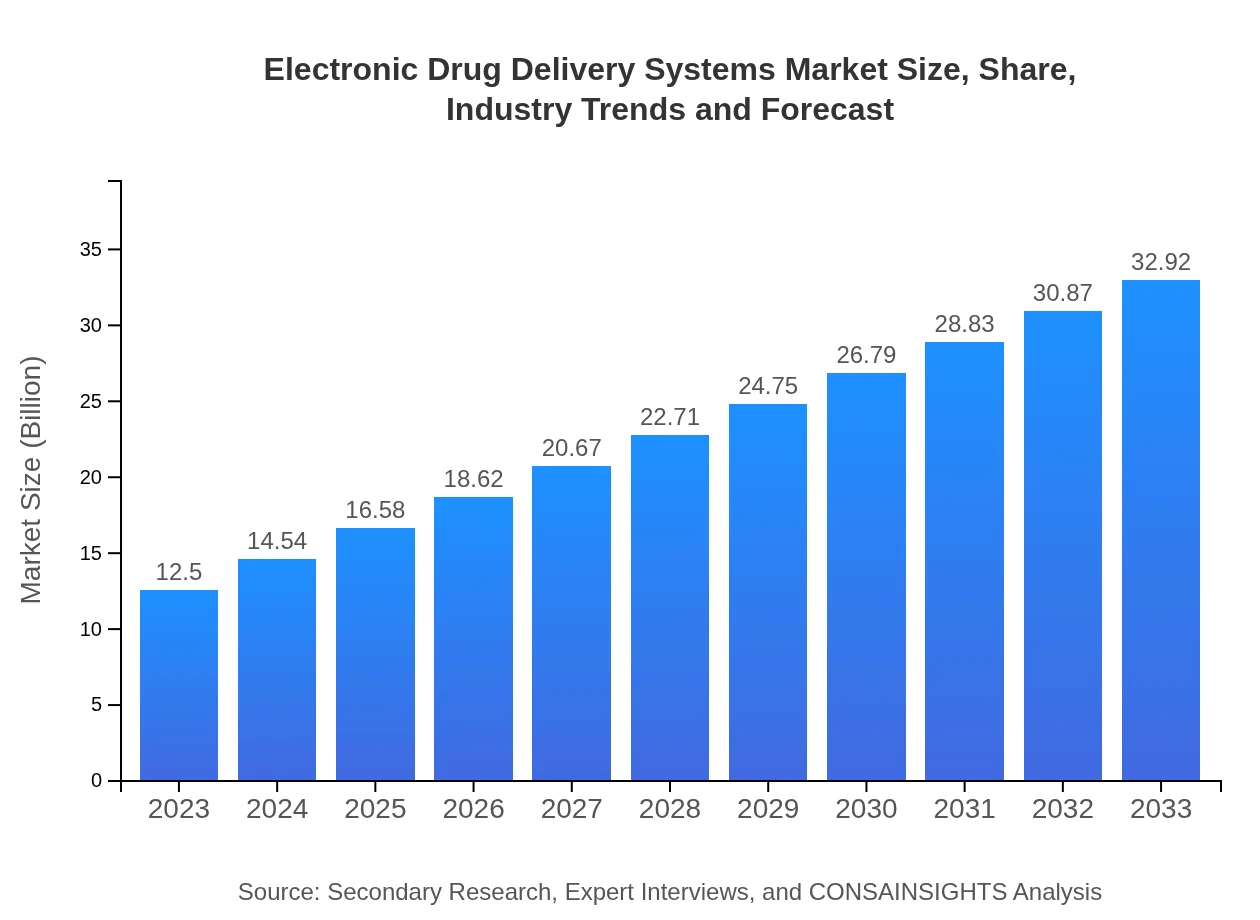

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 9.8% |

| 2033 Market Size | $32.92 Billion |

| Top Companies | Medtronic , Roche, Becton, Dickinson and Company, AstraZeneca, Johnson & Johnson |

| Last Modified Date | 31 January 2026 |

Electronic Drug Delivery Systems Market Overview

Customize Electronic Drug Delivery Systems Market Report market research report

- ✔ Get in-depth analysis of Electronic Drug Delivery Systems market size, growth, and forecasts.

- ✔ Understand Electronic Drug Delivery Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Electronic Drug Delivery Systems

What is the Market Size & CAGR of Electronic Drug Delivery Systems market in 2023?

Electronic Drug Delivery Systems Industry Analysis

Electronic Drug Delivery Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Electronic Drug Delivery Systems Market Analysis Report by Region

Europe Electronic Drug Delivery Systems Market Report:

The European market for EDDS is projected to grow from approximately $3.07 billion in 2023 to $8.08 billion by 2033. The focus on quality healthcare and regulatory support for innovative medical devices bolster the adoption of advanced drug delivery systems across the region. Countries like Germany and the UK are leading this growth due to investments in healthcare technologies.Asia Pacific Electronic Drug Delivery Systems Market Report:

The Asia Pacific EDDS market, valued at $2.48 billion in 2023, is anticipated to reach $6.54 billion by 2033. Increased investment in healthcare infrastructure, coupled with rising geriatric populations, drives market growth in this region. Additionally, a growing emphasis on telemedicine and smart health solutions is expected to catalyze further expansion.North America Electronic Drug Delivery Systems Market Report:

North America remains the leading region in the EDDS market, with a size of $4.02 billion in 2023, set to grow to $10.59 billion by 2033. The presence of key players, coupled with high healthcare expenditures and advanced healthcare systems, significantly contributes to market growth. Moreover, the increasing prevalence of chronic diseases fuels the demand for innovative drug delivery systems.South America Electronic Drug Delivery Systems Market Report:

Latin America is emerging as a significant market for EDDS, projected to expand from $1.24 billion in 2023 to $3.26 billion by 2033. The region is characterized by a growing awareness of advanced drug delivery solutions, although economic constraints may pose challenges. Collaborations between local governments and healthcare firms can potentially enhance market accessibility.Middle East & Africa Electronic Drug Delivery Systems Market Report:

The Middle East and Africa market is expected to see growth from $1.69 billion in 2023 to $4.45 billion by 2033. Increasing healthcare investments in the Gulf region, paired with rising consumer awareness, drive the market forward. However, varying regulatory environments and economic disparities may impede broader adoption.Tell us your focus area and get a customized research report.

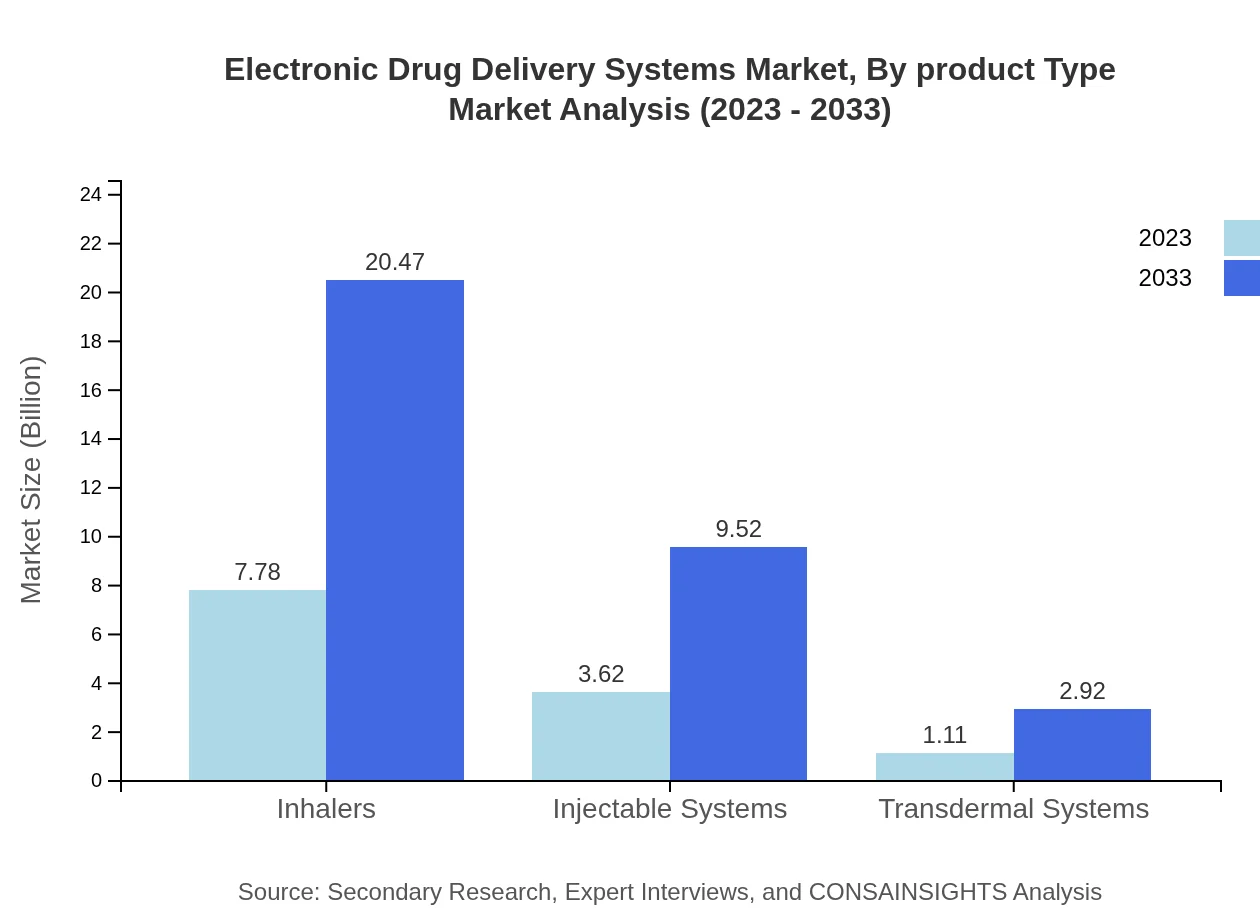

Electronic Drug Delivery Systems Market Analysis By Product Type

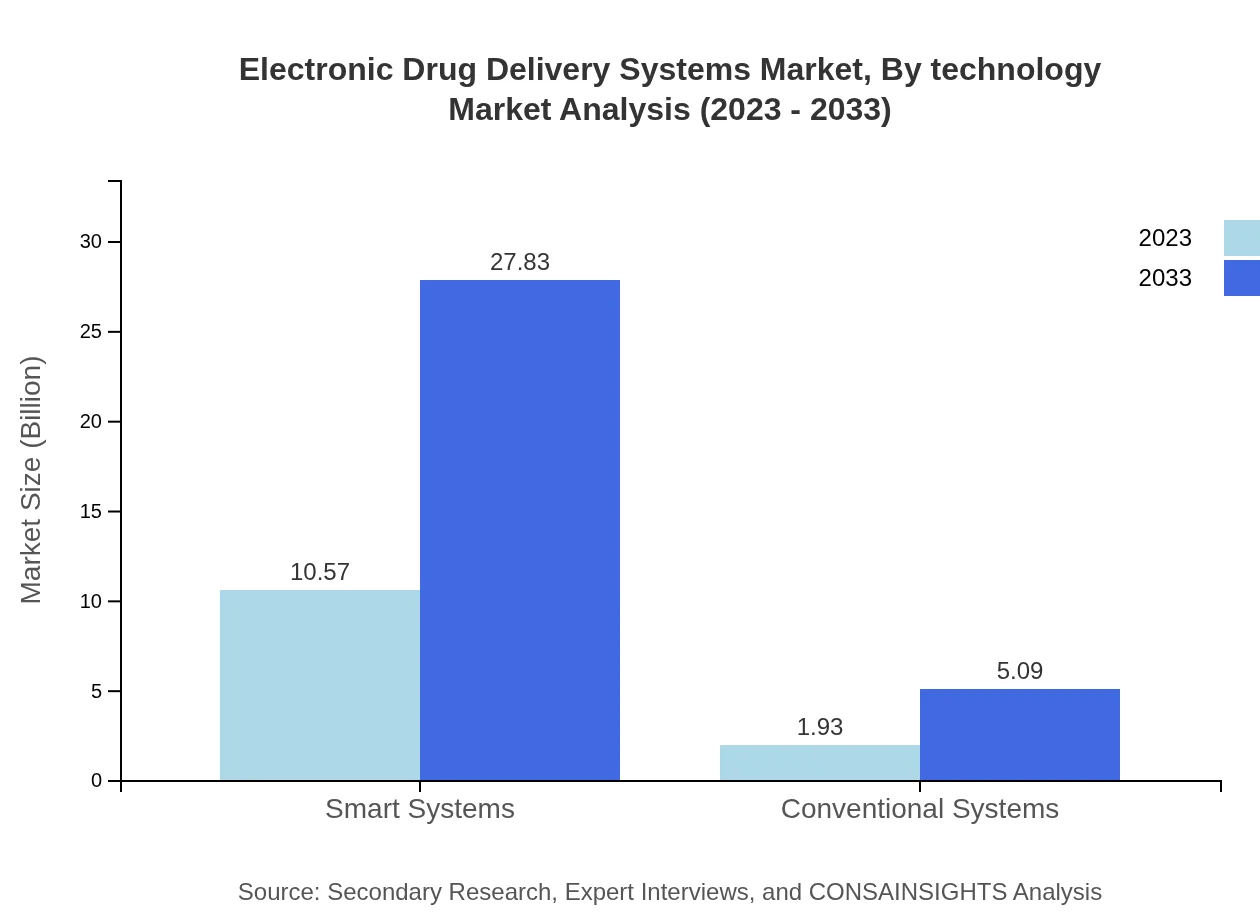

By 2033, smart systems are expected to dominate the market, growing from $10.57 billion in 2023 to $27.83 billion. Inhalers and injected systems collectively maintain a significant share with projections indicating continued growth driven by innovations in device technology. Conventional systems will hold a smaller market presence but remain relevant in specific therapeutic applications.

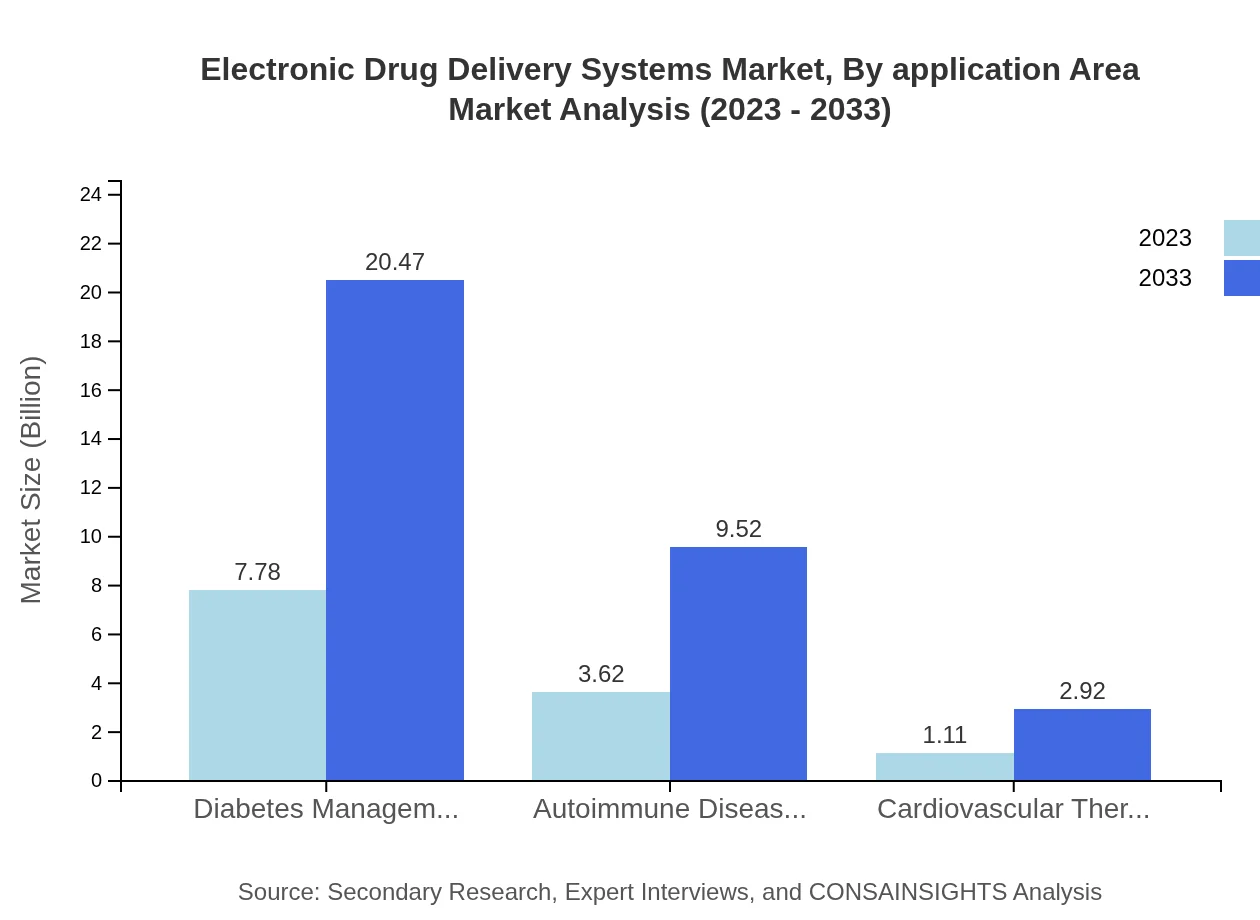

Electronic Drug Delivery Systems Market Analysis By Application Area

Diabetes management remains a leading application area due to the prevalence of diabetes globally. This segment is expected to grow from $7.78 billion in 2023 to $20.47 billion by 2033, followed closely by areas addressing autoimmune diseases and cardiovascular therapies, which are also experiencing significant growth spurts.

Electronic Drug Delivery Systems Market Analysis By Technology

The market is increasingly gravitating towards smart delivery technologies that integrate real-time monitoring and patient feedback systems. This trend is confirmed by the projected growth and enhanced functionalities in device interfaces that cater to user-friendliness and real-time health tracking.

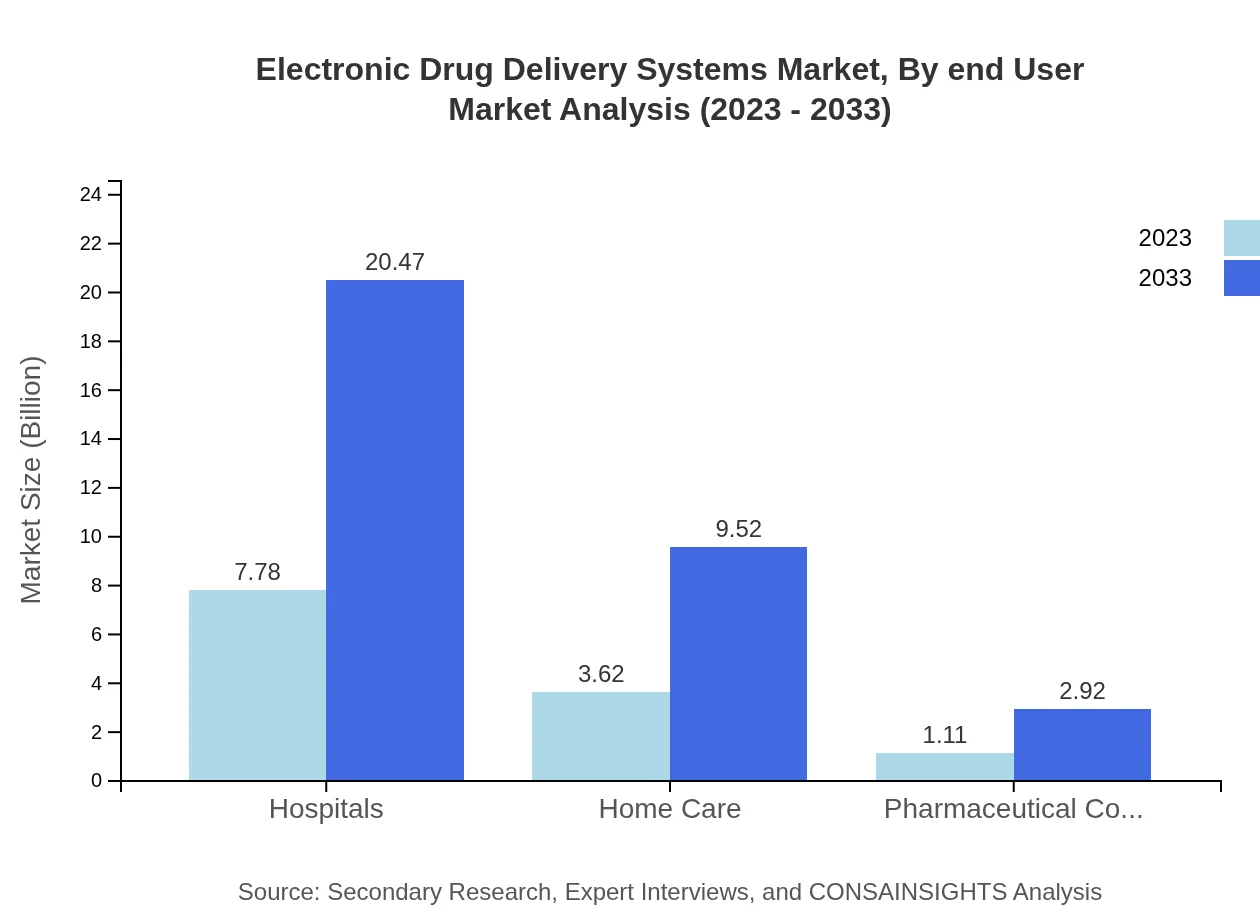

Electronic Drug Delivery Systems Market Analysis By End User

Hospitals constitute the largest end-user segment, retaining a stable share of the market (62.2% in 2023) and increasing in size from $7.78 billion to $20.47 billion by 2033. Home care settings are gaining importance, growing rapidly due to changing patient expectations and technological advancements in remote monitoring.

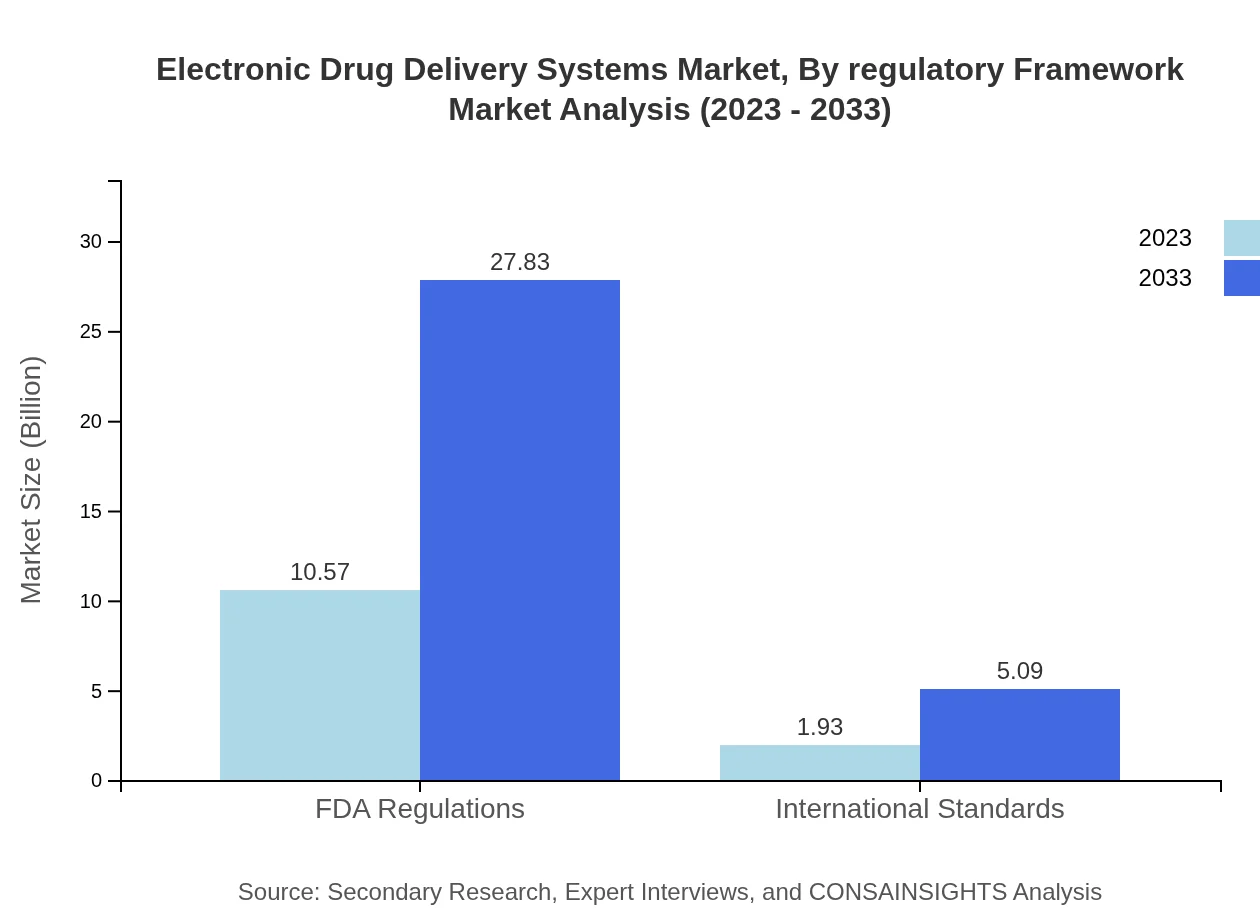

Electronic Drug Delivery Systems Market Analysis By Regulatory Framework

With stringent regulations from bodies like the FDA, the market's adherence to international standards ensures high product integrity and patient safety. Companies focusing on obtaining necessary certifications will gain competitive advantages, adding credibility to their product offerings.

Electronic Drug Delivery Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Electronic Drug Delivery Systems Industry

Medtronic :

Medtronic is a global leader in medical technology, offering innovative drug delivery devices that enhance patient outcomes, particularly in chronic disease management.Roche:

Roche is renowned for its high-quality drug delivery systems tailored specifically for personalized medicine, driving advancements in diabetic care and oncology treatments.Becton, Dickinson and Company:

BD’s innovative solutions in injection systems exemplify their commitment to improving drug delivery and patient safety.AstraZeneca:

AstraZeneca has pioneered research into smart insulin delivery systems, enhancing patient management through innovative healthcare solutions.Johnson & Johnson:

Johnson & Johnson's commitment to innovation in drug delivery devices is demonstrated through their advancements in infusion management systems.We're grateful to work with incredible clients.

FAQs

What is the market size of electronic Drug Delivery Systems?

The electronic drug delivery systems market is valued at approximately $12.5 billion in 2023 and is projected to grow at a CAGR of 9.8% through 2033, indicating significant expansion and opportunity in this sector.

What are the key market players or companies in this electronic Drug Delivery Systems industry?

Key players in the electronic drug delivery systems industry include major pharmaceutical companies and biomedical device manufacturers that design and manufacture innovative drug delivery solutions. Their contributions shape market dynamics and technological advancement.

What are the primary factors driving the growth in the electronic Drug Delivery Systems industry?

The growth in this industry is primarily driven by advancements in technology, increasing prevalence of chronic diseases, and growing demand for targeted drug delivery systems that improve patient outcomes and adherence.

Which region is the fastest Growing in the electronic Drug Delivery Systems?

The fastest-growing region in the electronic drug delivery systems market is North America, with a market size expected to reach $10.59 billion by 2033, up from $4.02 billion in 2023, driven by technological innovations and healthcare infrastructure.

Does ConsaInsights provide customized market report data for the electronic Drug Delivery Systems industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the electronic drug delivery systems industry, allowing businesses to gain insights based on unique market segments or geographies.

What deliverables can I expect from this electronic Drug Delivery Systems market research project?

From this project, you can expect comprehensive market analysis reports, including trends, forecasts, competitive analysis, and insights into key segments and regions, providing a holistic view of the market landscape.

What are the market trends of electronic Drug Delivery Systems?

Market trends include the rise of smart systems for drug delivery, increased focus on patient-centric designs, and integration of digital health technologies, enhancing the efficacy and safety of treatment protocols.