Electronically Scanned Array Radar Market Report

Published Date: 03 February 2026 | Report Code: electronically-scanned-array-radar

Electronically Scanned Array Radar Market Size, Share, Industry Trends and Forecast to 2033

This report explores the Electronically Scanned Array Radar market, offering insights on its growth trajectory from 2023 to 2033, including market size, trends, regional analysis, and key players driving innovation in this sector.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

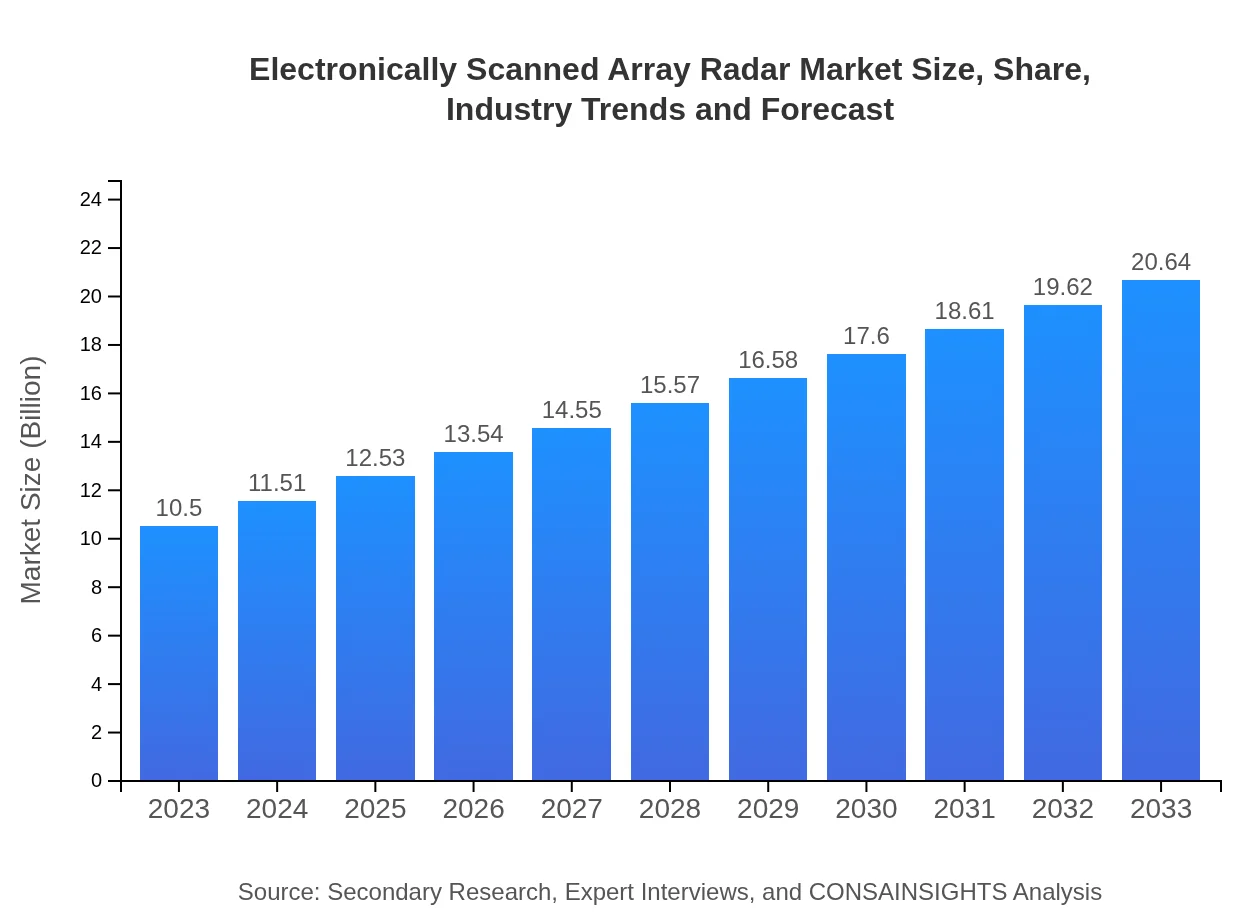

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $20.64 Billion |

| Top Companies | Raytheon Technologies, Lockheed Martin, Northrop Grumman, Honeywell , Thales Group |

| Last Modified Date | 03 February 2026 |

Electronically Scanned Array Radar Market Overview

Customize Electronically Scanned Array Radar Market Report market research report

- ✔ Get in-depth analysis of Electronically Scanned Array Radar market size, growth, and forecasts.

- ✔ Understand Electronically Scanned Array Radar's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Electronically Scanned Array Radar

What is the Market Size & CAGR of Electronically Scanned Array Radar market in 2023?

Electronically Scanned Array Radar Industry Analysis

Electronically Scanned Array Radar Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Electronically Scanned Array Radar Market Analysis Report by Region

Europe Electronically Scanned Array Radar Market Report:

The European market is expected to grow from $3.07 billion in 2023 to $6.03 billion in 2033, supported by increased collaborations among government bodies and industries aimed at boosting defense capabilities and research in civil security applications.Asia Pacific Electronically Scanned Array Radar Market Report:

In 2023, the Asia Pacific market is valued at approximately $1.99 billion, expected to reach $3.91 billion by 2033. Key drivers include rising investment in military capabilities across countries like India and China, along with increasing natural disasters, pushing demand for advanced weather monitoring systems.North America Electronically Scanned Array Radar Market Report:

North America leads the market with a valuation of approximately $4.06 billion in 2023, anticipated to grow to $7.97 billion by 2033, driven by the U.S. military’s continuous modernization initiatives and significant investments from aerospace firms.South America Electronically Scanned Array Radar Market Report:

The South American market, valued at $0.80 billion in 2023, is projected to reach $1.58 billion by 2033. Increased defense spending and regional collaborations will likely enhance the demand for advanced radar technologies in defense applications.Middle East & Africa Electronically Scanned Array Radar Market Report:

The Middle East and Africa market, valued at $0.58 billion in 2023, is expected to reach $1.15 billion by 2033. Ongoing conflicts and rising security concerns are driving demand for effective radar technology in defense and civil security sectors.Tell us your focus area and get a customized research report.

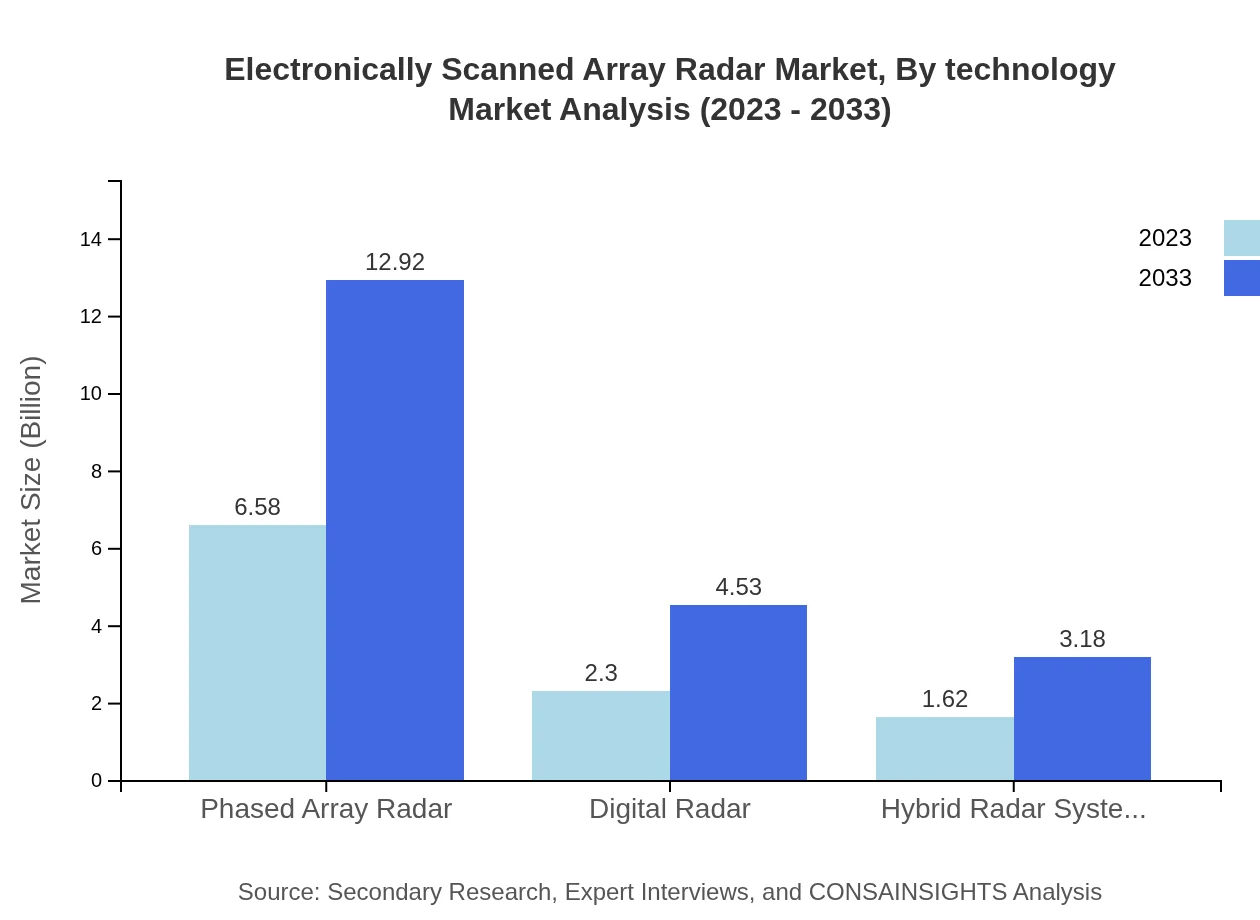

Electronically Scanned Array Radar Market Analysis By Technology

The Electronically Scanned Array Radar market by technology includes segments like transmit/receive modules which held a market size of $6.58 billion in 2023, expected to grow to $12.92 billion by 2033. This segment comprises the majority share of the market at 62.63%, highlighting its critical role in radar system functionalities.

Electronically Scanned Array Radar Market Analysis By Application

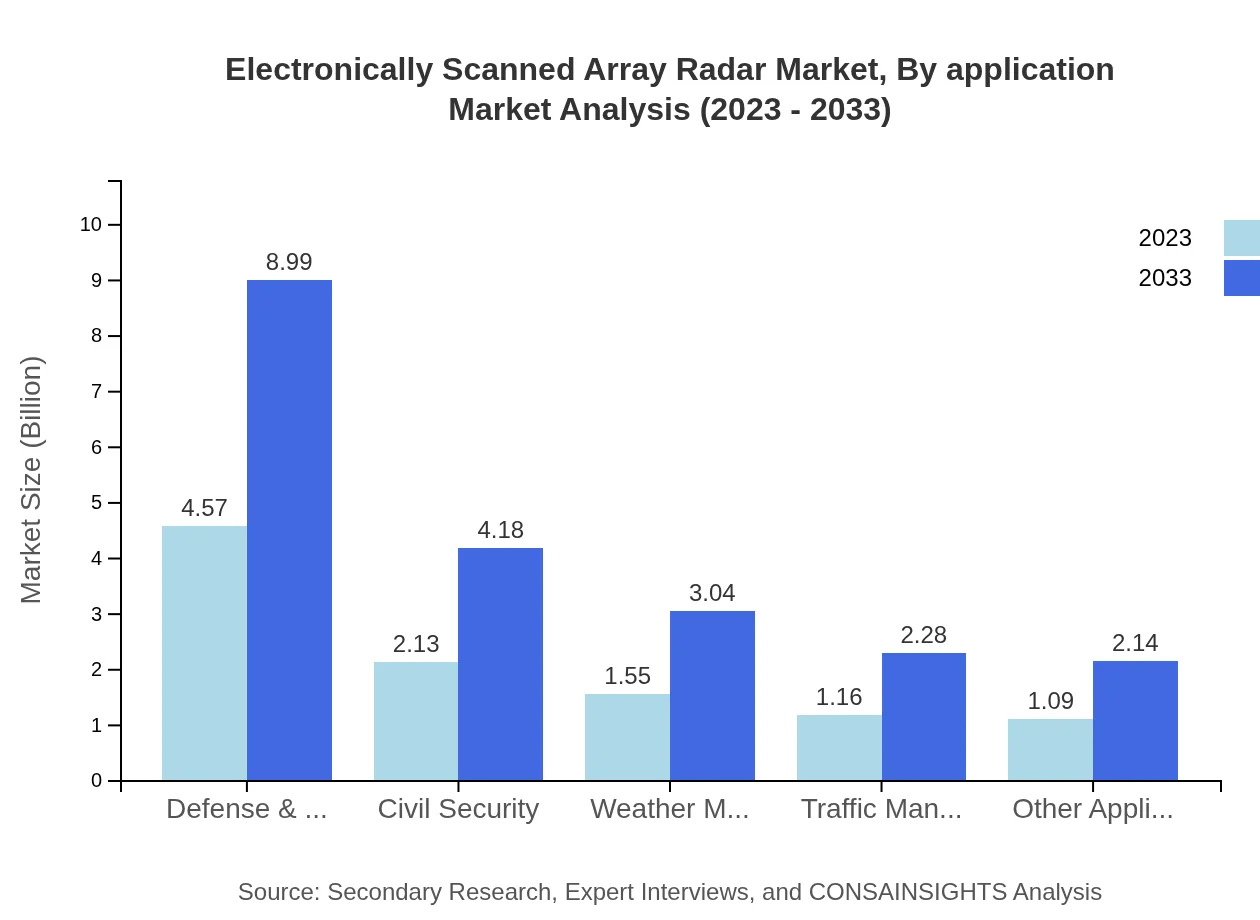

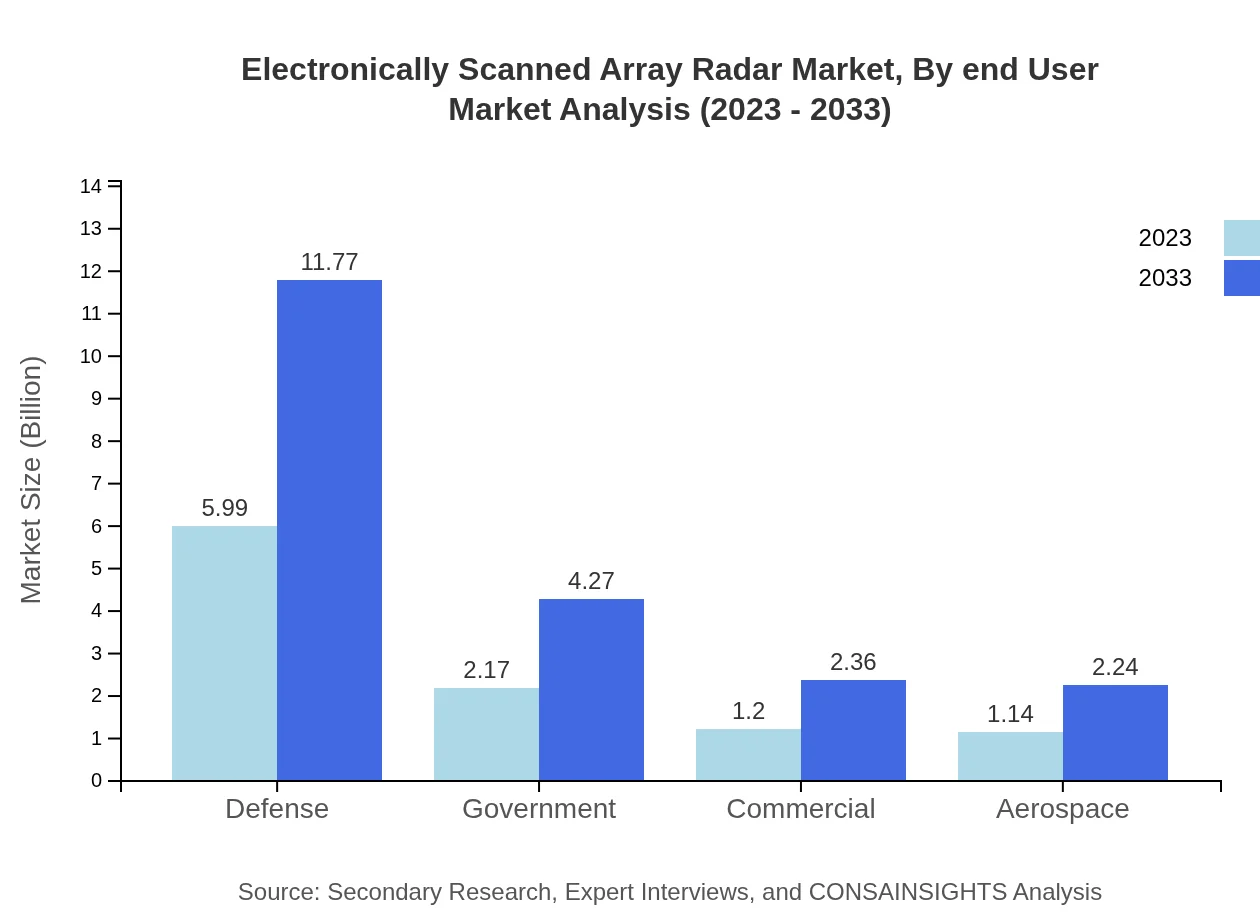

In terms of application, the defense sector dominates the electroncially scanned array radar market with a size of $5.99 billion in 2023, projected to reach $11.77 billion by 2033. This sector captures 57.03% market share, emphasizing its significance for national security and military operations.

Electronically Scanned Array Radar Market Analysis By Component

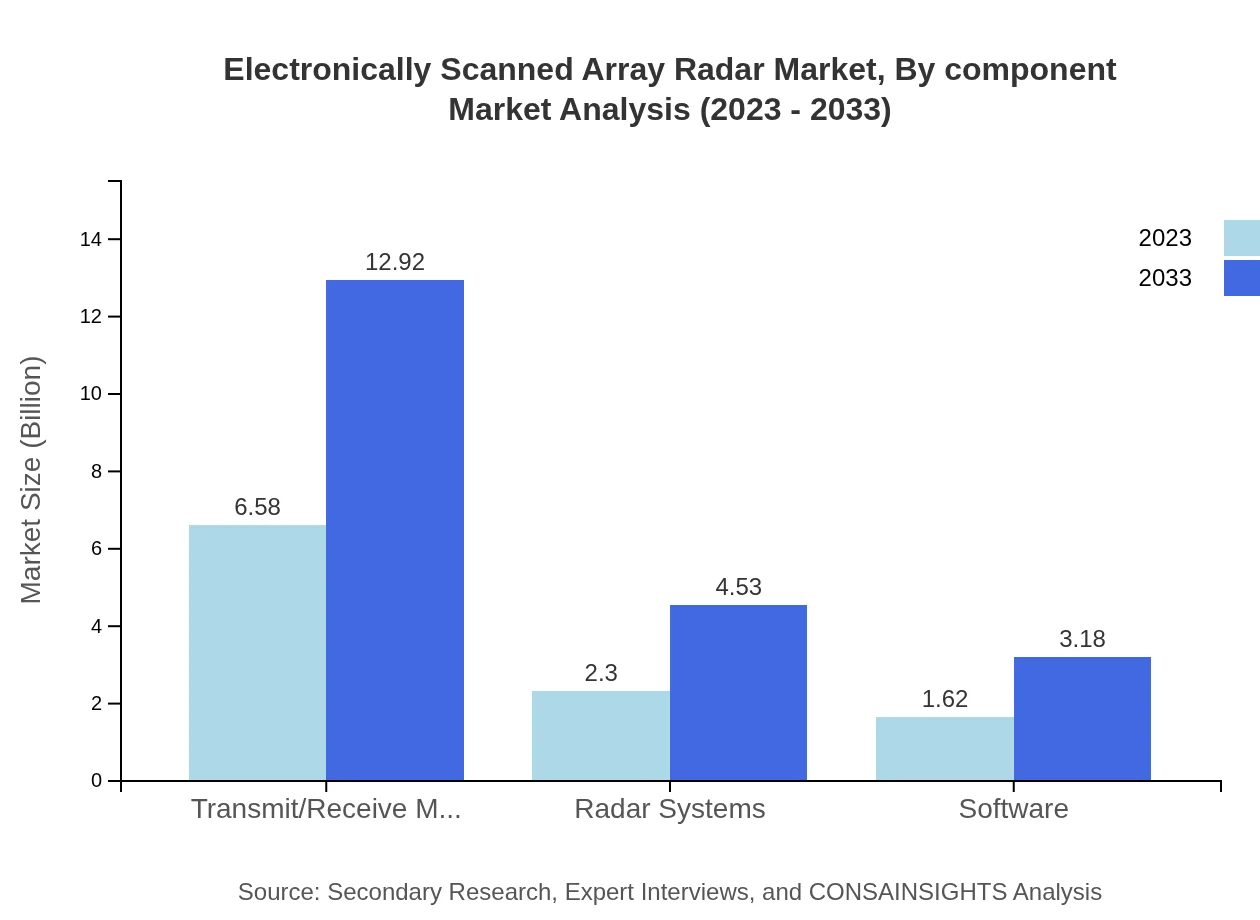

The market by component showcases hardware and software respectively, with $6.58 billion from hardware in 2023, anticipated to reach $12.92 billion by 2033, and software at $1.62 billion, growing to $3.18 billion. The rapid technological advancements support these estimates and indicate robust growth in software solutions.

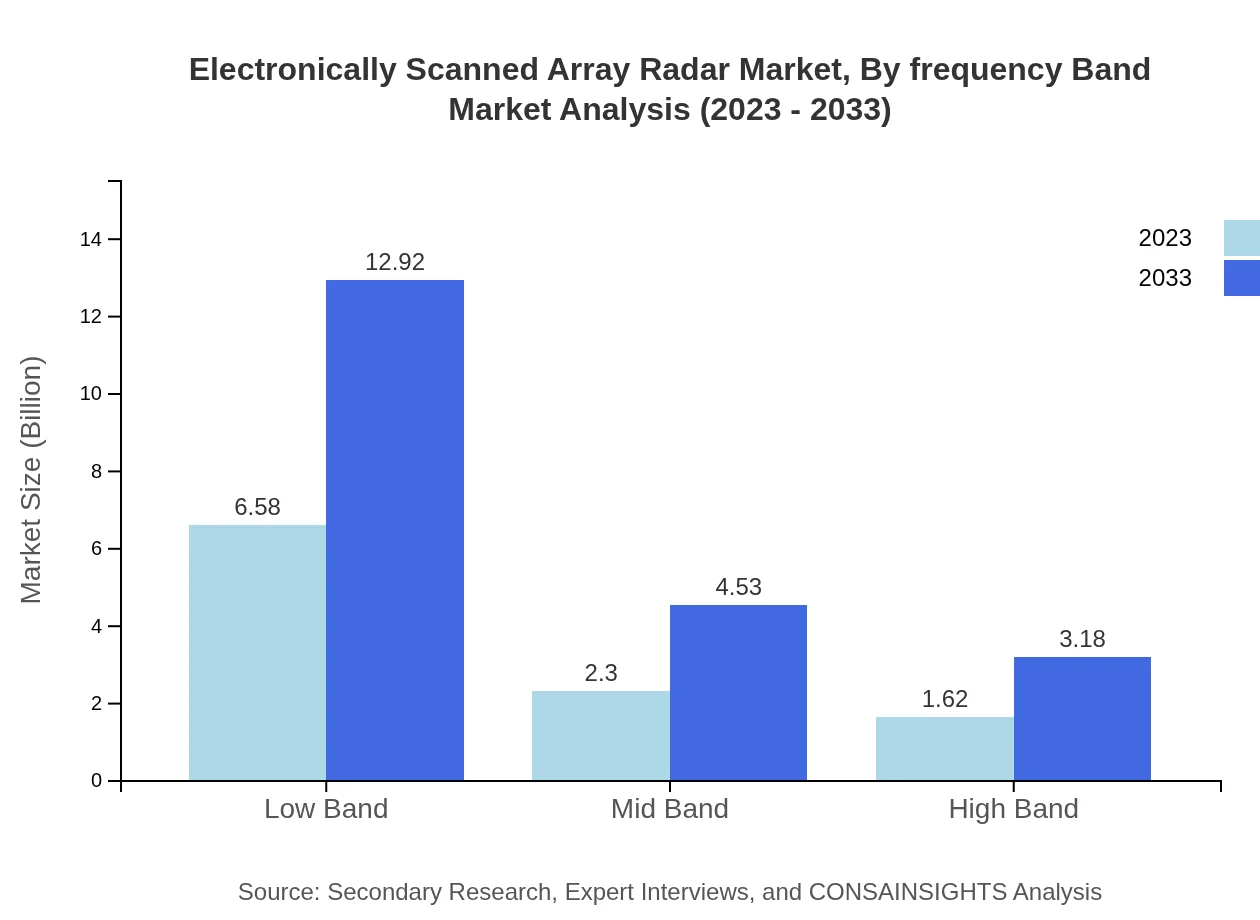

Electronically Scanned Array Radar Market Analysis By Frequency Band

Frequency band analysis reveals that low-band systems ($6.58 billion in 2023) will continue to dominate with a share of 62.63%, while mid-band ($2.30 billion) and high-band ($1.62 billion) segments are rapidly evolving. The focus on low-band operations for long-range detection remains a primary growth factor.

Electronically Scanned Array Radar Market Analysis By End User

The end-user analysis indicates the defense & military sector remains the largest contributor, with an anticipated growth from $4.57 billion in 2023 to $8.99 billion by 2033, constituting a 43.55% market share. Other sectors like civil security and weather monitoring are also expected to see significant increases, underscoring rising applications.

Electronically Scanned Array Radar Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Electronically Scanned Array Radar Industry

Raytheon Technologies:

A leader in defense technology, Raytheon Technologies specializes in advanced radar systems, contributing innovative solutions to military and civilian sectors worldwide.Lockheed Martin:

An aerospace and defense giant, Lockheed Martin plays a pivotal role in the development of radar technologies, focusing on advanced applications for national defense.Northrop Grumman:

Known for its cutting-edge technology, Northrop Grumman designs advanced electronically scanned array radar systems that enhance military capabilities.Honeywell :

Honeywell integrates radar technology with automation systems to support both defense and commercial applications, promoting efficient and effective operations.Thales Group:

Thales Group is a global leader in radar technology, focusing on providing advanced electronic systems for defense, security, and civil applications.We're grateful to work with incredible clients.

FAQs

What is the market size of electronically Scanned Array Radar?

The globally electronically scanned array radar market is valued at $10.5 billion in 2023 and is projected to grow at a CAGR of 6.8%, reaching significant growth by 2033. This expansion highlights increasing demand across various sectors.

What are the key market players or companies in this electronically Scanned Array Radar industry?

Key players in the electronically scanned array radar industry include major firms like Raytheon Technologies, Thales Group, Northrop Grumman, and BAE Systems. These companies drive innovation and competition in this rapidly expanding market.

What are the primary factors driving the growth in the electronically Scanned Array Radar industry?

Growth in the electronically scanned array radar industry is primarily driven by increased defense budgets, technological advancements, and rising demand for improved surveillance capabilities. Additionally, the expansion of civilian applications further supports market development.

Which region is the fastest Growing in the electronically Scanned Array Radar?

The fastest-growing region for electronically scanned array radar is Europe, with market growth from $3.07 billion in 2023 to $6.03 billion by 2033. Asia-Pacific also shows substantial growth potential, improving from $1.99 billion to $3.91 billion in the same period.

Does ConsaInsights provide customized market report data for the electronically Scanned Array Radar industry?

Yes, ConsaInsights offers customized market report data for the electronically scanned array radar industry. Clients can obtain tailored insights and forecasts to cater to their specific research needs and market interests.

What deliverables can I expect from this electronically Scanned Array Radar market research project?

From the electronically scanned array radar market research project, expect detailed reports, market forecasts, competitive analysis, and growth opportunities along with custom insights tailored to your strategic needs.

What are the market trends of electronically Scanned Array Radar?

Current trends in the electronically scanned array radar market include the increasing integration of advanced radar technologies into defense systems, growing adoption in commercial aviation, and heightened focus on the development of multi-functional radar systems.