Electronic Manufacturing Services Market Report

Published Date: 31 January 2026 | Report Code: electronic-manufacturing-services

Electronic Manufacturing Services Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Electronic Manufacturing Services (EMS) industry, covering market trends, sizes, growth forecasts, and insights from 2023 to 2033. It aims to highlight key opportunities, challenges, and critical data that shape the future of the EMS market.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

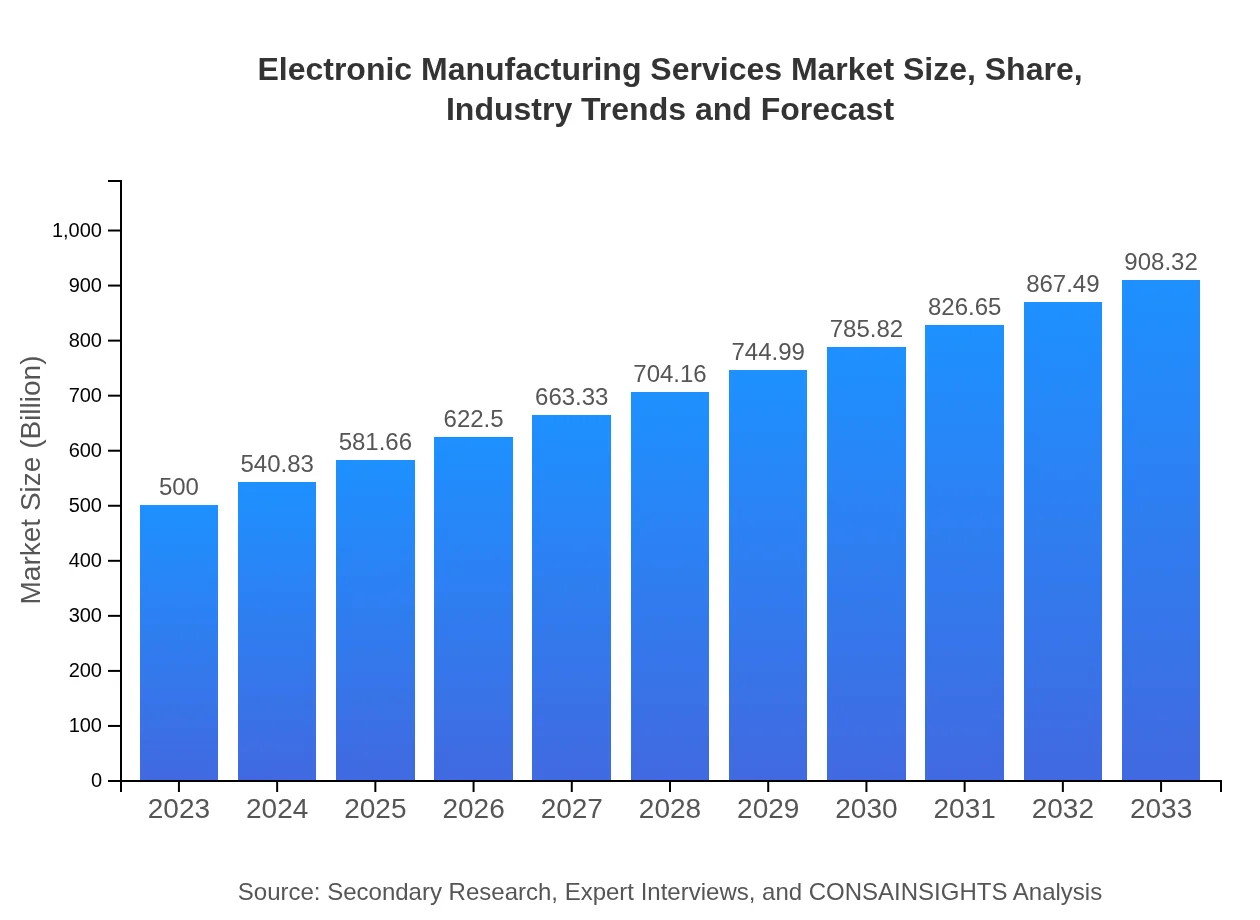

| 2023 Market Size | $500.00 Billion |

| CAGR (2023-2033) | 6% |

| 2033 Market Size | $908.32 Billion |

| Top Companies | Foxconn Technology Group, Flex Ltd., Jabil Inc., Celestica Inc. |

| Last Modified Date | 31 January 2026 |

Electronic Manufacturing Services Market Overview

Customize Electronic Manufacturing Services Market Report market research report

- ✔ Get in-depth analysis of Electronic Manufacturing Services market size, growth, and forecasts.

- ✔ Understand Electronic Manufacturing Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Electronic Manufacturing Services

What is the Market Size & CAGR of Electronic Manufacturing Services market in 2033?

Electronic Manufacturing Services Industry Analysis

Electronic Manufacturing Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Electronic Manufacturing Services Market Analysis Report by Region

Europe Electronic Manufacturing Services Market Report:

Europe's EMS market stands at $163.15 billion in 2023 and is expected to reach $296.38 billion by 2033. Demand for EMS is bolstered by the automotive industry's shift towards electric and automated vehicles, necessitating advanced manufacturing services.Asia Pacific Electronic Manufacturing Services Market Report:

The Asia Pacific region is the largest market for Electronic Manufacturing Services, valued at approximately $95.85 billion in 2023, projected to reach $174.12 billion by 2033. This growth is driven by the presence of major electronics manufacturers in countries like China, Japan, and South Korea, coupled with the increasing adoption of smart devices and technological advancements.North America Electronic Manufacturing Services Market Report:

The North American EMS market, valued at $161.80 billion in 2023, is projected to grow to $293.93 billion by 2033. The growth is spurred by strong demand from sectors such as automotive and healthcare, along with increasing outsourcing of manufacturing services to specialized firms.South America Electronic Manufacturing Services Market Report:

South America is expected to witness steady growth in the EMS market, with a projected increase from $46.40 billion in 2023 to $84.29 billion by 2033. The region is investing in technology and electronics manufacturing capabilities, which are essential for meeting burgeoning local demand.Middle East & Africa Electronic Manufacturing Services Market Report:

The Middle East and Africa are anticipated to grow significantly, with the EMS market moving from $32.80 billion in 2023 to $59.59 billion by 2033. Emerging markets in this region show promising potential for electronics and manufacturing sectors.Tell us your focus area and get a customized research report.

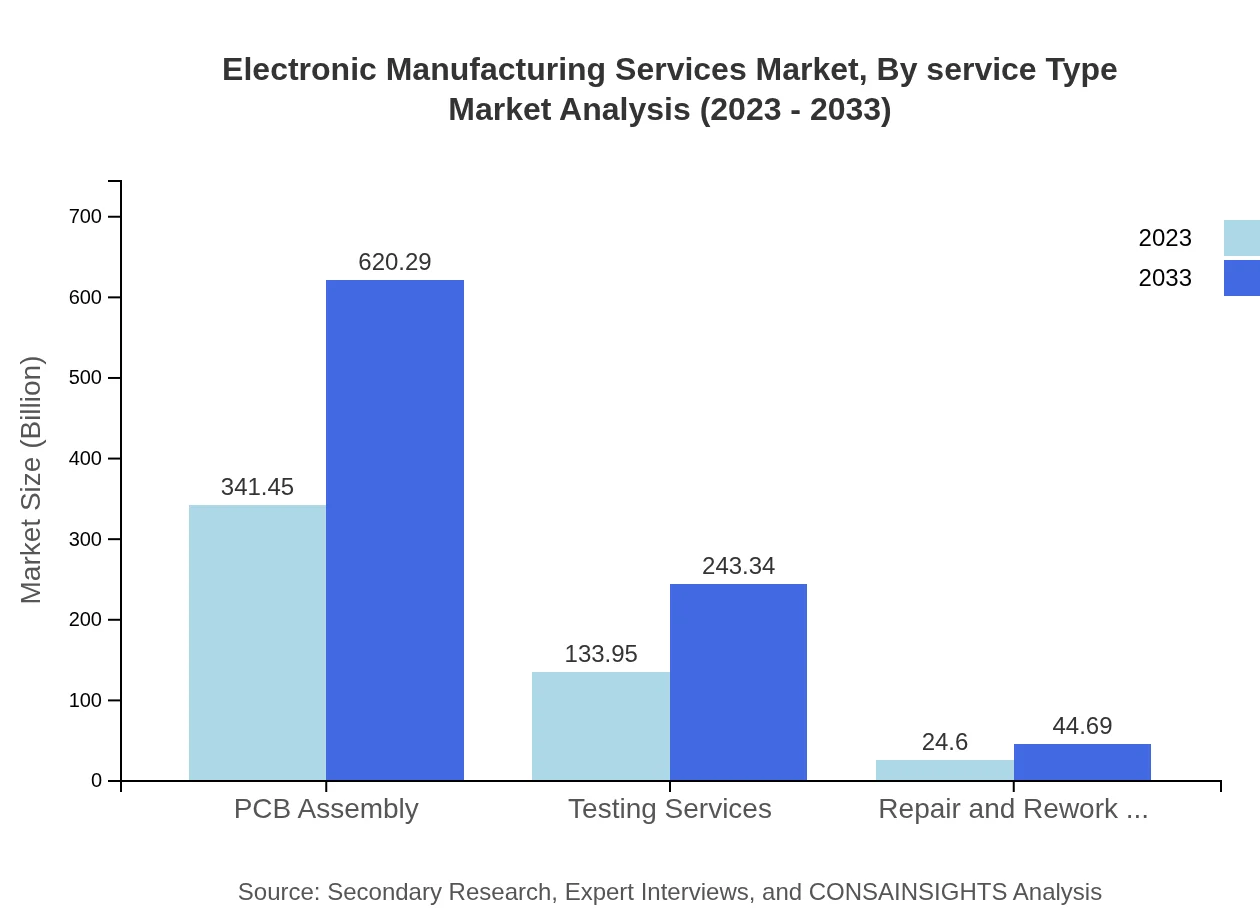

Electronic Manufacturing Services Market Analysis By Service Type

The analyses indicate that key service types, such as Automated Manufacturing Technologies and PCB Assembly, have significantly contributed to the market's growth. Automated manufacturing technologies are projected to grow from $403.55 billion in 2023 to $733.10 billion in 2033, highlighting a shift towards greater automation in manufacturing processes.

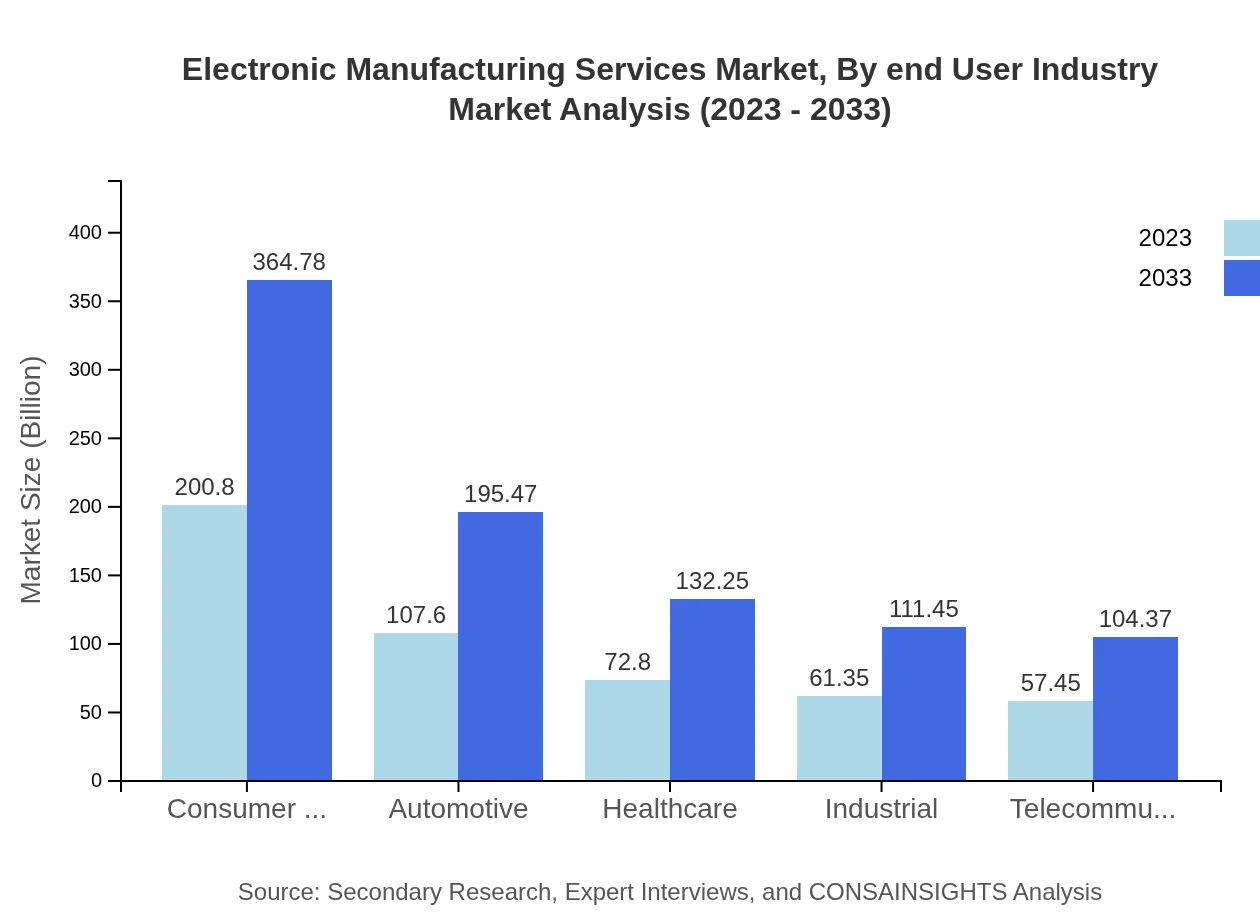

Electronic Manufacturing Services Market Analysis By End User Industry

Different industries drive demand for EMS, with Consumer Electronics being a leading segment, expected to grow from $200.80 billion in 2023 to $364.78 billion in 2033. The automotive and healthcare sectors also exhibit strong demand, fostering growth in this segment.

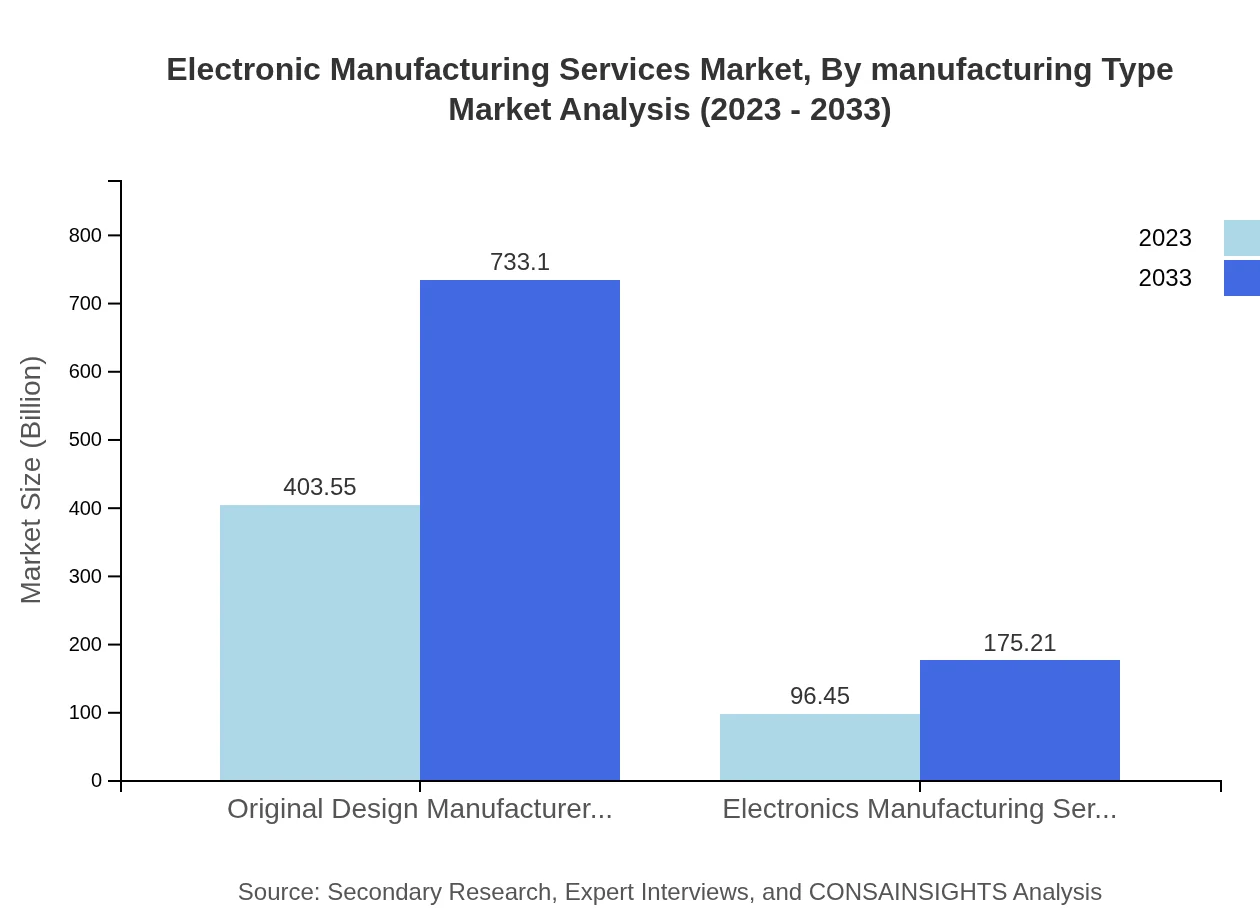

Electronic Manufacturing Services Market Analysis By Manufacturing Type

Manufacturing types such as Original Design Manufacturers (ODMs) and Electronics Manufacturing Services (EMS) dominate the market landscape. Each type offers distinct advantages that cater to the specific needs of their industries, thereby enhancing overall market growth.

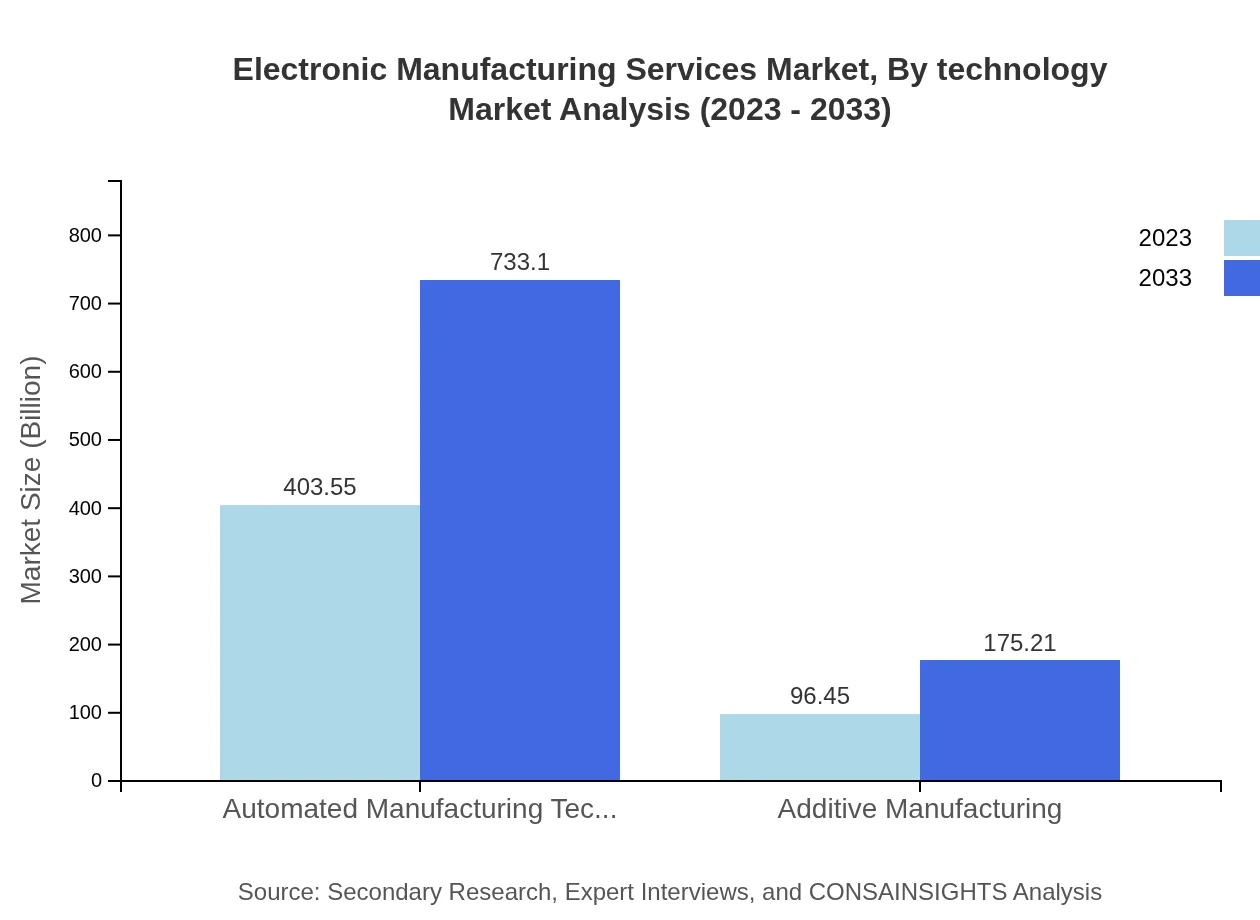

Electronic Manufacturing Services Market Analysis By Technology

The technological advancements in the EMS sector include automation and digital manufacturing processes. With an anticipated market increase, innovations in additive manufacturing are expected to reshape service offerings and industry standards.

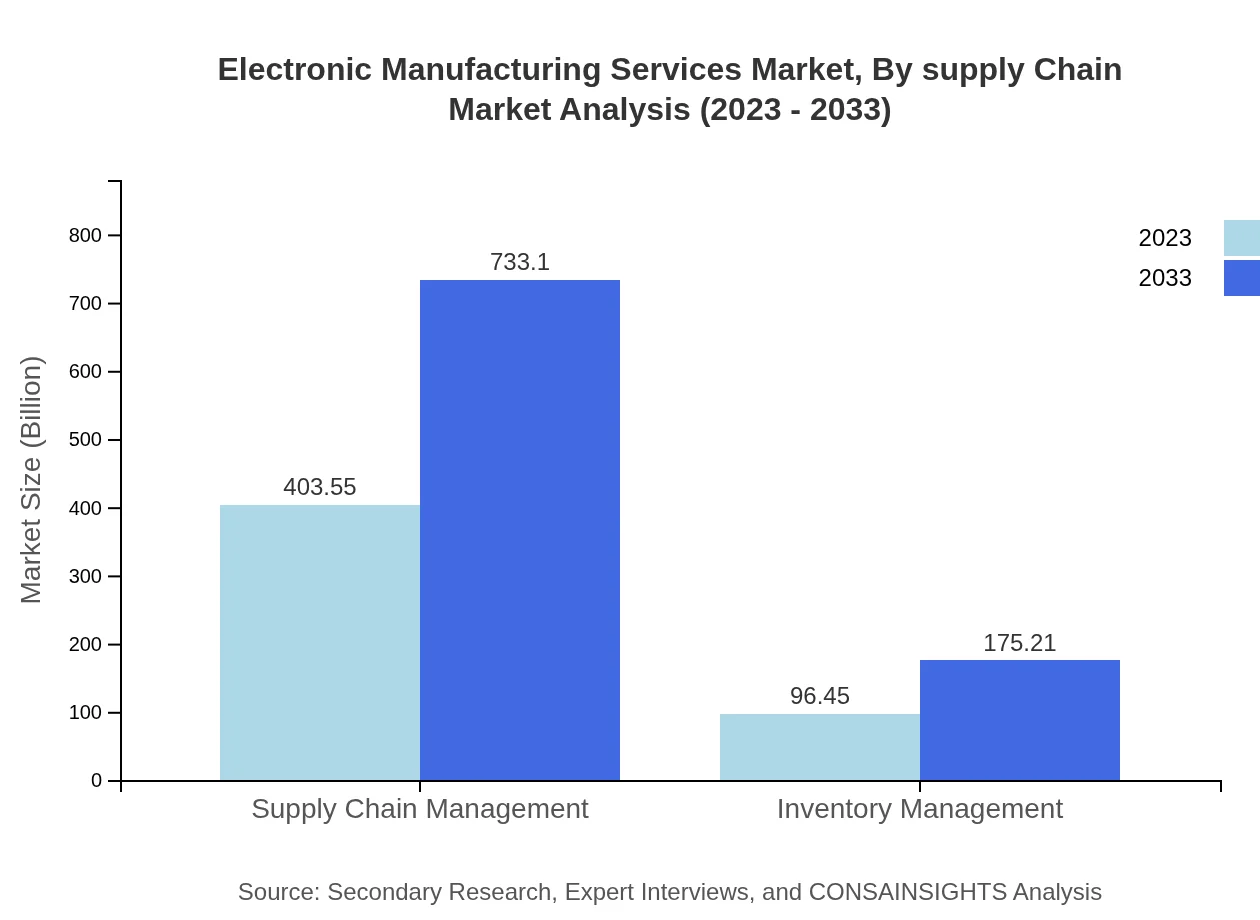

Electronic Manufacturing Services Market Analysis By Supply Chain

The supply chain for EMS segments includes logistics, inventory management, and procurement services, with each contributing from substantial revenue streams. Effective supply chain management can enhance efficiency and reduce costs in manufacturing processes.

Electronic Manufacturing Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Electronic Manufacturing Services Industry

Foxconn Technology Group:

As one of the largest electronics contract manufacturers in the world, Foxconn specializes in OEM and ODM and has positioned itself as a key player in sectors such as consumer electronics and telecommunications.Flex Ltd.:

Flex operates globally and provides innovative solutions in design, engineering, and manufacturing while serving various markets including automotive and healthcare.Jabil Inc.:

Jabil is a major player known for its comprehensive manufacturing and service solutions tailored to meet the unique needs of its diverse clientele across multiple sectors.Celestica Inc.:

Celestica offers an array of electronic manufacturing services with a strong focus on healthcare, industrial, and communication sectors, helping drive innovation and growth.We're grateful to work with incredible clients.

FAQs

What is the market size of electronic Manufacturing Services?

The electronic manufacturing services market is valued at approximately $500 billion in 2023, with an expected CAGR of 6%. By 2033, this market is projected to significantly expand, reflecting growing demand across various sectors.

What are the key market players or companies in this electronic Manufacturing Services industry?

Key market players in the electronic manufacturing services industry include companies like Foxconn, Jabil Circuit, and Flextronics. These companies lead with innovative technologies and extensive manufacturing capabilities, driving competitive growth in the sector.

What are the primary factors driving the growth in the electronic Manufacturing Services industry?

Factors driving growth include increasing demand for consumer electronics, technological advancements, and globalization of manufacturing operations. The push for automation and efficiency also propels the need for EMS providers to deliver integrated solutions.

Which region is the fastest Growing in the electronic Manufacturing Services?

The Asia Pacific region is the fastest-growing in the electronic manufacturing services market. With a market size of $95.85 billion in 2023 projected to grow to $174.12 billion by 2033, it significantly contributes to the industry's expansion.

Does ConsaInsights provide customized market report data for the electronic Manufacturing Services industry?

Yes, ConsaInsights offers customized market report data for the electronic manufacturing services industry, tailoring insights and analyses based on specific client needs and strategic objectives within this dynamic market.

What deliverables can I expect from this electronic Manufacturing Services market research project?

Deliverables include comprehensive market analysis reports, regional breakdowns, industry trends, and competitive landscape insights. Additionally, data on segment performance and forecasts will be provided to support decision-making.

What are the market trends of electronic Manufacturing Services?

Current trends include increased adoption of automation technologies, a rising focus on sustainability, and the expansion of services beyond traditional manufacturing. These trends are shaping the evolving landscape of electronic manufacturing services.