Electronic Warfare Market Report

Published Date: 03 February 2026 | Report Code: electronic-warfare

Electronic Warfare Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Electronic Warfare market, including insights into market size, growth forecasts, industry trends, and significant players in the field for the forecast years 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

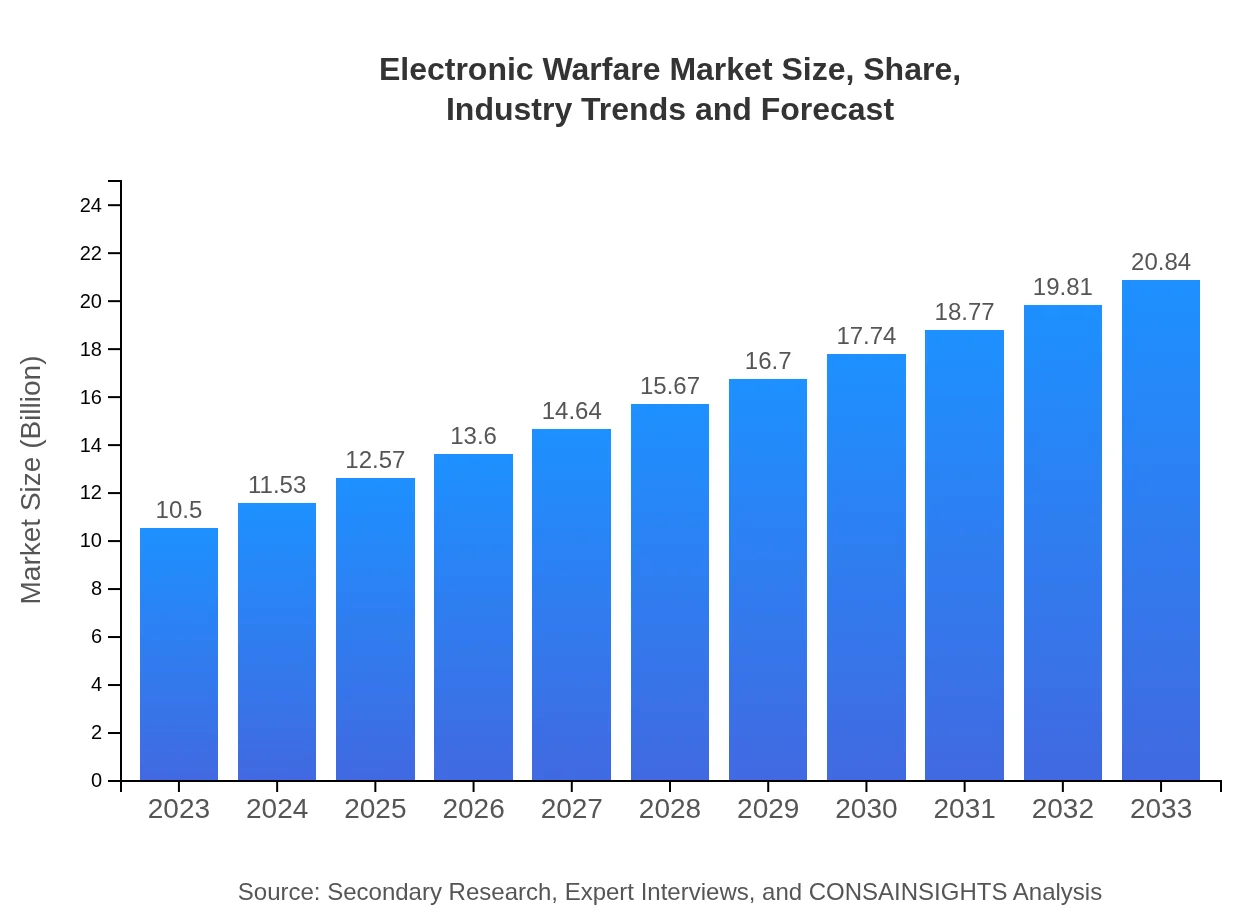

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.9% |

| 2033 Market Size | $20.84 Billion |

| Top Companies | Raytheon Technologies, Northrop Grumman Corporation, Lockheed Martin, BAE Systems, General Dynamics |

| Last Modified Date | 03 February 2026 |

Electronic Warfare Market Overview

Customize Electronic Warfare Market Report market research report

- ✔ Get in-depth analysis of Electronic Warfare market size, growth, and forecasts.

- ✔ Understand Electronic Warfare's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Electronic Warfare

What is the Market Size & CAGR of the Electronic Warfare market in 2023?

Electronic Warfare Industry Analysis

Electronic Warfare Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Electronic Warfare Market Analysis Report by Region

Europe Electronic Warfare Market Report:

The European market is anticipated to grow from $2.90 billion in 2023 to $5.76 billion by 2033. Increasing concerns regarding security threats from Russia have prompted nations in this region to enhance their electronic warfare capabilities, leading to increased spending and partnerships in defense technologies.Asia Pacific Electronic Warfare Market Report:

In the Asia-Pacific region, the market is projected to grow from $2.04 billion in 2023 to $4.04 billion by 2033. This growth can be attributed to rising investments in defense capabilities and strategic initiatives to address territorial disputes. Countries such as India and China are emphasizing strengthening their electronic warfare capabilities, creating significant market opportunities.North America Electronic Warfare Market Report:

North America remains the largest market, expanding from $3.81 billion in 2023 to $7.56 billion by 2033. Prime factors include consistent enhancements in military budgets, significant investments in research and development, and a high demand for advanced electronic warfare capabilities from the U.S. Defense Department.South America Electronic Warfare Market Report:

The South American electronic warfare market is relatively nascent but is expected to grow from $0.58 billion in 2023 to $1.15 billion by 2033. Increased government focus on military modernization programs, coupled with collaborative defense initiatives with larger military powers, is driving growth in this region.Middle East & Africa Electronic Warfare Market Report:

The Middle East and Africa region is projected to grow from $1.18 billion in 2023 to $2.33 billion by 2033, driven by political instability and the need for nations to safeguard against threats. Countries are investing in electronic warfare systems and technologies to gain a strategic edge.Tell us your focus area and get a customized research report.

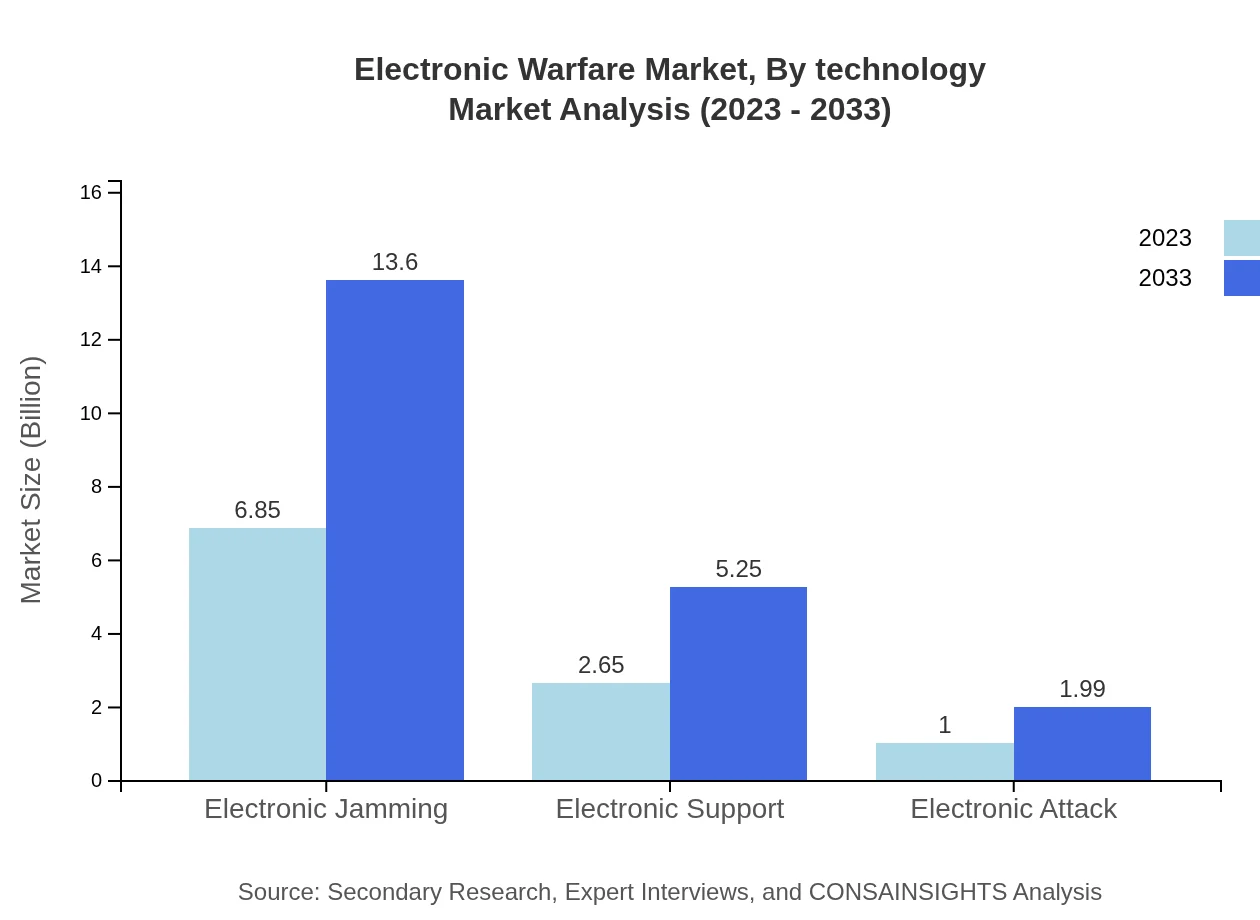

Electronic Warfare Market Analysis By Technology

The Electronic Warfare market is primarily segmented by technology into three main areas: Electronic Jamming, Electronic Support, and Electronic Attack. As of 2023, Electronic Jamming accounts for a market size of $6.85 billion, projected to grow to $13.60 billion by 2033, maintaining a share of around 65.27%. Electronic Support is forecasted to increase from $2.65 billion to $5.25 billion with a stable 25.2% share, while Electronic Attack is expected to grow from $1 billion to $1.99 billion, holding a 9.53% market share.

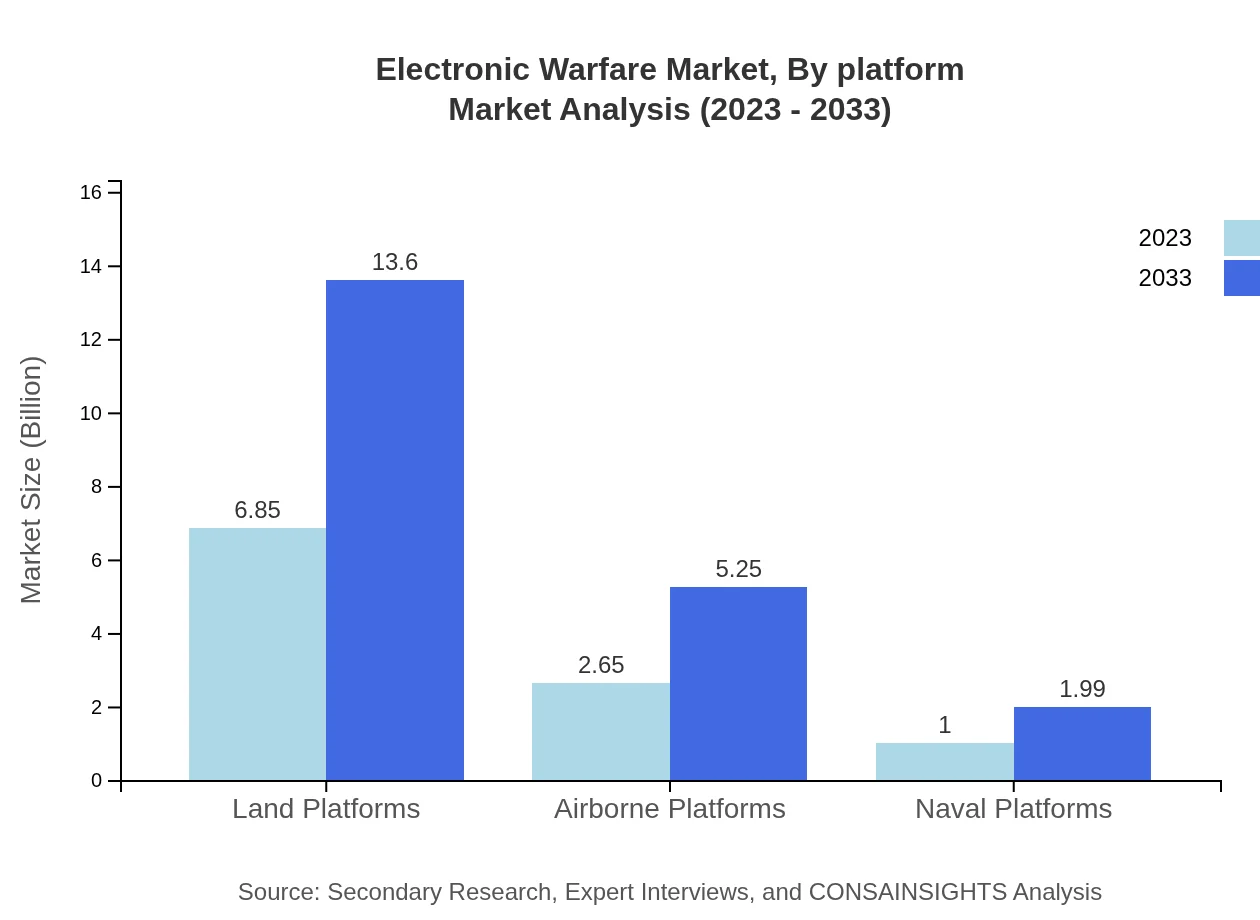

Electronic Warfare Market Analysis By Platform

The segmentation by platform reveals significant insights. Land Platforms lead the market with a size of $6.85 billion in 2023, expected to rise to $13.60 billion by 2033, maintaining a 65.27% market share. Airborne Platforms follow with a market size of $2.65 billion in 2023, projected to increase to $5.25 billion with a share of 25.2%. Naval Platforms are smaller in size, showcasing growth from $1 billion to $1.99 billion, with a 9.53% market share.

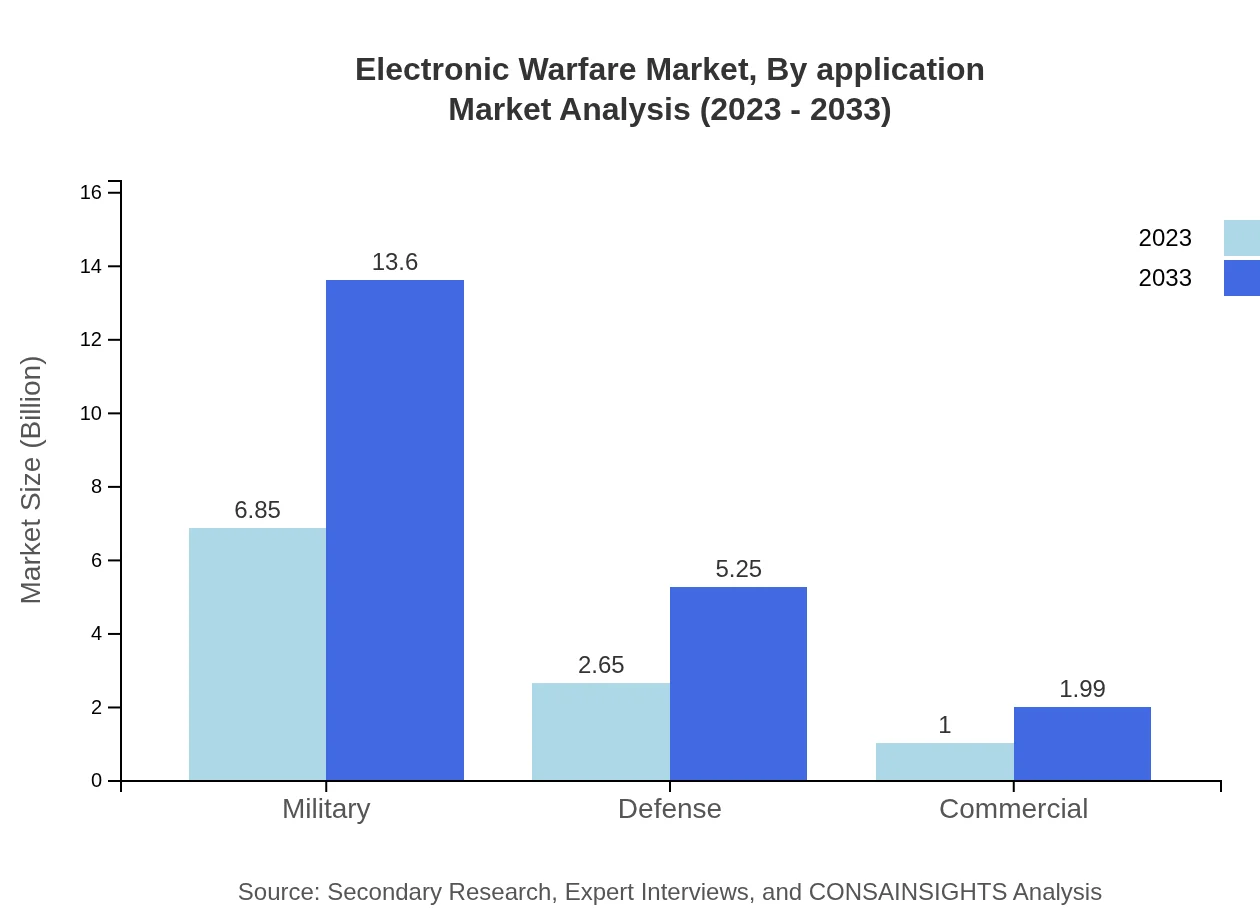

Electronic Warfare Market Analysis By Application

The market segmentation by application identifies military applications as the dominant segment, with a size of $6.85 billion in 2023, projected to reach $13.60 billion by 2033 (65.27% share). Defense applications follow advancements with a forecasted growth from $2.65 billion to $5.25 billion (25.2% share), while commercial applications remain small, growing from $1 billion to $1.99 billion (9.53% share).

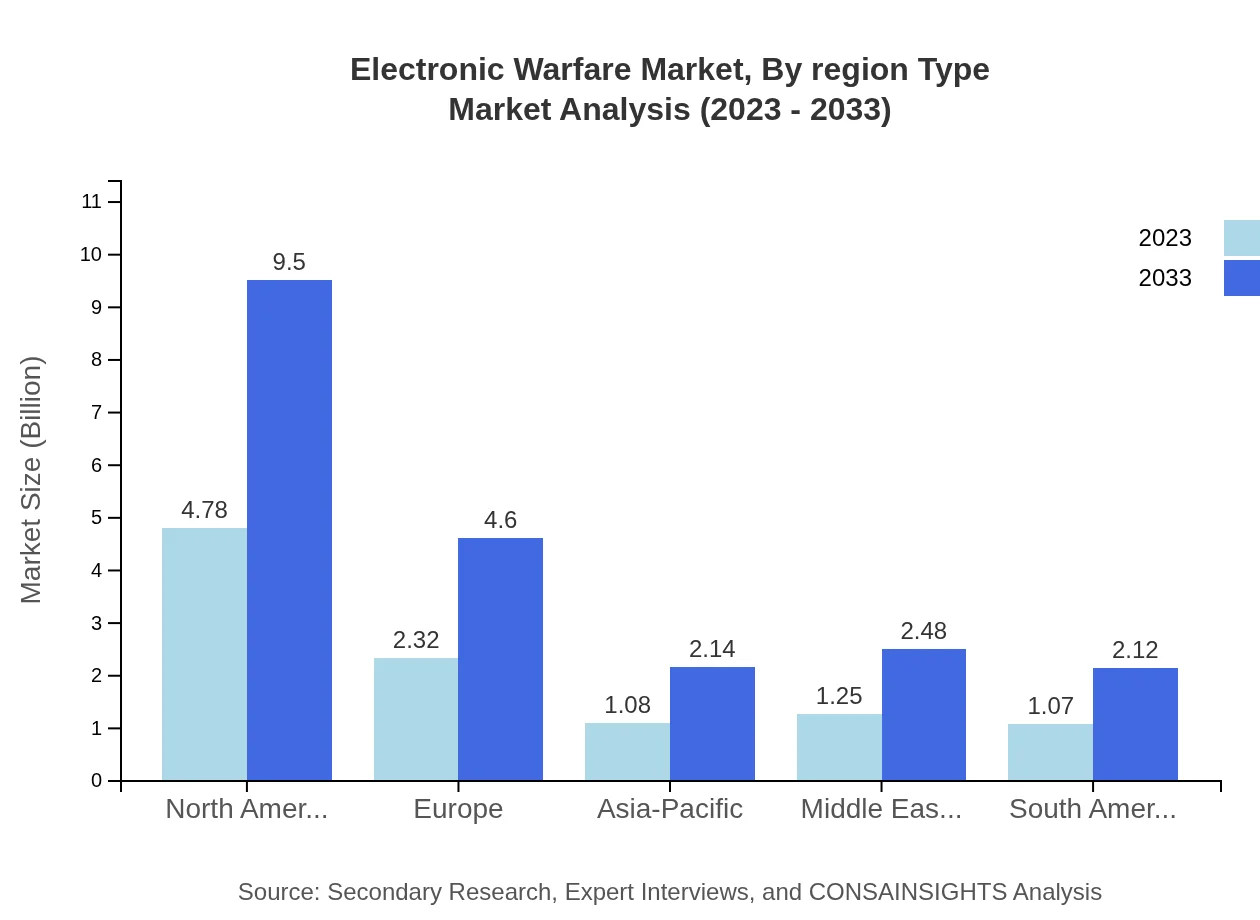

Electronic Warfare Market Analysis By Region Type

Segmenting the market by region reveals North America as the leading market with $4.78 billion in 2023, and expected to reach $9.50 billion by 2033 (45.57% share). Europe follows with a size of $2.32 billion in 2023, projected to grow to $4.60 billion (22.08% share), while the Asia-Pacific region holds a size of $1.08 billion with a forecasted growth to $2.14 billion (10.29% share).

Electronic Warfare Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Electronic Warfare Industry

Raytheon Technologies:

A leading player in defense technology, Raytheon provides comprehensive electronic warfare solutions encompassing jammers, electronic attack systems, and advanced ISR capabilities.Northrop Grumman Corporation:

Northrop Grumman specializes in developing advanced electronic warfare systems, offering sophisticated platforms enabling national defense strategies and military operations.Lockheed Martin:

Lockheed Martin is known for its innovative electronic warfare products, including integrated solutions that enhance situational awareness for military forces.BAE Systems:

BAE Systems provides advanced electronic systems for intelligence and electronic warfare applications, playing a crucial role in modern military operations.General Dynamics:

General Dynamics presents cutting-edge electronic warfare solutions that cater to both military and commercial sectors, focusing on electronic protection and support.We're grateful to work with incredible clients.

FAQs

What is the market size of electronic Warfare?

The electronic warfare market was valued at approximately $10.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.9%. By 2033, the market size is expected to significantly increase, reflecting the growing demand for advanced electronic warfare systems.

What are the key market players or companies in this electronic warfare industry?

Major players in the electronic warfare market include Northrop Grumman, Raytheon Technologies, and BAE Systems. These companies are leading in innovative technologies and solutions, catering to both military defense and commercial applications.

What are the primary factors driving the growth in the electronic warfare industry?

Key drivers of growth in the electronic warfare industry include increasing geopolitical tensions, advancements in military technology, and the rising demand for enhanced military capabilities. Furthermore, the expanding use of unmanned aerial vehicles is also contributing to market growth.

Which region is the fastest Growing in the electronic warfare?

North America is the fastest-growing region in the electronic warfare market, set to increase from $4.78 billion in 2023 to $9.50 billion in 2033. This growth is propelled by robust military expenditure and technological advancements in the defense sector.

Does ConsaInsights provide customized market report data for the electronic warfare industry?

Yes, ConsaInsights offers customized market report data tailored to the electronic warfare industry. Clients can request specific insights and analytics based on their unique needs, enabling informed strategic decision-making.

What deliverables can I expect from this electronic warfare market research project?

Expect comprehensive reports that include market size analyses, growth forecasts, segmented data, competitive landscape evaluations, and insights into regional performance, providing a holistic understanding of the electronic warfare market.

What are the market trends of electronic warfare?

Emerging trends in the electronic warfare market include increased investment in cyber capabilities, integration of artificial intelligence in warfare systems, and a shift towards agile and modular systems. These trends are reshaping how military operations are conducted.