Elevator Modernization Market Report

Published Date: 22 January 2026 | Report Code: elevator-modernization

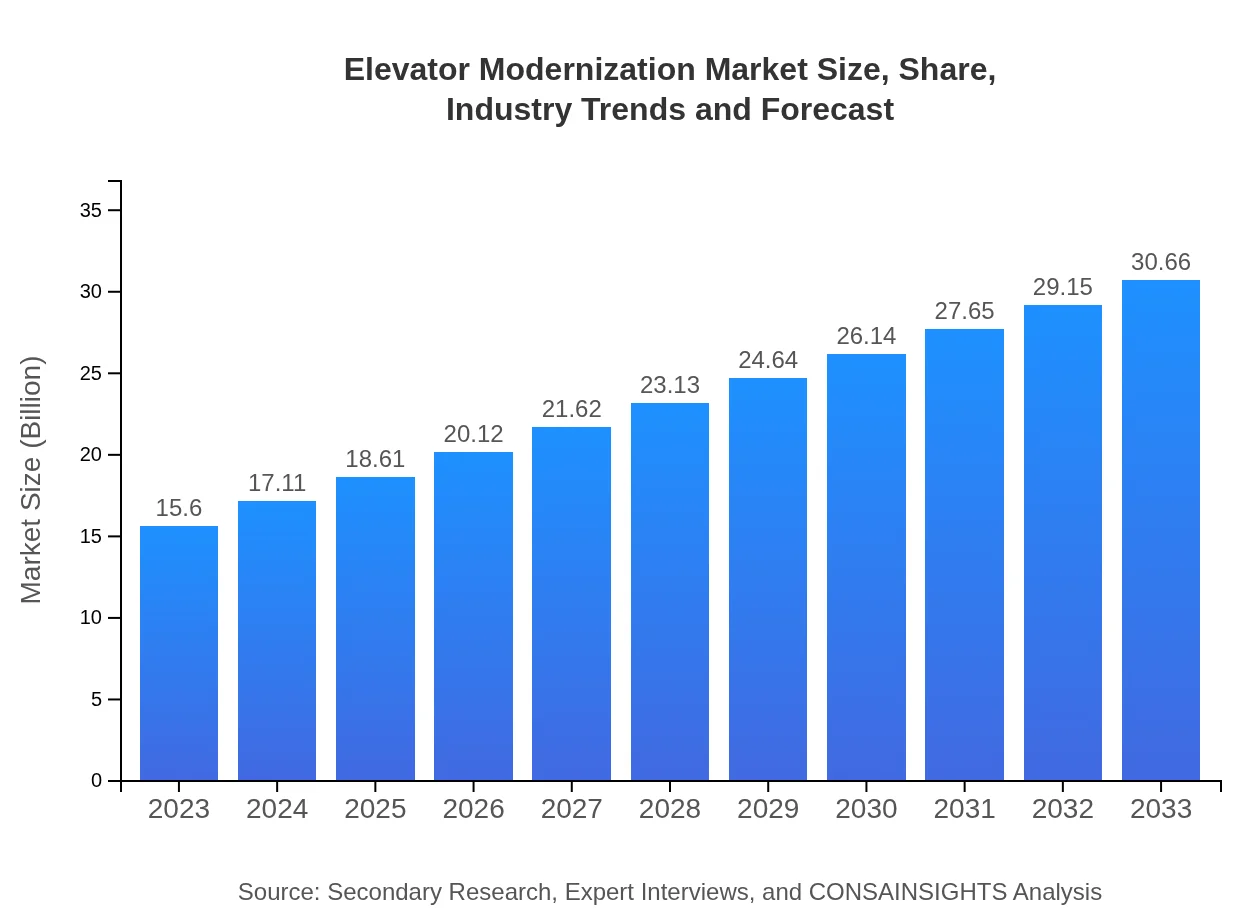

Elevator Modernization Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Elevator Modernization market, covering market size, trends, regional insights, and future forecasts for the period from 2023 to 2033. It aims to equip stakeholders with data-driven insights for strategic decision-making.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $30.66 Billion |

| Top Companies | Otis Elevator Company, Schindler Group, Thyssenkrupp Elevator |

| Last Modified Date | 22 January 2026 |

Elevator Modernization Market Overview

Customize Elevator Modernization Market Report market research report

- ✔ Get in-depth analysis of Elevator Modernization market size, growth, and forecasts.

- ✔ Understand Elevator Modernization's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Elevator Modernization

What is the Market Size & CAGR of Elevator Modernization market in 2023?

Elevator Modernization Industry Analysis

Elevator Modernization Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Elevator Modernization Market Analysis Report by Region

Europe Elevator Modernization Market Report:

Europe's Elevator Modernization market is projected to grow from $5.39 billion in 2023 to about $10.60 billion by 2033. Countries in this region are heavily investing in green technology and energy-efficient systems, contributing significantly to market growth.Asia Pacific Elevator Modernization Market Report:

In 2023, the market for Elevator Modernization in Asia Pacific stands at approximately $2.89 billion, with projections indicating growth to around $5.69 billion by 2033. This region is characterized by rapid urbanization, significant investments in infrastructure, and a growing emphasis on smart city initiatives that drive the modernization of existing elevators.North America Elevator Modernization Market Report:

North America leads in the Elevator Modernization market, with a value of $5.22 billion in 2023, anticipated to reach about $10.25 billion by 2033. This growth can be attributed to stringent codes regarding safety and energy efficiency, alongside an increasing number of high-rise buildings requiring modernization to keep up with technological advancements.South America Elevator Modernization Market Report:

The South American market for Elevator Modernization is relatively small, starting at $0.02 billion in 2023 and expected to reach $0.03 billion by 2033. While the market is limited compared to other regions, there are emerging opportunities driven by the construction of new buildings and the refurbishing of old ones to comply with modern safety standards.Middle East & Africa Elevator Modernization Market Report:

With a market size of $2.08 billion in 2023 and an expected increase to $4.09 billion by 2033, the Middle East and Africa are seeing growth driven by developing urban centers and investments in upgrading infrastructure, including elevators.Tell us your focus area and get a customized research report.

Elevator Modernization Market Analysis Property Developers

Global Elevator Modernization Market, By Property Developers (2023 - 2033)

The Property Developers segment holds a significant portion of the market, valued at approximately $9.91 billion in 2023, with expectations to grow to $19.48 billion by 2033, representing 63.52% market share. This sector's growth is predominantly driven by rising construction activities and the need to modernize existing buildings.

Elevator Modernization Market Analysis Facility Managers

Global Elevator Modernization Market, By Facility Managers (2023 - 2033)

Facility Managers contribute a market size of around $3.45 billion in 2023, anticipated to rise to $6.78 billion by 2033, accounting for 22.11% of the market share. They play an essential role in maintaining elevators and ensuring that they meet compliance and functionality standards.

Elevator Modernization Market Analysis End Users (Occupants)

Global Elevator Modernization Market, By End Users (Occupants) (2023 - 2033)

The end users segment is estimated to maintain a size of $2.24 billion in 2023, expected to grow to $4.41 billion by 2033, with a market share of 14.37%. The emphasis on user experience and safety drives investments in modernization.

Elevator Modernization Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Elevator Modernization Industry

Otis Elevator Company:

Otis, a pioneer in the elevator industry, is renowned for its cutting-edge technology and sustainability initiatives in elevator modernization.Schindler Group:

Schindler is known for its innovative solutions in vertical transportation and is a prominent player in the modernization sector, enhancing elevators through smart technology.Thyssenkrupp Elevator:

Thyssenkrupp provides comprehensive modernization services and is recognized for its commitment to safe, efficient, and environmentally friendly elevator solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of elevator modernization?

The global elevator modernization market is valued at approximately $15.6 billion in 2023, with an anticipated compound annual growth rate (CAGR) of 6.8% from 2023 to 2033. This growth reflects increasing urbanization and demand for modernized elevator systems.

What are the key market players or companies in this elevator modernization industry?

Key players in the elevator modernization market include global leaders such as Otis Elevator Company, Schindler Group, KONE Corporation, Thyssenkrupp AG, and Mitsubishi Electric Corporation, all of which contribute significantly to market development and innovation.

What are the primary factors driving growth in the elevator modernization industry?

The elevator modernization market growth is driven by factors such as increasing urban infrastructure development, aging elevator systems requiring upgrades, advancements in technology focusing on energy efficiency, and rising safety standards in building regulations.

Which region is the fastest Growing in the elevator modernization?

The Europe region is the fastest-growing in the elevator modernization market, slated to grow from $5.39 billion in 2023 to $10.60 billion by 2033. The Asia-Pacific region also shows significant potential, expanding from $2.89 billion to $5.69 billion in the same period.

Does ConsaInsights provide customized market report data for the elevator modernization industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs and insights of clients in the elevator modernization industry. These reports can be adapted to focus on particular regions, segments, or trends.

What deliverables can I expect from this elevator modernization market research project?

Deliverables from the elevator modernization market research project typically include detailed market analysis reports, growth forecasts, competitive landscape evaluations, segmentation insights, and regional market assessments to support strategic decision-making.

What are the market trends of elevator modernization?

Current trends in elevator modernization include an increased focus on smart technology integration, sustainability efforts emphasizing energy-efficient systems, greater demand for retrofitting old elevators, and rising consumer expectations for safety and convenience.