Electronic Flight Bag Market Report

Published Date: 03 February 2026 | Report Code: electronic-flight-bag

Electronic Flight Bag Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Electronic Flight Bag (EFB) market, detailing market size, industry trends, and forecasts from 2023 to 2033, focusing on key segments and regional insights that are shaping the future of aviation technology.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

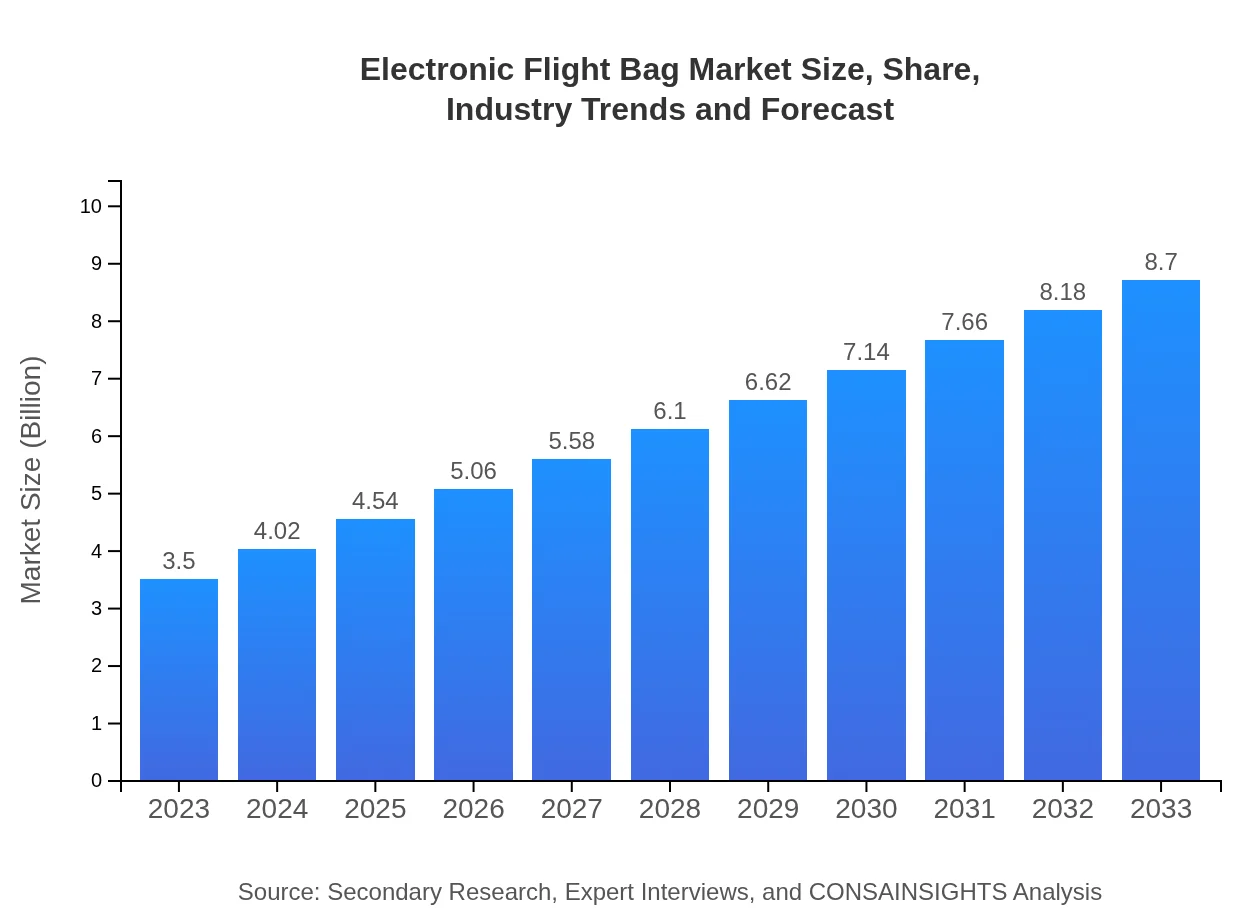

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $8.70 Billion |

| Top Companies | Jeppesen, L3Harris Technologies, Rockwell Collins, C-MAP |

| Last Modified Date | 03 February 2026 |

Electronic Flight Bag Market Overview

Customize Electronic Flight Bag Market Report market research report

- ✔ Get in-depth analysis of Electronic Flight Bag market size, growth, and forecasts.

- ✔ Understand Electronic Flight Bag's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Electronic Flight Bag

What is the Market Size & CAGR of Electronic Flight Bag market in 2023 and 2033?

Electronic Flight Bag Industry Analysis

Electronic Flight Bag Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Electronic Flight Bag Market Analysis Report by Region

Europe Electronic Flight Bag Market Report:

The European EFB market is estimated to be worth $1.30 billion in 2023 and is expected to expand to $3.22 billion by 2033. The aviation regulations in Europe often mandate the adoption of EFB solutions, thus driving significant market growth.Asia Pacific Electronic Flight Bag Market Report:

The Asia Pacific EFB market size in 2023 is valued at approximately $0.65 billion, with projections reaching $1.60 billion by 2033. The growth in this region is propelled by an increase in air travel and a surge in new aircraft deliveries, which encourage the adoption of updated aviation technologies, including EFBs.North America Electronic Flight Bag Market Report:

North America dominates the EFB market, with a market size of $1.13 billion in 2023, projected to increase to $2.80 billion by 2033. The advanced aviation infrastructure coupled with the strong presence of major airlines propels the ongoing adoption of EFB solutions.South America Electronic Flight Bag Market Report:

The South American EFB market is relatively smaller, valued at about $0.07 billion in 2023 and expected to grow to $0.18 billion by 2033. The growth is largely attributed to the gradual modernization of the aviation industry and increasing investment in infrastructure.Middle East & Africa Electronic Flight Bag Market Report:

The Middle East and Africa EFB market shows promise, with a value of $0.36 billion in 2023 and anticipated to grow to $0.89 billion by 2033. Increasing air travel and investments in airlines are encouraging the adoption of digital aviation solutions in these regions.Tell us your focus area and get a customized research report.

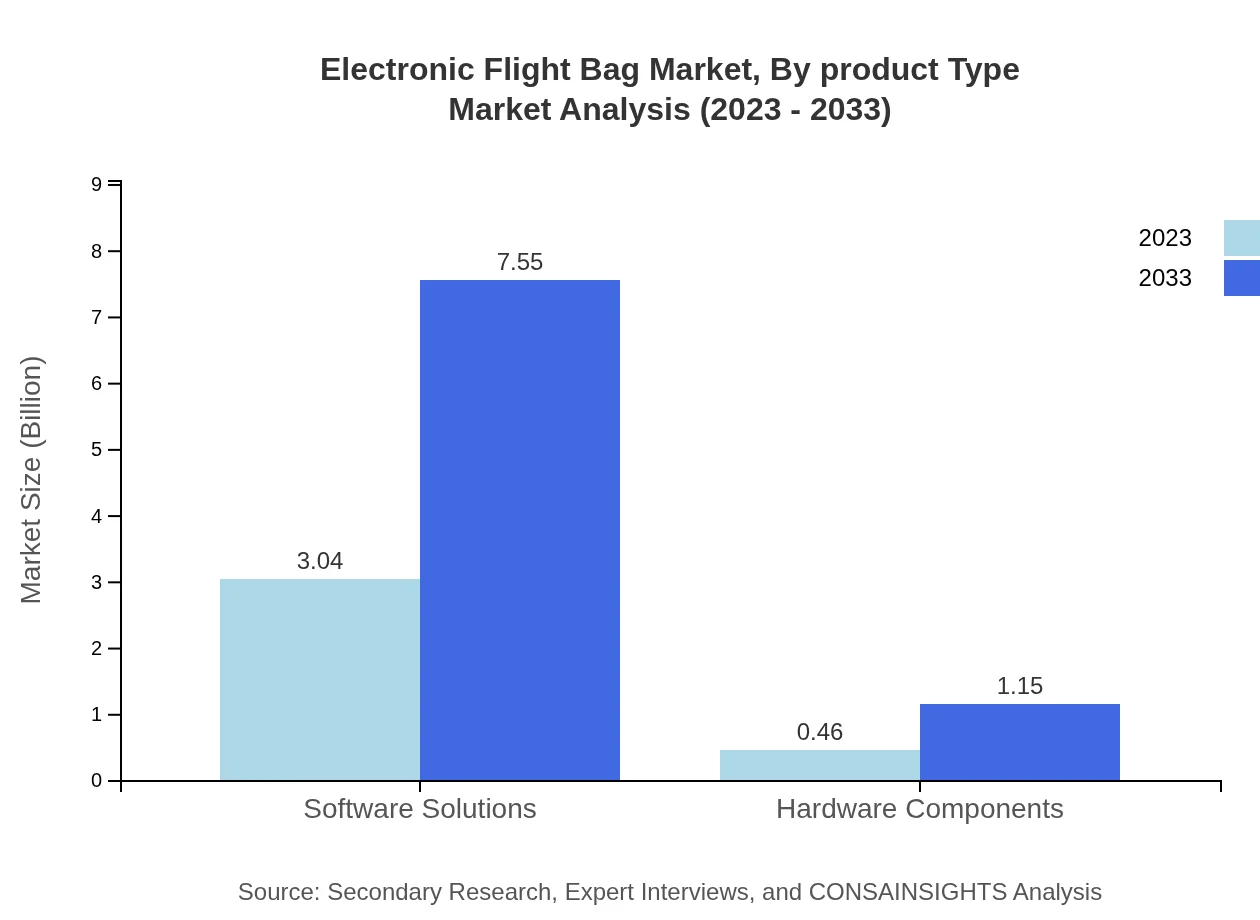

Electronic Flight Bag Market Analysis By Product Type

Software solutions dominate the Electronic Flight Bag market, accounting for 86.8% of the market share in 2023. This segment includes essential applications for flight management, navigation, and performance analysis. Hardware components contribute 13.2%, focusing largely on the physical devices required for EFB systems.

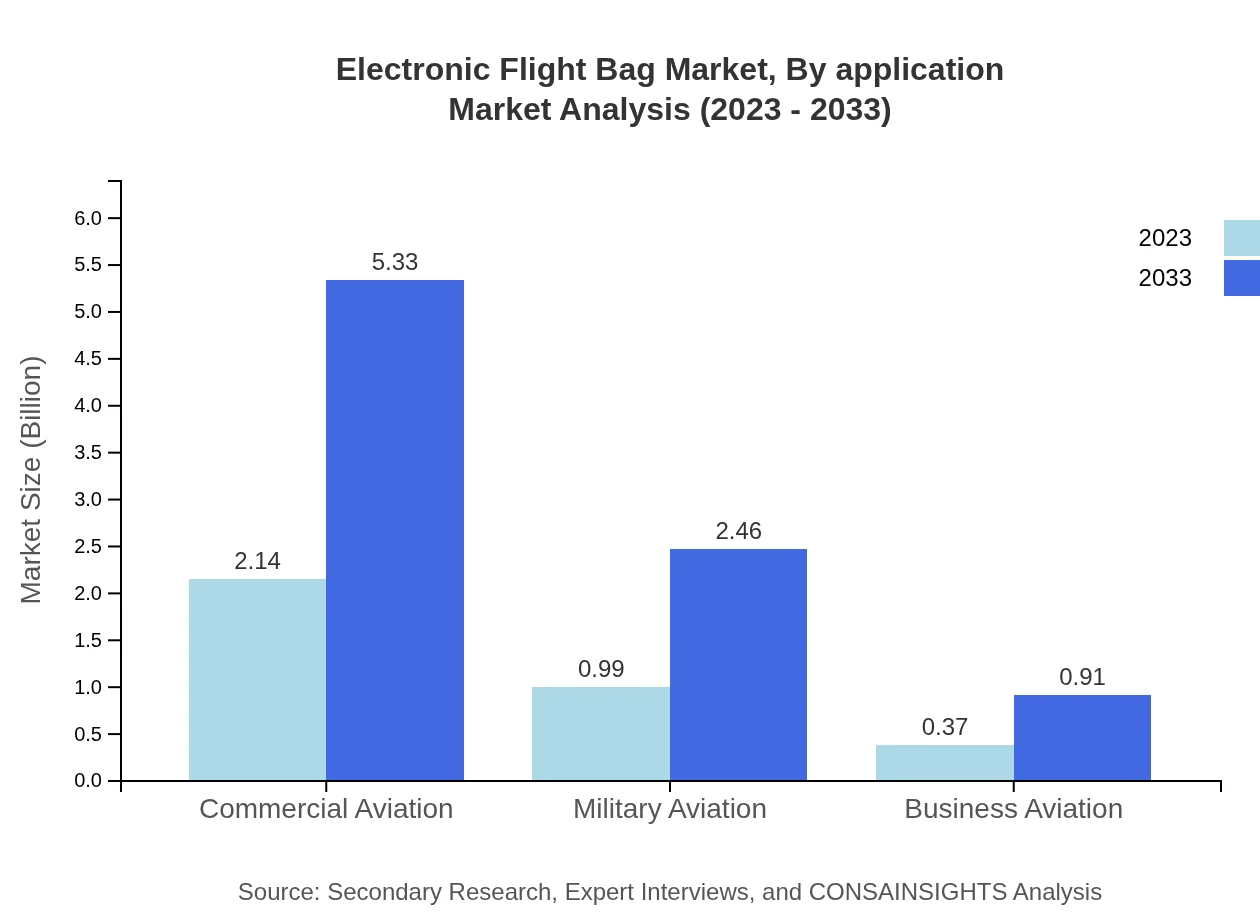

Electronic Flight Bag Market Analysis By Application

The commercial aviation application leads the market with a significant share of 61.26% in 2023, followed closely by military aviation at 28.27%. With increased passenger air traffic and military modernization, both segments are expected to see substantial growth in the coming years.

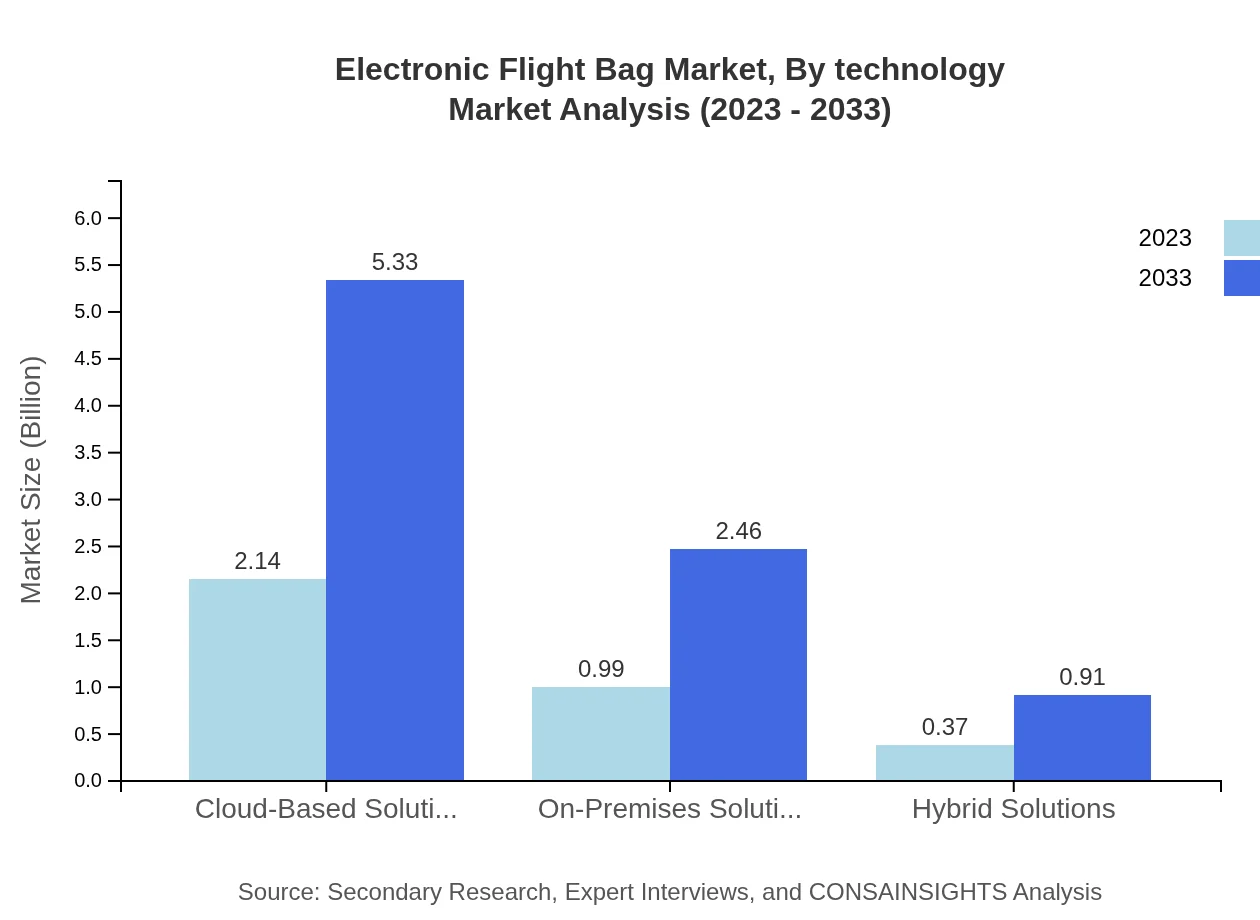

Electronic Flight Bag Market Analysis By Technology

Cloud-based EFBs are the leading technology in the market, contributing to superior data management and accessibility, accounting for approximately 61.26% of the market share by 2023. On-premises solutions and hybrid models also hold significant shares, serving specific requirements of various operators.

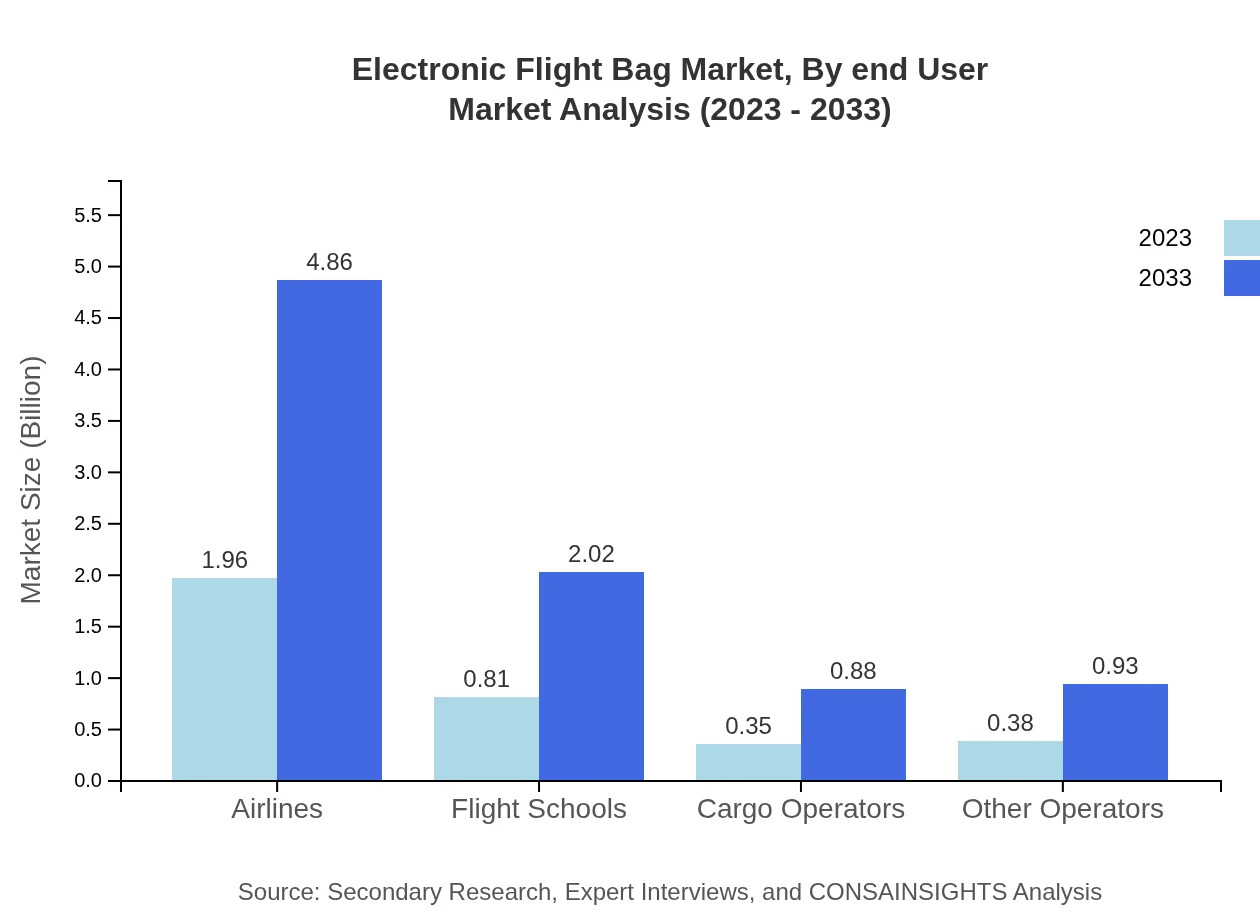

Electronic Flight Bag Market Analysis By End User

Airlines represent the largest end-user segment, accounting for 55.9% in terms of market share and showing positive growth trends as airlines increasingly implement EFB systems to improve efficiency. Flight schools and cargo operators also play important roles in driving market demand.

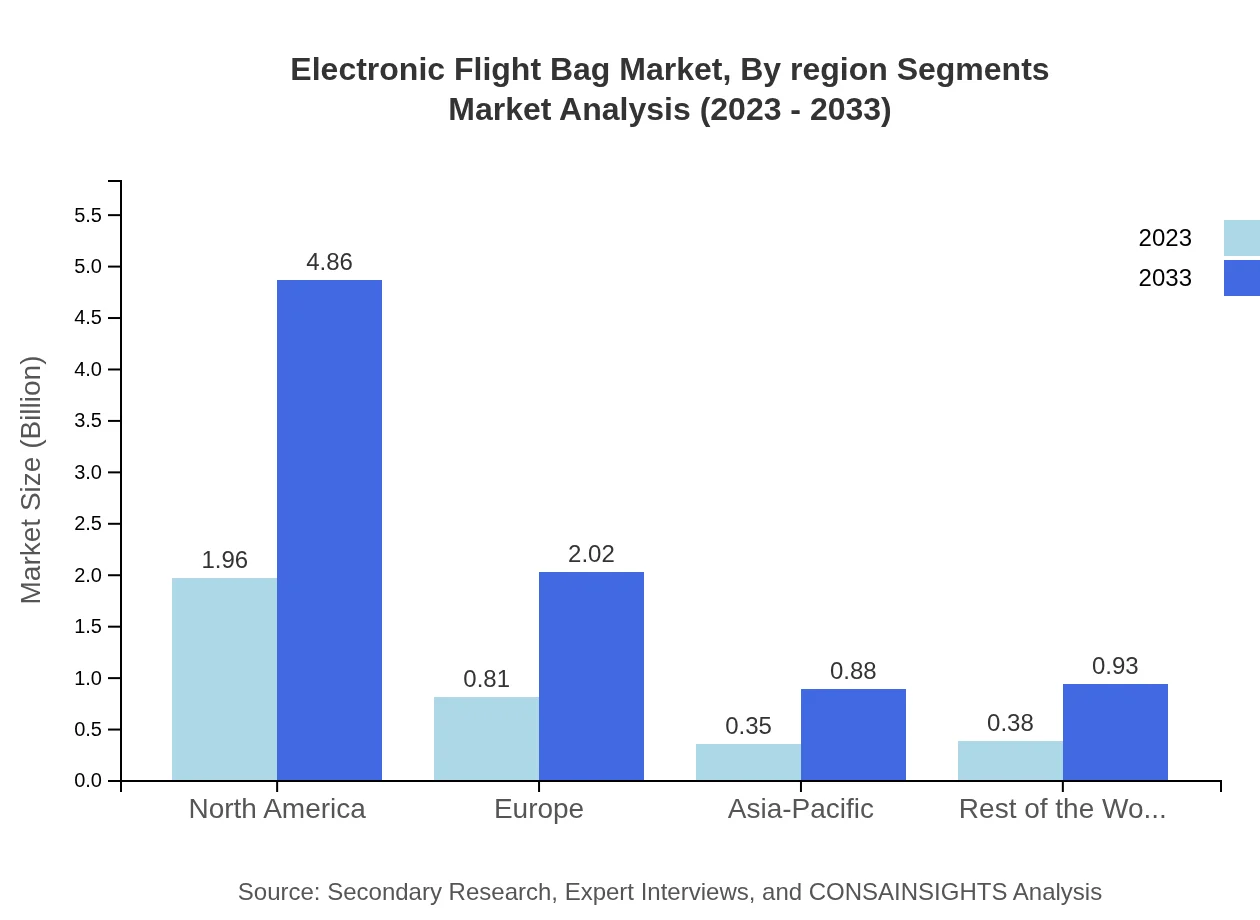

Electronic Flight Bag Market Analysis By Region Segments

The North American region is a notable leader in market size and growth due to its well-established aviation industry. Europe follows closely, driven by stringent regulations. Emerging markets in Asia-Pacific also exhibit significant growth potential as more carriers adopt EFB technologies.

Electronic Flight Bag Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Electronic Flight Bag Industry

Jeppesen:

A subsidiary of Boeing, Jeppesen is a leading provider of navigation and operational services that offers comprehensive EFB solutions tailored for both commercial and military aviation.L3Harris Technologies:

This company specializes in communications and electronic systems providing innovative EFB solutions focused on enhancing operational efficiency and safety for global aviation.Rockwell Collins:

A pioneer in avionics and airplane systems, Rockwell Collins offers advanced EFB software that integrates seamlessly with existing hardware in aircraft.C-MAP:

C-MAP provides EFB systems that emphasize navigation and charting capabilities, catering to both commercial and recreational aviation segments.We're grateful to work with incredible clients.

FAQs

What is the market size of electronic flight bag?

The electronic flight bag market is valued at approximately $3.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 9.2%, indicating significant growth potential through 2033.

What are the key market players or companies in this electronic flight bag industry?

Key players in the electronic flight bag industry include prominent firms such as Honeywell International Inc., Boeing, L3Harris Technologies, Jeppesen, and Airbus, which are leading innovations and technology advancements.

What are the primary factors driving the growth in the electronic flight bag industry?

Major growth drivers for the electronic flight bag industry include the increasing demand for automation in aviation, the need for efficient flight operations, advancements in technology, and regulatory compliance towards digitization in aviation sectors.

Which region is the fastest Growing in the electronic flight bag?

The Asia-Pacific region is the fastest-growing market for electronic flight bags, projected to grow from $0.65 billion in 2023 to $1.60 billion by 2033, supported by rapid aviation expansion and technology adoption.

Does ConsaInsights provide customized market report data for the electronic flight bag industry?

Yes, ConsaInsights provides customized market report data tailored to client needs in the electronic flight bag industry, enabling businesses to gain insights that align with their strategic goals and market dynamics.

What deliverables can I expect from this electronic flight bag market research project?

Expect comprehensive deliverables including detailed market analysis, growth forecasts, competitive landscape summaries, segment insights, and actionable recommendations based on robust research methodologies.

What are the market trends of electronic flight bag?

Current market trends in the electronic flight bag industry include a shift towards cloud-based solutions, increased focus on software innovation, and growing adoption among various aviation segments like commercial and military aviation.