Electronics Manufacturing Services Market Report

Published Date: 31 January 2026 | Report Code: electronics-manufacturing-services

Electronics Manufacturing Services Market Size, Share, Industry Trends and Forecast to 2033

This report offers an in-depth analysis of the Electronics Manufacturing Services market from 2023 to 2033, detailing market size, growth trends, regional performance, and key players. Insights into segmentation, technology shifts, and product relevance will also be covered to understand the evolving landscape of the industry.

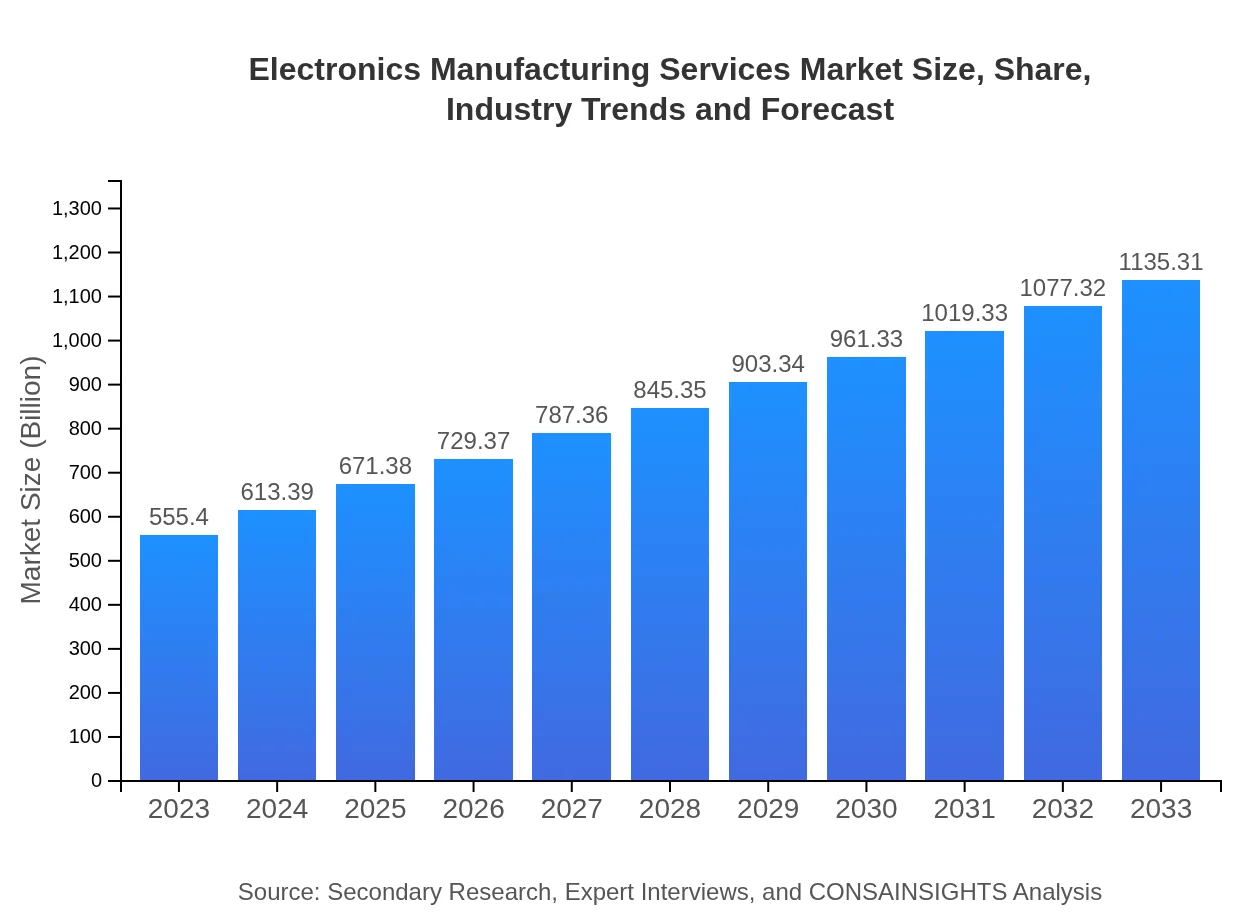

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $555.40 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $1135.31 Billion |

| Top Companies | Foxconn Technology Group, Jabil Circuit, Inc., Flex Ltd., Sanmina Corporation |

| Last Modified Date | 31 January 2026 |

Electronics Manufacturing Services Market Overview

Customize Electronics Manufacturing Services Market Report market research report

- ✔ Get in-depth analysis of Electronics Manufacturing Services market size, growth, and forecasts.

- ✔ Understand Electronics Manufacturing Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Electronics Manufacturing Services

What is the Market Size & CAGR of Electronics Manufacturing Services market in 2023?

Electronics Manufacturing Services Industry Analysis

Electronics Manufacturing Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Electronics Manufacturing Services Market Analysis Report by Region

Europe Electronics Manufacturing Services Market Report:

Europe's EMS market is valued at $154.12 billion in 2023, with growth to $315.05 billion anticipated by 2033. The region is characterized by a high emphasis on quality and regulatory compliance, making it a significant player in specialized electronics manufacturing.Asia Pacific Electronics Manufacturing Services Market Report:

The Asia Pacific region is a significant hub for the EMS market, comprising a market size of approximately $109.47 billion in 2023, expected to grow to $223.77 billion by 2033. Key factors driving this growth include lower manufacturing costs, a skilled labor force, and high demand for consumer electronics.North America Electronics Manufacturing Services Market Report:

North America's market size is estimated at $207.16 billion in 2023, with expected growth to $423.47 billion by 2033. This region benefits from advanced technology adoption and a strong focus on innovative product development across sectors.South America Electronics Manufacturing Services Market Report:

In South America, the EMS market is valued at approximately $17.72 billion in 2023, with projections to reach $36.22 billion by 2033. The region is gaining attention due to its growing electronics industry, bolstered by government initiatives aimed at fostering manufacturing.Middle East & Africa Electronics Manufacturing Services Market Report:

The Middle East and Africa show a market size of $66.93 billion in 2023, with projections rising to $136.80 billion by 2033. Increasing investments in technology and infrastructure are likely to drive growth in the EMS sector in this region.Tell us your focus area and get a customized research report.

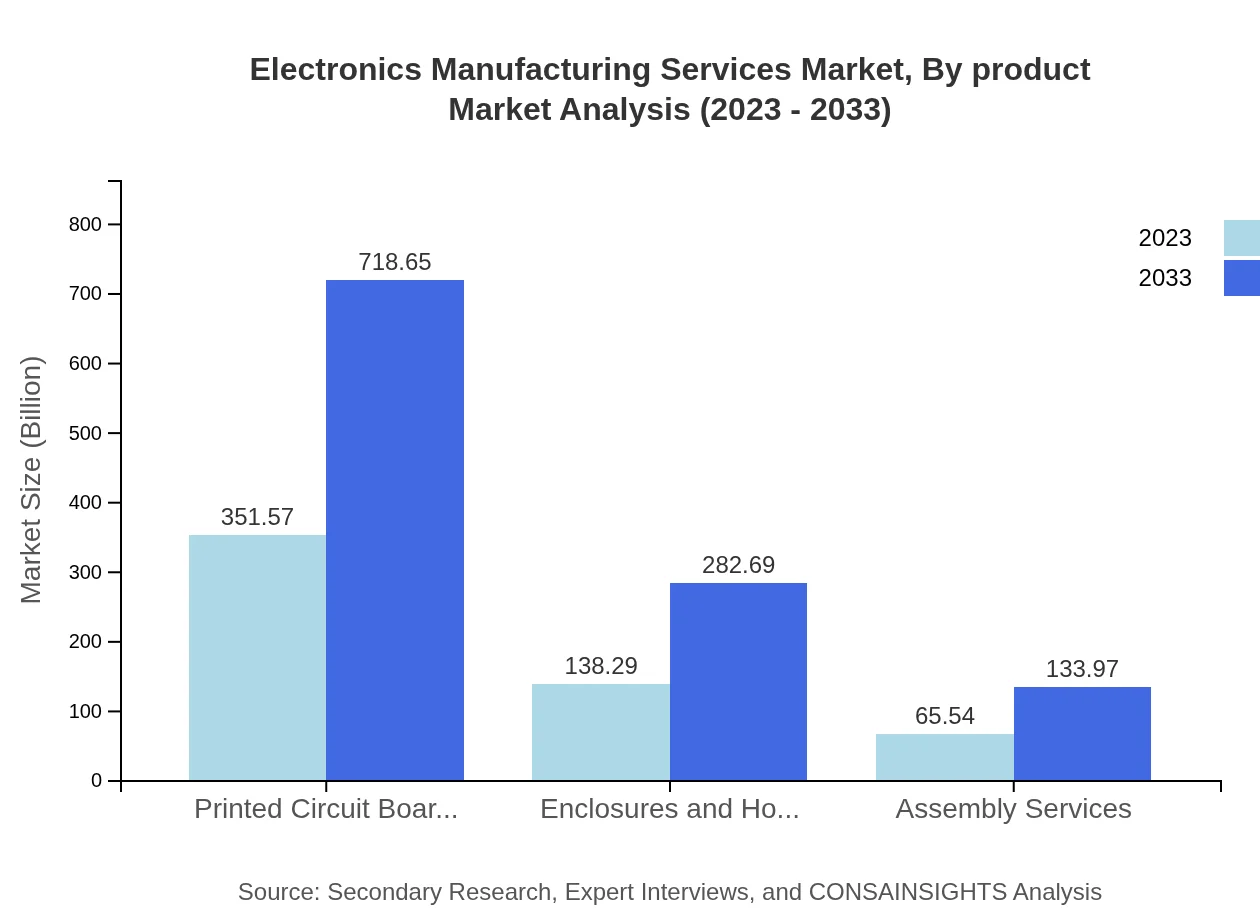

Electronics Manufacturing Services Market Analysis By Product

The Electronics Manufacturing Services market comprises several product segments, with Printed Circuit Boards (PCBs) leading the market, valued at $351.57 billion in 2023 and reaching $718.65 billion by 2033. Other notable product types include consumer electronics, automotive components, and medical devices, each contributing significantly to market revenues.

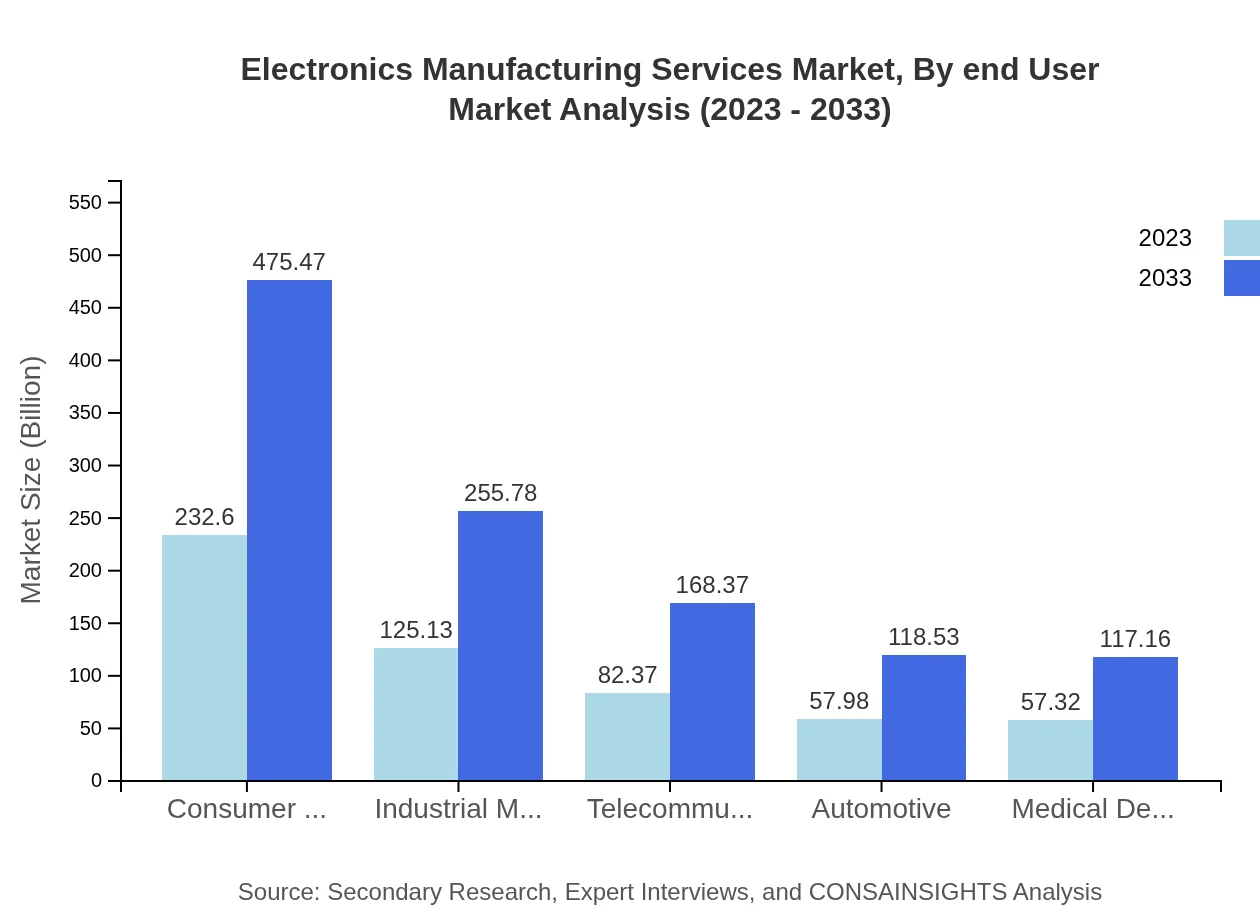

Electronics Manufacturing Services Market Analysis By End User

End-user segments in the Electronics Manufacturing Services market include consumer electronics (41.88% market share), automotive (10.44%), telecommunications (14.83%), and industrial manufacturing (22.53%). Each of these segments exhibits distinct requirements, influencing the services and solutions offered by EMS providers.

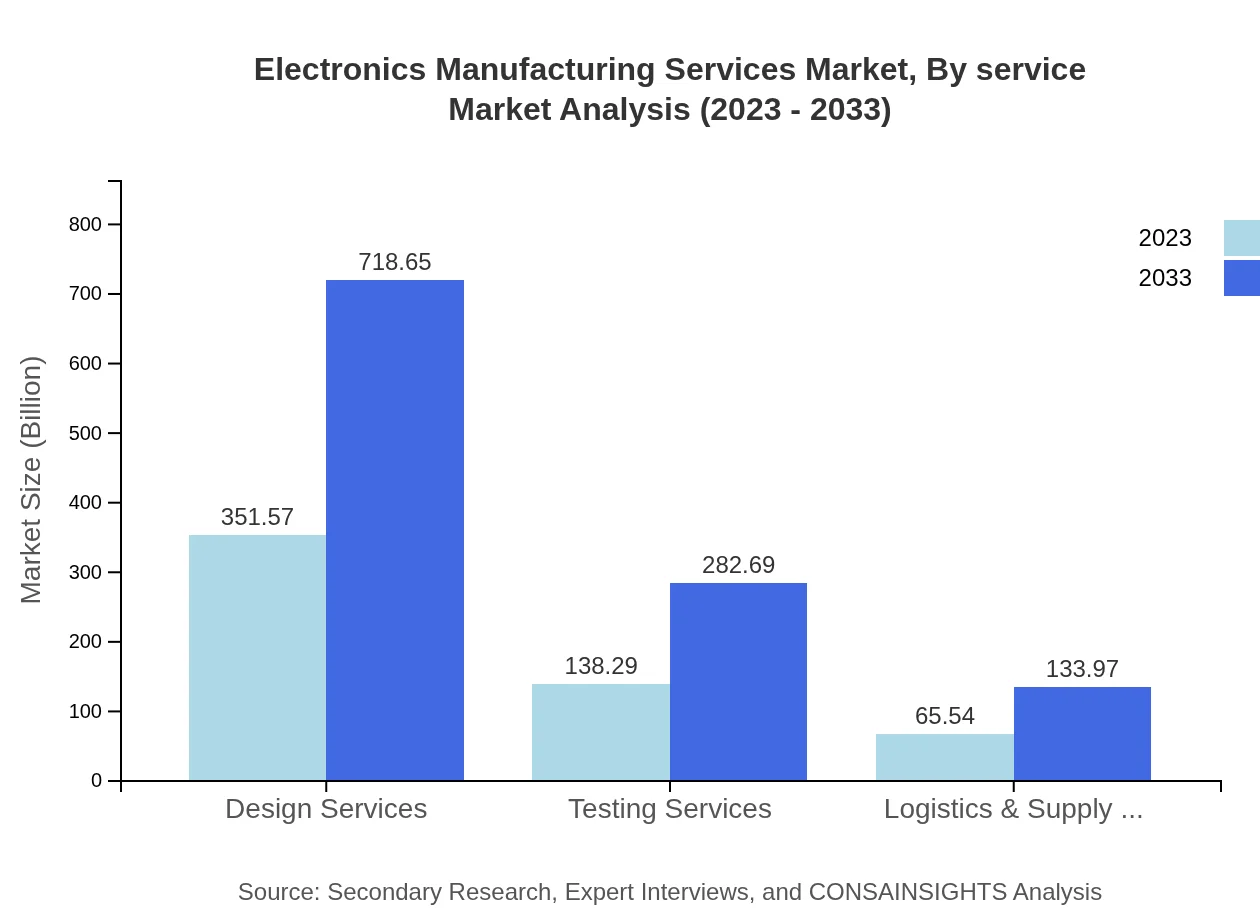

Electronics Manufacturing Services Market Analysis By Service

Key services in the EMS industry include assembly services, testing services, design services, and logistics. Assembly services dominate the market, while logistics and supply chain management are increasingly critical for enhancing efficiency and responsiveness in delivery.

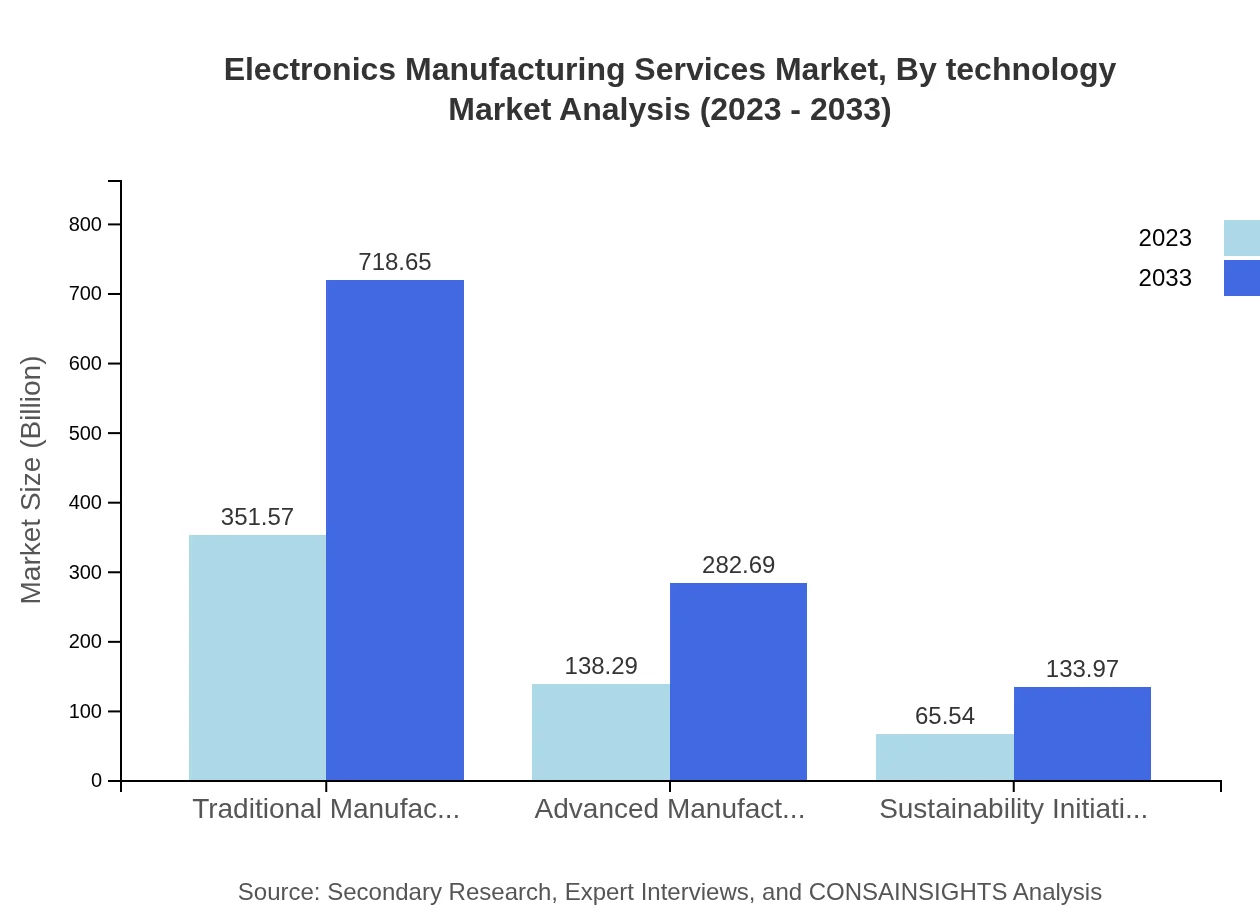

Electronics Manufacturing Services Market Analysis By Technology

Emerging technologies such as automation, IoT integration, and AI-driven manufacturing processes are reshaping the EMS landscape. These technologies enhance production capabilities, improve quality assurance, and drive operational efficiencies across the entire manufacturing spectrum.

Electronics Manufacturing Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Electronics Manufacturing Services Industry

Foxconn Technology Group:

Foxconn is a leading EMS provider known for its vast manufacturing capabilities, primarily producing consumer electronics for major companies like Apple.Jabil Circuit, Inc.:

Jabil provides comprehensive electronics manufacturing solutions, emphasizing innovation and sustainability in its operations.Flex Ltd.:

Flex is an established player in the EMS market, focusing on connected devices and advanced manufacturing techniques.Sanmina Corporation:

Sanmina offers end-to-end manufacturing services and is recognized for its expertise in complex electronics systems.We're grateful to work with incredible clients.

FAQs

What is the market size of electronics Manufacturing Services?

The global electronics manufacturing services market is projected to grow from $555.4 billion in 2023 to significant heights by 2033, at a compound annual growth rate (CAGR) of 7.2%. This growth reflects the continuous demand and innovations in the electronics sector.

What are the key market players or companies in this electronics Manufacturing Services industry?

The electronics manufacturing services industry is dominated by key players such as Foxconn, Flex Ltd., Jabil, Sanmina, and Celestica, which specialize in various segments including PCB assembly, design services, and logistics, contributing to industry advancements.

What are the primary factors driving the growth in the electronics Manufacturing Services industry?

Key factors driving growth in the electronics manufacturing services industry include the rising demand for consumer electronics, advancements in technology, expansion of automotive electronics, and the increasing need for outsourcing production to improve efficiency and reduce costs.

Which region is the fastest Growing in the electronics Manufacturing Services?

Asia Pacific is the fastest-growing region in the electronics manufacturing services market, expanding from $109.47 billion in 2023 to $223.77 billion by 2033, driven by high demand for electronics from countries like China and South Korea.

Does ConsaInsights provide customized market report data for the electronics Manufacturing Services industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the electronics manufacturing services industry, allowing businesses to gain insights that are aligned with their strategic objectives and market positioning.

What deliverables can I expect from this electronics Manufacturing Services market research project?

From the electronics manufacturing services market research project, clients can expect comprehensive reports detailing market size, growth forecasts, regional analysis, competitive landscape, key trends, and actionable insights tailored to their specific sector needs.

What are the market trends of electronics Manufacturing Services?

Current trends in the electronics manufacturing services market include a focus on sustainability initiatives, automation in manufacturing processes, and advancements in design and testing services, reflecting the industry's adaptation to technological shifts and environmental pressures.