Embedded Controllers Market Report

Published Date: 31 January 2026 | Report Code: embedded-controllers

Embedded Controllers Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Embedded Controllers market from 2023 to 2033, covering market size, segmentation, industry trends, and regional insights. The data highlights key growth drivers and forecasts, providing valuable insights for stakeholders in the embedded systems industry.

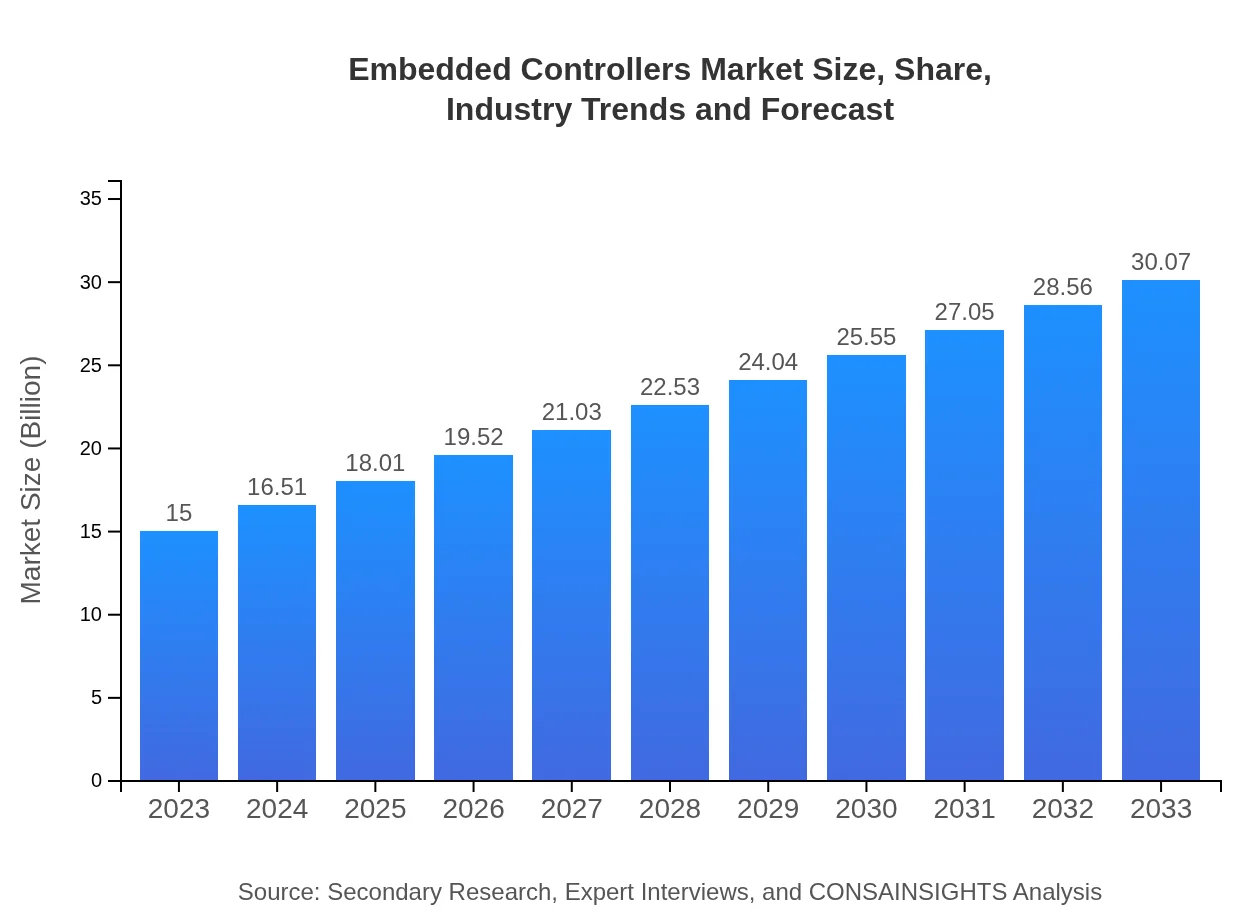

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.00 Billion |

| CAGR (2023-2033) | 7% |

| 2033 Market Size | $30.07 Billion |

| Top Companies | Microchip Technology Inc., Texas Instruments Inc., NXP Semiconductors N.V., Infineon Technologies AG |

| Last Modified Date | 31 January 2026 |

Embedded Controllers Market Overview

Customize Embedded Controllers Market Report market research report

- ✔ Get in-depth analysis of Embedded Controllers market size, growth, and forecasts.

- ✔ Understand Embedded Controllers's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Embedded Controllers

What is the Market Size & CAGR of Embedded Controllers market in 2023?

Embedded Controllers Industry Analysis

Embedded Controllers Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Embedded Controllers Market Analysis Report by Region

Europe Embedded Controllers Market Report:

Europe's market is currently valued at USD 5.12 billion with a forecast of USD 10.26 billion by 2033. Innovations in automotive electronics and supportive regulatory environments for energy-efficient technologies are key growth enablers, alongside a rich ecosystem of embedded technology manufacturers.Asia Pacific Embedded Controllers Market Report:

In Asia Pacific, the market size in 2023 is estimated at USD 2.43 billion, anticipated to reach USD 4.87 billion by 2033. The growth is propelled by strong electronics manufacturing sectors, rapid industrialization, and increasing demand for smart appliances. Countries like China, Japan, and India lead in embedded technologies, bolstering regional advancements.North America Embedded Controllers Market Report:

In North America, the embedded controllers market recorded a size of USD 5.21 billion in 2023, with expectations to reach USD 10.44 billion by 2033. This region benefits from high investments in technology, strong demand in automotive and healthcare sectors, and a robust presence of key market players.South America Embedded Controllers Market Report:

The South American market is valued at USD 1.49 billion in 2023 and projected to grow to USD 2.99 billion by 2033. Factors driving growth include improving infrastructure and a rising trend in consumer electronics adoption, though challenges such as economic instability may impact overall growth prospects.Middle East & Africa Embedded Controllers Market Report:

The Middle East and Africa reflect a nascent stage of growth with a market size of USD 0.75 billion in 2023, expected to double to USD 1.50 billion by 2033. Demand is gradually increasing in various sectors including telecommunications and automotive, stimulated by strategies to enhance digital transformation.Tell us your focus area and get a customized research report.

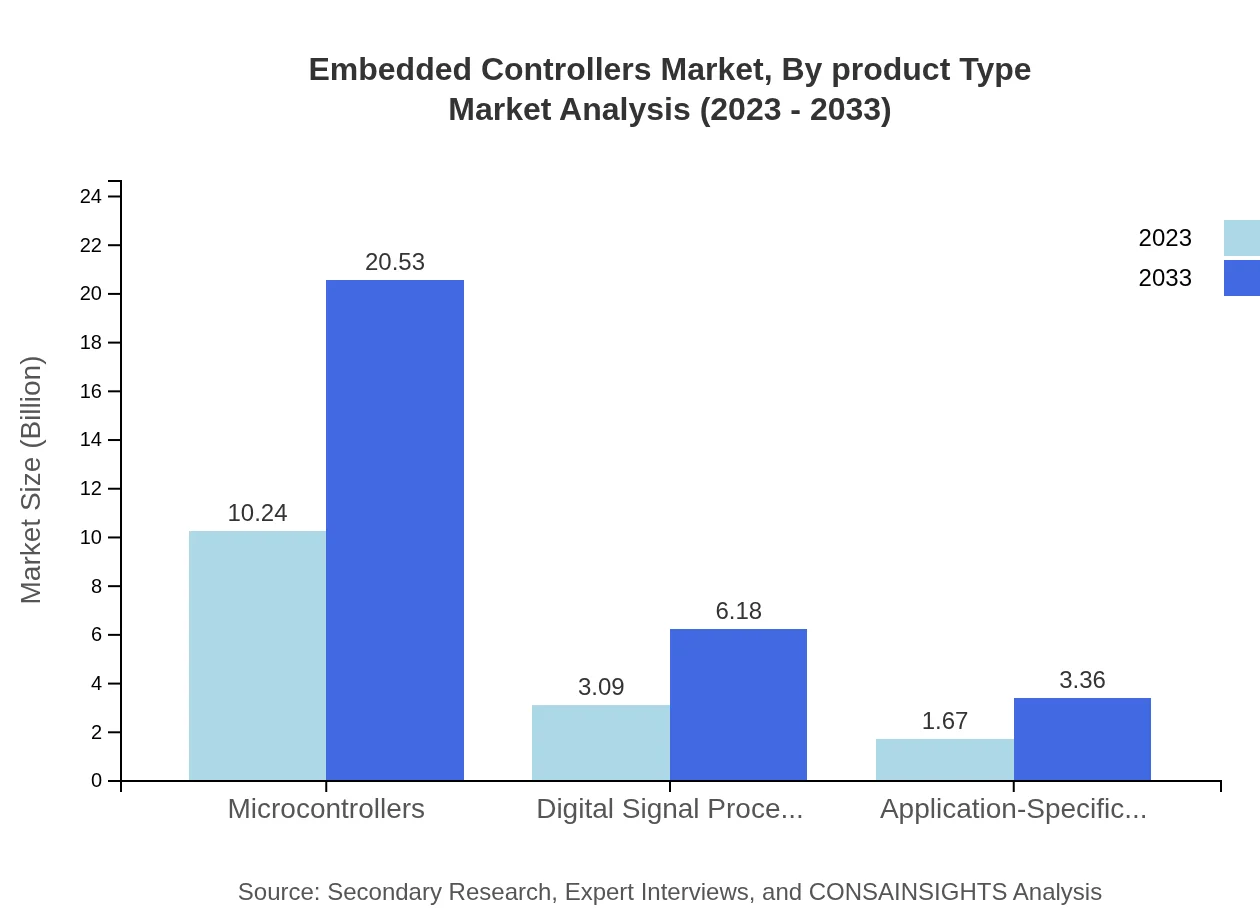

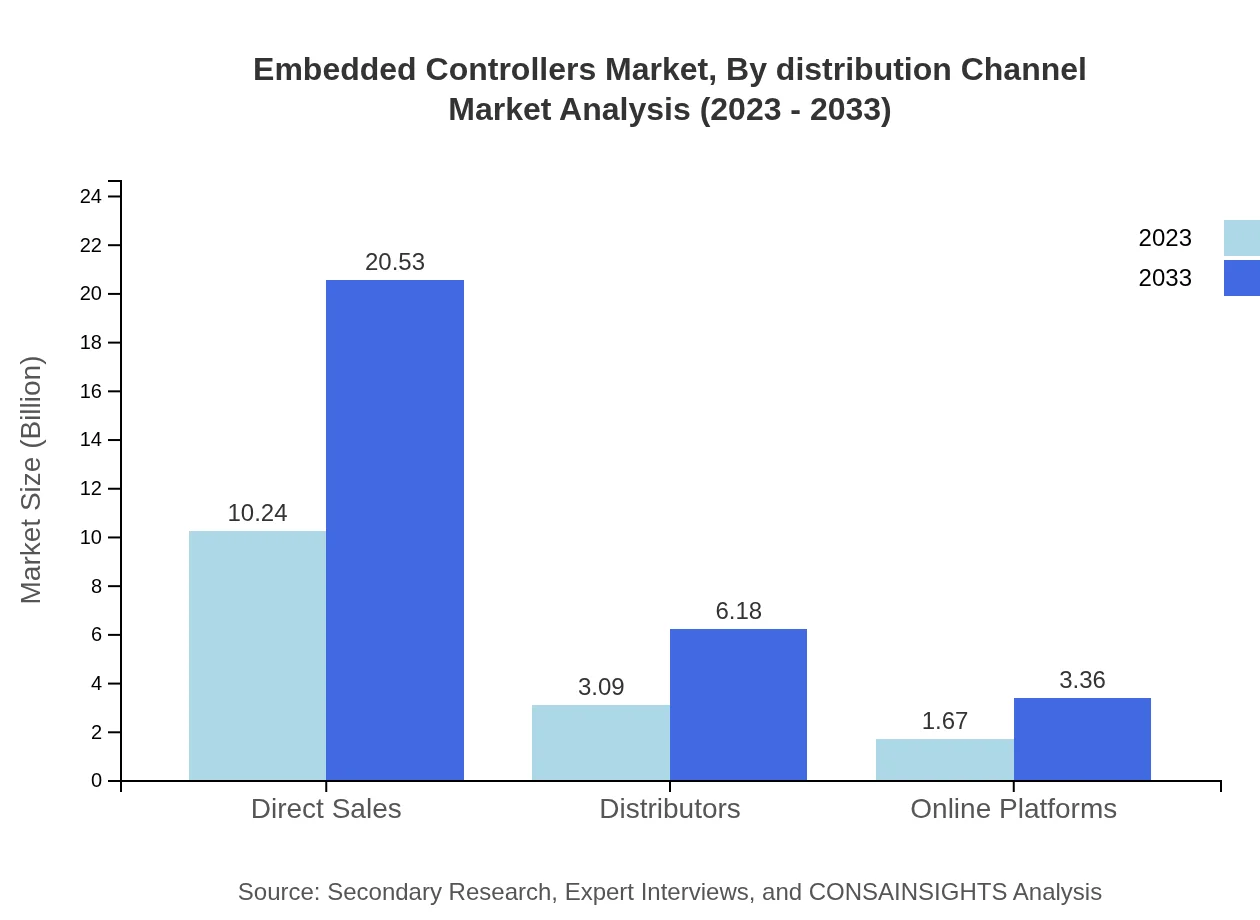

Embedded Controllers Market Analysis By Product Type

The Embedded Controllers market product segmentation reveals significant trends. Analog Controllers dominate with a market size of USD 10.24 billion in 2023, forecasted to increase to USD 20.53 billion by 2033, maintaining a stable market share of 68.27%. Digital Controllers are positioned as the second largest segment with a size of USD 3.09 billion and a steady 20.57% share, projected to expand to USD 6.18 billion by 2033. Hybrid Controllers, while smaller, are expected to see growth from USD 1.67 billion to USD 3.36 billion, indicating rising interest in multifunctional devices.

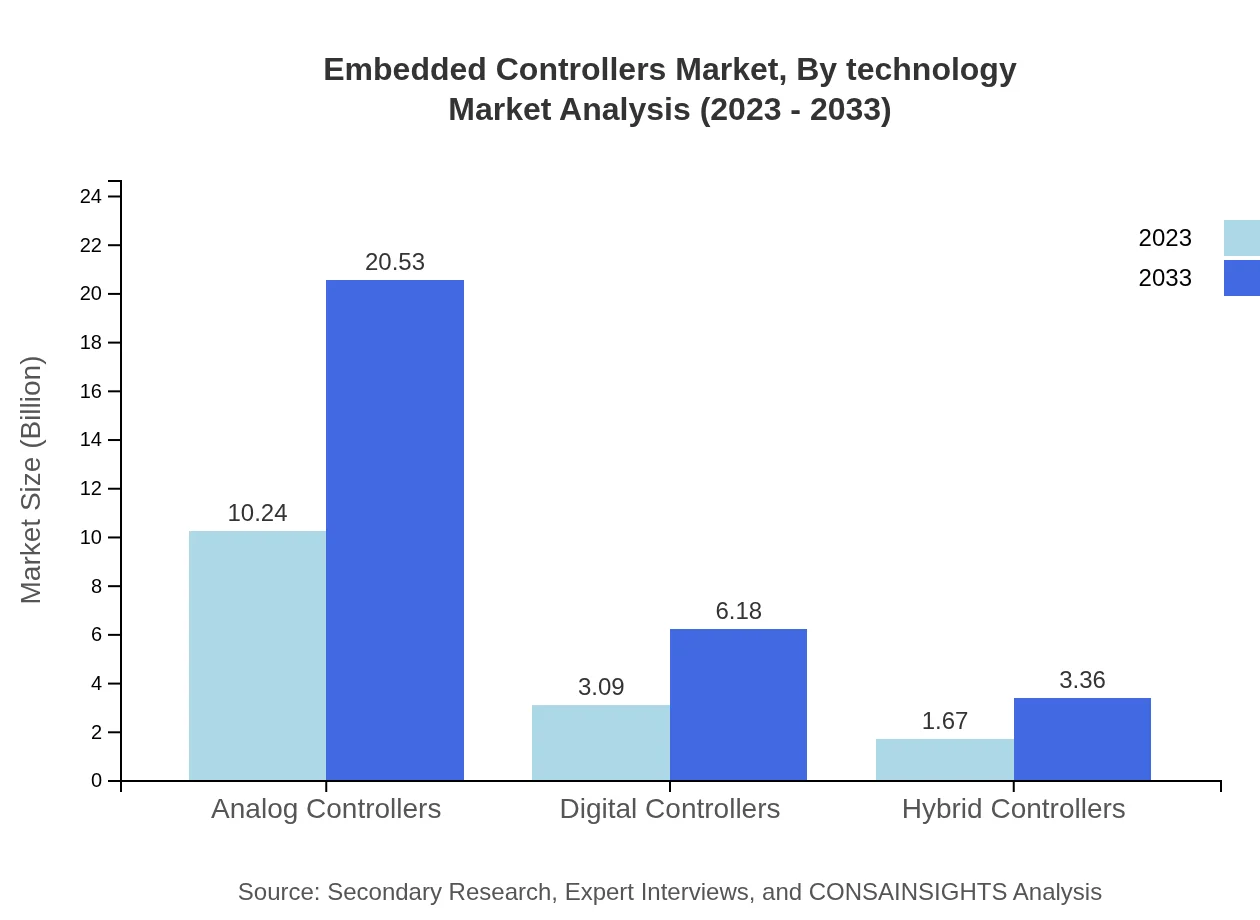

Embedded Controllers Market Analysis By Technology

Technological advancements greatly influence the Embedded Controllers market, with a split focus on analog, digital, and hybrid technologies. Analog Controllers continue to drive the market, largely due to their application in traditional systems. Meanwhile, Digital Signal Processors and Microcontrollers are on the rise, incorporating capabilities for improved data processing. The shift towards hybrid solutions reflects an increasing demand for versatility in functionality.

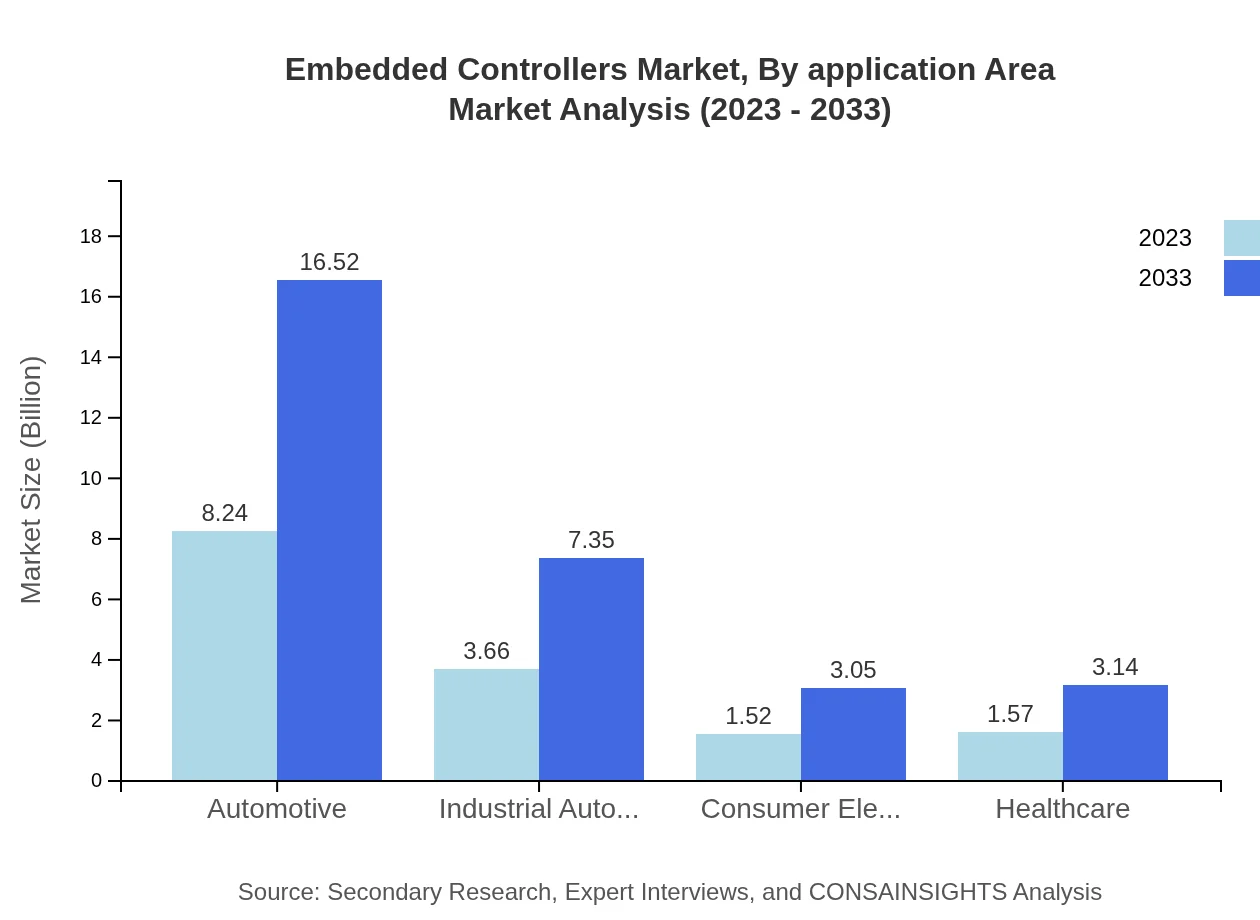

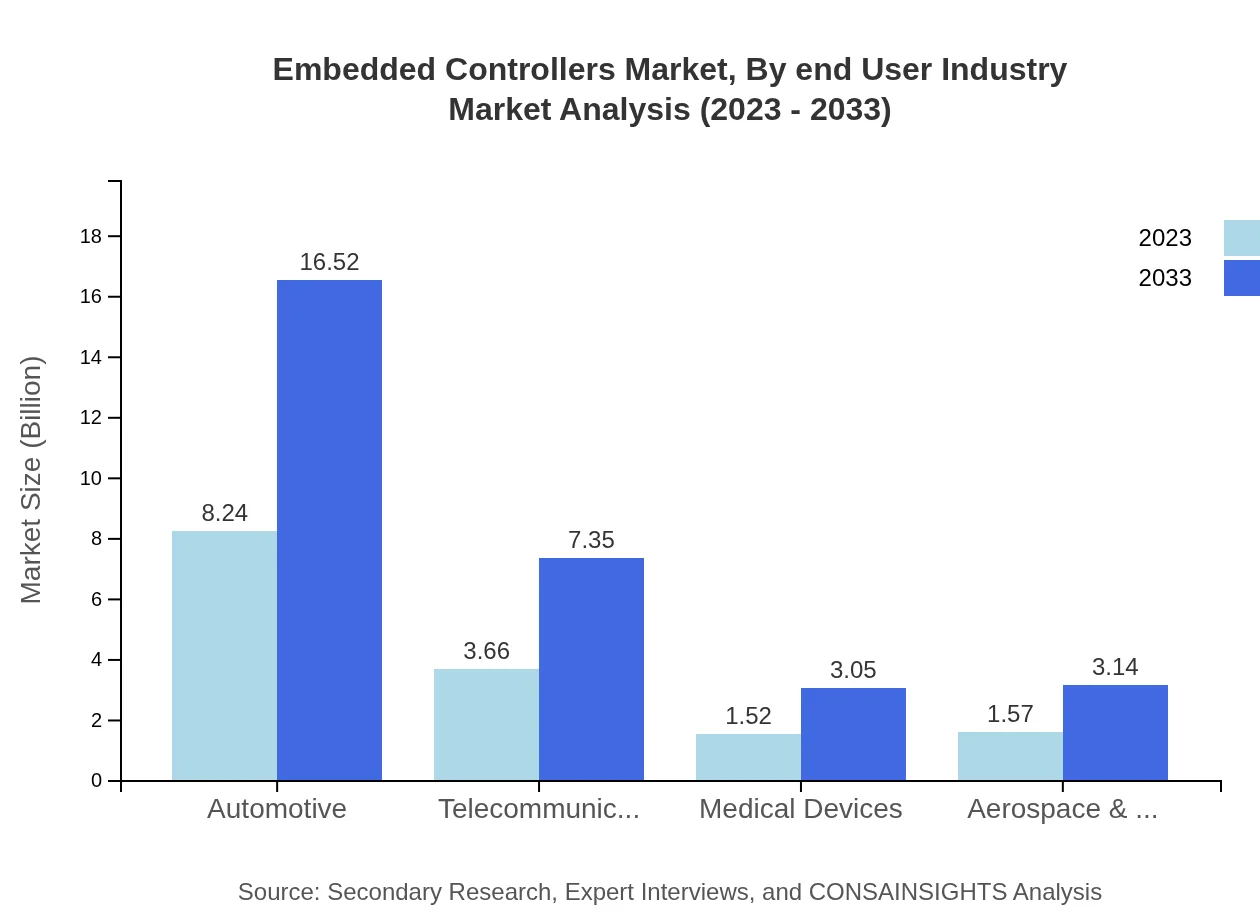

Embedded Controllers Market Analysis By Application Area

The application area segmentation demonstrates that the Automotive sector leads the market, valued at USD 8.24 billion in 2023 and anticipated to evolve to USD 16.52 billion by 2033. Industries such as Industrial Automation and Telecommunications also play significant roles, indicating a robust trend towards automation and connectivity in various system architectures.

Embedded Controllers Market Analysis By Distribution Channel

Direct Sales remain the largest distribution channel, holding a market size of USD 10.24 billion in 2023, with expectations to rise to USD 20.53 billion by 2033. Distributors contribute notably, particularly in expanding market reach for innovative products, while Online Platforms emerge as a critical channel for accessing emerging markets, indicating a shift towards e-commerce solutions.

Embedded Controllers Market Analysis By End User Industry

Key end-user industries include Automotive, Industrial Automation, and Consumer Electronics. The Automotive sector, with its growing emphasis on electronic components for vehicles, represents about 54.95% market share in 2023. Healthcare, Telecommunications, and Aerospace also contribute, reflecting the widespread applicability of embedded control solutions across various critical domains.

Embedded Controllers Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Embedded Controllers Industry

Microchip Technology Inc.:

A leading provider of microcontroller and analog products that enable smart, connected designs.Texas Instruments Inc.:

Known for its extensive range of embedded processors and components largely used in consumer electronics and industrial applications.NXP Semiconductors N.V.:

Specializes in embedded processing solutions for automotive, security, and IoT applications.Infineon Technologies AG:

Focuses on semiconductor solutions which support automotive and industrial sectors, ensuring efficiency and sustainability.We're grateful to work with incredible clients.

FAQs

What is the market size of embedded controllers?

The global embedded controllers market is currently valued at approximately $15 billion, with a projected compound annual growth rate (CAGR) of 7% from 2023 to 2033. This growth indicates a strong demand for embedded technology across various sectors.

What are the key market players or companies in the embedded controllers industry?

Key players in the embedded controllers market include industry leaders such as Texas Instruments, Microchip Technology, NXP Semiconductors, STMicroelectronics, and Infineon Technologies. These companies drive innovation and competition within the rapidly evolving embedded systems landscape.

What are the primary factors driving the growth in the embedded controllers industry?

Factors driving growth in the embedded controllers industry include increasing automation across industries, demand for smart devices, advancements in IoT technologies, and the need for enhanced energy efficiency, which create substantial opportunities for embedded solutions.

Which region is the fastest Growing in the embedded controllers market?

The Asia Pacific region is currently the fastest-growing market for embedded controllers, expected to reach approximately $4.87 billion by 2033, up from $2.43 billion in 2023, driven by rapid industrialization and increasing consumer electronics adoption.

Does ConsaInsights provide customized market report data for the embedded controllers industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the embedded controllers industry. Our reports can be adjusted to focus on particular segments, regions, or industry trends for a detailed analysis.

What deliverables can I expect from this embedded controllers market research project?

Deliverables from the embedded controllers market research project include comprehensive market analysis reports, regional insights, segment-specific data, market forecasts, competitor analysis, and actionable recommendations tailored to client needs.

What are the market trends of embedded controllers?

Current market trends in the embedded controllers industry include increasing integration of AI and machine learning, a shift towards smart manufacturing solutions, heightened demand for automotive applications, and growing trends in personal and medical devices to enhance operational efficiencies.