Electronically Scanned Arrays Market Report

Published Date: 03 February 2026 | Report Code: electronically-scanned-arrays

Electronically Scanned Arrays Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Electronically Scanned Arrays market from 2023 to 2033, detailing market growth, trends, regional insights, and competitive landscape, along with forecasts that guide strategic planning.

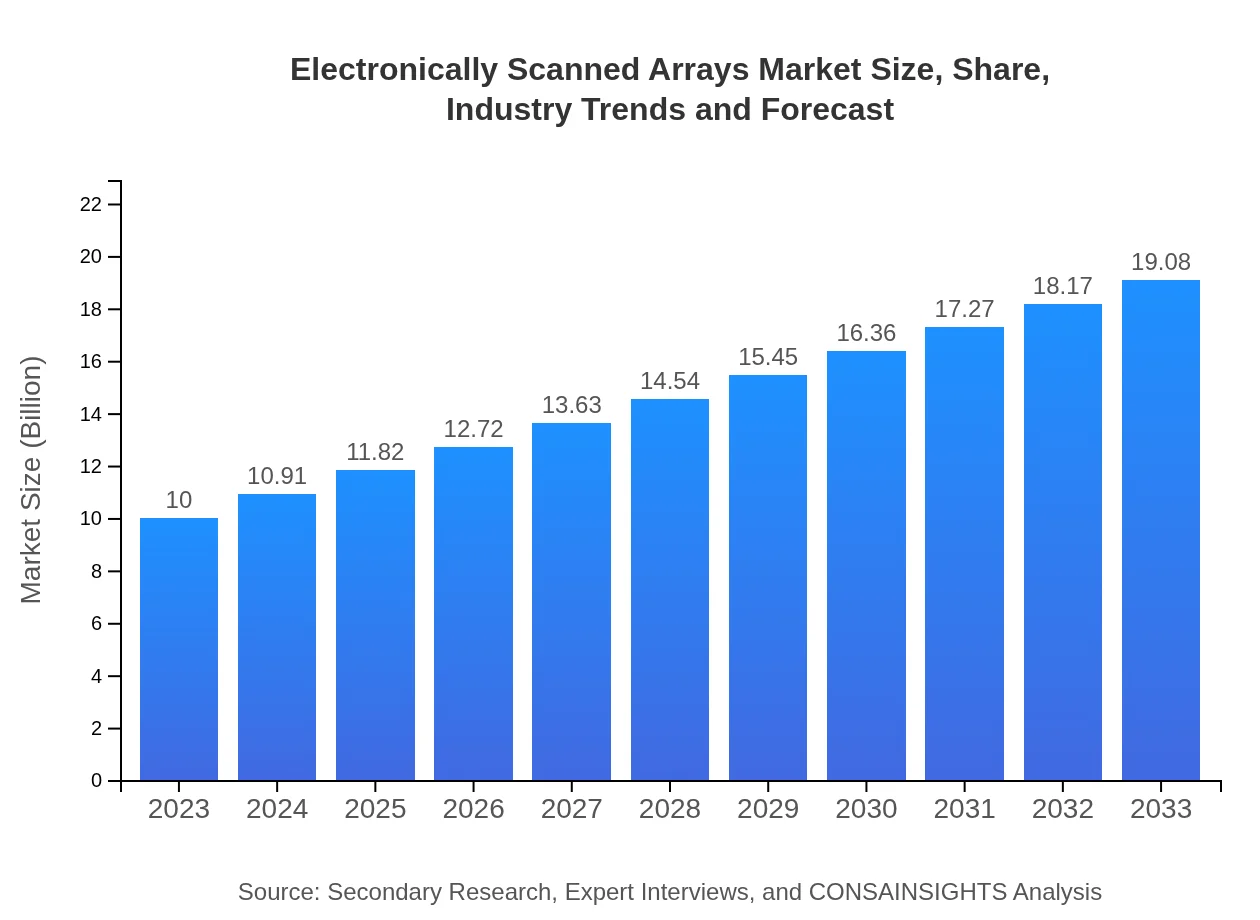

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $19.08 Billion |

| Top Companies | Raytheon Technologies, Northrop Grumman, Thales Group, Boeing , Lockheed Martin |

| Last Modified Date | 03 February 2026 |

Electronically Scanned Arrays Market Overview

Customize Electronically Scanned Arrays Market Report market research report

- ✔ Get in-depth analysis of Electronically Scanned Arrays market size, growth, and forecasts.

- ✔ Understand Electronically Scanned Arrays's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Electronically Scanned Arrays

What is the Market Size & CAGR of Electronically Scanned Arrays market in 2033?

Electronically Scanned Arrays Industry Analysis

Electronically Scanned Arrays Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Electronically Scanned Arrays Market Analysis Report by Region

Europe Electronically Scanned Arrays Market Report:

In Europe, the Electronically Scanned Arrays market will increase from $2.69 billion in 2023 to $5.14 billion by 2033, driven by advancements in aerospace and telecommunications. Countries like the UK, Germany, and France are investing heavily in state-of-the-art radar and communication systems.Asia Pacific Electronically Scanned Arrays Market Report:

In the Asia Pacific region, the Electronically Scanned Arrays market is expected to grow from $2.04 billion in 2023 to $3.89 billion by 2033, reflecting a surge in infrastructure projects and defense initiatives, especially in countries like China and India. The increasing adoption of advanced communication systems also bolsters the demand for ESAs.North America Electronically Scanned Arrays Market Report:

North America leads with a market size of $3.23 billion in 2023, expected to grow to $6.15 billion by 2033. The presence of major defense contractors and technological innovators in the U.S. significantly contributes to market expansion, alongside growing investments in commercial aerospace.South America Electronically Scanned Arrays Market Report:

The market in South America is projected to increase from $0.94 billion in 2023 to $1.79 billion by 2033. Key growth drivers include the enhancement of telecommunication infrastructure and defense capabilities, particularly as countries enhance their military technology to address security challenges.Middle East & Africa Electronically Scanned Arrays Market Report:

The market in the Middle East and Africa is expected to grow from $1.11 billion in 2023 to $2.11 billion by 2033, fueled by increasing defense budgets among Gulf states and investments in modernizing military capabilities and communication systems.Tell us your focus area and get a customized research report.

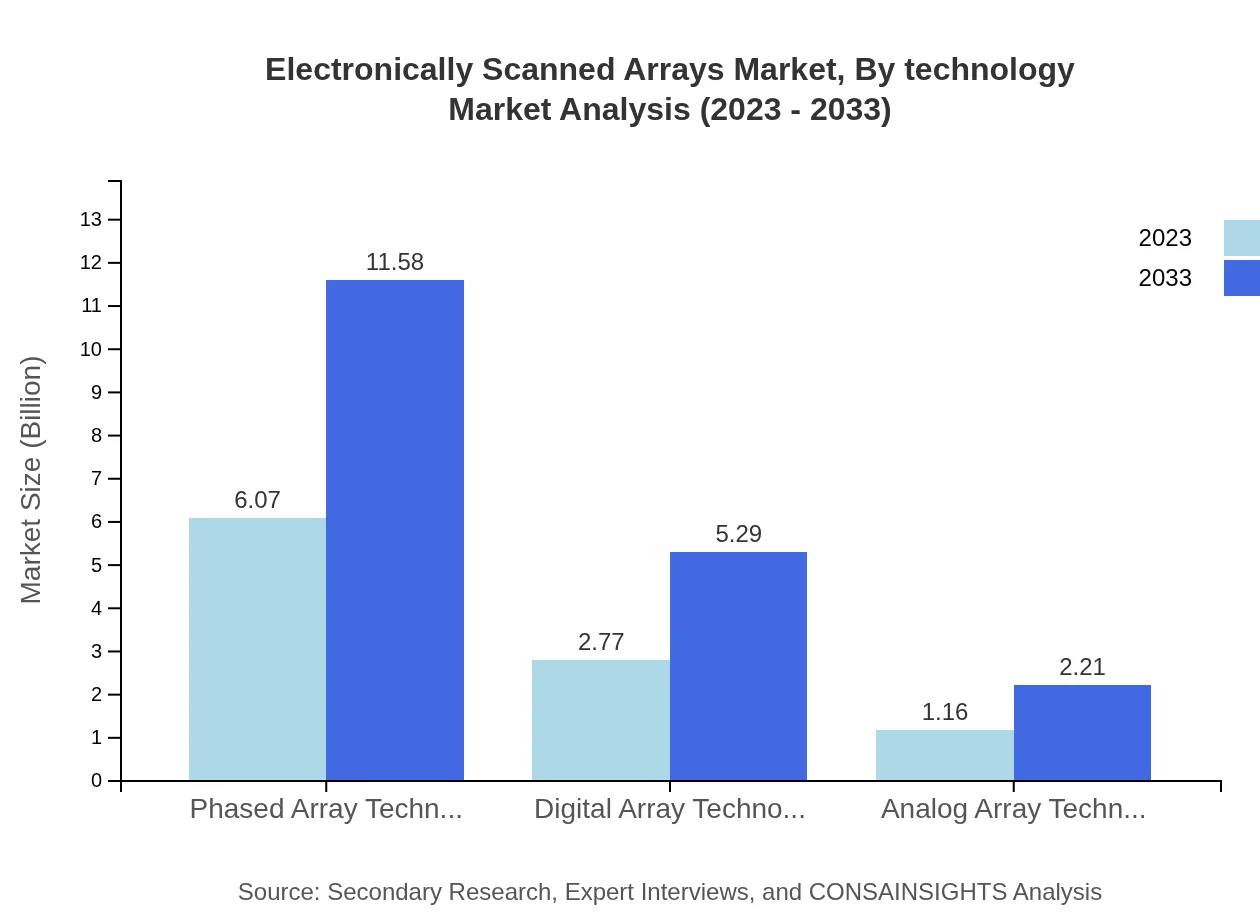

Electronically Scanned Arrays Market Analysis By Technology

The market segment covers Phased Array, Digital Array, and Analog Array technologies. Phased Array technology holds the largest market share due to its versatility in both defense and telecommunications, fostering a growth from $6.07 billion in 2023 to $11.58 billion by 2033. Digital Array technology, meanwhile, exhibits rapid growth, expected to rise from $2.77 billion to $5.29 billion in the same timeframe.

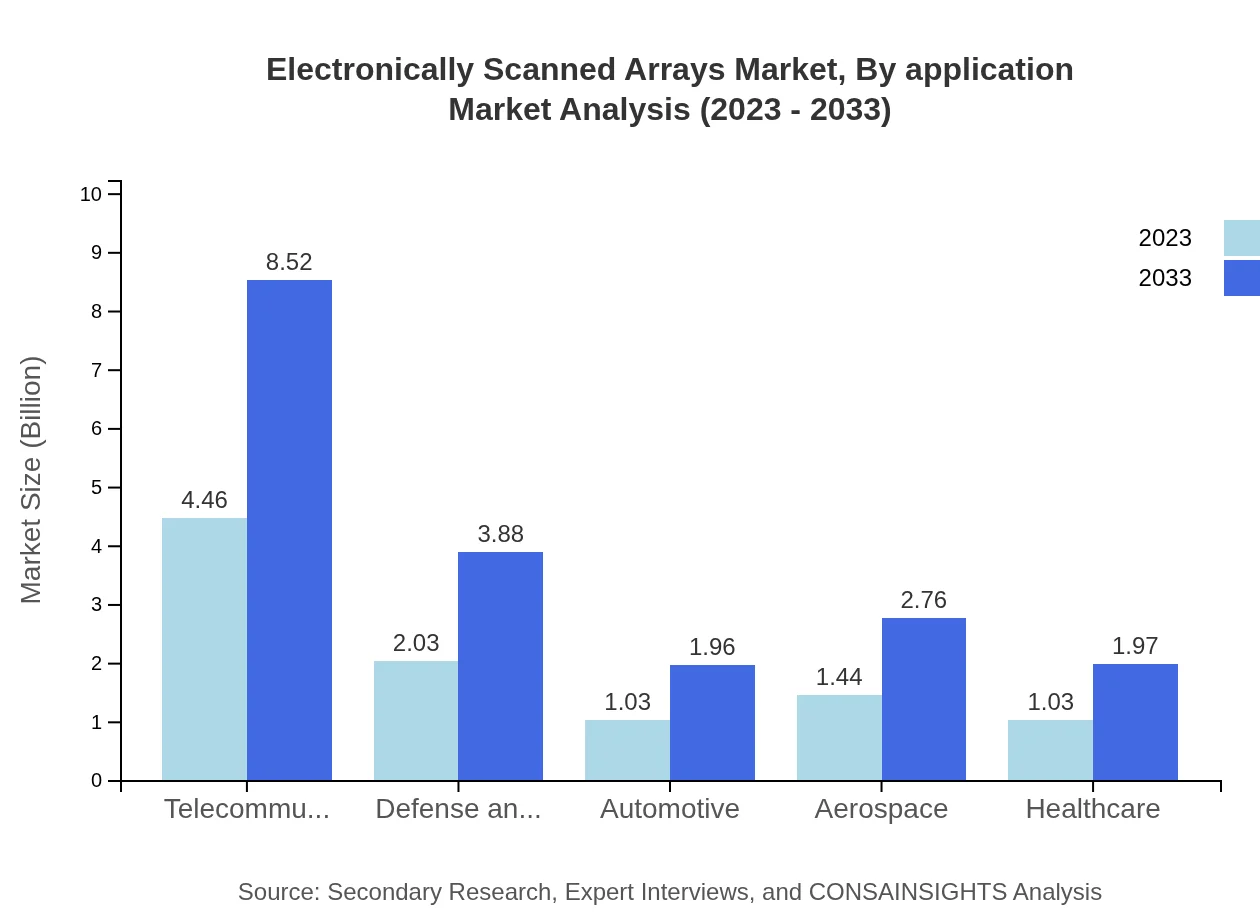

Electronically Scanned Arrays Market Analysis By Application

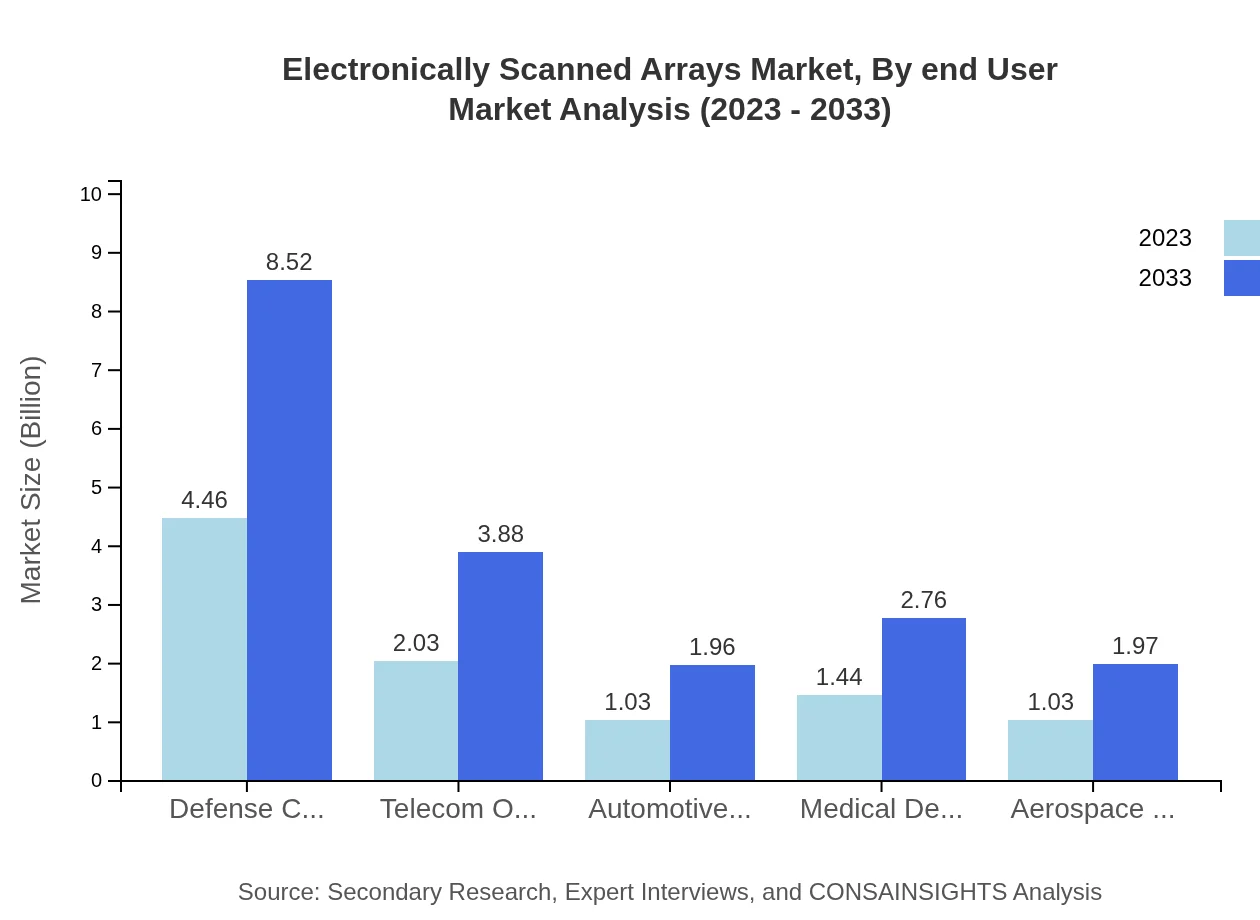

Defense applications dominate the ESAs market, accounting for a significant share due to heightened military expenditures. As of 2023, the defense sector's market size is projected at $4.46 billion, expected to reach $8.52 billion by 2033. The telecommunications sector is also crucial, anticipated to grow from $2.03 billion to $3.88 billion.

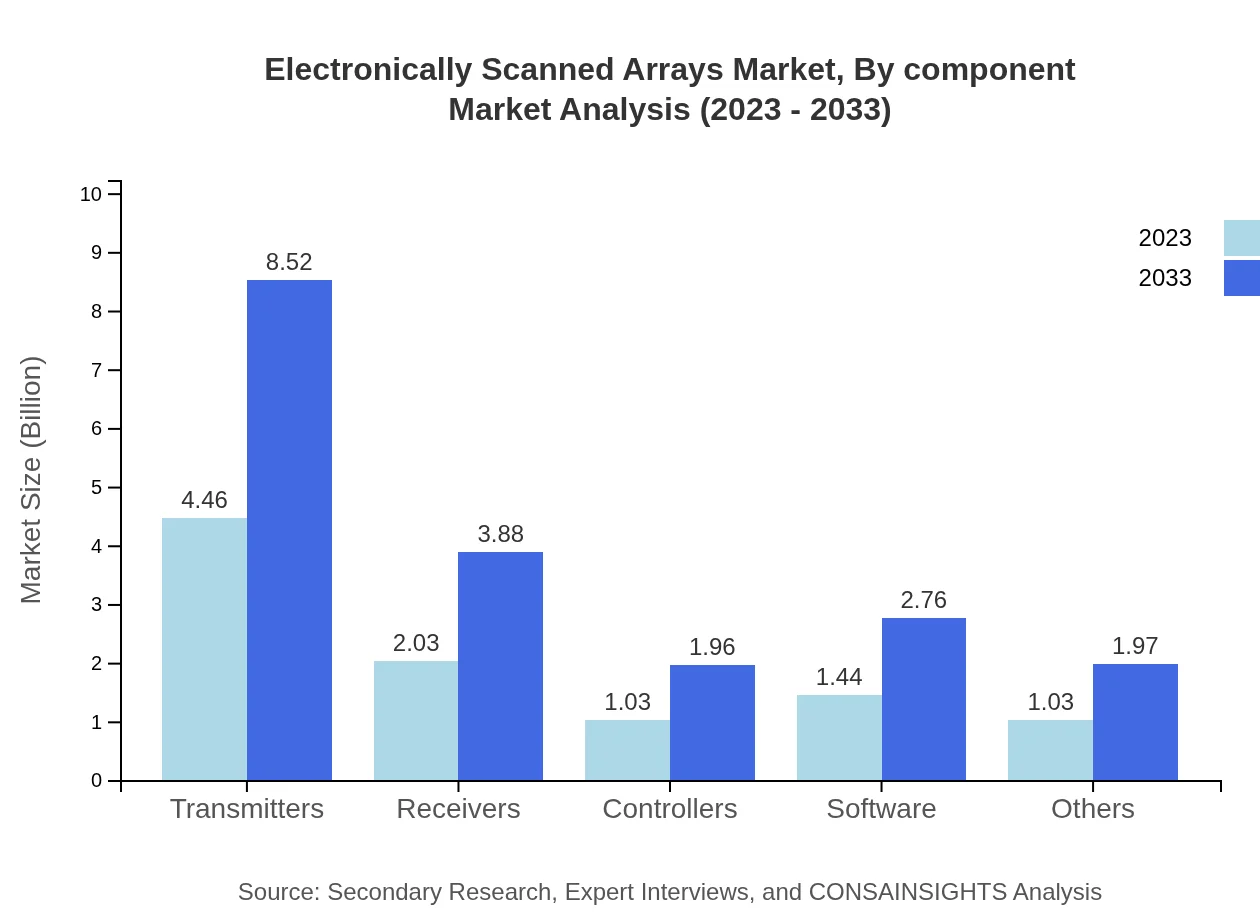

Electronically Scanned Arrays Market Analysis By Component

Key components of the Electronically Scanned Arrays market include transmitters, receivers, and software. Transmitters represent the largest segment, accounting for $4.46 billion in 2023, with an upward trend expected at $8.52 billion in 2033. Software solutions also drive substantial growth, expanding from $1.44 billion to $2.76 billion.

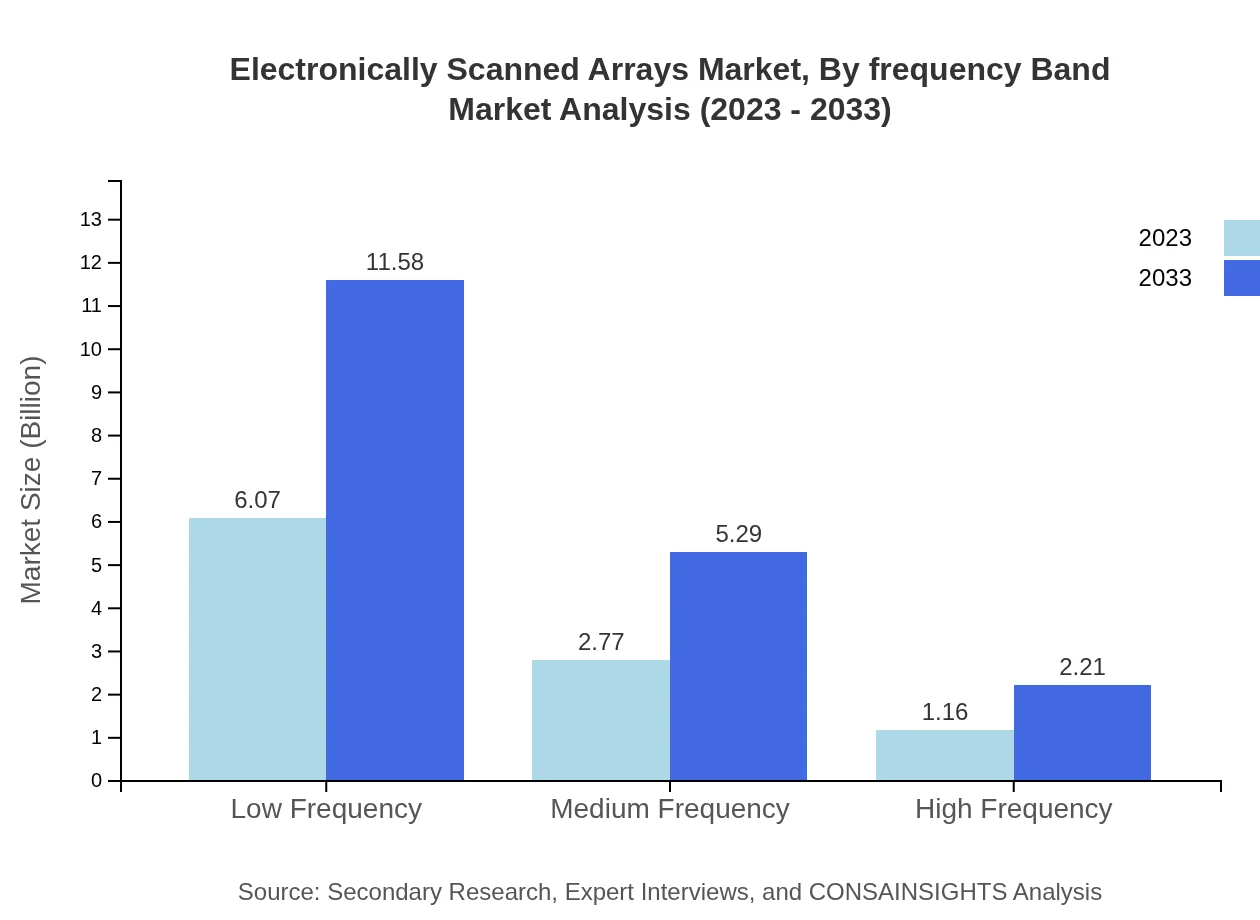

Electronically Scanned Arrays Market Analysis By Frequency Band

The market is segmented into Low, Medium, and High Frequency bands. Low Frequency bands dominate with a size of $6.07 billion in 2023, projected to increase to $11.58 billion by 2033. Medium Frequency technology is also expected to grow significantly, from $2.77 billion to $5.29 billion, increasing application in telecommunications and defense.

Electronically Scanned Arrays Market Analysis By End User

Key end-users include defense contractors, automotive manufacturers, medical device manufacturers, and aerospace players. The defense contractor segment is poised for remarkable growth from $4.46 billion in 2023 to $8.52 billion by 2033, accounting for a substantial market share. Automotive manufacturers follow, with a forecasted growth from $1.03 billion to $1.96 billion.

Electronically Scanned Arrays Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Electronically Scanned Arrays Industry

Raytheon Technologies:

A leader in defense and aerospace technologies, specializing in advanced radar systems and sensors.Northrop Grumman:

A key player in defense electronics, known for innovative ESAs in military applications.Thales Group:

Offers high-tech solutions for defense, aerospace, and transport with expertise in radar and communication systems.Boeing :

Major contractor in aerospace, providing integrated multi-mode radar systems with ESAs technology.Lockheed Martin:

Engaged in advanced technologies, including electronic scanning systems used in various military applications.We're grateful to work with incredible clients.

FAQs

What is the market size of electronically Scanned Arrays?

The electronically scanned arrays market is valued at approximately $10 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.5%, indicating significant growth opportunities through 2033.

What are the key market players or companies in this electronically Scanned Arrays industry?

Key players in the electronically scanned arrays market include leading public and private sector companies that focus on defense, telecommunications, and aerospace. These companies drive technological advancements in electronically scanned arrays.

What are the primary factors driving the growth in the electronically Scanned Arrays industry?

The growth of the electronically scanned arrays market is driven by increasing defense spending, advancements in radar technology, and the demand for high-speed wireless communication systems. These factors are critical for military and civilian applications.

Which region is the fastest Growing in the electronically Scanned Arrays?

The fastest-growing region in the electronically scanned arrays market is North America, projected to grow from $3.23 billion in 2023 to $6.15 billion by 2033. Europe and Asia Pacific are also significant contributors to market growth.

Does ConsaInsights provide customized market report data for the electronically Scanned Arrays industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the electronically scanned arrays industry, addressing unique market dynamics for different stakeholders.

What deliverables can I expect from this electronically Scanned Arrays market research project?

Deliverables from the electronically scanned arrays market research project typically include comprehensive reports, market forecasts, competitive analysis, and regional insights, providing actionable information for strategic decision-making.

What are the market trends of electronically Scanned Arrays?

Market trends in electronically scanned arrays include the rise of digital and phased array technologies, increasing integration in automotive and healthcare sectors, and a focus on miniaturization and enhanced performance in various applications.