Elevator And Escalator Market Report

Published Date: 22 January 2026 | Report Code: elevator-and-escalator

Elevator And Escalator Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive market report covers insights into the Elevator and Escalator industry, examining trends, market size, segment performance, and forecasts for the years 2023 to 2033. It highlights opportunities and challenges in the evolving landscape, providing valuable data for strategic decisions.

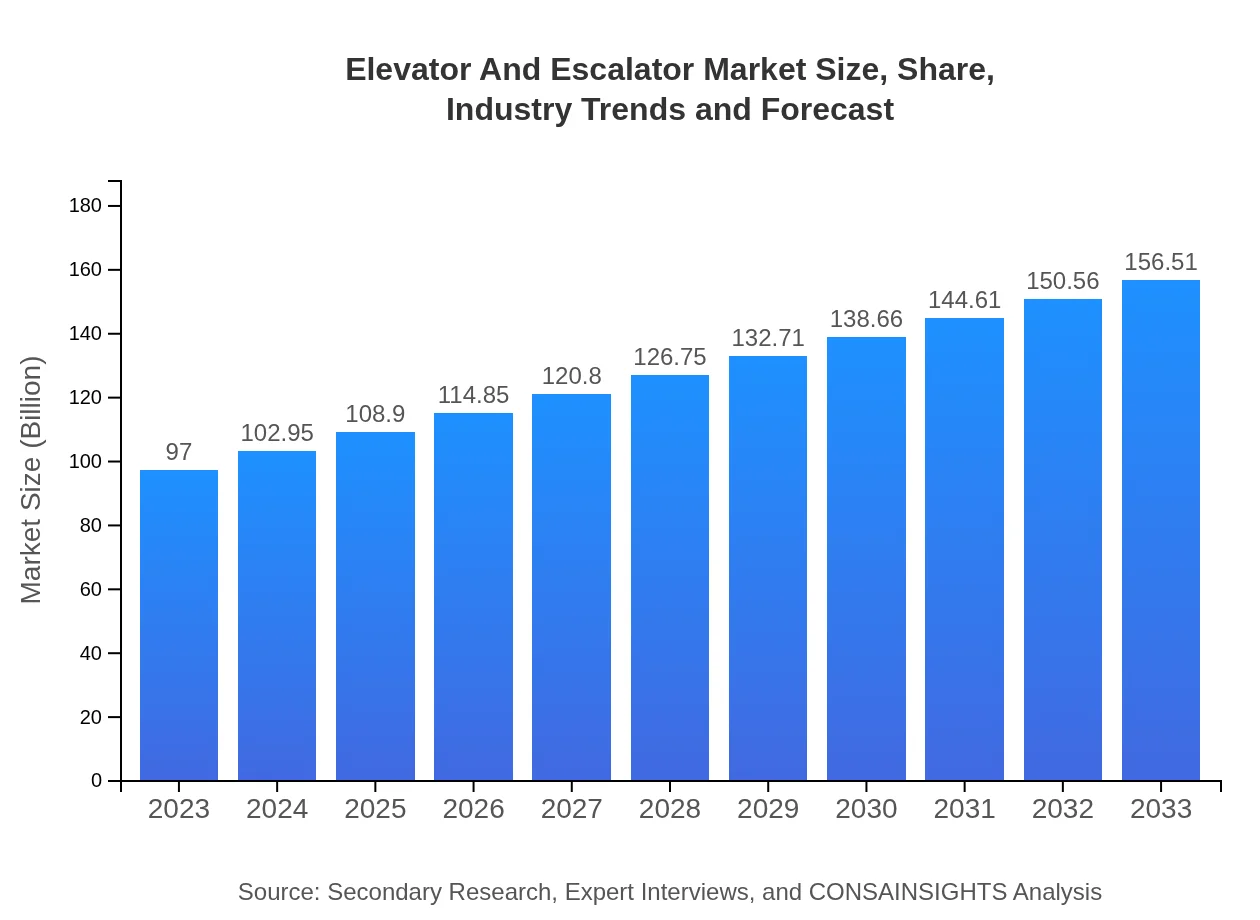

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $97.00 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $156.51 Billion |

| Top Companies | Otis Elevator Company, KONE Corporation, Schindler Group, Thyssenkrupp AG, Hitachi Ltd. |

| Last Modified Date | 22 January 2026 |

Elevator And Escalator Market Overview

Customize Elevator And Escalator Market Report market research report

- ✔ Get in-depth analysis of Elevator And Escalator market size, growth, and forecasts.

- ✔ Understand Elevator And Escalator's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Elevator And Escalator

What is the Market Size & CAGR of Elevator And Escalator market in 2023?

Elevator And Escalator Industry Analysis

Elevator And Escalator Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Elevator And Escalator Market Analysis Report by Region

Europe Elevator And Escalator Market Report:

Europe’s market value stands at 23.46 billion USD in 2023, expected to grow to 37.86 billion USD by 2033. Factors contributing to this growth include a focus on energy efficiency, safety regulations, and investment in modernization of existing infrastructure.Asia Pacific Elevator And Escalator Market Report:

The Asia Pacific region holds a significant share of the Elevator and Escalator market, valued at 20.73 billion USD in 2023, growing to 33.45 billion USD by 2033. The rapid urbanization and infrastructure expansion in countries like China and India drive market demand, as well as an increasing focus on smart city initiatives.North America Elevator And Escalator Market Report:

North America displays a robust market presence with a value of 37.16 billion USD in 2023, projected to rise to 59.96 billion USD by 2033. The presence of key market leaders and advancements in technology coupled with stringent building regulations ensure a steady market trajectory.South America Elevator And Escalator Market Report:

In South America, the market size is around 6.40 billion USD in 2023, projected to reach 10.33 billion USD by 2033. Growth in this region is propelled by ongoing investment in public infrastructure and residential developments, with Brazil playing a significant role.Middle East & Africa Elevator And Escalator Market Report:

The Middle East and Africa market, valued at 9.24 billion USD in 2023, is anticipated to reach 14.92 billion USD by 2033. This growth is fostered by urbanization, infrastructure development projects, and rising standards of living that necessitate better mobility solutions.Tell us your focus area and get a customized research report.

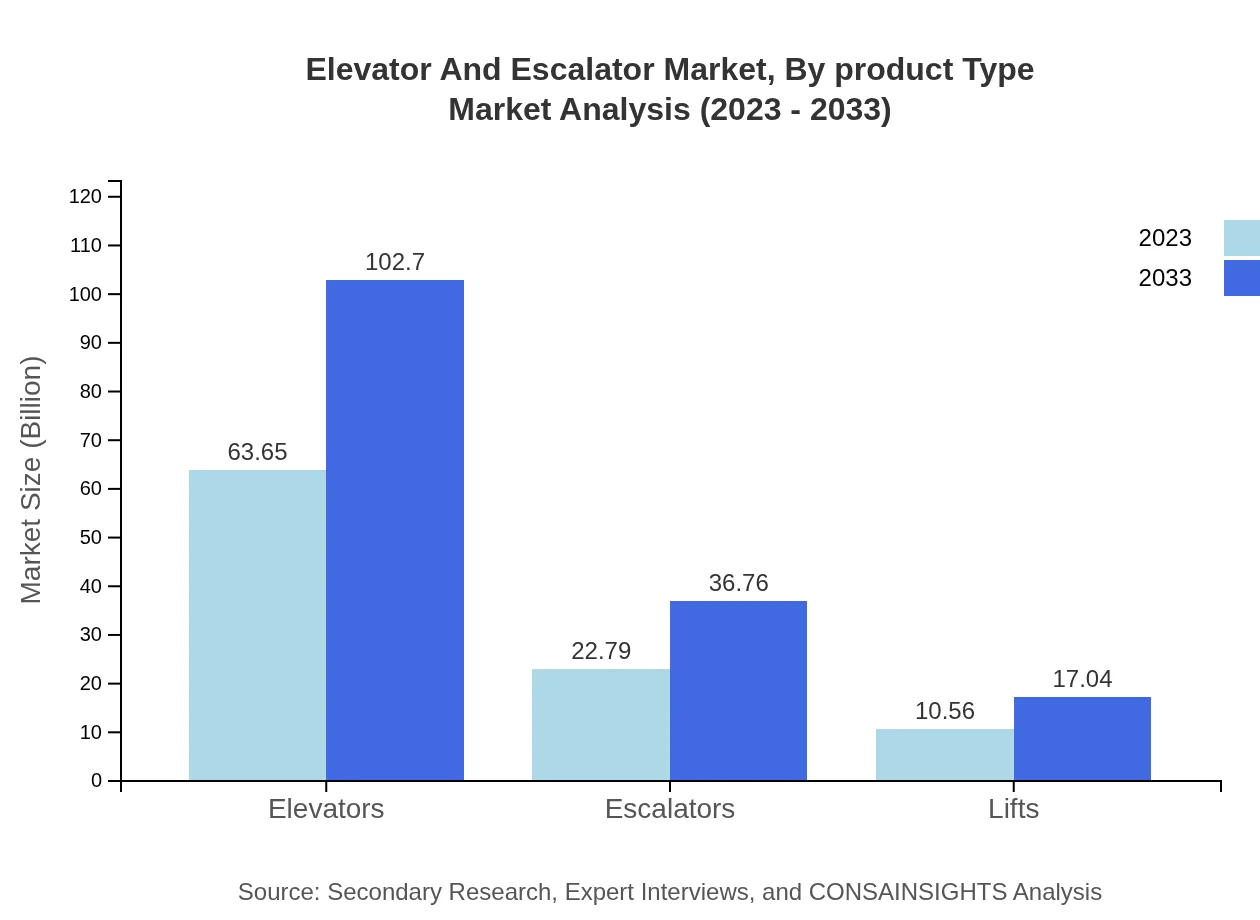

Elevator And Escalator Market Analysis By Product Type

In 2023, elevators dominate the market with a size of 63.65 billion USD, expected to grow to 102.70 billion USD by 2033, representing a strong share of 65.62%. Escalators, on the other hand, show a size of 22.79 billion USD in 2023, projected to reach 36.76 billion USD by 2033, capturing 23.49% of the market.

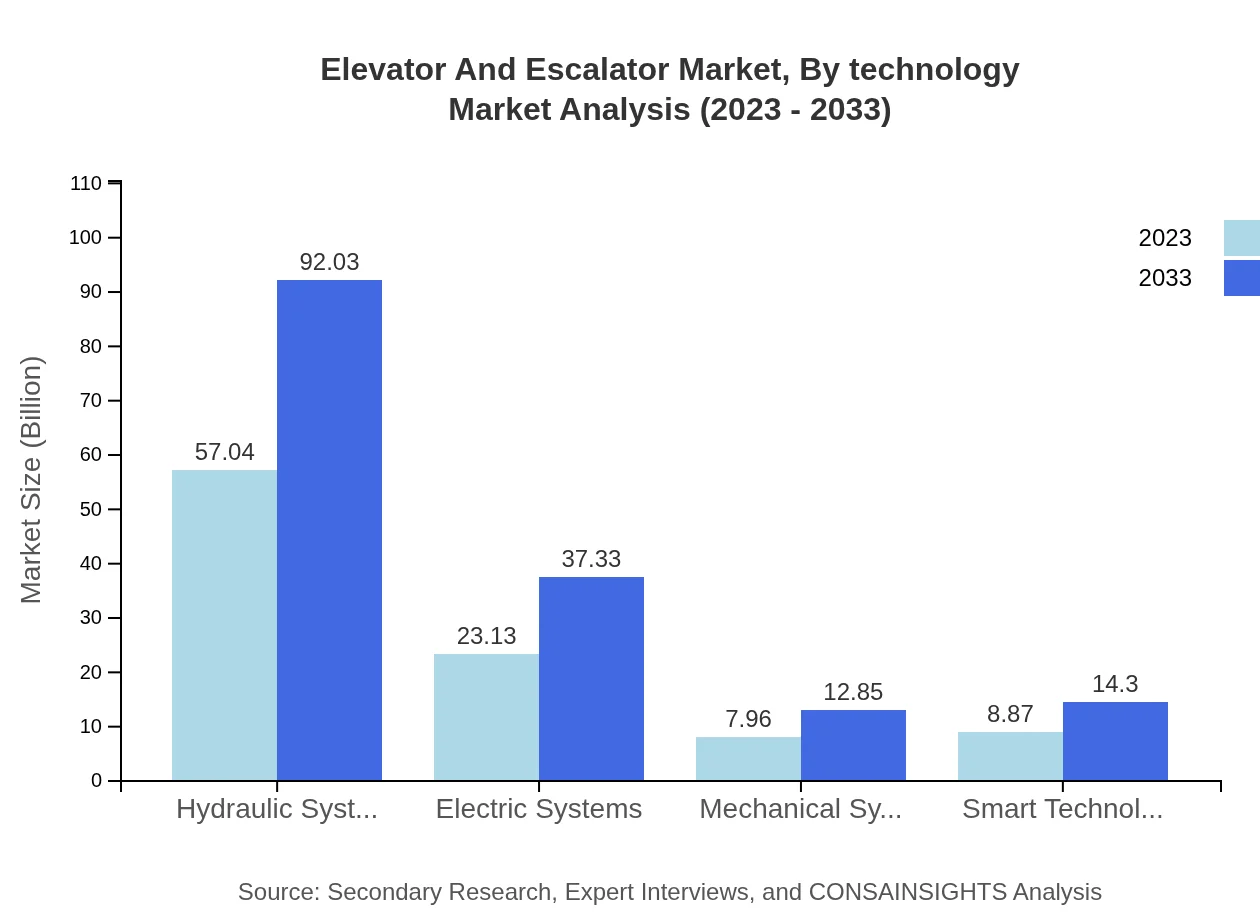

Elevator And Escalator Market Analysis By Technology

The market is increasingly leaning towards hydraulic systems, representing 57.04 billion USD in 2023 and expected to rise to 92.03 billion USD by 2033. Electric systems, holding a size of 23.13 billion USD, are also on an upward trajectory, with projections of reaching 37.33 billion USD by 2033.

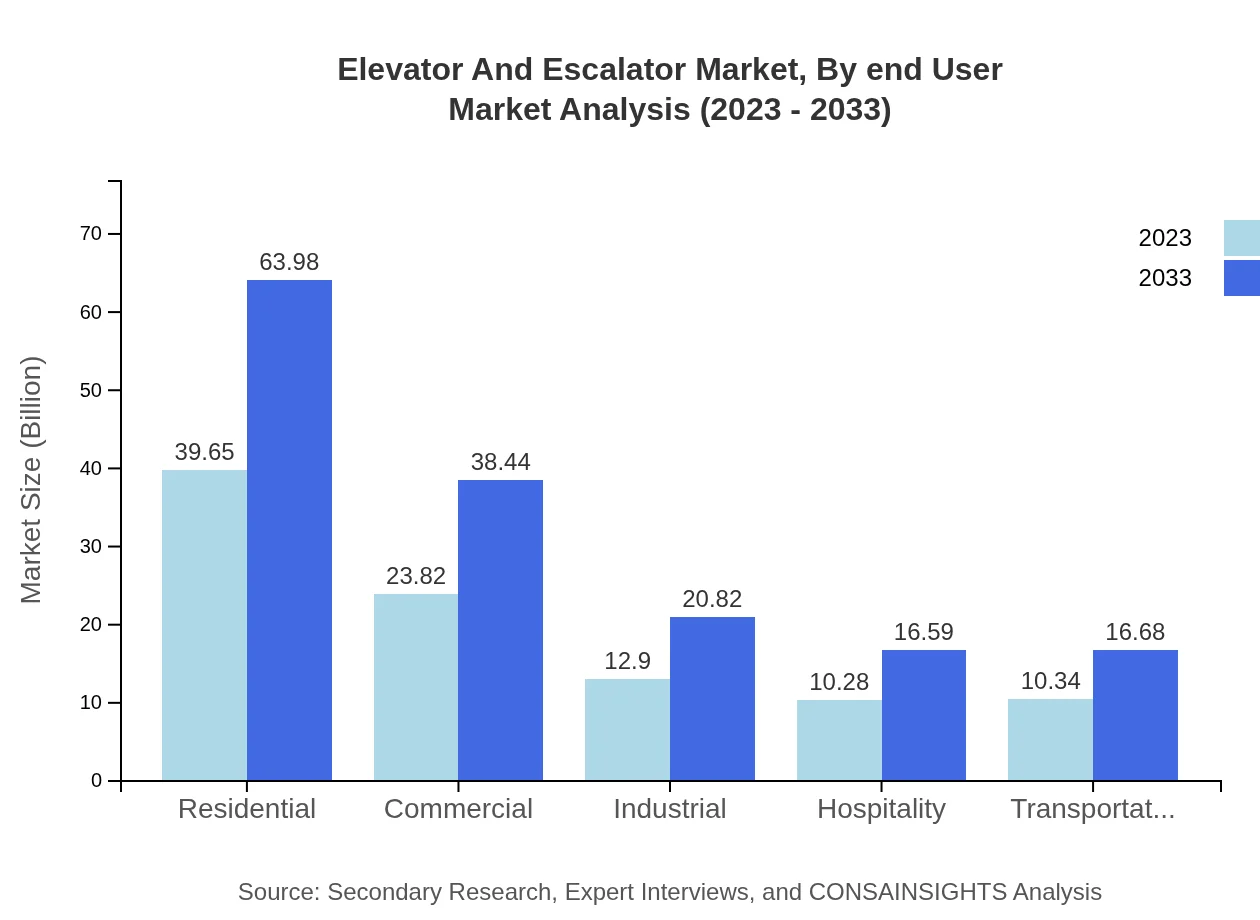

Elevator And Escalator Market Analysis By End User

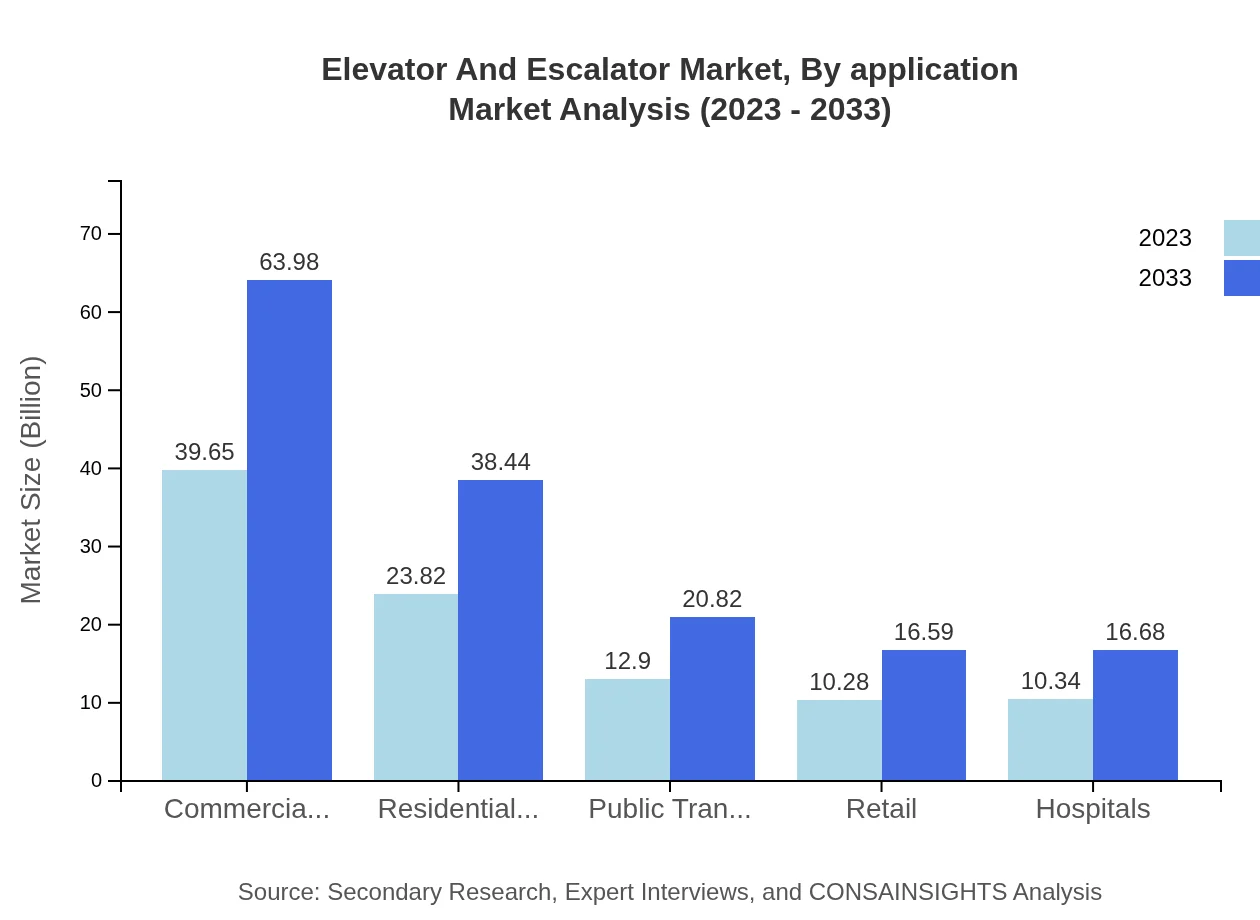

The residential segment accounts for a significant share, showing a market size of 39.65 billion USD in 2023 and expected to grow to 63.98 billion USD by 2033. Commercial segments follow closely, marking a size of 23.82 billion USD in 2023 and anticipated growth to 38.44 billion USD by 2033.

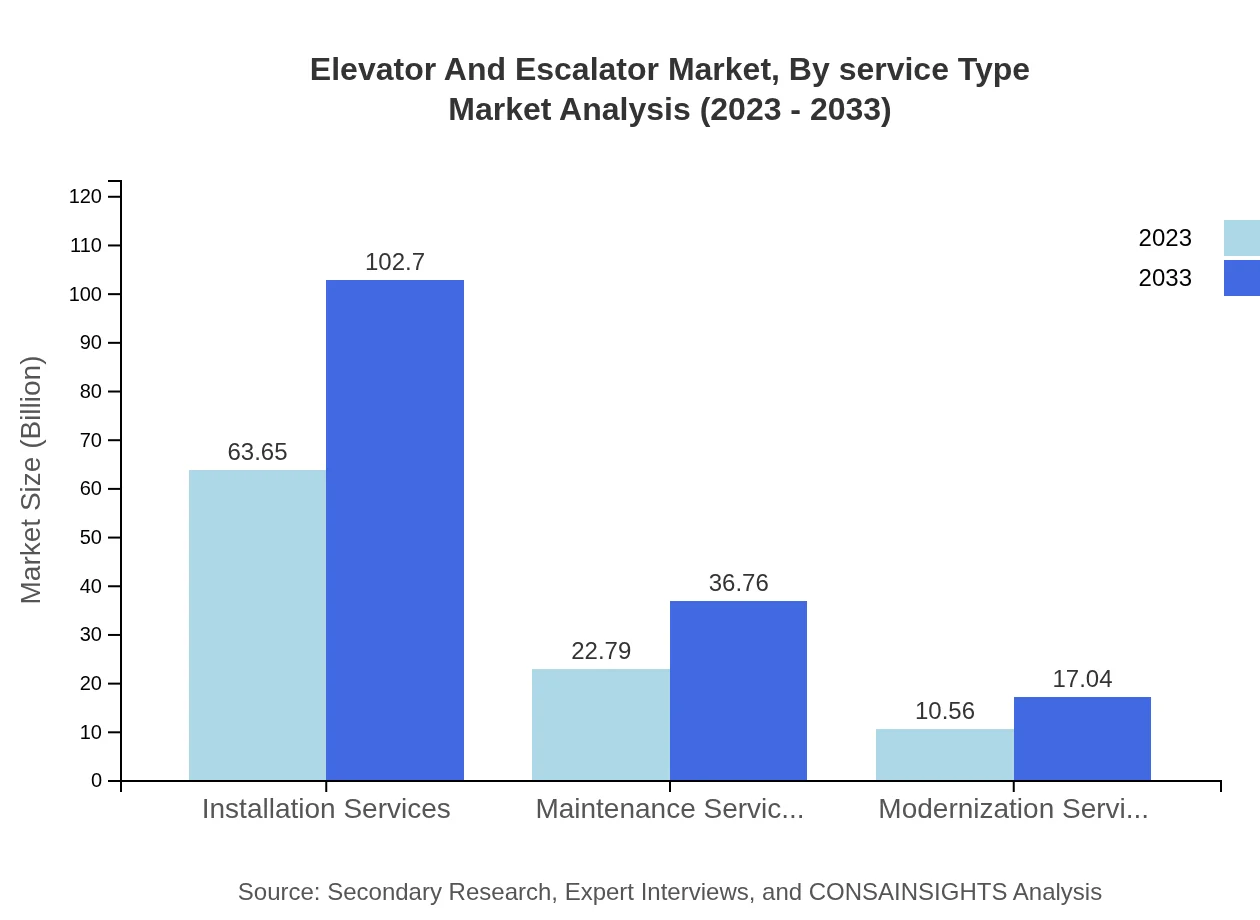

Elevator And Escalator Market Analysis By Service Type

Installation services lead the service market with a size of 63.65 billion USD in 2023, forecasted to grow to 102.70 billion USD by 2033. Maintenance services and modernization services also represent critical areas of growth, driven by the need to update aging infrastructure.

Elevator And Escalator Market Analysis By Application

Key applications include residential buildings with a size of 23.82 billion USD, commercial buildings at 39.65 billion USD, and public transport applications demonstrating significant market potential as urban populations increase.

Elevator And Escalator Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Elevator And Escalator Industry

Otis Elevator Company:

A global leader in elevator and escalator manufacturing, Otis focuses on sustainability and innovation, with a significant market share and advanced technologies.KONE Corporation:

KONE is known for its sustainable solutions and intelligent transport systems, holding a strong presence in both new and maintenance markets.Schindler Group:

A leader in mobility solutions, Schindler emphasizes technology and environmental responsibility, contributing significantly to the global market.Thyssenkrupp AG:

Thyssenkrupp specializes in innovative elevator technology and high-rise transportation solutions, with a robust international footprint.Hitachi Ltd.:

Hitachi’s elevator and escalator division is recognized for advanced technological solutions including smart elevators, enhancing efficiency and user experience.We're grateful to work with incredible clients.

FAQs

What is the market size of elevator And Escalator?

The global elevator and escalator market is currently valued at approximately $97 billion, with a projected compound annual growth rate (CAGR) of 4.8% from 2023 to 2033.

What are the key market players or companies in this elevator And Escalator industry?

Key players in the elevator and escalator market include prominent companies such as Otis, Schindler, Thyssenkrupp, Kone, and Mitsubishi Electric, which lead in innovation and service offerings in this rapidly growing industry.

What are the primary factors driving the growth in the elevator And Escalator industry?

The growth in the elevator and escalator industry is primarily driven by urbanization, the increasing number of residential and commercial buildings, technological advancements, and the rising demand for energy-efficient and smart elevators.

Which region is the fastest Growing in the elevator And Escalator market?

As per the current data, the Asia Pacific region is witnessing the fastest growth within the elevator and escalator market, with a projected increase from $20.73 billion in 2023 to $33.45 billion by 2033.

Does ConsaInsights provide customized market report data for the elevator And Escalator industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs for the elevator and escalator industry, ensuring clients receive insights that are most pertinent to their market interests.

What deliverables can I expect from this elevator And Escalator market research project?

Typical deliverables include comprehensive market analysis reports, segmentation data, trend insights, and forecasts, providing a complete overview of the elevator and escalator market dynamics.

What are the market trends of elevator And Escalator?

Current trends in the elevator and escalator market include the integration of smart technologies, increased demand for energy-efficient systems, modernization of aging infrastructure, and a focus on enhanced safety and user experience.