Electronic Packaging Market Report

Published Date: 31 January 2026 | Report Code: electronic-packaging

Electronic Packaging Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Electronic Packaging market, highlighting current trends, segmented analysis, regional insights, and future growth forecasts from 2023 to 2033.

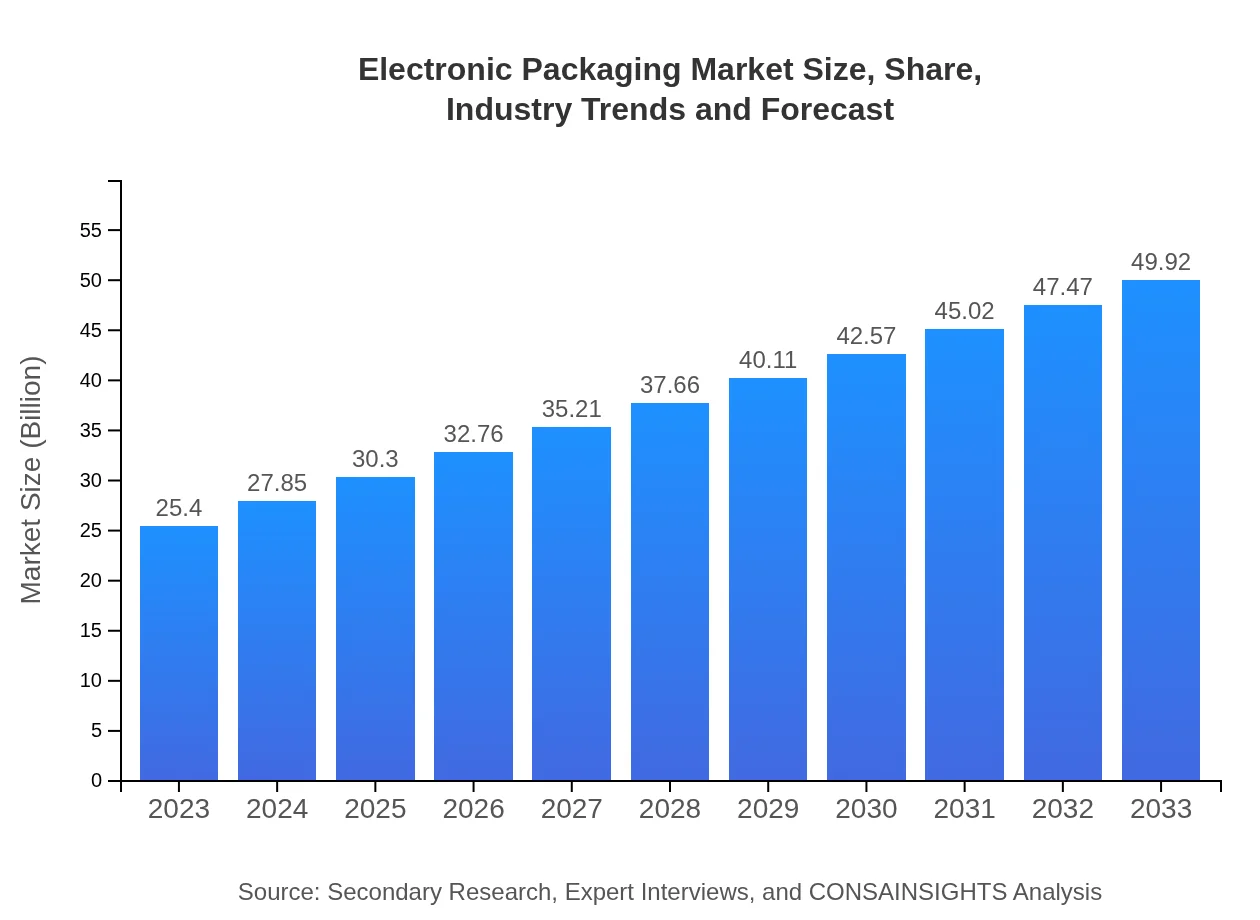

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.40 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $49.92 Billion |

| Top Companies | Amkor Technology, Inc., ASE Technology Holding Co., Ltd., Intel Corporation, STMicroelectronics N.V. |

| Last Modified Date | 31 January 2026 |

Electronic Packaging Market Overview

Customize Electronic Packaging Market Report market research report

- ✔ Get in-depth analysis of Electronic Packaging market size, growth, and forecasts.

- ✔ Understand Electronic Packaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Electronic Packaging

What is the Market Size & CAGR of the Electronic Packaging market in 2023?

Electronic Packaging Industry Analysis

Electronic Packaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Electronic Packaging Market Analysis Report by Region

Europe Electronic Packaging Market Report:

In 2023, the European Electronic Packaging market is valued at USD 6.49 billion, forecasted to reach USD 12.75 billion by 2033. The shift to sustainable and biodegradable packaging solutions is propelling market growth in response to EU regulations.Asia Pacific Electronic Packaging Market Report:

The Asia Pacific region is the largest market for Electronic Packaging, valued at USD 5.03 billion in 2023 with a projected growth to USD 9.89 billion by 2033. Key drivers include the burgeoning consumer electronics industry in countries like China, Japan, and South Korea, alongside substantial investments in semiconductor manufacturing.North America Electronic Packaging Market Report:

North America is poised for significant growth, with market size estimated at USD 8.26 billion in 2023, expected to expand to USD 16.24 billion by 2033. The region is heavily influenced by technological advancements in the consumer electronics and aerospace sectors.South America Electronic Packaging Market Report:

Latin America’s Electronic Packaging market stands at USD 2.13 billion in 2023 and is expected to reach USD 4.18 billion by 2033. The growth is facilitated by increasing adoption of electronics in automotive and industrial sectors, despite economic fluctuations.Middle East & Africa Electronic Packaging Market Report:

The Middle East and Africa market, estimated at USD 3.49 billion in 2023, is projected to grow to USD 6.86 billion by 2033. Growth is driven by increasing investment in infrastructure and expanding technology sectors in the region.Tell us your focus area and get a customized research report.

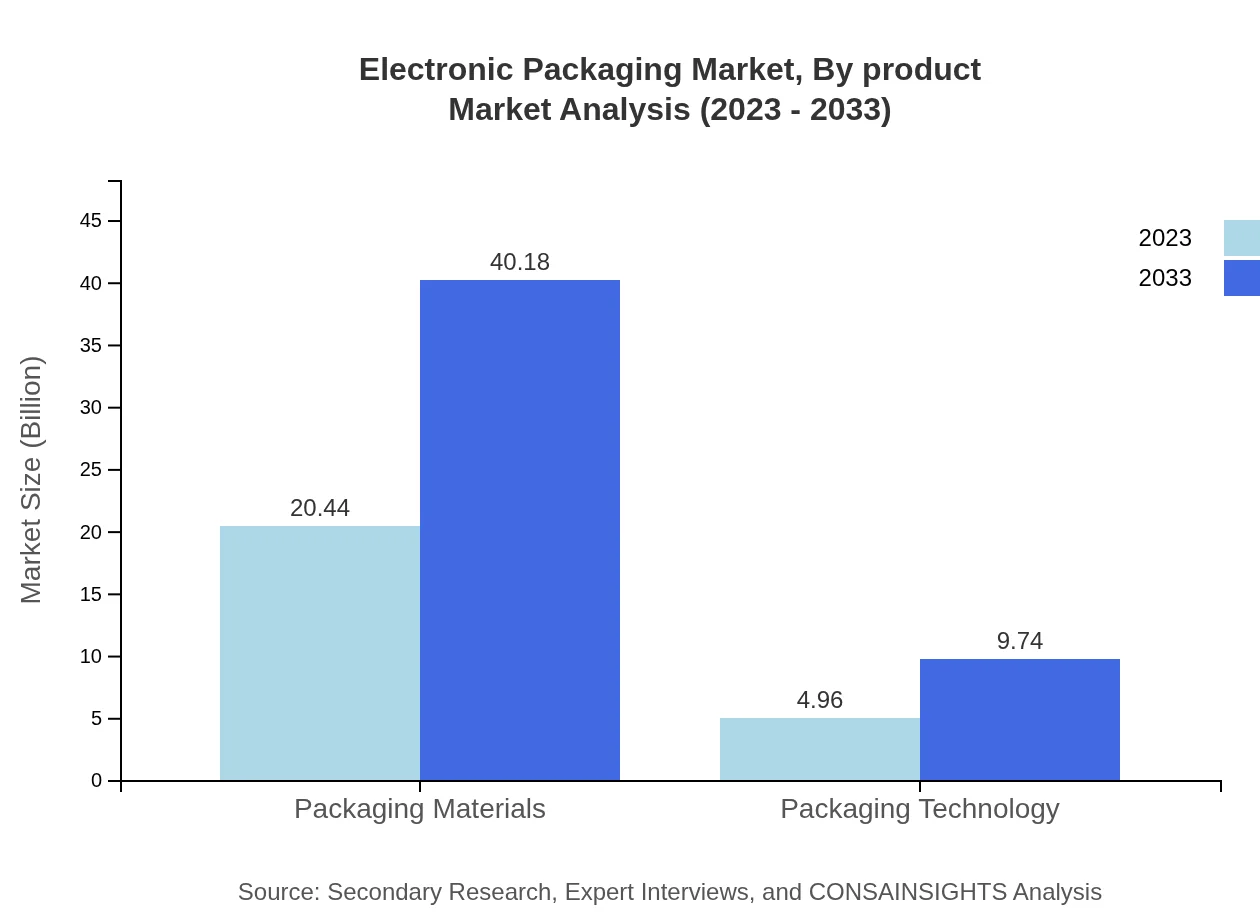

Electronic Packaging Market Analysis By Product

The Packaging Materials segment dominates the market, valued at USD 20.44 billion in 2023 and expected to grow to USD 40.18 billion by 2033. Single-chip packages and multi-chip modules offer essential performance for varying application requirements, exhibiting a steady share of the market revenue.

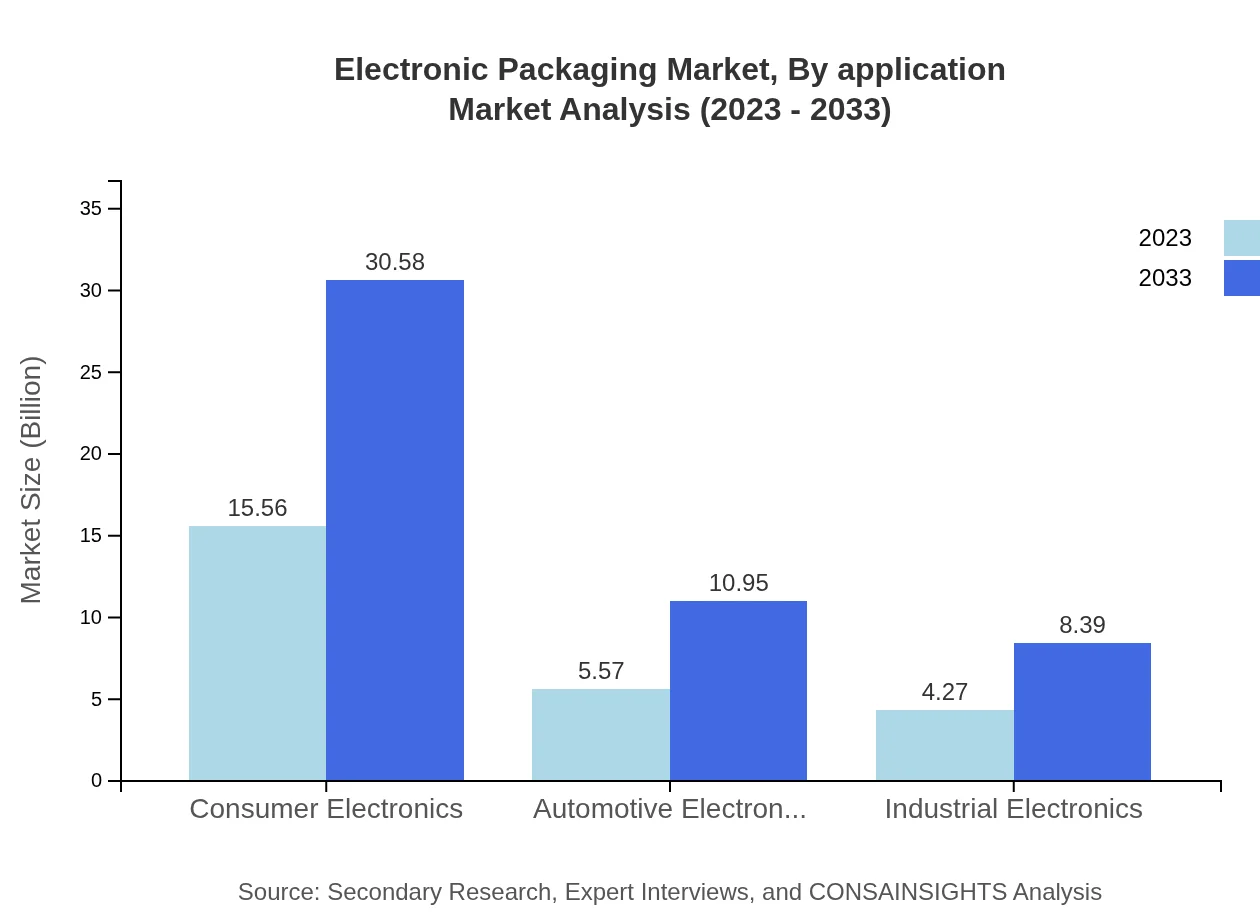

Electronic Packaging Market Analysis By Application

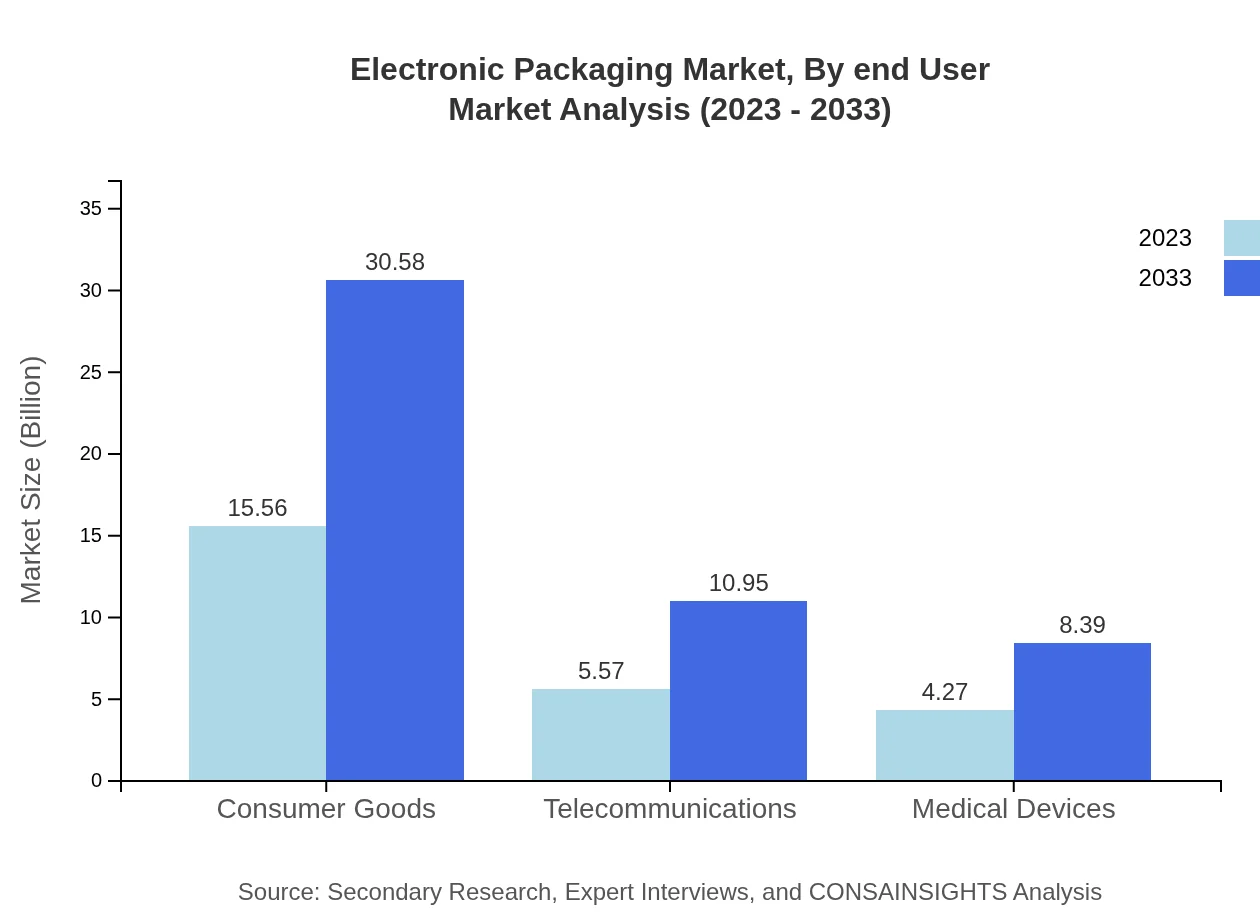

Consumer Goods, including appliances and personal devices, represent a market size of USD 15.56 billion in 2023 and are projected to double by 2033. Telecommunications and automotive sectors similarly show robust growth patterns, fueled by digital transformation and increasing electronic integration.

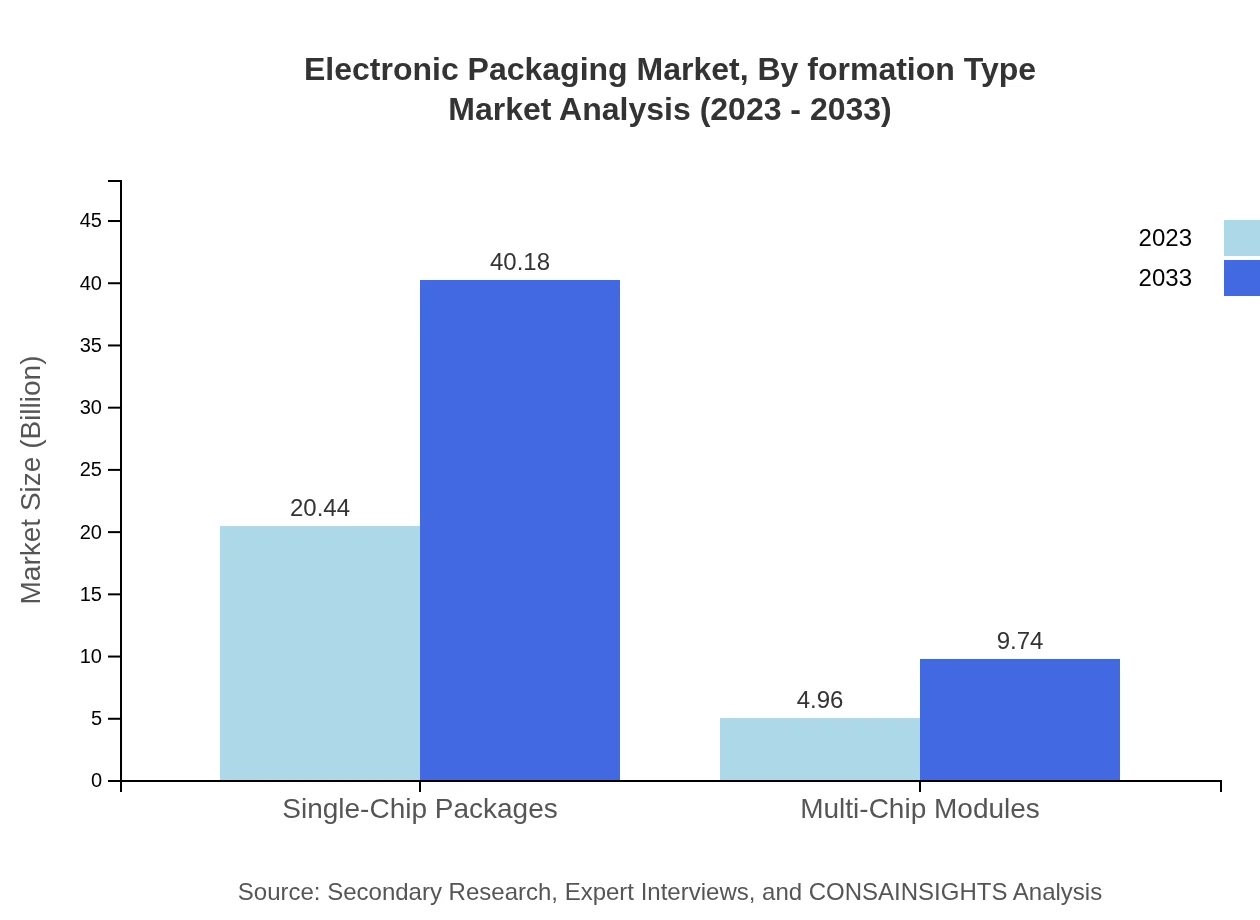

Electronic Packaging Market Analysis By Formation Type

Single-chip packaging predominates, capturing over 80% market share with a size of USD 20.44 billion in 2023 and forecasted to reach USD 40.18 billion by 2033, owing to its efficiency in power and space utilization.

Electronic Packaging Market Analysis By End User

The Consumer Electronics sector leads with a share of 61.25% in 2023. With a market valuation of USD 15.56 billion growing to USD 30.58 billion by 2033, it underscores the importance of efficient packaging in product longevity and consumer satisfaction.

Electronic Packaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Electronic Packaging Industry

Amkor Technology, Inc.:

A semiconductor packaging company that provides high-performance packaging solutions for various electronic applications.ASE Technology Holding Co., Ltd.:

One of the largest providers of independent semiconductor packaging and testing services in the world.Intel Corporation:

Known for its innovation in chip development and manufacturing, Intel also provides advanced packaging technologies to enhance performance.STMicroelectronics N.V.:

A global semiconductor leader that designs and manufactures a wide range of products, offering innovative packaging solutions in the electronics space.We're grateful to work with incredible clients.

FAQs

What is the market size of electronic packaging?

The electronic packaging market is projected to reach $25.4 billion by 2033, growing at a CAGR of 6.8%. This growth highlights the increasing demand for innovative packaging solutions across various sectors, enhancing product reliability and performance.

What are the key market players or companies in the electronic packaging industry?

Key players in the electronic packaging industry include major corporations such as Intel, Amkor Technology, and Samsung. These companies lead in technology innovations and market share, significantly contributing to the industry's growth and advancements.

What are the primary factors driving the growth in the electronic packaging industry?

Growth in the electronic packaging industry is primarily driven by advancements in semiconductor technologies, increasing demand for consumer electronics, and the rising need for efficient packaging solutions in telecommunications and automotive applications.

Which region is the fastest Growing in the electronic packaging?

The Asia Pacific region is the fastest-growing in the electronic packaging market, with a projected increase from $5.03 billion in 2023 to $9.89 billion in 2033. This growth is fueled by thriving electronics manufacturing and consumption in countries like China and India.

Does ConsaInsights provide customized market report data for the electronic packaging industry?

Yes, ConsaInsights offers customized market report data for the electronic packaging industry, allowing clients to tailor reports according to specific needs and insights that are relevant to their business interests and objectives.

What deliverables can I expect from this electronic packaging market research project?

Deliverables from the electronic packaging market research project include comprehensive reports detailing market size, growth forecasts, competitive analysis, regional breakdowns, and insights into market trends and opportunities over the forecast period.

What are the market trends of electronic packaging?

Current trends in electronic packaging include a shift towards sustainability, miniaturization of components, and advanced materials that improve thermal performance. Innovations in packaging technology are also enhancing the integration of smart features in electronic devices.