Electronic Medical Records Market Report

Published Date: 31 January 2026 | Report Code: electronic-medical-records

Electronic Medical Records Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Electronic Medical Records market, covering market size, growth trends, segmentation, regional insights, key players, and future forecasts from 2023 to 2033.

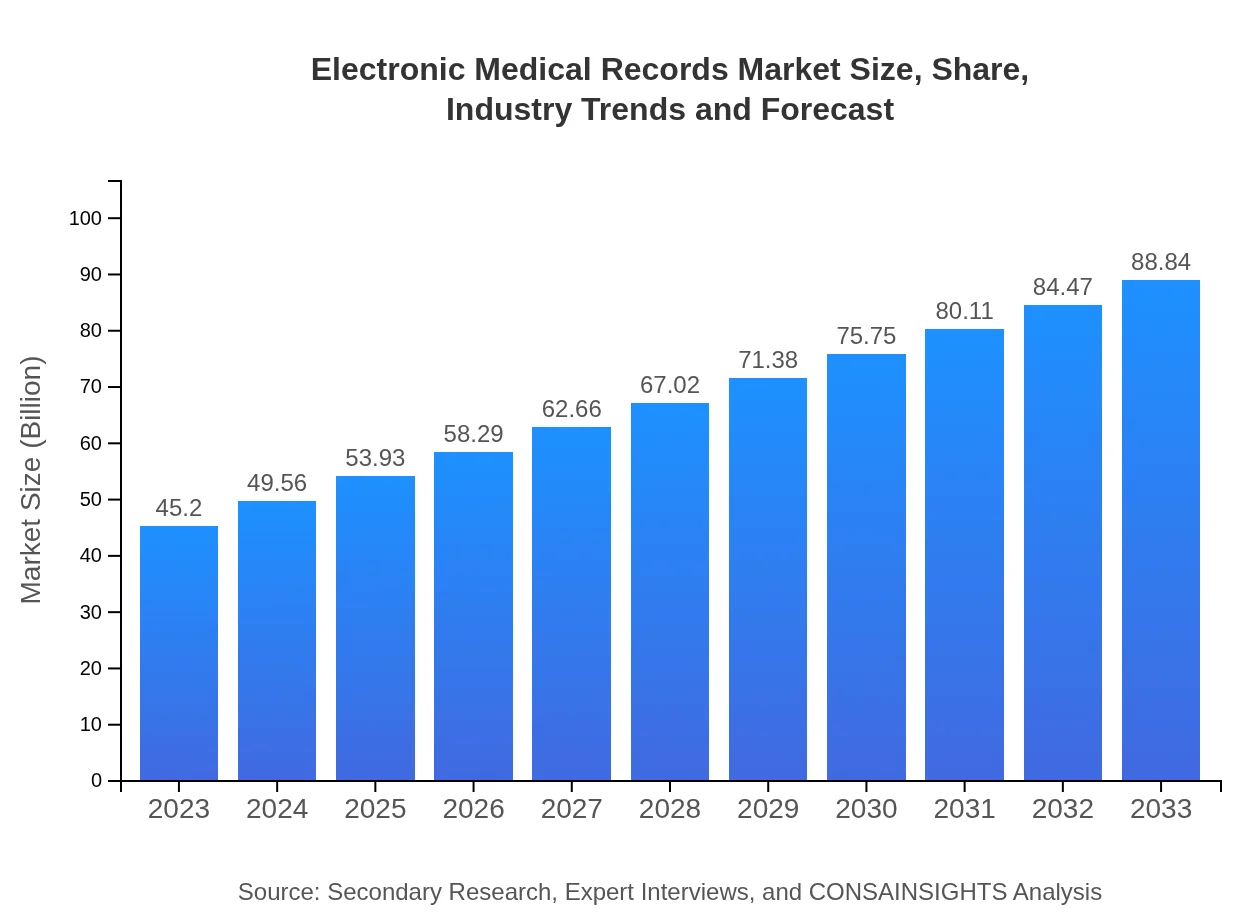

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $45.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $88.84 Billion |

| Top Companies | Epic Systems Corporation, Cerner Corporation, Allscripts Healthcare Solutions, MEDITECH |

| Last Modified Date | 31 January 2026 |

Electronic Medical Records Market Overview

Customize Electronic Medical Records Market Report market research report

- ✔ Get in-depth analysis of Electronic Medical Records market size, growth, and forecasts.

- ✔ Understand Electronic Medical Records's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Electronic Medical Records

What is the Market Size & CAGR of Electronic Medical Records market in 2023?

Electronic Medical Records Industry Analysis

Electronic Medical Records Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Electronic Medical Records Market Analysis Report by Region

Europe Electronic Medical Records Market Report:

In Europe, the EMR market size is estimated at $11.86 billion in 2023, anticipated to expand to $23.30 billion by 2033. The EU’s regulatory framework on data protection, alongside initiatives promoting digital health and interoperability, is contributing to robust market growth in this region.Asia Pacific Electronic Medical Records Market Report:

In Asia Pacific, the market size in 2023 is estimated at $9.71 billion, with projections reaching $19.08 billion by 2033. The region's growth is driven by increasing investment in healthcare infrastructure, the government's push for digital health, and the growing patient population. Countries like India and China are leading the adoption of EMRs, facilitating significant advancements in healthcare.North America Electronic Medical Records Market Report:

The North American EMR market stands at $15.84 billion in 2023, showing substantial growth to $31.14 billion by 2033. This growth is primarily supported by advanced healthcare IT infrastructure, a strong presence of key market players, and regulatory incentives encouraging the adoption of electronic records and health information exchange.South America Electronic Medical Records Market Report:

In South America, the market reached $3.64 billion in 2023 and is expected to grow to $7.16 billion by 2033. Factors such as rising healthcare expenditure, improving medical facilities, and heightened awareness about health information management are driving the EMR adoption in this region.Middle East & Africa Electronic Medical Records Market Report:

The Middle East and Africa show a market size of $4.15 billion in 2023, growing to $8.16 billion by 2033. The region is witnessing enhanced investments in healthcare IT, government initiatives for modernizing healthcare systems, and a push towards integrated healthcare services that are vital for EMR growth.Tell us your focus area and get a customized research report.

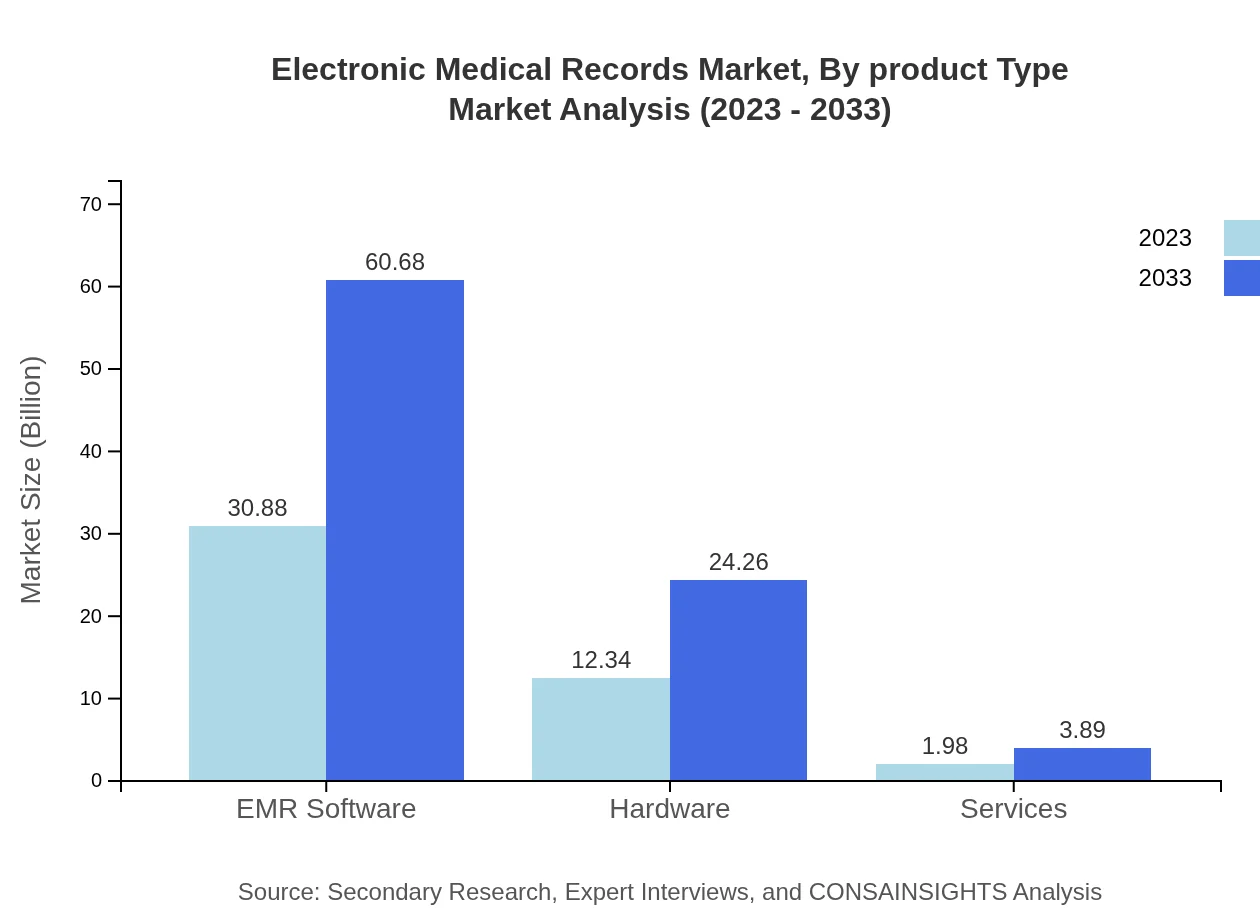

Electronic Medical Records Market Analysis By Product Type

The product types within the EMR market include EMR software and hardware solutions. In 2023, the EMR software segment holds a market size of $30.88 billion, projected to double to $60.68 billion by 2033. The hardware sector, including servers and devices, is estimated at $12.34 billion in 2023, with expectations of reaching $24.26 billion by 2033. These segments reflect the fundamental components required for the implementation of EMR systems.

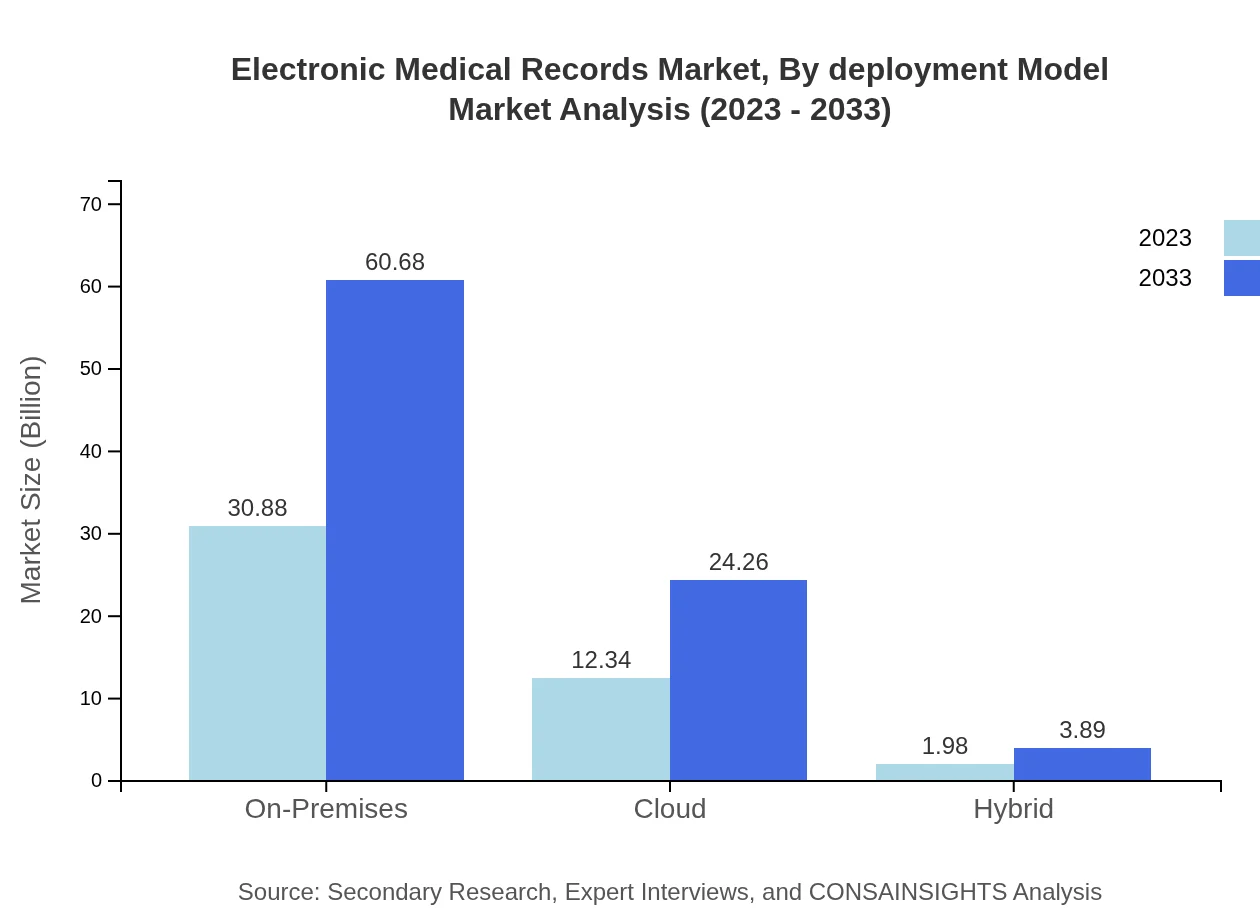

Electronic Medical Records Market Analysis By Deployment Model

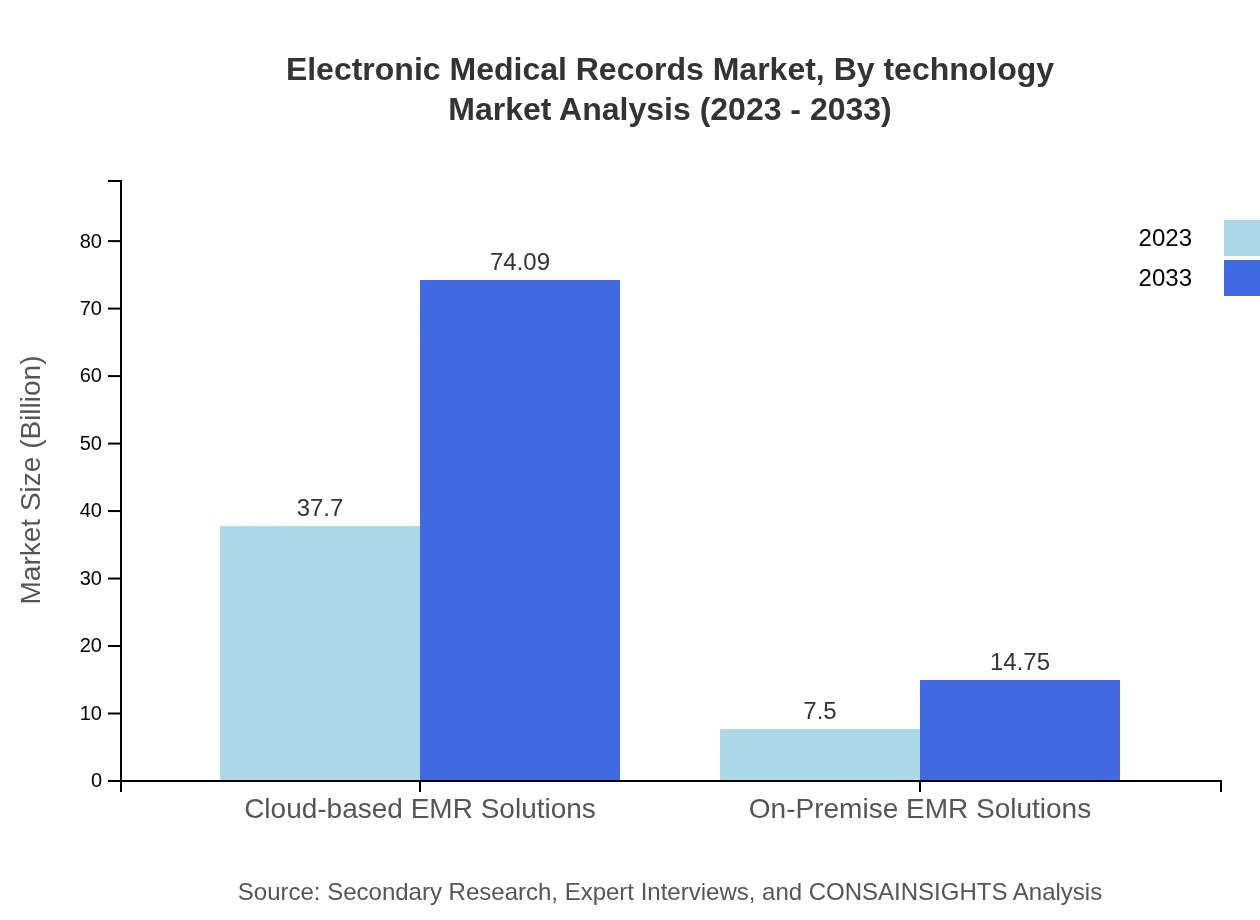

The EMR deployment models consist of cloud-based, on-premise, and hybrid solutions. Cloud-based EMR solutions dominate the market, valued at $37.70 billion in 2023, expected to grow significantly to $74.09 billion by 2033. On-premise models hold a market size of $7.50 billion in 2023, which will reach $14.75 billion by 2033, while the hybrid models are anticipated to make a smaller yet growing impact.

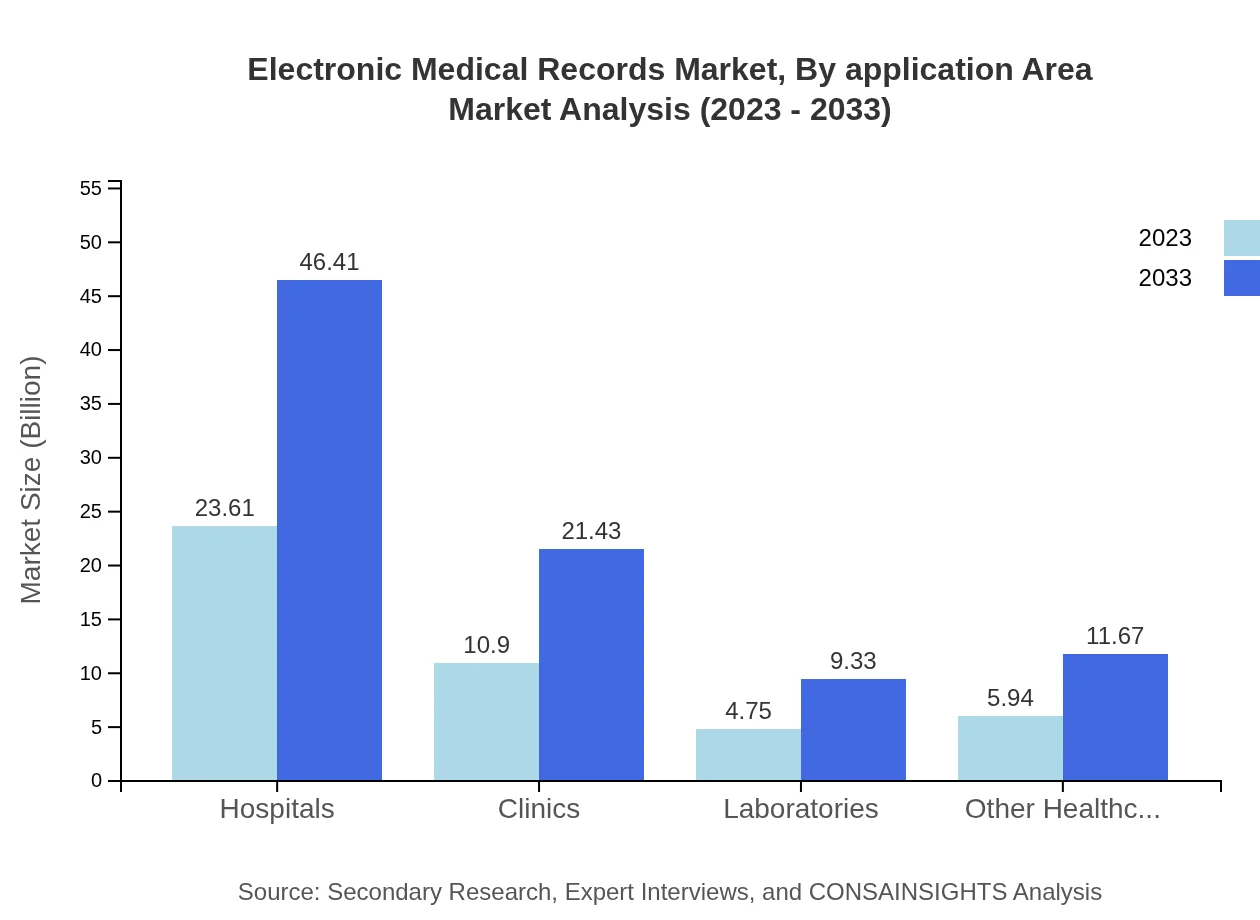

Electronic Medical Records Market Analysis By Application Area

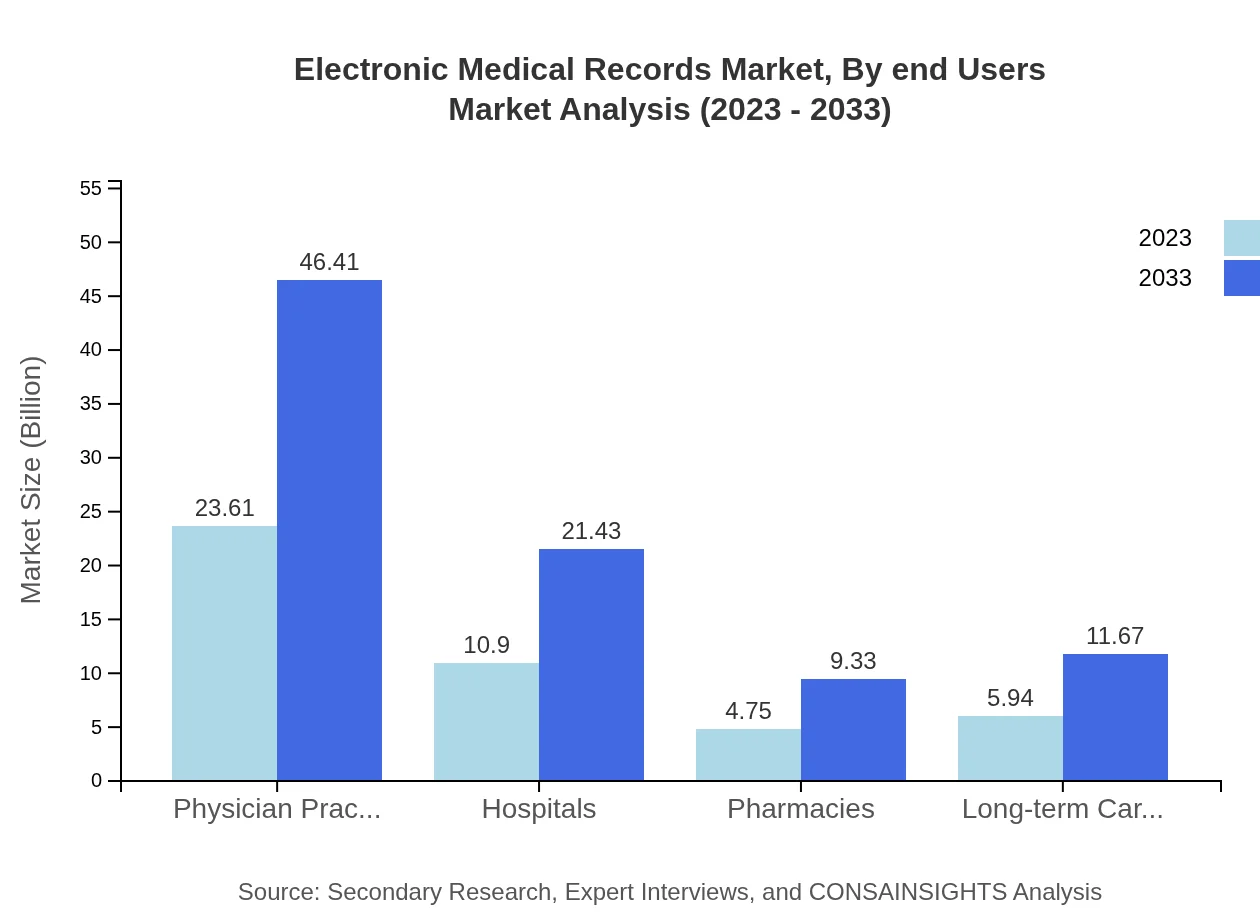

The application areas for EMRs include hospitals, physician practices, long-term care facilities, and laboratories. Physician practices lead the market with a size of $23.61 billion in 2023, projected to grow to $46.41 billion by 2033. Hospitals follow closely, with an expected growth from $10.90 billion in 2023 to $21.43 billion by 2033.

Electronic Medical Records Market Analysis By End Users

The EMR market caters to various end-users including hospitals, clinics, long-term care facilities, and pharmacies. Hospitals, significantly, represent a large share with a market size of $23.61 billion in 2023, growing to $46.41 billion by 2033. This is closely tied to the increased need for comprehensive patient care solutions and electronic health records management.

Electronic Medical Records Market Analysis By Technology

The technology segment is pivotal in shaping the EMR landscape. Key technologies include AI-driven solutions, interoperability standards, and patient engagement tools. As these technologies evolve, they significantly influence care delivery, patient experience, and data management systems, creating an agile healthcare environment.

Electronic Medical Records Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Electronic Medical Records Industry

Epic Systems Corporation:

Epic Systems is a major player in the EMR market known for its comprehensive electronic health record solutions. They provide tools facilitating data interoperability and health information exchange across systems.Cerner Corporation:

Cerner Corporation offers innovative healthcare solutions in the EMR space, focusing on streamlining clinical workflows and enhancing operational efficiency for healthcare organizations.Allscripts Healthcare Solutions:

Allscripts provides a range of EMR systems dedicated to improving the quality of care through health data technologies that support physician decision-making.MEDITECH:

MEDITECH specializes in developing healthcare information systems, including EMRs, that provide seamless integration for various healthcare providers across all care settings.We're grateful to work with incredible clients.

FAQs

What is the market size of electronic medical records?

The electronic medical records market is valued at approximately $45.2 billion in 2023, with a projected CAGR of 6.8% through 2033. This growth reflects the increasing adoption of digital record-keeping in healthcare settings.

What are the key market players or companies in this electronic medical records industry?

Key players in the electronic medical records industry include Epic Systems, Cerner Corporation, Allscripts Healthcare Solutions, and MEDITECH, among others, who are at the forefront of developing innovative solutions and services.

What are the primary factors driving the growth in the electronic medical records industry?

The growth of the electronic medical records industry is driven by factors such as increasing patient demand for digital services, government healthcare mandates, the need for operational efficiency, and advancements in technology.

Which region is the fastest Growing in the electronic medical records?

North America is the fastest-growing region in the electronic medical records market, with a market size of $15.84 billion in 2023 expected to reach $31.14 billion by 2033, indicating robust growth and high adoption rates.

Does ConsaInsights provide customized market report data for the electronic medical records industry?

Yes, ConsaInsights offers customized market report data for the electronic medical records industry, allowing clients to tailor their research requirements for better insights and strategic business planning.

What deliverables can I expect from this electronic medical records market research project?

The deliverables from this electronic medical records market research project include comprehensive market analysis reports, regional insights, competitive landscape overviews, and segment performance assessments to inform strategic decisions.

What are the market trends of electronic medical records?

Market trends in electronic medical records include the shift towards cloud-based solutions, increased EMR interoperability, enhanced data security measures, and a growing focus on patient-centered care facilitated by digital tools.