Electronic Sensors Market Report

Published Date: 31 January 2026 | Report Code: electronic-sensors

Electronic Sensors Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the electronic sensors market, covering key insights, trends, and forecasts from 2023 to 2033, highlighting growth opportunities and regional dynamics.

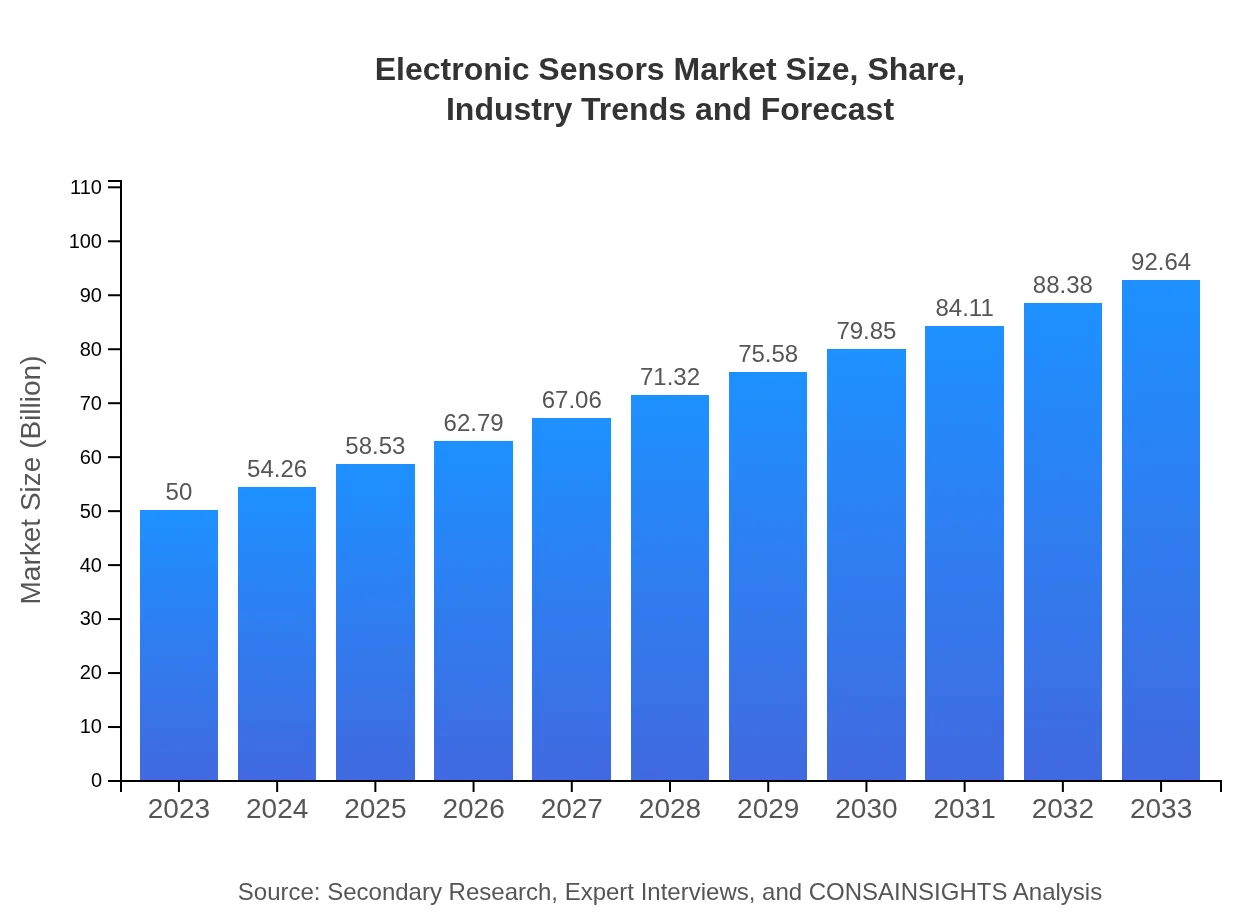

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $50.00 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $92.64 Billion |

| Top Companies | Honeywell International Inc., Siemens AG, Texas Instruments, Bosch Sensortec GmbH, Analog Devices, Inc. |

| Last Modified Date | 31 January 2026 |

Electronic Sensors Market Overview

Customize Electronic Sensors Market Report market research report

- ✔ Get in-depth analysis of Electronic Sensors market size, growth, and forecasts.

- ✔ Understand Electronic Sensors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Electronic Sensors

What is the Market Size & CAGR of Electronic Sensors market in 2023?

Electronic Sensors Industry Analysis

Electronic Sensors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Electronic Sensors Market Analysis Report by Region

Europe Electronic Sensors Market Report:

Europe is projected to see a market increase from 17.77 billion USD in 2023 to 32.93 billion USD in 2033, with a focus on renewable energy and efficiency in industrial applications driving sensor demand. Stringent regulations regarding energy efficiency in the EU further catalyze market growth.Asia Pacific Electronic Sensors Market Report:

The Asia Pacific region is expected to witness robust growth, with the market size projected to reach 15.13 billion USD by 2033, up from 8.16 billion USD in 2023. This growth is driven by increasing demand for advanced industrial automation technologies and smart manufacturing processes, coupled with substantial investments in IoT infrastructure across major economies such as China and Japan.North America Electronic Sensors Market Report:

North America holds a substantial share of the electronic sensors market, expected to expand from 16.82 billion USD in 2023 to 31.15 billion USD by 2033. The region's growth is primarily driven by the demand for smart technologies in automotive applications and the strong presence of key players investing in sensor innovations.South America Electronic Sensors Market Report:

In South America, the electronic sensors market is anticipated to grow from 2.52 billion USD in 2023 to approximately 4.67 billion USD by 2033. The growth is spurred by governmental initiatives aimed at enhancing industrial capabilities and increasing adoption of smart sensors in the agriculture sector.Middle East & Africa Electronic Sensors Market Report:

In the Middle East and Africa, the electronic sensors market is expected to grow from 4.72 billion USD in 2023 to 8.75 billion USD by 2033. Continued investment in smart city projects and infrastructure development across the region boosts the demand for electronic sensors.Tell us your focus area and get a customized research report.

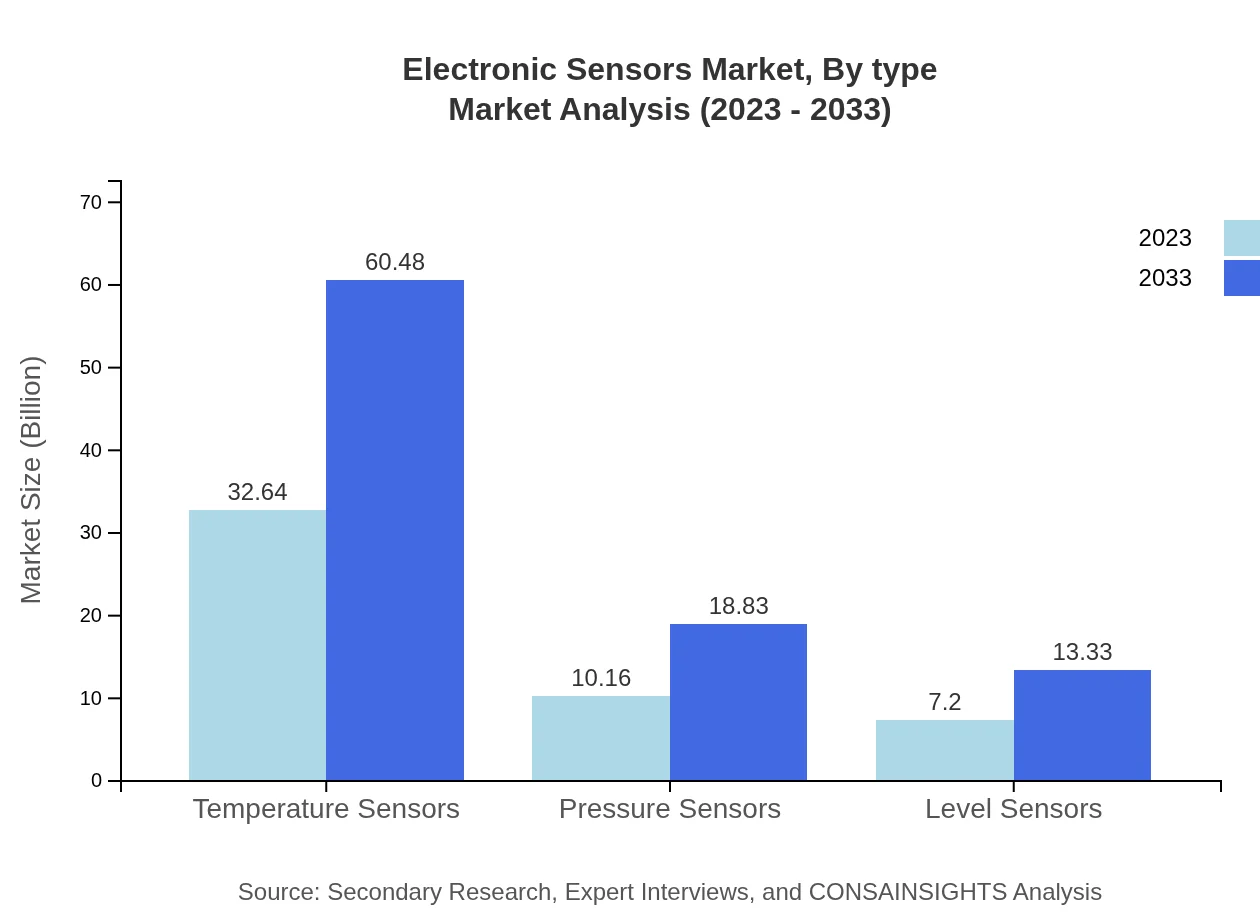

Electronic Sensors Market Analysis By Type

The temperature sensors segment leads with a market size of 32.64 billion USD in 2023 and projected growth to 60.48 billion USD by 2033. Pressure sensors follow with a size of 10.16 billion USD, expected to reach 18.83 billion USD. Level sensors and other segments also contribute significantly, reflecting the diversified applications across industries such as automotive and healthcare.

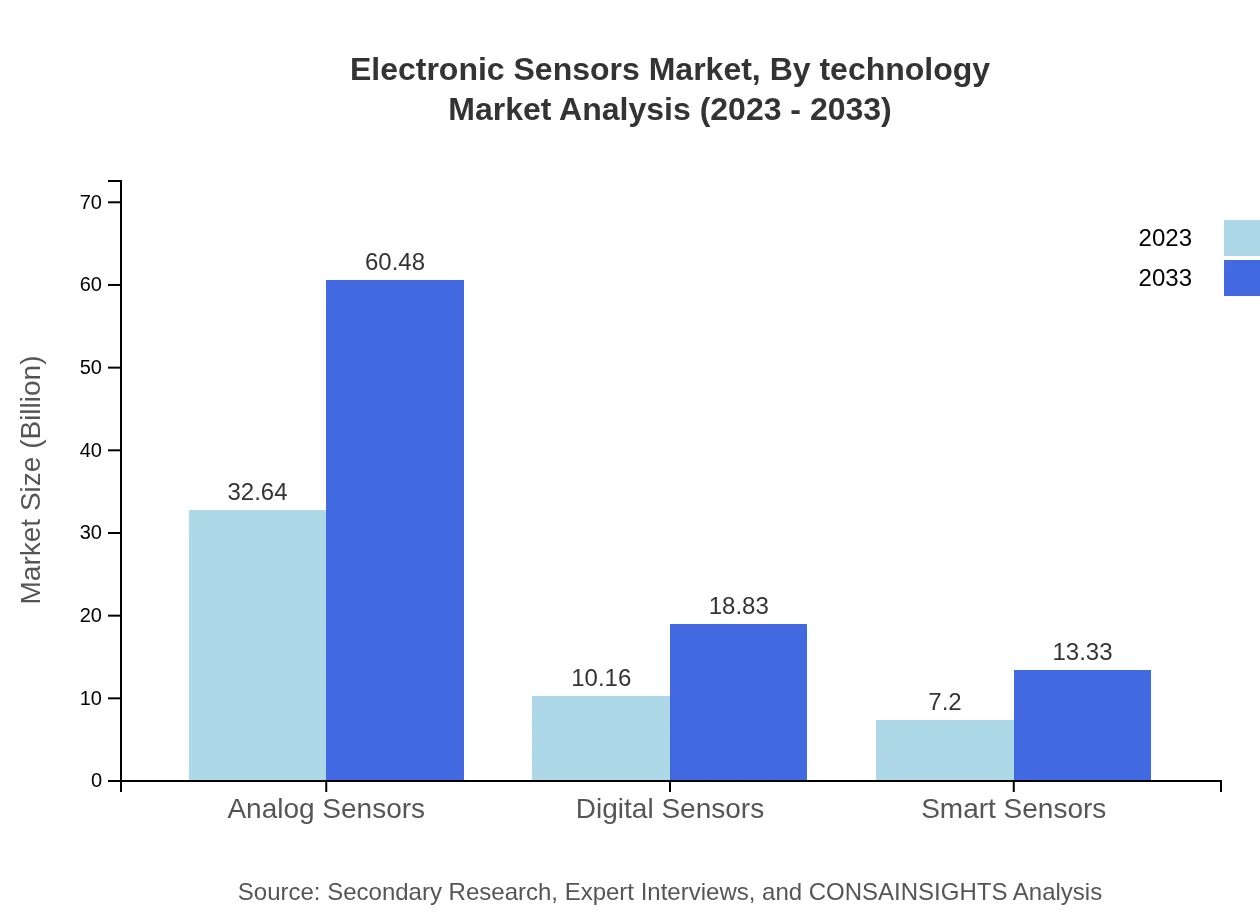

Electronic Sensors Market Analysis By Technology

Analog sensors dominate with a 2023 market size of 32.64 billion USD (65.28% share) and are projected to grow to 60.48 billion USD. Digital sensors have a market size of 10.16 billion USD (20.33% share) in 2023, while smart sensors are becoming increasingly significant with projections of 7.20 billion USD in 2023.

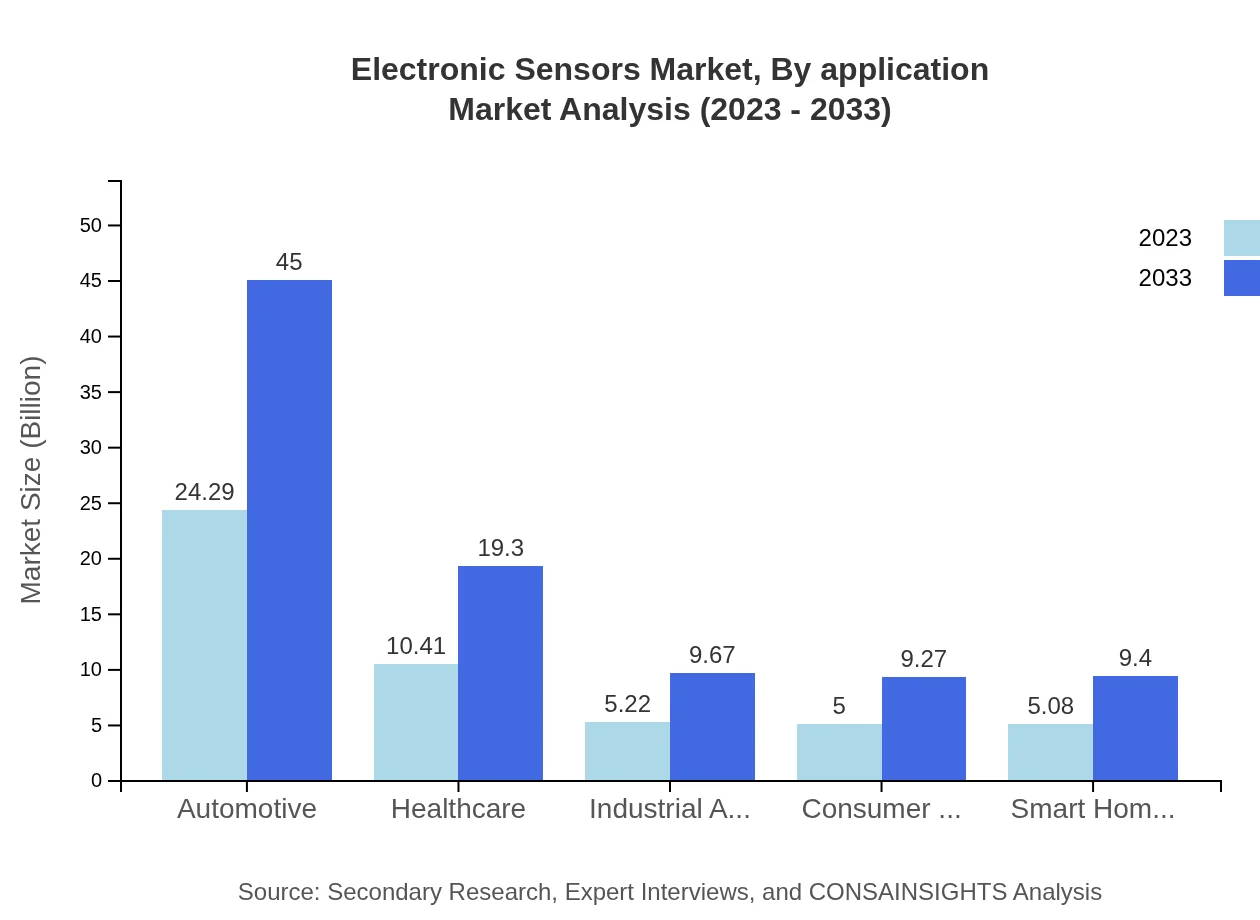

Electronic Sensors Market Analysis By Application

Industries such as automotive and healthcare lead in sensor adoption. The automotive sector's market size stands at 24.29 billion USD in 2023, and the healthcare segment is valued at 10.41 billion USD. These applications are critical as they pave the path for innovative, functionality-driven solutions in various domains.

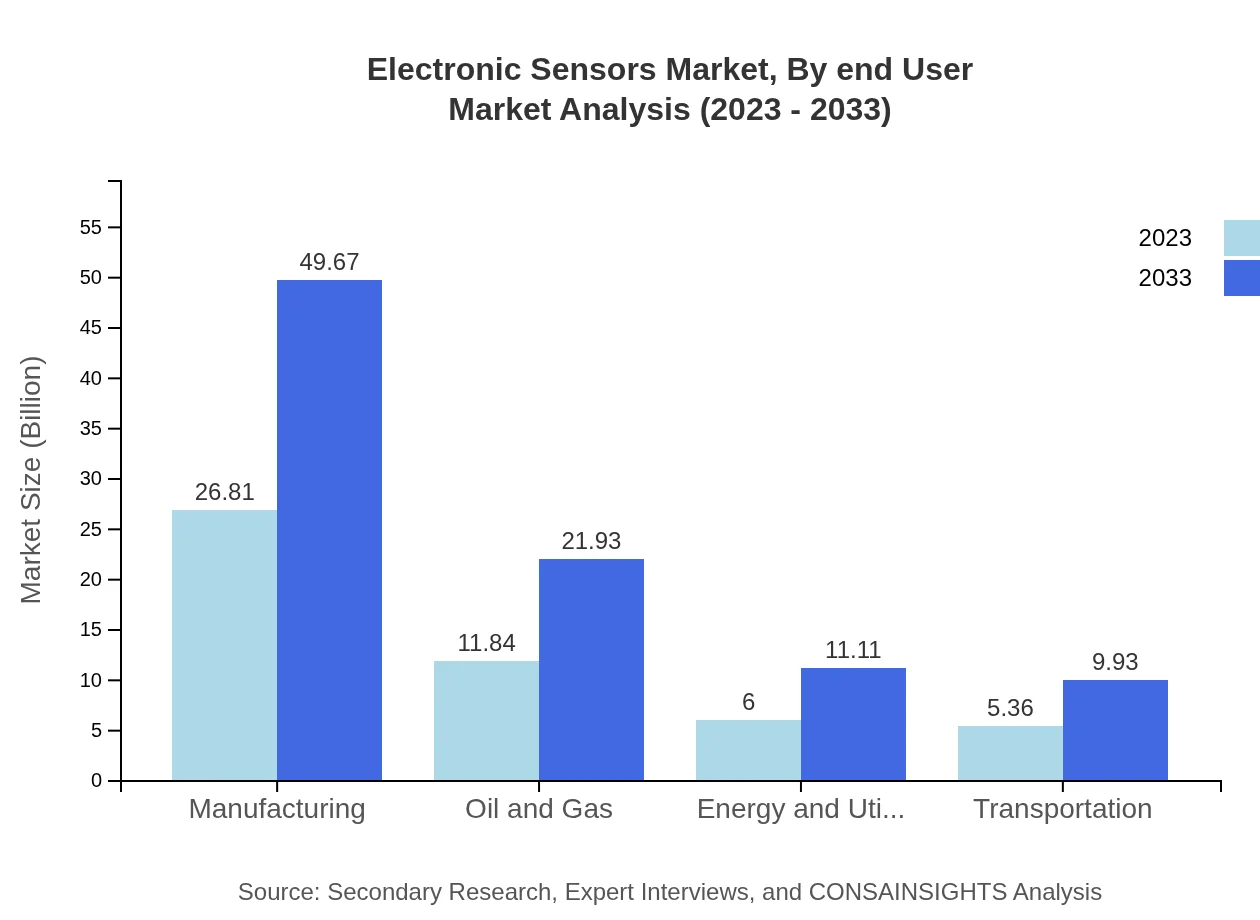

Electronic Sensors Market Analysis By End User

Key end-user industries include manufacturing, where the market size is 26.81 billion USD (53.62% share) in 2023, and oil and gas, which holds 11.84 billion USD. Each segment highlights the growing integration of sensors to improve operations and efficiency across sectors.

Electronic Sensors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Electronic Sensors Industry

Honeywell International Inc.:

A global leader in control technologies, Honeywell develops various electronic sensors for aerospace, industrial, and commercial applications.Siemens AG:

Siemens offers a wide range of integrated solutions, including advanced sensors for building technologies and industrial applications worldwide.Texas Instruments:

A pivotal player in the semiconductor market, Texas Instruments provides innovative sensor solutions that enhance performance across numerous applications.Bosch Sensortec GmbH:

A leading manufacturer of MEMS sensors, Bosch Sensortec focuses on consumer electronics, automotive, and applications in smart homes.Analog Devices, Inc.:

Analog Devices specializes in high-performance signal processing, providing state-of-the-art sensors for industrial automation and healthcare industries.We're grateful to work with incredible clients.

FAQs

What is the market size of electronic sensors?

The electronic sensors market is valued at approximately $50 billion in 2023 and is expected to grow at a CAGR of 6.2%, reaching significant market sizes by 2033, reflecting robust demand across various sectors.

What are the key market players or companies in the electronic sensors industry?

Key players in the electronic sensors industry include renowned companies like Bosch, Texas Instruments, Honeywell, and STMicroelectronics, which contribute significantly through innovation, production, and global sales, driving competition and technological advancement.

What are the primary factors driving the growth in the electronic sensors industry?

The growth in the electronic sensors industry is driven by increasing demand for automation, advancements in IoT technology, growing applications in automotive and healthcare sectors, and the rise in smart infrastructure developments globally.

Which region is the fastest Growing in the electronic sensors market?

Europe stands as the fastest-growing region in the electronic sensors market, projected to expand from $17.77 billion in 2023 to $32.93 billion by 2033, driven by advancements in industrial automation and automotive technology.

Does ConsaInsights provide customized market report data for the electronic sensors industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the electronic sensors industry, ensuring clients receive relevant and actionable insights according to their strategic goals.

What deliverables can I expect from this electronic sensors market research project?

Expected deliverables from the electronic sensors market research project include comprehensive market analysis reports, data on regional market sizes, segment breakdowns, competitive landscape overviews, and actionable insights for strategic decision-making.

What are the market trends of electronic sensors?

Current trends in the electronic sensors market include the rising adoption of smart sensors, increased integration with artificial intelligence, the growth of the automotive sector, and enhanced demand for health-monitoring devices across consumer electronics.