Electronic Paper Display Market Report

Published Date: 31 January 2026 | Report Code: electronic-paper-display

Electronic Paper Display Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Electronic Paper Display market, covering insights on market size, trends, segmentation, and future forecasts from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

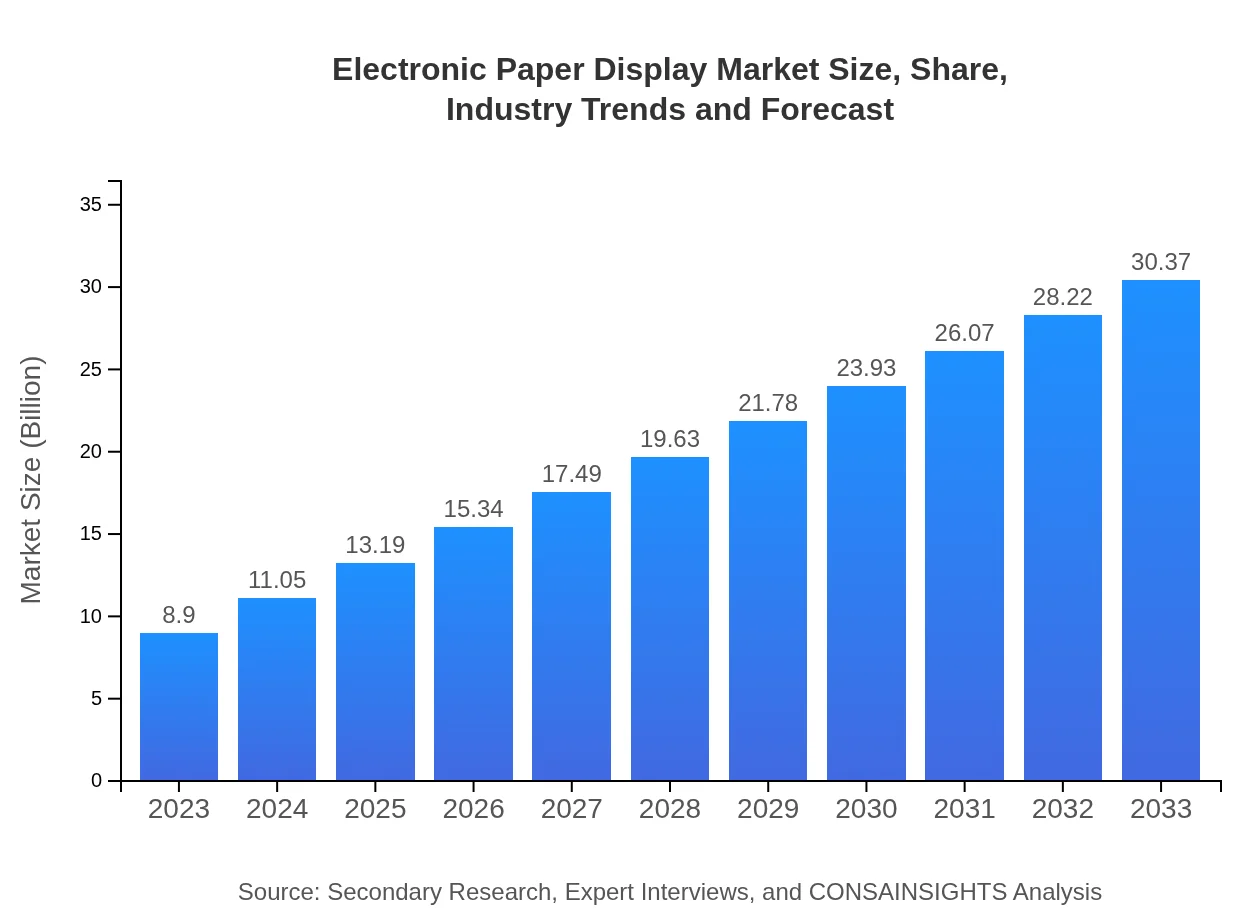

| 2023 Market Size | $8.90 Billion |

| CAGR (2023-2033) | 12.5% |

| 2033 Market Size | $30.37 Billion |

| Top Companies | E Ink Holdings, Sony Corporation, LG Display, BOE Technology Group, Amazon |

| Last Modified Date | 31 January 2026 |

Electronic Paper Display Market Overview

Customize Electronic Paper Display Market Report market research report

- ✔ Get in-depth analysis of Electronic Paper Display market size, growth, and forecasts.

- ✔ Understand Electronic Paper Display's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Electronic Paper Display

What is the Market Size & CAGR of Electronic Paper Display market in 2023?

Electronic Paper Display Industry Analysis

Electronic Paper Display Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Electronic Paper Display Market Analysis Report by Region

Europe Electronic Paper Display Market Report:

The European market for Electronic Paper Displays is forecasted to rise from $2.62 billion in 2023 to $8.93 billion by 2033, led by sustainability trends and the integration of EPDs in various industries, especially education and advertising.Asia Pacific Electronic Paper Display Market Report:

The Asia Pacific region is anticipated to experience robust growth, with the market size reaching approximately $5.79 billion by 2033, up from $1.70 billion in 2023. This growth is driven by increasing consumer electronics usage and technological integration in education and retail sectors.North America Electronic Paper Display Market Report:

North America is expected to advance significantly, with market growth from $3.21 billion in 2023 to $10.94 billion by 2033. The region's focus on innovation, particularly in consumer electronics and digital signage, propels demand for EPD technologies.South America Electronic Paper Display Market Report:

In South America, the Electronic Paper Display market is projected to grow from $0.16 billion in 2023 to $0.53 billion by 2033. Factors such as rising e-commerce and literacy initiatives contribute to this growth, suggesting evolving adoption of EPDs across educational tools.Middle East & Africa Electronic Paper Display Market Report:

In the Middle East and Africa, the market size is expected to grow from $1.22 billion in 2023 to $4.18 billion by 2033, driven by initiatives aimed at enhancing education and digital transformation in emerging markets.Tell us your focus area and get a customized research report.

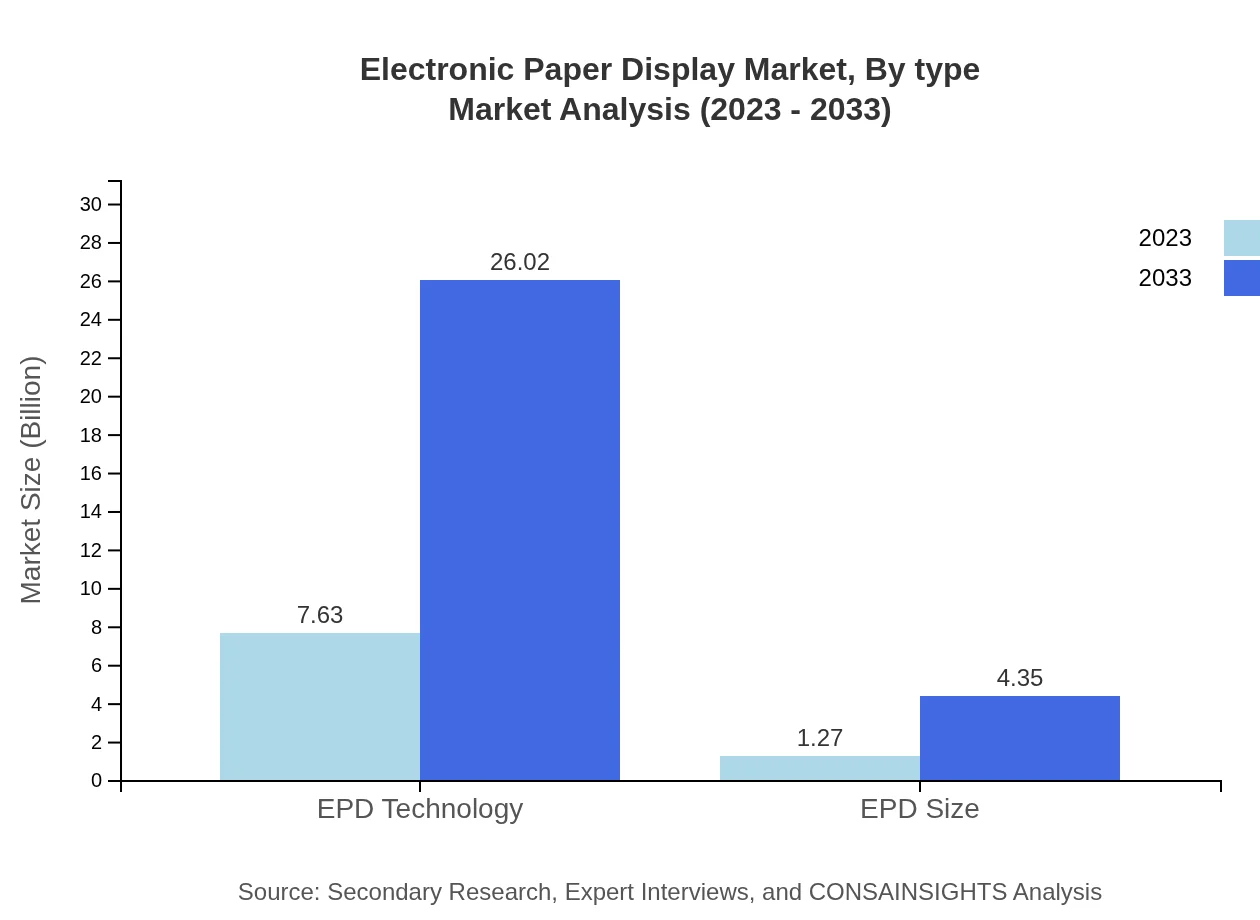

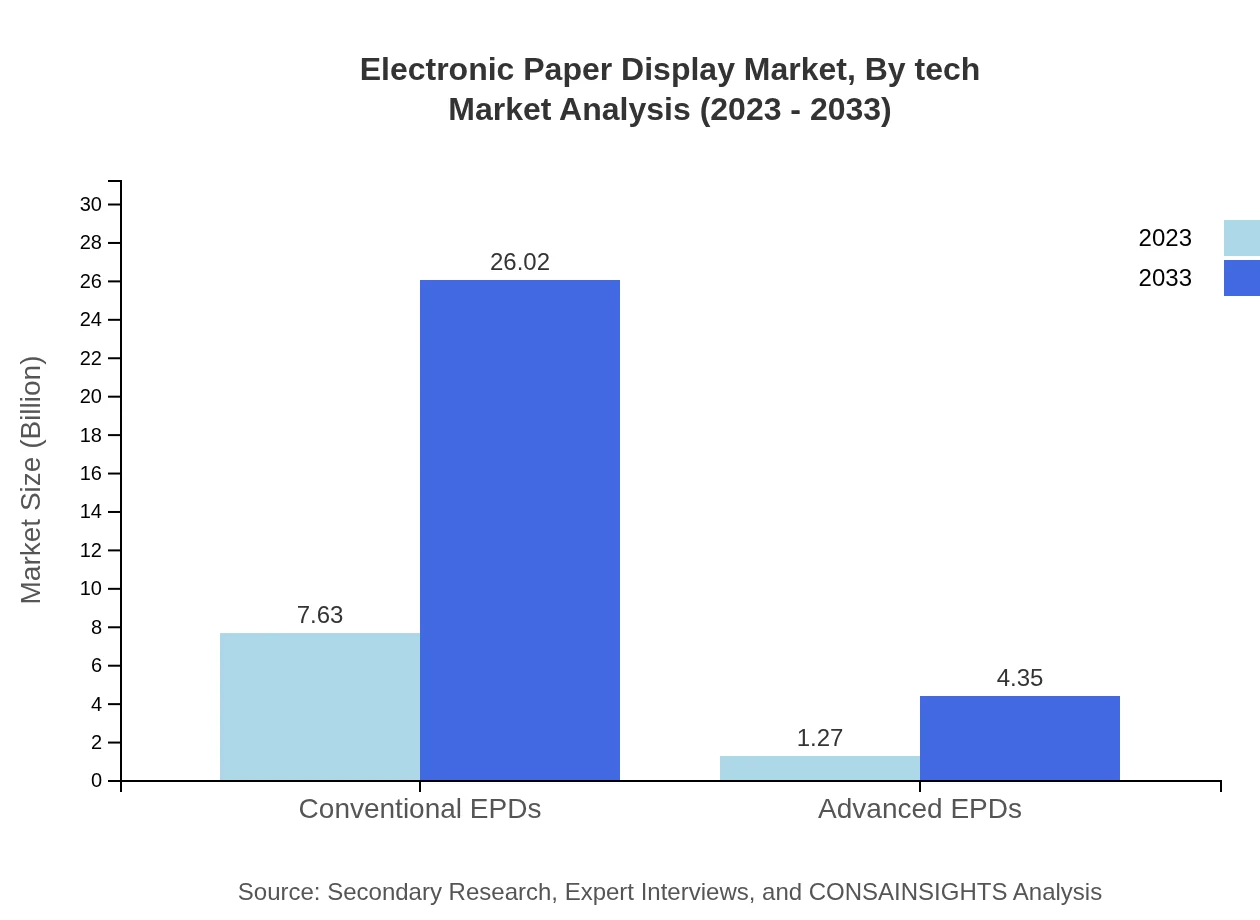

Electronic Paper Display Market Analysis By Type

The Electronic Paper Display market is predominantly composed of Conventional EPDs, which represent an approximate market size of $7.63 billion in 2023 and are projected to grow to $26.02 billion by 2033, maintaining a market share of 85.68%. Advanced EPDs are also making strides with a size increase from $1.27 billion to $4.35 billion during the same period, capturing a market share of 14.32%.

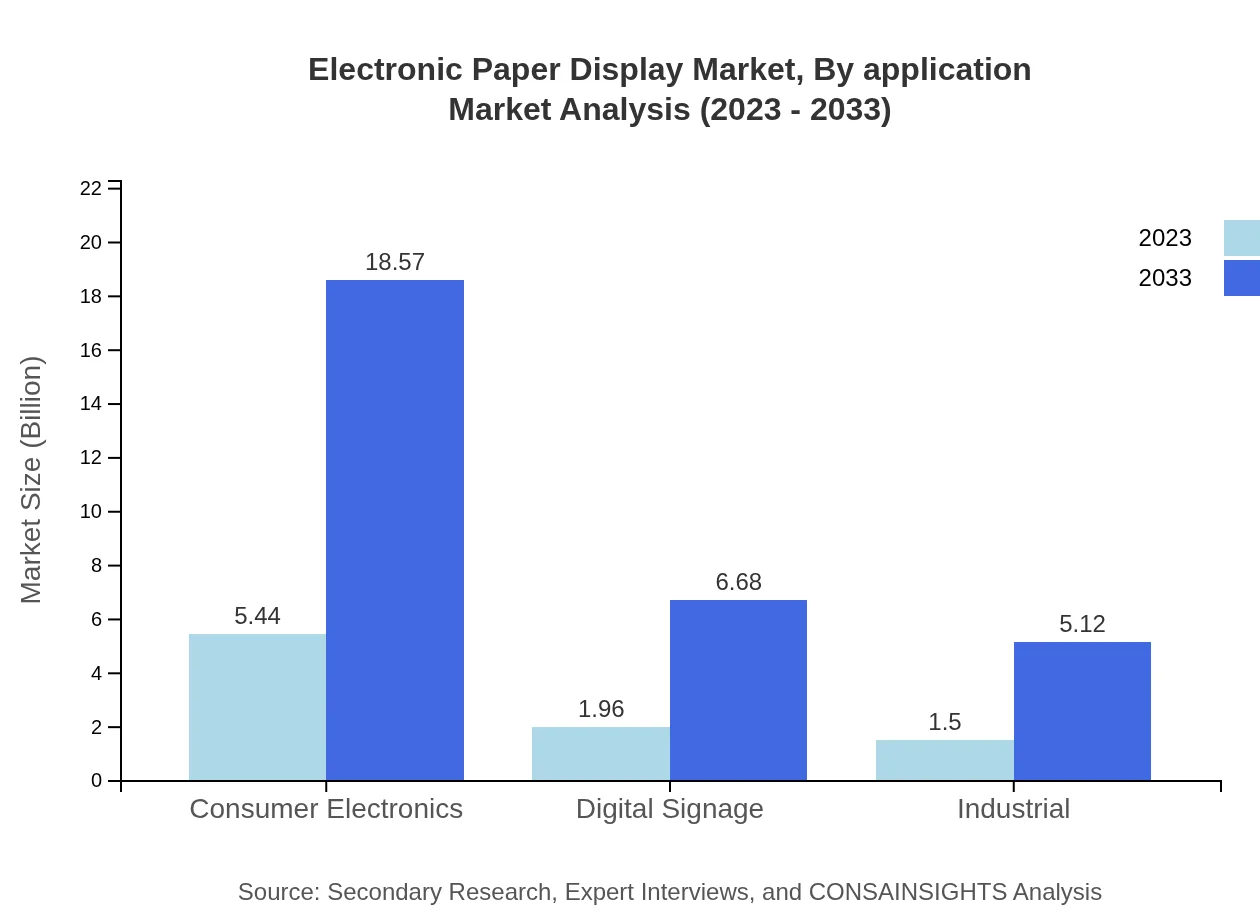

Electronic Paper Display Market Analysis By Application

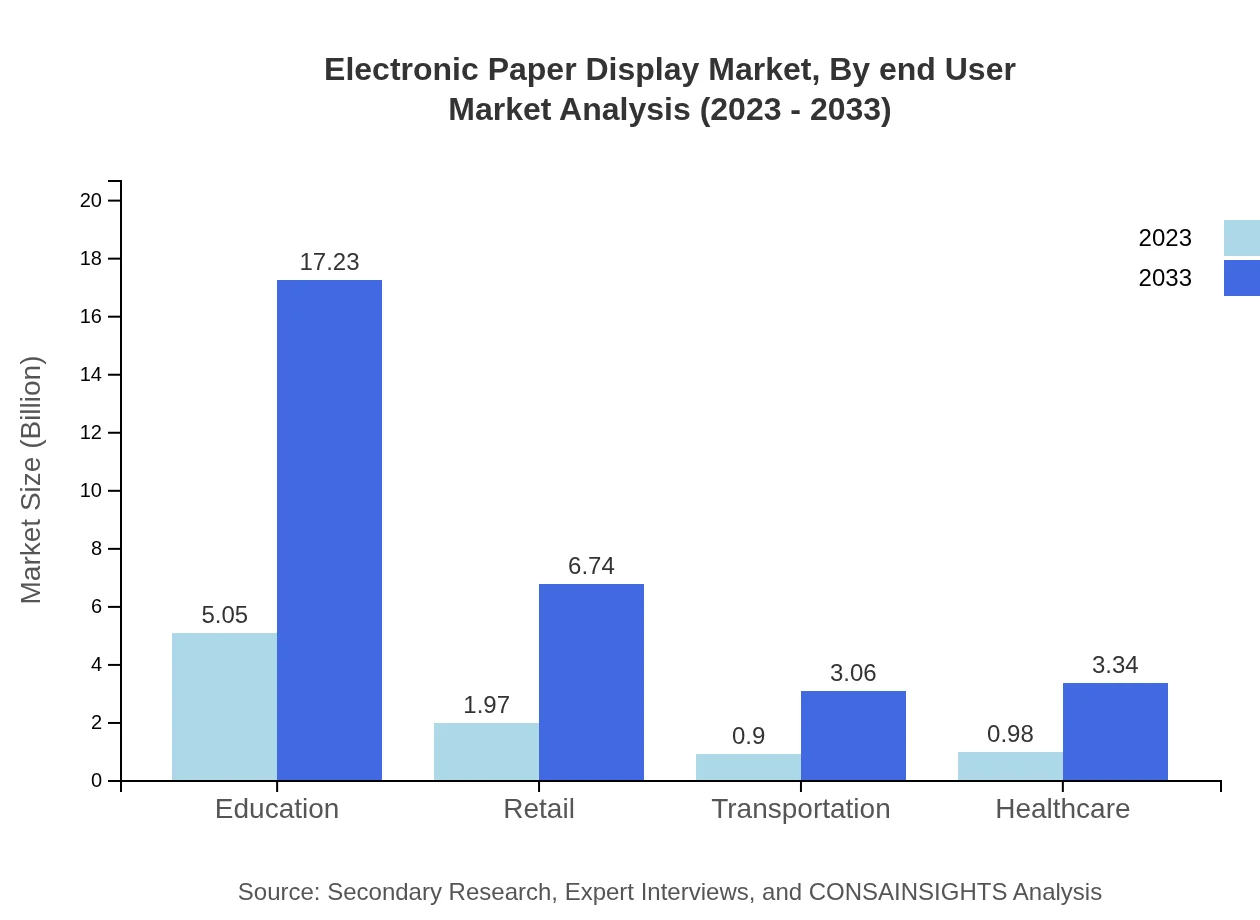

In terms of applications, the education sector remains the largest contributor, with a market size of $5.05 billion in 2023, expanding to $17.23 billion by 2033, retaining a 56.73% share. Other applications like consumer electronics ($5.44 billion in 2023) and digital signage ($1.96 billion) also show significant growth potential, reinforcing the demand for EPD technology.

Electronic Paper Display Market Analysis By End User

The end-user segmentation highlights consumer electronics as the leading area, valued at $5.44 billion in 2023 and expected to reach $18.57 billion by 2033, reflecting a 61.15% market share. Other notable sectors include transportation and healthcare, demonstrating EPD's versatility in various applications.

Electronic Paper Display Market Analysis By Tech

Technological advancements play a pivotal role in shaping the EPD market. The technology trends indicate that the shift towards more energy-efficient and flexible displays is crucial. With significant market contributions from conventional and advanced EPD technologies, their growth prospects appear promising, aligning with global sustainability goals.

Electronic Paper Display Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Electronic Paper Display Industry

E Ink Holdings:

Pioneering the development of electronic ink technology, E Ink Holdings is a leading manufacturer of EPDs, primarily serving the e-reader and digital signage markets.Sony Corporation:

Sony is notable for its innovative electronic paper technology, deploying EPDs across various consumer electronic devices and digital information displays.LG Display:

Focused on developing advanced display technologies, LG Display has made significant investments in EPD technology, catering to the demand for low-power display solutions.BOE Technology Group:

As one of the largest display manufacturers, BOE is actively engaged in the EPD market, focusing on integrating advanced technologies in the production of their display products.Amazon :

Amazon's Kindle e-reader series has significantly boosted the Electronic Paper Display market, showcasing the advantages of EPD technology in portable reading devices.We're grateful to work with incredible clients.

FAQs

What is the market size of electronic Paper Display?

The electronic paper display market was valued at approximately $8.9 billion in 2023 and is projected to grow at a CAGR of 12.5%. By 2033, the market size is expected to significantly increase as demand for innovative display solutions rises.

What are the key market players or companies in this electronic Paper Display industry?

Key players in the electronic paper display industry include E Ink Holdings, LG Display, and Samsung Electronics. These companies are renowned for their technological advancements and innovations in electronic paper technologies, contributing significantly to market growth.

What are the primary factors driving the growth in the electronic Paper Display industry?

The growth in the electronic paper display industry is driven by rising demand for energy-efficient display technologies, increased adoption in e-readers, and expansion in digital signage. Enhanced features such as flexibility and better readability further stimulate market interest.

Which region is the fastest Growing in the electronic Paper Display market?

The Asia Pacific region is the fastest-growing market for electronic paper displays, expected to increase from $1.70 billion in 2023 to $5.79 billion by 2033. This growth is dominated by advancements in technology and increasing consumer electronic demand.

Does ConsaInsights provide customized market report data for the electronic Paper Display industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements within the electronic paper display industry. This customization ensures that clients receive insights that align with their strategic business needs.

What deliverables can I expect from this electronic Paper Display market research project?

Deliverables from the electronic paper display market research project typically include comprehensive market analysis reports, insights on trends, competitive analysis, and forecasts, along with customized data specific to client needs.

What are the market trends of electronic Paper Display?

Current trends in the electronic paper display market include increasing use in retail and advertising, growth in education and healthcare applications, and advancements in manufacturing technologies that enhance display performance and reduce costs.