Electronic Shelf Label Market Report

Published Date: 31 January 2026 | Report Code: electronic-shelf-label

Electronic Shelf Label Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Electronic Shelf Label (ESL) market, covering key insights, market trends, sizes, and forecasts from 2023 to 2033. It highlights industry dynamics, segmentation, regional performance, and competitive landscape.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

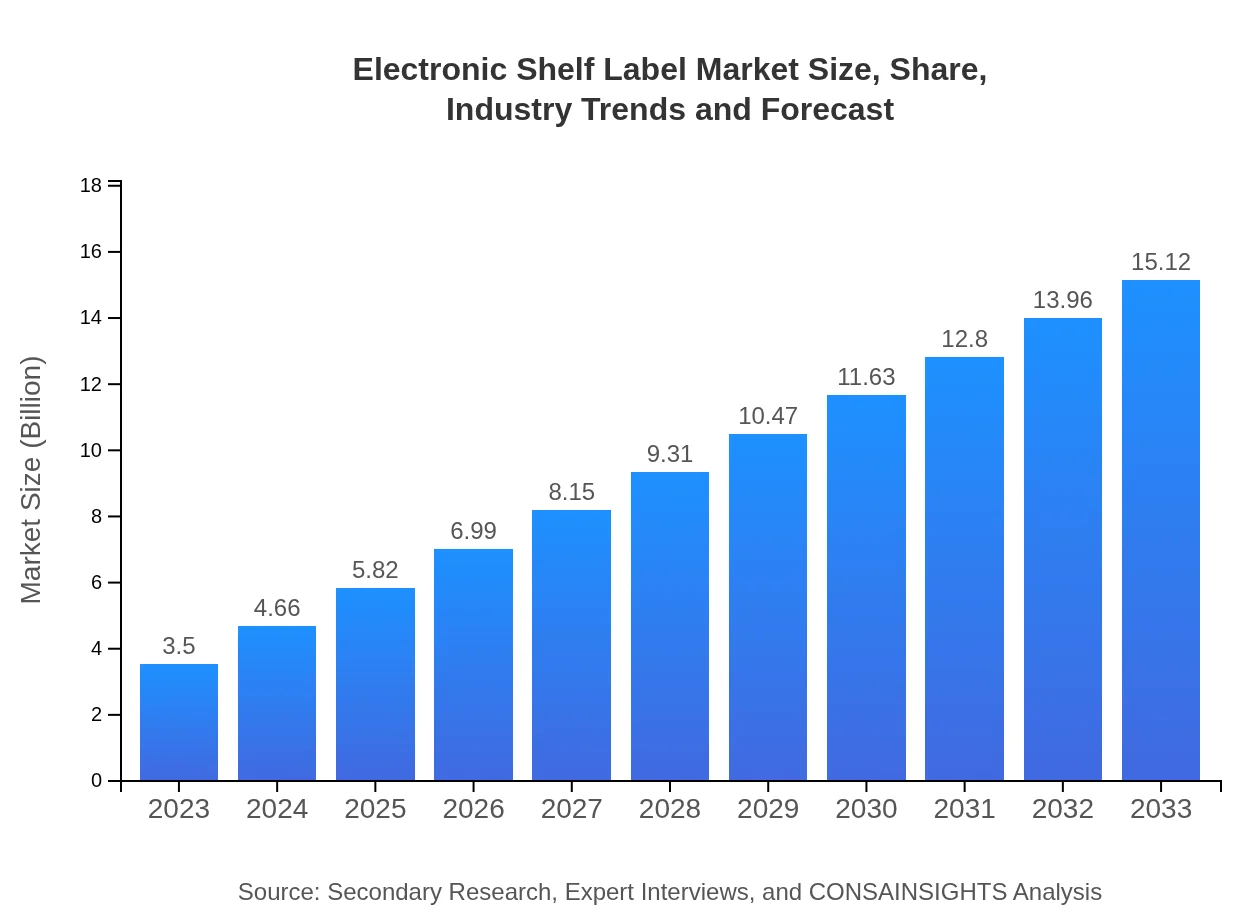

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 15% |

| 2033 Market Size | $15.12 Billion |

| Top Companies | SES-imagotag, Pricer, Electronic Shelf Labels Ltd., Displaydata |

| Last Modified Date | 31 January 2026 |

Electronic Shelf Label Market Overview

Customize Electronic Shelf Label Market Report market research report

- ✔ Get in-depth analysis of Electronic Shelf Label market size, growth, and forecasts.

- ✔ Understand Electronic Shelf Label's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Electronic Shelf Label

What is the Market Size & CAGR of the Electronic Shelf Label market in 2023?

Electronic Shelf Label Industry Analysis

Electronic Shelf Label Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Electronic Shelf Label Market Analysis Report by Region

Europe Electronic Shelf Label Market Report:

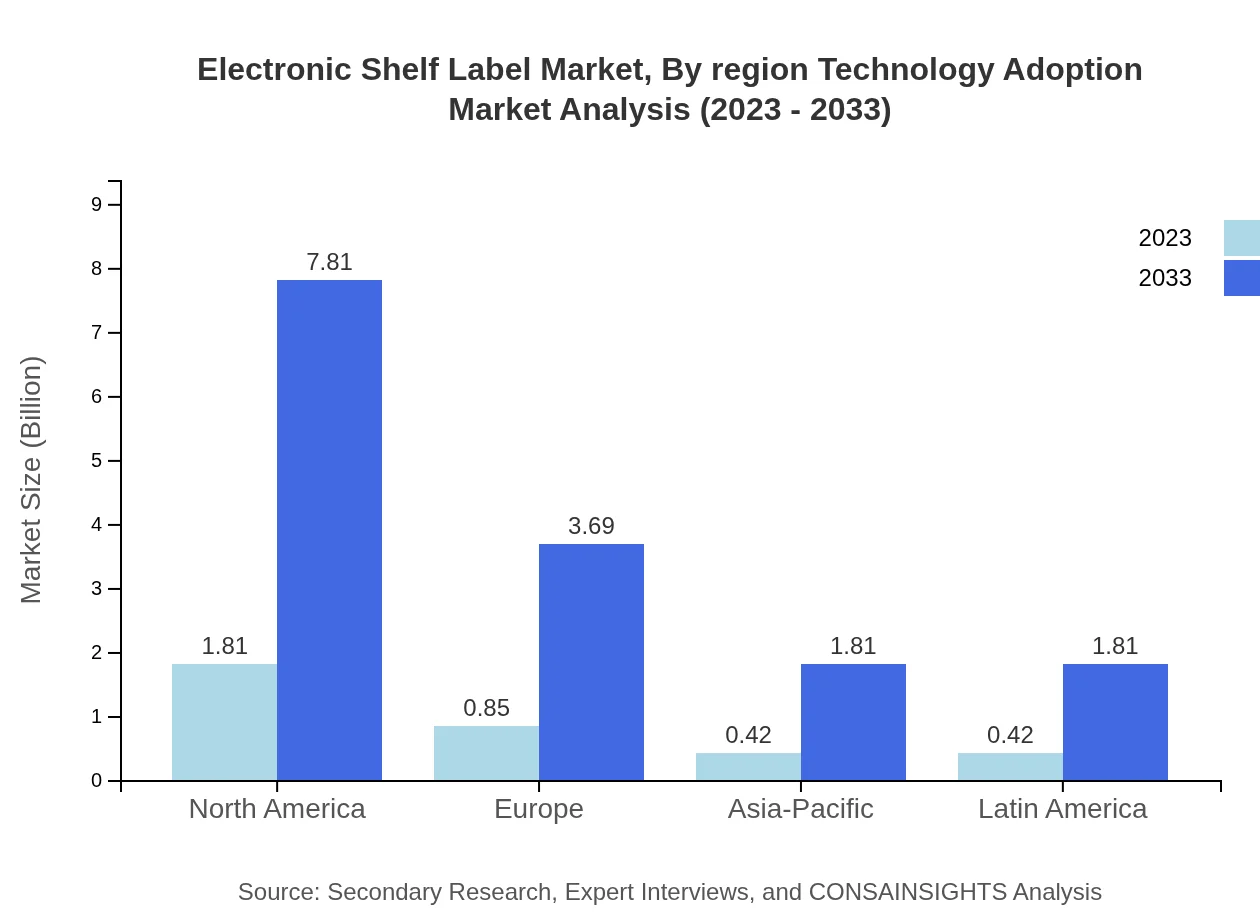

In Europe, the ESL market is anticipated to grow from $0.90 billion in 2023 to approximately $3.89 billion by 2033. Retailers' focus on sustainable practices and efficient pricing strategies significantly drive market expansion.Asia Pacific Electronic Shelf Label Market Report:

The Electronic Shelf Label market in the Asia Pacific region reached $0.69 billion in 2023 and is projected to grow to $3.00 billion by 2033, showcasing significant growth opportunities driven by increasing consumer demand and the rapid expansion of retail infrastructure.North America Electronic Shelf Label Market Report:

North America holds a prominent share, with the ESL market valued at $1.23 billion in 2023 and projected to reach $5.32 billion by 2033. The technological advancements and high adoption rates among major retailers propel this market forward.South America Electronic Shelf Label Market Report:

In South America, the ESL market is expected to grow from $0.33 billion in 2023 to $1.44 billion by 2033. The rise in e-commerce and modernization of shopping experiences in urban areas contribute to this growth.Middle East & Africa Electronic Shelf Label Market Report:

The Middle East and Africa region's ESL market size is expected to increase from $0.34 billion in 2023 to $1.48 billion by 2033, spurred by market modernization and improvement in retail technology deployment.Tell us your focus area and get a customized research report.

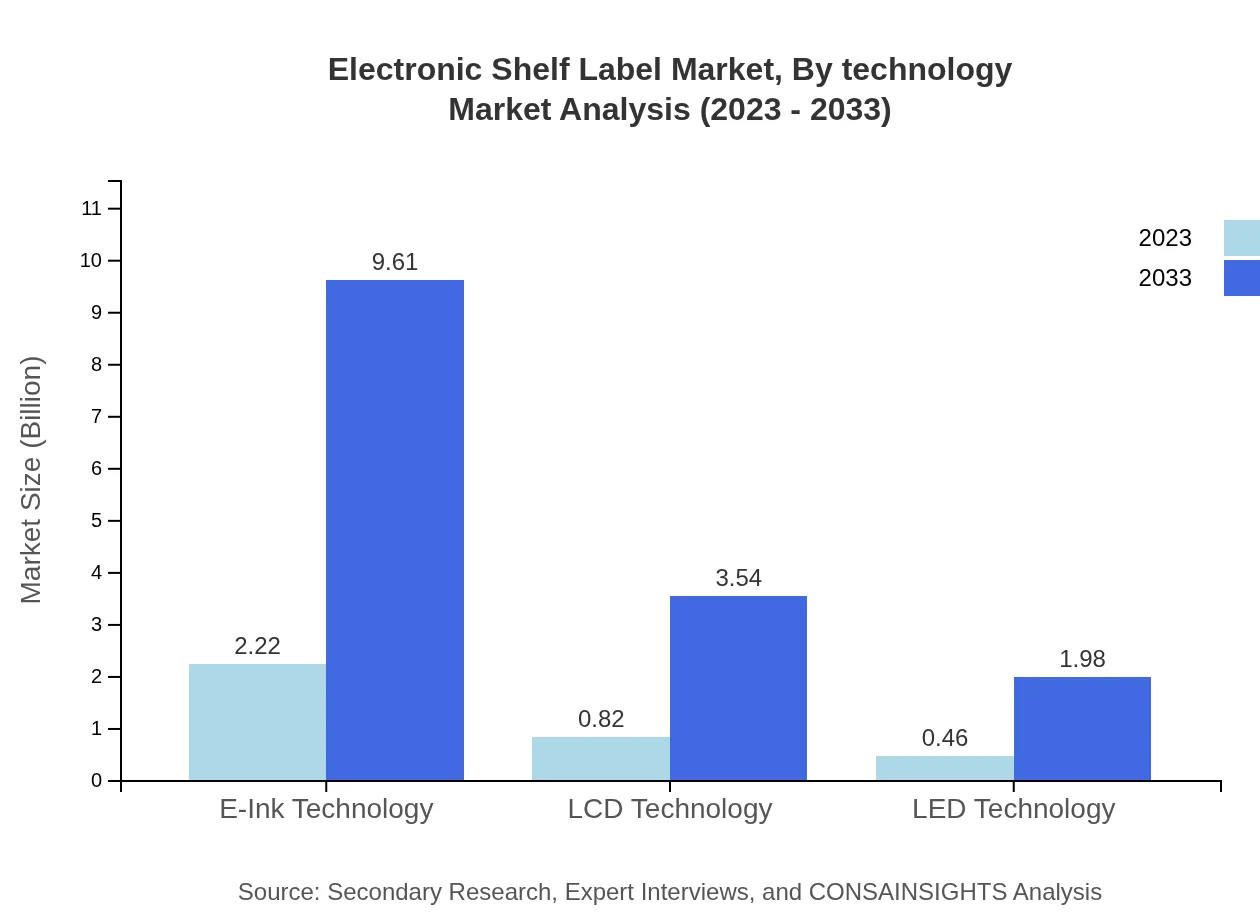

Electronic Shelf Label Market Analysis By Technology

E-Ink technology dominates the Electronic Shelf Label market, accounting for $2.22 billion in 2023, and projected to grow to $9.61 billion by 2033. LCD technology, currently valued at $0.82 billion, is expected to increase to $3.54 billion, while LED technology will rise from $0.46 billion to $1.98 billion in the same period.

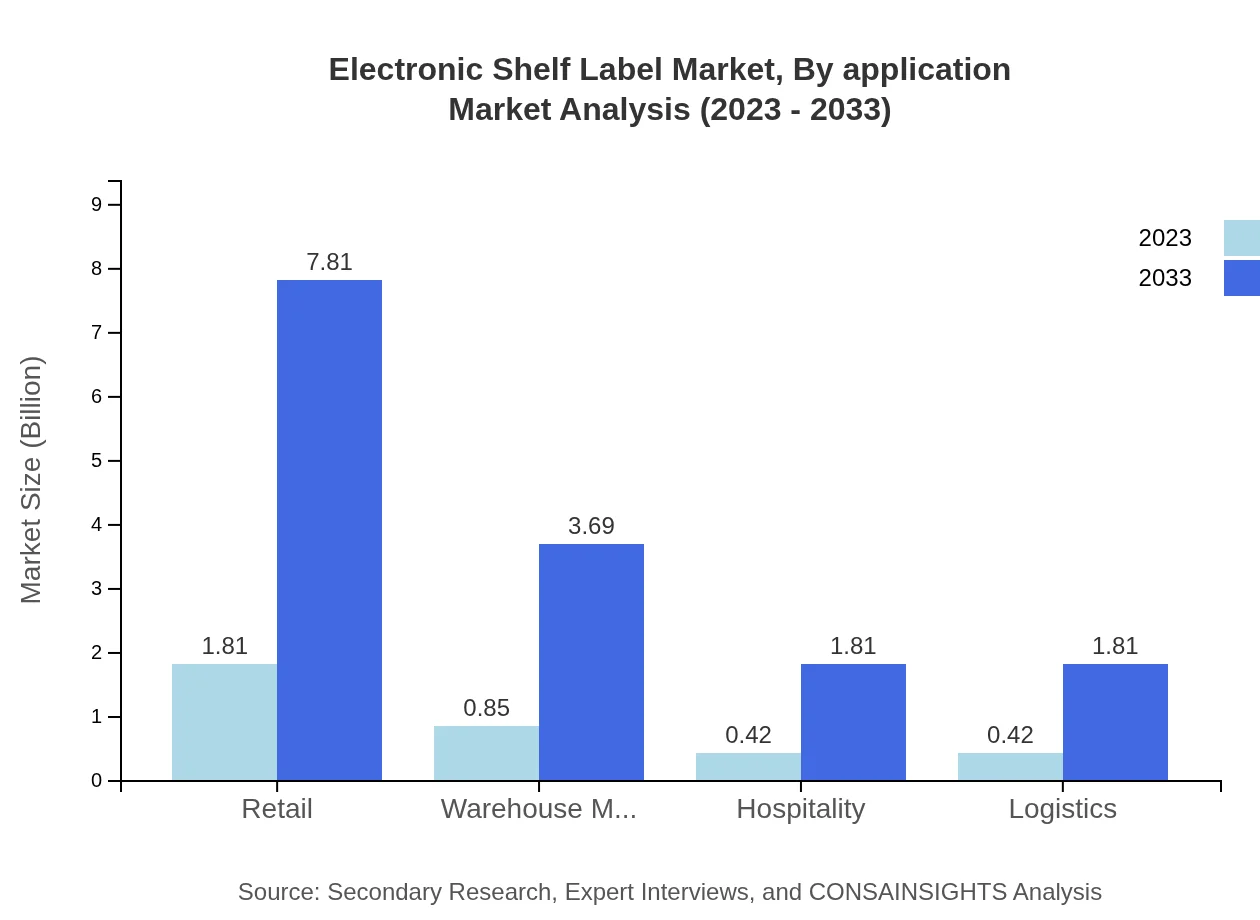

Electronic Shelf Label Market Analysis By Application

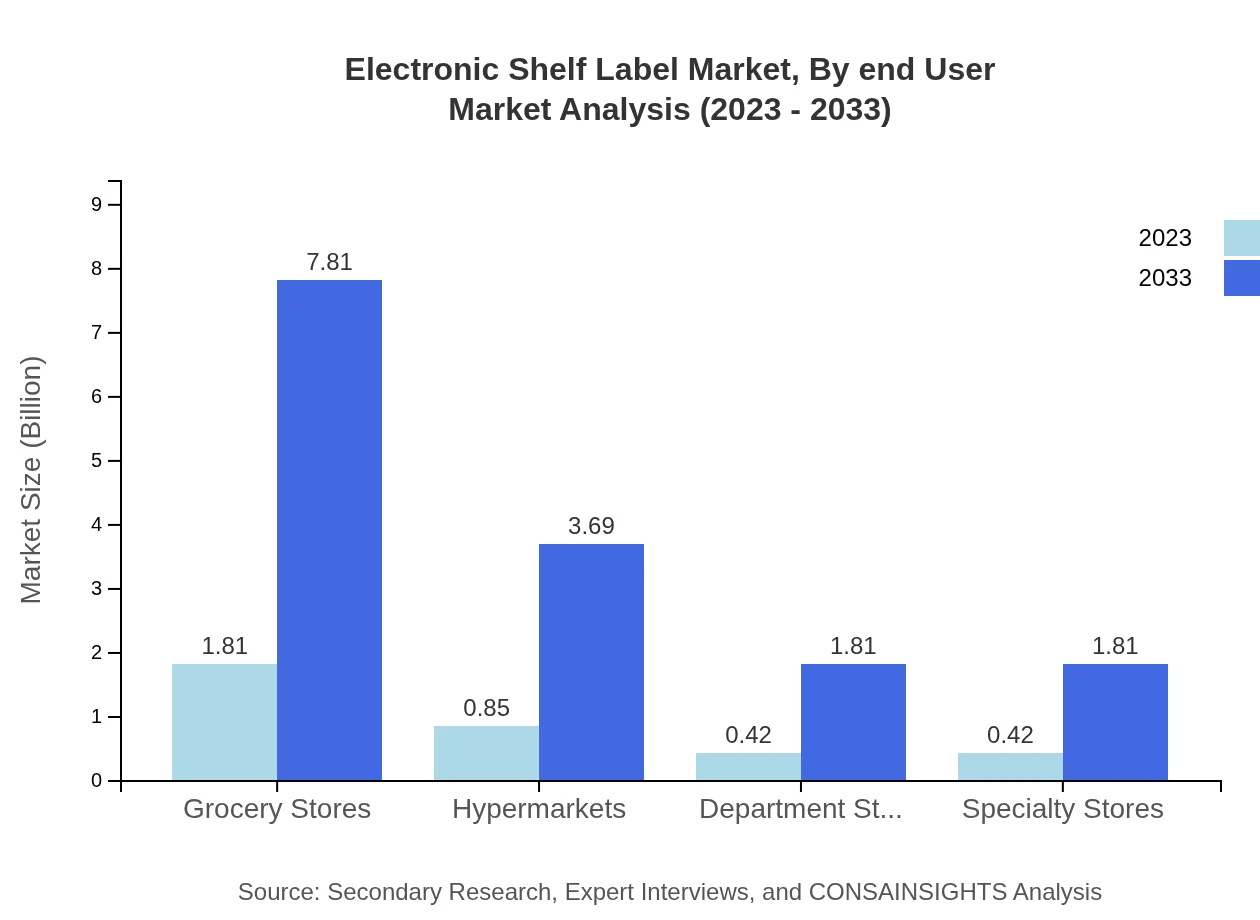

Retail applications constitute a significant share, projected to reach $7.81 billion by 2033 from $1.81 billion in 2023. Grocery stores will see growth from $1.81 billion to $7.81 billion. Hypermarkets and other retail stores play an equally important role in escalating the overall market demand.

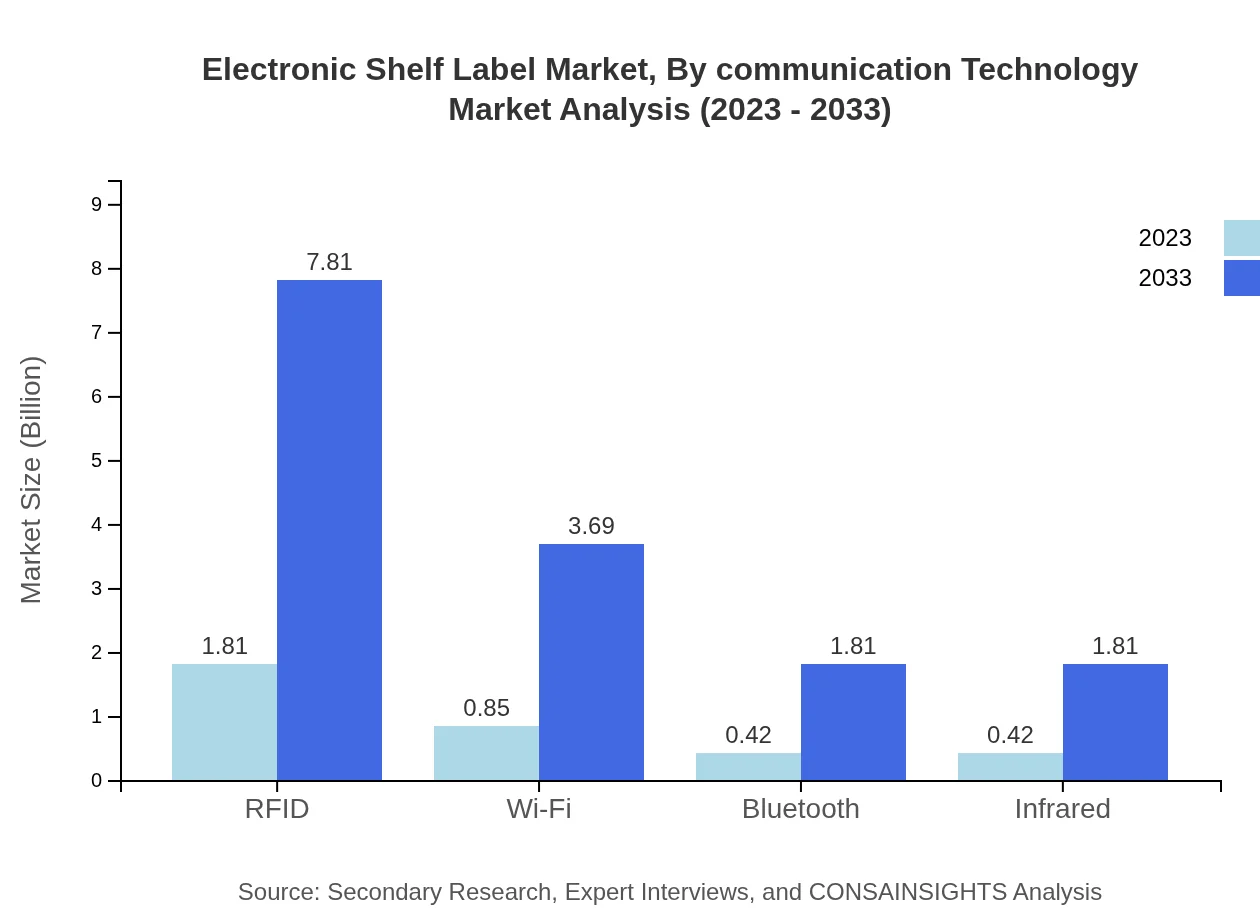

Electronic Shelf Label Market Analysis By Communication Technology

RFID technology is the leading communication type in the ESL market, expected to grow substantially from $1.81 billion in 2023 to $7.81 billion by 2033, maintaining a market share of 51.62%. Wi-Fi and Bluetooth follow, with respective values projected to increase from $0.85 billion to $3.69 billion, and from $0.42 billion to $1.81 billion during the same period.

Electronic Shelf Label Market Analysis By End User

In terms of end-users, the retail sector remains the largest market segment for Electronic Shelf Labels, with a share of approximately 51.62%. Other sectors such as hospitality and logistics are also gradually adopting ESL technology, contributing to overall market growth.

Electronic Shelf Label Market Analysis By Region Technology Adoption

North America leads in terms of technology adoption, particularly in RFID and E-Ink technologies. Europe closely follows with significant progress in adopting ESL solutions due to its advanced retail ecosystems.

Electronic Shelf Label Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in the Electronic Shelf Label Industry

SES-imagotag:

A global leader in ESL technology, SES-imagotag offers innovative ESL solutions to enhance pricing accuracy and store digitalization.Pricer:

Pricer is known for its advanced ESL systems, providing retailers with digital price tags that allow for real-time updates and improved inventory management.Electronic Shelf Labels Ltd.:

Focused on providing robust ESL systems, this company integrates various technologies to streamline retail operations.Displaydata:

Displaydata specializes in electronic labeling solutions, offering advanced and sustainable ESL options, helping businesses enhance customer engagement.We're grateful to work with incredible clients.

FAQs

What is the market size of Electronic Shelf Label?

The electronic shelf label market is currently valued at approximately $3.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 15%, indicating significant expansion expected by 2033.

What are the key market players or companies in the Electronic Shelf Label industry?

Key players in the electronic shelf label industry include prominent companies like Panasonic Corporation, SES-imagotag, Pricer AB, and Diebold Nixdorf, which contribute significantly to technological advancements and market growth.

What are the primary factors driving the growth in the Electronic Shelf Label industry?

The growth in the electronic shelf label industry is primarily driven by increased demand for automation in retail, enhanced customer experiences, and operational efficiencies achieved through technology integration, leading to higher adoption rates.

Which region is the fastest Growing in the Electronic Shelf Label industry?

The North American region is currently the fastest-growing market for electronic shelf labels, projected to grow from $1.23 billion in 2023 to $5.32 billion by 2033, indicating robust demand in retail settings.

Does ConsaInsights provide customized market report data for the Electronic Shelf Label industry?

Yes, ConsaInsights offers customized market report data tailored specifically for the electronic shelf label industry, allowing clients to obtain insights suited to their individual business needs and strategic objectives.

What deliverables can I expect from this Electronic Shelf Label market research project?

When engaging in this electronic shelf label market research project, expect detailed reports that include market sizing, trends analysis, company profiles, competitive landscape assessments, and actionable insights tailored to your specific needs.

What are the market trends of Electronic Shelf Label?

Key market trends for electronic shelf labels include advancements in display technology, integration with inventory management systems, and a growing preference for energy-efficient solutions, reflecting the industry's shift towards smarter retail environments.