Embedded Die Packaging Market Report

Published Date: 31 January 2026 | Report Code: embedded-die-packaging

Embedded Die Packaging Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Embedded Die Packaging market, covering insights about market dynamics, trends, forecasts from 2023 to 2033, and the influence of technological advancements on the industry landscape.

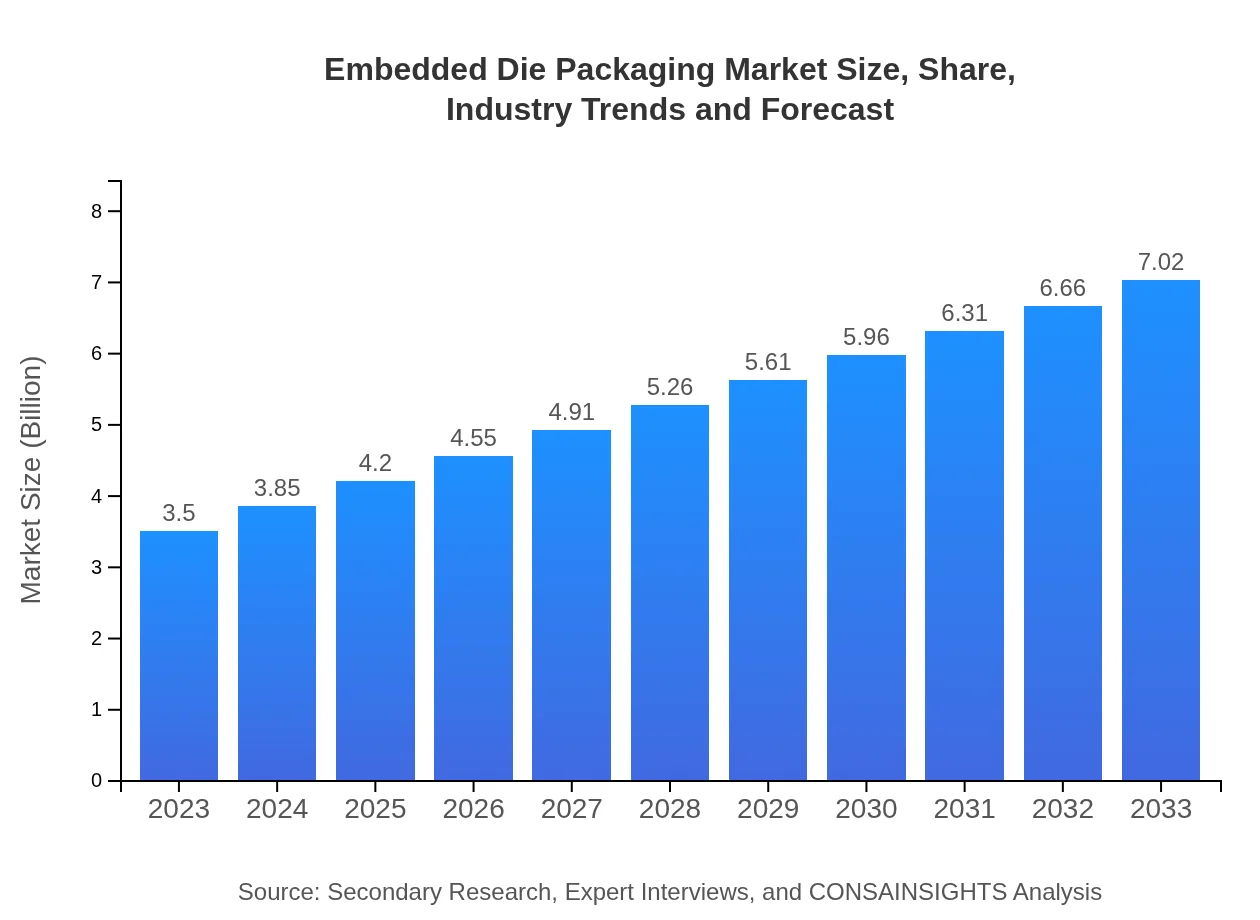

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 7% |

| 2033 Market Size | $7.02 Billion |

| Top Companies | Intel Corporation, Samsung Electronics, TSMC (Taiwan Semiconductor Manufacturing Company), Amkor Technology, Inc. |

| Last Modified Date | 31 January 2026 |

Embedded Die Packaging Market Overview

Customize Embedded Die Packaging Market Report market research report

- ✔ Get in-depth analysis of Embedded Die Packaging market size, growth, and forecasts.

- ✔ Understand Embedded Die Packaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Embedded Die Packaging

What is the Market Size & CAGR of Embedded Die Packaging market in 2023?

Embedded Die Packaging Industry Analysis

Embedded Die Packaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Embedded Die Packaging Market Analysis Report by Region

Europe Embedded Die Packaging Market Report:

The European market for Embedded Die Packaging is forecasted to expand from $0.89 billion in 2023 to $1.78 billion by 2033. The shift towards electric vehicles and IoT devices in Europe supports a fertile ground for advanced packaging solutions, positioning this region as a key player.Asia Pacific Embedded Die Packaging Market Report:

Asia Pacific is poised to dominate the Embedded Die Packaging market, estimated to grow from $0.72 billion in 2023 to $1.44 billion in 2033. The demand is fueled by the region's burgeoning electronics manufacturing sector, particularly in countries like China, Japan, and South Korea. With a strong emphasis on innovation and technology adoption, Asia Pacific is a critical landscape for embedded solutions.North America Embedded Die Packaging Market Report:

North America holds significant promise, with the market size projected to increase from $1.17 billion in 2023 to $2.35 billion in 2033. This region benefits from technological advancements and a strong presence of major electronics manufacturers committed to improving efficiency in packaging techniques.South America Embedded Die Packaging Market Report:

The South American market for Embedded Die Packaging is expected to experience growth from $0.27 billion in 2023 to $0.55 billion in 2033. This growth can be attributed to the increasing demand for consumer electronics and automotive applications in this region, coupled with developing supply chains.Middle East & Africa Embedded Die Packaging Market Report:

In the Middle East and Africa, the market is expected to grow from $0.45 billion in 2023 to $0.90 billion in 2033, driven by increased investments in telecommunications and automotive industries, focusing on enhanced packaging technologies.Tell us your focus area and get a customized research report.

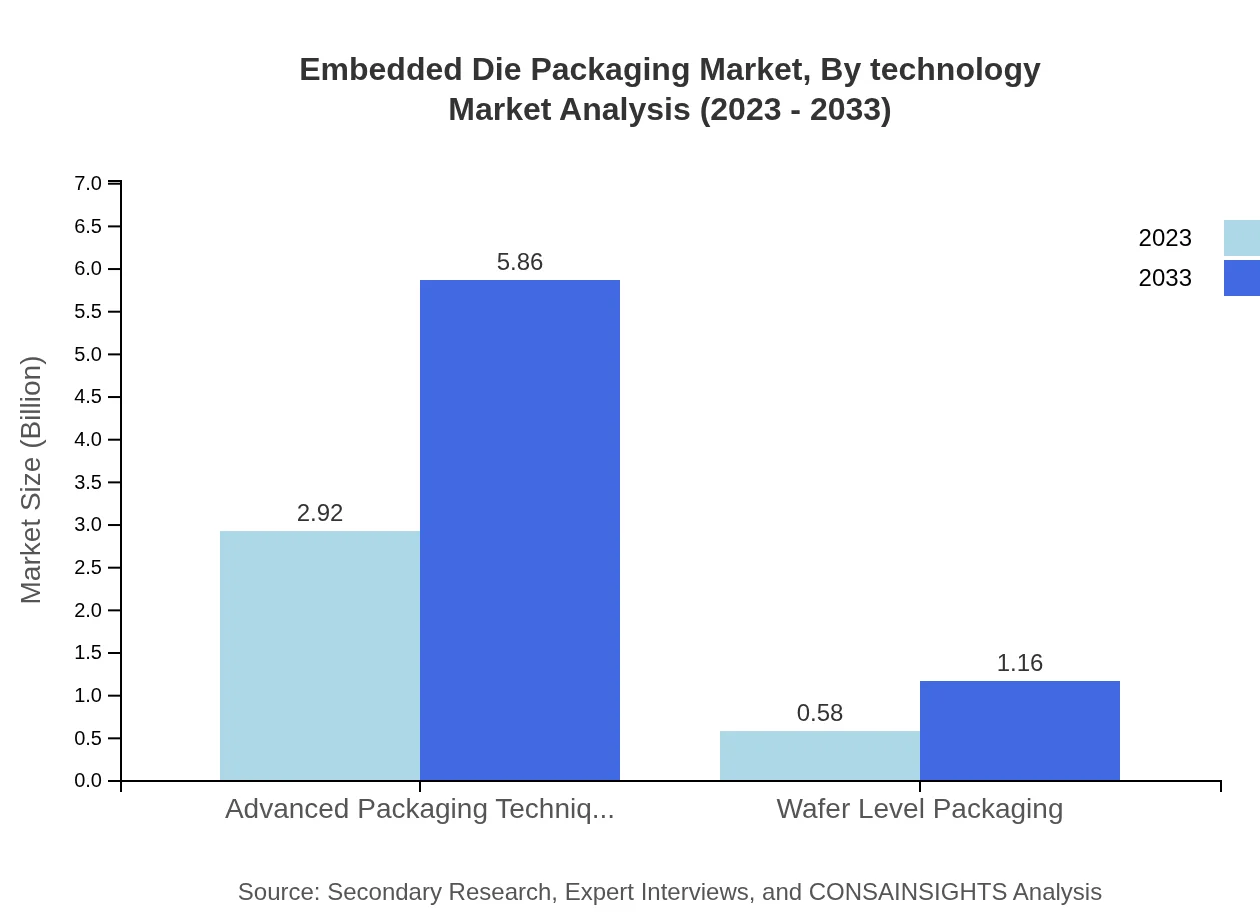

Embedded Die Packaging Market Analysis By Technology

The technology segment of the Embedded Die Packaging market includes advanced packaging techniques and wafer level packaging. Advanced packaging techniques dominate the market with a size of approximately $2.92 billion in 2023, expected to double to $5.86 billion by 2033. Wafer level packaging, while smaller, plays a crucial role in lowering costs and enhancing performance, with a projected growth from $0.58 billion to $1.16 billion during the same period.

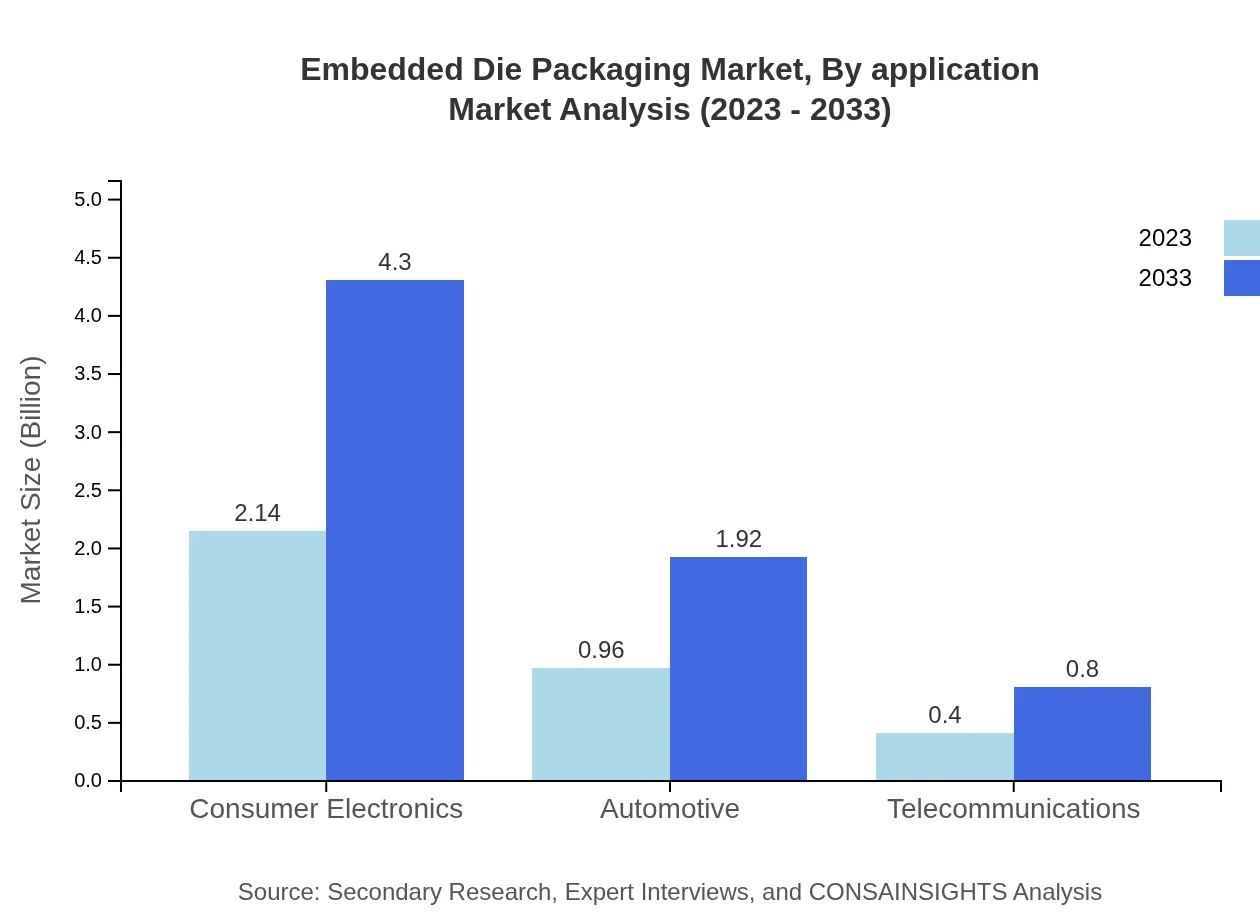

Embedded Die Packaging Market Analysis By Application

The application landscape for Embedded Die Packaging is primarily shaped by demand from consumer electronics, automotive, and telecommunications. The consumer electronics segment holds a leading market share, anticipated to grow from $2.14 billion in 2023 to $4.30 billion by 2033. Automotive applications are also on a growth trajectory, expected to reach $1.92 billion by 2033.

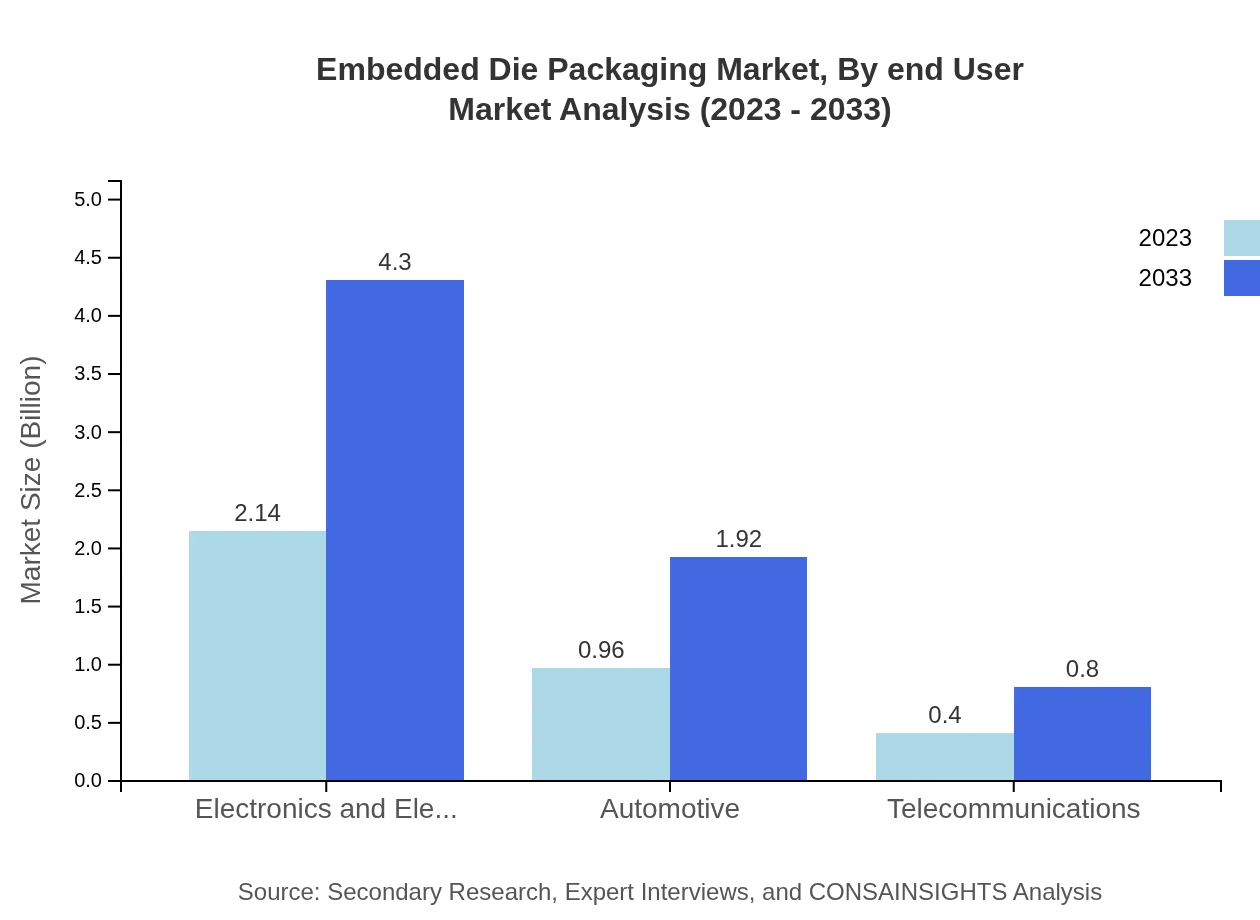

Embedded Die Packaging Market Analysis By End User

End-users of Embedded Die Packaging range from electronics and electrical sectors to automotive and telecommunications. Electronics & Electrical will contribute the most with a market size of $2.14 billion in 2023, projected to reach $4.30 billion by 2033, holding a substantial market share of 61.24%.

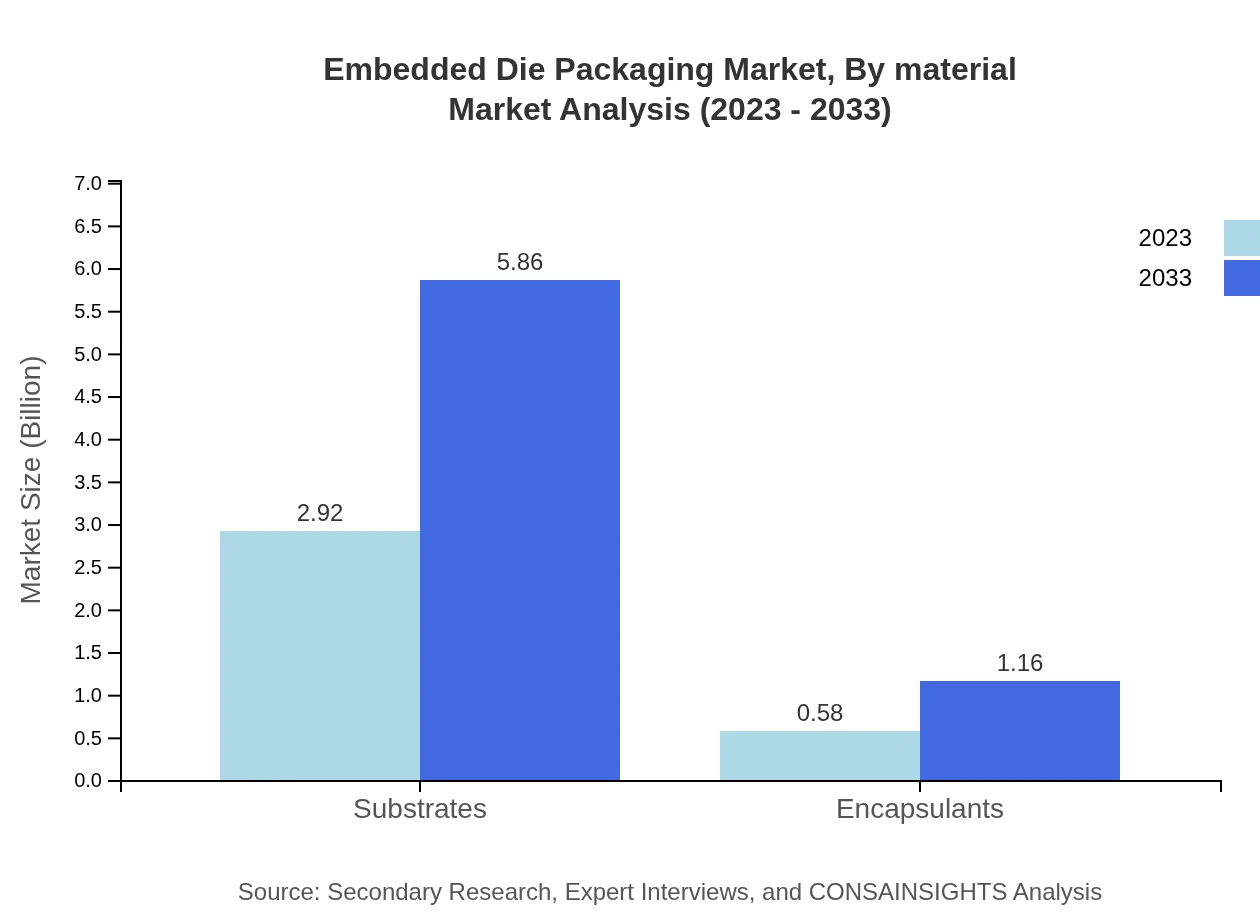

Embedded Die Packaging Market Analysis By Material

Material-wise, the segment is dominated by substrates, which represent a staggering market size of $2.92 billion in 2023 and expected to increase to $5.86 billion by 2033, capturing 83.52% of the market share. Encapsulants, although smaller with a market size of $0.58 billion in 2023, are anticipated to reach $1.16 billion in 2033, contributing significantly to packaging performance.

Embedded Die Packaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Embedded Die Packaging Industry

Intel Corporation:

Intel is a leader in semiconductor manufacturing and Embedded Die Packaging technology, providing innovative packaging solutions that enhance performance and energy efficiency across various applications.Samsung Electronics:

Samsung excels in advanced packaging solutions, including Embedded Die Packaging, driving growth through innovation aimed at consumer electronics and mobile products.TSMC (Taiwan Semiconductor Manufacturing Company):

TSMC is a major player in the semiconductor industry, specializing in advanced packaging technologies that integrate seamlessly with their fabrication and testing services.Amkor Technology, Inc.:

As a global provider of outsourced semiconductor packaging services, Amkor focuses on embedded solutions that cater to high-performance computing and consumer electronic devices.We're grateful to work with incredible clients.

FAQs

What is the market size of embedded die packaging?

The global embedded die packaging market is valued at approximately $3.5 billion in 2023 and is projected to grow at a CAGR of 7%, reaching substantial growth by 2033.

What are the key market players or companies in the embedded die packaging industry?

Key players in the embedded die packaging industry include major semiconductor companies and packaging technology firms, which are critical for driving innovation and maintaining competitive advantage.

What are the primary factors driving the growth in the embedded die packaging industry?

Growth in the embedded die packaging market is driven by increasing demand for miniaturization in electronics, advancements in semiconductor technology, and rising applications in consumer electronics and automotive sectors.

Which region is the fastest Growing in the embedded die packaging?

North America is currently the fastest-growing region in the embedded die packaging market, with projections indicating a rise from $1.17 billion in 2023 to $2.35 billion by 2033.

Does ConsaInsights provide customized market report data for the embedded die packaging industry?

Yes, ConsaInsights offers customized market report data for the embedded die packaging industry, catering to specific business needs and focusing on unique market segments.

What deliverables can I expect from this embedded die packaging market research project?

Expect comprehensive deliverables including market analysis, growth forecasts, competitive landscape insights, and segmented data by region and application for the embedded die packaging sector.

What are the market trends of embedded die packaging?

Current market trends include increased adoption of advanced packaging techniques, emphasis on consumer electronics, and heightened focus on reducing size and enhancing performance in electronic devices.