Electroretinography Market Report

Published Date: 31 January 2026 | Report Code: electroretinography

Electroretinography Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Electroretinography market, covering market size estimates, industry trends, and growth forecasts from 2023 to 2033. It highlights segmentation, regional insights, major players, and technological advancements reshaping the industry.

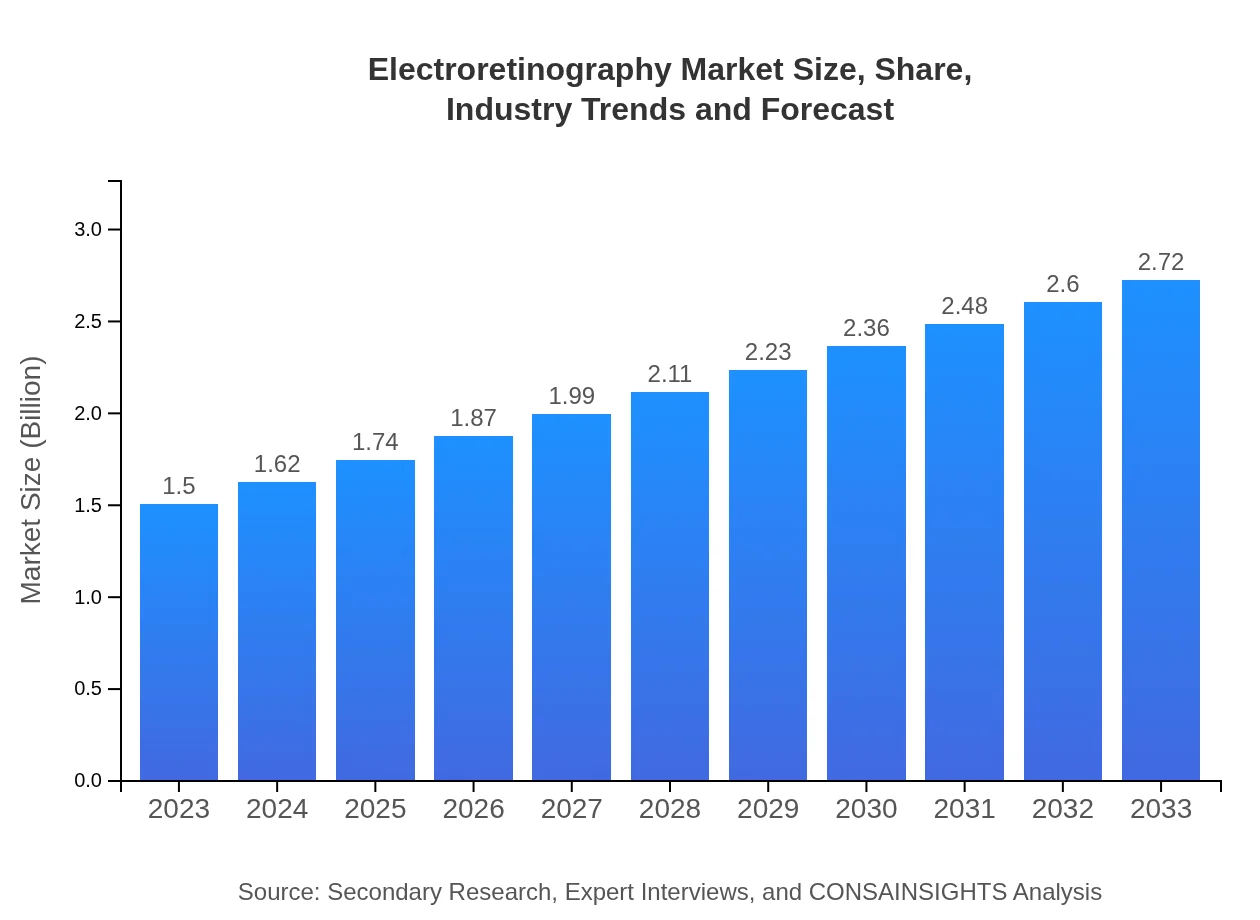

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.0% |

| 2033 Market Size | $2.72 Billion |

| Top Companies | Carl Zeiss AG, Electro-Diagnostic Imaging, LLC, RETIRED, Diagnosys LLC |

| Last Modified Date | 31 January 2026 |

Electroretinography Market Overview

Customize Electroretinography Market Report market research report

- ✔ Get in-depth analysis of Electroretinography market size, growth, and forecasts.

- ✔ Understand Electroretinography's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Electroretinography

What is the Market Size & CAGR of Electroretinography market in 2023?

Electroretinography Industry Analysis

Electroretinography Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Electroretinography Market Analysis Report by Region

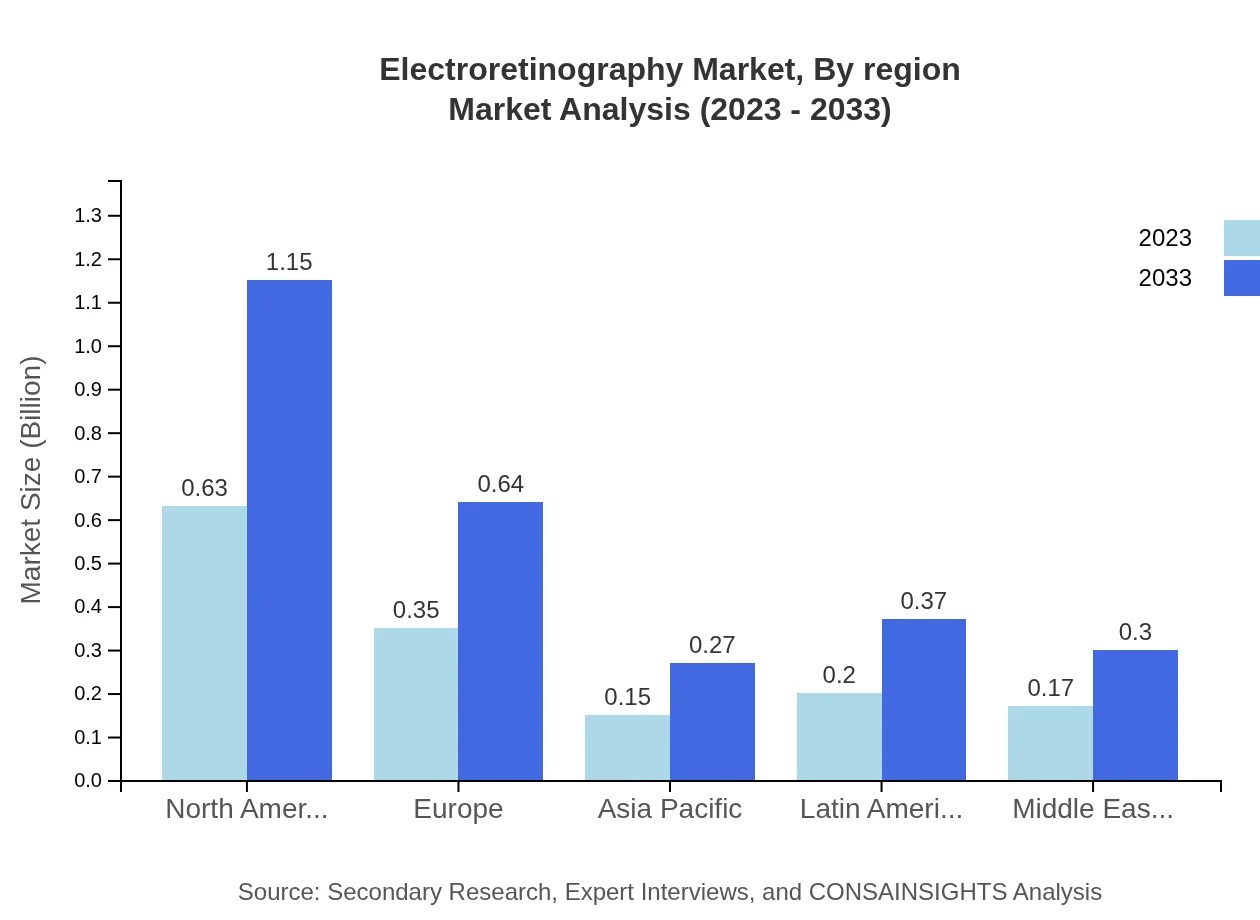

Europe Electroretinography Market Report:

Europe's Electroretinography market shows robust growth, increasing from $0.48 billion in 2023 to $0.87 billion by 2033 fueled by well-established medical infrastructures and strong government support for healthcare innovation.Asia Pacific Electroretinography Market Report:

The Asia Pacific region has a growing Electroretinography market estimated at $0.26 billion in 2023, projected to reach $0.47 billion by 2033. Factors such as increasing healthcare access, rising incidences of eye disorders, and expanding awareness contribute to this growth.North America Electroretinography Market Report:

North America is the largest market for Electroretinography, with a market size of about $0.54 billion in 2023 expected to grow to $0.98 billion by 2033. The significant share is attributed to advanced healthcare systems, enhanced research activities, and a high prevalence of retinal diseases.South America Electroretinography Market Report:

In South America, the Electroretinography market is valued at approximately $0.01 billion in 2023 and is forecasted to expand to $0.03 billion by 2033, driven by improve healthcare infrastructure and an increased focus on ocular diseases.Middle East & Africa Electroretinography Market Report:

The Middle East and Africa region’s market is poised for growth, with a size of $0.21 billion in 2023, projected to reach $0.37 billion by 2033, thanks to improvements in healthcare services and growing public awareness on eye health.Tell us your focus area and get a customized research report.

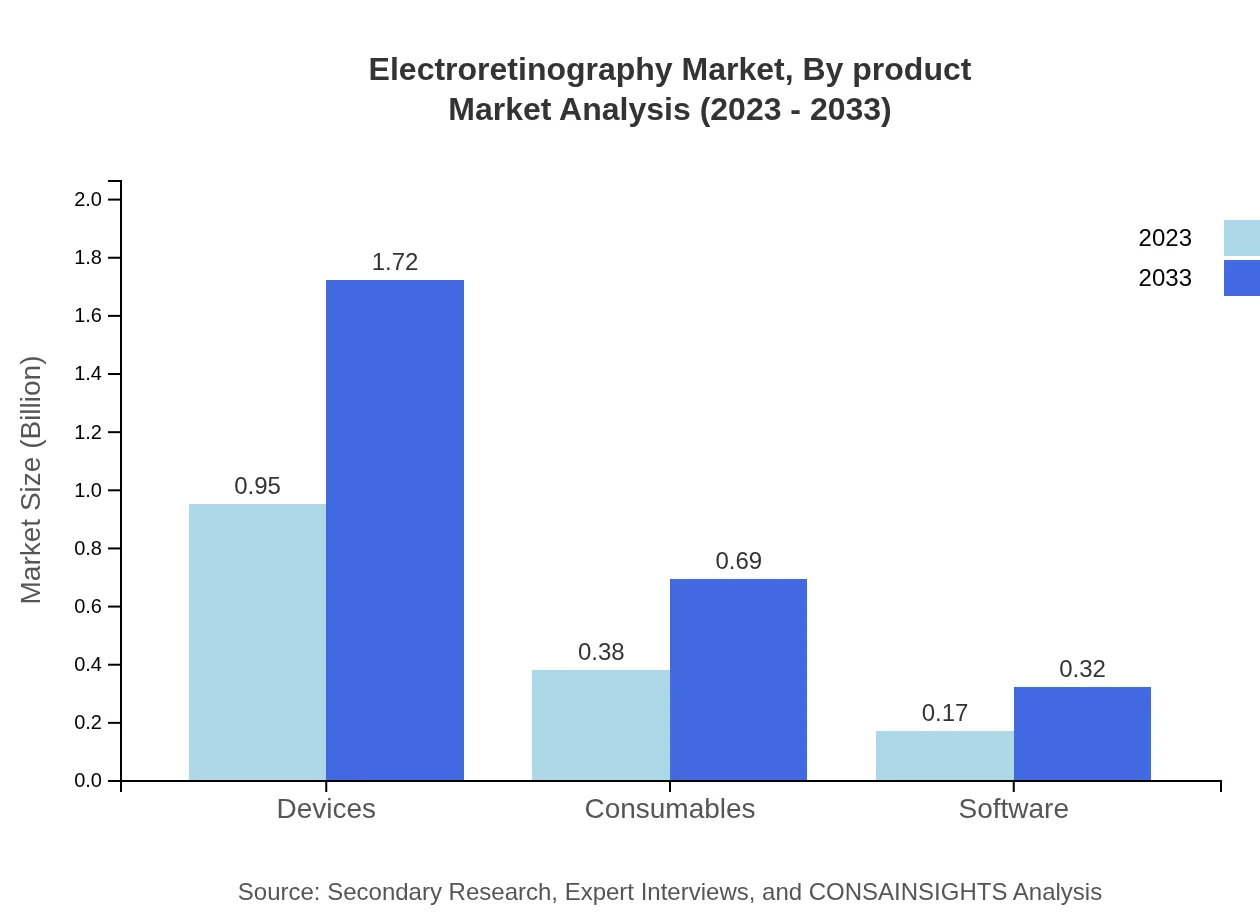

Electroretinography Market Analysis By Product

The product segment introduces three main categories: Devices, Consumables, and Software. Devices dominate the market, accounting for 63.1% of total revenue in 2023, with sales expected to grow as innovative models are introduced. Consumables represent 25.34% of the market and will witness growth alongside increased tests and treatments. Software, while smaller at 11.56%, is crucial for data analysis and interpretation, driving further integration of technology in clinical settings.

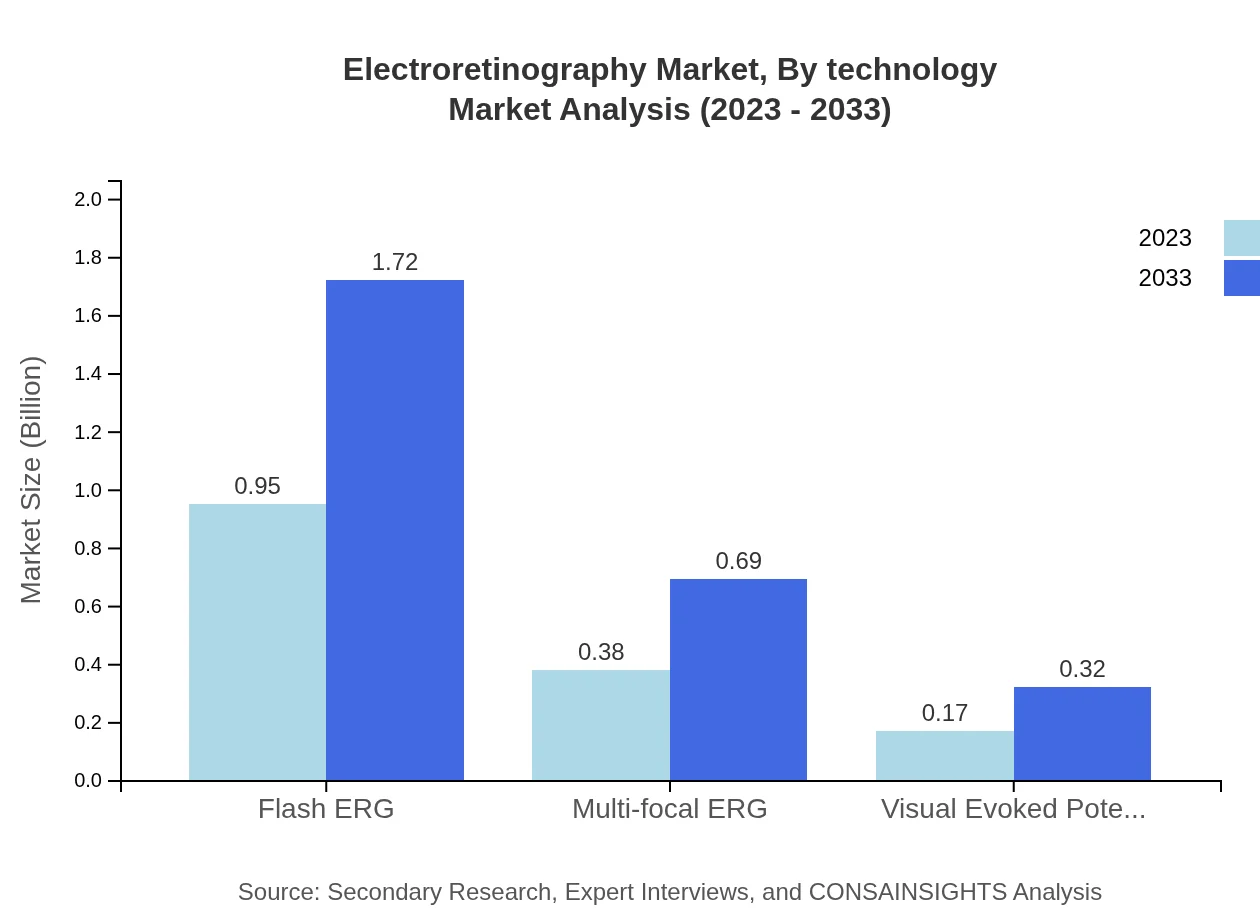

Electroretinography Market Analysis By Technology

Technological advancements play a crucial role in shaping the Electroretinography market. Key technologies include Flash ERG, Multi-focal ERG, and Visual Evoked Potentials. Flash ERG holds the largest market share, reflecting the demand for fast and effective diagnostics. Multi-focal ERG is gaining traction due to its ability to assess multiple areas of the retina simultaneously, while Visual Evoked Potentials hold niche applications in research settings.

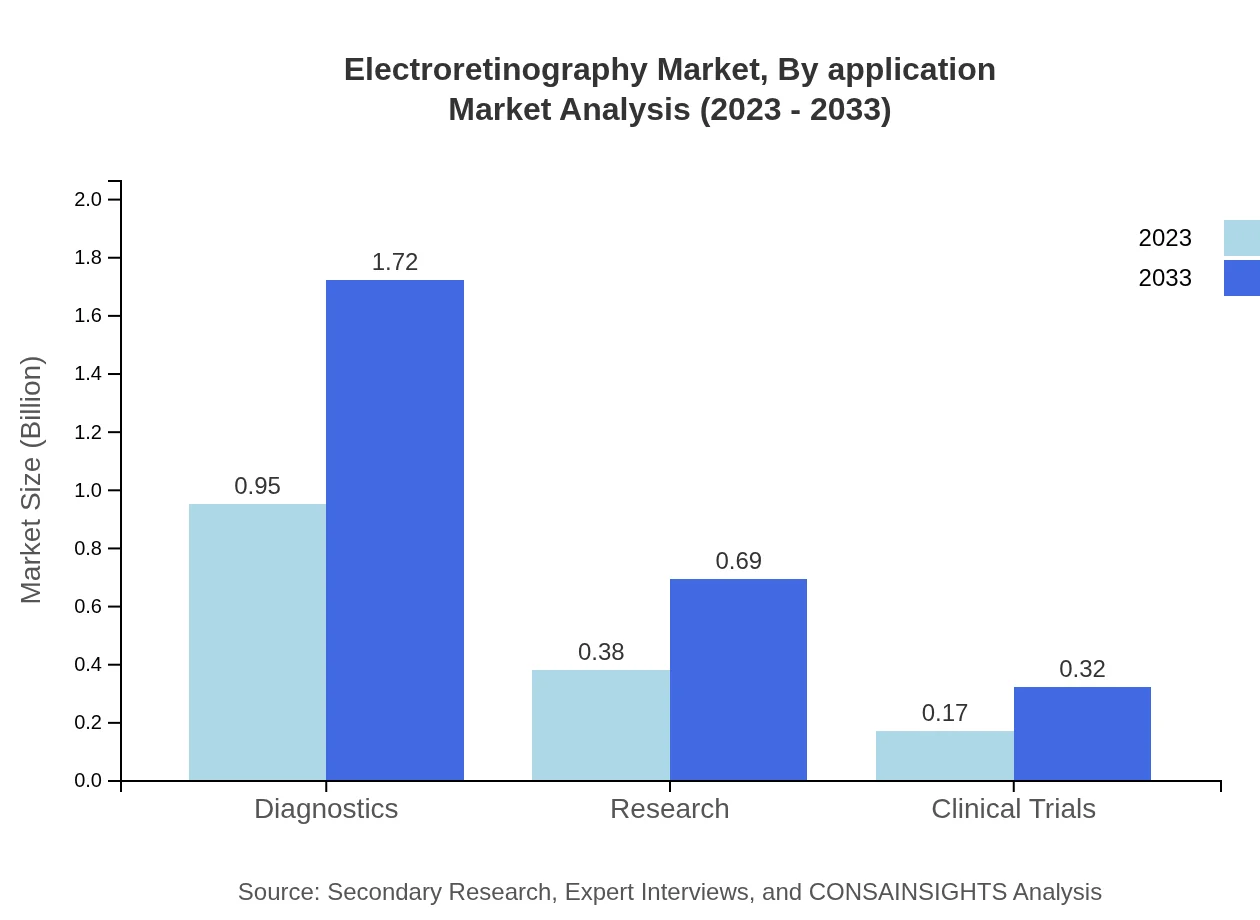

Electroretinography Market Analysis By Application

Applications of Electroretinography span across Diagnostics, Research, and Clinical Trials. The diagnostic segment is the largest, accounting for 63.1% in 2023, driven by an increasing number of eye examinations. Research applications are also significant, driven by growing funding in retinal disease studies, while clinical trials are essential for testing new therapies, reflecting robust innovations in eye care.

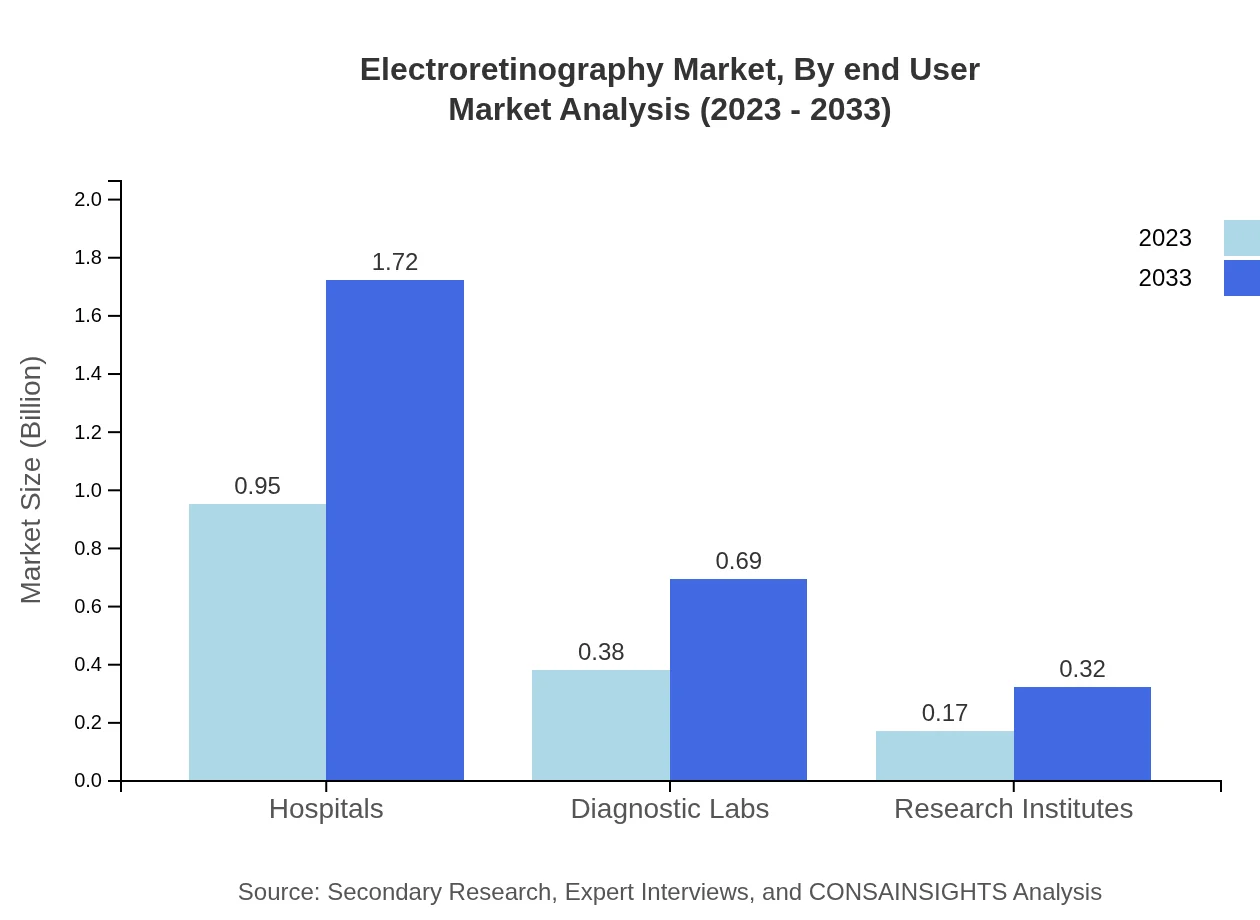

Electroretinography Market Analysis By End User

The primary end-users of Electroretinography products are hospitals, diagnostic labs, and research institutes. Hospitals account for a significant share (63.1%) of the market, reflecting their central role in treatment and diagnosis. Diagnostic labs and research institutes represent 25.34% and 11.56% respectively, demonstrating growing interest in specialized diagnosis and research.

Electroretinography Market Analysis By Region

Geographical segments show varied growth patterns. North America leads, driven by high healthcare expenditure and advanced technologies, while Europe benefits from strong healthcare policies. Asia Pacific, while currently smaller, is rapidly catching up due to improved health awareness and economic growth.

Electroretinography Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Electroretinography Industry

Carl Zeiss AG:

A leading provider of optical systems and equipment, Zeiss has spearheaded innovations in Electroretinography devices, focusing on enhancing diagnostic accuracy.Electro-Diagnostic Imaging, LLC:

Specializes in advanced diagnostic imaging solutions, including Electroretinography, and is known for its commitment to quality and innovative technologies.RETIRED:

A recognized brand in retinal diagnostics, RETIRED develops and manufactures cutting-edge Electroretinography systems widely used in clinical and research applications.Diagnosys LLC:

Offers a comprehensive range of ophthalmic diagnostic products, with a strong emphasis on developing user-friendly and efficient Electroretinography systems.We're grateful to work with incredible clients.

FAQs

What is the market size of Electroretinography?

The global Electroretinography market is expected to reach $1.5 billion by 2033, growing at a CAGR of 6.0% from its current size. This growth reflects the increasing demand for retinal diagnostic tools and advancements in medical technology.

What are the key market players in the Electroretinography industry?

Key players in the Electroretinography industry include prominent medical device manufacturers and research institutions. Their contributions in innovation and technology significantly shape market dynamics, enhancing diagnostic and treatment capabilities for retinal diseases.

What are the primary factors driving the growth in the Electroretinography industry?

Important growth drivers include the rising prevalence of retinal disorders, advancements in imaging technology, increased healthcare expenditure, and greater awareness about eye health, pushing demand for reliable electroretinography diagnostic tools.

Which region is the fastest Growing in the Electroretinography?

The North American region is projected to be the fastest-growing area for the Electroretinography market, with a market size increasing from $0.54 billion in 2023 to $0.98 billion in 2033, driven by high healthcare standards and technological advancements.

Does ConsaInsights provide customized market report data for the Electroretinography industry?

Yes, ConsaInsights offers customized market report data tailored specifically for the Electroretinography industry, catering to unique client needs, optimizing market strategies, and helping businesses stay competitive in a dynamic marketplace.

What deliverables can I expect from this Electroretinography market research project?

Deliverables include comprehensive market analysis reports, segment insights, historical data comparisons, key trends, and competitive landscape evaluations, all designed to assist stakeholders in informed decision-making for the Electroretinography sector.

What are the market trends of Electroretinography?

Market trends indicate a growing emphasis on non-invasive diagnostic technologies, increasing investment in research and development, and a shift towards digitalization in eye care practices, enhancing the accuracy and efficiency of electroretinography assessments.