Embedded Die Packaging Technology Market Report

Published Date: 31 January 2026 | Report Code: embedded-die-packaging-technology

Embedded Die Packaging Technology Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Embedded Die Packaging Technology market, covering key insights, market trends, and forecasts from 2023 to 2033. It includes information on market size, industry performance, regional analysis, and leading companies shaping the industry.

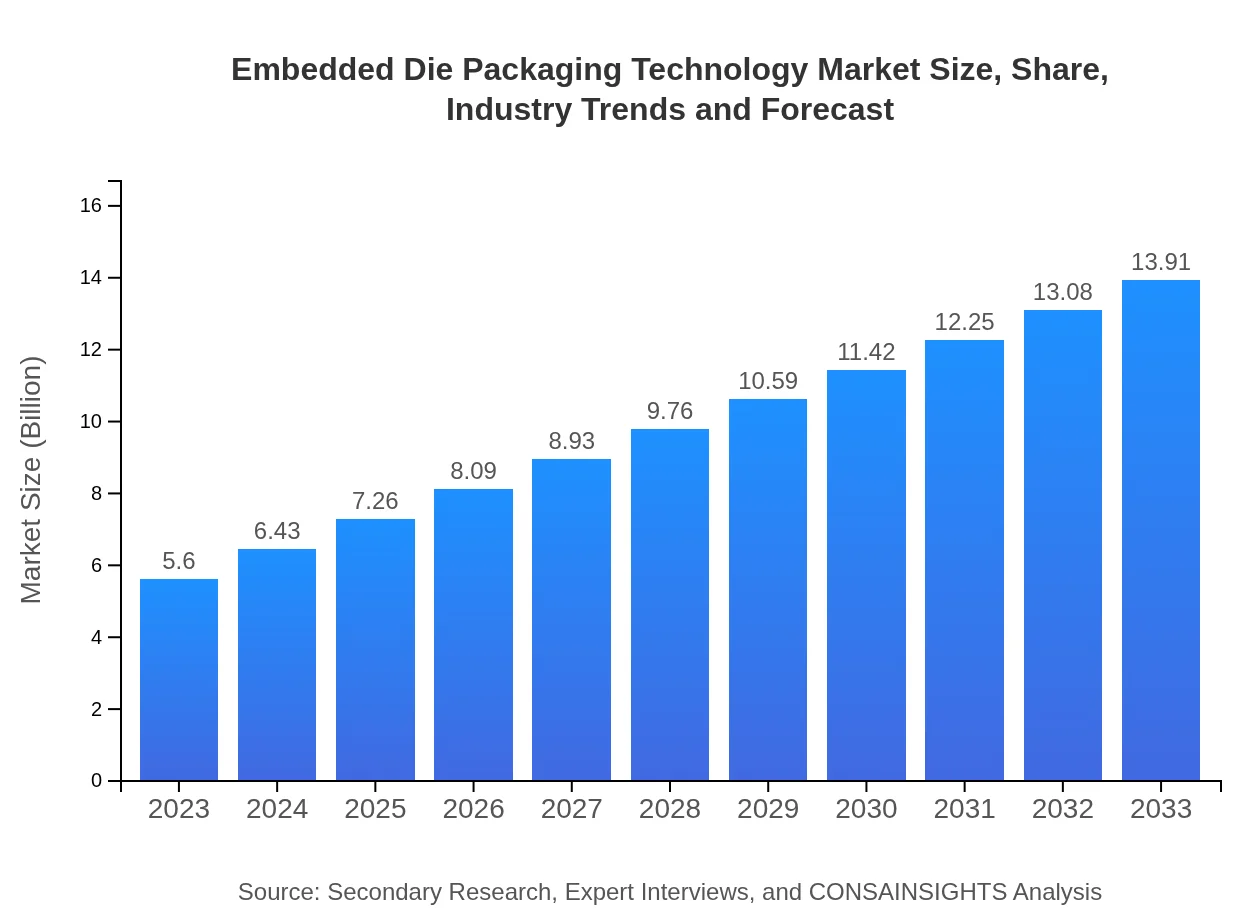

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $13.91 Billion |

| Top Companies | Intel Corporation, AMD (Advanced Micro Devices), Texas Instruments, STMicroelectronics |

| Last Modified Date | 31 January 2026 |

Embedded Die Packaging Technology Market Overview

Customize Embedded Die Packaging Technology Market Report market research report

- ✔ Get in-depth analysis of Embedded Die Packaging Technology market size, growth, and forecasts.

- ✔ Understand Embedded Die Packaging Technology's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Embedded Die Packaging Technology

What is the Market Size & CAGR of Embedded Die Packaging Technology market in 2023 and 2033?

Embedded Die Packaging Technology Industry Analysis

Embedded Die Packaging Technology Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Embedded Die Packaging Technology Market Analysis Report by Region

Europe Embedded Die Packaging Technology Market Report:

Europe's Embedded Die Packaging Technology market is anticipated to increase from $1.82 billion in 2023 to $4.51 billion in 2033. The adoption of this technology within automotive and industrial applications is driving growth, alongside initiatives promoting semiconductor production in the region.Asia Pacific Embedded Die Packaging Technology Market Report:

In the Asia Pacific region, the market is expected to grow from $0.91 billion in 2023 to $2.26 billion in 2033, driven by rising electronic device consumption and strong manufacturing capabilities in countries like China and Japan. The increase in investments in technological advancements further supports growth, particularly in the semiconductor sector.North America Embedded Die Packaging Technology Market Report:

North America holds a significant share of the market, expected to expand from $2.05 billion in 2023 to $5.10 billion by 2033. The region benefits from leading technology firms, robust R&D, and early adoption of innovative semiconductor packaging solutions.South America Embedded Die Packaging Technology Market Report:

The South American market is relatively small but projected to grow from $0.17 billion in 2023 to $0.43 billion by 2033. Factors such as governmental support for technology adoption and increasing investments in electronics manufacturing are likely to spur market growth.Middle East & Africa Embedded Die Packaging Technology Market Report:

The Middle East and Africa market is expected to grow from $0.65 billion in 2023 to $1.61 billion by 2033. Increased technology penetration in telecommunications and infrastructure development is bolstering demand, with several emerging markets ramping up electronics manufacturing.Tell us your focus area and get a customized research report.

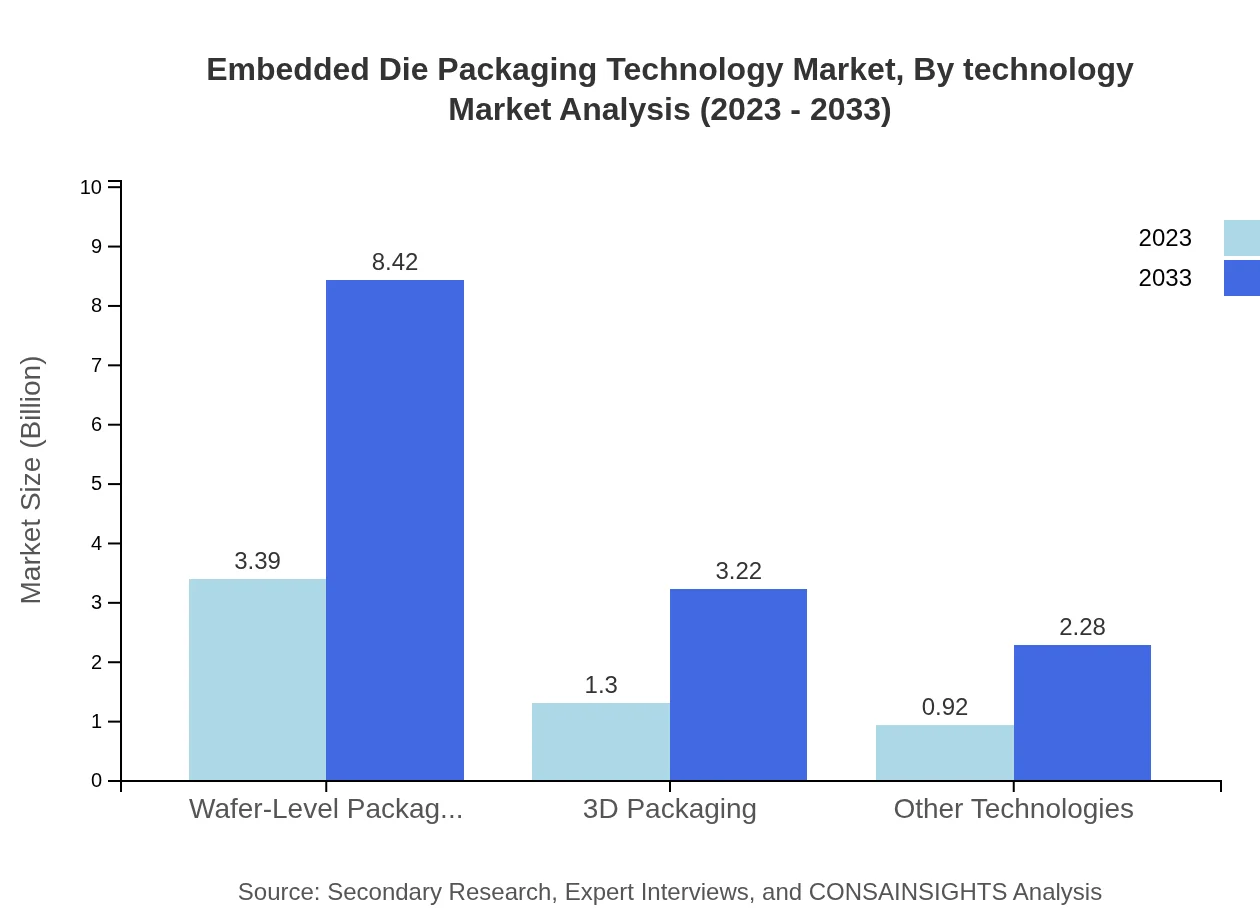

Embedded Die Packaging Technology Market Analysis By Technology

The technology segment reveals that Wafer-Level Packaging is the dominant technology, expected to hold a market share of 60.49% from 2023 to 2033. This segment is valued at $3.39 billion in 2023, projected to reach $8.42 billion in 2033, due to its efficiency in semiconductor integration. 3D Packaging follows suit, with a market size of $1.30 billion in 2023 and an anticipated growth to $3.22 billion by 2033, representing a growing trend toward more advanced packaging solutions.

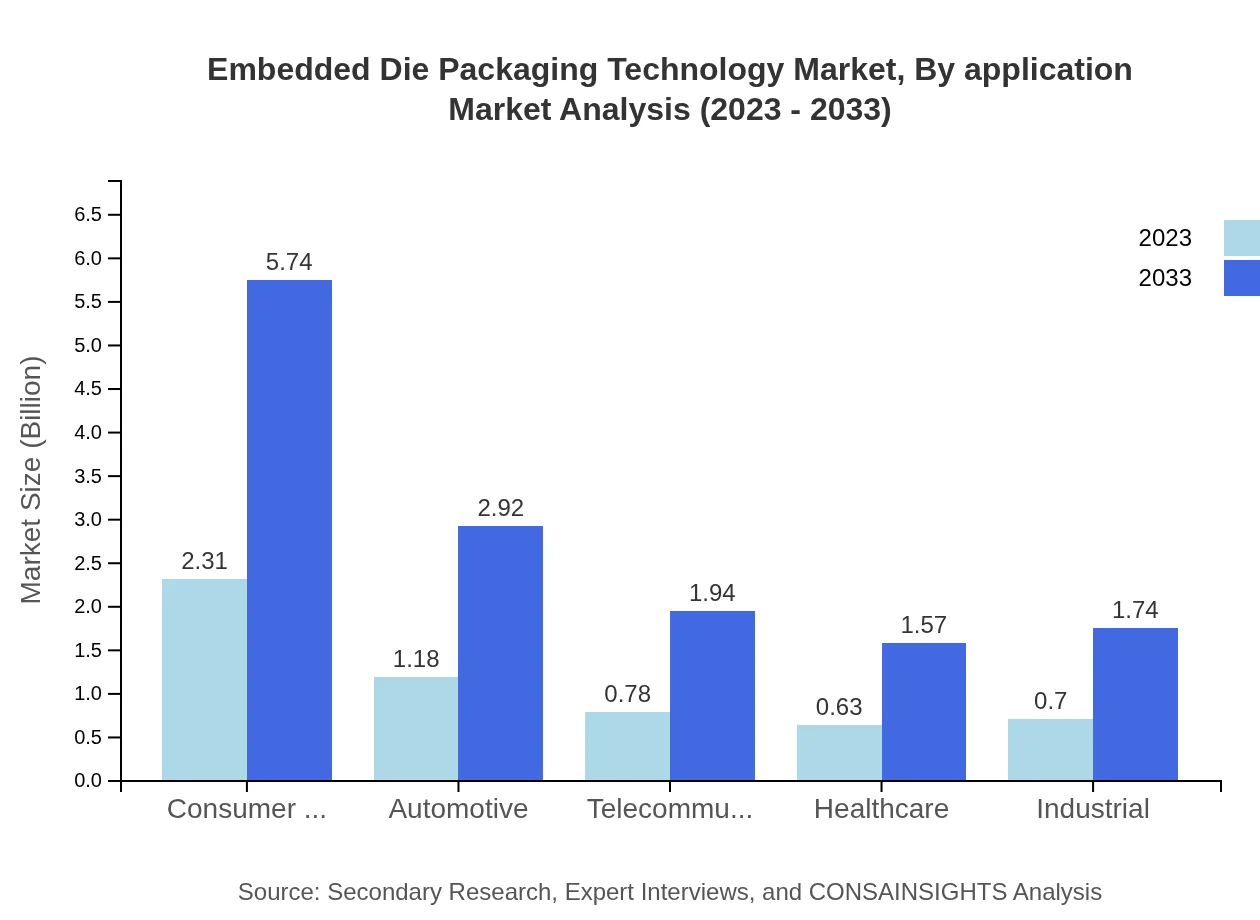

Embedded Die Packaging Technology Market Analysis By Application

Consumer electronics is currently the largest application segment, holding 41.29% market share, growing from $2.31 billion in 2023 to $5.74 billion in 2033. The automotive segment also shows significant potential with growth from $1.18 billion to $2.92 billion, driven by increasing demand for smart automotive technologies, including advanced driver-assistance systems and electrification.

Embedded Die Packaging Technology Market Analysis By Material

Global Embedded Die Packaging Technology Market, By Material Market Analysis (2023 - 2033)

In terms of materials used, the substrate segment dominates with a market size of $3.39 billion in 2023, projected to grow to $8.42 billion by 2033. Die attach materials and packaging materials are also critical, with sizes of $1.30 billion and $0.92 billion, respectively, emphasizing material diversity in enhancing device performance and thermal management.

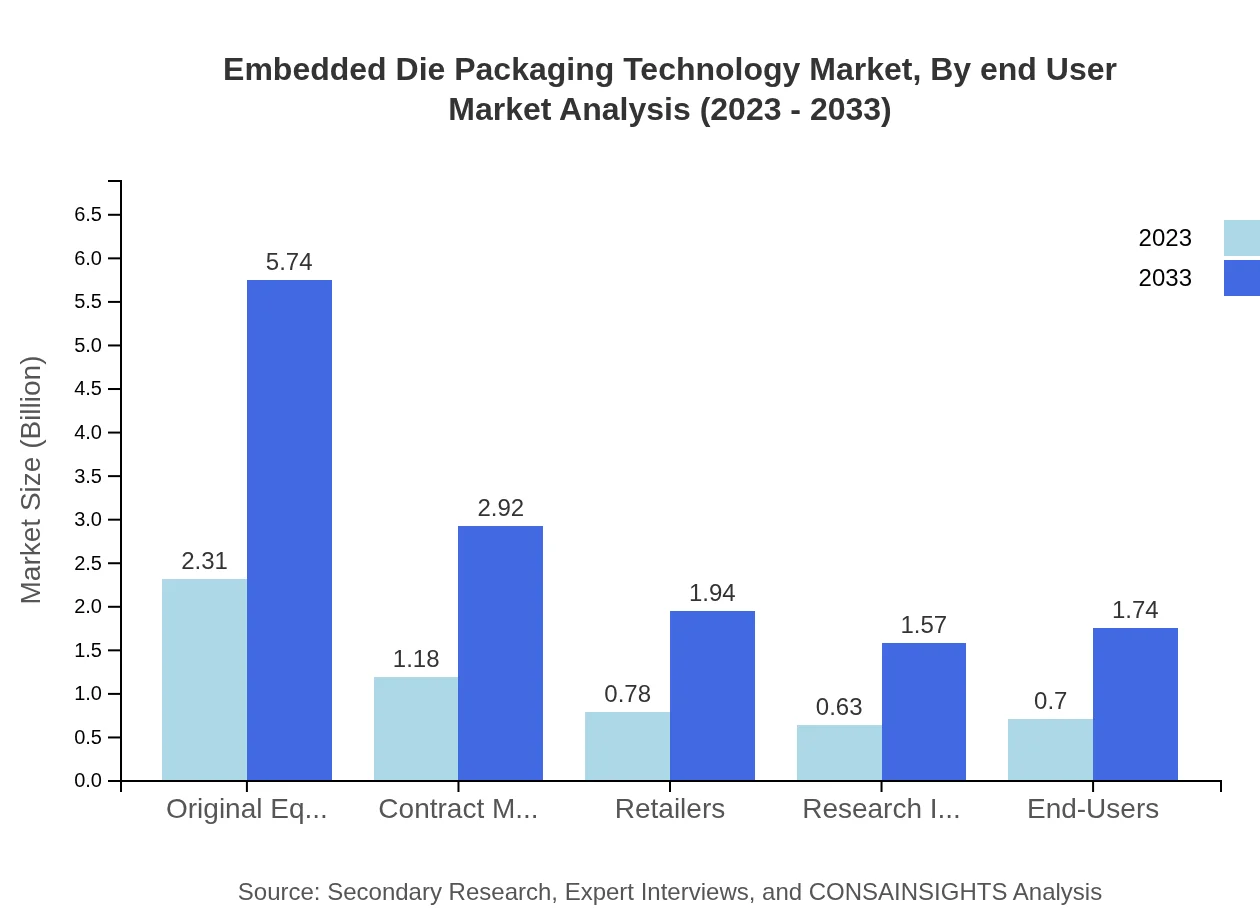

Embedded Die Packaging Technology Market Analysis By End User

OEMs are a significant end-user segment, with a market size of $2.31 billion in 2023, expected to reach $5.74 billion by 2033. The presence of contract manufacturers at $1.18 billion, alongside strong demand from research institutes, highlights the role of research and innovation in driving technological advancements and adoption.

Embedded Die Packaging Technology Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Embedded Die Packaging Technology Industry

Intel Corporation:

A global leader in semiconductor innovation, Intel develops advanced packaging technologies, focusing on integrating more functionalities while reducing physical space in devices.AMD (Advanced Micro Devices):

AMD is renowned for its cutting-edge microprocessors and graphics technology, utilizing embedded die packaging to enhance performance and thermal management.Texas Instruments:

Texas Instruments is a major player in the embedded die packaging space, providing solutions that cater to the increasing demand for energy-efficient electronics across industries.STMicroelectronics:

STMicroelectronics focuses on providing high-performance embedded systems, enhancing operational efficiencies through innovative packaging solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of Embedded Die Packaging Technology?

The global Embedded Die Packaging Technology market is valued at approximately $5.6 billion in 2023, and it is projected to grow at a CAGR of 9.2% through 2033. This growth reflects increasing applications in consumer electronics and automotive sectors.

What are the key market players or companies in the Embedded Die Packaging Technology industry?

Key players in Embedded Die Packaging Technology include major semiconductor manufacturers and packaging solution providers that focus on innovative materials and designs, tapping into diverse sectors like consumer electronics, automotive, and telecommunications.

What are the primary factors driving the growth in the Embedded Die Packaging Technology industry?

Growth drivers include demand for miniaturization of electronic devices, advancements in semiconductor technologies, and increased adoption in high-performance applications across consumer electronics and automotive sectors, leading to innovative packaging solutions.

Which region is the fastest Growing in the Embedded Die Packaging Technology?

The Asia Pacific region emerges as the fastest-growing market for Embedded Die Packaging Technology, expected to grow from $0.91 billion in 2023 to $2.26 billion by 2033, driven by robust electronic manufacturing and increased demand.

Does ConsaInsights provide customized market report data for the Embedded Die Packaging Technology industry?

Yes, ConsaInsights offers customized market report data for the Embedded Die Packaging Technology industry. Clients can request tailored insights, detailed analyses, and forecasts to meet specific business needs and strategic planning.

What deliverables can I expect from this Embedded Die Packaging Technology market research project?

Deliverables include comprehensive market analysis reports, growth forecasts, competitive landscape evaluations, regional insights, and segment-specific data, providing actionable intelligence for strategic decision-making and market entry strategies.

What are the market trends of Embedded Die Packaging Technology?

Trends in Embedded Die Packaging Technology include a shift towards advanced packaging techniques like 3D packaging, increasing collaboration between OEMs and packaging manufacturers, and a growing focus on sustainability in material selection and manufacturing processes.