Electronic Security Market Report

Published Date: 31 January 2026 | Report Code: electronic-security

Electronic Security Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Electronic Security market, highlighting key trends, segmentation, regional dynamics, market leaders, and future forecasts from 2023 to 2033.

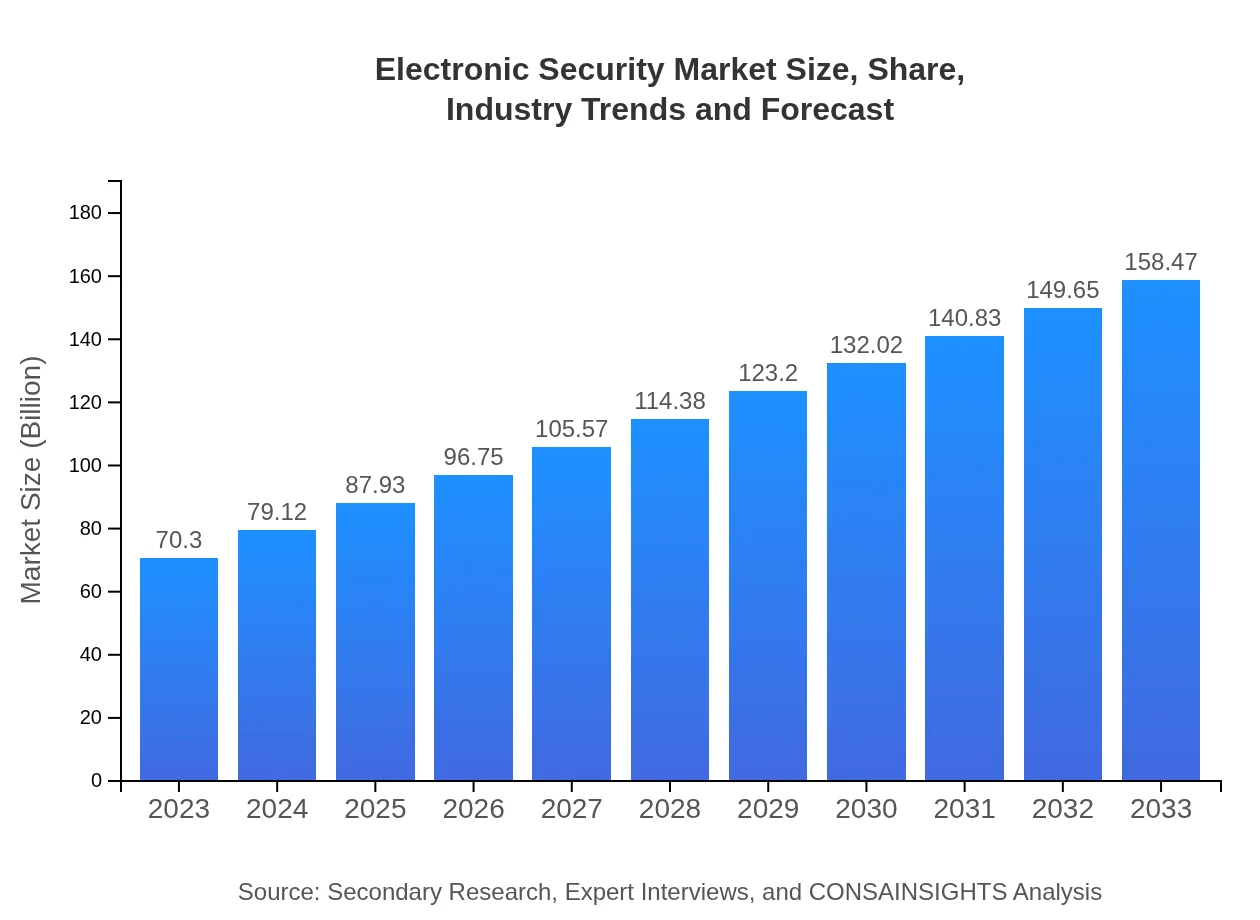

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $70.30 Billion |

| CAGR (2023-2033) | 8.2% |

| 2033 Market Size | $158.47 Billion |

| Top Companies | Johnson Controls, Hikvision, Honeywell Security Group, Bosch Security Systems, Tyco Integrated Security |

| Last Modified Date | 31 January 2026 |

Electronic Security Market Overview

Customize Electronic Security Market Report market research report

- ✔ Get in-depth analysis of Electronic Security market size, growth, and forecasts.

- ✔ Understand Electronic Security's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Electronic Security

What is the Market Size & CAGR of Electronic Security market in 2023?

Electronic Security Industry Analysis

Electronic Security Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Electronic Security Market Analysis Report by Region

Europe Electronic Security Market Report:

Europe's Electronic Security market is expected to double, increasing from USD 20.41 billion in 2023 to USD 46.00 billion by 2033. Factors such as stringent security regulations, an active focus on cybersecurity, and significant investments in smart infrastructure propel this growth. The region is also increasingly investing in multi-layered security solutions to protect against evolving threats.Asia Pacific Electronic Security Market Report:

The Asia Pacific market is projected to grow significantly, reaching USD 33.99 billion by 2033 from USD 15.08 billion in 2023. Key factors include rapid urbanization, increasing investments in infrastructure development, and a growing emphasis on smart city initiatives. Countries like China and India are anticipated to be major contributors to this growth, bolstered by government initiatives promoting security solutions.North America Electronic Security Market Report:

North America remains one of the largest markets for Electronic Security, with the market projected to grow from USD 22.91 billion in 2023 to USD 51.64 billion by 2033. This growth is supported by advanced technology adoption, a robust regulatory framework, and increased spending on security solutions within the private and public sectors.South America Electronic Security Market Report:

In South America, the market is expected to increase from USD 6.68 billion in 2023 to USD 15.05 billion by 2033. The growth is driven by rising crime rates and an increasing need for security measures in both urban and rural areas. Additionally, investment in digitalization and technological advancements is fostering innovation in security solutions.Middle East & Africa Electronic Security Market Report:

In the Middle East and Africa, the Electronic Security market is projected to grow from USD 5.22 billion in 2023 to USD 11.77 billion by 2033. This growth is driven by escalating security concerns due to geopolitical tensions, urbanization, and government initiatives aimed at improving public safety and infrastructure.Tell us your focus area and get a customized research report.

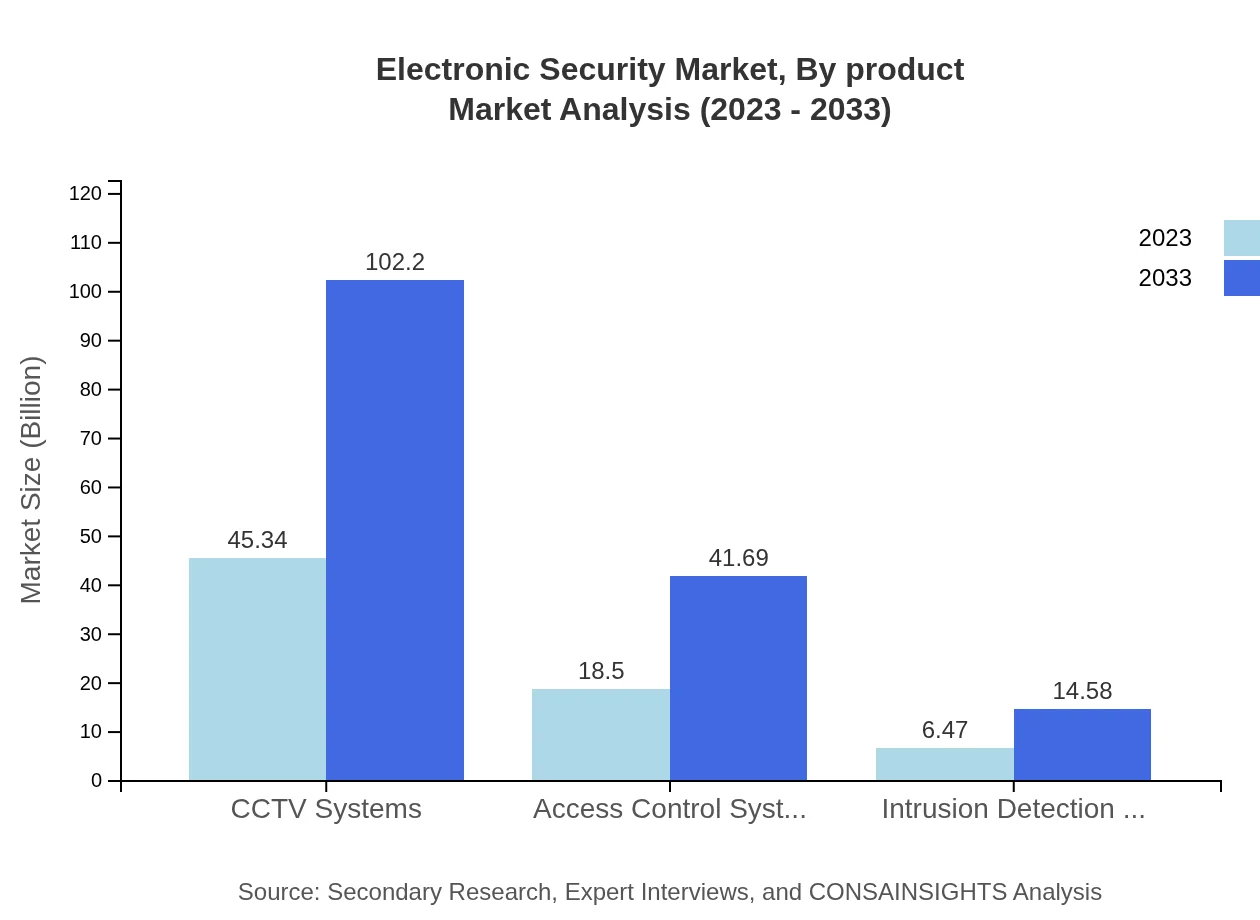

Electronic Security Market Analysis By Product

In 2023, CCTV systems hold the largest market share in the Electronic Security sector, accounting for USD 45.34 billion. By 2033, this segment is expected to grow significantly to USD 102.20 billion, reflecting a steady demand for enhanced surveillance capabilities. Access Control Systems follow with a projected growth from USD 18.50 billion in 2023 to USD 41.69 billion in 2033. Intrusion Detection Systems and Installation Services are also important segments that demonstrate robust growth prospects based on the increasing need for integrated security systems.

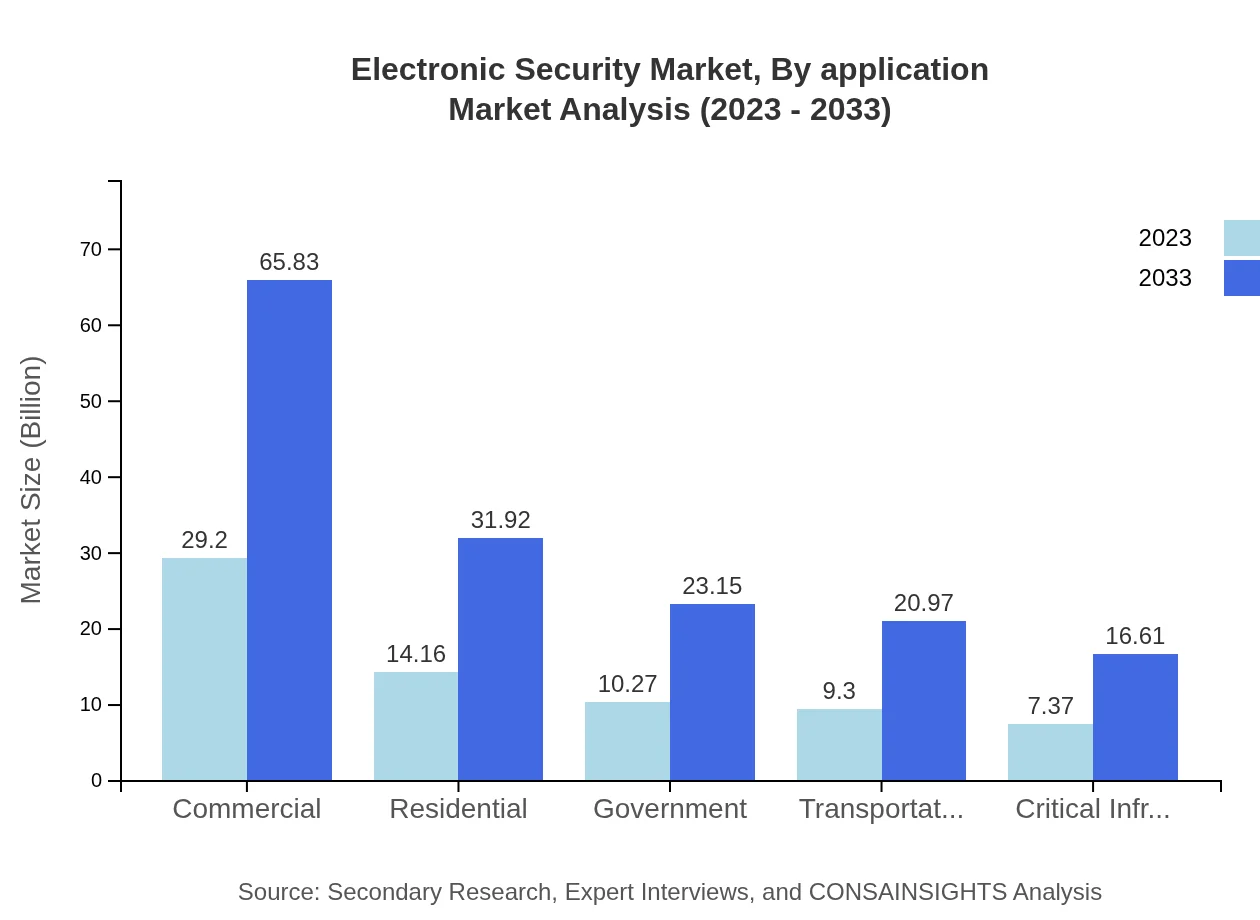

Electronic Security Market Analysis By Application

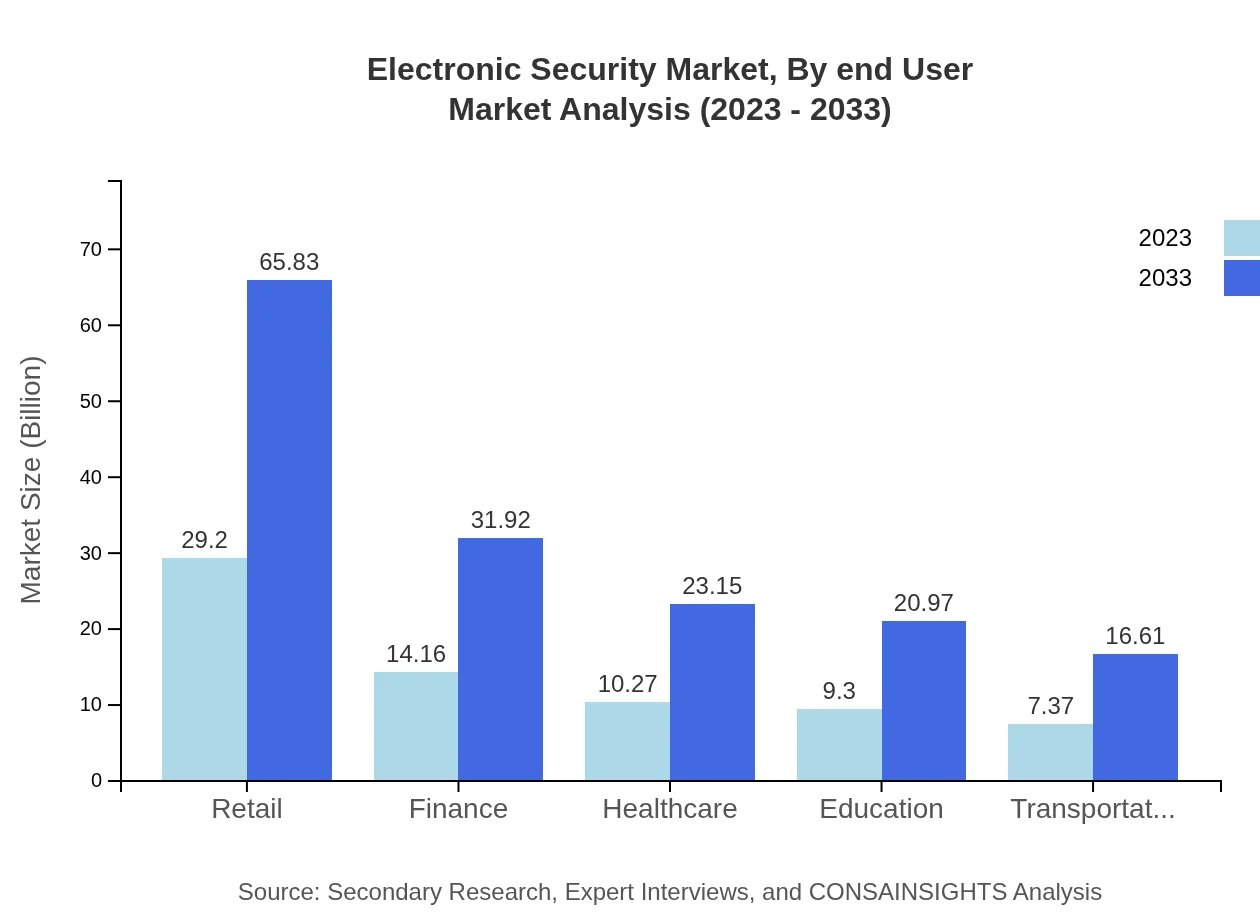

The top applications of Electronic Security span several sectors, with Retail leading at USD 29.20 billion in 2023, expected to grow to USD 65.83 billion by 2033. Other significant segments include the Finance sector, with a growth from USD 14.16 billion to USD 31.92 billion, and Healthcare, which is projected to expand from USD 10.27 billion to USD 23.15 billion over the same period. These applications illustrate the increasing prioritization of security across various industries.

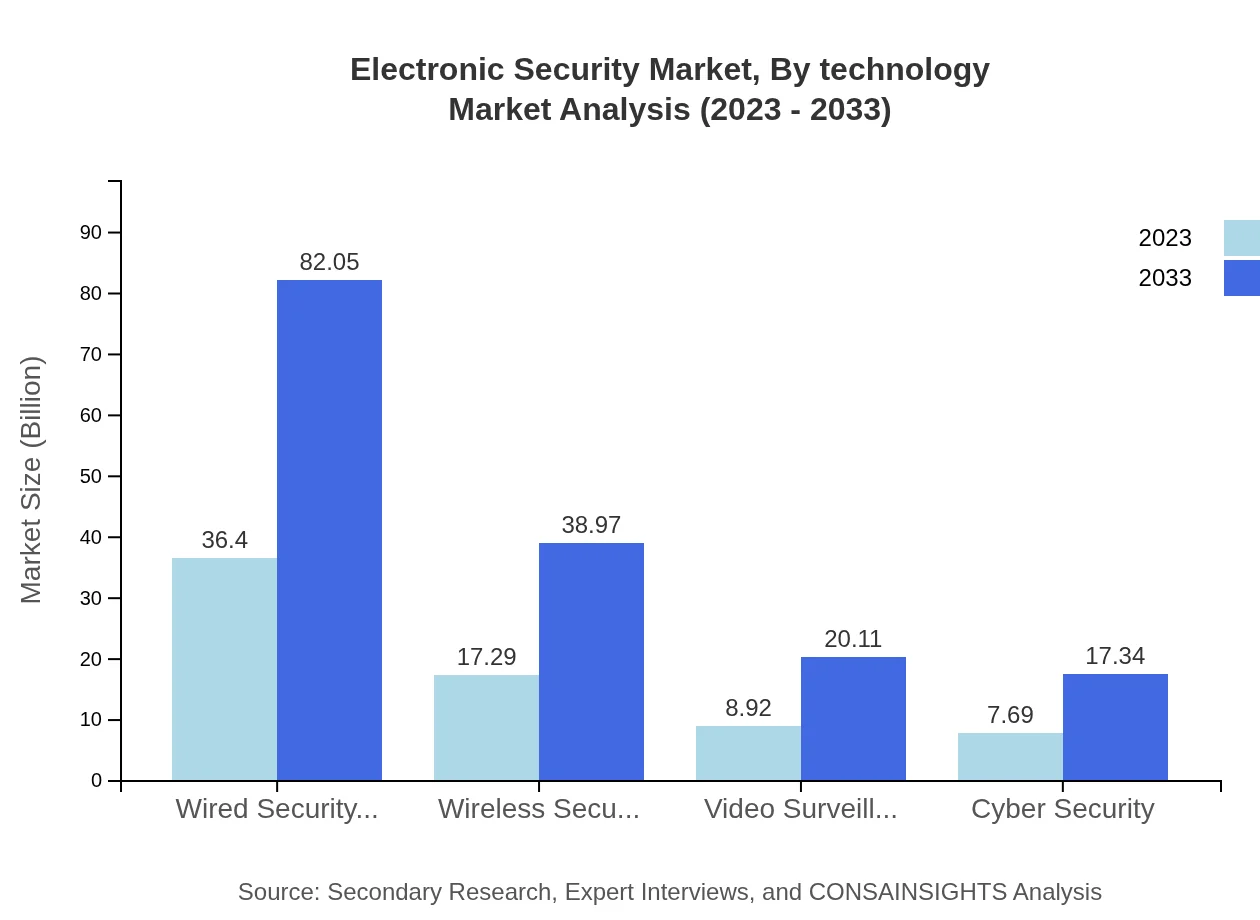

Electronic Security Market Analysis By Technology

The technology segment of Electronic Security showcases a substantial shift towards wired and wireless security systems. Wired Security Systems are projected to grow from USD 36.40 billion in 2023 to USD 82.05 billion by 2033. In contrast, Wireless Security Systems will expand from USD 17.29 billion to USD 38.97 billion, highlighting the trend toward flexibility and ease of installation in modern security solutions.

Electronic Security Market Analysis By End User

The Electronic Security market serves various end-users, including Commercial, Residential, and Government sectors. The Commercial segment leads with projections of growth from USD 29.20 billion to USD 65.83 billion by 2033. The Residential sector is forecasted to grow from USD 14.16 billion to USD 31.92 billion, showcasing a rise in homeowners' investments in security. The Government sector is anticipated to expand from USD 10.27 billion to USD 23.15 billion, as public safety concerns drive increased investment in security infrastructure.

Electronic Security Market Analysis By Service

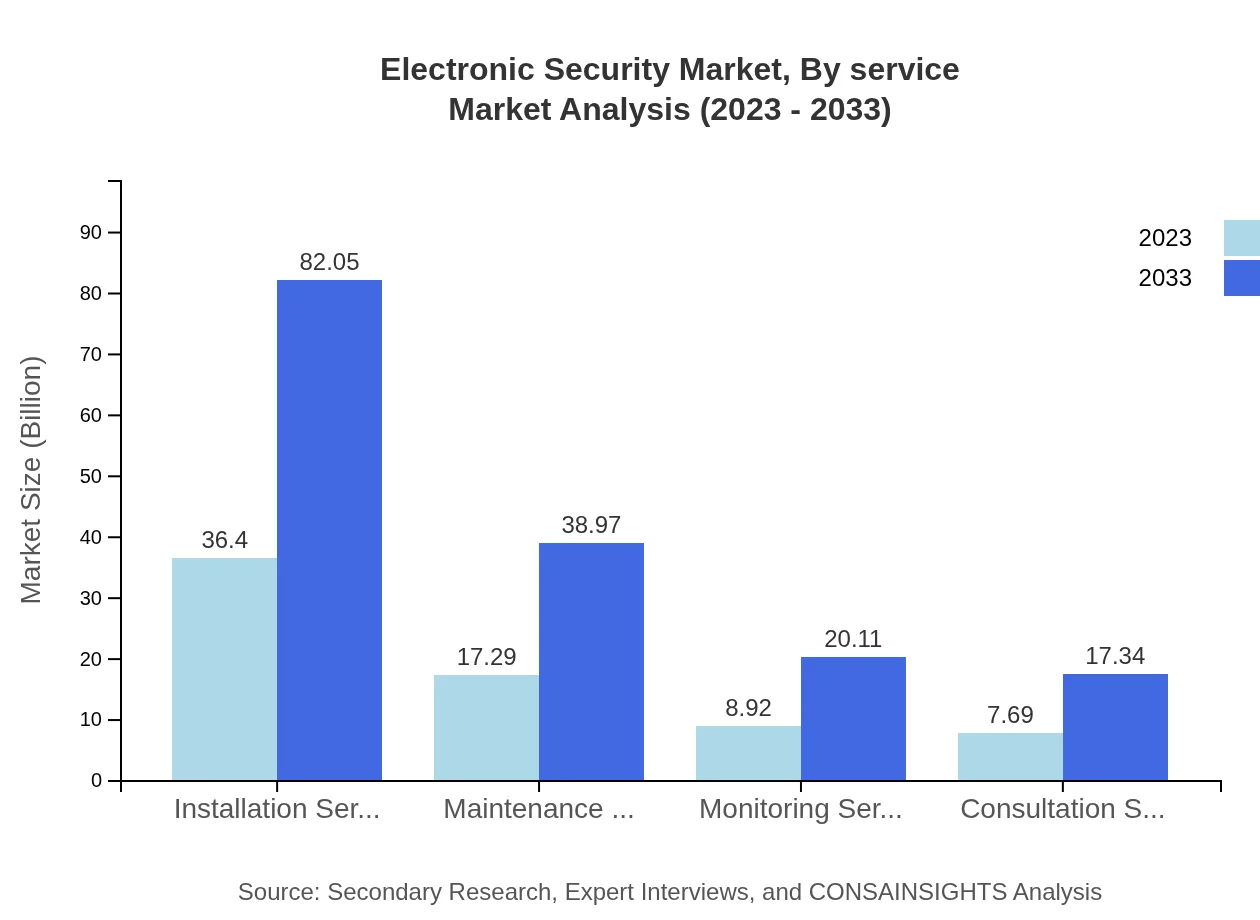

In terms of services, Installation Services are leading, projected to grow from USD 36.40 billion in 2023 to USD 82.05 billion by 2033. Maintenance Services will see a rise from USD 17.29 billion to USD 38.97 billion, driven by the need for ongoing support for installed security systems. Monitoring Services from USD 8.92 billion to USD 20.11 billion, and Consultation Services from USD 7.69 billion to USD 17.34 billion also reflect the increasing demand for comprehensive security solutions.

Electronic Security Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Electronic Security Industry

Johnson Controls:

A leader in building technologies and solutions, Johnson Controls offers a range of integrated security solutions aimed at enhancing safety and efficiency across various sectors.Hikvision:

Recognized as a prominent manufacturer of video surveillance products and solutions, Hikvision is at the forefront of security innovation, focusing on smart technologies.Honeywell Security Group:

Honeywell provides comprehensive security solutions ranging from intrusion detection and access control to video surveillance, catering to residential and commercial sectors.Bosch Security Systems:

Bosch specializes in providing reliable security solutions, offering a diverse portfolio that includes video surveillance, intrusion detection, and fire detection systems.Tyco Integrated Security:

A subsidiary of Johnson Controls, Tyco offers advanced security solutions and services, focusing on integrated and customized security systems.We're grateful to work with incredible clients.

FAQs

What is the market size of electronic Security?

The electronic security market is valued at approximately $70.3 billion in 2023 and is projected to grow at a CAGR of 8.2% reaching substantial figures by 2033.

What are the key market players or companies in this electronic Security industry?

Key players in the electronic security industry include globally recognized companies that specialize in various security technologies, including CCTV systems, access control, and cybersecurity solutions.

What are the primary factors driving the growth in the electronic Security industry?

Growth in the electronic security industry is driven by escalating security concerns, technological advancements, and increased investments in smart home and business security solutions.

Which region is the fastest Growing in electronic Security?

The fastest-growing region in the electronic security market is North America, expected to grow from $22.91 billion in 2023 to $51.64 billion by 2033.

Does ConsaInsights provide customized market report data for the electronic Security industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the electronic security industry, providing detailed insights and analysis.

What deliverables can I expect from this electronic Security market research project?

Expect comprehensive deliverables including market size analysis, trends, forecasts, profiles of key players, and insights across various segments of the electronic security market.

What are the market trends of electronic Security?

Market trends in electronic security include rising demand for integrated security systems, advancements in AI-based surveillance, and a shift towards remote monitoring solutions.